The Impact of Foreign Ownership on Corporate Risk Taking

Behavior

Dewi Asri Rosalina, Feri Rustandi, Amir Machmud

and Ikaputera Waspada

Universitas Pendidikan Indonesia, Jalan Setiabudhi 229, Bandung, Indonesia

{d.a.rosalina, ferirustandi}@student.upi.edu, {amir, ikaputerawaspada}@upi.edu

Keywords: Corporate Risk-taking, Foreign Ownership, Indonesia.

Abstract: This study aims to analyse the impact of foreign ownership on corporate risk taking behaviour at

non-financial, non-trade, non-service and non-investing companies that are listed in the Indonesian

Stock Exchange in 2014-2016. We use explanatory survey for this study. The sampling technique

used is the purposive sampling method. We use secondary data obtained from the Indonesian Stock

Exchange and annual reports. We then analyse the data using multiple linear regressions. The

result of this study shows that foreign ownership has a positive but statistically non-significant

impact on corporate risk taking behaviour.

1 INTRODUCTION

The participation of foreign investors in investing

activities in the Indonesian stock market is increasing

due to the local government’s policy of opening

business sectors that were previously restricted to

foreign investors. This economic liberalization is one

of the government's strategies to attract more foreign

investors and expand several business sectors in

Indonesia. (Suroyo & Nangoy, 2016).

The involvement of foreign investors in the stock

market is often associated with increased risk. One

reason for this is because foreign investors often

focus on seeking high short-term earnings, so they

encourage firm management to take higher risks, a

move aimed at boosting profits (Vo, 2015). Some

studies of foreign ownership conducted in the context

of developing countries (An, Huang, Li, & Xiao,

2014; Zhao & Xiao, 2016), indicate that foreign

investors often push local firms to conduct aggressive

investment strategies, which could lead to an increase

corporate risk taking activities. Given the

government's policy to open more business sectors in

Indonesia to foreign investors, it is interesting to

examine the relationship between foreign ownership

and corporate risk taking in the Indonesian context.

2 LITERATURE REVIEW

Research on the relationship between foreign

ownership and corporate risk taking has been done

before by, among others, Boubakri, Cosset, & Saffar

(2013), Paligorova, (2010), and Vinh (2016).

However, the available literature displays mixed

results.

Several previous studies have found that foreign

investors can influence corporate risk taking through

improvements in the implementation of corporate

governance in local companies. Foreign investors

often show more initiative in improving corporate

governance practices in local firms than local

investors (Ferreira & Matos, 2008). These

improvements are beneficial in reducing risk taking

activities conducted by management (Nguyen, 2010).

In contrast, a research done by An, Huang, Li, & Xiao

(2014) states that the improvement of corporate

governance practices due to foreign investors actually

increases corporate risk taking. This is because better

corporate governance increases the transparency and

reliability of the company, resulting in increased

investor confidence.

When companies operate in countries with poor

corporate governance standards, they typically

employ a more conservative investment policy. This

is because countries with poor corporate governance

practices typically have less developed stock markets

and fewer diversification opportunities (Stulz, 2005).

164

Rosalina, D., Rustandi, F., Machmud, A. and Waspada, I.

The Impact of Foreign Ownership on Corporate Risk Taking Behavior.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 164-167

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

In countries like these most shareholders, both

foreign and local, often prefer to avoid risk (John,

Litov, & Yeung, 2008).

Research conducted by Vo (2015) found that

foreign ownership in Vietnamese companies is

associated with lower levels of corporate risk taking

activities because of a tendency for foreign investors

investing in Vietnam to focus on long-term earnings.

When foreign investors own a significant amount of

stock in a particular company, they tend to limit the

risk taking activities of the company’s management

to prevent large losses to their portfolio. (Cheng et al.,

2011).

3 METHODS

The method used in this study is explanatory survey.

Consistent with prior literature, the population of this

research are non-financial, non-trading, non-services

and non-investment companies that went public and

are listed on the Indonesia Stock Exchange (BEI) for

the period of 2014-2016. We use purposive sampling

method to determine sample for this research. The

criteria for selecting the sample under study are as

follows: (a) Firms must be non-financial, non-trade,

non-service and non-investment companies (b) Firms

must be listed in the Indonesia Stock Exchange for

the period of 2014- 2016, (c) Firms must issue

financial statements continuously during the period of

2014-2016, (d) Firms have went public for at least 6

years (e) Firms must report financial statements with

rupiah as a currency unit. Ownership data is obtained

from the website of PT Kustodian Sentral Efek

Indonesia (KSEI). Company data and financial

statements are obtained from the Indonesia Stock

Exchange website and each company's website. The

analysis technique used is multiple linear regression

analysis.

This study follows research conducted by Faccio,

Marchica, & Mura (2011) in measuring corporate risk

taking behaviour, by using the ratio of profitability to

the volatility of profitability. The ratio is as follows:

CRT = ROA

ϬROA

(1)

Foreign ownership is measured by the following

ratio:

FOROWN = ∑foreign investors’ shares

x100%

∑shares outstanding

(2)

This study uses two control variables, namely

firm size and leverage.

SIZE = Ln total assets (3)

LEV = total liabilities

total assets

(4)

Company size was chosen because large firms are

considered less risky and shows lower levels of risk

(Vo, 2016). The leverage variable was chosen

because leverage plays an important role in increasing

the company's financial risk (Boubakri et al., 2013).

4 RESULTS AND DISCUSSION

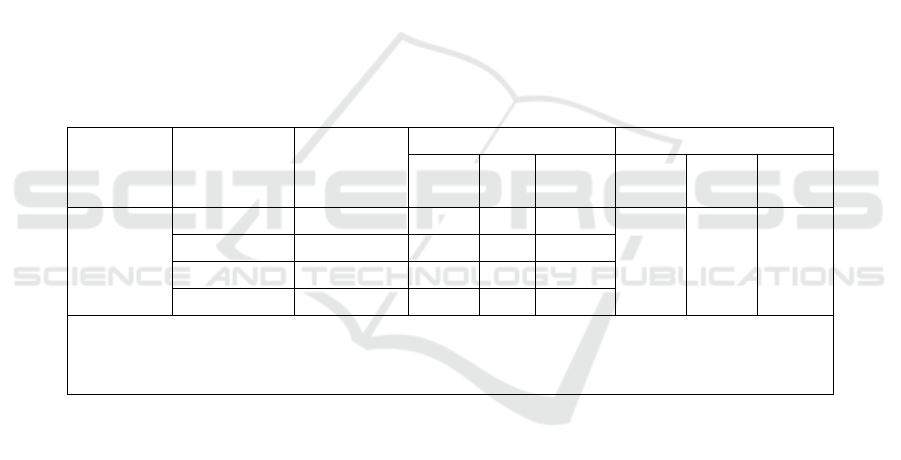

Table 1 shows the results of the regression tests that

examined the effect of foreign ownership along with

firm size and leverage as control variables on

corporate risk taking.

The regression coefficients of the study showed

varying signs, positive and negative. A positive

coefficient indicates the unidirectional effect of the

independent variable to the dependent variable,

whereas a negative coefficient indicates the opposite

effect of the independent variable to the dependent

variable. Based on table 1, foreign ownership has a

positive but non-significant effect on corporate risk

taking. The size of the firm has a negative, significant

effect on corporate risk taking. Leverage has a

positive, significant effect on corporate risk taking.

A coefficient of determination test was done to

determine the proportion of the variance in the

dependent variable that is predictable from the

independent variable. Based on table 1, a coefficient

of determination (R Square) value of 0,550 or 55%

was obtained for the model. Regression results show

that foreign ownership along with the control

variables firm size and leverage were able to explain

55% of the variance in volatility of profitability as a

proxy for corporate risk taking and the remaining

45% is influenced by other variables not examined by

this research.

According to the results of the study, foreign

ownership has a positive but non-significant impact

on corporate risk taking. These results do not support

the studies done by Vinh, (2016) and Cheng et al.,

(2011) which show that foreign ownership actually

reduces corporate risk taking behaviour. However,

these results support the studies conducted by An et

al., (2014) and Zhao & Xiao, (2016), which state that

The Impact of Foreign Ownership on Corporate Risk Taking Behavior

165

foreign ownership has a positive influence on

corporate risk taking.

Foreign ownership can increase corporate risk

taking behaviour for several reasons. One possibility

is that the involvement of foreign investors leads to

an improvement in corporate governance, which

leads to an increase in corporate risk taking (An,

Huang, Li, & Xiao, 2014). This is because

commitments and monitoring by foreign institutional

investors increase the transparency and reliability of

the company, resulting in increased investor

confidence. The implication is that managers in

companies with foreign investors are more trusted by

investors and are more likely to take risky projects.

Another possible explanation is that the increase of

foreign investment provides local firms with larger

capital and enables them to take advantage of risk-

sharing effect, meaning managers often feel they can

afford to take more risk because they have a stronger

buffer against risk. This supports the view of Umutlu,

Akdeniz & Altay-Salih, (2010).

The results show that leverage has a significant

positive relationship to corporate risk taking. This is

in accordance with the results of research conducted

by Bhagat, (2015) and Vinh, (2016). Leverage is one

of the strategies company management do when they

are seeking to increase company value, and

aggressive leveraging practices often lead to an

increase in the level of corporate risk (Moreno-

Bromberg & Roger, 2016).

The results show that firm size has a significant

negative relationship with corporate risk taking.

These results are consistent with research conducted

by Nguyen, (2010) and Boubakri et al., (2013).

Companies with greater asset levels are judged to

have a smaller risk level. In contrast, firms with

smaller amounts of assets are often in their growth

stage, so investors will usually encourage these

companies to take on riskier projects or engage in

more aggressive investment strategies (Lu, 2011).

Table 1: Results of regression tests

5 CONCLUSIONS

This study examines the relationship between foreign

ownership and corporate risk taking in non-financial,

non-trade, non-service and non-investment firms

listed on the Indonesia Stock Exchange in the period

2014-2016. Based on the results of our analysis we

find that foreign ownership tends to increase

corporate risk taking behaviour, although not on a

significant level. The results of this study are in

accordance with research conducted by An et al.,

(2014) and Zhao & Xiao, (2016), which state that

foreign ownership tends to increase corporate risk

taking behaviour. The results of this study are also in

accordance with the research conducted by Umutlu,

Akdeniz & Altay-Salih, (2010) which states that the

influence of foreign ownership on corporate risk

taking is non-significant.

The implications of our study are important for a

variety of stakeholders. It is relevant to company

shareholders, firm management, and policymakers in

emerging markets. For example, policymakers and

regulators are interested in the possible adverse or

beneficial volatility effects on stock market that

foreign investment brings, and might adjust their

economic policies accordingly. In emerging markets,

especially, strict regulations on foreign investments

tend to lead to poor economic growth, and so

governments might be interested in easing back the

restrictions on foreign investments to benefit from the

larger and more diverse capital foreign investors

bring.

Dependent

Variables

Independent

Variables

Coefficient t Test F Test

t value Sig Results F

value

Sig Results

CRT Constant ,265 4,31 ,000 43,51 ,000

b

sig

SIZE -,010 -4,32 ,000 si

g

LEV ,058 10,88 ,000 si

g

FOROWN ,030 2,12 ,036 not si

g

significance at (α): 0,05

R : ,741

a

R² : ,550

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

166

In this study, we measure corporate risk taking

using only a single proxy and two control variables,

Future studies might want to employ more proxies to

measure risk taking and sue more control variables.

Furthermore, future studies might analyze other

examine the influence of other factors of ownership

on corporate risk taking, such as local investor

ownership, ownership structure, and state ownership.

REFERENCES

An, Z., Huang, G., Li, D., & Xiao, S. (2014). Foreign

institutional ownership, risk-taking, and crash risk

around the world. Working Paper.

Bhagat, S. (2015). Size, leverage, and risk-taking of

financial institutions. Journal of Banking and Finance, 59.

Boubakri, N., Cosset, J.-C., & Saffar, W. (2013). The role

of state and foreign owners in corporate risk-taking:

Evidence from privatization. Journal of Financial

Economics, 108(3), 641–658.

Cheng, J., Elyasiani, E., & Jia, J. J. (2011). Institutional

ownership stability and risk taking: Evidence from the

life–health insurance industry. Journal of Risk and

Insurance, 78(3).

Dennis, D. K., & McConnell, J. . (2003). International

corporate governance. Journal of Financial and

Quantitative Analysis, 28(1).

Doidge, C., Karolyi, G. A., Lins, K. V., Miller, D. P., &

Stulz, R. M. (2009). Private Benefits of Control,

Ownership, and the Cross-listing Decision. Journal of

Finance, LXIV(1).

Estrin, S., Hanousek, I., Kocenda, E., & Svejnar, J. (2009).

The effects of privatization and ownership in transition

economies. Journal of Economic Literature.

Faccio, M., Marchica, M.-T., & Mura, R. (2011). Large

shareholder diversification and corporate risk-taking.

Review of Financial Studies.

Ferreira, M. A., & Matos, P. (2008). The colors of

investors’ money: The role of institutional investors

around the world. Journal of Financial Economics,

88(3), 499–533.

John, K., Litov, L., & Yeung, B. (2008). Corporate

Governance and Risk-Taking. The Journal of Finance,

63(4), 1679–1728.

Lu, J. (2011). Size, Leverage and Risk Taking.

Moreno-Bromberg, S., & Roger, G. (2016). Leverage and

Risk Taking. Working Paper.

Nguyen, P. (2010). Corporate governance and risk-taking :

Evidence from Japanese firms. Pacific Basin Finance

Journal, (April).

https://doi.org/10.1016/j.pacfin.2010.12.002

Paligorova, T. (2010). Corporate Risk Taking and

Ownership Structure Corporate Risk Taking and

Ownership.

Stulz, R. (2005). The limits of financial globalization.

Journal of Finance, 60, 1595–1638.

Suroyo, G., & Nangoy, F. (2016). Indonesia eases foreign

ownership in “Big-Bang” liberalization.

Umutlu, M., Akdeniz, L., & Altay-Salih, A. (2010). The

degree of financial liberalization and aggregated stock-

return volatility in emerging markets. Journal of

Banking and Finance, 34(3), 509–521.

https://doi.org/10.1016/j.jbankfin.2009.08.010

Vinh, V. X. (2016). Foreign Investors and Corporate Risk

Taking Behavior in an emerging market. Finance

Research Letters.

https://doi.org/10.1016/j.frl.2016.04.027

Vo, X. V. (2015). Foreign ownership and stock return

volatility–evidence from Vietnam. Journal of

Multinational Financial Management, 30, 101–109.

Vo, X. V. (2016). Foreign ownership and stock market

liquidity-evidence from Vietnam. Afro-Asian Journal

of Finance and Accounting, 6(1).

Zhao, S., & Xiao, S. (2016). Ownership Structure and

Corporate Risk Taking : Evidence from an Emerging

Market, 2016(December), 1–21.

The Impact of Foreign Ownership on Corporate Risk Taking Behavior

167