Financial Literacy Analysis on Students of Economic Faculty

Feri Febriandi, Agung Haryono, and Ro’ufah Inayati

Economic Faculty, State University of Malang, Indonesia

Keywords: Financial literacy, branchless banking.

Abstract: This study aims to describe the users of Branchless Banking financial literacy and students’ consideration

factors in financial management. This research used qualitative method and case study approach. The

sampling technique used was snowball sampling. Data were obtained by in-depth interview technique and

observation, while sources triangulation was used to check the validity of data. The results show that, Faculty

of Economics students who use branchless banking service are categorized to have good financial literacy.

Students with good financial literacy have high rationality in consumption strategies, efficiency, resource

optimization, and risk management consideration in making decision. On the other hand, there are a small

number of students who have low financial literacy, their actions are still inclined to spend money only for

satisfaction in consuming. Implication are presented to department and faculty of Economics to improve

practicing for the students through non-academic activity that can create equity of student financial literacy.

1 INTRODUCTION

The rapid development of technology affect has an

impact on the increase of technology based economic

activity. For instance, banks have used technology

based services since the introduction of branchless

banking. The advanced development of economics

and finance information technology needs to be in

line with the rate of decision making. One of the

abilities that must be possessed to make decision

quickly and properly is financial intelligence.

Financial intelligence a competence that can be built

from financial literacy, it is an ability to manage

assets which always consider the benefits, costs, and

outcome of any decision made (Bosshardt and

Walstad, 2014: 68). Financial problems are not only

caused by the lack of income, but can also occur due

to the lack of proper management and financial

planning. Financial literacy is very important in

supporting the realization of individual goals in

decision making. This study aims to describe the

users of Branchless Banking financial literacy and

students’ consideration factors in financial

management on Students of Economic Development

Department.

The result of Otoritas Jasa Keuangan (OJK)

survey shows that the index of public financial

literacy reached 21.84% in 2013 to 29.66% in 2016

(OJK: 2016). As knowledgeable people, students are

expected to have better awareness and understanding

of financial management than common people.

However, Rishang (2014) stated that high consumer

attitudes among students and other young people

recently cause financial management becomes a

difficult task. Apart from these attitudes, many young

people do not yet have financial management

knowledge.

To improve financial literacy and public access to

banks, the government propose Strategi Nasional

Inklusi Keuangan (SNIK) programs. One of the

programs is through branchless banking, is a limited

payment and financial service which is done not

through offices, but by means of technology.

The benefits of the increase of financial inclusion

according to Bank Indonesia are: (1) Improve

economic efficiency. (2) Support the stability of the

financial system. (3) Reduce shadow banking or

irresponsible finance. (4) Support financial markets

deepening. (5) Provide new market potential for

banking. (6) Supports the improvements of

Indonesian Human Development Index (HDI). (7)

Positively contribute to local and national economic

development sustainably.

OJK expects that Branchless Banking can

improve the understanding of less literate people on

financial institution, utilization and condition, and

financial management. By providing easy,

convenient, and more efficient access, it will

encourage the utilization of financial institution

services for well literate people.

40

Febriandi, F., Haryono, A. and Inayati, R.

Financial Literacy Analysis on Students of Economic Faculty.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 40-45

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Lusardi and Mitchell (2006) suggest that men

have a higher level of financial literacy than women.

While Erner, Menke and Oberste (2016) the basic

financial literacy is influenced by gender, age, IQ and

mathematical skills. As for the more complex

financial literacy influenced by gender, age,

occupation, IQ and foreign language skills.

2 METHODS

This research used qualitative method and case study

approach. This research was conducted in di Faculty

of Economy, Universitas Negeri Malang, and the

subject were the Branchless Banking users who are

majoring in Development Economics. Samples were

taken by Snowball technique on 15 students. Data

were obtained by using Indepth interviews and

observation. Interviews were conducted intensely in

order to explore all information related to the rational

use and the type of service used, while observation

was conducted to view related documents to the use

of branchless banking services.

The data analysis technique used in this research

was qualitative data analysis, following the concepts

by Miles, Huberman and Spradley. Miles and

Huberman in Sugiyono (2014) suggests that the ac-

tivities in qualitative data analysis are done

interactively and continuously in every stages of

research until it is complete. The validity of the data

in this study were checked by using observation and

triangulation.

3 RESULTS AND DISCUSSION

3.1 Students Financial Literacy

3.1.1 Well Literate Student of Branchless

Banking User Service

Well Literate students are able to combine the

management and the use of their resource for

consumption needs and increase their revenue

through the production process. In utilizing their

money for goods or services, students at this level

tend to acquire some information before. This shows

how the students tend to make analytical spending or

consumption decisions or policies effectively and

efficiently based on some considerations. Students in

this state have already had deep knowledge of

financial institutions, as well as reliance to the

institution, especially in banking. Students also

optimize the use of banking services, by considering

the benefits and risks of using the services. Below is

a diagram of the Well Literate level:

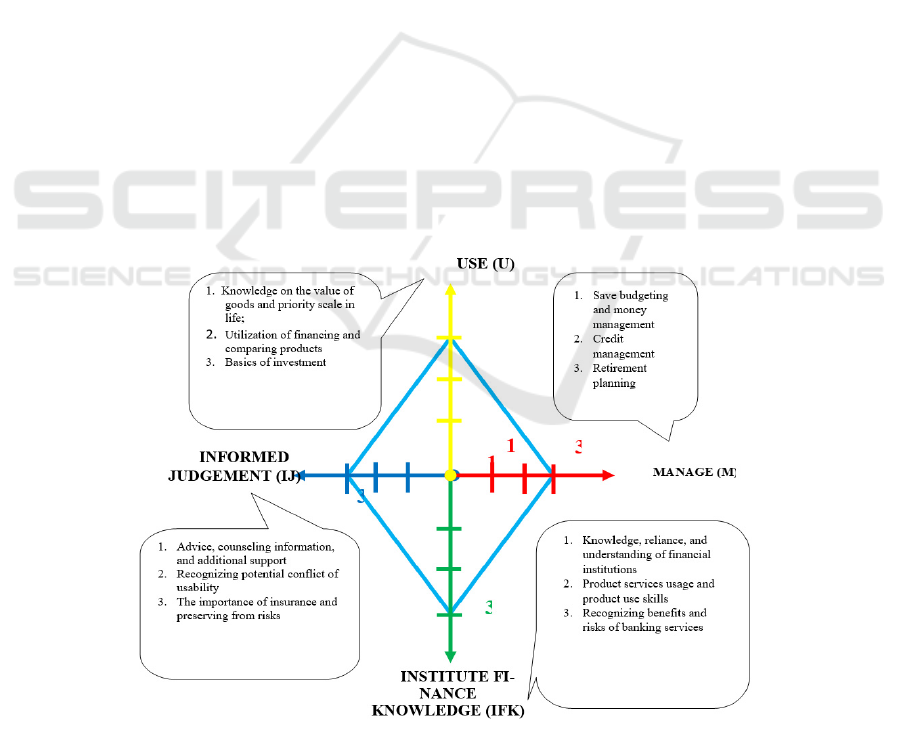

Figure 1: Graph of Students of Branchless Banking Service User with Well Financial Literacy

Financial Literacy Analysis on Students of Economic Faculty

41

The figure 1 shows that the ideal conditions of student

financial literacy are on the light blue line, this

indicates that the student has a balanced level of

economic literacy and management, planning, and

optimal and smart decision making. Students of

Branchless Banking users with financial literacy on

M =3; IFK = 3; IJ = 3; and U = 3, have the best

financial use and management from their experience,

along with good knowledge and use of banking

products. (M = 3) in this state of their perception have

been on good financial management, from savings

lifestyle and the desire to prosper their life through

seeking other sources of finances such as producing.

(IFK = 3) in this state, informants already have a deep

knowledge on financial institutions, as well as

reliance to the institution, especially banking.

Informants also optimize the use of banking services,

for instance the benefits and risks of service use.

Informants also understand and have the purpose in

using the service. (IJ = 3) Stu-dents have been able to

overcome the conflicts and financial problems by

making the right decisions. (U = 3) those students

have a good consideration in man-aging their

finances, knowing their needs in depth and having the

fundamentals of investment for financial welfare that

will come. Well Literate students, have had the

awareness and ability to manage and the use of their

funds, so they are safe from the financial risks and

financial management failures

3.1.2 Sufficient Literate Student of

Branchless Banking User

Sufficient literate students combine the management

and use of their funds for consumption needs, their

financial management tends to be able to meet the

needs without increasing their income. Benefits that

can be taken by those informants from spending and

comparing products are the satisfaction in fulfilling

their needs.

Students of this level do not yet have an

understanding of the fundamentals of investment for

their future especially in raising the income in their

finances. Students in this level are quite good at

understanding the financial institution, the use of in-

depth financial services and a deep understanding of

the benefits and risks of using the services. The

following graph illustrates the level of literacy of the

Sufficient Literate category.

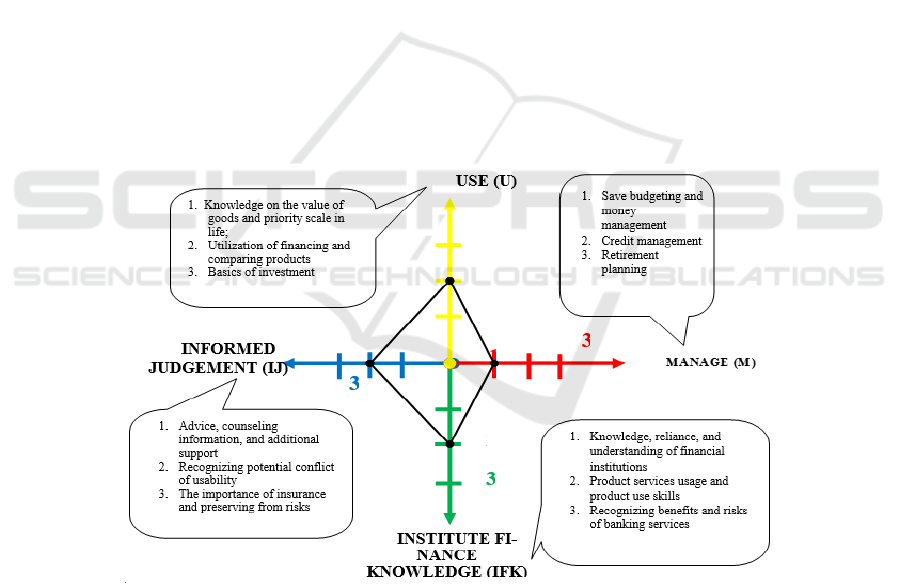

Figure 2: A Graph on Students’ Financial Literacy on the Use of Branchless Banking Service in Sufficient Literate Category

The figure 2 presents the ideal condition of students’

financial literacy is on the blue line. It indicates that

students have the level of economic literacy which is

offset by management, planning, optimum decision

making. Students who use Branchless Banking

service with financial literacy under the condition

M=1; IFK=2; IJ=2 and U=2, have good enough

ability in using and managing their finance. (M=1)

students under this condition be-long to average in

managing their finance starting from their saving

habit and budgeting their finance. The informants’

paradigm tends to desire to have what is wanted,

without any thought to get other sources of revenue.

(IFK=2) students in this condition are good enough in

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

42

understanding financial institution, less indepth in the

use of financial service as well as enough

understanding in knowing the benefits and risks of the

service use. (IJ=2) in this category, students could

overcome the financial conflict although sometimes

they need their parents’ help. (U=2) this category

shows that the use of funds by the informants have

been wise, they are more precise and selective during

the consideration process. Students in Sufficient

Literate type have already had the ability in managing

and spending funds, yet they do not have enough

skills in managing their money thus they are prone to

risks and failure resulting from the management.

3.1.3 Less Literate Student of Branchless

Banking User

Students in Less Literate category combine the

management and the usage of their funds as

consumption needs, to fulfil their needs, they have

never made a clear planning but a budgeting merely

for the primary needs. In saving and consuming, they

do not have special allocation. The desire to meet

their satisfaction beats rationality in self-control for

economic activity.

Students in this type do not have fine knowledge

on the value of things and priority scale in their life as

students. The priority scale as students that must put

life and education first are often interrupted due to the

desire to meet their private needs.

There is no willingness in maximizing the income

that they have as students since they only need to

fulfil their consumption needs. Parents who let their

children manage their own money make these

students excessive in spending their money. All

financial problems will be handed over the parents.

Students in this category tend to use banking

service only to withdraw money and check the

balance thus they do not use the service optimally.

They do not have sufficient knowledge on the

benefits and risks of banking service thus created an

impression that they use the service merely to

withdraw money since they are far from their parents.

The following graph presents the literacy of the Less

Literate category

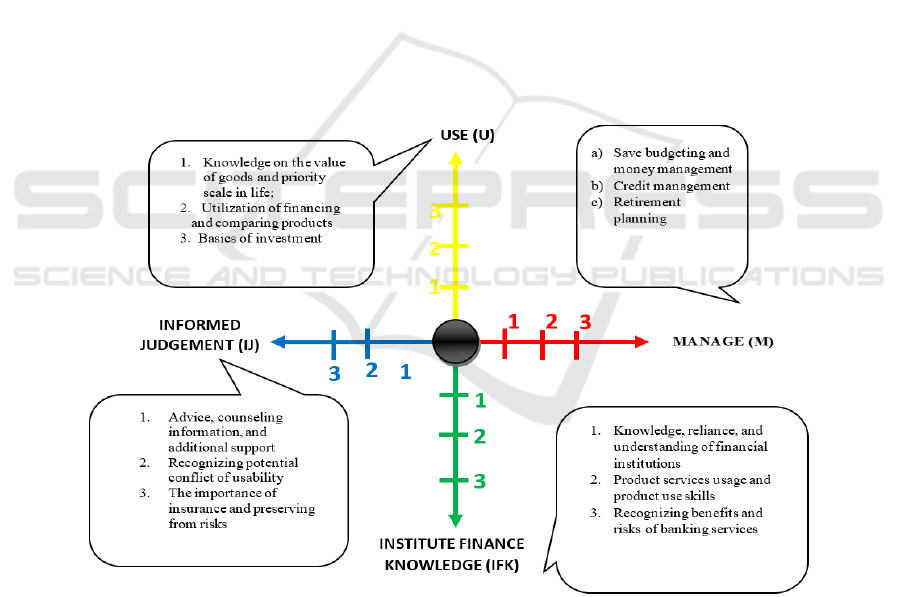

Figure 3: A Graph on Students’ Financial Literacy on the Use of Branchless Banking Service in Less Literate Category

The figure 3 above depicts that users of Branchless

Banking service with financial literacy on M=0;

IFK=0; IJ=0; and U=0 have the lowest financial

ability skill compared to the others. (M=0) those type

of students commonly have no skill and experience in

managing their finance due to less control from the

parents and allow them to be in charge of their

finance. (IFK=0) this type of students tend to use

banking service merely to withdraw money and check

the balance therefore they do not use the service

optimally. They do not have sufficient knowledge on

the benefits and risks of banking service thus created

an impression that they use the service only to

withdraw money since they live far from their

Financial Literacy Analysis on Students of Economic Faculty

43

parents. (IJ=0) students on this type are more

emotional in using their money. They are ignorant on

others’ opinions and tend to hand over the financial

problems to their parents. They manage the money for

something that they want without having further

consideration. (U=0) These students have already had

thoughts on how to spend their funds, yet they lack of

control and are more emotional in meeting their in-

ward fulfilment.

3.2 Students Consideration in Managing

Funds

3.2.1 Well Literate Students

Students in this category have more consideration on

arranging and managing funds to meet their needs as

well as obtain more income. They do not use the

funds for consumption satisfaction. They are likely to

dig deeper information on the quality, price and use

of the products. In fact, some students have thoughts

on how the goods could provide additional income. It

illustrates that students have effective and efficient

analytical decision in expenditure. In handling the

risks, they often look for preventive and effective

actions to solve them. They have thought and

considered the short term and long term possibilities.

These results are in line with Need Achievement

theory (McClelland: 2010) and studies Satrio Y.D

(2012).

3.2.2 Sufficient Literate Students

Students under this criteria spend their money to

fulfill their consumptive desire. The consideration on

how to spend the money for goods or services is

frequently changing depends on their eagerness.

Their analytical thoughts are more on the price and

quality of certain products. Generally, students on this

type rely their funds only to their parents. The failure

in managing their money is tolerable and can be a

lesson for them.

3.2.3 Less Literate Students

These students heavily depend on their parents to

meet their needs. They are more emotional in

spending their money. After receiving money from

their parents, they think about how they could spend

all the money to earn what they want. They do not

have good analytical thoughts in spending the money

com-pared to other types. Failure in managing the

funds is not a problem to them. When they face such

problems, they will ask their parents for help. These

results are in line with previous studies, suggesting

that democratic characteristic and parent’s

socioeconomic are systematically related to literacy

levels (Erner C. et. All: 2016).

4 CONCLUSIONS

The majority of Economics students who use the

Branchless Banking service have fine financial

literacy. The high financial literacy covers the

budgeting, saving and managing money, the bases of

investment and knowledge about the value of good

and priority scale of their lives. In addition, it also

covers the potential of conflicts and benefits, under-

standing and belief in banking service and its benefits

and risks and finding additional information and

support.

Students with high financial literacy are not only

prioritize their desire but also eager to have additional

income. They are likely to look for further

information on the quality, price and use of the

products. They tend to have effective and efficient

analytical thoughts. Students with average level of

financial literacy often use the money to fulfill their

wish. The consideration on how to spend the money

for goods or services is frequently changing depends

on their eagerness. Students with low financial

literacy tend to spend the money without taking into

account the economic consequences. They do not

have good analytical thoughts in spending the money

and failure in managing the funds is not a problem to

them.

A few students have low financial literacy.

Therefore, the faculty and department of economy

have to develop either academic or non-academic

activity to involve students thereby encouraging

students’ level of financial literacy.

REFERENCES

Bosshardt W, and Walstad W. B. 2014, National Standards

for Financial Lit-eracy: Rational and Content. The

Journal of Economics Education, 45 (1), 63-70.

Bank Indonesia, Keuangan Inklusif di Indonesia. Diakses

dari http:// www. bi.go.id/ /perbankan/ keuanganin-

klusif/Indonesia/Contents/Default.aspx

Erner C. Goedde-Menke M, and Oberste M. 2016.

Financial Literacy of High School Student: Evidence

from Germany. The Journal of Economic Education

2016, Vol 47 no. 2, 95 – 105

Lusardi, A and Mitchell, O. S. 2006. Financial Literacy

and Planning: Implications for Retirement Wellbeing.

Google.com- Financial Literacy.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

44

McClelland, D.C. (Inggris) The Achieving Society, New

York: Van Nostrand Reinhold, 1961, hal. 63-73 (online,

diakses pada wikipedia.com tanggal 2 Juni 2012)

OJK. 2013. Strategi Nasional Literasi Keuangan

Indonesia. Jakarta: Direktorat Informasi dan Edukasi.

OJK, 2016. Hasil Survey Nasional Indek Literasi keuangan

Masyakat, diakses dari http://www.rappler.com/

indone-sia/ekonomi/159498-ojk-literasi-keuangan-

indonesia-2016.

Rishang. 2014. Analisis Literasi Keu-angan Mahasiswa

Jurusan EKP Prodi Pendidikan Ekonomi Angkatan

2010 Fakultas Ekonomi Universitas Negeri Malang.

Skripsi tidak diterbitkan. Malang: FE.

Satrio, Y .D. 2012. Analisis Tingkat Fi-nancial Literacy

Mahasiswa Fakultas Ekonomi Universitas Negeri

Malang. Tesis tidak diterbitkan. Malang: FE.

Sugiyono. 2014. Metode Penelitian Kuantitatif, Kualitatif

dan R and D, Bandung: Alfabeta

Financial Literacy Analysis on Students of Economic Faculty

45