Fixed Asset Revaluation: Impact on Taxable Income

Jeremia Pradnya and Handiani Suciati

Universitas Padjadjaran, Bandung, Jawa Barat, Indonesia

Keywords: Fixed asset, revaluation, disclosure, compliance.

Abstract: The economic downturn at the end of 2015, made Indonesian Government issued economic policy

regarding fixed asset revaluation, in order to boost economic condition. This policy believe could improve

company’s financial performance. The purpose of this study is to evaluate the impact of fixes asset

revaluation on the taxable income and the fixed asset disclosure compliance. This research use descriptive

method, with survey approach. Listed companies at Indonesia Stock exchange are used as the subject of this

study. We are using purposive sampling method in selecting the sample. This study is using multiple linier

regression analysis to analyze the data. We concluded that the fixed asset revaluation did increase the

taxable income. As for fixed asset disclosure compliance, we found that 2 out of 16 disclosure criterions still

need to be improved, in order to provide more complete information for the financial statement users.

1 INTRODUCTION

In the mid of 2015, the Indonesia’s economic

growth had been slower, so it was only reached 4.67

%. It was the lowest growth ever for the past six

years. This unfovaroble condition, made Indonesian

Government took a strategic movement, by

launching another stimulus to boost economic

growth. One of the stimulus, was the new tax

incentives on revaluation of fixed assets.

Previously many companies reporting their fixed

assets under historical cost, which pretty much, far

below current market price. It because the asset is

being reported undervalued, as it was acquired

several years ago. At that time, company choose to

report the asset using historical cost in order to avoid

the tax being imposed on fixed asset growth,

amounted 10 % from the capital gain.

This new tax incentives, is very interesting and

provide benefit not only for the company itself but

also for the government. At that time, the income tax

realization was much less than the targeted one. It

will provide opportunity for government to obtain

additional income tax, so government programs to

provide and support public welfare could be

executed

Under this policy, the government waive 70 % of

tax rate on the fixed asset growth, should the

company interested in this policy and submit their

proposal for fixed asset revaluation before the end of

2015. They only need to pay 3 % from the fixed

asset increasing amount. Having their asset reported

under current market value will resulted in an

increase on company’s equity. This will affect

companies’s financial performance, as the increased

equity will improve company’s leverage, it will

easier for company to obtain source of fund. All of

these benefit, will be reflected in company’s

financial statement

The financial statement preparation of entity

with public accountability, the listed and state

owned companies in Indonesia should be based on

Indonesian Statement of Financial Accounting

Standard (Pernyataan Standar Akuntansi Keuangan

or PSAK) and related regulation. It also regulate the

requirement for financial statement disclosure

aspect. Therefor it is also important, to evaluate the

company’s financial statement compliance, which is

in this study limited to disclosure compliance.

It has been known that one of country’s

economic instrument is tax, as a source of income

that support country development programs, for

providing a better public service and welfare.

Moreover tax could be use to cover budget deficit

and to distribute income among society, which is the

world economic problem nowaday (Dwi

Sulastyawati, 2014: 125).

Debate on tax incentives point of view is still

exist. It may consider as inequitable as they provide

preferential treatment for particular sector or party.

Tax incentives undermine fairness sense, because a

heavier tax burden must be placed on other sectors

340

Pradnya, J. and Suciati, H.

Fixed Asset Revaluation: Impact on Taxable Income.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 340-345

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

to raise a given tax revenue (Dale Chua, in Sutrisno

et al, 2011: 2)

At one level, tax incentives are easy to identify.

They are those special provisions that allow for

exclusions, credits, preferential tax rates, or deferral

of tax liability. Tax incentives can take many forms:

tax holidays for a limited duration, current

deductibility for certain types of expenditures, or

reduced import tariffs or customs duties. At another

level, it can be difficult to distinguish between

provisions considered part of the general tax

structure and those that provide special treatment.

This distinction will become more important when

countries become limited in their ability to adopt

targeted tax incentives. For example, a country can

provide a 10 % corporate tax rate for income from

manufacturing. This low tax rate can be considered

an attractive feature of the general tax structure as it

applies to all taxpayers (domestic and foreign) or it

can be seen as a special tax incentive (restricted to

manufacturing) in the context of the entire tax

system (Zolt & Schill, 2015:5)

In Oct 2015 Indonesian Government launched

economic policy by reducing a tax rate, as a tax

incentives on fixed asset revaluation, as stipulated in

Minister of Finance Regulation number

191/PMK.10/2015. PSAK No.16 stated that fixed

assets are tangible assets, owned to be used in the

production process or in providing goods or service

to be rented to other parties, or for administrative

purposes and is expected will provide benefit more

than one accounting period. (SAK IAI, PSAK 16,

2015).

The valuation of fixed assets could be based on

its historical cost or Fair value (SAK IAI, PSAK 16,

2015). In commercial practices, the implemantation

of valuing fixed asset based on its fair value, should

be done according to the tax regulation authorised

by Republik Indonesia Minister of Finance.

The revaluation of fixed asset is the adjustment

of company’s fixed assets value which had been

used for generating income, as the value is no longer

reflected the fair or market value. The purpose of

asset revalution is enabling company to calculate its

income and expense more fairly, so it will reflect

company’s real value. The revaluation of fixed asset

will ensure that the asset value on financial

statement will reflect the real fair value and also will

increase company’s overall value (Kusmahargyo,

2015).

The preparation of company’s financial

statement, including its diclosure, must be made

based on PSAK and related regulation. Disclosure

became an important issue under IFRS and also

other accounting standard based on IFRS, including

PSAK. The more disclosure made to investor, the

more effective capital market. By providing

mandatory disclosure, enabling company to list its

share in the capital market, to increase its reputation

and to minimize its cost of capital which will

increase company’s value (Meek, et al in Andian,

2016).

Study on the impact of Asset Revaluation on

Financial Performance, conducted by Andian (2016)

shown that asset revaluation has significant and

negative impact on debt to asset ratio. Study by Zolt

& Michael (2015) on tax incentives shown that tax

incentives can play a useful role in encouraging,

specifically both domestic and foreign investment.

How useful they can be, and at what cost, depends

on how well the tax incentive programmes are

designed, implemented and monitored. Study on

disclosure, revealed that the average mandatory

disclosure level by manufacturing company in the

first year of full adoption IFRS in Indonesia, is only

63% from all mandatory disclosures required by

BapepamLK (Andian, 2016).

2 METHODS

This research aims to evaluate whether the asset

revaluation has a significant impact on the

company’s taxable income and to analyze the fixed

assets disclosure compliance based on PSAK 16.

We used both statistical and non-statistical

analysis on this research. The statistical analysis use

to study the asset revaluation impact on the taxable

income, which involves variables:

Fixed assets revaluation (as independent

variable)

The changes in company’s taxable income (as

dependent variable)

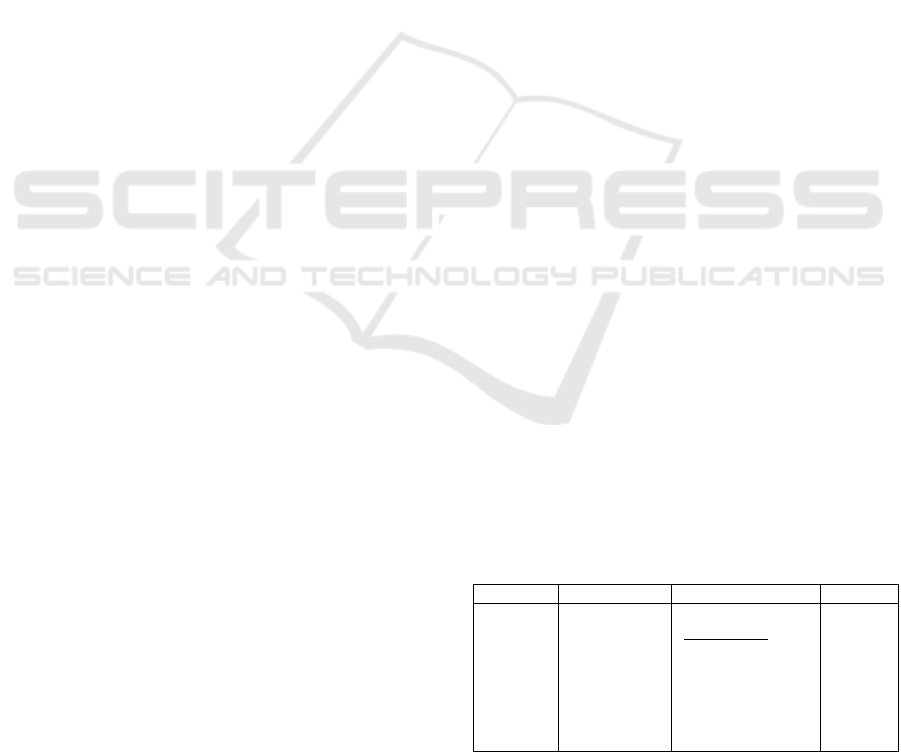

The measurement of each variable, is provided in

table 1.

Table 1: The operational variable and measurement

Variable

Indicator

Measurement

Scale

Fixed

asset

revaluati

on (X)

The

increasing of

revaluation

surplus

compare with

the original

book value

Rev

t

Asset

(t-1)

Ratio

Fixed Asset Revaluation: Impact on Taxable Income

341

Table 1. Cont.

The

taxable

income

after

revaluati

on (Y)

Taxable

income under

fixed asset

revaluation

minus

previous year

taxable

income (∆TI

t

)

TI

(t)

– TI

(t-1)

TI

(t-1)

ratio

To analyze the fixed asset disclosure compliance,

we use non statistical analysis research, which will

analyze and compare the required disclosure level

with the existing ones. The required diclosure item

based on PSAK 16 are provided in table 2.

Table 2: Fixed asset disclosure checklist

Number

Disclosure Item

1

Measurement base for determining the carrying

amount (gross)

2

Depreciation method employed

3

Useful life or depreciation rate

4

Gross carrying amount and accumulated

depreciation, at the beginning and ending of period

5

Reconciliation of fixed asset carrying amount

addition, at at the beginning and ending of period

6

Reconciliation of the carrying amount of asset held

to be sold, at the beginning and ending of period

7

Reconciliation of the acquisition amount from

business combination, at the beginning and ending

of period

8

Reconciliation of any increase or decrease on

carrying amount, due to revaluation at the

beginning and ending of period

9

Reconciliation of impairment loss on income

statement

10

Reconciliation of any reversal of impairment loss

on income statement

11

Reconciliation of the accumulated depreciation, at

the beginning and ending of period

12

Reconciliation of gain or loss on exchange rate due

to financial statement translation, at the beginning

and ending of period

13

The description and amount of restricted fixed

asset and property as debt collateral

14

The amount of expenditure capitalised as asset

under cosntruction

15

The amount of contactual commitment to acquire

fixed assets

16

The compansation amount from thir party for any

impaired, lost or disposed fixed asset

Researcher conducted analysis, by made

disclosure checklist, enlisted 16 items of fixed assets

that have to be disclosed, as stated in table 2. The

checklist indicate whether the indicators fixed asset

item disclosed or not disclosed. Researcher will give

1 if the items is disclosed, give 0 if items is not

disclosed and give blank if the disclosure item is not

applicable for certain company. Researcher will then

calculate disclosure score, by adding all of

disclosure checklist items.

Research population is all companies listed in

Indonesian Stock Exchange in 2015, with total 534

companies, which then reduced by 88 companies

which did not publish financial statement in 2015,

47 companies which made fixed asset revalution

based on accounting, and 367 companies which did

not participate in fixed asset revaluation for tax

puposes until the end of 2015. At the end, we used

31 companies as research sample.

Hypotheses being tested in this study are:

Ho

1 :

β

1

≤ 0 “ fixed asset revaluation does not

positively influence the taxable

income under revaluation”

Ha

1 :

β

1

> 0 " fixed asset revaluation positively

influence the taxable income under

revaluation”

Ho

2 :

X1 = Y1 “the company which had

revaluation in 2015 does not

disclose items as required by

PSAK”

Ha

2

: XI

≠ Y1 “the company which had

revaluation in 2015 disclose items

as required by PSAK”

This research is using simple linear regression

analysis:

∆TI

t-1(i)

= a + REV

t(i)

+ ε

t

where as :

∆TI

t-1(i)

= change in taxable income (t-1)

REV

t(i)

= the revaluation surplus of fixed asset

ε = Other variable, not being studied in

this research

a

= Konstanta, Koefisien Regresi

3 RESULTS AND DISCUSSION

Based on the test, we found that the data has a

normal distribution and passed the heteroscedasticity

test.

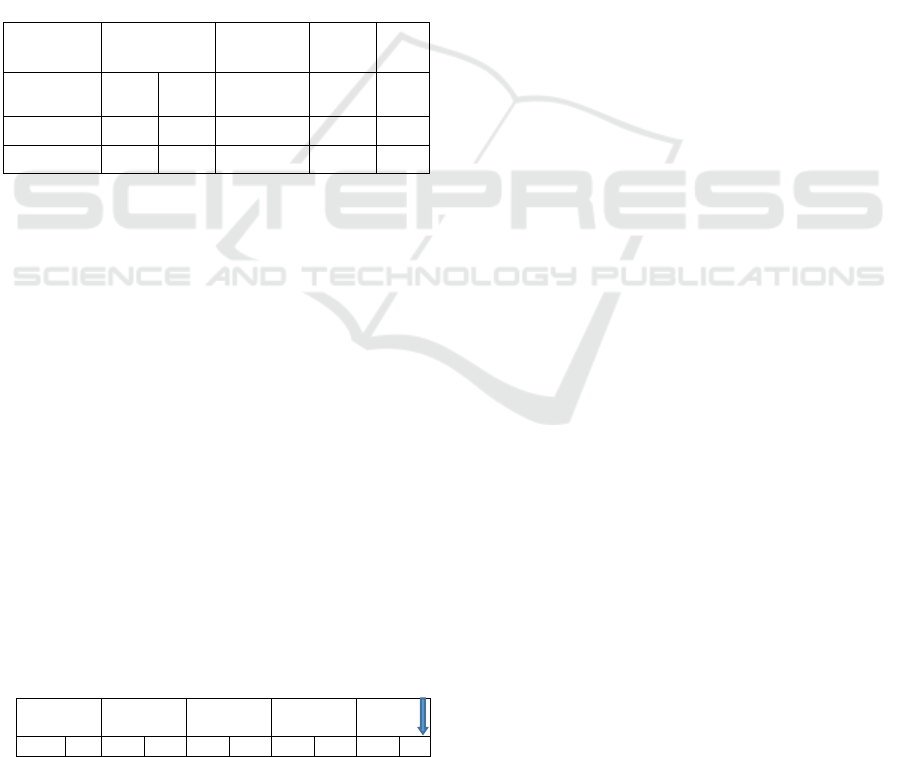

Table 3: Simple linear regression

Unstandardized

Coefficients

Standar

dized

Coeffic

ients

t

Sig

Model

B

Std.

Error

Beta

1 (Constant)

-4.965

1.617

-3.070

0.005

Rev

0.197

0.063

0.504

3.142

0.004

a. dependent variable: TI

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

342

From table 3, we found equation:

Y = -4,965 + 0,197X

Which implies:

Constanta = -4.965. Shown that when asset

revaluation amount is zero, the taxable income

value is -4,965.

The coefficient regression of taxable income

(X) is 0.197, which shown the increase in fixed

asset revaluation surplus will increase the

taxable income amounted 0.197 %.

Based on calculation, we found that the

coefficient determination (R

2

) is 25,4 %, which

means that the fixed asset revaluation has 25,4 %

contribution on the taxable income and the rest 74,6

% is contribution from other variable, which not

being analyzed in this research, such as the sales

increased.

Table 4: Hypothesis test

Unstandardized

Coefficients

Std

Coefficients

t

Sig

Model

B

Std.

Error

Beta

1 (Constant)

-4.965

1.617

-3.070

0.005

Rev

0.197

0.063

0.504

3.142

0.004

a. dependent variable: TI

From table 4, we can see that t-

count

is 3.142

which will be compared with the t

table

amounted ±

2.045 form the t distribution table, with α = 0.05, df

= n-k-1 = 31 -1-1 =29, for two tail test. We found

that t

count

3.142 is outside the t

table

(-2.045 and 2.045),

so we reject H

0

which mean the fixed asset

revaluation influence significantly the taxable

income of companies conducted revaluation in 2015.

For evaluating the fixed assets disclosure

compliance, researcher performed diclosure

checklist analysis on each of 16 dislosure item,

required by PSAK 16, as follow :

a. Measurement base for determining the carrying

amount (gross)

Disclosure score = 31

Maximum score = 31

Disclosure compliance score = 31/31 x 100%

= 100%

Interval range = (maximum score – minimum

score) : 5 = (100 % - 0 %) : 5 = 20%

Not

Comply

Less

Comply

Comply

Quite

Comply

Fully

Comply

0% 20% 40% 60% 80% 100%

Figure 1: Continuum line compliance level measurement

base

Disclosure compliance level for this item is

excellent (100%), as all of companies has already

implemented it

b. Depreciation method employed

Disclosure score = 30

Maximum score = 31

Disclosure compliance score = 30/31 x 100%

= 97%

Disclosure compliance level for this item is

almost excellent (97%).

c. Useful Life or depreciation rate

Disclosure score = 30

Maximum score = 31

Disclosure compliance score = 30/31 x 100%

= 97%

Disclosure compliance level for this item is

almost excellent (97%).

d. Gross carrying amount and accumulated

depreciation, at the beginning and ending of

period

Disclosure score = 31

Maximum score = 31

Disclosure compliance score = 31/31 x 100%

= 100%

Disclosure compliance level for this item is

excellent (100%).

e. Reconciliation of fixed asset carrying amount

addition, at at the beginning and ending of

period)

Disclosure score = 30

Maximum score = 31

Disclosure compliance score = 31/31 x 100%

= 97%

Disclosure compliance level for this item is

almost excellent (97%).

f. Reconciliation of the carrying amount of asset

held to be sold, at the beginning and ending of

period

Disclosure score = 13

Maximum score = 17

Disclosure compliance score = 13/17 x 100%

= 76%

Disclosure compliance level for this item is quite

comply (76%).

g. Reconciliation of the acquisition amount from

business combination, at the beginning and

ending of period

Disclosure score = 18

Maximum score = 22

Disclosure compliance score = 18/22 x 100%

= 82%

Disclosure compliance level for this item is

almost comply (82%).

Fixed Asset Revaluation: Impact on Taxable Income

343

h. Reconciliation of any increase or decrease on

carrying amount, due to revaluation at the

beginning and ending of period

Disclosure score = 21

Maximum score = 31

Disclosure compliance score = 21/31 x 100%

= 68%

i. Reconciliation of impairment loss on income

statement

Disclosure score = 15

Maximum score = 21

Disclosure compliance score = 15/21 x 100%

= 71%

j. Reconciliation of any reversal of impairment loss

on income statement

Disclosure score = 6

Maximum score = 6

Disclosure compliance score = 6/6 x 100% =

100%

Disclosure compliance level for this item is

excellent (100%).

k. Reconciliation of the accumulated depreciation,

at the beginning and ending of period

Disclosure score = 30

Maximum score = 31

Disclosure compliance score = 30/31 x 100%

= 97%

l. Reconciliation of gain or loss on exchange rate

due to financial statement translation, at the

beginning and ending of period

Disclosure score = 23

Maximum score = 28

Disclosure compliance score = 23/28 x 100%

= 82%

m. The description and amount of restricted fixed

asset and property as debt collateral

Disclosure score = 14

Maximum score = 26

Disclosure compliance score = 14/26 x 100%

= 54%

Disclosure compliance level for this item is not

good which is only 54%.

n. The amount of expenditure capitalised as asset

under cosntruction

Disclosure score = 20

Maximum score = 23

Disclosure compliance score = 20/23 x 100%

= 87%

o. The amount of contactual commitment to acquire

fixed assets

Disclosure score = 10

Maximum score = 18

Disclosure compliance score = 10/18 x 100%

= 56%

Disclosure compliance level for this item is not

good as it only 56%.

p. The compensation amount from third party for

any impaired, lost or disposed fixed asset

Disclosure score = 2

Maximum score = 3

Disclosure compliance score = 2/3 x 100% =

67%

Disclosure compliance level for this item is not

too good, as its only 67%.

4 CONCLUSIONS

The researcher find the evidence that fixed asset

revaluation has a significant influence on the

company taxable income, with 24.5 % contributions.

Therefor by taking this tax policy intensive,

company will not only give benefit to the

government, but it will also give benefit for the

company as it will increase company’s equity.

In overall, the compliance disclosure level has

already in a very good or excelent condition, this

study revealed certain fixed assetd disclosure item,

which still need to be improved. Dislosure item

related with reconciliation of the carrying amount of

asset held to be sold, dislosure item related with

reconciliation of any increase or decrease on

carrying amount due to revaluation, dislosure item

related with reconciliation of impairment loss

dislosure item related with description and amount

of restricted fixed asset and property as debt

collateral, dislosure item related with the amount of

contactual commitment to acquire fixed asset,

dislosure item related with compensation amount

from third party for any impaired, lost or disposed

fixed asset.

REFERENCES

Andian, I., 2016. Karakteristik Perusahaan Sebagai

Anteseden Pengungkapan Wajib Informasi Akuntansi.

Jurnal Economia, Volume 12, Nomor 1.

http://www.idx.co.id/beranda/perusahaantercatat/laporan

keuangan dan tahunan.aspx, 26 Juli 2016

Ikatan Akuntan Indonesia, 2015, Standar Akuntansi

Keuangan per 1 Januari 2015, Jakarta, Ikatan Akuntan

Indonesia

Kusmahargyo, H., (2015). Metrotvnews.com. ac-cessed on

30/01/2016

Menteri Keuangan Republik Indonesia, "Penilaian

Kembali Aktiva Tetap Untuk Tujuan Perpajakan Bagi

Permohonan Yang Diajukan Pada Tahun 2015 dan

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

344

2016",

http://www.ortax.org/ortax/?mod=aturan&page=show

&id=15899, 22 Juni 2016

Menteri Keuangan Republik Indonesia, 2015, Peraturan

Nomor 191/PMK.10/2015, Jakarta, Kementerian

Keuangan Republik Indonesia

Sulastyawati, D., (2014). Hukum Pajak dan Imple-

mentasinya Bagi Kesejahteraan Rakyat. Sekolah

Tinggi Agama Islam Negeri (STAIN) Curup

Bengkulu. Salam; Jurnal Filsafat dan Budaya Hukum.

Sutrisno, A., Bunasor Sanim, Harianto, Setiadi Djohar.

(2011). Analisis Manfaat Insentif Pa-jak Penghasilan

Dan Pengaruhnya Pada Kepatuhan Wajib Pajak. Vol.

4. No. 1 Januari.

Zolt, E., Michael H. Schill. (2015). Tax Incentives:

Protecting the tax base. Paper for Workshop on Tax

Incentives and Base Protection New York. 23-24 April

2015.

Fixed Asset Revaluation: Impact on Taxable Income

345