The Impact of Memory Dependency on Precision Forecast

An Analysis on Different Types of Time Series Databases

Ricardo Moraes Muniz da Silva, Mauricio Kugler and Taizo Umezaki

Nagoya Institute of Technology, Department of Computer Science and Engineering,

Showa-ku, Gokiso-cho, 466-8555, Nagoya, Japan

rikarudo.mori25@hotmail.co.jp, mauricio@kugler.com, umezaki@nitech.ac.jp

Keywords: Time Series Forecast, ARIMA, ARFIMA, Memory Dependency.

Abstract: Time series forecasting is an important type of quantitative method in which past observations of a set of

variables are used to develop a model describing their relationship. The Autoregressive Integrated Moving

Average (ARIMA) model is a commonly used method for modelling time series. It is applied when the data

show evidence of nonstationarity, which is removed by applying an initial differencing step. Alternatively,

for time series in which the long-run average decays more slowly than an exponential decay, the

Autoregressive Fractionally Integrated Moving Average (ARFIMA) model is used. One important issue on

time series forecasting is known as the short and long memory dependency, which corresponds to how

much past history is necessary in order to make a better prediction. It is not always clear if a process is

stationary or what is the influence of the past samples on the future value, and thus, which of the two

models, is the best choice for a given time series. The objective of this research is to have a better

understanding this dependency for an accurate prediction. Several datasets of different contexts were

processed using both models, and the prediction accuracy and memory dependency were compared.

1 INTRODUCTION

Time series forecasting is one of the most important

types of quantitative models in which past

observations of same variables are collected and

analyzed to develop a model describing their

underlying relationship (Aryal and Wang, 2003).

These models have been used to forecast various

phenomena in many fields, such as agriculture,

economics, environment, tourism and meteorology.

These methods are constantly being improved

and adapted for each particular context in order to

obtain a better prediction of future events (Khashei

and Bijari, 2011).

One example of such adaptations is the classic

case of long and short memory dependence, which

corresponds to how much past history is necessary

in order to make a better prediction, i.e. the

correlation between the data and the model

parameters, which can deviate along time

(Gourieroux and Monfort, 1997).

When modelling a time series, a commonly used

method is the Autoregressive Integrated Moving

Average (ARIMA) model, which is a generalization

of the Autoregressive Moving Average (ARMA)

model.

These methods are applied in the cases where

data show evidence of short memory nonstationarity,

which can be removed by an initial differencing. The

model is generally referred to as an ARIMA(p,d,q)

model, where p, d and q are non-negative integers

that correspond to the order of the autoregressive,

integrated and moving average parts of the model,

respectively.

Alternatively, for modelling time series in the

presence of long memory dependency, the

Autoregressive Fractionally Integrated Moving

Average (ARFIMA) model is used (Granger and

Joyeux, 1980; Hosking, 1984). The ARFIMA(p,d,q)

model generalizes the ARIMA model by allowing

non-integer values of the differencing parameter d.

The main objective of the model is to explicitly

account for long term correlations in the data. It is

useful to model time series in which deviations for

the long-run mean decay more slowly than an

exponential decay.

In this research, we identify the short and long

dependence of ARIMA and ARFIMA models,

estimate their parameters and compare their

forecasting performance in different types of

Silva, R., Kugler, M. and Umezaki, T.

The Impact of Memory Dependency on Precision Forecast - An Analysis on Different Types of Time Series Databases.

DOI: 10.5220/0006203405750582

In Proceedings of the 6th International Conference on Pattern Recognition Applications and Methods (ICPRAM 2017), pages 575-582

ISBN: 978-989-758-222-6

Copyright

c

2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

575

databases in order to know the better model for each

different scenario.

The paper is organized as follows. In Section 2,

we briefly present some background on the

mentioned models. The methodology of this

research is discussed in Section 3, and Section 4

present experimental results. Finally the conclusions

are presented in Section 5.

2 BACKGROUND

The particular details of the aforementioned models

in the analysis of correlation and memory

dependency are described in details as follows.

2.1 ARIMA

The ARIMA method is one of the most important

and widely used linear time series models. The

popularity of ARIMA model is due to its statistical

properties as well as the well-known Box-Jenkins

methodology (Box and Jenkins, 1976) in the model

building process. It is an important forecasting

approach that goes through model identification,

parameter estimation and model validation. The

main advantage of this method relies on the

accuracy over a wider domain of series.

The model is based on a linear combination of

past values (AR components) and errors (MA

components). Mathematically, the ARIMA predicted

value

is given by:

=

(

)

(

1+

(

)

)

(1)

where is the order of differencing,

is the error,

is the lag operator,

(

)

is given by:

(

)

=1−

−

− … −

(2)

where are the parameters of the AR terms on the

polynomial of order , and

(

)

is given by:

(

)

=1+

+

+ …

(3)

where indicate the parameters of the MA terms on

the polynomial of order .

In this model, a nonstationary time series is

differentiated times until it becomes stationary,

where is an integer. Such series are said to be

integrated of order , denoted

(

)

, with the non-

differentiated

(

0

)

being the option for stationary

series. Is important to notice that many series exhibit

too much dependence to be

(

0

)

but are not

(

1

)

. In

these cases, there is a persistence in the

observations, which requires the use of prediction

methods that take into consideration the slowly

decaying autocorrelations, among which is the

ARFIMA model (Contreras-Reyes and Palma, 2013;

Dickey and Fuller, 1979), which will be explained

further in this section.

2.1.1 Auto-Correlation Function (ACF)

There are two phases to the identification of an

appropriate ARIMA model (Box and Jenkins, 1976):

changing the data, if necessary, into a stationary

time series and determining the tentative model by

observing the behaviour of the autocorrelation and

partial autocorrelation functions.

A time series is considered stationary when it

does not contain trends, that is, it fluctuates around a

constant mean (Hosking, 1984). The autocorrelation

coefficient

measures the correlation between a set

of observations and a lagged set of observation in a

time series:

=

∑(

−̅

)(

−̅

)

∑(

−̅

)

(4)

where

is the

sample of the stationary time

series,

is the sample from time period ahead

of and

is the mean of the stationary time series.

Box and Jenkins suggest the number of pairs

used to calculate the autocorrelation to be no more

than =4. The sample autocorrelation coefficient

is an initial estimate of ρ

.

2.1.2 Partial Auto-Correlation Function

(PACF)

The estimated Partial Autocorrelation Function

(PACF) is used as a guide, along with the estimated

ACF, in choosing one or more ARIMA models that

might fit the available data.

The objective of the partial autocorrelation

analysis is to measure how

and

are related.

The equation that gives a good estimate of the partial

autocorrelation

is:

,

=

−

∑

,

1−

∑

,

(5)

where:

,

=

,

−

,

,

,

=

(6)

2.1.3 Stationary Process

The ARIMA model is intended to be used with

stationary time series, i.e. time series in which their

ICPRAM 2017 - 6th International Conference on Pattern Recognition Applications and Methods

576

statistical properties are constant over time

(Hosking, 1984).

The stationarity of a time series can be evaluated

by accuracy measures, such as the Sum Squared

Error (SSE) or the Mean Absolute Percentage Error

(MAPE), given by:

SSE =

∑(

−

)

(7)

MAPE =

∑

×100%

(8)

where N is the number of predicted values and

and

are, respectively, the

actual and predicted

values.

However, is not always clear if a given process is

stationary or not. In this cases, the ARFIMA model

can be used, since can work with nonstationary time

series (Granger, 1989).

2.2 ARFIMA

The ARFIMA model is one of the best-known

classes of long-memory models (Contreras-Reyes

and Palma, 2013). It provide a solution for the

tendency to over-differentiate stationary series that

exhibit long-run dependence, allowing a continuum

of fractional differencing parameter −0.5 < <

+0.5 (Souza, and Smith, 2004; Zhang, 2003).

This generalization to fractional differences

makes possible to handle processes that are neither

(

0

)

nor

(

1

)

, to test for over-differentiation, and to

model long-run effects that only die out at long

horizons (Baum, 2000; Fildes and Makridakis,

1995).

The ARFIMA model is described as follow:

(

)(

1−

)

=

(

)

(9)

where:

(

1−

)

=

(

−

)

(

−

)(

+1

)

(10)

The stochastic process

is both stationary and

invertible if all the roots of

(

)

and

(

)

present

<0.5.

In recent years, studies about long memory

dependency have received the attention of

statisticians and mathematicians. This phenomenon

has grown rapidly and can be found in many fields,

such as hydrology, chemistry, physics, economics

and finances (Boutahar and Khalfaoui, 2011;

Moghadam and Keshmirpour, 2011).

2.2.1 Long and Short Memory Dependency

A times series with long memory dependence is

often referred to the concept of fractional

integration, since there is the necessity to expand the

differentiation order, spreading the use of past

values.

An stationary time series can be considered a

short memory process, since the AR(p) model has

infinite memory, as all the past values of

are

embedded in

. However, the effects on the past

values, rapidly decreasing geometrically to near

zero. The MA(q) model uses a memory of order q;

consequently, the effects of the moving average

component also diminish fast (Palma, 2007;

Anderson, 2000).

In comparison, the autocorrelation of the

ARFIMA model has a hyperbolical decay, in

contrast to the faster, geometric decay of a stationary

ARMA process. Consequently, a series with long

memory dependency has an autocorrelation function

that decline more slowly than the decrease exhibited

on the short memory process (Hurvich and Ray,

1995; Geweke and Porter-Hudak, 1983).

This was observed in other works, in which some

datasets present better accuracy with the ARIMA

model with short memory (Shitan et al., 2008),

while other datasets perform better with the

ARFIMA model with long memory (Amadeh et al.,

2013).

Thus, an ARFIMA process may be predictable at

longer horizons. A survey of long memory models

applied in economics and finance is given by Baillie

(Baillie, 1996).

2.2.2 Spectral Density

Inverting the ARFIMA model described in equation

(7) gives:

=

(

1−

)

(

(

)

)

(

)

(11)

After the parameter estimation, the short-run

effects are obtained by setting =0 in equation

(11), and describe the behaviour of the fractionally

differenced process

(

1−

)

. The long-run effects

use the estimated value of d from equation (9), and

describe the behaviour of the fractionally integrated

.

Granger and Joyeux (Granger and Joyeux, 1980)

motivate the use of ARFIMA models by noting that

their implied spectral densities for >0 are finite

except at null frequency, whereas stationary ARMA

models have finite spectral densities at all

frequencies. The ARFIMA model is able to capture

The Impact of Memory Dependency on Precision Forecast - An Analysis on Different Types of Time Series Databases

577

the long-range dependence, which cannot be

expressed by stationary ARMA models.

The two models imply different spectral

densities for frequencies close to zero when >0.

The spectral density of the ARMA model remains

finite, but is pulled upward by the model's attempt to

capture long-range dependence. The short-run

ARFIMA parameters can capture both low-

frequency and high-frequency components in the

spectral density (Sowell, 1992; Priestley, 1981). In

contrast, the ARMA model confounds the long-run

and short-run effects.

3 METHODOLOGY

In this study, the standard modelling time series

methodologies ARIMA and ARFIMA have been

employed. These models require the following steps

in order to be trained: identification, parameters

estimation, validation, modelling and prediction.

Specific details are described on the literature

(Granger and Joyeux, 1980; Box and Jenkins, 1976).

The modelling tools for time series forecast were

developed in-house using MATLAB, given special

attention to the monitoring of some particular

aspects of each dataset.

Although both methods have been widely

applied in several different contexts and long and

short memory dependency analysed for independent

datasets, the forecasting process still requires both

methods to be applied and their performance

compared in order to determine the best model for

each case (Chan, 1992; Chan 1995).

Thus, the objective of this research is to have a

better understanding of the level of dependency and

how much historical data is necessary for an

accurate prediction, considering the follow aspects:

spectral density and statistical properties;

differences on stationary series behaviour;

impact of long and short memory dependency;

This aspects were analysed on several different

datasets described in the following section.

3.1 Datasets

The datasets used in the experiments were obtained

from the UCI Machine Learning Repository

(Lichman, M., 2013) and Sugar Price Database from

the Brazilian Stock Market BM&F Bovespa (BM&F

Bovespa, 2016).

Datasets of a wide variety of contexts were

selected in order to generalize the analysis of the

different models to several different scenarios. The

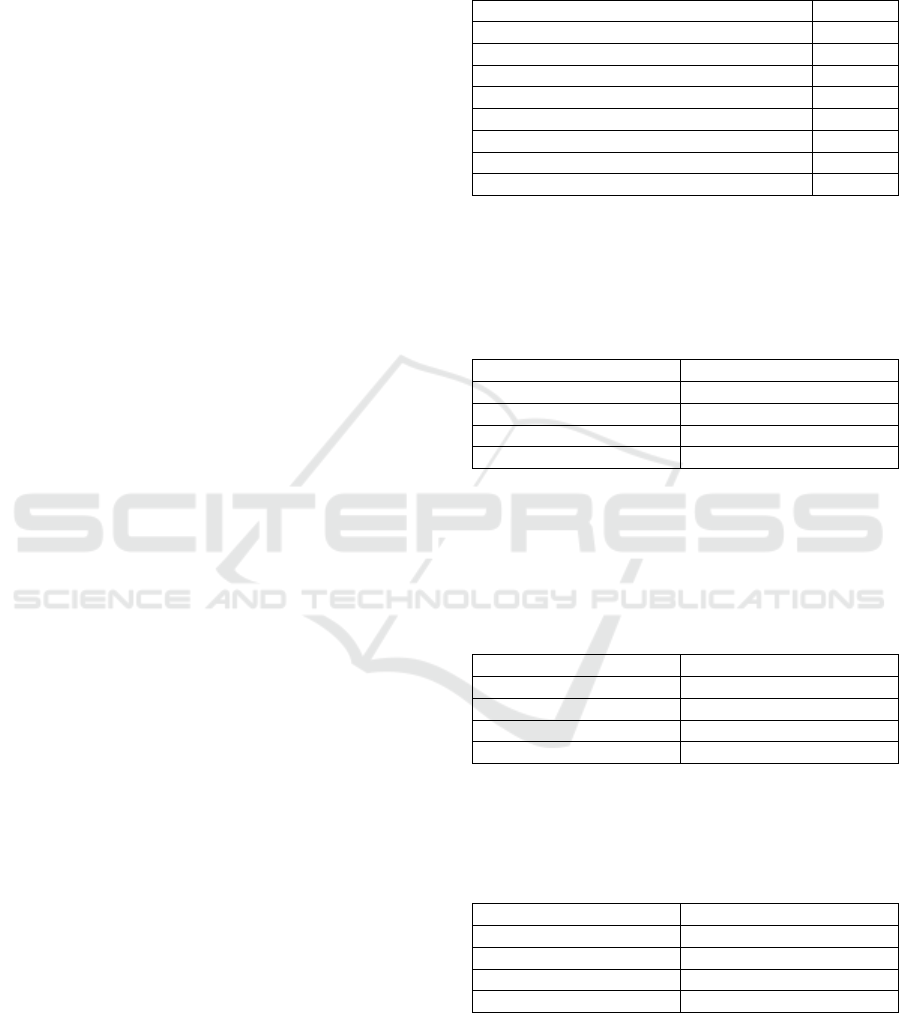

datasets are listed in Table 1, while the details of

each dataset are shown in Tables 2-9.

Table 1: Time Series Datasets.

Dataset Table

Sugar Price Database 2

Greenhouse Gas Observing Network 3

Electricity Load Diagrams 4

Individual Household Power Consumption 5

Combined Cycle Power Plant 6

Solar Flare 7

Istanbul Stock Exchange 8

Dow Jones Index 9

Table 2 describes the Ibovesp Stock Market

database, which tracked the evolution of the price of

50kg sugar bag from November 2003 to

May 2009.

Table 2: Sugar Price Database.

Datasets Characteristics Time Series

Number of Instances 3346

Number of Attributes 3

Associated Task Classification / Regression

Area Business

The dataset in Table 3 contains values of

greenhouse gas (GHG) concentrations at 2921 grid

cells in California, created using simulations of the

Weather Research and Forecast model with

Chemistry (Lucas et al., 2015).

Table 3: Greenhouse Gas Observing Network.

Datasets Characteristics Multivariate, Time Series

Number of Instances 2921

Number of Attributes 5232

Associated Task Regression

Area Physical

Table 4 describes a datasets of electricity

consumption from 370 points per clients from 2011

to 2014 period.

Table 4: Electricity Load Diagrams.

Datasets Characteristics Time Series

Number of Instances 370

Number of Attributes 140256

Associated Task Regression / Clustering

Area Computer

The dataset in Table 5 contains measurements of

electric power consumption in one household with a

one-minute sampling rate over a period of almost 4

years. It also contains different electrical quantities

and sub-metering values.

ICPRAM 2017 - 6th International Conference on Pattern Recognition Applications and Methods

578

Table 5: Individual Household Power Consumption.

Datasets Characteristics Multivariate, Time Series

Number of Instances 2075259

Number of Attributes 9

Associated Task Regression / Clustering

Area Physical

Table 6 describes a dataset of points collected

from a combined cycle power plant over 6 years

(2006-2011), when the plant was set to work with

full load (Tüfekci, 2014; Kaya et al., 2012).

Table 6: Combined Cycle Power Plant.

Datasets Characteristics Multivariate

Number of Instances 9568

Number of Attributes 4

Associated Task Regression

Area Computer

The dataset in Table 7 contains the number of

solar flares of 3 potential classes that occurred in a

24 hour period.

Table 7: Solar Flare.

Datasets Characteristics Multivariate

Number of Instances 1389

Number of Attributes 10

Associated Task Categorical

Area Physical

Table 8 details a datasets that includes returns of

the Istanbul Stock Exchange with seven other

international indexes, from June 2009 to February

2011 (Akbilgic et al., 2013).

Table 8: Istanbul Stock Exchange.

Datasets Characteristics Multivariate, Time Series

Number of Instances 536

Number of Attributes 8

Associated Task Classification / Regression

Area Business

Finally, the dataset described in Table 9 contains

weekly data from the Dow Jones Industrial Index.

(Brown et al., 2013).

Table 9: Dow Jones Index.

Datasets Characteristics Time Series

Number of Instances 750

Number of Attributes 16

Associated Task Classification / Clustering

Area Business

As shown in Tables 2-9, the selected datasets

present a wide range of instances and attributes, as

well as different areas of application.

3.2 Time Series Modelling Procedures

The standard approach to temporal series prediction

is to apply different methods (e.g. ARIMA and

ARFIMA), and compare their performances in order

to select the method with the minimal average

forecasting error.

In this paper, not only the performance of the

methods but also the influence of the use of short

and long memory dependency was evaluated for

each different datasets in several scenarios.

4 EXPERIMENTS AND RESULTS

Considering the several different types of databases,

the analysis was made in order to show the impact of

memory dependency on the forecasting accuracy in

different areas. In all cases, the models were

simulated with both methodologies (ARIMA and

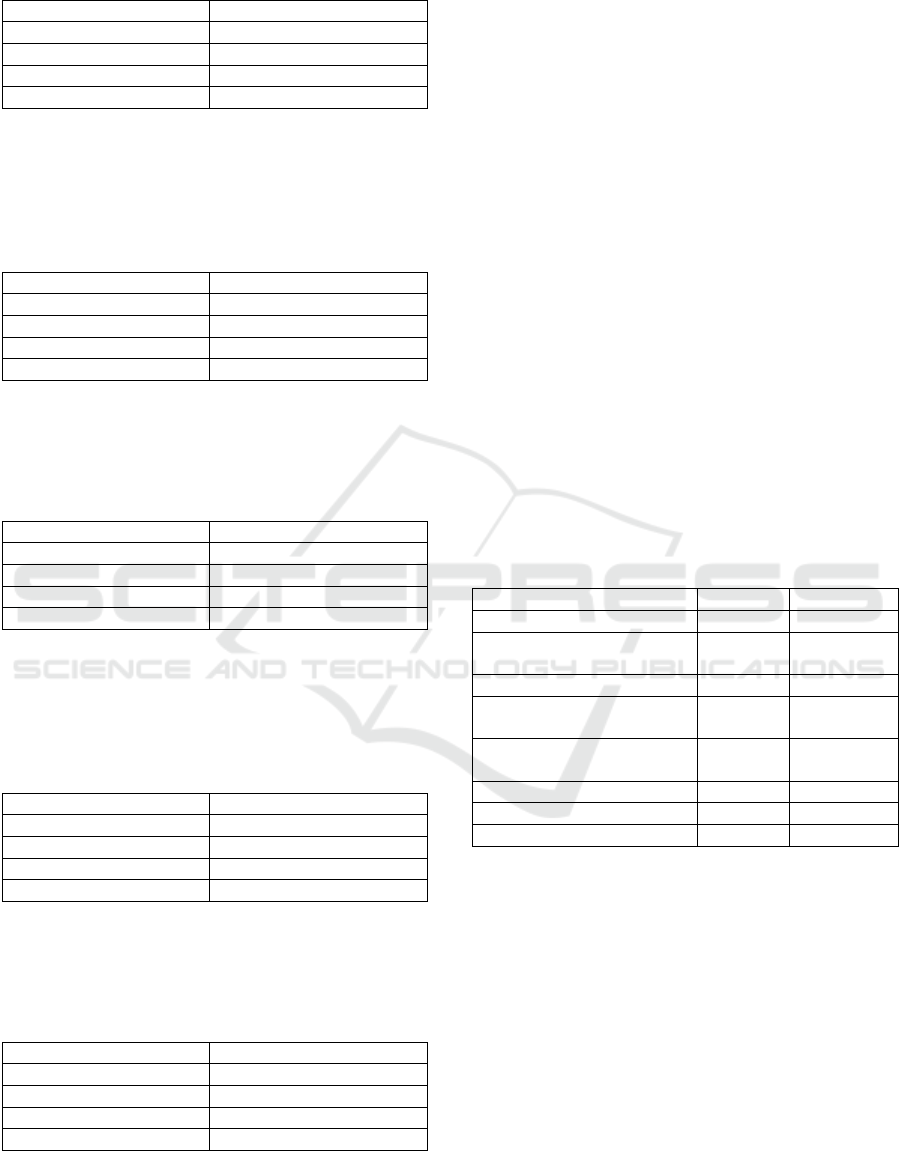

ARFIMA). Table 10 shows the best fit (p, q and d)

for both model in each dataset.

Table 10: Best fit for each model (p, q, d).

Database ARIMA ARFIMA

Sugar Price Database (1, 1, 3) (2, 0.23, 4)

Greenhouse Gas

Observing Network

(1, 0, 2) (2, 0.17, 1)

Electricity Load Diagrams (2, 1, 1) (3, 0.5, 2)

Individual Household

Power Consumption

(4, 0, 1) (1, -0.34, 5)

Combined Cycle

Power Plant

(3, 1, 5) (1, 0.47, 3)

Solar Flare (1, 1, 6) (2, 0.33, 1)

Istanbul Stock Exchange (2, 0, 1) (3, 0.29, 5)

Dow Jones Index (3, 0, 5) (4, -0.42, 3)

In a typical ARIMA process, the patterns of ACF

and PACF indicate the structure of the model. A

long autocorrelation imply that the process is non-

linear with time variance, implying that the

properties of memory dependency between two

distance observations are still visible.

In order to maintain the correlation between the

observed values and their lag, and consequently the

influence of the past value in the current

observation, the value of the lag is suggested to be

no greater than 4. This value, however, was

exceeded in some cases, as shown in Table 11.

The Impact of Memory Dependency on Precision Forecast - An Analysis on Different Types of Time Series Databases

579

Table 11: Memory Dependency based on the

Autocorrelation Function.

Database Lag

Sugar Price Database -

Greenhouse Gas Observing Network Exceeded

Electricity Load Diagrams -

Individual Household Power Consumption -

Combined Cycle Power Plant Exceeded

Solar Flare -

Istanbul Stock Exchange Exceeded

Dow Jones Index Exceeded

In some time series, these larger lag values

indicate that the ACF do not decay exponentially

over time, but rather decay much slower and show

no clear periodic pattern.

The memory dependency can also be estimated

by observing the statistical properties of the data,

such as MAPE and SSE, as demonstrated by Alireza

and Ahmad (Alireza and Ahmad, 2009). In this

work, the percentage average absolute error (PAAE)

for both models was calculated and the results

shown in Table 12.

Table 12: Percentage of Average Absolute Error.

Database ARIMA ARFIMA

Sugar Price Database 31.67% 32.23%

Greenhouse Gas

Observing Network

18.47% 17.26%

Electricity Load Diagrams 10.98% 11.56%

Individual Household

Power Consumption

15.64% 17.12%

Combined Cycle Power Plant 21.05% 19.22%

Solar Flare 9.68% 10.42%

Istanbul Stock Exchange 29.12% 28.41%

Dow Jones Index 30.05% 29.85%

When ARFIMA was used on data with small

variance, the observed PAAE was low. By contrast,

when ARIMA was used on data with high variance,

the observed PAAE was high. This is because the

accumulative error per sampling will be greater on a

high variance data with smaller order of integration.

The analysis performed so far enable the

comparison of the forecast precision (high or low),

as well as how much dependency each dataset

presents (short or long). It must be noticed that some

of the datasets have particular behaviour or external

influences (e.g. stock market) that affect the quality

of the prediction. The results are shown in Table 13.

Table 13: Memory Dependency and Forecast Precision.

Database

Dependenc

y

Precision

Sugar Price Database Short *Low

Greenhouse Gas Observing

Network

Long High

Electricity Load Diagrams Short *High

Individual Household

Power Consumption

Short High

Combined Cycle

Power Plant

Long *High

Solar Flare Short *High

Istanbul Stock Exchange Long *Low

Dow Jones Index Long *Low

Some datasets, marked with *, denoted an

unexpected behaviour when considering the

properties of the time series. For instance, it is

usually considered that a linear series with small

number of samples and short dependency will result

in a high precision (Yule, 1926). However, the

obtained results show that this is not always the case

(e.g. Sugar Price).

The databases related with stock market

(Istanbul Stock Exchange and Dow Jones Index)

have a long memory dependency, but present low

accuracy. This is due to the fact that these are highly

volatile processes and are difficult to predict with

linear modelling tools (Engle and Smith, 1999). In

the other hand, the Solar Flare dataset is a classic

example of seasonal behaviour, but the

measurements need to be carefully made on a

correct window of time.

Datasets related with electricity and power

consumption usually have a linear behaviour,

achieving high precision (Taylor et al., 2006). The

Electricity Load Diagrams dataset, however, has a

very large number of attributes, resulting in a large

variance. Although it presents short dependency

characteristics, this dataset requires a careful

selection of the most relevant attributes on the

quantification of electricity consumption.

On the Combined Cycle Power Plant, the data

was acquired only at full-load times. Thus, the data

presents characteristics of long memory dependence,

leading to a high forecast precision.

5 CONCLUSIONS

This paper analyses the effects of memory

dependency in several different time series datasets

and the influence on the forecast accuracy. Two

commonly used methods, ARIMA and ARFIMA,

were used for this analysis.

ICPRAM 2017 - 6th International Conference on Pattern Recognition Applications and Methods

580

For some datasets, the ARIMA model presented

better forecast results (smaller PAAE) when

compared with the ARFIMA model. This might be

because the ARFIMA model is based on a long

memory process, while some datasets are less

affected by external activities and other processes.

However, that does not imply that having more

historical data will always result in a better forecast.

In a linear model scenario, independently of the used

statistical properties and the monitoring of memory

dependency values, the data itself should still be

carefully analysed in order to achieve an accurate

prediction.

This indicates that it is not always clear how

much impact the past values have on the

accumulative error and what is their influence in the

future values. A possible solution for this is to

increase the lag in the ACF and observe the effect of

the prediction accuracy of future values. Different

time windows can also be used to achieve a better

fitting, as observed in the course of this study.

Specific pre-processing operations can be

applied to each dataset in order to reduce the

accumulative error, but only in situations in which a

clear objective exists.

The obtained results motivate the development

of a combined methodology compatible with both

fractional and integer integration values along the

time series prediction, in order to account for short

and long memory dependencies. Future work also

include the use of more and larger datasets in order

to further understand the memory dependency

effects on time series forecasting.

ACKNOWLEDGEMENTS

The first author is supported by the Ministry of

Education, Culture, Sports, Science and Technology

(MEXT), Government of Japan.

REFERENCES

Aryal, D. R., Wang, Y., 2003. Neural Network

Forecasting of the Production Level of Chinese

Construction Industry. Journal of Comparative

International Management, vol. 6, no. 2, pp. 45-64.

Khashei M., Bijari M., 2011. A New Hybrid Methodology

for Nonlinear Time Series Forecasting. Modelling and

Simulation in Engineering, Article ID 379121, 5

pages.

Gourieroux, C. S., Monfort, A., 1997. Time Series and

Dynamic Models, Cambridge University Press.

Granger, C. W. J., Joyeux, R., 1980. An introduction to

long memory time series models and fractional

differencing. Journal of Time Series Analysis, vol. 1,

no. 1, pp. 15-29.

Hosking, J. R. M., 1984. Modelling Persistence in

Hydrological Time Series using Fractional

Differencing. Water Resources Research, vol. 20, no.

12, pp. 1898-1908.

Box, G. E. P., Jenkins, G. M., 1976. Time series analysis:

forecasting and control, Holden Day. San Francisco,

1

st

edition.

Contreras-Reyes, J. E., Palma, W. 2013. Statistical

analysis of autoregressive fractionally integrated

moving average models in R. Computational

Statistics, vol. 28, no. 5, pp. 2309-2331.

Dickey, D. A., Fuller, W. A., 1979. Distribution of the

estimators for autoregressive time series with unit

root. Journal of the American Statistical Association,

vol. 74, no. 366, pp. 427-431.

Granger, C. W. J., 1989. Combining forecasts - Twenty

years later. Journal of Forecasting, vol. 8, no. 3, pp.

167-173.

Souza, L. R., Smith, J., 2004. Effects of temporal

aggregation on estimates and forecasts of fractionally

integrated processes: a Monte-Carlo study.

International Journal of Forecasting, vol. 20, no. 3,

pp. 487-502.

Zhang, G. P., 2003. Time series forecasting using a hybrid

ARIMA and neural network model. Neurocomputing,

vol. 50, pp. 159-175.

Baum, C. F., 2000. Tests for stationarity of a time series.

Stata Technical Bulletin, vol. 57, pp. 36-39.

Fildes, R., Makridakis, S., 1995. The impact of empirical

accuracy studies on time series analysis and

forecasting, International Statistical Review, vol. 63,

no. 3, pp. 289-308.

Boutahar, M., Khalfaoui, R., 2011. Estimation of the long

memory parameter in non stationary models: A

Simulation Study, HAL id: halshs-00595057.

Moghadam, R. A., Keshmirpour, M., 2011. Hybrid

ARIMA and Neural Network Model for Measurement

Estimation in Energy-Efficient Wireless Sensor

Networks, In ICIEIS2011, International Conference

on Informatics Engineering and Information Science.

Springer, vol. 253, pp. 35-48.

Palma, W., 2007. Long-Memory Time Series: Theory and

Methods, Wiley-Interscience, John Wiley & Sons.

Hoboken.

Anderson, M. K., 2000. Do long-memory models have

long memory? International Journal of Forecasting,

vol. 16, no. 1, pp. 121-124.

Hurvich C. M., Ray, B. K., 1995. Estimation of the

memory parameter for nonstationary or noninvertible

fractionally integrated processes. Journal of Time

Series Analysis, vol. 16, no. 1, pp. 17-42.

Geweke, J., Porter-Hudak, S., 1983. The estimation and

application of long-memory time series models.

Journal of Time Series Analysis, vol. 4, no. 4, pp. 221-

238.

The Impact of Memory Dependency on Precision Forecast - An Analysis on Different Types of Time Series Databases

581

Shitan, M., Jin Wee P.M., Ying Chin, L., Ying Siew, L.,

2008. Arima and Integrated Arfima Models for

Forecasting Annual Demersal and Pelagic Marine Fish

Production in Malaysia, Malaysian Journal of

Mathematical Sciences, vol. 2, no. 2, pp. 41-54.

Amadeh, H., Amini, A., Effati, F., 2013. ARIMA and

ARFIMA Prediction of Persian Gulf Gas-Oil F.O.B.

Iranian Journal of Investment Knowledge, vol. 2, no.

7, pp. 213-230.

Baillie, R. T., 1996. Long memory processes and

fractional integration in econometrics. Journal of

Econometrics, vol. 73, no. 1, pp. 5-59.

Sowell, F., 1992. Modelling long-run behaviour with the

fractional ARIMA model. Journal of Monetary

Economics, vol. 29, no. 2, pp. 277-302.

Priestley, M. B., 1981. Spectral Analysis and Time Series,

Academic Press. London.

Chan, W. S., 1992. A note on time series model

specification in the presence outliers, Journal of

Applied Statistics, vol. 19, pp. 117–124.

Chan, W. S., 1995. Outliers and financial time series

modelling: a cautionary note. Mathematics and

Computers in Simulation, vol. 39, no. 3-4, pp. 425-

430.

Lichman, M., 2013. UCI Machine Learning Repository

[http://archive.ics.uci.edu/ml]. Irvine, CA: University

of California, School of Information and Computer

Science.

Brazilian Stock Market BM&F Bovespa. Accessed on

April 2016. [http://www.bmfbovespa.com.br]

Lucas, D. D., Yver Kwok, C., Cameron-Smith, P., Graven,

H., Bergmann, D., Guilderson, T. P., Weiss, R.,

Keeling, R., 2015. Designing optimal greenhouse gas

observing networks that consider performance and

cost. Geoscientific Instrumentation, Methods and Data

Systems, vol. 4, no. 1, pp. 121-137.

Tüfekci, P., 2014. Prediction of full load electrical power

output of a base load operated combined cycle power

plant using machine learning methods. International

Journal of Electrical Power & Energy Systems, vol.

60, pp. 126-140.

Kaya, H., Tüfekci, P., Gürgen, S. F., 2012. Local and

Global Learning Methods for Predicting Power of a

Combined Gas & Steam Turbine, In ICETCEE2012,

International Conference on Emerging Trends in

Computer and Electronics Engineering, pp. 13-18.

Akbilgic, O., Bozdogan, H., Balaban, M. E., 2013. A

novel Hybrid RBF Neural Networks model as a

forecaster, Statistics and Computing, vol. 24, no. 3, pp.

365-375.

Brown, M. S., Pelosi, M. J., Dirska, H., 2013. Dynamic-

Radius Species-Conserving Genetic Algorithm for the

Financial Forecasting of Dow Jones Index Stocks. In

MLDM2013, 9th International Conference on

Machine Learning and Data Mining in Pattern

Recognition, Springer, pp. 27-41.

Alireza, E., Ahmad J., 2009. Long Memory Forecasting of

Stock Price Index Using a Fractionally Differenced

Arma Model. Journal of Applied Sciences Research,

vol. 5, no. 10, pp. 1721-1731.

Yule, G. U., 1926. Why do we sometimes get nonsense-

correlations between time series? A study in sampling

and the nature of time-series. Journal of the Royal

Statistical Society, vol. 89, no. 1, pp. 1-63.

Engle, R. F., Smith A. D., 1999. Stochastic permanent

breaks. Review of Economics and Statistics, vol. 81,

no. 4, pp. 553-574.

Taylor, J. W., Menezes, L. M., McSharry, P. E., 2006. A

comparison of univariate methods for forecasting

electricity demand up to a day ahead, International

Journal of Forecasting, vol. 22, no. 1, pp. 1-16.

ICPRAM 2017 - 6th International Conference on Pattern Recognition Applications and Methods

582