Influence of Interest Rate of Commercial Conventional Banks and

Levels for Results on the Impact of the Number of Deposits in

Sharia Banks of 2010-2015

Meta Arief, Asep Kurniawan and F.M. Nugraha

Universitas Pendidikan Indonesia

Keywords: Interest Rate, Profit Sharing Rate and Mudharabah Deposit.

Abstract: This study aims to determine the effect of conventional bank interest rates and the level of profit sharing on

the increase in the number of deposits in Sharia Commercial Banks. The research method used is descriptive

analytic and verifikatif. Data collection technique used is documentation method. This study uses secondary

data collected from the website of financial statements and annual reports of sharia banking that started from

2010-2015. The sampling technique is based on purposive sampling so that the sample of 11 sharia banks is

obtained. Hypothesis testing in this study used multiple linear regression analysis using EViews computer

pro-gram. The results showed that simultaneously conventional commercial bank interest rates and profit

sharing rates significantly influence the increase in the number of deposits in Sharia Commercial Banks.

Partially, the significant interest rate has a negative effect on the amount of deposits in the Sharia Commercial

Bank and the significant profit sharing rate has a positive effect on the amount of deposits in the Sharia

Commercial.

1 INTRODUCTION

Banks in Indonesia use dual system banking, namely

conventional and syariah systems. Currently

registered in January 2016 there are 34 units, namely

12 sharia commercial banks and 22 units of sharia

business. Meanwhile, the number of syariah-based

lending banks increased to 164 units (Sharia Banking

Statistics, January 2016). Sharia banking began to be

known in 1992 after the enactment of Law No.7 of

1992 which enables sharia banking to run its

operational activities based on the principle of profit

sharing. Fundamental be-tween sharia and

conventional banks lies in the principles in

operational activities. Husni (2009) said that "one of

the principles in sharia banking operations is profit

and loss sharing, this principle does not apply in

conventional banking that implements the interest

system." The existence of such operational

differences makes people in Indonesia can choose to

invest in both types of banking, namely sharia or

convention. The rational society of society that

determines choice based on profit not based on

religious beliefs, will certainly determine & nbsp;

Option based on the level of profit offered by both

types of banking. Society invests to improve its

welfare and one of human nature who always wants

to secure his property. One of the investment

instruments that can be done by the public is by

depositing funds in banking fundraising products. On

the one hand, one of the main interests of the bank is

to collect public funds. The new bank can operate if

the funds al-ready exist. One source of bank funds is

Third Party Fund (DPK). DPK is funds in rupiah or

foreign currency owned by a third party (the public)

consisting of demand deposits, savings and time

deposits or deposits. In addition to raising public

funds, banks should be able to return the funds along

with the return or return in accordance with the

agreement. In the banking world there is often a

competition to gain customer trust in order to keep the

funds in the Bank concerned. Competition between

these banks can occur between Banks adhering to the

Sharia system with Conventional Bank due to the

existence of floating market segment. This Customer

may make withdrawal of funds or placement of funds

from one Bank to another Bank causing a decrease or

increase of DPK in the Bank. Floating market

Arief, M., Kurniawan, A. and Nugraha, F.

Influence of Interest Rate of Commercial Conventional Banks and Levels for Results on the Impact of the Number of Deposits in Sharia Banks of 2010-2015.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 441-446

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

441

segment, has more characteristic shows the financial

benefit aspect compared with the aspect of sharia. The

existence of the floating market segment triggered the

Bank Syariah to provide services and benefits as

optimal as possible so that the community of money

owners interested to save funds in the bank concerned

DPK is used as one of the factors that can be used to

assess the Bank's success rate. There are several

parties related to the large number of DPK in the

Sharia Bank, the bank itself, the management and the

bank as a company. The Bank expects the increasing

DPK, to maximize funding and financing, the

management is concerned with the size of DPK in

relation to the assessment of managerial performance,

while the bank as a company expects high DPK for

the optimization of corporate profits. The following

is comparative data on the composition of

Conventional Commercial Banks' Deposits (BUK)

and Sharia (BUS) Commercial Banks in 2006-2015.

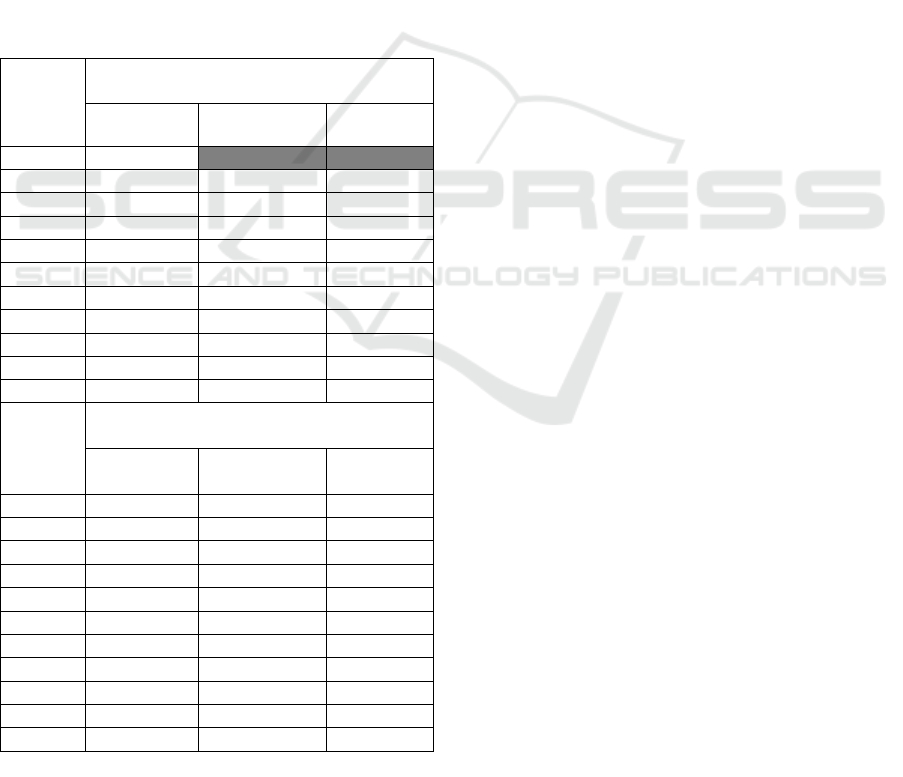

Table 1: Comparison of DPK BUK and BUS composition.

Years

Composition of DPK of Sharia

(billion rupiah)

Total DPK

Total Growth

of DPK

(%)

2006

20.708

2007

28.001

7.293

35,22%

2008

36.852

8.851

31,61%

2009

52.271

15.419

41,84%

2010

76.036

23.765

45,46%

2011

115.415

39.379

51,79%

2012

147.512

32.097

27,81%

2013

183.535

36.023

24,42%

2014

217.922

34.387

18,74%

2015

231.175

13.253

6,08%

Average

110.942,7

21.046,7

31,44%

Years

Composition of Conventional Commercial

Bank DPK (billion Rupiah)

Total DPK

Total Growth

of DPK

(%)

2006

1.287.102

2007

1.510.833

223.731

17,38%

2008

1.753.291

242.458

16,05%

2009

1.950.712

197.421

11,26%

2010

2.338.823

388.111

19,90%

2011

2.784.912

446.089

19,07%

2012

3.225.198

440.286

15,81%

2013

3.663.978

438.780

13,60%

2014

4.114.423

450.445

12,29%

2015

4.413.056

298.633

7,26%

Average

2.704.232,8

312.595,4

14,74%

Source: Indonesian Banking Statistics.

From the above table it can be seen that in terms

of total accounts both in sharia and conventional

banking continues to increase, but the percentage of

growth conditions total account of the year 2006-

2011 for the conventional bank looks volatile. while

the islamic banking showed relatively increased, but

in the last four years there was a decrease in total

growth of both conventional banking accounts and

sharia banking. Where the portion of the decline in

total growth of islamic banking accounts is greater

than conventional banking. The lowest decrease of

sharia banking occurred in 2015, which dropped to

6.08%, in the previous year was at 18.74%, ie

decreased by 12.66%, even in 2015 the decline in the

number of islamic banking DPK is under the banking

conventional in the figure of 7.26%. This is certainly

a problem that needs to be resolved. The DPK

function is vital in banking, the increase in deposits

will encourage the development of sharia banks, so

that banking management continues to strive to

increase the DPK (Piliyanti, 2014). There are some

impacts if the bank decreases the number of depositor

funds. the decline in the number of deposits allows

the public's trust in the bank to decline. According to

Hasibuan (2007: 71) "confidence means savers

believe that the money and interest on his savings can

be withdrawn from the bank in accordance with the

agreement." In addition, the decreasing dpk will

disrupt credit activities and bank operations are

disrupted so that banks are no longer rendebel. based

on the composition of deposits, the portion of deposits

always occupy the most amount of funds raised by

banks. Thus, deposits have a substantial share in

increasing or decreasing deposits. judging from the

type of fund raising facility offered by the bank, the

deposit includes an investment account, which is an

investment vehicle located in the bank. There are

several factors affecting dpk. according to husnan

(2006: 29) that customers who act as investors in the

bank will consider the level of risk and expected

profit levels of investment instruments. Based on

research conducted by nelwani (2013), there are

several factors that influence the deposit in sharia

commercial bank (bus), namely: inflation rate,

interest rate, promotion fee, office network amount,

profit sharing rate and rupiah exchange

rate.preferences, symbols and units.

Based on Adiwarman Karim and Adi Zakaria

Affif from Karim Business Consulting, the seg-

mentation of sharia banking customers in Indone-sia

is divided into three segments, namely shariah

loyalist, floating market and conventional loyalist

market. The floating market segment will keep its

money in the bank more due to economic ra-tionale

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

442

such as profit rate and quality of service offered. As

stated by Karim (in Nurlaeli, 2007) This market

segment will transact with the Sharia Bank if the

Sharia Bank provides the same mini-mum profit

service or more as compared to the Conventional

Bank. Vice versa with Convention-al Banking,

savings interest rate is an important variable to attract

debtor customers. The public interest in saving is

influenced by the interest rate. If interest rates

increase, allowing people who have already adopted

a Sharia Bank to move im-mediately to a

Conventional Bank. Based on the above description

can be concluded that one of the main differences

between conventional and syariah is the interest rate

in conventional banking and profit sharing in sharia

banking to describe the rate of return given to both

types of banks. In-terest rate movements and profit

sharing rates will attract rational customers to deposit

or withdraw funds at the Bank.

2 LITERATURE REVIEW

Bank Syariah Deposits Syariah deposits are de-posits

that are based on sharia principles (Karim, 2008:

303). The National Sharia Council of the MUI has

issued a fatwa stating that a justified de-posit is a

deposit based on mudaraba principles. Mudharabah is

a profit sharing agreement between the owner of the

fund (shahibul maal) that provides 100% capital to

the fund manager, in this case is the Bank that acts as

the fund manager (mudharib). This product is

intended as an investment tool for customers. Interest

Rate According to Kasmir, (2012: 133) Bank interest

can be interpreted as a fraction of the services

provided by the bank based on conventional

principles to customers who buy or sell their products.

Bank interest in this case can be interpreted as the

price to be paid bank to customers who have deposits.

The interest rate here is peroxide as an alternative

choice for floating market customers who save their

funds in sharia banking. Profit Sharing Rate the

profit-sharing agreement in principle, is a transaction

that seeks an added value of a cooperation between

parties in producing goods and services (Ascarya,

2008: 214). According to Agustianto (2013: 56),

profit sharing is a profit or a result obtained from the

management of both investment funds and buying

and selling transactions provided to customers. In

simple terms, profit sharing is the return or profit that

will be obtained by the parties who contribute to

provide funds for business activities.

3 METHODS

The method used is descriptive analytic and

verification methods. The independent variables of

this research are conventional bank interest rate and

profit sharing rate. Dependent variable of de-posit

amount in sharia commercial bank. The population in

this study is all Sharia Commercial Banks in

Indonesia. In sampling, the technique used is

Purposive Sampling, so that obtained 11 Sharia

Commercial Banks used in this study during the

period 2010-2015, i.e. six years.

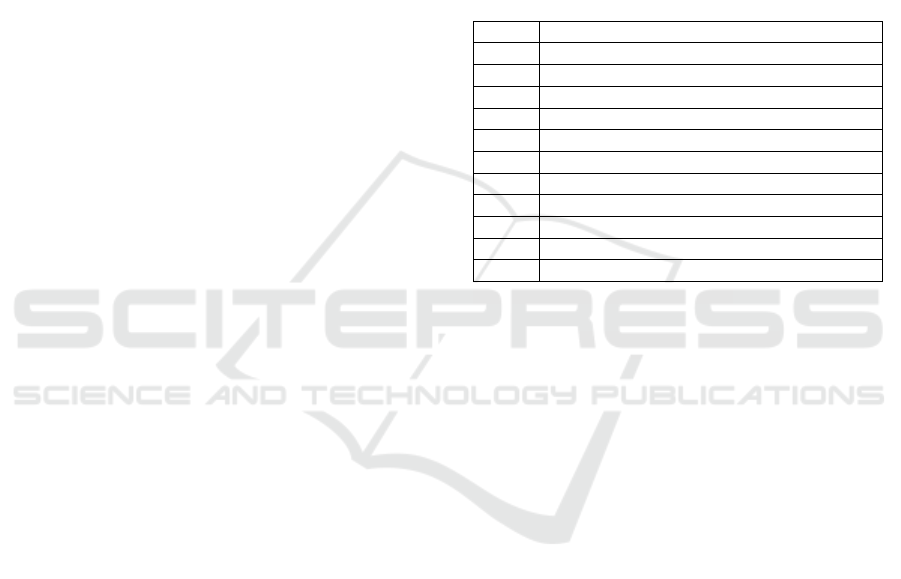

Table 2: List of sample Bank Syariah.

No.

Name of Bank Sharia

1

PT. Bank Muamalat Indonesia

2

PT. Bank Victoria Syariah

3

PT. Bank BRI Syariah

4

PT. Bank Jabar Banten Syariah

5

PT. Bank BNI Syariah

6

PT. Bank Syariah Mandiri

7

PT. Bank Mega Syariah

8

PT. Bank Panin Syariah

9

PT. Bank Syariah Bukopin

10

PT. Bank BCA Syariah

11

PT. Maybank Syariah Indonesia

Source: Statistics of Sharia Banking

3.1 Classic Assumption Test

Before performing the regression test, a classical

assumption test is performed first. For multiple linear

regression test the assumptions used are as follows:

JB value counted 24,746, while Chi Square with

dk = (n-1) = 66-1 = 65, at alpha; = 5% is 84.82,

then. Data is normally distributed.

VIF value of 1.647 means VIF < 10. There is no

multicollinearity problem.

The White test value can be calculated with a W

result of 25.94 which means W < 84.82 (chi

square value) with dk = (n-1) = 66-1 = 65 and &

alpha; = 5%. There is no heteroscedasticity

problem.

The Durbin-Watson count is 1.6316. Value du

and dL in DW table with & alpha; = 5%, dk = 2,

n = 66 is du at 1.5395 and dL 1.6640, thus

1.5395 ≤; 1.6316 ≤; 2.3360 (4 - 1.6640), that

there is no autocorrelation.

3.2 Panel Data Regression

Test Panel data is a combination of cross-section data

(cross) with time-series data (time series). Panel data

processing can be done with several models, namely:

Influence of Interest Rate of Commercial Conventional Banks and Levels for Results on the Impact of the Number of Deposits in Sharia

Banks of 2010-2015

443

Common Effect Model, Model Fixed Effect and

Model Random Effect. The steps to determine the

model in regression with panel data are as follows:

3.2.1 Chow Test

The Chow test model is used to find out whether the

panel data regression technique with fixed effect is

better than the common effect regression model. In

Chow test can be made hypothesis as follows:

Ho: Model follows PLS / common effect

H1: The model follows fixed

The scoring criteria are the results indicating that

F-test and Chi-square if p-value; 5% then H0 is

accepted, and if p-value & lt; 5% then H0 is rejected

(Rohmana, 2010: 242).

The chow test results show that the F-test and Chi-

square are significant (p-value is not more than 5%)

so that Ho is rejected, the more appropriate fixed

effect model is used compared to the PLS model.

3.2.2 Hausman Test

The hausman test is performed to determine whether

the fixed effect model is better than the REM model.

In the Hausman test, the proposed hypothesis is as

follows:

Ho: using the Random Effect model

H1: using Fixed Effect model

With assessment criteria, if p-value & gt; 5%,

then received, if p-value & le; 5%, then rejected.

The hausman test results show that p-value is

greater than 5% so Ho is accepted. Then a more

appropriate random effect model is used than the

fixed effect model. Based on chow test and hausman

test that has been done, then the most appropriate

model used in this research is random effect model.

3.2.3 Test of Simultaneous Regression

Coefficient (Test F)

This test is to determine whether all the independent

variables included in the model of interest rate and

profit sharing rate have simultaneous effect on the

amount of deposit in sharia bank as dependent

variable. Hypothesis in this research:

BUK interest rate and profit sharing rate do not

affect the increase of deposit amount in Sharia

Commercial Bank.

BUK interest rate and profit sharing rate

influence the increase of deposit amount in

Sharia Commercial Bank.

3.2.4 Partial Regression Coefficient Test (t

test)

Hypothesis testing partially with t-test aims to

determine the influence of each independent variable

to the dependent variable. Assuming other

independent variables are fixed. Hypothesis in this

research are:

Hypothesis of variable X1 to Y:

The interest rate of BUK does not affect the

increase of deposit amount in Sharia

Commercial Bank, The interest rate of BUK

affects the increase in the number of deposits in

Sharia Commercial Banks

Hypothesis of variable X2 to Y:

The profit-sharing rate does not affect the in-

crease in the number of deposits in Sharia

Commercial Banks, The profit sharing rate has

an effect on the increase of deposit amount in

Sharia Commercial Bank.

4 RESULTS AND DISCUSSION

4.1 Interest Rate

The interest rate of the bank determines how much

the remuneration is provided by a bank based on the

conventional principle to the depositary customer.

One of the existing types of interest is the

conventional deposit interest rate, which means the

customer will get a fee of interest provided by the

bank after the maturity date.

Interest rates in the 2010-2015 period tend to

fluctuate with the trend having an average in-crease

of 1.13%. In the period 2010-2015 the average

interest rate set by banks was in the range of 7.42%.

The highest interest rates occur in 2014 (amounting

to 8.92%) and the lowest interest rates occur in 2012

(amounting to 5.90%).

The increase and decrease in interest rates is

caused by several reasons, such as the economic and

financial situation faced in foreign countries overseas

and monetary policy set by Bank Indonesia.

Generally, Bank Indonesia will raise the BI Rate if

inflation is expected to exceed the set target.

Banking with a flower system will certainly raise

public funds with the lure of interest rates that tower.

This is in line with Karnaen (2011: 24) "A savings

interest rate would be interesting if: higher than the

inflation rate, higher than the real interest rate abroad,

and more competitive in the country".

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

444

4.2 Profit Sharing Rate

The profit-sharing rate determines how much of the

services provided by the banks with the principles of

sharia to depositors. The profit-sharing principle is

only granted to customers who deposit funds on the

principle of mudaraba.

The description of profit sharing rate at Syariah

Public Bank in 2010-2015 is getting an average value

of 6.74%. Overall, the average Shariah-compliant

bank's share rate appears to be fluctuating every year,

but has declined by an average of 0.82%. The highest

share rate of Sharia Commercial Banks occurred in

2010 (7.32%) and the lowest average share-sharing

rate in 2013 (6.33%). The increase and decrease in

profit-sharing rate is strongly influenced by the ratio

provided and the financing activities performed by

the Sharia Bank.

4.3 Deposit of Sharia Commercial

Bank

As a financial intermediary institution, banking

activities cannot be separated from collecting funds

from the community and channelling the funds back

to the community. The portion of de-posits always

occupies the most number in third party collections.

The nominal amount of deposits of Sharia Banks

collected during the period 2010-2015 has increased.

In the period 2010-2015, the average amount of

mudharabah deposits of Sharia Commercial Bank as

a whole amounted to 74,692,000,000,000 rupiah.

Growth, however, the trend of mudharabah deposits

for six years (2010-2015) decreased by 11%.

Seeing the increase and decrease in deposits in

Islamic banking is influenced by several things, such

as factors of public confidence and public

understanding of sharia banking. These community

clusters will not pay attention to the level of revenue

share and the rate of interest that decreases or rises.

People will also see the quality of services provided

and benefits. Product products is-sued and

promotions made by sharia banks also become an

important role of banks to attract customers in raising.

4.4 Regression Coefficient Test

Simultaneously

This study used panel data, which is a combination of

cross-section data and time-series data. From research

procedure to panel data obtained result that this

research better use Random Effect model. The

applicable regression model is DM = 5616136 -

1486139 TSB + 1493060 TBH. Where the interest

rate variable has a negative influence on the number

of mudharabah deposits and the variable of profit

sharing rate has a positive influence on the number of

mudharabah deposits.

The result of regression significance test

simultaneously through F-test shows that the interest

rate of conventional commercial bank and profit

sharing rate influence the number of deposits in

Sharia Commercial Bank in 2010-2015. This is

evidenced by the value of F arithmetic of 20.37 is

greater than F table 3.14.

R square result shows that 0,393 means 39, 3%

variation of conventional bank interest rate variable

and profit sharing rate influence deposit amount in

Syariah Bank 2010-2015. While the remaining 60.7%

(100% -39.3%) is influenced by other factors outside

the interest rate and the level of profit sharing.

4.5 Effect of Interest Rates on Deposits

in Sharia Commercial Banks

Partial test for profit sharing through t-test is obtained

result that at 5% significance level, th > tta that is

4,76 1,67 with a significance value of 0.0000 then

H0 is rejected and H1 accepted which means there is

influence between the level of prof-it sharing and the

amount of deposits in Islamic banks.

Regression coefficient value of 1.493.060 which

means any increase of 1% profit sharing rate will

increase the number of Islamic banking mudharabah

deposits of 1.493.060 million rupiah. This result is in

accordance with the theory that the in-crease in profit

sharing will affect the amount of third party funds,

where one of the largest contributor of third party

fund sources is deposits. Banking customers in

Indonesia are divided into three layers, namely;

Conventional market, floating market, and sharia

loyalist market. As stated by Karim (in Nurlaeli,

2007: 65), "The factor that attracts a floating market

customer is transacting with a Sharia Bank if a Sharia

Bank provides a profit service of at least the same or

more than that of a Conventional Bank".

It means that some customers make the choice to

place funds in sharia banking is very dependent on the

yield obtained. With a high profit sharing rate will

increase the interest of the community, especially the

floating market segment to save funds in Islamic

banks. Therefore, when the profit sharing rate is high,

there is an increase in the number of syariah banking

deposits. For that Islamic banks need to keep in order

to still be able to provide attractive revenue sharing to

its customers.

From the research conducted, confirmed that the

preference of Indonesian people, especially the

floating market segment in saving the funds in

banking will see the benefits offered. This means that

Influence of Interest Rate of Commercial Conventional Banks and Levels for Results on the Impact of the Number of Deposits in Sharia

Banks of 2010-2015

445

customers consider the choice to place funds in either

sharia or conventional banking is very de-pendent on

the level of returns to be obtained. So by using only

sharia principles, it is not the primary value to acquire

customers, although some Indonesians are Muslim.

The results of this study support the results of

research conducted by Nurika (2014), Suratman

(2011), Reswari (2010) and Nurlaeli (2007)

concluded that the profit sharing effect on mudhara-

bah deposits due to some customers who put their

funds in Islamic banks are still influenced by the

motive Looking for profit.

5 CONCLUSIONS

In 2010-2015 conventional bank interest rates ranged

from 5.90% - 8.92%, while the profit sharing rate

ranged from 6.33% - 7.32%. The nominal amount of

Sharia Commercial Bank deposits has increased, but

the growth of total deposits in Sharia Commercial

Banks in 2010-2015 percentage decreased by an

average of 11% per year. The interest rate of

conventional banking and the level of profit sharing

simultaneously have a significant effect on the growth

of deposit amount in Sharia Commercial Bank. The

conventional bank interest rate has a significant

negative effect on the amount of deposits in Sharia

Commercial Banks, while the profit sharing rate

significantly affects the amount of deposits in Sharia

Commercial Banks.

REFERENCES

Agustianto. 2013. Determination of Profit Sharing of

Mudharabah Deposit at Bank Syariah. [On line].

Available: Brawijaya. http://www.iaei-pusat.net [12

Juni 2016].

Ascaraya. 2008. Akad & Bank Syariah Products. Jakarta:

Raja Grafindo Persada.

Azmansyah, Ahmad, Z. 2012. Comparative Analysis of

Profit Sharing and Interest and Its Influence on

Community Funds Collection (Case Study at Riaukepri

Syariah Bank Pekanbaru). Journal of Economics,

Management and Accounting. Vol.18 No. 1, p.1-25

Bank Indonesia. 2006-2015. Indonesian Banking Statistics.

Jakarta: Bank Indonesia

Hasibuan. 2007. Fundamentals of Banking. Jakarta: PT

Bumi Aksara.

Husnan. 2006. Fundamentals of Financial

Management.Yogyakarta: UPP STIM YKPM.

Husni, A. 2009. Factors Affecting Third-Party Funds

Growth in Syariah Banking in Indonesia Period:

January 2006-December 2007.

Karim, A.A. 2008. Islamic Bank Fiqh and Financial

Analysis. Jakarta: Raja Grafindo Persada.

Karim, A., Affif, A. Z. Islamic Banking Consumer

Behavior in Indonesia, a Qualitative Approach.

[Online]. Tersedia:

http://www.kantakji.com/media/163564/file515.pdf.[2

5 Juni 2016]

Kasmir. 2012. Dasar-Dasar Perbankan. Jakarta: Rajawali

Pers.

Karnaen, A., 2011. Bank Syariah Theory, Practice and

Role. Jakarta: Celestial Publishing.

Nelwani, C.Y., 2013. Factors Affecting Mudharabah

Deposits in Sharia (BUS) Banks Period 2009-2012.

Essay. Yogyakarta: Department of Islamic Economics

UIN Sunan Kalijaga

Nurika. 2014. Analysis of Profit Sharing Factor and

Interest Rate to Third Party Fund at Bank Muamalat

Indonesia with Variation Moderation of Financial

Crisis of 2008. Thesis. Bandung: M2B Department

Universitas Pendidikan Indonesia.

Nurlaeli, L., 2007. The Effect of Profit Sharing and Interest

Rate on Total Mudharabah Deposits at PT Bank

Muamalat Indonesia Tbk. Thesis. Bandung:

Department of Economic Education UPI.

Financial Services Authority. 2016. Statistics of Sharia

Banking.Jakarta: Bank Indonesia

Reswari, Y.A., Abdurahim, A. 2010. Influence of Interest

Rate, Profit Sharing and LQ 45 on Mudharabah

Deposit at Indonesian Sharia Bank. Journal of

Accounting and Investment.Vol. 11 No.1, p.30-141

Rohmana, Y. 2010. Econometrics (Theory and

Applications with Eviews). Bandung: Economic and

Cooperative Lab.

Suratman. 2013) Effect of Mudharabah Deposit Amount,

SBIS Reward Rate, 1 Month Deposit Interest Rate, and

Inflation Rate on Mudharabah Deposit (Case Study of

PT Bank Syariah Mandiri Tahun 2007-2011 Thesis,

Jakarta: Department of Management UIN Syarif

Hidayatullah.

Wulansari, D. I., 2015. The Effect of Profit Sharing and

Interest Rate on the Number of Mudharabah Deposits

(Case Study of Sharia Banking Year 2009-2013). Essay.

Malang: Department of Economic Universitas

Brawijaya.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

446