Decision of Cooperative Capital Structure, Profitability and Firm

Value

Sugiyanto Sugiyanto

Institut Manajemen Koperasi Indonesia

Keywords: Decision of cooperative capital structure, profitability, firm value.

Abstract: Capital structure theory explained by combination of capital sources are still rarely implemented in

cooperatives enterprises especially in Indonesia, also cooperative financial managers have not been aware if

this theory very importance. The purpose of this study is to investigate decision of cooperative capital structure

and its impact on profitability and firm value. This research use statistical approach by using path analysis so

that it can be known magnitude of direct and indirect impact between independent and dependent variables,

this model is applied to test the panel threshold impact of cooperative capital structure on profitability and

firm value from 2011 to 2015 with sample size 52 cooperatives in West Java using the simple random

sampling technique. In this study, cooperative capital structure described by Debt to Asset Ratio (DAR),

Profitability is described by Return on Equity (ROE) and Firm value described by ratio of cooperative

permanent capital or capital allowance plus grant to total equity. The results of this study, decision of

cooperative capital structure has a significant impact on profitability, and cooperative capital structure and

profitability have impact on firm value either directly or indirectly, means capital structure theory also

applicable on cooperative enterprises that have certain characteristics. Implication of this research, indicate

that profitability and firm value can be improved by decision of cooperative capital structure through

increasing debt capital sources, cooperative profitability and firm value can be leveraged by decision of capital

structure.

1 INTRODUCTION

Cooperatives as one of the economic actors in

Indonesia still face many challenges related to

business development, which began by difficulty of

cooperatives in raising capital. Like other business

entities, cooperative capital source also comes from

internal and external capital. The internal capital is

capital allowance derived from non-shared surplus,

while external capital sources come from member's

savings as an equity capital and debt from other

parties including banks, other financial institutions,

members and other cooperatives.

The cooperative enterprise has a self-help

principle that is to help their members, cooperative

should be established from member’s idea, and a

business development must be capitalized and

managed by members, in order to provide economic

benefits for members. In fact, most of Indonesia's

cooperative capital source is still depend on debt

capital. It is shown that during last 5 years on average

equal to 47.69% cooperative capital source from debt.

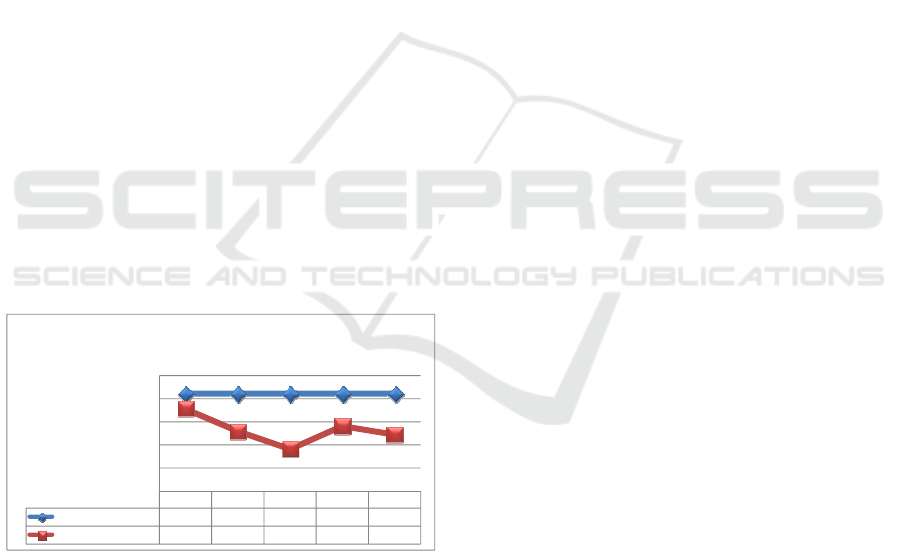

A comparison between debt and equity capital

development of cooperatives in Indonesia, see figure

1.

2011 2012 2013 2014 2015

DebtCapital

39.69 51.40 80.84 94.86 99.79

EquityCapital

35.79 51.42 89.54 105.80 142.65

Assets

75.48 102.83 170.38 200.66 242.45

DebttoAssetsRatio

53% 50% 47% 47% 41%

EquitytoAs set sRatio

47% 50% 53% 53% 59%

‐

50.00

100. 00

150. 00

200. 00

250. 00

300. 00

Tot al

Tabl e1:CapitalStructureDevelopmentofCooperati ve

inIndonesia

Figure 1: Capital structure development of cooperative in

Indonesia.

Source: Financial Report of Ministry of Cooperative and

SME’s Of Indonesia

690

Sugiyanto, S.

Decision of Cooperative Capital Structure, Profitability and Firm Value.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 690-696

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Based on figure 1, shows that source of

cooperative capital is still highly depend on debt

capital, in 2011 more than 53% cooperative capital

requirement still filled by debt capital and then

decline only 41% in 2015. This condition indicated

that cooperative capital requirement has not been

fully fulfilled from member's capital contribution that

has not been sufficient for a cooperative business

development this condition indicates that member

participation in capital contribution still needs to be

improved. Cooperative equity capital not only

sources from member’s saving but also from capital

investment, capital allowance and other party’s grant.

This condition is in accordance with statement that

"the capital function in a cooperative is handicapped,

that the capital is not depend on its capital

contribution but on its patronage of the cooperative"

(Röpke J, 2002). This opinion is also supported by the

statement that cooperatives are less attractive to

members, members’ candidate and other

stakeholders, who would like to be a member caused

by excess capital. (Sugiyanto, 2007).

Limitations of capital contribution from members,

because capital contribution are made in stages and

there are still many members who are not active. The

cooperative surplus is still limited, so cooperative

surplus set aside for capital allowance also limited.

Based on these conditions, the prime of cooperative

capital sources are still come from debt capital.

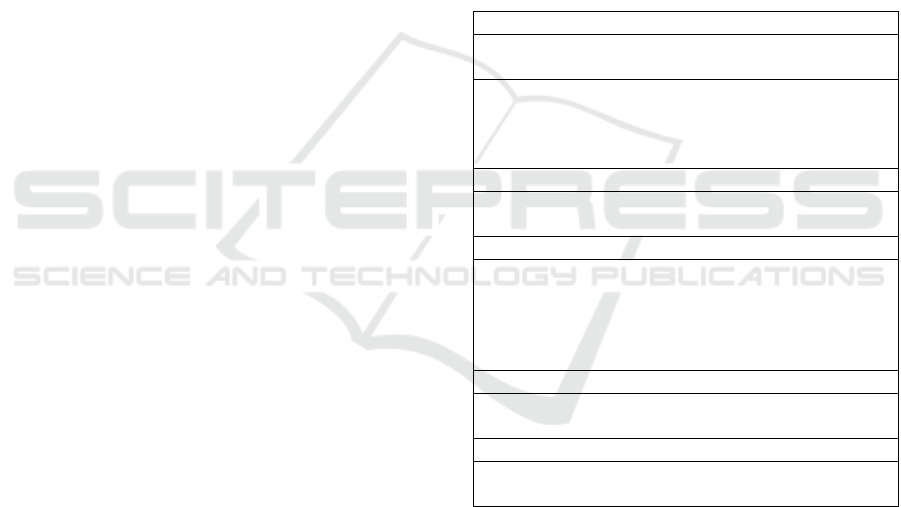

Cooperative performance can be indicated by

development of cooperative profitability as measured

by return on equity (ROE) (see figure 2):

2011 2012 2013 2014 2015

Standard(%)

21 21 21 21 21

ReturnOnEquity(%)

17,7 12,95 9,05 14,08 12,14

0

5

10

15

20

25

ROE %

Table2:ReturnOnEquityofCooperativeIn

Indones ia

Figure 2: Return on equity of cooperative in Indonesia.

Source: Financial Report of Ministry of Cooperative and

SME’s Of Indonesia.

Figure 2 describe that ROE of Indonesia’s

cooperative over last 5 years is still fluctuating

growth, in 2011 ROE of 17,7%, 2012 decline equal to

12,95% and 2013 to 9.05%, 2014 increased to

14,08% and 12,14% in 2015. But, ability of

cooperatives to obtaining profitability as measured by

ROE is still under the standard set by government, i.e.

21%.

In the financial perspective many factors impact

on ability of cooperatives to obtain return, such as

business effectiveness, liquidity, and also from

leverage is ability to raise capital, especially debt

capital that is usually measured by capital structure.

In reality, financial managers have not yet

implemented capital structure approaches and their

impact on cooperative returns. Almost never realized

that cost of capital, as a consequences of capital

source have an impact on the results of surplus.

Cooperative managers almost never consider that

capital structure in funding decisions is very

important and its impact on the acquisition of

business results, usually only consideration how

cooperative can obtain capital source quickly.

The source of debt capital or financial leverage

has three important implications, one of which is: If

the firm obtains a greater return on investment that

financed by debt than interest payments then the

return on equity will be greater, or leveraged

(Brigham E. F, 1999). Still quoted from the same

author, states that Modigliani and Miller conclude

that leverage will increase firm value because interest

of debt reduces taxable income. In general, cost of

debt is cheaper than cost of equity so that company

gets a 'savings' when a company diverts equity

financing to debt financing.

Many studies on other business entities stating

that the capital structure has an impact on profitability

that measured by return on assets (ROA) or return on

equity (ROE). Capital structure positively leverage on

profitability even also has an impact on the firm

value, but the others research indicate that capital

structure unleveraged on profitability even also has

no impact on firm value. The discussion of firm value

in cooperative until now is still very rarely done.

Based on the previous research indicates that there

is inconsistent results related to impact of capital

structure on profitability and firm value. Quang, Do

Xuan, et al (2015), mention that there are different

relations between capital structure and financial

performance at different thresholds. In the range of

(0.040; 0.703), capital structure is positively related

to financial performance, outside that range, the

relation is negative.

Several researches state that capital structure has

a significant effect on profitability (Necib, Redjem, et

al, 2014; and Pontoh, Winston, et al, 2013). While

research conducted by Vătavu, Sorana, (2015);

Sultan, Ayad Shaker, et al, (2015); and Salawu, Rafiu

Oyesola, et al, (2009) states that the capital structure

has a negative effect on profitability.

While research related to impact of capital

structure to firm value also has different result

Decision of Cooperative Capital Structure, Profitability and Firm Value

691

conclusion. According to research conducted by

Masidonda, Jaelani La, et al (2013), states that capital

structure has a positive effect on firm value.

Effects of capital structure and profitability on

firm value with company size as the moderating

variable, the results show that independent variables

have simultaneous significant influence on the

corporate value (Mahdaleta, Ela, et al, 2016). In

addition, capital structure and profitability also have

impact the value of the company (LAWAL,

Adedoyin Isola, 2014).

Based on this description, the objective of this

study to examine the decision of cooperative capital

structure and impact on profitability, and the decision

of cooperative capital structure and profitability on

firm value, that is in practice almost does not discuss

these variables in cooperative financing decision

making.

2 LITERATURE REVIEW

2.1 Decision of Cooperative Capital

Structure

Cooperatives as a people economic movement based

on the principle of brotherhood that has an important

role in growing and developing the economic

potential of an equitable and prosperous society. The

cooperative is seen as an enterprises conducting

economic activities as well as other business entities,

as stated by Arifin, Ramudi (2003) "Cooperative is a

modern economic enterprises that demands

conceptual and rational thinking because the

cooperative lives in a dynamic economic

environment and keep moving forward, getting more

open, globalizing and creating increasingly

competition ".

Cooperative activities based on the values and

principles of cooperative, the values of cooperative is

a standard of morality and ethics agreed on a basis of

the traditions of its founders who became foundation

of cooperative ideology in achieving its goals. The

values of cooperatives are: (1) Self-help and

solidarity through togetherness or join action, (2)

Responsibility cooperative management, (3) Based

on equality of members; (4) Justice; and (5)

Solidarity, collective interests of their members.

Cooperative principle is a working guideline for

cooperatives in doing every effort it does.

Cooperative principles are essentially a more

operational translation of the cooperative values. In

Indonesia, Cooperative principles of are contained in

Indonesian Act No. 25 / 1992 / Cooperatives, Article

5. Where such principles include: (a) voluntary and

open membership, (b) management is democratically,

(c) the distribution of the surplus as a result of

operations is done fairly in proportion to the size of

business services of each member, (d) provision of

limited remuneration of capital, (e) independence, (f)

cooperative education, (g) collaboration between

cooperative.

Such as the other business entity, cooperative

needs supporting capital from debt and equity

sources. Capital structure decision is the second topic

of financial management after investment decisions,

often referred to as financing decisions for a

company. Capital structure is usually analogous to the

amount of debt. The capital structure is a balance of

the amount of permanent short-term debt, long-term

debt, with equity (Brigham, E. F, 1999).

Capital structure shows the source of capital

contribution from the owner and creditor. The change

in capital structure occurs in line with the additional

capital required by the cooperative either from debt

or equity. Debt capital has two advantages: The first,

paid interest can reduce tax, thus lowering effective

cost of debt. Secondly, creditor will earn a fixed

income, so a lender does not need to take part of profit

when in prime cooperative condition, so income for

the owner will increase. On the other hand debt

capital has a weakness, higher debt is higher risk, and

higher interest, for the business unit that financial

difficulties and operating profit is not sufficient to pay

interest then owner must cover the shortfall.

Cooperative capital structure shows the source of

the cooperative capital or as a capital contribution of

member and creditor. Hanel, A (1988) defines the

member's financial contribution as equity or stock,

formation of allowance and other deposits.

Other opinions about the theory of capital

structure still continue. The Modigliani and Miller

approach argues that leverage is independent of firm

value, with assumptions of which one is no tax, so this

approach is known as irrelevance theory. Based on

this approach the value of a non-unleveraged firm is

exactly the same as the firm using leverage.

Unleveraged and leverage firm value (Siaw, 1999).

Leverage approach model with MM Proportion I

model without tax. This proportion recognizes that

firm value is not influenced by the financing strategy,

but depends on the operationalization of the business

run and not on the funds acquired. If the unleveraged

firm value is equal to leverage firm value according

to the MM approach without taxes often referred to as

proposition 2, then the weighted average cost of

capital (WACC) of both companies is identical.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

692

According to Siaw (1999) the approach of MM

without taxes: The addition of financing with debt

will usually be followed by an increase in costs of

capital such as interest expenses. In accordance with

Proposition 1, changes in decision of capital structure

will not impact the firm value. In other words, the

owner is faced with an increased financial risk

without compensation from rising firm value. The

owner will ask for a higher return as a compensation

for the increased risk, this is called the higher cost of

equity capital for the leveraged company.

2.2 Profitability of Cooperatives

Profitability measures the ability of a business entity

to generate profits, in a cooperative enterprise called

as a business surplus at a certain level of sales, assets,

or capital. Cornett, et al (2012) and Ross, Stephen A

(2016) state that profitability of a business entity can

be measured with profit margin which describes the

ability to earn profit from sales, return on assets that

describe the ability to earn a profit of all assets

operationalized, and return on assets that illustrate the

ability to earn on equity.

In this study, profitability will be measured by

ROE to measure a company's ability to generate

profits based on a certain level of equity capital

(Hanafi, Mamduh, 2005). In the cooperative

enterprises, profitability is assumed to be equal to the

business surplus, according to Indonesian Act No. 25

/ 1992 / Cooperatives, Article 45, states that the

remaining surplus of the cooperative business

represent the income of the cooperative obtained in

one period minus expenses, depreciation, and other

liabilities including taxes in the relevant fiscal year.

2.3 The Cooperative Firm Value

The cooperative firm value to be considered as an

alternative to provide more value in improving the

member’s economic welfare. Increasing the

cooperative firm value has not been considered as one

of the objectives of cooperative enterprises, whereas

it is realized or not the value must occur in every

enterprises, for example from the higher value of

assets owned, the undistributed business surplus that

accumulate as a capital allowance in cooperative,

highly prospective cooperative business, increasing

human capital capability, systems that have been built

so far and others.

Cooperatives are not go public yet, and then of

course the cooperative firm value cannot be judged by

the stock market price. Using a value prediction

approach to be paid by prospective investors when a

cooperative is sold will also make it difficult for the

cooperative, since the first cooperative principle

states that members can leave at any time when

members want. A possible approach to use is the net

wealth improvement approach. Components of net

assets include members' deposit capital in the form of

principal savings, mandatory savings, other deposits

equivalent to mandatory savings, grants received by

cooperatives, and capital allowance formed by

business surplus.

Member’s deposits indicating ownership are the

rights of each member. Grants are accepted solely

because of the existence of cooperative, and capital

allowance are not shared to members, capital

allowance are only used to bear the risk when

cooperative suffers losses, so that magnitude of net

wealth increase can be valued at the amount of capital

allowance formed by business results, which can be

formulated as follows:

If we assume that cooperative firm value as an equity

Cooperative firm

value

= Equity

Net worth or equity in the form of members' deposits

and capital participation not as permanent capital of the

cooperative, because it must be paid back when the

member out and divest the capital of participation

Then

Cooperative firm

value

= Equity – nonpermanent

capital

Then:

Nonpermanent

Capital

= Principal saving +

mandatory saving + Other

deposits equivalent to

mandatory savings + Capital

participation

Then:

Cooperative firm

value

= Permanent capital

So:

Cooperative firm

value

= Capital Allowance + Grants

Source: Sugiyanto (2010)

Increasing the cooperative firm value is only

valued at capital allowance derived from business

surplus because it is not related to the rights / claims

of members at the time of the cooperative

membership out. We know that at any time members

may be out of membership, then members will only

be given a refund of principal savings, mandatory

savings, other deposits equivalent to mandatory

savings. This condition indicates that members of the

cooperative do not get the added value of the paid-up

capital if the person leaves the cooperative

membership. The increase of the value of the

Decision of Cooperative Capital Structure, Profitability and Firm Value

693

cooperative enterprises which is valued from the

capital allowance formed by undistributed business

surplus is actually a part of the member's business

surplus however, on basis of description, it is

preferable that the capital allowance not be

distributed to the member upon exit of the

cooperative membership. This is in accordance with

the Indonesian Act No 25 / 1992 / Cooperatives,

Article 45 (2) The rest of the business surplus after

deducting the capital allowance, distributed to

members in proportion to the business services

performed by each member to the cooperative, and

other purposes of the cooperative, in accordance with

the decision of the Member Meeting. From this

statement can be interpreted that is divided for

members limited to the surplus of the member's

business.

To support this study based on several previous

researches indicated that the leverage ratio measured

by debt to equity ratio has a positive effect on return

on equity (Salim, Jihan, 2015). Other research

indicates that firm's performance, which is measured

by profitability ratio, is an influenced by the degree

of capital structure (MOSCU, Raluca Georgiana,

2014).

The results of research conducted by Dewi, Inggi

Rovita, et al (2014) concluded that there is partially

and simultaneously significant influence of debt to

assets ratio on firm value measured by Tobin's Qar

var. The relationship between capital structure and

firm value has a nonlinear relationship represents a

convex Parapol shape, (Cuong, Nguyen Thanh,

2014).

2.4 Hypothesis

Based on the library review and previous researches,

it can be formulated hypothesis: (1) There is impact

of decision of cooperative capital structure decision

to profitability, (2) There are impact either directly or

indirectly of decision of cooperative capital structure

and profitability on cooperative firm value.

3 METHODS

This research conducted in West Java, Indonesia. The

type of research is descriptive quantitative analysis,

by using survey research the required data is

secondary data from cooperative financial statements

during 5 years, sample size 52 cooperatives using

simple random sampling technique. Path analysis

method used to explain the strength and direction of

the impact of some independent variables to one

dependent variable. Hypothesis test is done by using

t - test.

4 RESULTS AND DISCUSSION

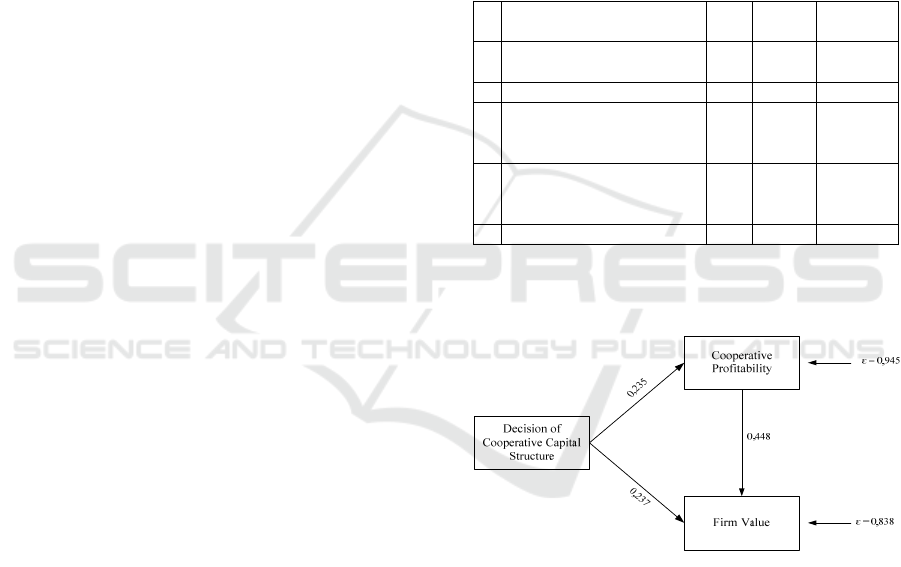

In accordance with the purpose of this study is to

examine the impact of decision of cooperative capital

structure on profitability and firm value, using path

analysis with the SPSS program version 20, summary

of analysis results can be presented in table 1 and

figure 3:

Table 1: Correlation coefficient.

No Description R

R Square

(%)

Significantly

1

Impact of Decision of Cooperative

Capital Structure on Profitability

0,235 5, 5 Significant

2 Impact of Profitability on Firm Value 0,448 20 Significant

3

Impact of Decision of Cooperative

Capital Structure on Firm Value

(Direct)

0,237 5,6 Significant

4

Impact of Decision of Cooperative

Capital Structure on Firm Value

Through P rofitability (Indirect)

0,324 10,53 Significant

5 Total Impact 16,13 Significant

Source: Path Analysis Results

The results of the analysis can be described in

figure 3:

Figure 3: The impact of decision of cooperative capital

structure on profitability and firm value.

Based on the table 1 and figure 3, result of this study

gradually can be explained as direct and indirect impacts.

4.1 Direct Impacts

4.1.1 Impact of Decision of Cooperative

Capital Structure on Profitability

Decision of cooperative capital structure as measured

by debt to asset ratio has an impact on profitability

measured by return on equity. The magnitude of

correlation coefficient (r) of 0.235 and significant, it

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

694

shows that decision of cooperative capital structure

that described by combination of debt capital and

equity capital, and usually the decision of capital

structure is emphasized on the acquisition of higher

debt capital sources, mean that the higher assets

financed by debt capital will impact on the return on

equity. In other words the return for the member

capital deposited in the cooperative will increase

when the cooperative is increasingly using debt

capital. Although the magnitude of the impact of

capital structure on profitability described by

determinant coefficient is only (r2) = 5.5%. This is in

accordance with previous theory which states that

decision of capital structure becomes leverage to

return on equity.

4.1.2 Impact of Profitability on Firm Value

In this study also examines the impact of profitability

as measured by return on equity on cooperative firm

value are measured by the ratio of permanent capital

to total equity capital. The permanent capital of the

cooperative consists of capital allowance and grants,

it means that cooperative capital which will basically

be in the cooperative during the cooperative are still

running. The result of analysis shows that there is

impact of profitability to cooperative firm value with

correlation coefficient (r) equal to 0,448 and have a

significant impact. It is indicates that increasing of

cooperative profitability will impact on the

development of permanent capital especially related

to the development of allowance capital, the reality in

the field shows that the higher the business surplus

obtained by the cooperative will have an impact on

the allowance of the business surplus used to cultivate

the allowance capital. The magnitude of the impact of

profitability on the cooperative firm value measured

by the determinant coefficient (r2) = 20.0%. It is

consistent with the results of previous research on

various types of business entities, means that theory

also applies to cooperative enterprises.

4.1.3 The Impact of Decision of Cooperative

Capital Structure on Firm Value

The impact of decision of cooperative capital

structure on cooperative firm value indicate that,

magnitude of correlation coefficient of the impact of

decision of cooperative capital structure on firm value

of r = 0.237, significant. This result indicates that

there will be an increase in the cooperative firm value

when the debt to assets ratio also increase, it means

that if the source of capital derived from the debt is

increased will have a positive impact on the increase

in the cooperative firm value is assessed by the ratio

of permanent capital to equity capital. The magnitude

of the impact of decision of cooperative capital

structure on cooperative firm value as measured by

the determinant coefficient (r2) = 5.6%. The results

of this study in line with previous studies which states

that one of the factors that impact cooperative firm

value is the decision of cooperative capital structure.

4.2 Indirect Impact of Decision of

Cooperative Capital Structure on

Firm Value through Profitability

The magnitude of indirect impact of decision of

cooperative capital structure on cooperative firm

value through profitability of correlation coefficient

(r) = 0.324, significant. This coefficient shows that

the impact of decision of cooperative capital structure

to the cooperative firm value through profitability has

a greater impact than the direct impact of decision of

cooperative capital structure on the cooperative firm

value of r = 0.237. It shows that the fact that has a

greater impact in determining the cooperative firm

value is profitability. It can be shown by the

magnitude of the impact of profitability on the

cooperative firm value with a correlation coefficient

(r) of 0.448, because the change in the cooperative

firm value described by the ratio of permanent capital

to equity is depend on the size of cooperative business

surplus, because some business surplus should be set

aside to foster capital allowance as one element of

cooperative permanent capital.

When combined with the direct impact of

decision of cooperative capital structure on firm value

and indirectly from the decision of cooperative capital

structure to firm value through profitability as

intervening variable then the overall magnitude of the

capital structure impact on cooperative firm value of

r2 = 16.13%.

5 CONCLUSIONS

Based on this study, we can draw some conclusions:

(1) Decision of cooperative capital structure as an

illustration of the size of the cooperative debt used to

finance the asset has a significant impact on

cooperative profitability, thus there is a leverage on

cooperative profitability; (2) Profitability has a

significant impact on cooperative firm value, thus the

development of the cooperative firm value influenced

by cooperative profitability; (3) The decision of

cooperative capital structure directly also impact on

the cooperative firm value, it shows that the larger

debt used to finance the assets of the cooperative will

have an impact on the cooperative firm value; (4) The

Decision of Cooperative Capital Structure, Profitability and Firm Value

695

decision of cooperative capital structure indirectly

impact on cooperative firm value through

profitability as intervening variables, it shows that

decision of cooperative capital structure impact on

firm value through profitability greater than direct

impact of decision of cooperative capital structure on

firm value; (5) Overall, it can be concluded that

decision of cooperative capital structure and

profitability become the determinant of increasing

cooperative firm value.

Based on the above conclusions, it can be

suggested that cooperatives should also be able to

utilize the source of capital derived from debt,

because the source of debt capital becomes leverage

to the profitability of the cooperative. The

cooperative profitability and firm value as an impact

of decision of cooperative capital structure should be

basis for financing management policy.

REFERENCES

Ariffin, R., 2003. Ekonomi Koperasi. Bandung: Ikopin.

Brigham E F, et al. 1999. Intermediate Financial

Management, Sixth Edition. Tokyo: The Dryden Press.

Cornet, and et al. 2012. Finance, Application & theory,

New York: Mc Graww Hill.

Cuong, N. T., et al. 2012. The Effect of Capital Structure

on Firm Value for Vietnam’s Seafood Processing

Enterprises, International Research Journal of Finance

and Economics ISSN 1450-2887 Issue 89 (2012).

Dewi, I. R., et al. 2014. Pengaruh Struktur Modal Terhadap

Nilai Perusahaan, Jurnal Administrasi Bisnis (JAB)

|Vol. 17.

Hanafi, M. M., 2005. Manajemen Keuangan. Yogyakarta:

BPFE UGM.

Hanel, A., 1988. Organisasi Koperasi, Pokok-pokok

Pikiran mengenai Organisasi Koperasi dan Kebijakan

Pengembangan di Negara-negara Berkembang.

Bandung: Universitas Padjadjaran.

LAWAL, A. I., 2014. Capital structure and the value of the

firm: evidence from the Nigeria banking industry. JAM

vol. 4, No 1.

Mahdaleta, E., et al. 2016. Effects of Capital Structure and

Profitability on Corporate Value with Company Size as

the Moderating Variable of Manufacturing Companies

Listed on Indonesia Stock Exchange. Academic Journal

of Economic Studies Vol. 2, No.3, September 2016, pp.

30–43 ISSN 2393-4913, ISSN On-line 2457-5836.

Masidonda, J. L., et al. 2013. Determinants of Capital

Structure and Impact Capital Structure on Firm Value.

IOSR Journal of Business and Management (IOSR-

JBM) e-ISSN: 2278-487X. Volume 7, Issue 3 (Jan. -

Feb. 2013), PP 23-30.

Ministry of Cooperative and SME’s of Indonesia. 2001.

Indonesia Act No.25/ 1992/ Cooperatives.

______________. 2016. Financial Report Cooperative

MOSCU, R. G., 2014. Capital Structure and Corporate

Performance of Romanian Listed Companies.

International Journal of Academic Research in

Accounting, Finance and Management Sciences Vol. 4,

No.1, pp. 287–292 E-ISSN: 2225-8329, P-ISSN: 2308-

0337.

Necib, R., et al. 2014. The Impact of Capital Structure and

Profitability on the Growth of Private Companies in

Algeria, International Journal Economics & Strategic

Management of Business Process 2nd International

Conference on Business, Economics, Marketing &

Management Research, Vol.4.

Pontoh, W., et al. 2013. Determinant Capital Structure and

Profitability Impact, Research Journal of Finance and

Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847

(Online) Vol.4, No.15, 2013.

Quang, D. X., et al. 2015. Measuring Impact of Capital

Structure on Financial Performance of Vietnamese

Soes. Innovative Journal of Business and Management

4:6 November – December (2015) 114 – 117.

Ropke, J., 2002. Entrepreneurship Training for

Cooperative Leader and Official, Training Material,

Jatinangor-Bandung.

Ross, S. A., et al. 2016. Fundamental of Corporate

Finance, second edition. New York: Mc Graw Hill

Education.

Salawu, R. O., et al. 2009. The Effect of Capital Structure

on Profitability: An Empirical Analysis of Listed Firms

in Nigeria, the International Journal of Business and

Finance Research, Volume 3 Number 2, 2009.

Salim, J., 2015. Pengaruh Leverage (Dar, Der, Dan Tier)

Terhadap Roe Perusahaan Properti Dan Real Estate

Yang Terdaftar Di Bursa Efek Indonesia Tahun 2010-

2014, Perbanas Review Volume 1.

Sugiyanto. 2007. Pengaruh Kompetensi dan Komitmen

Manajemen terhadap Kinerja Keuangan, Promosi

Ekonomi Anggota dan Perubahan Struktur Modal,

Manajemen Usahawan Indonesia, No 10/Th. XXXVI

Oktober 2007.

________. 2010. Indonesia Bangkit Untuk Kesejahteraan

Rakyat. Jatinangor: IKOPIN Press.

Siaw, P. W., 1999. Corporate Finance: Capital Structure

Decision, Working Paper, University of Illinois at

Urbana-Champaign, 1-28.

Sultan, A. S., et al. 2015. The Effect of Capital Structure on

Profitability: An Empirical Analysis of Listed Firms in

Iraq, European Journal of Accounting, Auditing and

Finance Research Vol.3, No.2, pp.61-78, December

2015.

Vătavu, S., 2015. The impact of capital structure on

financial performance in Romanian listed companies.

Procedia Economics and Finance 32 (2015) 1314 –

132.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

696