Mining and Linguistically Interpreting Data from Questionnaires

Influence of Financial Literacy to Behaviour

Miroslav Hudec

1

and Zuzana Brokešová

2

1

Faculty of Economic Informatics, University of Economics in Bratislava, Dolnozemská cesta 1, Bratislava, Slovakia

2

Faculty of National Economy, University of Economics in Bratislava, Dolnozemská cesta 1, Bratislava, Slovakia

Keywords: Financial Literacy, Questionnaire, Data Mining, Quantified Sentence of Natural Language, Flexible Data

Summarization, Fuzzy Logic.

Abstract: This paper is focused on mining and interpreting information about effect of financial literacy on

individuals’ behavior from the collected data by soft computing approach. Fuzzy sets and fuzzy logic allows

us to formalize linguistic terms such as most of, high literacy and the like and interpret mined knowledge by

short quantified sentences of natural language. This way is capable to cover semantic uncertainty in data and

concepts. The preliminary results in this position paper have shown that for majority of people of low

financial literacy angst and other treats represent serious issues, whereas about half of people with high

literacy do not consider these treats as significant. Finally, influence of literacy to anchoring questions is

mined and interpreted. Eventually, the paper emphasises needs for further data analysis and comparison.

1 INTRODUCTION

Adequate level of financial knowledge was

identified as important for sound financial decisions

(Lusardi, 2008). In addition, previous researches

indicate that individuals’ financial decisions are

affected by different psychological heuristics and

biases (Tversky and Kahneman, 1975). They include

emotional aspects in decision-making, loss aversion,

anchoring, framing and many others (see Gilovich et

al., 2002). According to our knowledge, the effect of

financial literacy to these heuristics and biases has

not been widely examined in the literature. Hence, in

the paper, we test the effect of high financial literacy

to (i) feeling like angst, nervousness, loss of control

and fear regarding possible catastrophic scenarios;

(ii) how these people are influenced by anchor

questions; (iii) how they decide about risky

investments.

The second task is mining and interpreting this

effect from the data collected by surveys in an easily

understandable and interpretable way. First,

summaries from the data are better understandable if

they are not as terse as numbers (Yager et al., 1990).

Secondly, there are often uncertainties in answers,

which should not be neglected (Hudec, 2015; Viertl,

2011). Thirdly, answers to respective questions

might be numbers, categorical data and short texts.

Hence, mining and interpreting survey data by

computational intelligence is beneficial. Fuzzy sets

and fuzzy logic allows us to mathemiatically

formalize linguistic terms such as most of, low

literacy, high angst and the like. They make possible

partial membership degrees of elements near the

borderline cases to these concepts.

In order to meet both aforementioned challenges,

we have conducted survey in Slovakia and adjusted

Linguistic Summaries (LSs) in order to mine and

interpret relational knowledge between financial

literacy and respective attributes.

2 LINGUISTIC SUMMARIES

AND THEIR QUALITY

LSs have been initially introduced by Yager (1982)

in order to express summarized information from the

data by linguistic terms instead of numbers.

Overview of recent development can be found in

(Boran et al., 2016). LSs of the structure Q R entities

in a data set are (have) S developed by Rasmussen

and Yager (1997) are relevant for our research. One

example of such summary is most of low financially

literate people feel high level of angst. The validity

of such a LS is computed as

Hudec, M. and Brokešová, Z.

Mining and Linguistically Interpreting Data from Questionnaires - Influence of Financial Literacy to Behaviour.

DOI: 10.5220/0006462402490254

In Proceedings of the 6th International Conference on Data Science, Technology and Applications (DATA 2017), pages 249-254

ISBN: 978-989-758-255-4

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

249

)

)(

))(),((

())((

1

1

n

i

iR

iR

n

i

iS

Q

xμ

xμxμt

μPxQxv

(1)

where n is the cardinality of elements in a data set

(in our case number of respondents),

n

i

iR

iR

n

i

iS

xμ

xμxμt

1

1

)(

))(),((

is the proportion of the elements

that belong to restriction R and satisfy summarizer S

(fully or partially), t is a t-norm, µ

S,

µ

R

and µ

Q

are

membership functions explaining summarizer S,

restriction R and relative quantifier Q, respectively.

The truth value (validity) v gets value from the

unit interval. If v is closer to the value of 1, then the

relation between R and S explained by Q is more

significant. The goal of LS is to reveal such

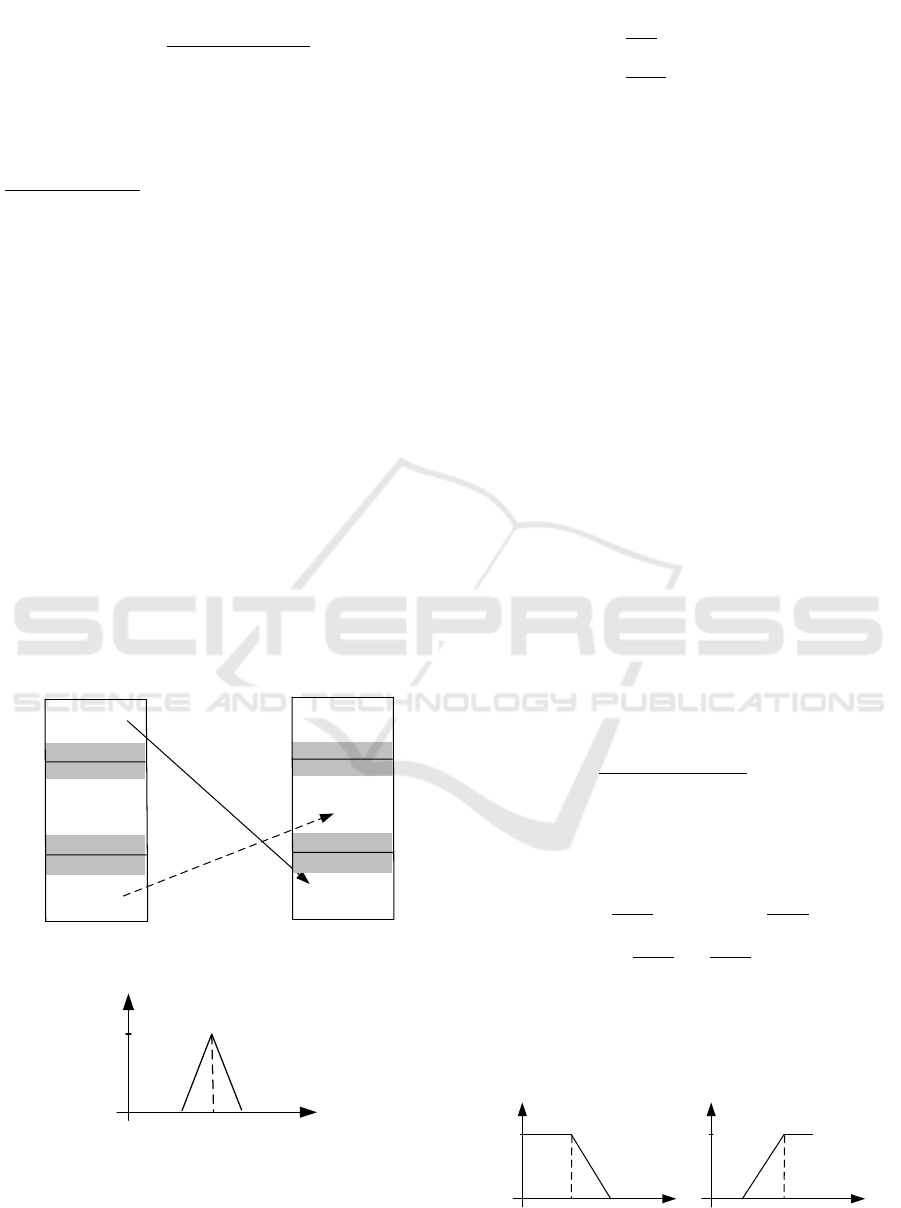

relations. LSs are graphically illustrated in Figure 1,

where grey areas between sets low, medium and high

emphasizes the uncertain area, i.e. area where

unambiguous belonging to a particular set cannot be

arranged.

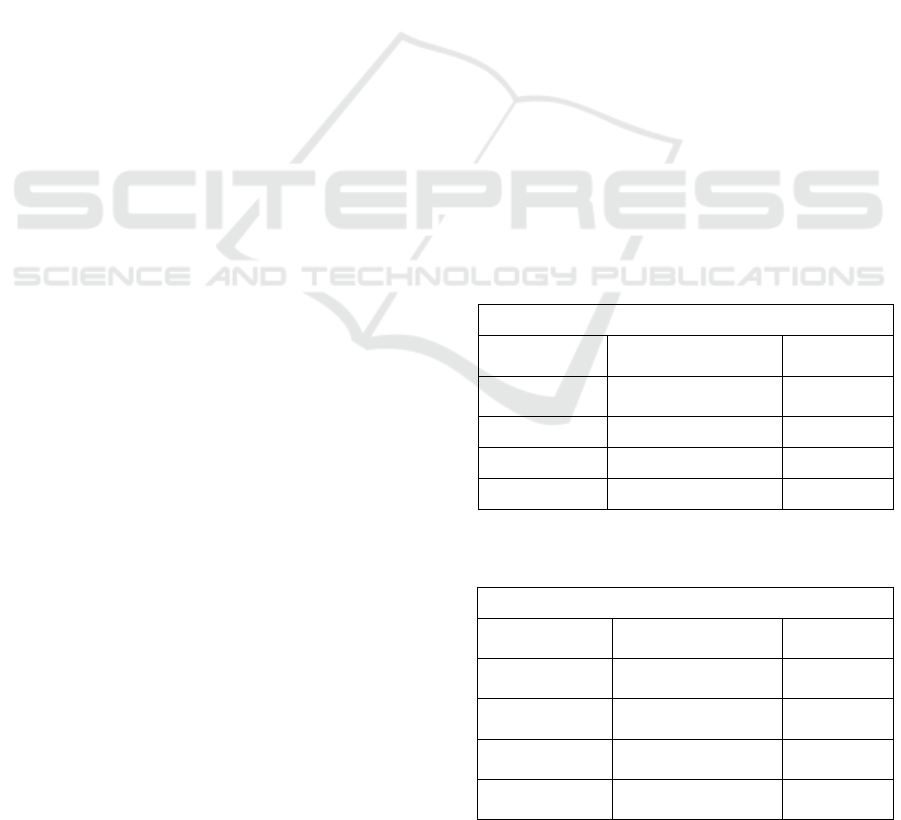

Flexible summarizers, restrictions and

quantifiers are mathematically formalized by fuzzy

sets. For instance, fuzzy set around anchor value of

m can be expressed as triangular fuzzy set (Figure

2).

attribute in

summarizer (S)

high validity

r

1

r

n

...

low

medium

high

r

n

...

low

medium

high

r

1

attribute in

restriction (R)

medium validity

Figure 1: Graphical illustration of LSs with restriction.

μ

A

(x)

0

1

a

X

b

m

Figure 2: Triangular fuzzy set around m.

otherwise0

)(

)(

1

)(

m,bx

mb

xb

a,mx

m-a

x-a

mx

x

(2)

where belonging to the set decreases when distance

to the anchor m increase.

The benefit against interval is in the intensity of

belonging to a set. The closer is element to

boundaries, the lower matching degree it has. Thus,

defining boundaries is not as sensitive as for

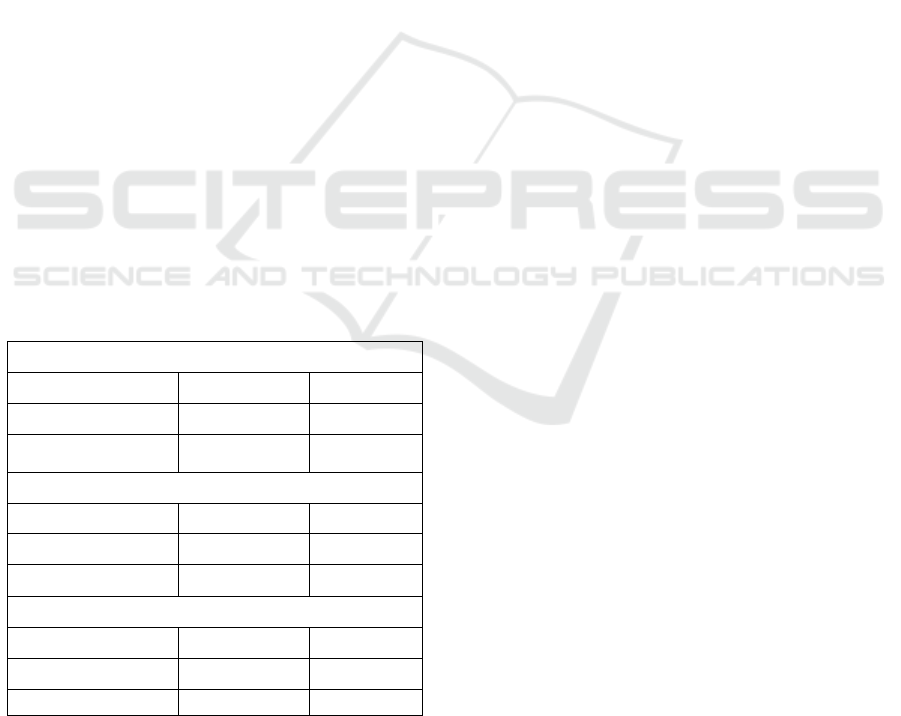

classical intervals. Similarly, fuzzy sets expressing

concepts small and high are plotted in Figure 3. For

categorical data matching degree is directly assigned

to each element, i.e.

))}(,()),...,(,{(

nn11

xxxxFL

(3)

where FL is a fuzzy set expressing concept in

summarizer or restriction.

If LS with restriction has high validity v (1), it

does not straightforwardly mean that such LS is

relevant. In order to solve this problem several

quality measures were suggested in (Hirota and

Pedrycz, 1990). Due to their complexity and partial

overlapping, simplified quality measure merging

validity and coverage is suggested in (Hudec, 2017)

otherwise0

5.0) ,(

CCvt

Q

c

(4)

where C is data coverage and t is a non-idempotent

t-norm, e.g. product one. Coverage is calculated

form the index of coverage.

))(μ),(μ(

1

n

xxt

i

iR

n

i

iS

C

(5)

where parameters have the same meaning as in (1)

and n is cardinality of data set by the transformation

(Wu et al, 2010)

,1

2

,)(21

2

,)(2

,0

)(

2

2

21

2

12

2

21

1

2

12

1

1

ri

ri

rr

rr

ir

rr

ir

rr

ri

ri

ifC

c

c

c

c

c

c

C

(6)

where r

1

= 0.02 and r

2

= 0.15, because in LSs with

restriction only small subset of data is included in

both sets R and S (Figure 1).

μ

H

(x)

0

1

a

m

X

μ

L

(x)

0

1

m

b

X

highlow

Figure 3: Fuzzy set expressing concepts small and high.

DATA 2017 - 6th International Conference on Data Science, Technology and Applications

250

3 MINING RELATIONAL

KNOWLEDGE AMONG

ATTRIBUTES

This section explains procedure, results, discussion

and challenges for further work. The data set

consists of 644 answers with no missing data.

Examples of questions, possible answers and fuzzy

sets are provided in successive sections.

3.1 Experiments

The first step consists of construction of membership

functions for attributes and their respective linguistic

labels appearing in summaries.

Question regarding financial literacy is used in

all experiments. The level of financial literacy was

not included in the questionnaire. It was aggregated

from answers to several questions. Financial literacy

is expressed on the [0, 5] scale, where 0 is the lowest

and 5 the highest level. Other questions were

directly focused on feelings to potential kinds of

threats, willingness to participate in financial games

and influences by anchor questions.

The level of financial literacy attribute is

fuzzified into three fuzzy sets: low literacy (LL),

medium literacy (ML) and high literacy (HL) using

notation (3) in the following way

HL = {(5, 1), (4, 0.75), (3, 0.45)}

ML = {(1, 0.35), (2, 1), (3, 1), (4, 0.35)}

LL = {(0, 1), (2, 0.75), (3, 0.45)}

It means that level 5 is without doubt high, level

4 significantly high but not fully and level 3 is

partially high. Other two levels do not belong to this

set. The recognized drawback in fuzzification is in

set ML. It contains two elements with matching

degree equal to 1. Hence, higher numbers of

elements belong to this set. The ideal option is using

scale of odd number of elements. Anyway, sets HL

and ML do not cope with this issue.

3.1.1 Relation between Financial Literacy

and Attributes of Fear, Angst,

Nervousness and Loss of Control

Emotional heuristics and biases including fear,

angst, nervousness or loss of control could

significantly shape financial decision (e.g. Lee and

Andrade, 2015). For example, in the case of

insurance purchase, Zaleskiewicz et al. (2002)

identified increase in the flood insurance demand

after the recent flood. The role of financial literacy

in this relation is questionable.

Our respondents were asked about emotions

(angst, fear, nervousness and loss of control) evoked

by imagination of possible negative events that

could affect their life. These imagination was

visualized in the pictures of unexpected natural

disaster, death of relatives, war and deadly epidemic.

Possible answers are: not at all, weakly, moderately,

intensely and very intensely. These categorical

attributes are fuzzified into sets low and high by (3):

L = {(not at all, 1), (weakly, 0.75), (moderately, 0.45)}

H = {(very intensely, 1), (intensely, 0.75), (moderately,

0.45)}

In order to get summaries, covered by sufficient

number of respondents, we have strengthened Eq.

(4) by condition C ≥ 0.75, instead of 0.5.

Mined results are shown in tables 1 and 2, where

terms low and high corresponds with terms

illustrated in Figure 1. Financial literacy is

restriction (R) and summarizers (S) are considered

attributes. First row in Table 1 means that LS about

half respondents with high financial literacy have

low angst has significantly higher validity than

sentence explained by quantifier most of.

Mined relational knowledge (Table 2) has shown

that people with low financial literacy have high

level of fear, angst, loss of control and nervousness.

The most problematic attribute is angst, where

significant proportion of respondents with low

Table 1: Result of summaries Q respondents of high

financial literacy have low values of respective attributes.

high financial literacy

low

validity for quantifier

Eq. (1)

coverage Eq.

(6)

angst

about half - 0.7129

most of - 0.1411

0.7888

loss of control

about half – 1

1.0000

fear

about half – 1

0.9988

nervousness

about half – 1

0.9346

Table 2: Result of summaries Q respondents of low

financial literacy have high values of respective attributes.

low financial literacy

high

validity for quantifier

(1)

coverage (6)

angst

most of - 0.9996

about half – 0.0004

1

loss of control

most of - 0.5863

about half – 0.4137

1

fear

most of - 0.5818

about half – 0.4182

1

nervousness

most of - 0.7674

about half – 0.2326

1

Mining and Linguistically Interpreting Data from Questionnaires - Influence of Financial Literacy to Behaviour

251

financial literacy consider angst as a treat. These

people might think that potential dangerous

situation, if appear, will significantly devalue their

lives and properties. On the other side, majority of

people with high financial literacy does not have

straightforwardly low intensities of these treats

(Table 1). But at least about half of them have low

values of respective threats.

3.1.2 Relation between Financial Literacy

and Answer to Anchor Question

Anchoring represents a subconscious tendency of

individuals to rely on onward information in the

decision-making. This information does not have to

be necessarily important for the decision. The role of

financial literacy in the process of anchoring has not

been previously studied.

In this experiment, we worked with numerical

attribute: number of inhabitants in Iowa. Anchor

value was set to 1 500 000 inhabitants. In order to

reveal behaviour of people who have answered

around this anchor value, we had relaxed crisp value

1 500 000 to the fuzzy number around 1 500 000,

which is a convex fuzzy set with limited support and

for value of 1 500 000 the matching degree is equal

to 1. Fuzzy set around 1 500 000 is represented by

(2) with the following values of parameters:

a = 1200000, m = 1500000, b = 1800000 (Figure 2).

Benefits against classical interval are explained in

Section 2.

In this experiment, significant relations between

literacy and answers to anchor questions have not

been recorded by LSs. From the opposite view

(restriction is anchor question and summarizer is

financial literacy), we recorded high validity for

summary: most of respondents with answer around

anchor have medium literacy. These relations are

summarized in Table 3.

Table 3: Result of summaries Q respondents with answer

around anchor value have (low, medium, high) values of

financial literacy.

number of inhabitants around the anchor value

validity for quantifier

(1)

coverage (6)

low financial

literacy

few – 0.5686

about half – 0.4314

0,1249

medium finan.

literacy

most of – 1

0,9456

high financial

literacy

few - 0.3018

about half – 0.6981

0,1918

We could conclude that individuals with high level

of financial literacy do not reflect the anchor in their

decision-making. However, also respondents with

low level of financial literacy do not react to

anchoring. Anyway, this experiment requires further

analysis. We consider trying different terms

regarding answers, for instance, far from 1 500 000,

significantly lower than 1 500 000, significantly

higher than 1 500 000 and the like. These terms can

be formalized by fuzzy sets plotted in Figure 3.

Another option is approach based on fuzzy

functional dependencies, which might be helpful due

to comparing conformance of each two respondents

answer on both attributes.

3.1.3 Relation between Financial Literacy

and Risk Taking

Risk aversion is an important parameter in financial

decisions as majority of these decisions include risk.

However, the effect of level of financial literacy is

not clear. In economic literature, risk taking is often

measured by the decisions in the lottery, where

individuals could choose between sure and risky

alternative (see e.g. Holt and Laury, 2002).

In our experiments, participation in lottery is

numerical attribute. Respondents were asked how

much they are willing to pay for the participation in

the lottery, where one out of 10 players win 1000 €.

Based on the expected value theory, those who are

willing pay less than 100 € could be considered as

risk averse, those who would like to pay 100 € are

assumed as risk neutral and those who will pay more

than 100 € are recognized as risk loving. The lowest

recorded value was 0 and the highest 333, whereas

mean value was 21.30 €. Data distribution is not

uniform, which means that we cannot create three

granules: low, medium and high by uniformly

covering domain. The options are statistical mean

based method (Tudorie, 2008) or logarithmic

transformation (Hudec and Sudzina, 2012).

Applying the former, fuzzy set low participation is

expressed by parameters m = 25 and b = 37.5,

whereas set high participation is expressed by

parameters a = 62.5 and m = 75 (Figure 3). Results

from this experiment are summarized in Table 4.

We have recorded that respondents belonging to

all three categories of financial literacy prefer low

participation in lottery. That is an expected result as

the majority of the population is risk averse and

prefer sure alternative over the risky one. We have

not identified effect of financial literacy on risk

taking. Other relations have not been recorded, due

to low data coverage.

DATA 2017 - 6th International Conference on Data Science, Technology and Applications

252

3.2 Discussion

The preliminary results are promising, but further

research is highly advisable. Regarding questions

angst, loss of control, fear and nervousness, we

reveal that improving financial literacy might be

beneficial for the population (tables 1 and 2).

Although, majority of people with high financial

literacy do not have straightforwardly low angst and

other threats, at least about half of them do not

consider the treats significant. For respondents with

low financial literacy the treats represent problems.

On the other hand, reaction to anchoring is low

in the group with high financial literacy and low

financial literacy as well. Several studies supported

the role of anchor in decision-making (Furnham and

Boo, 2011). The absence of this effect on the two

extremes of financial literacy (high, low) brings an

interesting finding to the literature. One could

speculate that those with high level of financial

literacy notice the anchor but isolate its effect in

decision-making. Those with low levels of financial

literacy presumably do not notice anchor. This

finding requires further research and robustness

checks.

Our results suggest that risk aversion do not vary

with financial literacy. Risk aversion is therefore

superior characteristic and cannot be changed by the

increase of the level of financial literacy.

Table 4: Result of summaries between financial literacy

and participation in lottery using quantifiers few, about

half and most of.

high financial literacy

validity for Q

coverage

low participation

most of – 1

1

high participation

few -1

0.0081<0.75

low financial literacy

validity for Q

coverage

low participation

most of – 1

1

high participation

few -1

0

medium financial literacy

validity for Q

coverage

low participation

most of – 1

1

high participation

few -1

0.2898<0.75

LSs are suitable for mining relational knowledge

from variety of data: numbers (either crisp or fuzzy),

(weighted) categorical data, short texts. The benefit

is in low computational effort when optimization

techniques are applied (Liu, 2011), covering non-

linear dependencies and fast estimation. In order to

reveal relational knowledge, domains are divided

into several flexible granules: low, medium and high.

This ensures that we can use all data types in (1), (4-

6) considering their respective membership degrees.

3.3 Further Tasks and Opportunities

This is, according your best knowledge, first attempt

to analyse impact of financial literacy to people

perceptions and decisions as well as to analyse these

data with linguistic summaries. The framework and

mathematical formulation have been developed. In

next parts of our project, we are going to analyse

other possible combinations of attributes and their

respective granules, such as answer far from anchor,

significantly lower answers, etc.

Answers to majority of questions are linguistic

terms. Such terms do not have clear definition in

terms of set theory. Furthermore, concepts such as

around anchor value are understandable, even

though vague. Hence, we are considering building

model based on Fuzzy Functional Dependencies

(FFD) to compare with our results. Overview of

FFD can be found in, e.g. (Vučetić and Vujošević,

2012). In this way, we can cover mining relational

knowledge form questionnaires by two valuable

approaches capable to manage semantic uncertainty.

Hence, the preliminary results are going to be

confronted by approach based on FFD. Option based

on FFD is more demanding in terms of

computational effort, but is more powerful. It

compares each two values in order to reveal whether

similar values of one attribute causes similar values

of another attribute.

Our results reveal influence of financial literacy

to main threats and other attributes for Slovak

respondents. Promising aspect for research is

comparison with other countries as well as control

the effect of the socio-economic characteristics of

individuals in this relation. To reveal such answers

an international survey and research is advisable.

4 CONCLUSIONS

Financial literacy, its improvement and it drivers is a

relevant topic, which should be analysed. In this

paper, we have shown that mining relational

knowledge from well-designed questionnaires by

fuzzy logic is valuable contribution to this field.

Preliminary data mining results have shown that low

literacy causes that people have lower quality of life,

Mining and Linguistically Interpreting Data from Questionnaires - Influence of Financial Literacy to Behaviour

253

due to high level of angst, nervousness, fear and loss

of control. On the other side, high literacy does not

straightforwardly mean big improvement.

Further, we have recorded that respondents

belonging to all three categories of financial literacy

prefer low participation in lottery. It is an expected

result as the majority of the population is risk averse

and prefer sure alternative to the risky one.

Finally, result that reaction to anchoring is low in

the group of respondents with high financial literacy

and in the group with low financial literacy brings an

interesting finding, which is contribution to further

economical and data mining research.

These conclusions are preliminary. Regarding

the data mining, in the next stage of our research, we

are going to apply more powerful, but also

computationally demanding approach for revelling

flexible functional dependencies among attributes to

confront already reached results. In addition,

advisable are similar researches in other countries

with different economic situation.

ACKNOWLEDGEMENTS

This paper is part of a research grant VEGA

No. 1/0849/15 entitled ‘Economic and social aspects

of the information asymmetry in the insurance

market’ supported by the Ministry of Education,

Science, Research and Sport of the Slovak Republic.

REFERENCES

Boran, F. E., Akay, D., and Yager, R. R. 2016. An

overview of methods for linguistic summarization

with fuzzy sets. Expert Systems with Applications,

61:356–377.

Furnham, A., Boo, H. C. 2011. A literature review of the

anchoring effect. The Journal of Socio-Economics,

40(1):35-42.

Gilovich, T., Griffin, D., Kahneman, D. 2002. Heuristics

and Biases: The Psychology of Intuitive Judgment,

Cambridge University Press. Cambridge.

Hirota, K., Pedrycz, W. 1990. Fuzzy computing for data

mining. Proceedings of IEEE, 87:1575-1600.

Holt, C. A., Laury, S. K. 2002. Risk aversion and

incentive effects. American economic review,

92(5):1644-1655.

Hudec, M. 2017. Merging validity and coverage for

measuring quality of data summaries. In Information

Technology and Computational Physics. Springer

International Publishing, Switzerland (in press).

Hudec, M. 2015 Storing and analysing fuzzy data from

surveys by relational databases and fuzzy logic

approaches. In XXV-th IEEE International Conference

on Information, Communication and Automation

Technologies (ICAT 2015). IEEE.

Hudec, M., Sudzina, F. 2012. Construction of fuzzy sets

and applying aggregation operators for fuzzy queries.

In 14th International Conference on Enterprise

Information Systems (ICEIS 2012) SCITEPRESS.

Lee, C. J., Andrade, E. B. 2015. Fear, excitement, and

financial risk-taking. Cognition and Emotion, 29(1):

178-187.

Liu, B. 2011. Uncertain logic for modeling human

language. Journal of Uncertain Systems, 5:3-20.

Lusardi, A. 2008. Financial literacy: an essential tool for

informed consumer choice? (No. w14084). National

Bureau of Economic Research.

Rasmussen, D., Yager, R.R. 1997. Summary SQL - A

fuzzy tool for data mining. Intelligent Data Analysis,

1:49-58.

Tudorie, C. 2008. Qualifying objects in classical relational

database querying. In Handbook of Research on Fuzzy

Information Processing in Databases, pages. 218-245.

Information Science Reference, Hershey.

Tversky, A., Kahneman, D. 1975. Judgment under

uncertainty: Heuristics and biases. In Utility,

probability, and human decision making, pages. 141-

162. Springer, Netherlands.

Viertl, R. 2011. Fuzzy data and information systems. In

15th WSEAS International Conference on Systems.

WSEAS Press.

Vučetić, M., Vujošević, M. 2012. A literature overview of

functional dependencies in fuzzy relational database

models. Techniques and Technologies for Education

and Management, 7(4):1593-1604.

Wu, D., Mendel, J.M., Joo, J. 2010. Linguistic

summarization using if-then rules. In 2010 IEEE

International Conference on Fuzzy Systems. IEEE.

Yager, R. R. 1982. A new approach to the summarization

of data. Information Sciences, 28:69–86.

Yager, R.R., Ford, M., Cañas, A.J. 1990. An approach to

the linguistic summarization of data. In 3rd

International Conference on Information Processing

and Management of Uncertainty in Knowledge-based

Systems (IPMU ’90). EUSFLAT.

Zaleskiewicz, T., Piskorz, Z., Borkowska, A. 2002. Fear

or money? Decisions on insuring oneself against

flood. Risk, Decision and Policy, 7(3):221-233.

DATA 2017 - 6th International Conference on Data Science, Technology and Applications

254