The Influence of Fundamental Factors on Stock Price

Research to Mining Companies Listed on The Indonesia Stock Exchange

Pamella Pamella, Yayat Supriyatna and Leni Yuliyanti

Fakultas Pendidikan Ekonomi dan Bisnis, Universitas Pendidikan Indonesia, Bandung, Indonesia

{pamellabungakasih, yatsuprh29, yuliyanti.leni)@gmail.com

Keywords: Fundamental Factors, Profitability, Liquidity, Leverage, Activity, Stock Price.

Abstract: This paper aims to prove the influence fundamental factors that consist of profitability, liquidity, leverage and

activity to towards the stock price at mining companies listed on Indonesia Stock Exchange in 2013-2015.

Profitability was measured by Return on Asset (ROA), liquidity was measured by Current Ratio (CR),

leverage was measured by Debt to Equity Ratio (DER) and activity was measured by Total Asset Turnover

(TATO). This research used descriptive study with verification method and documentation technique for

collecting data. This research also used secondary data which financial report and annual report from mining

companies in 2013-2015. The technique for collecting sample is based on purposive sampling to get 24

companies in three years from 2013 to 2015 with 72 observation data. The statistic analysis is used panel data

regression. The conclution of this research is in a simultaneously fundamental factors that consist of

profitability, liquidity, leverage and activity have a significant effect on stock price. In partially profitability

and activity has positive significant effect on stock price, liquidity hasn’t positive significant effect on stock

price and leverage has negative significant effect on stock price.

1 INTRODUCTION

Capital market is a means of obtaining the funds used

finance in investment with a mechanism for

collecting funds from public and circulate the funds

back into the productive sectors. Capital markets also

have an important role to national development and

especially for the development of business, as an

alternative source of external financing by the

company.

The alternative investments in the capital market

that has been chosen by the investors is a shares

because shares can give them big profits. According

to Hanafi (2012: 124), "Share is a proof of

ownership." Shares can be interpreted as a sign of

ownership an individual or business entity in an

enterprise, especially publicly traded companies who

trade shares on the capital market.

An investor must be understand about stock prices

and analysis of it first because the movement of stock

prices can’t be predicted certainty. The share of price

is value of a stock that reflects wealth of company and

the movement of stock prices will be directly

proportional with company performance.

During 2015, decrease in crude oil prices due to

slow energy demand from China as well as the supply

of oil from Saudi Arabia and Iran. The decline in

crude oil prices to the lowest level is the first time has

happened since the global financial crisis in 2008,

which then led to high inflation and soaring oil prices

accompanied by rising prices of subsidized fuel.

World oil prices are under pressure because of the

abundance of global oil supplies by the number

continues to increase.

If the decline in stock price the mining sector

allowed to continue, then will impact on the loss that

would be suffered by investors and the company,

because with this condition investors will assume that

the performance of mining companies has declined,

so investors will change his mind to invest and find

another company that can provide more benefits.

There are several approaches that can be used to

assess the price of a stock. Husnan (2009: 307) argues

that "To perform the analysis and stock picking, there

are two basic approaches, namely technical analysis

and fundamental analysis." Then Fischer and Jordan

(2005: 304) argues that "Fundamental factors are

factors that give information about the performance

of companies such as: the ability of management,

business prospects, the outlook for marketing and

other factors that influence such as socio-economic

540

Pamella, P., Supriyatna, Y. and Yuliyanti, L.

The Influence of Fundamental Factors on Stock Price - Research to Mining Companies Listed on The Indonesia Stock Exchange.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 540-548

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

conditions, political, security, government

regulations and policies. "

Thus we can conclude that the fundamental factor

used to analyze the information provided by the

company, and is directly related to the performance

of the company as well as provide an overview of

management achievements in terms of management

of the company. This study focuses on the micro

approach that approaches that analyze companies

based on financial ratio analysis.

Signalling theory emphasizes that the information

that have relevance to the company becoming a

necessity for investors and businessmen. One of

information that can help investors and businessmen

in the decision that the information contained in the

financial statements. Fundamental factors focuses on

key data in the financial statements to take into

account whether the stock price accurately been

appreciated or not.

Thus, the fundamental factor is one way to assess

the stock through the observation of various

indicators related to the economic conditions of a

company so this research will focus on the analysis of

companies using financial ratios as a measure of the

company's performance to be examined.

In this context, this paper aims to prove the

influence fundamental factors that consist of

profitability, liquidity, leverage and activity to

towards the stock price at mining companies listed on

Indonesia Stock Exchange in 2013-2015.

2 LITERATURE REVIEW

2.1 Stock

Fahmi (2012: 81) defines, "Stocks are paper proof of

ownership participation capital / funds at a company

that is clearly stated nominal value, and the company

name followed by clear rights and obligations to each

holder". Meanwhile, according Rusdin (2006: 68)

shares is "The certificate showing proof of ownership

of a company, and shareholders have the right to

claim or income from the assets of the company."

It can be concluded that the stocks are securities

that show ownership of the company so that

shareholders have the right to claim on dividends or

other distributions by the company to its

shareholders.

2.2 Stock Price

Hartono (2010: 8) defines, "The share price is the

price that occurred in the stock market at the

appropriate time determined by the behavior of the

market and is also determined by demand and supply

of the relevant shares in the capital market". While

Rusdin (2006: 73) defines that, "The stock price is the

price of a stock when the market is in progress."

It can be concluded that the share price is the price

of a stock that occurred in the capital market and is

determined by the demand and the offer. Then the

stock price becomes a sign of a person or entity

ownership in a company.

2.3 Factors Affecting on the Stock

Price

Arifin (2007: 116) states that the fluctuating factors

on stock prices, namely:

Fundamental conditions Issuer

Law of Demand and Supply

Interest Rate (SBI)

Foreign exchange

Foreign Funds in Stock

Stock Price Index (CSPI)

News and Rumors

While Fahmi and Lavianti (2009: 72) states that

there are some conditions and situations that can

result in fluctuating stocks, namely:

Micro and macro economic conditions

The company's policy in deciding to expand

(expansion)

Substitution of directors suddenly

Their directors or commissioners of the

companies involved in a crime and the case has

been entered into the court

A company's performance is steadily declining

in every time

Systematic risk, which is a form of risk that

occurs as a whole and has contributed to the

company involved

The effect of market psychology has reduced the

share purchase technical conditions

It can be concluded that an investor must be able

to read the situation and market conditions so that

investment activities can be run well then investors

should be able to anticipate the various possibilities

that occur to observe the situation and the market

conditions.

2.4 Fundamental Analysis

Husnan (2009: 315) states that "The fundamental

analysis tries to predict stock prices in the future by

estimating the value of the fundamental factors that

affect stock prices and establish the relationship of

these variables in order to obtain the estimated price

The Influence of Fundamental Factors on Stock Price - Research to Mining Companies Listed on The Indonesia Stock Exchange

541

of the stock." While Liembono (2015: 1) states

"basically, fundamental analysis aims to look at the

performance of a company and assess whether the

price of its shares on the stock exchange in

accordance with the fundamental financial condition

of the company. In fundamental analysis of a

company, which is seen is the company's financial

statements. "

Therefore through fundamental analysis, the

expected potential investors will know how the

company's operations one through the financial

statements of the company for the value of a stock is

strongly influenced by the performance of the

company concerned.

Husnan and Pudjiastuti (2006: 137), states

"Stages in conducting fundamental analysis consists

of (1) calculate the macroeconomic conditions or the

overall market conditions, (2) calculate the overall

industry conditions, and (3) calculate the specific

conditions of the company."

Therefore, fundamental analysis is an analytical

study of the economic, industrial and condition of the

company. Then fundamental analysis is oriented key

data in the financial report and closely related to the

company's financial condition is described through

the company's financial performance.

Hery (2015: 166) states that the types of financial

ratios commonly used to assess the financial

condition and performance of the company, among

others:

2.4.1 Liquidity Ratio

This ratio describes the company's ability to meet its

short term obligations immediately due. One

indicator that can be used to measure the liquidity is

the Current Ratio (CR).

2.4.2 Leverage Ratio

This ratio describes the company's ability to meet all

obligations. One indicator that can be used to measure

the leverage is Debt to Equity Ratio (DER).

2.4.3 Activity Ratio

This ratio is used to measure the efficiency of the

utilization of the resources owned by the company, or

to assess the company's ability to run the company's

daily activities. One indicator that can be used to

measure the activity is the Total Asset Turnover

(TATO).

2.4.4 Profitability Ratio

This ratio describes the company's ability to generate

profits. One indicator that can be used to measure

profitability is Return on Assets (ROA).

3 METHODS

The research design used in this research is

descriptive and verification. Descriptive method used

in this study to describe and explain an overview of

the fundamental factors that consisted of profitability,

liquidity, leverage and activity in the mining sector

companies listed on the Stock Exchange in 2013-

2015. While the verification method used in this study

to test the effect of the fundamental factors that

consisted of profitability, liquidity, leverage and

activity to the stock price on mining companies listed

on the Stock Exchange in 2013-2015.

The independent variable of this research is a

fundamental factor consisting of profitability,

liquidity, leverage and activity. While the dependent

variable is the stock price. The population in this

research that mining companies listed on the Stock

Exchange in 2013-2015. The population in this study

is the mining sector companies listed on the Indonesia

Stock Exchange and companies engaged in the

mining sector amounted to 44 companies. Sampling

technique used is purposive sampling with certain

criteria in order to take a sample of 24 companies as

follows.

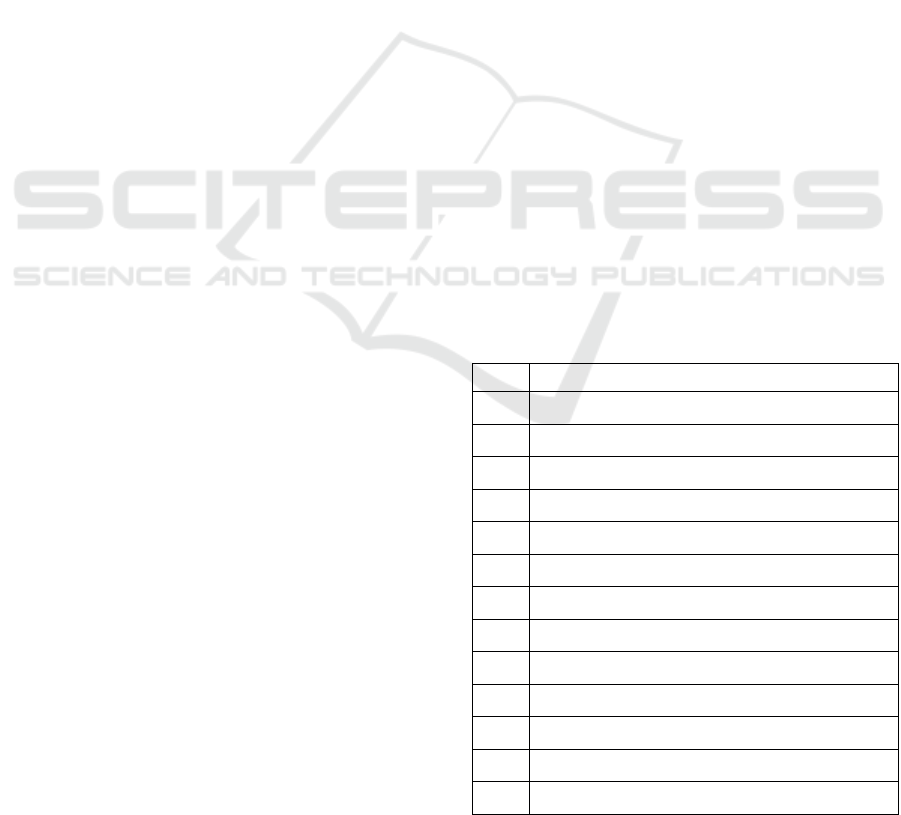

Table 1: Sample company.

No.

Company name

1

PT. Adaro Energy Tbk

2

PT. Atlas Resources Tbk

3

PT. ATPK Resources, Tbk

4

PT. Baramulti Suksessarana, Tbk

5

PT. Golden Energy Mines Tbk

6

PT. Harum Energy Tbk

7

PT. Resource Alam Indonesia Tbk

8

PT. Samindo Resources, Tbk

9

PT. Perdana Karya Perkasa Tbk

10

PT. Petrosea Tbk

11

PT. Toba Bara Sejahtera Tbk

12

PT. Ratu Prabu Energy Tbk

13

PT. Benakat Petroleum Energy Tbk

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

542

14

PT. Elnusa Tbk

15

PT. Surya Esa Perkasa Tbk

16

PT. Medco Energi Internasional, Tbk

17

PT. Interinsco Radiant Utama Tbk

18

PT. Aneka Tambang (Persero), Tbk

19

PT. Cita Mineral Investindo, Tbk

20

PT. Vale Indonesia Tbk

21

PT. J Asia Pacific Resources, Tbk

22

PT. SMR Utama Tbk

23

PT. Timah (Persero) Tbk

24

PT. Mitra Investindo, Tbk

Research will be conducted on 24 samples of the

company's financial statements for the three-year

study period, namely from the years 2013-2015 so

that the data observed in this study amounted to 72

data.

3.1 Classic Assumption Test

Before performing regression tests, performed first

classical assumption. For a multiple regression

analysis of the assumptions used are as follows:

JB value calculated at 27.57 while Chi Square

with df = 5, then df = 67 at α = 5% is 87.11.

Normal distribution of data.

The correlation coefficient between independent

variables never be more than 0.8. There is no

problem of multicollinearity.

The value of t-statistic and probability value was

not significant (greater than 0.05). No problem

heteroskedastisitas

Durbin-Watson value of 2.1923, which means

1.7366 <2.1923 <(4-1.5029) or 1.7366 <2.1923

<2.4971. There is no autocorrelation.

3.2 Panel Data Regression Models

Based on the operationalization of the variables

mentioned above, the variable X1 is profitability, X2

is liquidity, X3 is leverage, variable X4 is activity and

Y is the stock price. Regression analysis will give you

an idea how much value if the stock price of

profitability, liquidity, leverage and activity change

(increase or decrease).

General panel data regression equation is as

follows:

Yit = β0 + β1Xit + β2Xit + β3Xit + β4Xit + eit

The formulation of the panel data regression in

this study are as follows:

HSit = β0 + β1ROAit + β2CRit + β3DERit + β4TATOit + eit

3.3 Panel Data Estimation Techniques

According Rohmana (2013: 232) panel data

estimation techniques can use models with PLS

model (common effect), the fixed effect model,

random effect models. The discussion of test that will

be used to obtain the right model in estimating panel

data regression is as follows:

3.3.1 Significance Tests Fixed Effect through

the F test statistics

The formulation of the hypothesis in statistical F test

is expressed as follows:

H

0

: Follow the model of OLS

Ha : Follow the model Fixed Effect

The criteria for acceptance and rejection as

follows:

If the p-value> 5% then H0 is accepted.

If the p-value ≤ 5% then H0 is rejected.

3.3.2 Significance Tests Random Effect

through Lagrange Multiplier test (LM

test)

The hypothesis is as follows:

H

0

: Model follow Random

Ha : Model follow OLS

The criteria for acceptance and rejection as

follows:

If the value of LM statistic is greater than the

value of chi-square Statistically, the null

hypothesis is rejected.

If the value of LM statistics> critical value of

chi squares then rejected and accepted.

3.3.3 Significance Tests Fixed Effect or

Random Effect through Hausman Test

With the acceptance criteria as follows:

If the value of the Hausman statistic is greater

than the critical value then the right model is

the fixed effect model.

The Influence of Fundamental Factors on Stock Price - Research to Mining Companies Listed on The Indonesia Stock Exchange

543

Conversely, if the value of the Hausman

statistic is less than the critical value then the

right model is a model Random Effect.

3.4 Regression Coefficients

Simultaneous Test (Test F)

The statistical test F basically indicates whether all

the independent variables included in the model have

jointly influence on the dependent variable /

dependent. By hypothesis as follows.

H0 : Vsimultaneous independent variable no

effect on the dependent variable

Ha : V independent variable simultaneously

affect the dependent variable

Testing criteria:

If the value of F count> F table, then H0

rejected and H1 accepted.

If the value of F ≤ F table, then H0 and H1

rejected.

3.5 Partial Regression Coefficient Test

(T Test)

Significance test of regression coefficients basically

shows how far the influence of the explanatory

variables / independent individual variation in the

dependent variable explained by assuming other

independent variables remain valuable. The

formulation of a hypothesis is as follows.

3.5.1 Profitability (X1)

H0 : profitability is not a positive influence

on stock prices

Ha: profitability has a positive effect on

stock prices

3.5.2 Liquidity (X2)

H0 : Liquidity is not a positive effect on stock

prices

Ha: liquidity has a positive effect on stock

prices

3.5.3 Leverage (X3)

H0 : leverage no negative effect on stock

prices

Ha: leverage negatively affect the stock

price

3.5.4 Activities (X4)

H0 : No activity has a positive effect on stock

prices

Ha: activity has a positive effect on stock

prices

With the following criteria.

If t

count

≤ t

table

value, then

H

0

Ha accepted and

rejected

If the value of t> t table value, then

H

0

rejected and Ha accepted

4 RESULTS AND DISCUSSION

4.1 Profitability

Profitability indicators Return on Assets shows that

the return on assets of any company listed mining

sector in the Stock Exchange in 2013-2015 has a

value that fluctuates and tends to decline.

Companies with the average value of the highest

ROA from 2013 to 2015, namely PT Resource Alam

Indonesia Tbk with an average value of ROA of 0.16

or 16%. This means that any use of the assets of PT

Resource Alam Indonesia Tbk amounting to Rp 1.-

can generate a profit of USD 18.- for the company.

Although the value of its profitability remains below

the industry standard of 40%, the profitability of PT

Resource Alam Indonesia Tbk is higher when

compared with other mining companies. This is due

to the average performance of PT Resource Alam

Indonesia Tbk in generating profits from the use of

the entire assets of the company is greater when

compared with other companies and the management

of PT Resource Alam Indonesia Tbk able to maintain

commodity prices amid oversupply of coal on the

market and the weakening of growth global economy.

While companies with the average value of the

lowest ROA from 2013 till 2015, namely PT SMR

Utama Tbk and PT Bayan Resources Tbk with an

average value of ROA of -0.10 or -10%. This is

because PT SMR Utama Tbk suffered losses in the

year 2013 to 2014 and PT Bayan Resources, also

suffered losses from 2014 to 2015 so that the value of

ROA for both companies is negative. The losses

caused by PT SMR Utama Tbk and PT Bayan

Resources Tbk is not able to maintain the price of

commodities in the market and are not able to

compete with other mining companies.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

544

4.2 Liquidity

Liquidity as measured by the Current Ratio Current

Ratio indicates that the value of any mining company

listed on the Stock Exchange in 2013-2015 has a

value that fluctuates and tends to decline.

Companies with the average value of the highest

CR from 2013 to 2015, PT SMR Utama Tbk with an

average value CR of 5.42 or 542%. This means that

every USD 1.- current liabilities the company is able

to be guaranteed by current assets of Rp 5,42.- This

shows that during 2013 to 2015 the company has a

number of assets are more likely to pay all debts of

the company that is due soon. The Company was able

to maintain its liquidity amid the global economic

slowdown has been to create cash.

While companies with the average value of the

lowest CR from 2013 till 2015, namely PT Atlas

Resources Tbk with an average value CR of 0.32 or

32%. It proves that the management of PT Atlas

Resources Tbk has a problem in liquidation due to the

company's inability to pay a debt that must be met

with current assets owned by the company.

4.3 Leverage

Leverage as measured by Debt to Equity Ratio

indicates that the value of Debt to Equity Ratio of

each mining company listed on the Stock Exchange

in 2013-2015 has a value that fluctuates and tends to

rise.

Companies with an average value of DER highest

from 2013 to 2015, PT Radiant Utama Tbk Interinsco

with an average value of DER of 2.65 or 265%. It

shows that during 2013 to 2015 the company's

management use more debt than capital to fund its

operations.

While companies with the average value of the

lowest DER from 2013 till 2015, namely PT Harum

Energy Tbk and PT Golden Energy Mines Tbk with

an average value of DER of 0.27 or 27%. It proves

that the management company can manage its

operations with the use of debt are few and tend to

rely on the company's capital.

4.4 Activity

Activity as measured by the Total Asset Turnover

indicates that the value of Total Asset Turnover from

any mining company listed on the Stock Exchange in

2013-2015 has a value that fluctuates and tends to

decline.

Companies with the average value of the highest

TATO from 2013 to 2015, PT Resources Alam

Indonesia Tbk with an average value of 1.75 TATO,

or 175%, but average values are still below the

average for the industry standard for asset turnover ie

2 or 200%. While companies with the average value

of the lowest TATO from 2013 till 2015, namely PT

SMR Utama Tbk with an average value TATO of

0.01 or 1%.

4.5 Stock Price

The average stock price the mining sector with the

indicator closing price during the 3 years from 2013

to 2015 amounted to USD 945.- per share. From the

theory outlined above, the ideal stock price is the

stock price above the average value of the company.

When compared to the average price of the company

shares the mining sector amounted to Rp 945.- per

share then only 46% of mining companies whose

share price is above average. The remaining 54% of

mining companies were below the average during the

3 years of the study period.

Companies with an average stock price highs

from 2013 to 2015, namely PT Vale Indonesia Tbk

with an average value of Rp 2.637.- per share. This

proves that the management of PT Vale Indonesia

Tbk is able to manage the operations of the company

in generating higher revenues. High stock price also

reflects the good performance of the company. While

the average share price lows from 2013 to 2015

experienced by PT Perdana Karya Perkasa Tbk with

an average value of US $ 75.- per share. This shows

the poor condition of the company's performance

because the company is not able to manage the

operations of the company with good use to generate

income.

4.6 Regression Coefficients

Simultaneous Test (Test F)

This study used panel data, which combines cross-

section data and time-series data. From the research

procedures for panel data showed that the better this

study using Random Effect models.

From the hypothesis testing using a panel data

regression models with the help of Eviews Random

Effect 9 shows that Fhitung> Ftable is 3.0976> 2.35,

so H0 is rejected and H1 accepted. It showsthat the

fundamental factor consisting of profitability,

liquidity, leverage and activity simultaneously affect

the stock price,

The Influence of Fundamental Factors on Stock Price - Research to Mining Companies Listed on The Indonesia Stock Exchange

545

The regression model that applies is HS = 57.3810

+ 36.8607 + 14.8978 ROA CR - DER + 16.5038

34.4267 TATO. Where ROA, CR and TATO has a

positive influence on the share price, while the DER

has a negative effect on stock prices. with

constant(β

0

) Amounted to 57.3810 implies that if

profitability (X1it), liquidity (X2it), leverage (X3it)

and activity (X4it) has a value of 0 (zero), then the

company's stock price (YIT) would be worth

57.3810. Regression coefficient of 36.8067 means

that any increase in ROA amounted to 100%

(assuming other variables constant) it will raise the

price of shares amounted to 3680.67. Regression

coefficient of 14.8978 meaning that each increase of

100% CR (assuming other variables constant) it will

raise the price of shares amounted to 1489.78. -

34.4267 regression coefficient means that any

increase in DER 100% (assuming other variables

constant) will lower the share price of 3442.67.

Regression coefficient of 16.5038 meaning that each

increase of 100% TATTOO (assuming other

variables constant) it will raise the price of shares

amounted to 1650.38.

4.7 Profitability Influence on the Stock

Market

Results of testing the partial regression

coefficients through t test stated that profitability

indicators of return on assets (ROA) has a positive

effect on stock prices with a value of 2,881 t statistic.

This means that whenever there is an increase

profitability will increase stock prices and reverse any

decline in profitability then the stock price will

decline. Thus the results of research on the

profitability variable according to the initial

hypothesis, and in line with the theory that the

number of profits from the company is one of the

factors that affect stock prices.

Impairment ROA on mining companies led to a

decline in stock prices. The company could not

achieve a good profit in every year because it is

influenced by global economic conditions are

slowing economic growth in China, which have an

impact on the number of commodity supply so that

the average selling price of the commodity in

Indonesia decreased. The low profitability of the

company gives a bad signal (bad news) to investors

because investors can estimate how many of the gains

in the future. Declining profitability also reflects the

company's performance conditions are unstable and

make investors hesitate to invest so investors tend to

withdraw their funds and invest in the company of

other more promising sectors.

This shows that the market reacted to the

company's profitability information mining sector.

The statistical results meant that profitability

information proxied through ROA published in the

financial statements sufficiently informative to

investors in estimating the expected profit. The

results of this research was supported by the results of

research and Asteriou Dimitropulos (2009) which

states that the profitability indicators ROA positive

effect on the company's stock price.

4.8 Liquidity Influence on the Stock

Market

Results of testing the partial regression

coefficients through t test states that there is a positive

effect on the liquidity of the stock price with the value

t statistic of 1.6486. This is because the level of

liquidity of a company into consideration for creditors

in granting the loan funds to the company.

Rejection of this hypothesis is that because many

companies that have low liquidity value. Based on

Table 4.5 shows that there are 58% of the company

decreased liquidity due to the number of the

company's current liabilities greater than the amount

of current assets. The high current debts of companies

do not always indicate poor performance because it

can show the confidence gained from the company's

creditors in making an investment. When companies

are not able to settle all current liabilities, the

company will lose the confidence of creditors and the

opportunity to expand the business gets smaller.

Low liquidity makes companies have to face the

cost of scarcity (Shortage cost). The low liquidity

makes the level of receivables is low. Whereas for

creditors, lack of liquidity will lead to delays in

obtaining payment for interest and principal, or even

lose both. The low liquidity mining companies does

not affect the investor because the investor only see

the business activities of the company without seeing

its liquidity. In this study the variables CR liquidity

indicators are not taken into consideration for

investors in investing in the company so that the

results of this study are supported by the results of

research Ozlen (2014) which states that the liquidity

indicators CR has no effect on stock prices.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

546

4.9 Leverage Influence on the Stock

Market

Results of testing the partial regression

coefficients through t test states that leverage using

indicators of debt to equity ratio (DER) negatively

affect the stock price with the value of t statistic of -

2.2332. These results indicate that if leverage

increases, the share price will decline. Conversely,

when leverage decreases, it will increase the

company's stock price so the leverage has a negative

correlation to the stock price. Thus the results of

research on leverage variable according to the initial

hypothesis, and in line with the theory that companies

that use excessive debt can result in a decrease in the

value of the company and adversely affects the

company's stock price.

Increasing the value of DER in the mining sector

companies led to a decline in stock prices. This is

because the use of debt in a larger amount of capital

owned by perusahhaan will cause interest expense.

The greater the debt owned by the company, the

greater the interest burden borne by companies that

profit resulting company would be small. This

resulted in reduced interest of investors to invest in

the company so that the company will be a shortage

of funds and lead to lower stock prices in the capital

market. Investors tend to prefer a low-level DER due

to low risks to be borne. If a company DER higher

then the company's stock price will be low because

when the company makes a profit, the company uses

the profits to pay down debt rather than distribute

profits.

Thus DER variables in this study are highly used

by the investor as consideration for investing so that

the results of this study are supported by the results of

research Pandansari (2012) which stated that the

leverage with DER indicators negatively affect the

stock price.

4.10 Influence Activities on the Stock

Market

Results of testing the partial regression

coefficients through t test states that the activities

using the indicators of total asset turnover (TATO)

positive effect on the stock price with the value of t

statistic of 1.6881. These results indicate the extent to

which assets the company has used in the activities of

the company and also shows how many times the

operating assets spins in a certain period. The higher

the activity of a company, the better for the company's

assets can be used effectively in order to create a sale

so that the profits that will be generated is also high,

then the better financial performance and impact on

the company's stock price increases. Conversely,

when the value of the low corporate activity will show

less optimal management of the company in the use

of assets to generate sales. This makes the company's

financial performance is bad and decrease the price of

shares in the capital market.

Thus the results of research on variable activity

according to the initial hypothesis, and in line with the

theory that the low value of the activity reflects that

the company has not been effective in managing their

assets. Impairment TATO on mining companies led

to a decline in stock prices. This is because the total

asset turnover as measured by sales volume is not

necessarily able to increase profits because there are

some of the profits are used to pay the company's

debt. The results are consistent with the results of

research and Oetomo Suwahyono (2006) which states

that the activity of the indicator TATO positive effect

on stock prices.

5 CONCLUSIONS

Based on the results of the discussion and the research

that has been done it can be concluded as follows:

Overview fundamentals consist of profitability by

using indicators Return on Assets (ROA) in the

mining sector companies listed on the Indonesian

Stock Exchange has continued to decline each year

with an average value of 0.05 or 5%, overview

fundamentals consist of liquidity by using indicators

Current Ratio (CR) in the mining sector companies

listed on the Indonesian Stock Exchange has

continued to decline each year with an average value

of 1.97 or 197%, overview of the fundamental factors

consisting of leverage by using indicators Debt to

Equity Ratio (DER) on mining companies listed on

the Indonesia Stock Exchange showing an upward

trend every year with an average value of 1.01 or

101%, overview of the fundamental factors that

consists of activities by using indicators Total Asset

Turnover (TATO) on mining companies listed on the

Indonesian Stock Exchange has continued to decline

each year with an average value of 0.69 or 69%,

illustration stock price as seen from the annual

closing price on mining companies listed on the

Indonesian Stock Exchange has continued to decline

each year with an average value of USD 945.- per

share, simultaneously fundamentals consist of

profitability, liquidity, leverage and activity influence

the stock price on mining companies listed on the

Indonesia Stock Exchange, fundamental factors

The Influence of Fundamental Factors on Stock Price - Research to Mining Companies Listed on The Indonesia Stock Exchange

547

consisted of profitability positive effect on the stock

price on mining companies listed on the Indonesia

Stock Exchange, fundamentals consist of liquidity no

positive effect on the stock price on mining

companies listed on the Indonesia Stock Exchange,

fundamental factors consisting of leverage negatively

affect the stock price on mining companies listed on

the Indonesia Stock Exchange. Fundamental factors

that consists of activity has a positive effect on stock

prices in the mining sector companies listed on the

Indonesia Stock Exchange.

REFERENCES

Arifin, A., 2007. Shares reading. Yogyakarta: Andi Offset

Dimitropoulos, P.E. and Asteriou, D., 2009. The Value

Relevance of Financial Statements and Their Impact on

Stock Prices: Evidence from Greece. Managerial

Auditing Journal 24: 248-265

Fahmi, I. and Lavianti, Y.H., 2009. Portfolio Theory and

Investment Analysis. Bandung: Alfabeta

Fahmi, I., 2012. Financial Statement Analysis. (Mold-2).

Bandung: Alfabeta

Fischer, D.E. and Jordan, D.J., 2005. Business Essential.

New Jersey: Prentice Hall

Hanafi, M.M., 2012. Fundamentals of Financial

Management. Jakarta: Balai Pustaka

Hartono, J., 2010. Portfolio Theory and Investment

Analysis (7th Edition). Yogyakarta: BPFE

Hery, 2015. Financial Statement Analysis. Yogyakarta:

CAPS

Husnan, S. and Pudjiastuti, E., 2006. Basics of Financial

Management (5th Edition). Yogyakarta: UPP STIM

YKPN

Husnan, S., 2009. Fundamentals of Securities Portfolio

Theory and Analysis (4th Edition). Yogyakarta: UPP

STIM YKPN

Liembono, R.H., 2015. Fundamental Analysis. Jakarta:

Brilliant

Ozlen, S., 2014. The Effect of Company Fundamentals on

Stock Values. European Researcher. International

Multidisciplinary Journal 71 No. 3-2

Pandansari, F.A., 2012. Fundamental Factor Analysis on

the Stock Market. Journal of Accounting 1 (1)

Rohmana, Y., 2013. Eviews Econometrics Theory and

Applications. Bandung: Laboratory of Economic and

Cooperative

Rusdin, 2006. Capital market. Bandung: Alfabeta

Suwahyono, R. and Oetomo, H.W., 2006. Analysis of

Effect of Several Variables Fundamentals of Corporate

Finance Share Price Telecommunications Companies

Listed on the Jakarta Stock Exchange. Equity Journal

10.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

548