The Analysis of the Effect of Liqudity Risk and Credit Risk to the

Profitability in Conventional Banks of Indonesia

Diah Dianti Rohani, Indri Ayu Lestari and Amir Machmud

Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi 229, Bandung, Indonesia

diahdianti@student.upi.edu

Keywords: Liquidity Risk, Credit Risk, Profitability, Banking, Loan to Deposit Ratio (LDR), Non-Performing Loan

(NPL), Return On Assets (ROA).

Abstract: This paper aims to analyze the effect of liquidity risk and credit risk to the profitability in conventional

banks. The method used is explanatory survey. The data used in this study was secondary data from the

annual financial statements of each of the banks listed on the stock exchanges of Indonesia in 2007 - 2016.

The samples used are top 10 conventional Banks (chosen by asset). The method used is panel data

regression model. Liquidity risk is measured by Loan to Deposit Ratio (LDR), credit risk is measured by

Non-Performing Loan (NPL) and profitability is measured by Return On Assets (ROA). The result showed

that liquidity risk (LDR) and credit risk (NPL) have significant negative impact on the profitability (ROA)

in conventional banks.

1 INTRODUCTION

The existence of the banking sector as a sub-system

in the economy of a country has a significant role,

even the daily lifes of modern society largely

involve services from the banking sector. This is

because the banking sector has a primary function as

a financial intermediary between economic units

with a surplus of funds and underfunded economic

units. Through a bank, funds can be collected from

the community in various forms of deposits. Then,

the funds that have been collected are channeled

back by the bank in the form of credit to the business

sector or other parties in need. If the community life

and economic are more developed, it also needs to

increase the role of the banking sector through the

development of its services products (Rahmi, 2014).

Due to the relationship to the community, the

Bank must be able to improve its performance by

maintaining the bank's soundness. To keep its

performance, bank encounters various risks such as

liquidity risk and credit risk. According (Hartley, et

al., 2013), liquidity risk is a risk when the bank is

not able to provide funds/cash. Liquidity in

commercial banks is the ability to repay funds as the

due date.

Here are some previous studies that examined

the relationship between liquidity risk and bank

profitability showing differences in their research

results. A study by (Bourke, 1989) found that there

was a positive relationship between liquidity and

bank profitability in 90 banks in Europe, North

America and Australia in 1972-1981. In contrast,

other studies had different results from Bourke's

research, Such as (Molyneux & Thornton, 1992) and

(Goddard et al., 2004), they found that there was a

negative relationship between liquidity and

profitability in the European Bank of the late 1980s

to the mid-1990s.

(Funso, et al., 2012) state that of several risks

faced by banks, credit risk plays the role most in

bank profitability. Credit risk is the possibility of

losing the outstanding loan either in whole or in part

until the specified time (Basel Committee, 2001).

The effect of credit risk on profitability has been

done by several researchers. (Funso, et al., 2012)

found that Non Performing Loans negatively affect

the profitability of banks. Other researchers also

found similar results, as (Kargi, 2011) found that

credit risk had a negative effect on the Bank's

profitability in Nigeria. (Epure and Lafuente, 2012)

found that non-performing loans negatively affected

the performance of banks in Costa Rica between

1998 and 2007. Then, (Kithinji, 2010) found that

non-performing loans had no effect on commercial

bank profits in Kenya.

180

Rohani, D., Lestari, I. and Machmud, A.

The Analysis of the Effect of Liqudity Risk and Credit Risk to the Profitability in Conventional Banks of Indonesia.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 180-183

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

The purpose of this research is to analyze the

effect of liquidity risk and credit risk to profitability

by using explanatory survey method. The results of

this study can be used to find out what and how

much influence of risks that arise in maintaining the

soundness of a bank.

2 METHODS

The method used is explanatory survey. The

population in this study are Conventional

Commercial Banks listed on the Indonesia Stock

Exchange in 2007 - 2016. The sample technique

used in this study is purposive sampling with the

banks of which criterion having 10 largest assets in

Indonesia in 2016, so that there are 100 observation

data obtained.

The data collected was analyzed by panel data

regression by following the equation below:

2211 XXY

(1)

Where:

Y = Profitability (ROA)

Α = Constants

β1, β2 = Regression Coefficient

X1 = Liquidity Risk (LDR)

X2 = Credit Risk (NPL)

ε = error term

Bank Indonesia Regulation Number 11/25 / PBI /

2010 concerning changes in PBI Number 5/8 / PBI /

2003 concerning the Implementation of Financial

Management Risk defines liquidity risk as a risk due

to the inability of the Bank to meet the obligations

due from sources of cash flow and / or high quality

liquid assets which can be used, without disrupting

the activity and the inancial condition of the bank.

Liquidity risk is calculated using the Loan Deposit

Ratio (LDR) proxy. LDR is the ratio between the

total amount of credit provided by the bank and

funds received by the bank (Dendawijaya, 2009).

Credit Risk according to Bank Indonesia

Regulation Number 11/25 / PBI / 2010 concerning

Changes in PBI Number 5/8 / PBI / 2003 concerning

Implementation of Risk Management is risk due to

failure of debtors and/or other parties to fulfill

obligations to banks. Credit risk arises because the

borrower is unable to meet its financial obligations

to the bank at the due date. Credit risk is calculated

using a Non Performing Loan (NPL) proxy. NPL is

the ratio of total loans with problem to total credit

given to third party (Dendawijaya, 2009).

Credit risk is calculated using a Non Performing

Loan (NPL) proxy. NPL is the ratio of total loans

with problem to total credit given to third party

(Dendawijaya, 2009).

Profitability is the ability of a company to

generate profit over a certain period. Profitability of

the company shows the comparison between profits

with assets or capital that generate such profits

(Dendawijaya, 2009). Profitability is calculated

using ROA proxy. ROA is the ratio between net

income and total company assets.

3 RESULTS AND DISCUSSION

Descriptive statistical analysis is used to provide an

overview of the variables in this study. Here are the

descriptive statistics results of each variable.

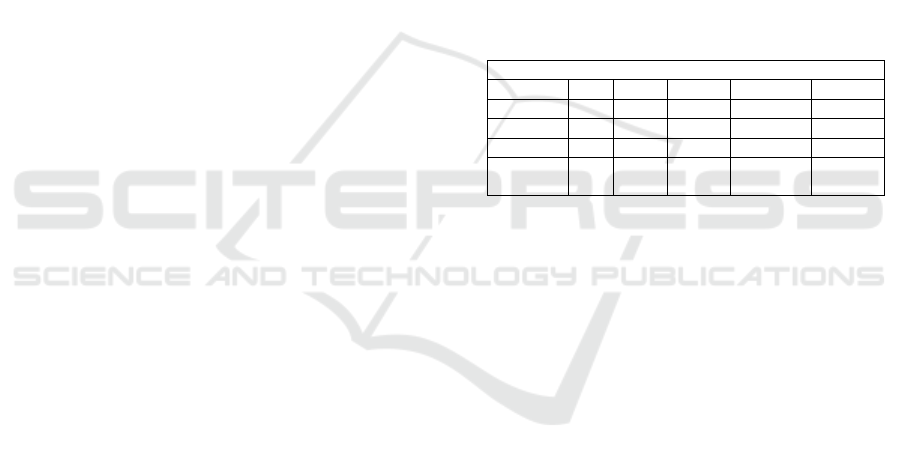

Table 1: Descriptive Statistics Results

Descriptive Statistics

N

Min

Max

Mean

Std. Dev

X1=LDR

100

43.60

108.86

83.4215

13.89627

X2=NPL

100

.37

8.83

2.7141

1.47527

Y=ROA

100

-4.90

5.15

2.3460

1.34636

Valid

N (listwise)

100

Based on Table 1. it can be seen that the number

of observation in this study is as many as 100 data.

The mean of liquidity risk (LDR) variable is 83.4215

with a maximum value of 108.86 and a minimum

value of 43.60.

The mean of credit risk variable (NPL) is 2.7141

with a maximum value of 8.83 and a minimum value

of 0.37. The mean of profitability variable (ROA) is

2.3460 with a maximum value of 5.15 and a

minimum value of -4.90. Based on the data, it can be

seen that all variables have greater mean value than

the standard deviation, so that it can be concluded

that the variable data are grouped or not varied.

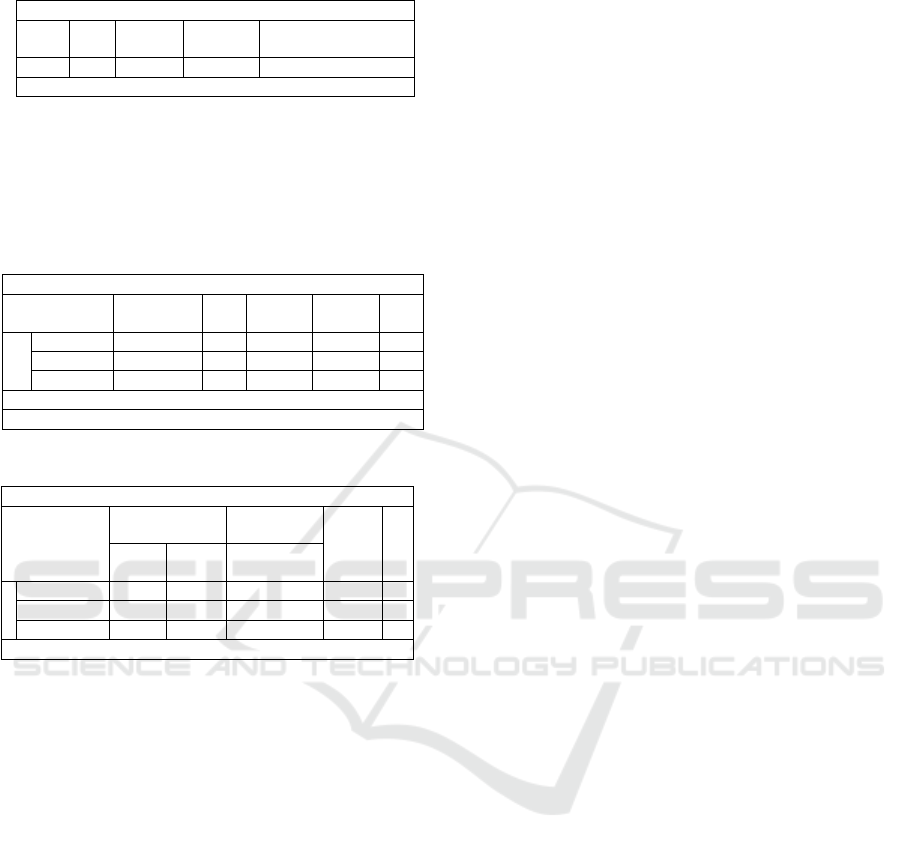

From Table 2. it can be seen that the value of

Adjusted R2 obtained is 0.226 or 22.6%. This means

that the ratio of LDR and NPL can explain the

profitability of Conventional Commercial Banks in

2007 - 2016 projected through ROA of 22.6%, while

the remaining (77.4%) is influenced by other

variables that are not analyzed in this research.

The Analysis of the Effect of Liqudity Risk and Credit Risk to the Profitability in Conventional Banks of Indonesia

181

Table 2: Coefficient of Determination Test Results (R

2

)

Model Summary

Model

R

R Square

Adjusted R

Square

Std. Error of the

Estimate

1

.492

a

.242

.226

1.18430

a. Predictors: (Constant), X2=NPL, X1=LDR

From Table 3. It can be seen that the F

calculate

is

15,475 and has probability value of 0.000 <0.05, the

regression model of this study is to predict the

research variables.

Table 3: F Statistics Test Results

ANOVA

a

Model

Sum of

Squares

df

Mean

Square

F

Sig.

1

Regression

43.408

2

21.704

15.475

.000

b

Residual

136.048

97

1.403

Total

179.456

99

a. Dependent Variable: Y=ROA

b. Predictors: (Constant), X2=NPL, X1=LDR

Table 4: Regression Test Results

Coefficients

a

Model

Unstandardized

Coefficients

Standardized

Coefficients

t

Sig.

B

Std.

Error

Beta

1

(Constant)

5.589

.743

7.524

.000

X1=LDR

-.028

.009

-.285

-3.213

.002

X2=NPL

-.347

.081

-.380

-4.285

.000

a. Dependent Variable: Y=ROA

Based on the result of t-test method, it can be

seen the influences between liquidity risk and credit

risk variable to the profitability variable are as

follows:

1. The LDR variable has t

calculate

of -3.213 and t

table

of 1.9847. Therefore, t

calculate

<t

tabel

which is -

3.213 <1.9847 and has probability value of

0.002 <0.05, then H1 is rejected which means

LDR has significant negeative influence on

ROA.

2. The NPL Variable has t

calculate

value of -4.285

and t

table

of 1.9847. Therefore, t

calculate

<t

tabel

and

has a probability value of 0.000 <0.05, then H

2

is rejected, which means NPL has a significant

negative impact on ROA.

Based on the tabulation of statistical data in table

4., it creates linear regression equation as follows:

The value of constants obtained is 5,589. This means

that if the LDR and NPL variables do not exist or are

zero, then the profitability (ROA) is 5.589.

Based on the test results, it is obtained significant

level of probability of LDR (0.002); less than 0.05

and negative regression coefficient (0.028); so, it can

be concluded that H

1

is accepted and H

0

is rejected,

which means that LDR has significant effect on the

profitability with negative effect. These results

indicate that the greater the LDR, the smaller the

profitability and the smaller the LDR, the greater the

profitability with an increase of 0.028.

Based on the test results, it is obtained significant

level of NPL probability (0.000); less than 0.05 and

negative regression coefficient (0.347); so it can be

concluded that H

2

is accepted and H

0

is rejected,

which means that the NPL has significant effect on

profitability with a negative effect. These results in

indicate that the larger the NPL, the smaller the

profitability and the smaller the NPL, the greater the

profitability with an increase of 0.347.

Thi study shown that Loan to Deposit and Non

Performing Loan significantly influence negatively

on Return On Assets at Banks listed on Indonesia

Stock Exchange (IDX) in 2007-2016. This study is

in line with previous researchers, (Molyneux &

Thornton, 1992), (Goddard et al, 2004), (Funso et

al., 2012), (Epure and Lafuente, 2012) and (Kargi,

2011).

4 CONCLUSIONS

Some of the findings in this study either

descriptively or in verifiable way indicate that this

research has shown the fact that Loan to Deposit and

Non Performing Loan significantly influence

negatively on Return on Assets at Banks listed on

Indonesia Stock Exchange (IDX) in 2007-2016. The

limitation of this study is to use only two bank risks

(liquidity risk and credit risk) which play role in the

profitability of the company, other risks used in the

banking industry are market risk, operational risk,

legal risk, reputation risk, strategic risk and

compliance risk. Other variables are Net Interest

Margin (NIM), Operating Cost compared to

Operating Income (BOPO), Earning Asset Quality

and Inflation in order to obtain more varied results

that can illustrate the things that can affect the

profitability. The results of the study can be used as

input for policy makers especially those related to

bank profitability. The policy maker can use joint

management of liquidity risk and credit risk to

increase bank stability and monitoring credit

disbursement process to maintain good account.

REFERENCES

Bank Indonesia. 2010. Peraturan Bank Indonesia Nomor

11/25/PBI/2010 mengenai Perubahan atas PBI Nomor

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

182

5/8/PBI/2003 tentang Penerapan Manajemen Risiko.

Jakarta.

Bank Indonesia. Peraturan Bank Indonesia Nomor

6/10/PBI/2004 tanggal 12 April 2004 tentang Sistem

Penilaian Tingkat Kesehatan Bank Umum. Jakarta.

Bourke, P., 1989. Concentration and other determinants of

bank profitability in Europe, North America and

Australia. Journal of Banking & Finance, 13(1),

pp.65-79.

Dendawijaya, L. 2009 .Manajemen Perbankan. Bogor:

Ghalia Indonesia.

Epure, M., Lafuente, E., 2015. Monitoring bank

performance in the presence of risk. Journal of

Productivity Analysis, 44(3), pp.265-281.

Goddard, J.A., Molyneux, P., Wilson, J.O., 2004.

Dynamics of growth and profitability in

banking. Journal of Money, Credit, and

Banking, 36(6), pp.1069-1090.

Imbierowicz, B., Rauch, C., 2014. The relationship

between liquidity risk and credit risk in banks. Journal

of Banking & Finance, 40, pp.242-256.

Kargi, H.S., 2011. Credit risk and the performance of

Nigerian banks. Ahmadu Bello University, Zaria.

Kolapo, T.F., Ayeni, R.K., Oke, M.O., 2012. CREDIT

RISK AND COMMERCIAL BANKS

PERFORMANCE IN NIGERIA: A PANEL MODEL

APPROACH. Australian Journal of Business and

Management Research, 2(2), p.31.

Lartey, V.C., Antwi, S., Boadi, E.K., 2013. The

relationship between liquidity and profitability of

listed banks in Ghana. International Journal of

Business and Social Science, 4(3).

Misman, F.N., Lou, W., Bhatti, I., 2013, January. The

Determinants of Credit Risk of Islamic Banks in

Malaysia: A Panel Study. In International Conference

on Accounting and Finance (AT). Proceedings (p. 99).

Global Science and Technology Forum.

Molyneux, P., Thornton, J., 1992. Determinants of

European bank profitability: A note. Journal of

banking & Finance, 16(6), pp.1173-1178.

Rahmi, C.L., 2014. Pengaruh Risiko Kredit, Risiko

Likuiditas Dan Risiko Tingkat Bunga Terhadap

Profitabilitas (Studi Empiris pada Perusahaan

Perbankan Terdaftar di Bursa Efek Indonesia). Jurnal

Akuntansi, 2(3).

The Analysis of the Effect of Liqudity Risk and Credit Risk to the Profitability in Conventional Banks of Indonesia

183