Factors Affecting the Quality of Audit

Case Study at Inspectorate Central Lombok Regency

Vera Baiq Febrina Angri, Ni Ketut Surasni and Hamdani Husnan

Master of Accounting Economics and the Business University of Mataram, Mataram, West Nusa Tenggara, Indonesia

Keywords: Due Professional Care, Independence, Characteristics auditee, Quality Audit.

Abstract: This paper aims to examine and obtain empirical evidence about whether due professional care, independence

of the auditor and auditee characteristics affect the audit quality at Inspectorate of Central Lombok regency.

This paper refers to the results of previous research. This is an explanatory research with purposive sampling

method of interpretation. The questionnaires were distributed to 45 respondent. The data was tested by

analysis tools SmartPLS 3.0. Based on the field test results found that due professional care auditor has

positive and significant effect on audit quality, while Independence and characteristics of auditee did not

significantly effect on audit quality. The results of this test further will be retested on the next research by the

number of samples and a wider factors affecting the quality of audit.

1 INTRODUCTION

Undang – Undang no 32 tahun 2004 on Regional

Government said that the area has the authority to

regulate and manage their own affairs and interests of

local communities in accordance with the legislation.

It requires regions to make up various aspects of

governance including institutional and financial

problems apply in areas of accountability and

transparency to achieve good governance, There are

three main aspects that support the creation of good

governance (good governance), namely monitoring,

control and inspection (Mardiasmo, 2005).

Quality Audit is very important because of the

audit results public as stakeholders can determine

whether the government has used the funds in

accordance with procedures and standards applicable

(Rai 2008 ; 32), For local government, the quality of

auditing are expected to reduce the findings of a loss

of area and improve the performance of Unit (SKPD),

while for the auditee in this regard SKPD, quality

auditing are expected to improve the value for money

(economy, efficiency, and effectiveness). However,

the fact that the findings of the area loss are never

decreased significantly and the type of findings

Inspectorate against SKPD as auditee recur-ring

annually that indicate SKPD cannot apply the concept

of value for money.

The findings were always appearing in any Audit

Reports are incomplete document, the mark up price,

payment of goods / services which exceed the market

price, and fictitious service trips (LHP Central

Lombok District Inspectorate, 2017).

In some studies that have been done about the

quality of audits states that audit quality is determined

by two things: the competence and independence

(Christiawan 2002Alim et al 2007). DeAngelo (1981)

defines the quality of audits as the probability that the

auditor will find and report violations to the client's

accounting system. It is strengthened with the opinion

of Donald R. Deis and Giroux (1992), which explains

that the probability of finding a violation depends on

the technical ability of auditors (competence) and the

probability of reporting a violation depends on

auditor independence.

In research Singgih & Bawono (2010) and

Febriyanti (2014) says that due professional care

positive effect on audit quality, while Saripudin,

Netty and Rahayu (2012) in his research indicates that

due professional care does not affect the quality of the

audit. Not only is it as contained in the study

Setyaningum (2012) quality audit cannot be separated

from the object of the audit itself or commonly called

the auditee,

This test combines the variables used by previous

researchers to analyze the impact on audit quality

improvement. This study was done considering the

number of cases is now questioning the quality of the

audit.

Angri, V., Surasni, N. and Husnan, H.

Factors Affecting the Quality of Audit - Case Study at Inspectorate Central Lombok Regency.

In Proceedings of the 2nd Inter national Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 745-750

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

745

Based on the explanation of the problem in the

quality of audits and previous research studies so that

this test will examine and provide empirical evidence

the independence of auditors, auditors and due

professional care, the characteristics of the auditee

effect on audit quality, this test analyzed by the

Agency Theory approach. The results of this test will

be used as the basis for a retest in thesis research with

larger samples and improve other variables that affect

the quality of the audit.

2 LITERATURE REVIEW

2.1 Theoretical Basis

Agency theory developed by Jensen and Meckling

(1976) in Elfarini (2007: 15) tried to ex-plain the

conflict of interest between the management agent

and the owner as well as the other entities in the

contract (e.g. creditors) as the principal.

Viewed from the standpoint of agency theory

above. The relationship between the community and

the government is like the relationship between prin-

cipal and agent. Society is the principal and the gov-

ernment is the agents. Principal authorizes the setting

to the agent and providing resources to the agent (in

the form of taxes and others). As a form of account-

ability for the authority given, agents provide

accountability reports to the principal. Because it

does not know what is actually done by the agent (the

case of information asymmetry), the principal needs

a third party that is able to convince the principal that

what is reported by the agent is true. In the position

as a third party is actually the auditor is expected to

play a major role. Given that some (or even most)

report given by the government is a form of financial

information. Auditors have an important position on

the grounds that; (1) have access to financial

information, (2) have access to information

management, (3) independent, (4) have received

professional training, and (5) can be obtained (No)

(Jones, 1990).

In this test, the author will provide empirical

evidence of the factors that affect audit quality as a

third-party auditor to analyze the variables

independence and due professional care on the

auditor and auditee characteristics (agent) striving to

audit quality produced by the auditors in the form of

audit reports where the purpose of the audit is to

reduce the agency conflict between agent and

principal (society).Based on the theoretical study and

previous studies, the research model developed by the

authors can be seen from Figure 1 below:

Figure 1: Research model.

2.2 The Research Hypothesis

Formulation

Mardiasmo (2005) suggested that the examination

(audit) is an activity undertaken by the party that has

the competence and independence to examine

whether the results of the government's performance

in accordance with established standards. The

auditor's professional proficiency to perform

demanding professional scepticism in auditing

activities (Rai, 2008: 51).

Several studies on the quality of audits that have

been done to conclude the different findings about

factors that affect audit quality. Research conducted

by Singgih and Bawono (2010) concluded that the

independence, due professional care and

accountability, both simultaneously and partially

influence on audit quality. Setyaningrum (2012) in

his research concluded that the characteristics of

auditors consisting of educational background,

professional skills, and continuing professional

education are partially not affect the quality of the

audit. While the characteristics of the auditee only the

size of the local government which proved negative

effect on the quality of the audit, the auditee

characteristics that form the complexity of local

government is not proven effect on audit quality.

Zawitri (2009) found that due care Professional

Skeptical negatively associated significant and

positive attitude is not significantly associated with

perceived audit quality. Ardini study (2010)

concluded that the competence, independence,

accountability and motivation together have a

significant effect on audit quality. Then partially

accountability has a positive and significant impact

on audit quality.

The independence is often also referred to as a

mental attitude that is free from influence, not control

and is not dependent on the other party. In-

dependence high attitude will produce quality audit

reports and accountable. Based on these explanations,

the first hypothesis in this test are:

Independence

Due

Professional

Characteristics

auditee

Quality

Audit

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

746

H1: Independence of the positive effect to audit

quality

Due Professional Care the other is absolute

attitude that must be owned by an auditor. This means

that an auditor must have a careful attitude and

earnest in their profession as an auditor in order to

produce quality audit reports. Accuracy and precision

requires the auditor to exercise professional

scepticism, which is an attitude that requires the

auditor to think critically about the audit evidence that

is by always questioning and evaluating audit

evidence that, be careful in the task, and not careless

in conducting examination and have perseverance in

carrying out the responsibility. Based on the

explanation, the second hypothesis in this test are:

H2: Due care professional’s positive effect on

audit quality

Accountability indicates Characteristics auditee

public sector can be seen from SKPD size and

complexity of the organization. SKPD size refers to

the number of managed funds, the greater the funds

managed by the greater demand for transparency

(Setyaningrum, 2012). While the complexity of the

organization includes a number of fields or echelon

III who served. The more complex an organizational

structure, the more comprehensive SKPD duties and

authority owned. Often auditors become more alert

and apply the high scepticism attitude toward auditees

have a big budget and a complex organizational

structure. Based on the explanation, the third

hypothesis in this test are:

H3: Characteristics auditee take effect positive the

quality audit

3 METHODS

3.1 Population and Sample

This test is used to experiments in central Lombok

regency government because it has the largest

population among the other districts in the island of

Lombok.

Sample interpretation technique in this test

method with probability sampling technique was

giving the same opportunity or chance for every

element of population being a member (Creswell:

220) such was the case in thi test using 45 respondents

i.e. Functional official auditor and functional P2UPD.

3.2 Method of Data Collection

Data collection was done with questionnaire survey

based development from previous risets roommates

strongly correlated with variables in this test.

Questionnaire is a set of questions arranged

systematically so that the same questions can be

submitted to every respondent. The questioner is an

effective instrument of the data collection can be

gotten standards because the data can be ac-counted

for analysis needs comprehensively re-searched

about a population characteristic (Suprinto, 2000). In

a test pilot, questioners are transferred directly to a

Functional official auditor and functional P2UPD

Becomes roommates sample of this research.

3.3 Method of Data Analysis

The data gotten from the result questioners was

managed with using SmartPLS 3.0. SmartPLS was

chosen because it was Able to help the writer to get

scores of latent variables for prediction. Chin and

Newsted (1999 in Ghozali and Latan) explained that

the formal model of latent variables in PLS De-

scribed explicitly with the aggregate linear variable

from its observation or indicators. Weight estimation

to create a component of the latent variable score was

gotten from inner and outer of the model specifically.

The result was the residual variance from the

endogenous variable minimized.

4 RESULTS AND DISCUSSION

4.1 Test of Outer Model (Evaluation of

Measurement Model)

Evaluation of the model or the outer measurement

models used to score the construct validity and

reliability. To measure the convergent validity can be

seen from loading factor for every construct factor. In

hair and friends (2013), he said that scores of loading

factor of 0.7 must be more than minimally because

latent variables can explain 50% variants for every

indicator. Loading factor in this test can be seen at the

picture below:

Factors Affecting the Quality of Audit - Case Study at Inspectorate Central Lombok Regency

747

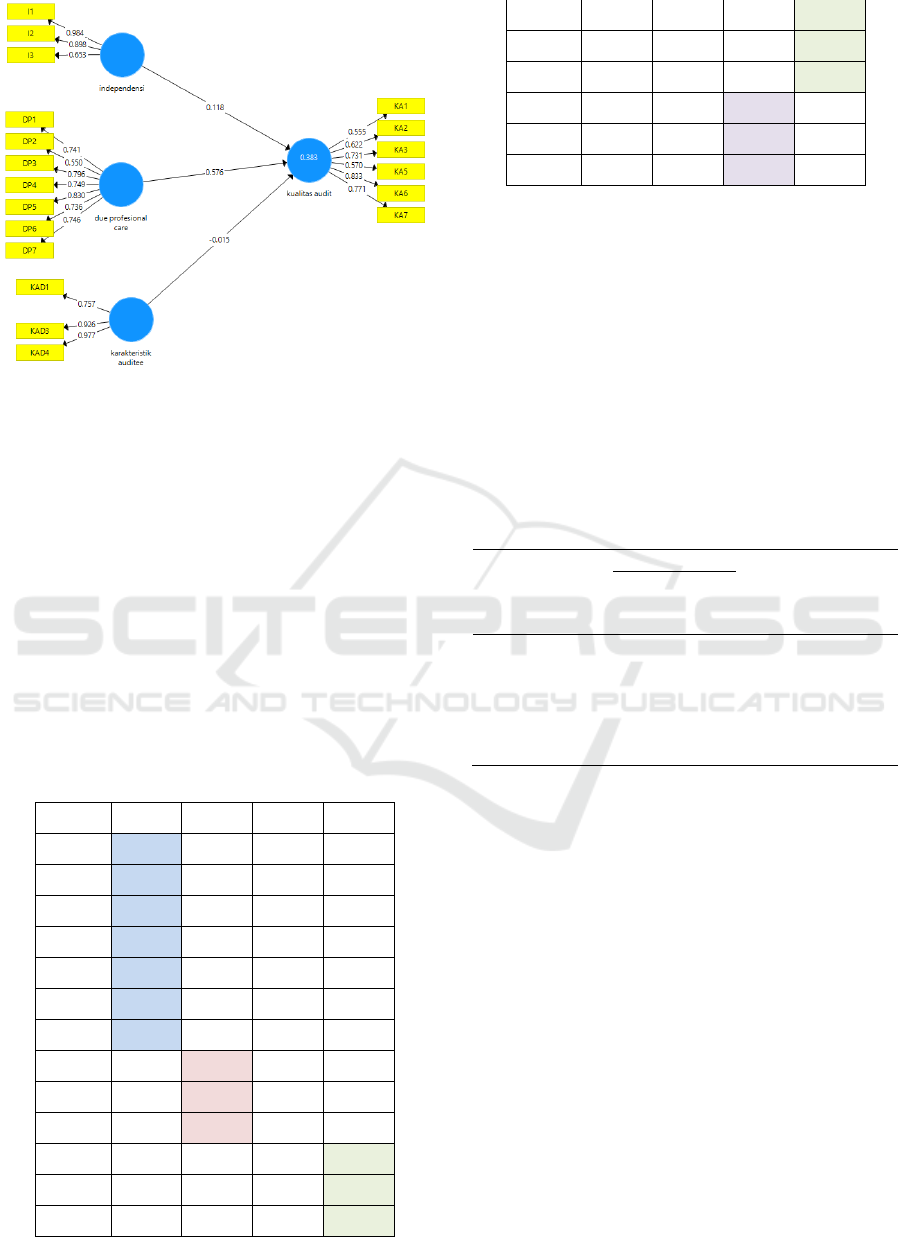

Figure 2: Load factor.

Based on the loading factor of the above, it can be

seen that there is the indicator value is less than 0, 70.

This is because of the indicator on low or indicator

data variation with nearly the same value. In Hair and

friends said that loading must be from 0.40 to 0.70

among Considered to be defended. Therefore

indicators of independence of auditors, auditors and

due professional care, the characteristics of the

auditee because convergent validity have fulfilled all

loading factors were upper than 0.50.

Next from the test of discriminate validity can be

seen at the cross loading with comparing the

correlation between its indicator construct

correlations and the other indicators such as at table

1. Be-low:

Table 1: Cross loading.

DP I KAD KA

DP1 .748 0.259 -0.149 .448

DP2 .773 0.345 -0.172 0,384

DP3 .789 0,312 0.061 0.554

DP4 0.739 0.345 -0.033 0,509

DP5 0.822 .193 -0.137 0.512

DP6 0,745 0.184 -0.135 0.376

DP7 0.754 0.256 -0.204 .449

I1 0.319 .917 -0.140 .309

I2 .220 .820 -0.083 0.126

I3 0,004 .636 0,040 -0.041

KA1 0.338 0.164 -0.492 0.611

KA2 0.594 .329 -0.271 .649

KA3 0.277 .220 0,032 .690

KA4 0,270 0.102 0,002 0.537

KA5 .409 0.354 -0.019 .807

KA6 0.411 .181 -0.194 0.754

KAD1 0,139 -0.057 -0.532 0,072

KAD2 0.204 0.135 -0.896 .178

KAD3 .220 0.167 -0.913 0.192

Source: PLS outputs; 2017

From this table, we can see that the construct

correlation of due professional care with its indicators

has higher correlation score Compared with the

indicator of the quality of the audit with the other

constructs. This Showed that reflective indicator has

fulfilled discriminant validity.

While the reliability test aims to prove the ac-

curacy, consistency, accuracy in measuring

instruments build. To measure the reliability can be

done with composite reliability with a score of more

than 0.7 for confirmation study. Results of reliability

can be seen in the table below:

Table 2: Results of validit

y

and reliabilit

y

test.

No. variable

reliabilit

y

Explanation

composit

e reliability

(0.60 to 0.70)

1

DP

0.909

Valid and Reliable

2

I

0.726 Valid and Reliable

3

KAD

.654 Valid and Reliable

4

KA

.787 Valid and Reliable

Source: PLS outputs; 2017

From the table above, this can be explained that

the construct variable of due professional care,

independence, the characteristics of the auditee and

audit quality have more than fulfilled the reliability

score of 0.70 for every variable (Ghozali & Latan:

77).

4.2 Hypothesis Testing

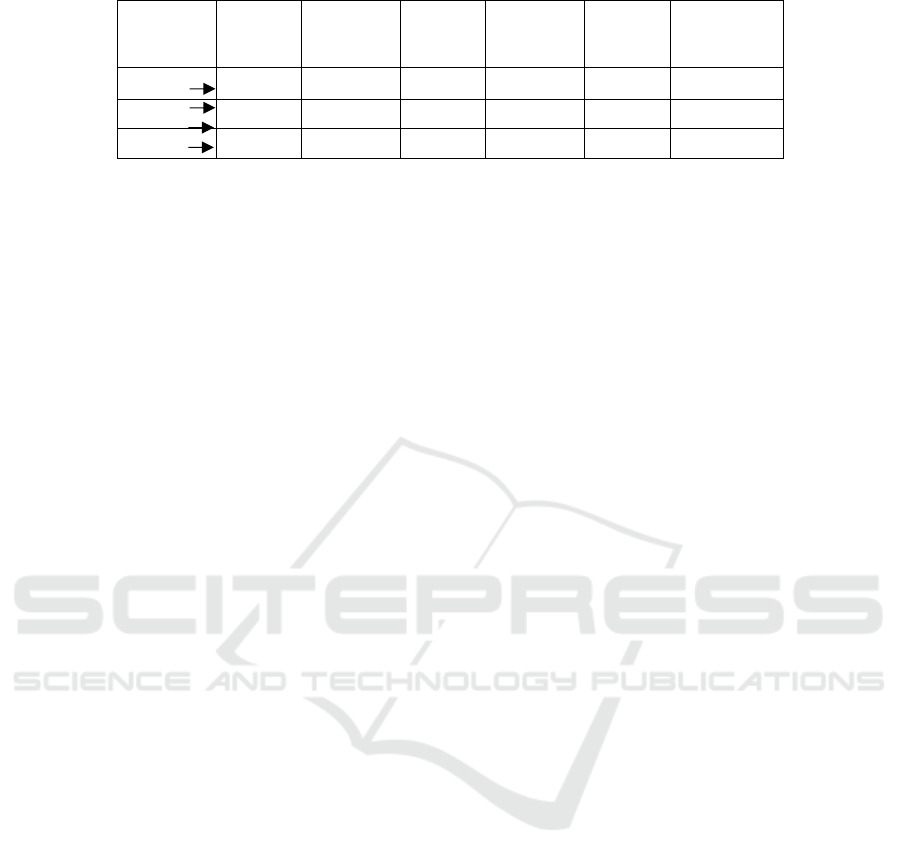

Hypothesis test results can be seen in Table 3 below

where the results obtained from the bootstrap test

with SmartPLS 3.0 software to see the support of the

hypothesis.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

748

Table 3: Land coefficient.

Original

Sample

(O)

Samples

Mean (M)

Error

standard

T

Statistics

value P Conclusion

I KA 0111 0113 0172 0642 0521 rejected

DP KA 0579 0553 0117 4953 0000 be accepted

KA KAD -0016 0005 0211 0077 0939 rejected

Source: Output PLS 2017

Result of the first hypothesis test Showed that

independency did not influenced of quality audit, this

can be seen from Table 3 in the t-statistic was 0.642

less than 1.64 t-table this can therefore be concluded

that the first hypothesis was rejected. P-value was

0.521 more than 5% alpha means that significant.

Result of the second hypothesis test Showed that

positively influenced due professional care to-ward

the management of audit quality in the which T-

Statistic score of due professional care was

4.953more than T-Table 1.64 this can therefore be

concluded that the second hypothesis was accepted.

P-value of 0.000 was smaller than 5% alpha means

that significant.

Result of the third hypothesis test Showed that the

auditee characteristic did not influence quality of

audits in the t-statistic was 0.077 less than 1.64 t-table

this can therefore be concluded that the third

hypothesis was rejected. P-value of 0.939 was smaller

than 5% alpha means that significant.

4.3 Effect of Independence the Quality

Audit

The auditor's independence is one of the important

factors to produce high-quality audit. The in-

dependence by Halim (2003: 46) is a mental attitude

that is owned by the auditor to be impartial in con-

ducting the audit. Research conducted by Alim et al.

(2007) showed that the competence and

independence of a significant effect on audit quality,

but it is not the same as the results of the statistical

analysis in this study is that independence has no

significant effect on audit quality.

According Widhiarso (2011) there are seven

reasons why the test was not significant statistically,

namely: 1) the presence of outliers; 2) a model that

does not fit; 3) the small sample size; 4) the effect of

intervening variables; 5) pre-requisite analysis are not

obeyed; 6) differing contexts; 7) measuring devices

that are less valid and reliable.

4.4 Effect of Due Professional Care the

Quality Audit

Based on statistical analysis in this study it was found

that the second hypothesis (H2) due care

professionals have a significant positive influence

quality of the audit. In other words, the auditor should

implement professional scepticism in auditing

activities, which the auditor is always questioning and

critically evaluating audit evidence the results of

audits of quality expected. (Rai, 2008: 51), the results

of this study are supported by research con-ducted

Singgih & Bawono (2010) and Febriyanti (2014) says

that due professional care positive effect on audit

quality.

4.5 The Influence of the Characteristics

of the Auditee the Quality Audit

Results of the analysis showed that characteristics of

the auditee have no significant effect on audit quality.

This contrasts with research conducted by

Setyaningrum (2012) in "Analysis of the factors that

affect the quality of BPK-RI audit" to see that not

only the factor of the auditors that affect audit quality,

but from the auditee is also believed to affect the

quality of the audit. The results showed that the

characteristics of the auditor and auditee

characteristics together affect audit quality.

5 CONCLUSIONS

Based on the testing results of data analysis shows

that due professional care positive effect on audit

quality, so as to obtain results of quality audit reports

required accuracy and prudence - carefulness auditor.

Whereas the independence and the characteristics of

the auditee has no significant effect on audit quality

inspectorate central Lombok district.

The results of these tests are expected to be a

reference to the author of the thesis by adding more

variables and samples and improve analysis of the

Factors Affecting the Quality of Audit - Case Study at Inspectorate Central Lombok Regency

749

data is higher (Ghozali & Latan) to obtain better

results and improve other factors in that.

Although the implications of these tests may be

suggestions for local governments in central Lombok

in Indonesia in particular and government in general

to improve the quality of audits in order to achieve

good governance.

Restrictiveness from this test will give direction

for next Researchers in thesis research to be Able to

test the implication from quality audits.

REFERENCES

Alim, M. N., Hapsari, T., Purwanti, L., 2007. “Pengaruh

Kompetensi dan Independensi terhadap Kualitas Audit

dengan Etika Auditor sebagai Variabel Moderasi”.

SNA X Makassar.

Anderson, J. C. et al., 1997. “The Mitigation of Hindsight

Bias in Judges’ Evaluation of Auditor Decisions.

Auditing”. A Journal of Practice and Theory, 16 (2),

20-39.

Christiawan, Y. J., 2002. “Kompetensi dan Independensi

Akuntan Publik: Refleksi Hasil Penelitian Empiris”.

Jurnal Akuntansi dan Keuangan. (4)2. 79-92.

Creswell W. J., 2010. Research Design of qualitative and

quantitative approach and mixed. Yogyakarta; Pustaka

Pelajar.

Ghozali Imam, Latan Hengky. 2014. Partial Least Square:

concepts, technique and application of Smart PLS 3.0.

Semarang; Diponegoro University

Harhinto, T., 2004. Pengaruh Keahlian dan Independensi

Terhadap Kualitas Audit (Studi Empiris pada KAP di

Jawa Timur). Tesis Maksi Universitas Diponegoro

Semarang.

Hussey, R., George Lan. 2001. “An Examination of Auditor

Independence Issues from the Perspectives of U.K.

Finance Directors”. Journal of Business Ethics, (32)2,

169-178.

Ikatan Akuntan Indonesia-Kompartemen Akuntan Publik

(IAI-KAP). 2001. Standar Profesional Akuntan Publik.

Jakarta: Salemba Empat.

Indriantoro, N., Supomo, B., 2002. Metodologi Penelitian

Bisnis untuk Akuntansi dan Manajemen. Yogyakarta:

BPFE.

Kadous, K., 2000. “The Effects of Audit Quality and

Consequence Severity on Juror Evaluations of Auditor

Responsibility for Plaintiff Losses”. The Accounting

Review. (75)3,327-341.

Louwers, T. et al. 2008. “Deficiencies in Auditing Related-

Party Transactions: Insights from AAERs”. Current

Issues in Auditing, (2)2, A10–A16.

Mansur, T., 2007. “Faktor-Faktor yang Mempengaruhi

Kualitas Audit Ditinjau dari Persepsi Auditor atas

Pelatihan dan Keahlian, Independensi dan

Penggunaan Kemahiran Profesional”. Tesis Program

Studi Magister Sains Akuntansi Universitas Gadjah

Mada (Tidak Dipublikasikan).

Mardisar, D., Sari, R. N., 2007. “Pengaruh Akuntabilitas

dan Pengetahuan terhadap Kualitas Hasil Kerja

Auditor”. SNA X Makassar.

Mautz, R. K., Sharaf, H. A., 1980. The Philosophy of

Auditing. Florida: American Accounting Association.

Safitri dkk (2014). Analisis Faktor-Faktor Yang

Mempengaruhi Kualitas Audit Dengan Reward

Sebagai Variabel Pemoderasi (Studi Pada Aparat

Pengawas Internal Pemerintah Di Inspektorat Daerah

Kabupaten Se Eks Karesidenan Banyumas. Fakultas

Ekonomi Universitas Jenderal Soedirman

Saripudin, N., Rahayu. 2012. Pengaruh Independensi,

Pengalaman, Due Professional Care dan Akuntabilitas

terhadap Kualitas Audit. E-Jurnal Binar Akuntansi.

Vol. 1 No. 1 September.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

750