Sharia Microfinance and Poverty Reduction in Indonesia

Amir Machmud

Universitas Pendidikan Indonesia, Setiabudhi 229 street, Bandung, Indonesia

amir@upi.edu

Keywords: Sharia Microfinance, Poverty, Indonesia.

Abstract: This study aims to analyse Sharia microfinance and poverty in Indonesia. In this study also analyzed the

impact of sharia microfinance on poverty alleviation. This study uses explanantory survey method with data

collection techniques through questionnaires and interviews. The population is the poor who have received

capital assistance from microfinance. The sample counted 94 of the population as much as hell. The collected

data is then analyzed by using descriptive analysis through Wilcoxon different test. The results of the study

show that Islamic microfinance is able to eradicate poverty in Indonesia. This can be seen from the difference

in income before and after receiving capital. This finding has implications for policies related to poverty

alleviation through the role of Islamic financial institutions.

1 INTRODUCTION

Microfinance is a financial institution engaged in the

special financing of small and medium entrepreneurs

(Machmud, 2009, 2012). In many countries,

microfinance plays a role in improving the welfare of

society and even able to cope with economic shocks

and fluctuations (Ledgerwood, 1998, Littlefield,

Murduch, & Hashemi, 2003, Robinson,

2001).Microfinance has been shown to have a

positive effect on poverty alleviation at the macro

level (Imai et al 2012), microfinance plays a role in

poverty reduction and socio-economic development

in Sub-Saharan African countries (Rooyen et al.,

2012).Microfinance in Malaysia has a positive effect

on economic vulnerability among inaccessible

households (Al-mamun et al., 2014).Studies by

(Ghaliba, Malki, and Imai 2014), emphasize that ;

Microfinance in Pakistan has a positive impact on

poverty alleviation that is manifested. In changes in

household income and expenditure, especially on

clothing and health. According to panel data findings,

microfinance in Bangladesh was found to have a

positive impact on poverty reduction and household

expenditures, especially food and non-food

(Khandker 2005).Ugandan microfinance has a

positive impact on rural clients, families, and

communities; Income diversification and asset

accumulation (Morris and Barnes 2005).

Based on data collected from Guatemala, India,

and Ghanamic micro-finance impact on the welfare

of household and business borrowers (Mcintosh,

Villaran, and Wydick 2008). Microfinance has a

positive impact on Revenue borrowers especially in

urban areas in India (Imai, Arun, and Annim 2010).

Zimbabwe's microfinance has a positive impact on

poverty reduction, as seen in the difference in average

income received by microfinance customers greater

than; Non-customer income; (Morduch and Graduate

2002).

Based on the results of the study, showing that;

Microfinance has a significant impact on poverty

reduction and household welfare at different levels

such as asset acquisition, household nutrition, health,

food security, children's education, women's

empowerment, and social ties (Armend & Aacute;

Riz de Aghion and Morduch 2000; Armend & amp;

aacute; riz and Morduch 2005, 2010; Hashemi,

Schuler, and Riley 1996; Littlefield et al. 2003;

Roodman and Morduch 2009). Malaysian

microfinance plays an important role in the socio-

economic development of poor and low-income

people, especially women (Al-mamun et al., 2014;

Al-Shami et al. 2013). However, studies using

Islamic microfinance are rare. Islam as a system that

is fundamentally different from the conventional

system in force, has Maqasid Al-Shariah (shari'a

goal) achieved through the practice and

implementation of Islamic law. This is important to

realize the falah or the success of human life in this

world and the hereafter. Machmud (2012) tries to

offer a model of poverty alleviation through the

78

Machmud, A.

Sharia Microfinance and Poverty Reduction in Indonesia.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 78-82

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

development of sharia micro finance with the capital

source of Zakat, Infak and Shadaqah.

Significant impact of microfinance highlighted by

some previous studies, most of the research was

conducted in rural areas and using simple statistical

tools such as T, Mann-Whitney test exposed to some

weaknesses such as bias selection and lack of control.

Influence of demographic characteristics (Hashemi et

al 1996).

The purpose of this review is to analyse the role of

sharia micro finance in poverty alleviation of urban

communities in Indonesia. This study is expected to

serve as an input for pre-adopting policies related to

sharia micro finance with poverty.

2 METHODS

This study used explanatory survey method with data

collection techniques through questionnaires and

interviews to 94 communities receiving financing

from microfinance in the city of Bandung, West Java.

Questionnaires distributed to previous respondents

were tested for validity and reliability. The collected

questionnaires were then analyzed using descriptive

analysis using differentiation test of wilcoxon before

and after.

Operational definitions of survey variables

Poverty line revenue is widely recommended for use

in measuring the impact of microfinance at the

household level on behalf of (Johnson and Rogaly

1997; Navajas et al., 2000; Panjaitan-Drioadisuryo

and Cloud 1999). In this study, Dependent is

Household income which is adopted from poverty

line in Indonesia based on BPS criteria. The source of

income of head of household is: farmer with land area

500m2, farm laborer, fisherman, construction worker,

planter and or other work with income below Rp.

600.000, - per month.

Review of gender the number of male respondents

is 17.02 percent; And female respondents is 82,98%.

Number of female respondents in microfinance; As

MFIs adopt Grameen Bank Prof.Yunus financing

pattern in which financing customers are prioritized

for women. The average age of respondents in this

study is 43 years. This age exists in productive age.

Based on education level, most of them are 97.87

middle to lower, only 2.13% Just the Above

medium. Respondents in general Owns used goods

business, juices, plants, water refills, plastic,

photocopy, Accessories, services, pulses, Toys,

barber and clothes Fruit, counter, vegetables, and

cakes. Type of business sewing and selling goods,

food business and food business. Financing obtained

by most of the respondents who get financing used for

its principal and sideline business. Reasons for using

financing 60% financing due to his desire to develop

business, while The remaining 40% Due to lack of

capital for his business. The amount of financing

made by the respondent is ranged from Rp.1.000.000

to Rp.5.000.000, - that is as much as 79.79%. He

remaining 20.21 percent more than Rp. 5.000.000.

The amount of this financing Due to the ability to pay

a small repayment of respondents. As mentioned

earlier that the goal of Microfinance sharia is a society

with low economy.

3 RESULTS AND DISCUSSION

3.1 Result Study

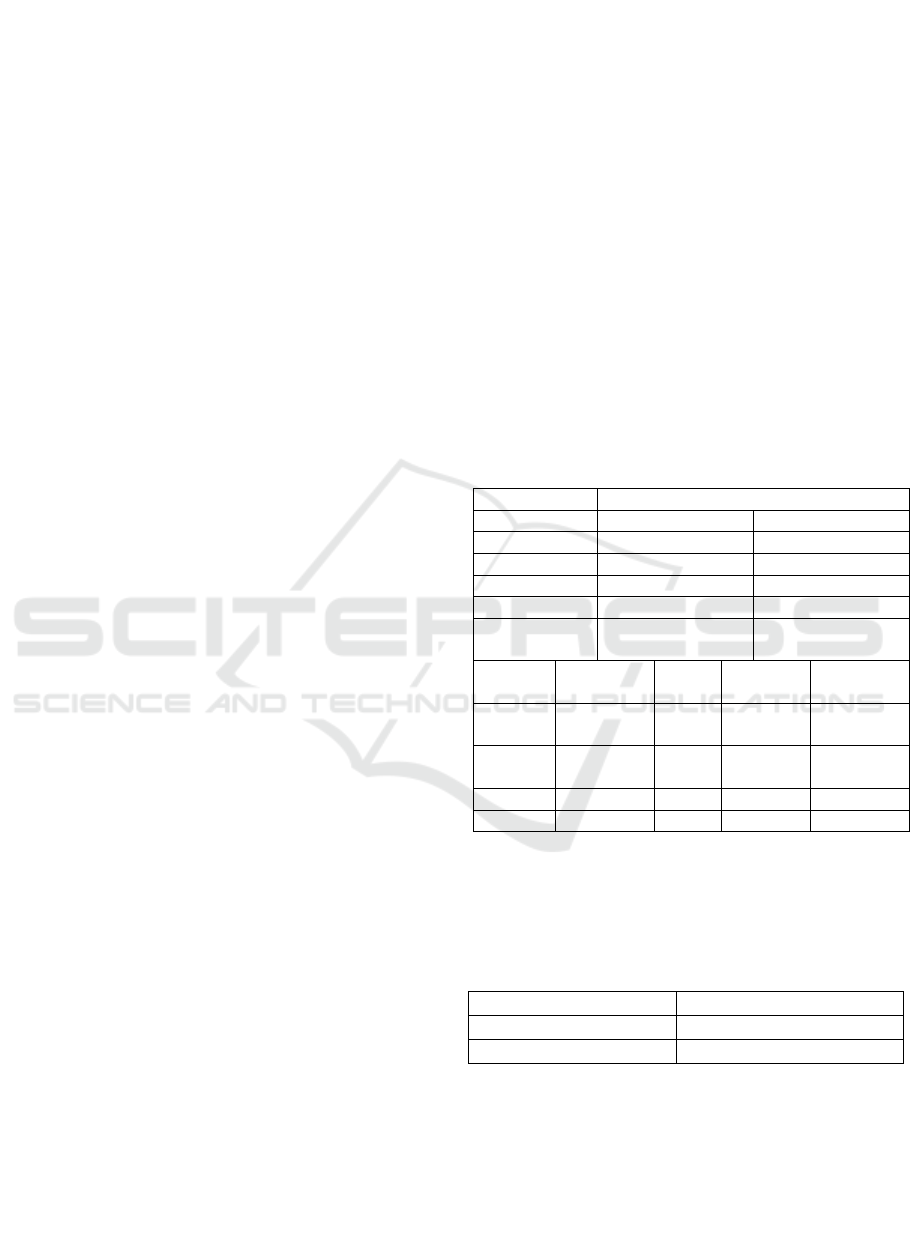

Table 1: Income Conditions Before and After Getting

Microfinance Sharia Financing

Income

Before

After

N

94

94

Minimum

470.00

12500.00

Maximum

735.00

19000.00

Mean

4131.8617

6442.4468

Std.

Deviation

2651.79063

4318.61461

N

Mean

Rank

Sum of

Ranks

Before

Negative

Ranks

0

a

.00

.00

After

Positive

Ranks

91

b

46.50

4186.00

Ties

3

c

Total

94

a. After <Before

b. After > Before

c. After = Before

Table 2: Different Test Income

Test Statistics

b

After - Before

Z

-8.284

a

Asymp. Sig. (2-tailed)

.000

3.2 Discussion

In Table 1 it is clear that there has been an increase in

revenue, the average sales volume during the 5

months before the financing increased by 55.92

percent compared to the previous income. Most

nsabah experience income increase after sharia

Sharia Microfinance and Poverty Reduction in Indonesia

79

microfinance financing. Table 2 looks calculation

results Rank Wilcoxon, the value of Z obtained at -

8.284 with Sig. (2-tailed) 0,000 where less than the

critical limits of the research is 0.05 which means

there is a difference in income.

Before and after receiving financing from sharia

microfinance prior to the business fluctuation of

respondents fluctuate. In the 3rd month there tends to

be a decrease in sales volume that results in their

income. This is because at that time there is an

increase in the price of basic commodities that cause

them cannot buy staples as much as usual, resulting

in decreased production volume of its business. The

decrease in the volume of business resulted in a

decrease in sales volume resulting in the profit

received in the third month decreased. In addition to

reducing the raw materials used in every

manufactured goods, there are also respondents who

keep selling as usual but with the price of goods sold

more expensive than before. The price increase also

has an impact on consumer buying desire so that there

are consumers who prefer to shop elsewhere whose

price is cheaper. The departure of consumers

elsewhere would result in reduced volume of goods

sold.

The sales volume of SMEs financing recipients

after financing becomes better. This is indicated by

the increase of monthly sales volume. However, there

are still respondents whose business volume remains

the same as before financing. This is because after the

respondents get financing funds, they do not use it for

the purpose of increasing the volume of production,

but to improve the existing facilities on the business.

As an example of one respondent's business selling

finished food, the business owner said that he did not

use the funds to increase his production volume, but

used it to buy fans, Tv and refrigerator. The reason

why he used the funds to buy these items is that

customers become more comfortable to eat in place.

The result of the addition of the facility makes the

merchandise become faster than usual.

One of the business respondents engaged in

services is a haircut. Prior to the financing of the

barber owner using ordinary shaving scissors to cut

the hair of his customers, this is due to lack of capital

to buy a more modern haircut. The use of ordinary

shaving scissors makes the hair cutting activities

become longer, so customers who get every day very

little. After getting the financing, he used the funds to

buy new equipment that support for his business one

of which is an electric haircut machine. The use of

electric hair cutting tool to make hair cutting activities

to be faster than before using the tool. This resulted

in an increasing number of customers that he got, so

it can be said that the business becomes more

developed than ever before.

Not all businesses that get the financing are

progressing, there are some undeveloped business.

According to sharia microfinance officers, the causes

of the undeveloped business because they do not use

the funds provided properly, for example there are

customers who use the money for his personal

interests not for the business he runs, there are also

customers who use to buy a refrigerator for the shop

just because not to be outdone by other stalls and not

well used for his business so instead of splitting

income instead of the greater the expenditure due to

increased electricity costs.

Sharia microfinance officers mention that whether

or not the financing depends on the customer, if the

funds are used properly then the business can grow

and vice versa if not used well then the business will

not grow. The use of good and bad funds refers to

what the customers do with the funds. The funds can

be used properly if the funds are used to increase the

volume of their business, such as adding raw

materials, and adding production equipment. The

fund is said not to be used properly if it is used for

personal purposes not related to the business

undertaken and cannot maximize the goods

purchased with these funds.

Findings show that sharia microfinance have a

positive impact on the welfare of urban communities

through increased incomes. This is in line with the

findings of previous researchers. Microfinance has a

positive impact on poverty reduction and household

income (Al-mamun et al 2014), household

expenditures (Ghaliba et al., 2014), food and non-

food expenditure (Khandker 2005) or diversification

of revenues and assets Accumulated Morris and

Barnes 2005). In line with this research, sharia micro

finance in Indonesia has a positive impact on urban

poverty alleviation. The results of this study also

shows the dominant increase in income of women.

This shows that women with knowledge of business

are better able to generate profits and increase their

business income. These findings have implications

for the importance of expanding nonfinancial services

such as business development and entrepreneurship

training to female clients before lending them (Karlan

and Valdivia 2011).

4 CONCLUSIONS

These findings provide insights on the role of sharia

micro finance against poverty alleviation of urban

communities in Indonesian context. These findings

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

80

indicate that sharia micro finance contribute

significantly to the achievement of new economic

policies and models in creating wealth. That happens,

through improving the socio-economic welfare of the

poor and low income people, especially women. It

also plays a central role in creating jobs for women

especially those with low education. Therefore,

microfinance opens opportunities for economic

development.

ACKNOWLEDGEMENTS

Thanks to the Directorate of Research and

Community Service, the Directorate General of

Higher Education, the Ministry of Research,

Technology and Higher Education as the grant

(Kemenristek Dikti) beneficiary grant.

REFERENCES

Al-mamun, Abdullah, Mohammad, Nurul, Huda,

Mazumder, and Malarvizhi, C. A. 2014. Measuring the

effect of amanah ikhtiar Malaysia’s microcredit

programme on economic vulnerability among hardcore

poor households. Progress in Development Studies, 1,

49–59.

Al-Shami, Sayed, Samer, Ali, Izaidin Bin Adbul Majid,

Nurulizwa Abdul Rashid, and Mohd Syaiful Rizal Bin

Abdul Hamid. 2013. Conceptual framework: The role

of microfinance on the wellbeing of poor people cases

studies from Malaysia and Yemen. Asian Social

Science 10(1), 230–42.

Angelucci, Manuela, Dean S., Karlan, and Jonathan,

Zinman. 2013. Win some lose some? Evidence from a

randomized microcredit program placement

experiment by compartamos banco. Institute for the

Study of Labor (IZA), 7439, 71.

Armendáriz, Beatriz, Aghion, and Jonathan, Morduch.

2005. The economics of microfinance, Economic

Record, 82, 491–92.

Armendáriz, Beatriz, and Jonathan, Morduch. 2010. The

economics of microfi nance second edition Beatriz

Armendáriz and Jonathan Morduch. second. United

States of America: Library of Congress Cataloging-in-

Publication Data.

Armendáriz de Aghion, and Morduch, J. 2000.

Microfinance beyond group lending. Economics of

Transition 8(2), 401–20.

Armendáriz, and Morduch, J. 2005. The economics of

microfinance. MIT Press: Cambridge, MA.

Brannen, Conner. 2010. An impact study of the village

savings and loan association (VSLA) program in

zanzibar, Tanzania. Wesleyan University. 728 Sayed

Samer et al. / Procedia - Social and Behavioral

Sciences 195 (2015) 721 – 728

Duvendack, Maren, Richard Palmer-Jones, and Lee,

Hooper. 2011. Systematic review what is the evidence

of the impact of microfinance on thewell-being of poor

people? By.

Ganlea, John, Kuumuori, Kwadwo Afriyie, and Alexander

Yao Segbefia. 2015. Microcredit: Empowerment and

disempowerment of rural women in Ghana” World

Development, 335–45.

Ghaliba, Asad K., Issam, Malki, and Katsushi, S. Imai.

2014. Microfinance and household poverty reduction:

Empirical evidence from rural Pakistan. Oxford

Development Studies, 84–104.

Hashemi, S. M., S. R. Schuler, and A. Riley. 1996. Rural

credit programs and women’s empowerment in

Bangladesh. World Development 24(4), 635–53.

Hiatt, Shon R., and Warner P. Woodworth. 2006.

Alleviating poverty through microfinance: Village

banking outcomes in Central America. The Social

Science Journal, 43(3), 471–77.

Imai, Katsushi S., Thankom, Arun, and Samuel, Kobina

Annim. 2010. Microfinance and household poverty

reduction: New evidence from India. World

Development, 38, 1760–74.

Imai, Katsushi S., Raghav, Gaiha, Ganesh, Thapa, and

Samuel, and Kobina Annim. 2012. Microfinance and

poverty-a macro perspective. World Development,

40(8), 1675–89.

Johnson, and Rogaly. 1997. Microfinance and poverty

reduction. UK and Ireland: UK: Oxfam.

Kabeer, Naila. 1999. Resources, Agency, Achievements:

Re-ections on the measurement of women’

empowerment. Blackwell Publishing Limited, 30(May),

435–64.

Karlan. 2001. Microfinance impact assessments: The perils

of using new members as a control group. Journal of

Microfinance, 3, 75–85.

Karlan, Dean. 2007. Cross sectional impact analysis: Bias

from dropouts. Microfinance Journal (December).

Karlan, Dean, and Martin Valdivia. 2011. Teaching

entrepreneurship: Impact of business training on

microfinance clients and institutions. Review of

Economics and Statistics, 93, 510–27.

Khandker, Shahidur. 2005. Micro-finance and poverty:

Evidence using panel data from Bangladesh.

Kondo, Toshio, Aniceto, Orbeta Jr., Clarence, Dingcong,

and Christine, Infantado. 2008. Impact of microfinance

on rural households in the Philippines. IDS Bulletin,

39(1), 51–70.

Ledgerwood, Joanna. 1998. Microfinance handbook: An

Institutional and Financial Perspective. Washing:

World Bank.

Lehar, Habibah, Yaacob Anas, and Tey Hwei Choo. 2014.

Malaysian Economy. Oxford University Press.

Littlefield, Elizabeth, Jonathan Murduch, and Syed

Hashemi. 2003. Is microfinance an effective strategy to

reach the millennium development goals?

Mcintosh, Craig, Gonzalo Villaran, and Bruce Wydick.

2008. “Microfinance and home improvement: Using

retrospective panel data to measure program effects on

fundamental events.

Sharia Microfinance and Poverty Reduction in Indonesia

81

Morduch, Jonathan, and Robert F. Wagner Graduate. 2002.

Analysis of the effects of microfinance on poverty

reduction.

Morris, Gayle, and Carolyn Barnes. 2005. An assessment

of the impact of microfinance. Journal of Microfinance,

7(1), 39–54.

Navajas, Sergio, Mark, Schreiner, Richard L., Meyer,

Claudio, Gonzalez-vega, and Jorge, Rodriguez-meza.

2000. Microcredit and the poorest of the poor: Theory

and evidence from Bolivia. World Development, 28(2),

333–46.

Panjaitan-Drioadisuryo, Rosintan D. M., and Kathleen

Cloud. 1999. Gender, self-employment and microcredit

programs an Indonesian case study. The Quarterly

Review of Economics and Finance, 39, 769–79.

Robinson, Marguerite. 2001. The microfinance revolution

sustainable finance for the poor. Washington, US:

World Bank.

Roodman, David, and Jonathan, Morduch. 2009. Mpact of

microcredit on the poor in Bangladesh: Revisiting the

Evidence. Washington.

Rooyen, C., R. Stewart, and T. de Wet. 2012. The impact

of microfinance in Sub-Saharan Africa: A systematic

review of the evidence. World Development, 40, 2249–

62.

Swain, Ranjula Bali, and Adel, Varghese. 2009. Does self

help group participation lead to asset creation? World

Development, 37, 1674–82.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

82