Assigning Business Processes: A Game-Theoretic Approach

Evangelos D. Spyrou and Dimitris Mitrakos

School of Electrical and Computer Engineering, Aristotle University of Thessaloniki,

54124 Thessaloniki, Greece

evang spyrou@eng.auth.gr, mitrakos@eng.auth.gr

Keywords:

Business process, market, assignment game, characteristic function, coalition formation.

Abstract:

Business processes are essential for the successful growth of an organisation. Business models aim to organise

such processes and invoke the necessary processes for particular tasks. Such a mechanism is responsible for the

appropriate response and time management of the business strategy of a corporation. To this end, we formulate

a scenario where business processes need to be invoked according to the expenditures of their operation, in

order to complete a transaction in a market model. We model such a mechanism using game theory and we

produce a characteristic function that we maximise, in order to reduce the cost of the business processes.

We employ the well-known assignment game to form business process coalitions and minimise the business

operation cost in the market.

1 INTRODUCTION

A current trend in the business oriented research is

the emergence of business intelligence, since it re-

flects on real problems that businesses deal and their

respective solutions (Chen et al., 2012). In particu-

lar, bid data has shown specific trends that businesses

follow in their market domains (Minelli et al., 2012).

Bid take place in a real-time fashion; hence, real-time

strategic interactions constitute a major issue in busi-

ness intelligence. Such decisions may introduce enor-

mous consequences to the development of a business;

thus, uncertainties must be taken into serious con-

siderations by managers. A risk-minimum estimate

needs to be identified, in order to proceed with busi-

ness process deployment. This belongs to a class of

problems named strategic business planning (Sonteya

and Seymour, 2012).

Business analysts face unique issues when at-

tempting to address a specific strategic problem. De-

cision time is usually limited. The potential of a

wrong decision increases the cost and overall conse-

quences of a business plan. In most of the cases, real-

time strategic planning is associated with cost. Hence,

a business analyst needs to have expert knowledge, in

order to act in a timely fashion and address the busi-

ness problem by keeping the cost at reasonable levels.

Business planning can be thought of a complex sys-

tem (Snowden and Boone, 2007); hence, often, de-

bates in meeting rooms are at hand, in order to come

up with the ideal strategic plan. Business processes

can assist to such a problem by trying to automate re-

sponses to real world business problems (Scheer et al.,

2004).

Game theory utilises models of conflict and coop-

eration (Von Neumann et al., 2007), between business

processes in this paper. Aumann (Aumann and Dreze,

1974) provides the difference between cooperative

and non-cooperative games. We deal with the class of

cooperative games in this paper. Agreements between

players can take place before the start of a cooperative

game. The cooperation in such games is given by a

set of players a set of strategies, and a set of payoffs

that represent the outcome of the strategies played, in

the form of a utility. A coalition is characterised by

the achievement of the coordination of the members’

strategies (Saad et al., 2009), (Curiel, 1988). As we

read in (Weber, 1994), should we consider the busi-

ness process assignment as a market game, a business

process not participating in the coalition does not af-

fect the trading within the coalition. Thus, the cor-

responding strategy profiles and their respective utili-

167

ties define the characteristic function of our game for-

mulation. Furthermore, when considering a Cournot

game in which business processes will select quanti-

ties, the outcome of the coalition depends on the be-

haviour assumption of the business processes outside

the coalition.

We aim to construct a cooperative model and de-

fine a characteristic function in order to maximise

the efficiency of a business process network. There

has been other research works that dealt with busi-

ness issues in a game theoretic and cooperative man-

ner (Binmore and Vulkan, 1999), (Yahyaoui, 2012),

(Katsanakis and Kossyva, 2012), (Li et al., 2002),

(Yasir et al., 2010). We encapsulate the characteris-

tic function to indicate the formed coalitions between

business processes. Games that involve forming of

coalitions are distinguished between the ones which

include transferable utilities and the ones that with

non-transferable utilities. In the former, utility is di-

vided within a coalition and in the latter, it is difficult

to show what the utility can define when a coalition is

formed.

In this paper, we address the assignment of busi-

ness processes to operational business processes that

need to be executed with time constraints. We

produce a cooperative coalition formation game-

theoretic model and we solve it to provide the optimal

business process assignment. Specifically we show

the following contributions:

• We build a game theoretic model of the business

process assignment problem

• We construct a characteristic function based on

the time/cost for an execution of a business pro-

cess

• We show that it may be more efficient for a busi-

ness process to form a coalition with another pro-

cess to fulfill a business process if the time spent

is less than the direct business process assignment

• We show the distribution of the time of comple-

tion with our model

This paper is structured as follows: Section 2 pro-

vides the method of our game-theoretic formulation,

section 3 gives results on a specific scenario and sec-

tion 4 provides the conclusions of our approach.

2 COOPERATIVE BUSINESS

PROCESS ASSIGNMENT

We consider a simple market model where business

processes may be assigned to intermediate (relay)

business processes within a time frame, in order to

save cost. Initially, we produce a cooperative model

for the relay business process selection problem and

we attempt to distribute the saved completion time

between different business processes. This will be

accomplished once we manage the completion time

appropriately. To this end, we propose a sellers - buy-

ers approach based on (Shapley and Shubik, 1971) to

solve the completion time distribution issue. We de-

fine the coalition formation game as an ordered pair

< N, φ >, where N = 1, 2, 3...N is the set of business

processes and φ is the value of the characteristic func-

tion, which is given over 2

n

possible coalitions of N.

Also, note that φ(

/

0) = 0. If we have a set of all busi-

ness processes in a coalition, then we can claim that

we have formed a grand coalition. On the other hand,

if our set does not include the entire set of the business

processes, the resulting subset is called coalition. The

price that a coalition C is worth, is obtained by the

value of the characteristic function φ(C). This value

constitutes the maximum common payoff of the busi-

ness processes in C upon cooperation. We denote the

T value that a source business process j requires to

complete by allocating it to another business process

further up the process stack k by T

jk

. Also, denote the

time demand of completion time required for a buyer

business process be allocated to a seller business pro-

cess by T

ji

. Furthermore, denote the completion time

value of the i

th

seller to her own offer to the comple-

tion time saving of the cooperative coalition by c

i

and

the the value of the j

th

buyer to the cooperation of the

i

th

seller by T

i j

. We denote the value required by the

relay business process to reach the target next busi-

ness process as T

f rwd

. At this point, we assume that

c

i

= T

f rwd

, since a seller business process has T

f rwd

amount of completion time, favouring its correspond-

ing source business process. Note that the sellers pay-

off will not be maximised unless its time of comple-

tion is compensated. On the contrary, the cooperation

between a buyer and a seller and the completion time

that will be saved constitutes the requirement of each

buyer to form a coalition with a seller business pro-

cess. Therefore we calculate T

i j

as

T

i j

= T

jk

− T

ji

(1)

if T

ji

> c

i

, then a value exists that both the sellers

and buyers select. When we refer to time of business

process completion saving, we mean the selection of

the best completion time required to finish the process

and move to the next business process of the business

plan network.

2.1 The Characteristic Function

We define the characteristic function φ(C) as the max-

imum completion time saving that the business pro-

Seventh International Symposium on Business Modeling and Software Design

168

cesses accomplish by cooperating between them, in

order to form a coalition. Let B and S denote the buy-

ers and the sellers respectively. If there is only one

business process present in the coalition, the business

process has no cooperation process; hence, its prefer-

ence is the direct transmission to the business process

with the less completion time T . Thus, we have

φ(C) = 0 if |C| = 0 or 1 (2)

since, there is no improvement we have

φ(C) = 0 if (C ∩ B =

/

0) or (C ∩ S =

/

0) (3)

In order to further explain equation (3), for a connec-

tion efficiency improvement to take place, a coalition

that consists of buyers and sellers business processes

must be established. Hence, we will separate business

processes into buyer and seller pairs respectively. Be-

fore we move into business process assignment, we

provide the simplest form of coalition, which is given

below:

σ

i j

= max[0, T

i j

− c

i

] if i ∈ B and j ∈ N (4)

Equation (4) states that cooperation between a buyer

and a seller business process will be instantiated only

if the direct connection requires a larger completion

time than the cooperative connection. In the case

that the direct connection is better than the cooper-

ative connection, σ

i j

= 0. Our aim is to calculate the

function φ for reasonably large coalitions; hence, we

are trying to identify the best buyers assignments to

the respective sellers business processes, which max-

imize the time efficiency and minimise the cost. This

is represented as

φ(C) = max[σ

i

1

, j

1

+ σ

i

2

, j

2

+ ... + σ

i

n

, j

n

] (5)

where n = min[|C ∩ B|, |C ∩ S|]. We maximize (5)

through all the arrangements of the players i in C ∩

B and j in C ∩ S. As we can see, we can formulate

the assignment game as a linear programming (LP)

problem. Let mn be a set of binary decision variables

that satisfy

x

i j

=

(

1, if i relay process assigned to process j

0, otherwise

(6)

where i = 1, 2, 3...m and j = 1, 2, 3...n. Each bi-

nary variable indicates whether a business process i

acting as a relay process will be allocated to a busi-

ness process j that is wishes to execute.

We denote as ξ the total time saving of the coop-

erative coalition formation and we formulate the busi-

ness process relay selection problem as an LP.

Maximize ξ =

∑

i∈B

∑

j∈S

σ

i j

x

i, j

(7)

s.t

∑

i∈B

x

i j

≤ 1 for i = 1, 2, ...m

∑

i∈S

x

i j

≤ 1 for i = 1, 2, ...n

The first constraint states that each relay business pro-

cess may be assigned to at most one business process.

The second constraint specifies that every business

process has to be connected to at least one relay busi-

ness process. Solving this LP problem will give us

the maximum completion time saved when a coalition

is formed of B relay business processes and S source

business processes. Hence, we have

ξ

max

= φ(B ∪ S) (8)

Thereafter, we transform the LP problem to its equiv-

alent matrix formulation.

maxc

T

x

s.t. A ·x ≤ b

x ≥ 0

(9)

Note that the constraint x ≤ 1 has been folded into the

constraint A ·x ≤ b

2.2 Business Process Selection Core

We proceed to the core of the coalition, which should

not be empty or consisting of one business process

only. According to Shapley and Shubik (Shapley and

Shubik, 1971), the core of the relay selection game

is the set of solutions of the dual LP problem of the

assignment problem. In this paper, we introduce the

Lagrangian dual. We take the nonnegative Lagrangian

multipliers (y, λ) to the constraints Ax ≤ b and x ≥ 0

as follows

L (x, y, λ) = c

T

x +y

T

(b −Ax) + λ

T

x (10)

which serves as an upper bound of the characteristic

function (9), whenever x is feasible or not. Therefore,

max

x

L (x, y, λ) bounds the optimum of (9). In order

to obtain the upper bound, we have to solve the fol-

lowing

min

y,λ

max

x

L (x, y, λ) =

min

y,λ

max

x

c

T

x +y

T

(b −Ax) + λ

T

x

(11)

We have the third equality since c − A

T

y +λ 6= 0 and

we may select an appropriate x such that L (x, y, λ)

goes to infinity. Therefore, we have a finite bound

when c −A

T

y + λ = 0. By taking the strong duality

of the linear program, the optimum of (9) coincides

with (Boyd and Vandenberghe, 2004). We can make

the formulation more simple by assuming that b > 0,

Assigning Business Processes: A Game-Theoretic Approach

169

since T is always positive. We denote P as a convex

set on x and f

i

(x) = (i = 1, ...m) as a set of convex

functions. Moreover, we define the general min-max

problem as

min

x∈P

max

i∈[k]

f

k

(x) (12)

where [k] = {1, ...m} is a set of indexes. For detailed

report on the solving method of this problem, we refer

the reader to (Spyrou and Mitrakos, 2017).

We have to mention that the dual problem consists

of m +n variables

y = [q

1

, ...q

m

, r

1

, ...., r

n

]

Moreover, we can see that the constraints of the prob-

lem are

q

i

+ r

j

≥ σ

i j

∀i ∈ B and ∀ j ∈ S (13)

Essentially, the solution of min-max problem is equiv-

alent to the solution of φ(B ∪ S). The remark above

dictates the incentive of relay and source business

processes to cooperate. Specifically, q

i

and r

j

com-

prise the T values that a relay business process i and a

source business process j receive, in order to perform

a cooperative transmission. Furthermore, the vector

y = [q

1

, ...q

m

, r

1

, ...., r

n

] provides the distribution of

the T enhancement and the equivalence of the dual

problem with the solution of φ(B ∪ S) constitutes an

imputation of the coalition formation relay selection

game. Additionally, from (5) and (13)

∑

i∈C∩B

q

i

+

∑

C∈S

r

i

≥ φ(C), ∀C ⊂ S (14)

Thus, we defined the core of the relay selection game

using (12) and (14),since we encapsulate the imputa-

tion efficiency and the fact that an improvement move

on the coalition cannot be made.

2.2.1 Completion Time Distribution

The enhancement of completion time T is shared be-

tween the business processes. On the other hand, the

T completion time enhancement cannot be transferred

to the relay business processes, unless the source busi-

ness processes receive the value first; however, ev-

ery source business process my be a relay business

process; thus, transferring the completion time T en-

hancement. Thereafter, we construct the T func-

tion, distinguished between the cooperative and self-

ish business processes and prevents any undesired be-

havior. The T function of the relay business process i

at a cooperative scenario is given by

T

i

[n] = T

i

[n −1] + c

i

+ q

i

(15)

Note that c

i

is the T completion time received by

the relay business process i and q

i

is the amount of

T available for the relay business process to proceed

with a cooperation. On the other hand, the T com-

pensation of the relay business process needs to be

provided by the source business process. Thus, the T

function of source business process j is given by

T

j

[n] = T

j

[n −1] − c

j

− q

j

(16)

Note that, even after transferring c

i

+ q

i

amount of

completion time T to the relay business process i, the

source business process j will have φ

j

of T enhance-

ment.

3 RESULTS

We consider a simple market and we take two sce-

narios on board; the first scenario is a single source

process - relay business process and the second is a

multiple source - relay business processes scenario.

3.1 Single Source and Relay Business

Process

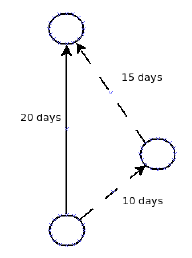

As we can see in figure 1, the source business pro-

cess executes by reaching the end-business process

directly, since its incentive is not to cooperate with the

relay business process. This is the case due to the fact

that the completion time of going directly to the end-

business process is less than the completion time after

forming the coalition with the relay business process.

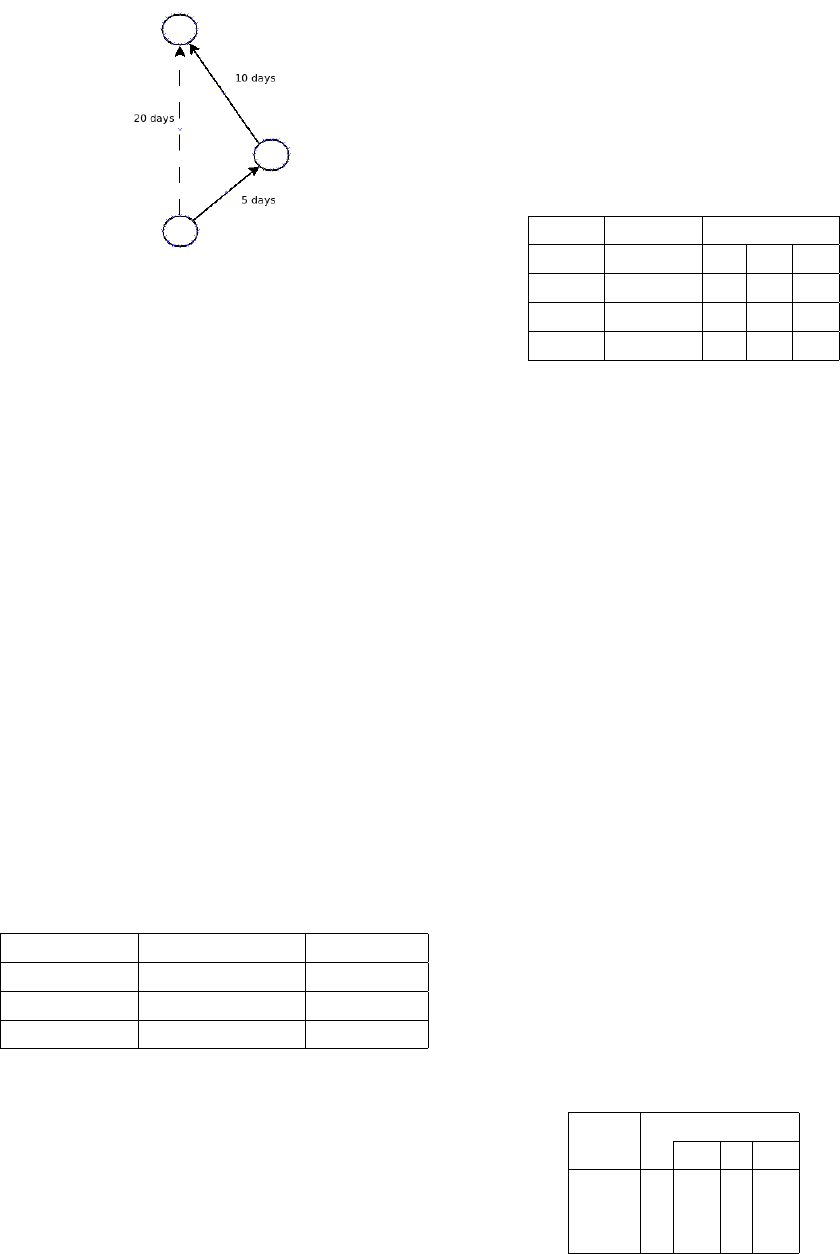

On the other hand, in figure 2, we see that the

source process forms a coalition with the relay busi-

ness process, since it is in its benefit to cooperate,

since it saves completion time. This is only the sim-

plest scenario. We investigate thoroughly a more

complicated scenario with a network of business pro-

cesses. In both figures the solid lines represent the

preferences of the source business process, while the

dashed lines the discarded choices.

Figure 1: Source Business Process Direct communication

with End-Business Process.

Seventh International Symposium on Business Modeling and Software Design

170

Figure 2: Source Business Process Direct forming Coalition

with Relay Business Process.

3.2 Multiple Source and Relay Business

Processes

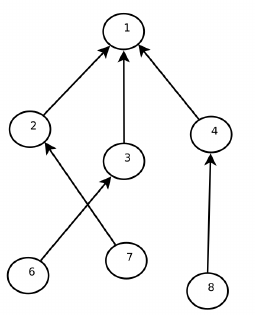

The objective is to maximise the time completion of

the business processes that will be formed after the

cooperation and the coalitions formed. In our sce-

nario, business process 1 is the business process that

the business plan leads to, business processes 2 − 4

are the relay business processes and business pro-

cesses 6 − 8 are the source business processes. The

source processes do not form coalitions with all the

relay business processes. In particular, source busi-

ness processes 6 and 8 form 3 coalitions respectively

and source business process 7 establishes 4 coalitions

respectively. These coalitions include a connection to

the end business process, in order to show the differ-

ence in the T value and the necessity of cooperation

between the business processes. The respective com-

pletion time values reside in table 1. Finally the com-

pletion time values between the relay business pro-

cesses 2, 3, 4 and the end-business process are 1, 1.5, 3

respectively.

Table 1: Network connections and T values.

Source Process Seller Connections T

6 1,2,3 23,20,16

7 1,2,3,4 16,12.5,11,12

8 1,3,4 21,15.10,14

Thereafter, we provide the reader with the val-

uations of the business processes (sellers and buy-

ers). Notably, the sellers’ valuations are calculated

by simply obtaining the completion time values re-

quired to transmit operate a business process to busi-

ness process 1. On the other hand, the valuations of

the buyers are estimated by the result of equation (1),

which gives us the difference of completion time be-

tween the one-hop connection of each buyer with the

end business process and the completion time of each

buyer with a seller. Note that when a connection does

not exist between a seller and a buyer, we set the re-

sult of (1) as 0. We provide the valuations in the table

2, which is counted in days of completion time.

Table 2: Business Processes and Completion Time

Values.

Source Seller Val Buyer Val

(i) (c

i

) T

i6

T

i7

T

i8

2 1.5 3 3.5 0

3 2 7 5 6.5

4 2 0 4 7

The result of the assignment of the most appropri-

ate seller to a buyer is the enhancement of completion

time value per pair. The outcome of the game is a

profit matrix that shows the resulting completion time

enhancement from coalitions between source and re-

lay business processes. We provide this information

in table 3. Furthermore we highlight the optimal

assignment between relay and source business pro-

cesses in bold numbers, which indicate the maximi-

sation of the completion time enhancement for each

pair that form a coalition.

We are able to identify the core solution of the

problem by solving the dual LP problem described

in the previous section. However, we are not in the

position to claim that the core solution is unique. One

of the core solutions obtained, which is close to the

Shapley value (Shapley, 1988)

y = [2.1708 0.95 2.55 0.55 3.30 2.44] (17)

Furthermore, we can derive from Table 1 that the

completion time required for a direct communication

of the buyer business process with the destination -

business process 1 - is 45. On the other hand, the suc-

cessful cooperation between the sellers and the buyers

is 17.5, which gives us an completion time enhance-

ment of 68.1%. In order to accomplish that we need

to connect business process 6 with business process

2, business process 8 with business process 3 and fi-

nally, business process 7 with business process 4. We

Table 3: Completion Time Enhancement.

Buyers

6 7 8

Sellers 2 1.5 2 0

3 5 3 4.5

4 0 2 5

Assigning Business Processes: A Game-Theoretic Approach

171

can see the final configuration of the business process

selection process in figure 3.

Figure 3: Final Transmission Configuration.

4 CONCLUSIONS

In this paper we attempted to approach the collabo-

ration between business processes in order to accom-

plish tasks of a business plan. To that end, business

processes either connect directly with the business

process they require to finish the task or they form

coalitions by finding a relay business process to con-

nect to, depending on the business process completion

time.

Subsequently, the business processes establish a

cooperative network in a game theoretic manner. Our

model is based on combinatorial optimisation, which

target the maximisation of the completion time en-

hancement when a relay and a source business pro-

cess cooperate. We derived the characteristic function

used in our game, the coalition core and the credit that

each business process has for playing the relay selec-

tion game. We evaluated a simple and a more com-

plicated scenario, which indicated the fact that using

cooperative business process cooperation the process

network exhibits a better completion time. This is due

to the fact that each source business process gets as-

signed to the relay business process that has the best

completion time enhancement.

REFERENCES

Aumann, R. J. and Dreze, J. H. (1974). Cooperative games

with coalition structures. International Journal of

game theory, 3(4):217–237.

Binmore, K. and Vulkan, N. (1999). Applying game theory

to automated negotiation. Netnomics, 1(1):1–9.

Boyd, S. and Vandenberghe, L. (2004). Convex optimiza-

tion. Cambridge university press.

Chen, H., Chiang, R. H., and Storey, V. C. (2012). Busi-

ness intelligence and analytics: From big data to big

impact. MIS quarterly, 36(4):1165–1188.

Curiel, I. J. (1988). Cooperative game theory and applica-

tions. [Sl: sn].

Katsanakis, I. and Kossyva, D. (2012). C-business: A

theoretical framework for the implementation of co-

opetition strategy in e-business. Procedia-Social and

Behavioral Sciences, 58:259–268.

Li, S. X., Huang, Z., Zhu, J., and Chau, P. Y. (2002). Co-

operative advertising, game theory and manufacturer–

retailer supply chains. Omega, 30(5):347–357.

Minelli, M., Chambers, M., and Dhiraj, A. (2012). Big data,

big analytics: emerging business intelligence and an-

alytic trends for today’s businesses. John Wiley &

Sons.

Saad, W., Han, Z., Debbah, M., Hjørungnes, A., and Bas¸ar,

T. (2009). Coalitional game theory for communica-

tion networks. Signal Processing Magazine, IEEE,

26(5):77–97.

Scheer, A. W., Abolhassan, F., Jost, W., and Kirchmer, M.

(2004). Business process automation. ARIS in prac-

tice.

Shapley, L. S. (1988). A value for n-person games. The

Shapley value, pages 31–40.

Shapley, L. S. and Shubik, M. (1971). The assignment game

i: The core. International Journal of game theory,

1(1):111–130.

Snowden, D. J. and Boone, M. E. (2007). A leader’s frame-

work for decision making. Harvard business review,

85(11):68.

Sonteya, T. and Seymour, L. (2012). Towards an under-

standing of the business process analyst: an analysis

of competencies. Journal of Information Technology

Education: Research, 11(1):43–63.

Spyrou, E. D. and Mitrakos, D. K. (2017). Etx-based relay

selection coalition game for wireless sensor networks.

IWCMC, to appear.

Von Neumann, J., Morgenstern, O., Rubinstein, A., and

Kuhn, H. (2007). Theory of games and economic be-

havior. Princeton Univ Pr.

Weber, R. J. (1994). Games in coalitional form. Handbook

of Game Theory with Economic Applications, 2:1285–

1303.

Yahyaoui, H. (2012). A trust-based game theoretical model

for web services collaboration. Knowledge-Based

Systems, 27:162–169.

Yasir, M., Majid, A., and Abdullah, M. T. (2010). An empir-

ical investigation into the matching problems among

game theoretically coordinating parties in a virtual or-

ganization. BRAND. Broad Research in Accounting,

Negotiation, and Distribution, 1(1):101–109.

Seventh International Symposium on Business Modeling and Software Design

172