Churn Prediction for Mobile Prepaid Subscribers

Zehra Can

1,2

and Erinç Albey

1

1

Industrial Engineering, Özyeğin University, İstanbul, Turkey

2

Business Intelligence Team, Turkcell Technology Research and Development Inc., İstanbul, Turkey

Keywords: RFM, Prepaid Subscriber, Telecommunication, Pareto/NBD, Logistic Regression, Mobile.

Abstract: In telecommunication, mobile operators prefer to acquire postpaid subscribers and increase their incoming

revenue based on the usage of postpaid lines. However, subscribers tend to buy and use prepaid mobile lines

because of the simplicity of the usage, and due to higher control over the cost of the line compared to postpaid

lines. Moreover the prepaid lines have less paper work between the operator and subscriber. The mobile

subscriber can end their contract, whenever they want, without making any contact with the operator. After

reaching the end of the defined period, the subscriber will disappear, which is defined as “involuntary churn”.

In this work, prepaid subscribers’ behavior are defined with their RFM data and some additional features,

such as usage, call center and refill transactions. We model the churn behavior using Pareto/NBD model and

with two benchmark models: a logistic regression model based on RFM data, and a logistic regression model

based on the additional features. Pareto/NBD model is a crucial step in calculating customer lifetime value

(CLV) and aliveness of the customers. If Pareto/NBD model proves to be a valid approach, then a mobile

operator can define valuable prepaid subscribers using this and decide on the actions for these customers, such

as suggesting customized offers.

1 INTRODUCTION

Under today’s challenging market conditions,

competitions become more and more important for

companies. The attention of a customer is disturbed

by the competitors. Therefore the companies must be

proactively analyze their customer behavior based on

their CRM and behavioral data and offer the customer

the best product or service to keep their attraction.

Satisfaction with the product or service improves the

loyalty of the customer with the brand. Customer

loyalty encourages customer to spend more money

with the company’s product and services, thus the

revenue of the firm grows.

In mobile sector the churn rate of the customers

are more dynamic than the other sectors. Especially

predicting the behavior of the prepaid subscribers are

more difficult than postpaid subscribers. Usually, it is

accepted that prepaid subscribers individually

generate less revenue than postpaid subscribers, as a

result of those, operators mostly focus on the postpaid

subscribers. However, in Turkey in last years,

proportionally the volume of the prepaid subscribers’

number converges to the postpaid subscribers’

number so the prepaid revenue cannot be ignored.

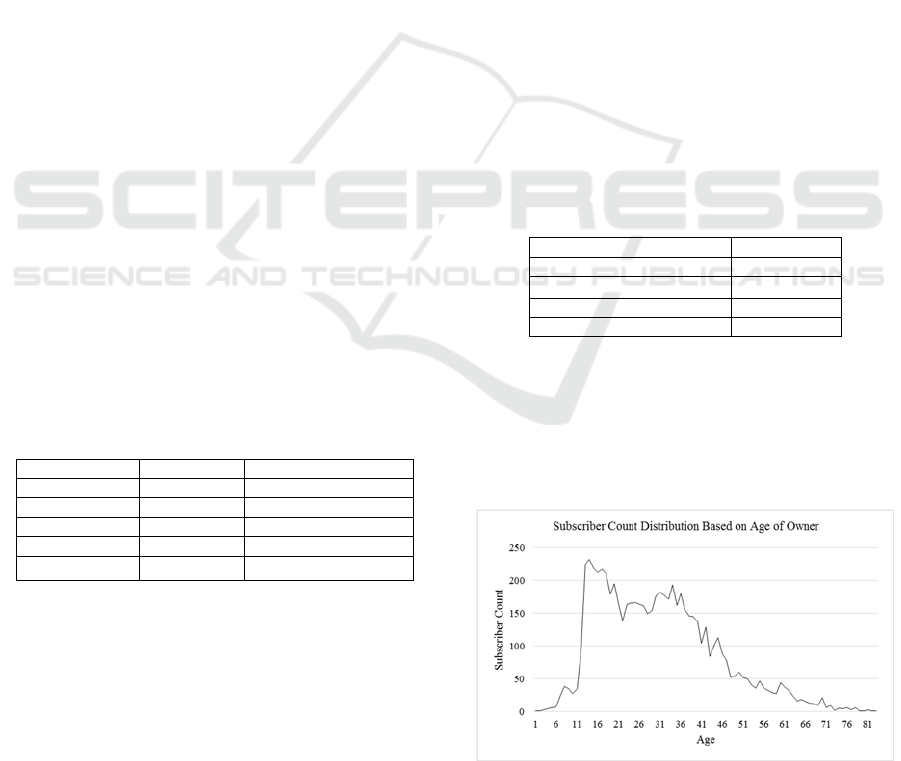

The trends of the postpaid and prepaid subscribers

can be seen in Figure 1. This market data is published

quarterly to report the market trends in mobile sector

by BTK knowns as “Bilgi Teknolojileri Kurumu”

which is the Governmental Organization of

Information Technologies.

Figure 1: Postpaid Prepaid Subscriber Trends in Turkey

Published By BTK.

One of the main question is who can be targeted

and what can be offered to these subscribers, to keep

them alive and make them satisfied and loyal

customers, that is postpaid subscribers.

Can, Z. and Albey, E.

Churn Prediction for Mobile Prepaid Subscribers.

DOI: 10.5220/0006425300670074

In Proceedings of the 6th International Conference on Data Science, Technology and Applications (DATA 2017), pages 67-74

ISBN: 978-989-758-255-4

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

67

In this paper, we focus on the prepaid subscribers

who have a non-contractual relation with the

company and company cannot observe the time when

the customer “dies”. The characteristic of the prepaid

subscribers’ behavior can be defined simply with the

recency, frequency, and monetary (RFM) data. RFM

analysis was probably the first “predictive model”

used in database marketing (Neslin et al., 2008). The

RFM values of a customer provide insight about

customers tendency to contact with the company

again. Recency gives what is the last time the

customer buys product or service from the company.

The customer who has the most recent transaction has

the highest probability to buy from you again. The

customer who has frequent contact with the company

has the highest probability to come back to the

company and lastly the customer who spends more

than other customers, has the highest probability to

spend more in the future. RFM model classifies the

customers into groups which the company can use in

targeting their product or service offers.

Pareto/NBD model (Schmittlein et al., 1987) is

specifically designed to handle the RFM values in a

way to generate individual level predictions for the

churn tendency. In addition to churn prediction,

Pareto/NBD model can be used to predict activeness

level of the customers and life time values.

As mentioned above, prepaid subscribers are

potential postpaid subscribers. RFM data as a base

data for Pareto/NBD model can be used by the mobile

operator to offer their products or services or switch

to an appropriate postpaid line offer. Thus the RFM

data can be used for Pareto/NBD model to define the

subscriber’s behavior.

2 BACKGROUND

Prepaid subscribers have to first make top-up before

making calls. Usage behavior of prepaid subscribers

differs from each other. The credit is purchased at any

time whenever the subscriber decides to. In Turkish

mobile market if the mobile subscribers does not

make any top-up, the line contract is terminated by

the mobile operator. The period for the cancellation

of the subscriber line contract is 270-days after the

last purchase. However, the operator never knows

when the subscriber would do the last credit purchase.

Hence, the subscriber behavior can be easily defined

with only recency/frequency data and Pareto/NBD

model can give the probability of a customer being

alive and the expected number of transactions for a

customer. Based on these valuable data a mobile

operator can calculate the “Customer Life Time

Value” and monetary value of a customer. (Fader et

al., 2005b)

2.1 Pareto/NBD Assumptions

The Pareto/NBD model is defined by SMC

(Schmittlein, Morrison and Colombo) to model the

repeat purchase for a non-contractual customers

(Schmittlein et al., 1987). SMC states the model has

several assumptions regarding customers:

Individual customer;

Poisson Purchases: While alive, each customer

makes purchases according to a Poisson process

with rate λ.

Exponential Lifetime: Each customer remains

alive for a lifetime which has an exponentially

distributed duration with death rate µ.

Heterogeneity across customers;

Individuals' purchasing rates are distributed

following Gamma distribution with rate λ

Customers is distributed according to a gamma

distribution across the population of customers

(NBD distribution).

Death rates also follow a Gamma distribution with

rate µ, and customers have different gamma

distribution across (Pareto distribution).

Rates λ and µ are independent: The purchasing

rates λ and the death rates µ are distributed

independently of each other.

By using these distributions on the basic RFM data,

SMC derived expressions for (Fader et al., 2005)

The probability of a customer is still alive,

The expected number of future transaction for a

customer.

2.2 RFM Analysis

RFM data includes the transactional data of the

customers. Recency can be calculated by the date of

the customers’ last transaction data, frequency can be

calculated by the count of the customers’ transaction

which fall into between the first transaction date and

last transaction date of the subscribers’ lifecycle and

the monetary value gives the transaction amount of

the subscriber. This is the simplest way which can be

used to define the non-contracted customers’

behavior.

The RFM values can be also used to segment

customers to identify the customers who have the

highest probability to respond to campaigns. By using

the RFM calculation, each subscriber would have a

value score assigned to them.

DATA 2017 - 6th International Conference on Data Science, Technology and Applications

68

The score is calculated first by dividing the

customers in quintiles then the recency, the frequency

and the monetary value of the customers are scored

beginning from 5 to 1 in descending order. The

customer who has the most recent value is scored with

5 then the less recent customers are scored with the

following numbers 4,3,2,1. The same method than

applied to the frequency and the monetary values of

each customer. At the end, each customer has a score

from 555 to 111. Totally, there could be 125 buckets

in which the customers are segmented. The customers

in the RFM bucket which is 555, could have the

highest probability to respond the campaigns (Birant,

2011).

2.3 Logistic Regression

Logistic regression measures the relationship

between categorical dependent variable and the

independent variables. The independent variables can

be one or more. The function which is used to

calculate the probability of the relation between the

dependent and independent variables is logistic

function. Logistic regression is one of the most

powerful methods to calculate the probability of an

event.

In this paper logistic regression is used to

benchmark the Pareto/NBD model. First logistic

regression is applied to the based RFM data and then

applied to other calculated variables which will be

explained in the following section.

3 RELATED WORKS

The activation of the prepaid subscribers can be

defined as non-contractual process. They stay alive

while continuing to purchase from the mobile

operator. There are some purchasing actions that

resets their 270-day period to zero day and the

subscriber continues to generate revenue. Otherwise,

they become inactive at the end of the 270-day period.

The importance is that the churn rate is higher

than the churn rate of the postpaid subscribers.

Increasing the customer loyalty or offering new

product services to the loyal customers will give the

control to the mobile operator rather than the

customer.

There are a lot of modelling works with postpaid

subscribers in mobile sector. However, defining and

managing prepaid subscribers’ future value is harder

than postpaid ones because of their unobserved

behavioral format.

There is a publication about this behavior of pre-

paid subscribers (Dairo et al., 2014). They use

decision tree algorithm to segment the prepaid

subscribers to define who are going to churn based on

CDR and SIM data.

There is a similar work as mentioned above. The

data set in this study (Owczarczuk, 2010) includes

prepaid subscribers model variables. The churn

prediction is done by using the logistic regression,

linear regression and Fisher linear discriminant

analysis and decision trees.

There are other studies for mobile operator churn

prediction. However, most of them does not directly

focus on prepaid subscribers’ behavior (Khan et al.,

2015). In this study, specifically churn prediction is

studied based on CDR data without specifying any

customer base. They work on feature selection

methods and supervised learning algorithms to

predict the churn score for the subscribers.

(Kirui et al., 2013), (Lu, 2002), (Ahna et al., 2006)

are again the studies that focus on postpaid

subscribers churn propensities. Another paper

(Dahiya et al., 2015) again analysis the churn

prediction but does not define a customer base.

As stated at the beginning, prepaid subscribers can

be accepted non-contractual subscribers. In

marketing non-contractual based data can be widely

analyzed with RFM data (Birant, 2011), (Neslin et al.,

2008)

In this paper (Coussement et al., 2014), RFM

analysis, logistic regression and decision trees are

used to compare with each other based on the

accuracy of the data.

Some other publications also focused on the

performance of the churn prediction models.

(Keramatia et al., 2014) applies many data mining

methods to a mobile operator data. But the main focus

is to improve the model accuracy. (Olle G. et al.,

2014) used hybrid churn prediction model for prepaid

subscribers and compared the accuracy of the data

mining models. (Huang et al., 2013) proposed a

hybrid model for churn prediction.

Although there are many churn pediction

publications, there are a few with mobile prepaid

subscribers data. Most of them focuses on the

performance improvement of the data mining

methods. In this work, the power of RFM data is used

to predict prepaid subscribers’ behavior.

4 DATA PREPARATION

4.1 RFM Data

Pareto-NBD model uses RFM data. In this paper we

Churn Prediction for Mobile Prepaid Subscribers

69

analyze the active mobile prepaid subscribers. The

data is provided by one of the mobile operators in

Turkey. If prepaid mobile subscribes do not make any

top-up, their contract will end in a defined period of

time, 270 days in Turkish market. But you never

know when they will stop making top-up so when

they will end their contract. In this paper the RFM

data set includes prepaid mobile subscribers who

make their first activation with the prepaid charging

method and do not change their charging method in

the selected time interval. The selected time interval

is 2 year period from 1

st

of February, 2015 to 31

th

of

January, 2017.

The number of distinct subscribers is 386K. The

refill amount and refill count is calculated based on

the refill transactions. The number of transactions is

2.7M. The subscribers with no transactions are

eliminated from the base subscriber set after

elimination the observer subscribers with refill

transactions are 327K.The refill transactions for the

same subscriber on the same date are merged into one

record so the 2.700.349 record has become 2.578.681

distinct transactions.

For the simplicity of the model, not all the

transactions are fed into the PARETO/NBD model,

the data is split into 50 buckets with ORA-HASH

function. The size of the one of the bucket has

approximately 55K refill transaction and the distinct

subscriber is 6500. The model is run with 6 sets of

this data. Each transaction contains a “Subscriber Id”

which uniquely defines the customers, refill date the

date of the transaction, refill amount the amount of

refill transaction in TL in other words the monetary

value of the refill transaction. The data is order by

subscriber id and refill date in ascending. A small

sample is presented in Table 1.

Table 1: A small sample of the RFM Data.

Subscriber Id Refill Date Refill Amount (TL)

132047392 20160812 15

132047392 20160901 20

…… ….. ….

132054290 20150328 25

132054290 20150416 12

4.2 Subscriber Variables for Data

Models

For model benchmarking with logistic regression the

defined variables were prepared. Usage (Data, Voice,

SMS) behaviors,

1. Usage statistics which includes if the subscriber

has any usage in the last 3 months.

2. Refill behaviors which holds the sum of the last

12 months refill transaction amounts. The refill

transactions include both voice and data

separately.

3. Package usage properties which hold if the

subscriber make any package refill in the last 12

months.

4. ARPU (average revenue per user) properties

5. Call center and online interaction transaction

variables were also included.

The subscriber set for this variable is the same with

RFM data set. The variables are calculated in monthly

bases. The selected month is the last month before the

calibration date which is January of 2016.

5 EXPLAROTARY DATA

ANALYSIS

As mentioned in Section 4 six buckets of the

transaction data is used. %15 of the subscribers,

which is 59.810 subscribers, never made a top-up

during the selected period. They are removed from

the used data set. The basic properties of the data sets

are shown in Table 2.

Table 2: Basic properties of the selected data sets.

Transaction Coun

t

~50

K

Distinct Subscriber Count ~6.500

Minimum Refill Date 01.03.2015

Maximum Refill Date 31.01.2017

Days Between Dates 708

The refill subscriber’s behavior cannot be

estimated beforehand like postpaid subscribers. The

demographic information for the prepaid subscribers

usually differs from the postpaid ones. Mostly young

people prefer to use prepaid lines which is shown in

the Figure 2.

Figure 2: Subscriber Distribution Based on Age.

DATA 2017 - 6th International Conference on Data Science, Technology and Applications

70

The basic statistics of the sets are given below in

Table 3. The statistics are generated based on the

Refill Amount (TL).

Table 3: Basic statistics of the selected data sets.

Set Trans Min Max Mean Var Stddev

Set 1 53,320 2 180 24 122 11

Set 2 52,683 2 360 24 123 11

Set 3 53,091 1 180 24 123 11

Set 4 51,920 1 180 24 124 11

Set 5 53,900 1 360 25 130 11

Set 6 53,248 2 360 24 147 12

The statistics for the subsets are nearly the same

as the main set which has 2.7M transactions. This

ensures that we can use one of the subsets to create

the model. The 5

th

, 25

th

, 50

th

, 75

th

and 95

th

percentiles

of the sets are listed in Table 4.

Table 4: The distributions of the data sets.

Set Q5 Q25 Median Q75 Q95

Set 1 10 19 25 30 40

Set 2 10 19 25 30 40

Set 3 10 19 25 30 40

Set 4 10 19 25 30 45

Set 5 10 19 25 30 45

Set 6 10 19 25 30 40

Main 10 19 25 30 40

According to Table 5 it can be easily seen that the

sets are shown similar distributions. To see the

distribution of the subscriber behavior for the days

between transactions, we can see there is positive

skewness for the distribution of the days.

Table 5: Values of the days between transactions.

Set Min 1

st.

Qu. Median Mean 3

rd.

Qu. Max

Set 1 1 9 24 31.72 34 593

Set 2 1 9 24 31.93 34 515

Set 3 1 10 26 32.74 35 590

Set 4 1 10 25 32.45 35 545

Set 5 1 9 24 31.45 34 462

Set 6 1 9 25 32.21 35 536

6 RESULTS

BTYD (Buy Till You Die) package in R is used to

implement the Pareto/NBD model. The selected 6

sets are used to calculate the model parameters. The

estimated parameters are given below in Table 6.

Table 6: The calculated model parameters.

Set r alpha S beta LL

Set 1 1.8201 9.5895 9.5451 10,000.00 -31018

Set 2 1.7126 9.1458 10.9913 9,771.91 -30304

Set 3 1.7446 9.5094 7.7747 9,730.02 -31396

Set 4 1.6936 8.8990 0.0382 33.31 -30647

Set 5 1.6907 8.7533 9.2325 8,773.72 -31393

Set 6 1.7154 9.0818 7.3129 9,990.86 -31170

It can be seen that all the sets shows the same

behavior, the parameter estimation nearly gives the

same result for all of them. We prefer to use one of

the data set “Set 6” to calculate the probability of

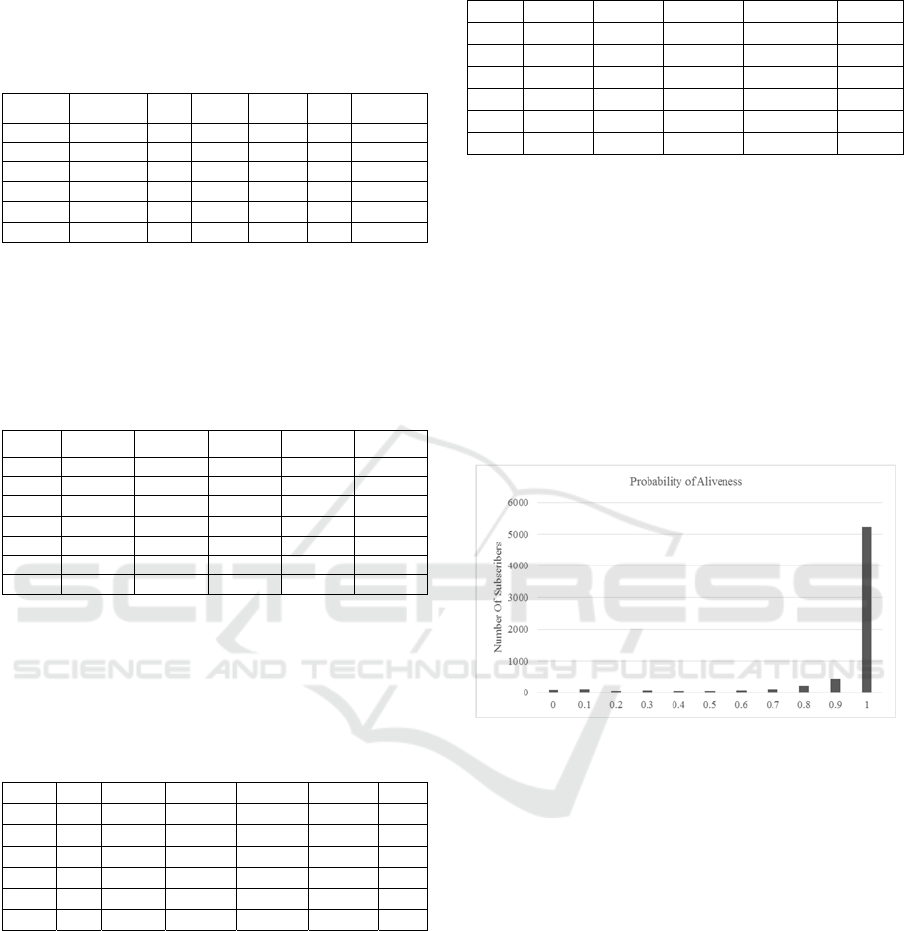

aliveness of the subscriber. After calculating the

probability of aliveness of each subscriber in the

selected data set, we get the actual values for the 6480

subscriber’s contract status of the holdout period from

the database as of the end of the holdout period

“31.01.2017”. The distribution for the probability of

alive are given in Figure 3 below, the model predicts

most of the subscriber to be alive.

Figure 3: Probability of Alive Distribution.

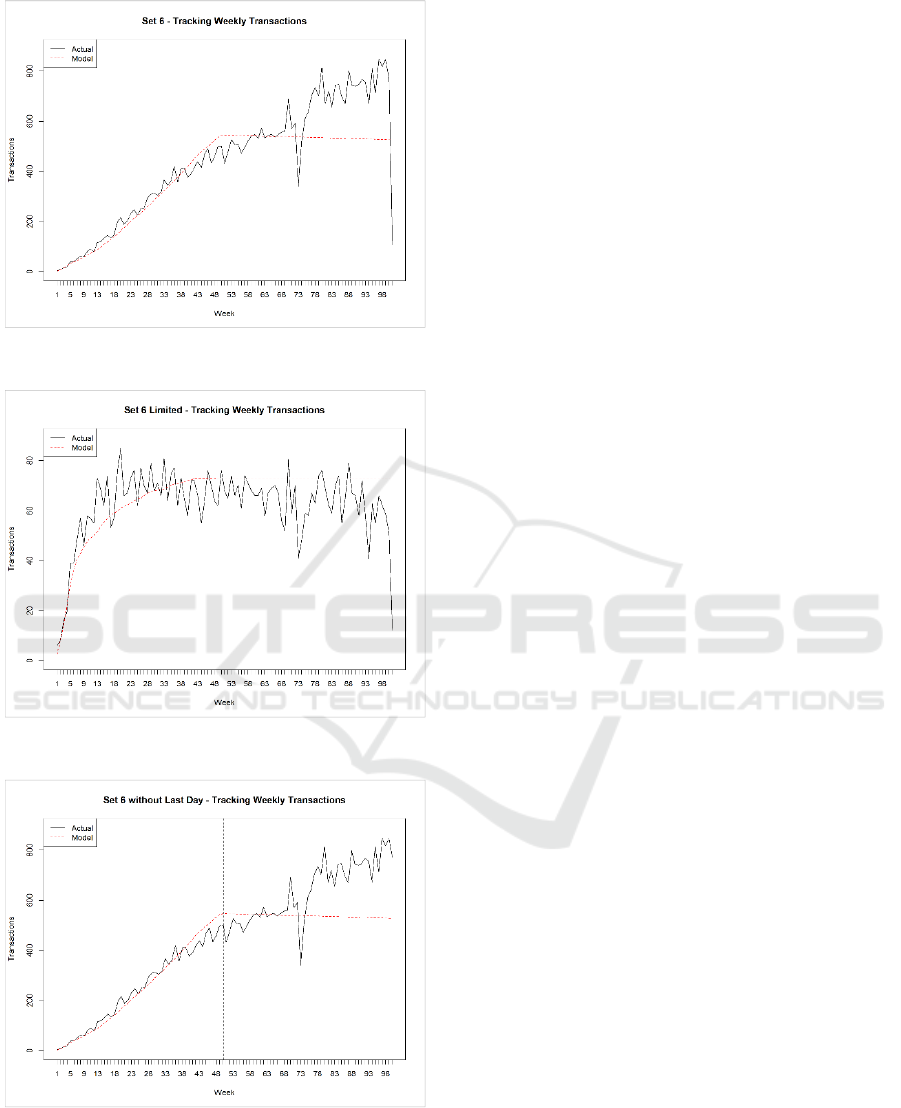

To see if the transaction count has an effect on the

model results we decreased the transaction counts and

subscriber records from the RFM data set “Set 6”, the

model is applied on the new data set which is called

“Set 6 Limited”. The result count for the transaction

is 7007. The model was also tested without the

transactions on the 31

st

of March, 2017, because the

transactions are incomplete for this day, and generate

a sharp decrease at the end of the model. The set is

called “Set 6 without Last Day”. The model vs actual

comparison for weekly transactions is shown in

Figure 4, Figure 5 and Figure 6. Only “Set 6 Limited”

gives expected results in the test period because of the

limited transaction count. However, when the

estimated parameters for this set was applied to a

larger set, it was again observed that the model for the

test period failed.

Churn Prediction for Mobile Prepaid Subscribers

71

Figure 4: Model Actual Comparison – Set 6.

Figure 5: Model Actual Comparison – Set 6 Limited.

Figure 6: Model Actual Comparison – Set 6 without Last

Day.

Consequently, using Pareto/NBD model does not

give the expected results for the prepaid mobile

subscribers’ RFM data. Instead of concluding that the

model fails for prepaid subscribers, we decided to

benchmark the results of the aliveness of the

subscribers with the logistic regression. First we used

the RFM data only and then used the calculated

variables which include usage, refill call center, and

online interaction and ARPU information of the

subscribers with RFM values. The confusion matrix

values of the two model results are given in Table 7.

The Pareto/NBD model predicted almost all the

subscribers would be alive. So we do not share the

model performance values in the confusion matrix in

Table 7.

7 CONCLUSIONS AND FUTURE

WORK

In mobile industry, subscribers generate a lot of

transactions, and refill transactions of the prepaid

subscribers are not an exception. Although, the

behaviour of the prepaid subscribers seems

appropriate for the Pareto/NBD model, the parameter

estimation does not give expected results in

Pareto/NBD model.

In Figure 1, it can be seen that model fits well in

the calibration period but has a lot of deviation in the

hold out period. There is a sharp decrease around 74

th

week. When we investigate the data the refill

transactions actually dropped around these dates and

also there is nothing special with the days of that week

(from 17

th

of July -> 23

rd

of July, 2016) like official

holiday.

When the model is applied on the new data set

named “Set 6 Limited”, with limited transactions, the

model gives better result. The model is also tested

with the set named “Set 6 without Last Day”.

However, removing these transactions did not have

any effect on the model parameter estimation. We can

conclude that the model has some limitations with

large number of transactions. If the number of

transactions is large, the estimation of model

parameters converges to 10.000 for the “beta” value

and the model for test period fail.

The “optim” R function is used in the BTYD

package to estimate the model parameters. Although

the number of subscriber is not very large, the

function runs very slowly. 6480 subscriber chosen for

the package to run. But the estimation of parameters

took very long time approximately one and half hour

to calculate and beta value got the highest default

value as parameter value. For that reason the model

did not behave well for the test period.

DATA 2017 - 6th International Conference on Data Science, Technology and Applications

72

Table 7: Confusion Matrix.

As mentioned in the previous section, we also

wanted to see the results with “Logistic Regression”

applied to both RFM data and mining variables that

were prepared for the selected subscriber set. The

results which got from Logistic Regression model

which was run only with the RFM data has the highest

“Accuracy” value for the probability of aliveness

which can be easily seen from Table 7, the model

performance values for Logistics Regression with

RFM data performed better than Logistics Regression

with other variables. This shows that for prepaid

subscribers simply using the RFM Data will enable

the operators to be able to target the most responsive

subscriber population.

For future work the parameter estimation can be

developed for high volume of transaction especially

like mobile data which has high potential to generate

big data. If this parameter estimation would give

better results, the RFM data will be valuable

predictive model for the prepaid subscribers’

behaviour analysis in mobile sector. Because most of

the time, there is not much definitive data for the

prepaid subscribers.

Moreover, the Pareto/NBD model is base model

for the lifetime calculation of a customer. Therefore

one of the next step could be calculating LTV if the

parameter estimation problem is solved.

REFERENCES

Neslin, S., Blattberg, R. and Kim, B., 2008. Database

Marketing: Analyzing and Managing Customers.

Springer

Fader, P., Bruce H., and Ka, L., 2005b. RFM and CLV:

Using Iso-Value Curves for Customer Base Analysis.

Journal of Marketing Research, 42 (November), 415–

430.

Schmittlein, David C., Donald G. Morrison, and Richard

Colombo, 1987. Counting Your Customers: Who They

Are and What Will They Do Next? Management

Science, 33 (January), 1–24.

Fader, P., Hardie, B., 2005. A Note on Deriving the

Pareto/NBD Model and Related Expressions.

“http://brucehardie.com/notes/009/”

Pfeifer, P., Haskins, M. and Conroy, R., 2005. Customer

Lifetime Value, Customer Profitability, and the

Treatment of Acquisition Spending, Journal of

Managerial Issues, 17 (Spring), 11–25

Dairo, A. and Akinwumi, T. 2014. Dormancy Prediction

Model in a Prepaid Predominant Mobile Market: A

Customer Value Management Approach. International

Journal of Data Mining & Knowledge Management

Process (IJDKP) Vol.4, No.1.

Owczarczuk, M. 2010. Churn models for prepaid

customers in the cellular telecommunication industry

using large data marts. Expert Systems with

Applications, Volume 37, Issue 6, Pages 4710–4712,

Elsevier.

Khan, M., Manoj, J., Singh, A., Blumenstock, J., 2015.

Behavioral Modeling for Churn Prediction: Early

Indicators and Accurate Predictors of Custom

Defection and Loyalty. 2015 IEEE International

Congress on Big Data, pp. 677-680.

Kirui, C., Hong, L., Cheruiyot, W. and Kirui, H., 2013.

Predicting Customer Churn in Mobile Telephony

Industry Using Probabilistic Classifiers in Data

Mining. IJCSI International Journal of Computer

Science Issues, Vol. 10, Issue 2, No 1.

Lu, J., 2002. Predicting Customer Churn in the

Telecommunications Industry - An Application of

Survival Analysis Modeling Using SAS. SUGI 27, Data

Mining Techniques, Paper 114-27.

Ahna, J., Hana, S. and Leeb, Y., 2006. Customer churn

analysis: Churn determinants and mediation effects of

partial defection in the Korean mobile

telecommunications service industry.

Telecommunications Policy, Volume 30, Issues 10–11,

Pages 552–568, Elsevier.

Dahiya, K. and Bhatia, S. 2015. Customer Churn Analysis

in Telecom Industry. 4th International Conference on

Reliability, Infocom Technologies and Optimization

(ICRITO) (Trends and Future Directions), 1 - 6, IEEE.

Birant, D., 2011. Data Mining Using RFM Analysis.

Knowledge-Oriented Applications in Data Mining,

Prof.Kimito Funatsu (Ed.).

Neslin, S., Blattberg, R. and Kim, B., 2008. RFM Analysis.

Database Marketing Volume 18 of the series

Model Cut-Off TP TN FP FN Total Accuracy TP Rate FP Rate Precision

0.5 5439 725 223 93 6480 0.95 0.98 0.24 0.96

0.6 5379 735 213 153 6480 0.94 0.97 0.22 0.96

0.7 5284 756 192 248 6480 0.93 0.96 0.20 0.96

0.8 5150 782 166 382 6480 0.92 0.93 0.18 0.97

0.9 4782 826 122 750 6480 0.87 0.86 0.13 0.98

0.5 5531 0 948 1 6480 0.85 1.00 1.00 0.85

0.6 5531 0 948 1 6480 0.85 1.00 1.00 0.85

0.7 5531 0 948 1 6480 0.85 1.00 1.00 0.85

0.8 5530 0 948 2 6480 0.85 1.00 1.00 0.85

0.9 5525 6 942 7 6480 0.85 1.00 0.99 0.85

Log Reg with RFM

Log Reg with Variable

Churn Prediction for Mobile Prepaid Subscribers

73

International Series in Quantitative Marketing pp 323-

337. Springer.

Coussement K., Bossche F., Bock K., 2014. Data

accuracy's impact on segmentation performance:

Benchmarking RFM analysis, logistic regression, and

decision trees. Journal of Business Research, Volume

67, Issue 1, January 2014, Pages 2751–2758

Keramatia A., Jafari-Marandia R., Aliannejadib M.,

Ahmadianc I., Mozaffaria M., Abbasia U., 2014.

Improved churn prediction in telecommunication

industry using data mining techniques. Applied Soft

Computing, Volume 24, November 2014, Pages 994–

1012.

Olle G., Cai S., 2014. A Hybrid Churn Prediction Model in

Mobile Telecommunication Industry. International

Journal of e-Education, e-Business, e-Management and

e-Learning, Volume 4, Issue 1, Pages 55-62.

Huang, Y., Kechadi T., 2013. An effective hybrid learning

system for telecommunication churn prediction. Expert

Systems with Applications, 2013, Volume 40, Issue 40,

Pages 5635-5647.

DATA 2017 - 6th International Conference on Data Science, Technology and Applications

74