Does Fiscal Decentralization Affect Education Inequality?

Ady Soejoto, Dhiah Fitrayati, Muhammad Abdul Ghofur, and Lucky Rachmawati

Universitas Negeri Surabaya, Surabaya, Indonesia

Keywords: Fiscal decentralization, education inequality.

Abstract: There are no regency or city in East Java Province that have the developed and grew rapidly area category.

Based on the analysis of such data, need for more attention to fiscal decentralization and inequality of

education to see the success of economic development, not just look at the economic growth. The aim of

this study is to analyze the effect of fiscal decentralization on education inequality among regency or city in

East Java Province. Data analysis techniques used panel analysis method. The result showed that fiscal

decentralization has negatively and significant effect on education inequality.

1 INTRODUCTION

Decentralization is the transfer of authority of the

government by the central government to the

autonomous regions to regulate and administer

government affairs in the system of the Unitary State

of the Republic of Indonesia (Article 1 paragraph (7)

of Law Number 32 Year 2004). Fiscal

decentralization is fundamental to the regional

autonomy system in the financial aspect. Where

fiscal decentralization is a central government's

financial transfers to sub-national governments

(Boex and Martinez-Vazquez, 2001). Fiscal

decentralization between the central government and

regional governments is done by transferring the

balance funds.

Based on data from the Revenue Service Office

of Finance and Regional Assets of East Java

Province (2013 on East Java Provincial Government,

2014), from year to year locally original revenue

became the largest contributor of revenue in East

Java Province. In 2011, locally original revenue of

East Java Province amounted to 11.49 trillion

rupiahs, increasing in 2012 by 15.4 trillion rupiah

and increasing again in the year 2013 amounted to

17.39 trillion rupiah. Similarly, the number of

Balanced Funds received, indicates an increase in

the number, but the percentage of total income

actually shows a decline. Such conditions indicate

that the ability of the Government of East Java

Province to explore its potential is very good. In

addition, it also shows the decreasing level of

dependency of East Java Provincial Government on

transfers from the Central Government to finance

their expenditure, in other words the level of

provincial independence is quite high.

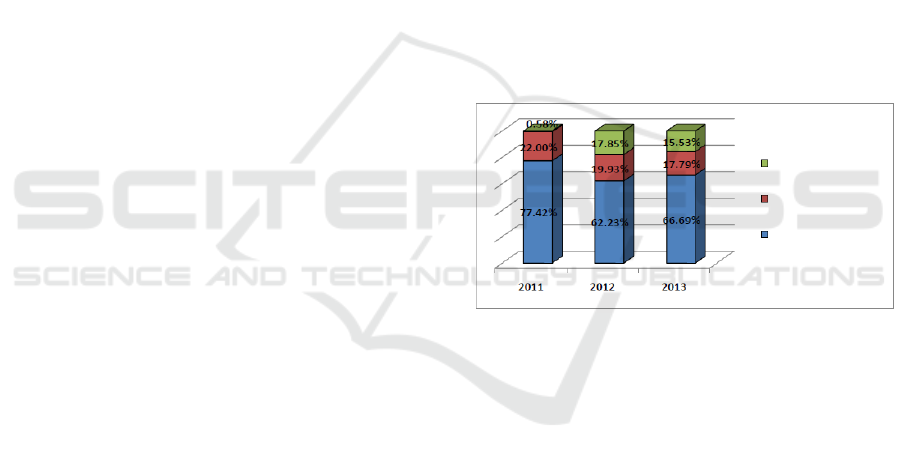

Figure 1: Composition of Revenue Realization East

Java Provincial Government

Source: Revenue Service Office of Finance and Regional Assets

of East Java Province, 2013

From an economic perspective, Waluyo (2007) says

that fiscal decentralization will have an impact on

reducing income inequality between regions if the

role of local government is optimal. So the condition

of income inequality that occurred in East Java

Province which tends to increase can be resolved.

Meanwhile, in terms of non-economic, fiscal

decentralization should be able to improve the

quality of human resources area (human capital).

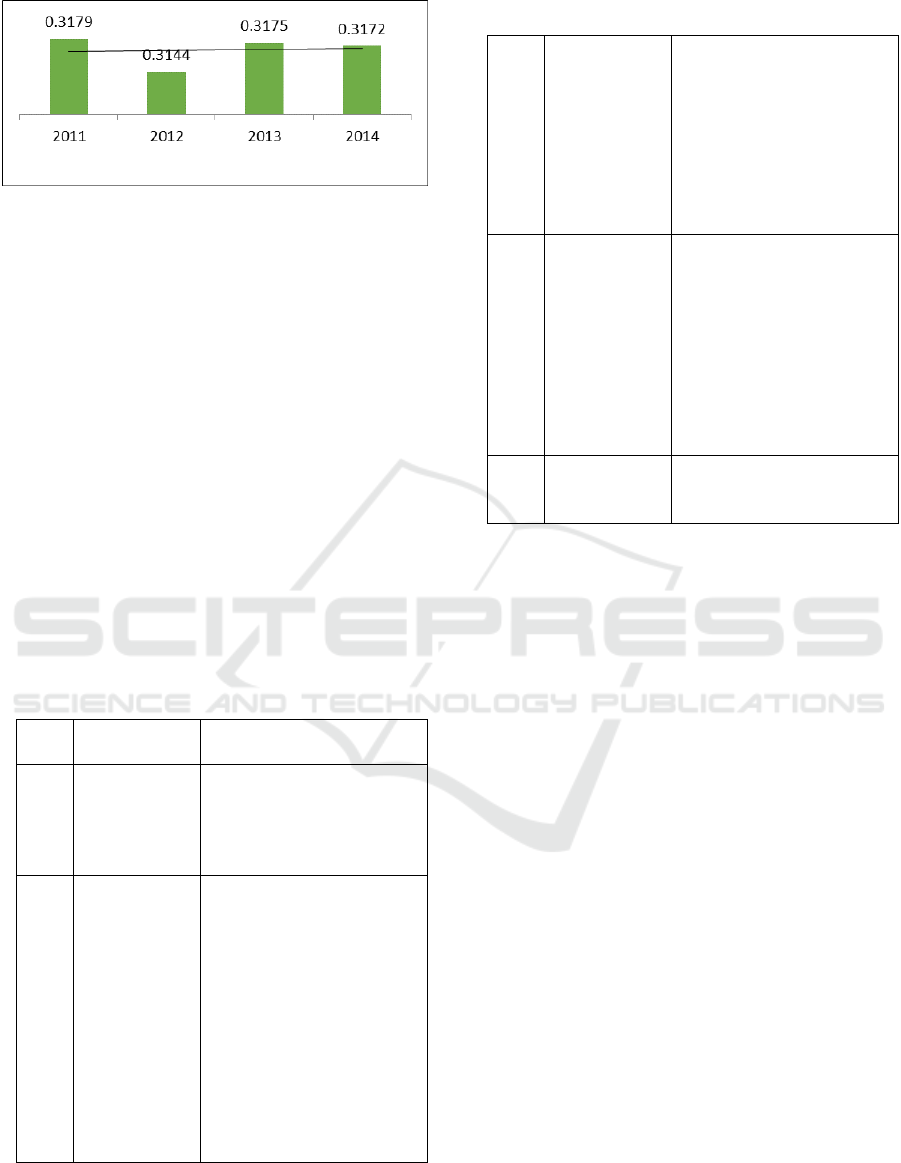

Soejoto et.al. (2016) suggested that education gini

index trend in East Java Education in 2011-2014

was increased. Thus illustrated on figure 2,

Other legitimate

Regional income

Balanced funds

Locally original

Revenue

30

Soejoto, A., Fitrayati, D., Ghofur, M. and Rachmawati, L.

Does Fiscal Decentralization Affect Education Inequality?.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 30-35

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Figure 2: Education Gini Index of East Java

Province, 2011-2014

Source: Soejoto et.al. (2016)

Pattern of regional development in East Java

Province mapped to 5 classification, among others:

1) Developed and grew rapidly (developed) area; 2)

Advanced but depressed area (stagnant); 3) Potential

areas may still be developing or (developing); 4)

Relatively lagging (underdeveloped) area; and 5)

Very underdeveloped area. The classification of the

regional development pattern was obtained by

developing the concept of Klassen Typology. The

results of the data analysis show that there are no

city/regency that are classified as developed and

grew rapidly (Soejoto et. al., 2016). The regional

development pattern of each city/regency in East

Java Province is described in Table 1.

Table 1: The Regional Development Pattern of Each

City/Regency in East Java

No.

Classificatio

n

City/Region

1.

Developed

and grew

rapidly

(developed)

area

2.

Advanced

but

depressed

area

(stagnant)

Tulungagung regency,

Kediri regency,

Banyuwangi regency,

Pasuruan regency,

Sidoarjo regency,

Mojokerto regency,

Ngawi regency,

Bojonegoro regency,

Tuban regency,

Lamongan regency,

Gresik regency,

Sumenep regency,

Surabaya City

Table 1. Cont.

3.

Potential

areas may

still be

developing

or

(developing)

Pacitan regency,

Ponorogo regency, Blitar

regency, Malang

regency, Jember regency,

Jombang regency,

Nganjuk regency, Blitar

City, Malang City,

Probolinggo City,

Madiun City, Batu City

4.

Relatively

lagging

(underdevelo

ped) area

Trenggalek regency,

Lumajang regency,

Bondowoso regency,

Situbondo regency,

Probolinggo regency,

Magetan regency,

Sampang regency,

Pamekasan regency,

Kediri City, Pasuruan

City, Mojokerto regency

5.

Very

underdevelo

ped area

Madiun regency,

Bangkalan regency

Source: Soejoto et.al. (2016)

There are no city/regency in East Java Province

that have categories of developed and grew rapidly

(developed) area, this means that although they have

economic growth or the balance funds larger than

other city/region, still have problems of income

inequality or inequality of education. There is still a

city/regency that is categorized as a very

underdeveloped area, which means that the regency

has low economic growth and low balance funds,

while the income inequality and education inequality

is high value. In fact, the balance funds aims to state

regional revenues. Thus it is necessary to pay more

attention to fiscal decentralization and educational

inequality to see the success of economic

development, not just economic growth.

The balance funds aims to increase local fiscal

capacity, reduce fiscal gap between central and

regional as well as inter-regional, improve the

quality of public services in the regency, and

increase attention to development in disadvantaged

areas, outermost and leading.

Revenue-sharing is allocated to regencies based

on State Budget of Admissions and Expenditures,

revenues to fund local needs for decentralization.

The general allocation fund is allocated to minimize

fiscal imbalances among regencies in funding

governmental affairs under regional authority. The

special allocation funds are allocated to assist

regencies in funding programs/activities that are

Does Fiscal Decentralization Affect Education Inequality?

31

under regional authority and a national priority

(Minister of Finance, 2013).

Potential resources owned by each city/regency

in East Java Province vary. Thus, the ability of each

city/regency to produce goods and services as a

source of income is also different. The economic

growth generated by the city/regency economy also

varies. Thus, the amount of balance funds received

each city/regency is expected to support the

city/regency that can still generate low income or

low economic growth. In the long term, the balance

funds are expected to make the community welfare.

The welfare of the people is not only measured by

the increase in city/regency income or economic

growth, but also other socio-economic indicators

such as equity of income and education.

Equity of education can be supported by

government through education investment in

education expenditure function. Based on Article 31

Paragraph 4 of the 1945 Constitution of the 4th

Amendment, the state at least 20 percent of the State

Budget of Admissions and Expenditures as well as

from the Regional Budget of Admissions and

Expenditures prioritize the education budget to meet

the needs of the implementation of national

education.

Doriza et.al. (2012) suggested that the special

allocation funds for education, the special allocation

funds non education, and locally original revenue

had significant impact in reducing education access

disparity along with the wealth and regional

characteristics. Nonetheless efforts need to be done

to optimize the equalization of education access

including strengthening the provincial government

role in resources allocation and distribution of basic

education services. It means that fiscal

decentralization has negatively effect on education

inequality.

Akai et.al. (2007) suggested that financial

decentralization has effect on education. But, the

effect of financial decentralization is not clear in the

primary level. The financial decentralization is

effective in the secondary level. The paper analyses

the effect of financial decentralization by focusing

on the difference of levels of education, primary and

secondary educations.

Ahmad (2016) suggested that “different sources

of fiscal decentralization have distinct effects on

education expenditure and quality. While

subnational governments that are financed through

own-tax revenues are more likely to increase the

funds allocated to education, they also seem less

concerned with maintaining teaching quality. The

study provides evidence that decentralized structures

cater better to local social needs. Fiscal

decentralization is, therefore, an important policy

instrument for achieving social goals”.

Bakti and Kodoatie (2012) had a different

opinion, they suggested that fiscal decentralization

did not have significant influence to women

education access in Special Region of Yogyakarta.

The balance funds that are transfers of funds

from the central government to the regencies are

sourced from the State Budget of Admissions and

Expenditures, not only concerning the potential

aspect of resources of each regency in generating

revenue, but also paying attention to the direction of

national priorities. This means that the use of the

balance funds is not only intended to meet the needs

of the city/regency in running its economy, but also

to support national priorities allocated in special

allocation funds. This national priority, during the

era of President Jokowi's administration is contained

in the Economic Policy Package.

Besides influenced by national priorities, the

amount of the received funds is also influenced by

regional needs as stated in the regional development

Work Plan. According to regional development Plan

of East Java Province 2016 (East Java Provincial

Government, 2015), it is mentioned that the priority

and direction of spatial development policy of East

Java Province in 2014-2019 is directed at

consolidation of urban National Centre of Activities

as metropolitan in East Java Province, Activities of

Territory, and increasing the linkage of the main

production pockets in East Java Province with the

processing and marketing centre as the core of

agropolitan system development as well as

stabilizing the development of strategic area by

dividing the strategic role of regional development.

The focus is on areas that functionally can contribute

to economic growth for the strategic regency and the

surrounding area.

The aim of this study is to analyze the effect of

fiscal decentralization on education inequality

among regency or city in East Java Province.

2 METHODS

This type of research is an explanatory research

using quantitative method used to test and analyze

the effect of fiscal decentralization on education

inequality between city/regency in East Java

Province. Data analysis techniques used panel

analysis method.

Fiscal decentralization is a balance of funds

consisting of revenue-sharing funds derived from

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

32

taxes and natural resources, general allocation funds

and special allocation funds each city/regency in

East Java Province.

Inequality of education is a problem of inequality

of education in an area by using gini index education

indicators. Gini index of education is measured by

using population based on education graduate in

city/regency of East Java Province. The index of

education has a value ranging from 0 (indicating

perfect equity) and 1 (indicates inequality perfect).

The calculation of educational index directly using

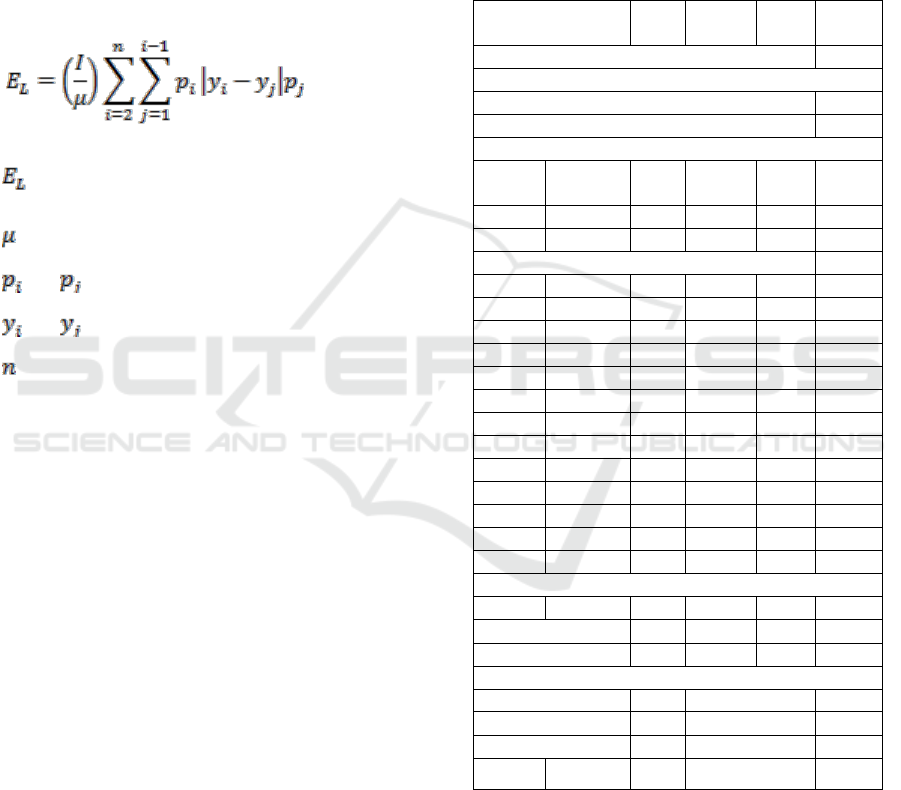

the following formula (Thomas, et al, 2000).

Gini index of education:

Where:

: The educational index is based on

the distribution of school attainment

: Average length of schooling from

population

and : the proportion of the population with

a definite level of school attainment

and : years of schooling at different levels

of educational attainment

: The number of categories of school

attainment in the data

The criteria of inequality used in the Education Gini

Index follow Todaro (2010) as follows: very high

inequality area (0.71 and above); high inequality

area (0,5-0,70); moderate inequality area (0.36-

0.49); low inequality area (0.21-0.35); very low

inequality areas (Less than 0.20).

2.1 Econometric Model

The effect of fiscal decentralization on education

inequality is investigated by employing the

following model:

fiscal

r,t

= b

0

+ b

1

eduine

r,t

+ e

1r,t

Where fiscalr,t is fiscal decentralization of

city/regency r at time t; eduiner, t is the education

gini index of city/regency r at time t; b0 is the

constanta; b1 is the regression coefficient of

education gini index variables; and e1r,t is the error

term.

3 RESULTS AND DISCUSSION

This study was conducted to examine whether there

is any effect of fiscal decentralization on education

inequality. The proof is done using panel analysis

method. The result of data analysis of 38

cities/regencies in East Java Province is shown in

Table 2.

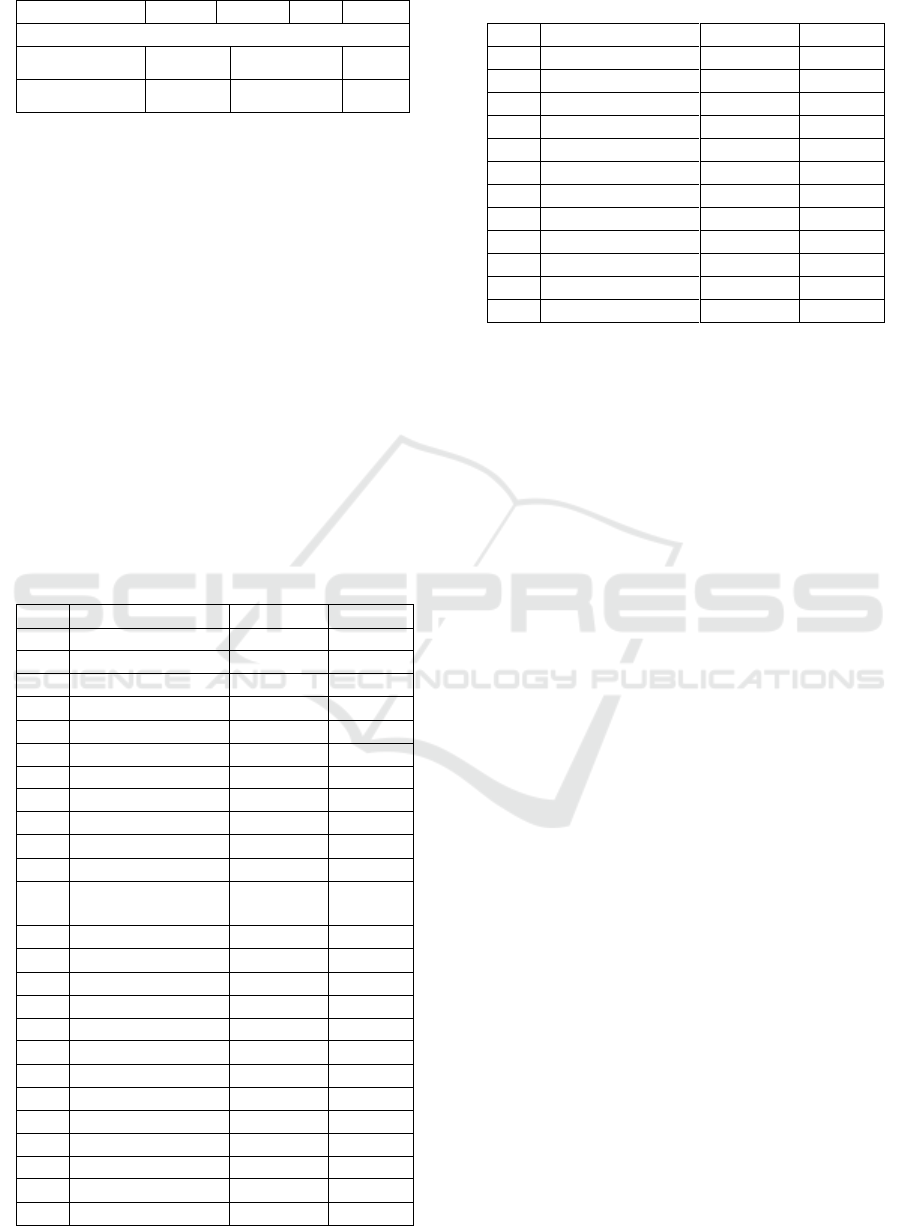

Table 2: Results of the Data

Dependent Variable:

EDUINE?

Method: Pooled EGLS (Cross-section random effects)

Sample: 2008 2014 observations: 7 Cross-sections: 38

Total pool (balanced) observations: 266

Swamy and Arora estimator of component variances

White cross-section standard errors & covariance (d.f. corrected)

Variable

Coefficient

Std.

Error

t-

Statistic

Prob.

C

0.3299

0.0269

12.2498

0.0000

FISCAL?

-2.850E-11

0.0000

-2.4927

0.0133

Random Effects (Cross)

_1--C

-0.0091

_14--C

0.0110

_27--C

0.1915

_2--C

0.0211

_15--C

-0.0862

_28--C

0.0776

_3--C

-0.0400

_16--C

-0.0347

_29--C

0.1326

_4--C

-0.0348

_17--C

-0.0285

_30--C

-0.0958

_5--C

-0.0145

_18--C

-0.0087

_31--C

-0.0895

_6--C

-0.0135

_19--C

0.0028

_32--C

-0.0840

_7--C

0.0222

_20--C

-0.0183

_33--C

-0.0309

_8--C

0.0288

_21--C

0.0389

_34--C

-0.0599

_9--C

0.0776

_22--C

0.0360

_35--C

-0.1019

_10--C

0.0250

_23--C

0.0258

_36--C

-0.1136

_11--C

0.0701

_24--C

0.0127

_37--C

-0.0717

_12--C

0.0884

_25--C

-0.0482

_38--C

-0.0617

_13--C

0.0555

_26--C

0.1279

_27--C

0.1915

Effects Specification

S.

Rho

Cross-section random

0.068086

0.9491

Idiosyncratic random

0.01577

0.0509

Weighted Statistics

R-squared

0.084705

Mean dependent var

0.0268

Adjusted R-squared

0.081238

S.D. dependent var

0.0165

S.E. of regression

0.015842

Sum squared resid

0.0663

F-statistic

24.43151

Durbin-Watson stat

1.4013

Does Fiscal Decentralization Affect Education Inequality?

33

Table 2. Cont.

Prob(F-statistic)

0.000001

Unweighted Statistics

R-squared

-0.047166

Mean

dependent var

0.3069

Sum squared resid

1.34395

Durbin-Watson

stat

0.0691

Based on the results of the data in Table 2, the

calculated p value (t statistics) of 0.0013 is less than

the critical p value, the null hypothesis is rejected. It

can be concluded that the hypothesis related to the

effect of fiscal decentralization on education

inequality raised in this study is acceptable. Fiscal

decentralization negatively and significantly

affecting education inequality.

The fiscal decentralization regression coefficient

is negative and 0.0285. It can be interpreted that as

fiscal decentralization increases by one billion,

predicted education inequality will decrease by

0.0285, while other independent variables are

assumed to be constant. Similarly, when fiscal

decentralization decreases by one billion, it is

predicted that educational inequality will increase by

0.0285, while other independent variables are

assumed to be constant.

Table 3: Constants of Each City/Region

No.

City/Region

Constants

Category

1

Madiun City

0.2162

Low

2

Mojokerto City

0.2280

Low

3

Kediri City

0.2341

Low

4

Blitar City

0.2404

Low

5

Sidoarjo regency

0.2436

Low

6

Malang City

0.2459

Low

7

Surabaya City

0.2581

Low

8

Batu City

0.2682

Low

9

Pasuruan City

0.2699

Low

10

Gresik City

0.2817

Low

11

Trenggalek regency

0.2899

Low

12

Tulungagung

regency

0.2950

Low

13

Mojokerto regency

0.2951

Low

14

Probolinggo City

0.2990

Low

15

Jombang regency

0.3014

Low

16

Magetan regency

0.3116

Low

17

Blitar regency

0.3154

Low

18

Kediri regency

0.3163

Low

19

Pacitan regency

0.3208

Low

20

Nganjuk regency

0.3212

Low

21

Madiun regency

0.3327

Low

22

Pasuruan regency

0.3409

Low

23

Lamongan regency

0.3425

Low

24

Ponorogo regency

0.3510

Low

25

Malang regency

0.3521

Low

Table 3. Cont.

26

Banyuwangi regency

0.3549

Medium

27

Tuban regency

0.3557

Medium

28

Lumajang regency

0.3586

Medium

29

Bojonegoro regency

0.3658

Medium

30

Ngawi regency

0.3687

Medium

31

Probolinggo regency

0.3854

Medium

32

Bondowoso regency

0.4000

Medium

33

Pamekasan regency

0.4075

Medium

34

Jember regency

0.4075

Medium

35

Situbondo regency

0.4183

Medium

36

Bangkalan regency

0.4578

Medium

37

Sumenep regency

0.4625

Medium

38

Sampang regency

0.5214

High

Table 3 describe the constants of each

city/regency from the lowest to the highest. The

constant value of each city/regency obtained from

the data analysis using the panel analysis method

can be used to determine which city/regency have

the potential to create high educational inequality

compared to other cities/regencies, if the fiscal

decentralization variable is considered constant.

Data analysis on the effect of fiscal

decentralization on education inequality was

conducted in 38 cities/ regencies in East Java

Province from 2008 to 2014. It was found that fiscal

decentralization negatively and significantly

affecting education inequality.

The negatively effect of fiscal decentralization

on education inequality, suggesting that an increase

in fiscal decentralization will decrease education

inequality. An additional fiscal decentralization of 1

billion would reduce education inequality by 0.0285.

This study is consistent with Doriza et.al (2012),

Akai et.al. (2007) and Ahmad (2016) that fiscal

decentralization has effect on education. Contrary to

the study of Bakti and Kodoatie (2012).

The findings of the study, as well as revealing

that the city/regency government in East Java

Province still care about education. The negatively

effect of fiscal decentralization on education

inequality, also implies that there is a share of fiscal

decentralization revenues used for expenditure of

educational functions. The greater of fiscal

decentralization received can create lower education

inequality.

In addition to know the effect of fiscal

decentralization on education inequality. Based on

the results of data analysis can also be known which

cities/regencies that have the potential to create a

high education inequality than other cities/regencies,

if the variable of fiscal decentralization is considered

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

34

constant. It is based on the constant value of each

city or regency.

Based on the analysis of the constant value of

each city/region, it was found that Sampang

Regency has the highest potential to create education

inequality with a constant value of 0.5214. While

Madiun City has the lowest potential in creating

educational inequality with a constant value of

0.2162.

The value of the constant can be used by the

government to determine which regency should get

more fiscal decentralization fund. Sampang Regency

should get more attention, given its potential in

creating education inequality. It also required

assistance in the use of funds, not only related to the

amount of fiscal decentralization. Assistance of the

use of funds related to the allocation of funds,

whether the actual funds for the expenditure of

education functions used according to function and

whether the amount of funds allocated for

expenditure of education function already reflects

the mandate of Article 31 Paragraph 4 of the 1945

Constitution of the 4th Amendment.

4 CONCLUSIONS

Fiscal decentralization negatively and significantly

affecting education inequality. The findings of the

study, as well as revealing that the city/regency

government in East Java Province still care about

education. The greater of fiscal decentralization

received can create lower education inequality.

Required assistance in the use of funds, not only

related to the amount of fiscal decentralization.

Assistance of the use of funds related to the

allocation of funds, whether the actual funds for the

expenditure of education functions used according to

function and whether the amount of funds allocated

for expenditure of education function already

reflects the mandate of Article 31 Paragraph 4 of the

1945 Constitution of the 4th Amendment.

REFERENCES

Ahmad, Iftikhar. 2016. Assessing the Effects of Fiscal

Decentralization on the Education Sector: A Cross-

Country Analysis. The Lahore Journal of Economics

21 : 2 (Winter 2016): pp. 53–96.

Akai, Nobuo; Sakata, Masayo; and Tanaka, Ryuichi. 2007.

Fiscal Decentralization and Educational

Performance. Presented at the Institute of Business

and Economic Research University of California,

Berkeley, Conference Paper No. C07-001.

Bakti, Galih Pramilu and Kodoatie, Johanna Maria. 2012.

Analysis of Fiscal Decentralization Impact on Ratio of

Woman Literasi and Ratio of Woman School

Participation In Regency/City of Special Region of

Yogyakarta Province. Diponegoro Journal of

Economics, Volume 1, No. 1, 2012, pages 1-7.

Boex, Jameson and Martinez-Vazquez, Jorge. 2001.

Budgeting and Fiscal Management in Transition

Economics. Journal of Public Budgeting, Accounting

and Financial Management, 13 (3): pages 353-396.

Doriza, Shinta, Purwanto, Deniey A., and Maulida Ernita.

2012. Fiscal Decentralization Impacts on Primary

Education Access Disparities in Indonesia. Indonesian

Economic and Development Journal, Vol. 13 No. 1,

July 2012: pages 31-46, ISSN 1411-5212.

East Java Provincial Government. 2015. Attachment of

East Java Governor Regulation No.40 of 2015 on

Regional Development Work Plan of East Java Year

2016. East Java Provincial Government, East Java.

........... 2014. Middle Term Development Plan for The East

Java Province 2014 – 2019. East Java Provincial

Government, East Java.

Minister of Finance. 2013. State Budget of Admissions and

Expenditures, 2013. Minister of Finance through

www.kemenkeu.go.id.

Soejoto, Ady; Fitrayati, Dhiah; Rachmawati, Lucky; dan

Sholikah, Ni’matus. 2016. Typology of Regional

Economic Development Pattern. International Journal

of Applied Business and Economic Research

(IJABER). Vol.14 No.13, July December 2016 ISSN:

0972-7302., Page 9493-9505.

Todaro, Michael dan Stephen C Smith. Economic

Development: Eleventh Edition. 2011. Jakarta:

Erlangga Publisher.

Thomas, Vinod, Yan, Wang, Xibo, Fan. 2000.

“Measuring Education Inequality: Gini Coefficients of

Education”. Policy Research Working Paper, World

Bank Institute.

Waluyo. 2007. Public Management. Concept, Application

& Implementation In Implementation of Regional

Autonomy. Bandung: Mandar Maju Publisher.

Does Fiscal Decentralization Affect Education Inequality?

35