Assessing Business Processes by Checking Transaction Documents for

Inconsistency Risks

Takafumi Komoto

1

, Kokichi Futatsugi

1

and Nobukazu Yoshioka

2

1

Japan Advanced Institute Science and Tecknology, Nomi, Japan

2

National Institute of Information Technology Grace Center, Tokyo, Japan

{komoto, futatsugi}@jaist.ac.jp, nobukazu@nii.ac.jp

Keywords: Internal Control, Transaction Documents, Reliability, Inconsistency Risks, Checked Documents Matrix.

Abstract: Business processes can be assessed by checking transaction documents for inconsistency risks and can be

classified into two categories. Inconsistency refers to a mismatch between items (product name, quantity,

unit price, amount price, etc.) among transaction documents. For any process in the first category, the

consistency of any pair of transaction documents in the process is checked, and there is no risk of

inconsistency. For any process in the second category, the consistency of some pairs of transaction

documents in the process cannot be checked, and there is a risk of inconsistency. This paper proposes a

method for the assessment of risk inconsistencies. The assessment can be used to design and evaluate

business processes for a company’s internal control over financial reporting. A business process diagram

and inconsistency risk detection algorithm for classifying business processes is provided.

1 INTRODUCTION

From the viewpoint of internal control, management

has a responsibility to establish business processes

that do not cause deficiencies over financial

reporting. When deficiencies over financial

reporting are pointed out by auditors, companies

lose the reliability of their investors. (Shimizu,

Nakamura, 2007); (Maruyama et al., 2008); (Sasano,

2006).

Certified Public Accountants (CPAs) examine

the consistency among accounting transaction

documents (slips, vouchers, etc.) related to

transactions when performing an accounting audit.

They check whether there is a mismatch between

them and confirm the reliability of transactions.

(Yamaura, 2002)

If such checks and confirmations performed by

CPAs to posted transactions are incorporated into

the business process, more reliable transactions may

be realized. Company workers check between

received slips and archived slips on the same

transaction for consistencies in product name,

quantity, unit price, and amount price in business

processes. In other words, checking and confirming

the consistency of transactions are already

performed on-site.

However, these checks are independently

performed at each department of a company during

the business process. Therefore, any inconsistencies

among whole documents in transactions cannot be

detected solely by checks performed in one

department when such transactions pass through

multiple departments.

For example, there are transaction documents

“a”, “b”, and “c” in a transaction. When division

“A” checks transaction documents “a” and “b”, and

division “B” checks transaction documents “b” and

“c”, inconsistencies in whole documents for the

transaction are detected considering a transitive

relation between “a” and “c” through “b”.

Conversely, when division “A” checks documents

“a” and “b”, and “B” only has document “c” any

inconsistencies between them cannot be detected

because there is no relation between “a”, “b”, and

“c”.

The detection of inconsistencies between

transaction documents depends on what divisions

check in transaction documents, i.e., the business

process.

This paper proposes a method for assessment of

risk inconsistencies. The assessment can be used to

design and evaluate business processes for a

company’s internal control over financial reporting.

A business process diagram and an inconsistency

risk detection algorithm for classifying business

39

Komoto T., Futatsugi K. and Yoshioka N.

Assessing Business Processes by Checking Transaction Documents for Inconsistency Risks.

DOI: 10.5220/0006222000390045

In Proceedings of the Sixth International Symposium on Business Modeling and Software Design (BMSD 2016), pages 39-45

ISBN: 978-989-758-190-8

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

processes are provided.

The paper is organized as follows. The next

section describes business process modeling using

our business process diagram while Section 3

introduces an inconsistency risk detection algorithm

for classifying business processes. Section 4 presents

a case study. Section 5 discusses related work.

Section 6 concludes this paper.

2 BUSINESS PROCESS

DIAGRAM

A business process diagram is a diagram used to

describe business processes of a company by listing

business events and archived transaction documents

and checked documents set. At first we will explain

the elements and notations of the “business process

diagram” using a simple example.

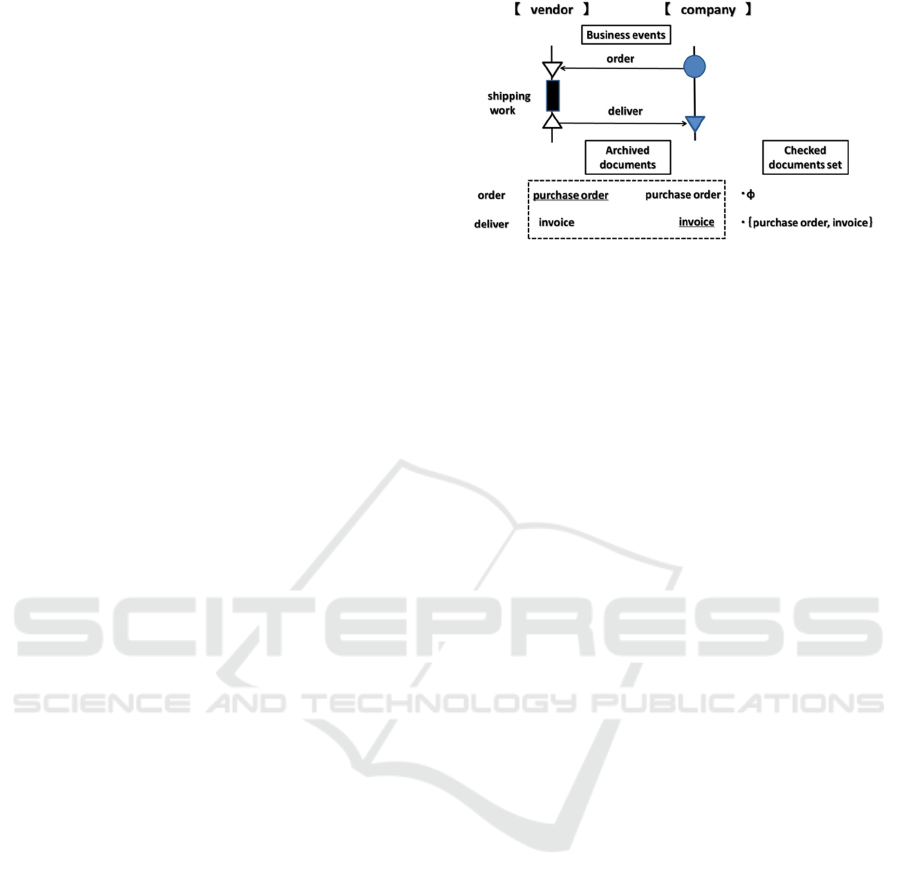

2.1 An Order-to-Delivery Process

Diagram

This simple diagram (Figure 1) describes an “order-

to-delivery process” in which a company orders

goods from a vendor, and the vendor delivers the

goods to the company. In this process, the company

orders goods from the vendor with a purchase order

document. When the vendor receives the purchase

order document, it prepares the goods for shipping

and delivers them with an invoice. The company

receives the goods with the invoice and checks

between the purchase order and the goods to ensure

consistency with the invoice. The diagram in Figure

1 describes the “order-to-delivery process.”

In this diagram, 【vendor】 and 【company】

show entities. An “order” and a “deliver” are

events in the transaction process. The events are

indicated by arrows pointing from a sending entity

toward a receiving entity of a transaction document.

The events are run sequentially from top to bottom

along a timeline of the entities.

The sides of an arrow are visualized by the

following symbols to distinguish between a

transmission and a reception.

"●": start of the process, "▽": end of an event

"△": start of an event, "▼": end of the process

On a side of the timeline between “▽” (end of an

event) and “△” (start of a following event), work

at the acceptance event can be described. (The work

can be omitted.)

Figure 1: Order-to-Delivery Process Diagram.

In general, each transaction document is issued

in accordance with a business event in the

transaction. A “purchase order” and an “invoice”

issued in this business process are described

sequentially in the dashed frame indicating the

archived transaction documents under the timeline

of each entity. A line is drawn under a received

document to distinguish it from a sent document.

Business events, an “order” and a “deliver,” can be

described in the side of the dashed frame to link to

the transaction documents, a “purchase order” and

an “invoice.”

In general, workers of a company also check

between a received transaction document and

archived transaction documents on the same

transaction for consistencies in product name,

quantity, unit price, and amount price in business

processes. In the “order-to-delivery process diagram,”

the state of transaction documents, whether checked

or not by a division receiving a transaction

document, is described.

At first, when 【vendor】 receives a purchase

order, it does not keep any documents. Therefore, a

checked documents set φ(empty set) is described.

Next, when 【company】 receives an invoice, it

keeps the purchase order. As 【company】 checks

between the invoice and the purchase order, a

checked documents set {purchase order, invoice} is

described.

2.2 Elements and Notation of Business

Process Diagram

As shown using the simple example, the business

process diagram consists of the following elements.

"Division": entity that performs the work in the

process.

"Timeline": time flowing from top to bottom.

"Event": things needed to send and receive a

transaction document from one division to

Sixth International Symposium on Business Modeling and Software Design

40

another division in a predetermined order.

"Transaction document": documented work

instructions and/or operating report in the

business process.

"Archived documents": transaction documents

that the divisions sent and received.

"Checked documents set": set of documents that

the department is keeping (including a received

document).

Figure 2: Business Process Diagram.

"Division", "Events", "Transaction document",

"Archived documents", and "Checked documents

set" are symbolized and defined as follows.

Division a, b ∈ Div (Div: the entire division)

Event e

n

(a, b) ∈ E (E: the entire event): the n-

th event to send and receive a document from

division “a” to division “b”.

Event order n ∈ N (N: natural number)

Transaction document d

n

∈ Doc (Doc: all

documents): the document to send and receive in

the event e

n

(a, b)

Archived documents S

n

(a): documents that

division “a” sent and received until the event en

Checked documents set V

n

: set of the documents

S

n

(a) that division “a” received the document d

n

in the event e

n

The elements and notation of the business process

diagram notation are shown in Figure 2.

2.3 Preconditions for Business Process

Diagram

There are some preconditions for the business

process diagram to represent practical standard

business processes.

In a business process, when a person in charge in

the division receives a transaction document, he/she

works in accordance with business rules and issues a

transaction document for reporting his/her task or

indicating a task of the next division. When he/she

receives a transaction document from another

division, and archive documents of the transaction

are kept in this division, he/she can prevent an

operational error by comparing the common items

(product name, quantity, unit price, amount price,

etc.) between the received document and archived

documents.

Business process diagrams are used to detect

inconsistency risks by examining mistakes or frauds.

Accordingly, in the business process diagram it is

assumed that transaction documents are not changed

during storage and delivery. In other words, a sent

document and a received document concerning the

same event are regarded as the same.

It is also assumed that the event order of the

business process is fixed. In general, business events

in the company, in accordance with the principle of

the separation of duty, are performed without being

indicated by a transaction document. Therefore, in

the business process diagram, the division not

receiving a transaction document cannot send a

transaction document except at the start of the event.

For example, in the purchase order process, the

accounting division cannot pay for goods without

receiving disbursement approval by the procurement

division. In other words, each business event is

carried out in the usual fixed order.

2.4 Example of Business Process

Diagram at Risk for Inconsistency

Figure 3, which has a slightly modified business

process diagram compared with Figure 1,

【company】 division of Figure 1 is divided into

【purchase】 division and 【warehouse】division.

The business event of receiving a report from

【warehouse】 division to 【purchase】division is

added.

Figure 3: Business Process Diagram at Risk for

Inconsistency.

Assessing Business Processes by Checking Transaction Documents for Inconsistency Risks

41

Looking at the checked documents set V

i

,

received report d

3

and order d

1

is compared.

However, invoice d

2

is not compared. Therefore,

inconsistencies cannot be detected even if there is an

error in the invoice. The business process diagram in

Figure 3 is at risk for inconsistency of transaction

documents.

3 INCONSISTENCY RISK

DETECTION ALGORITHM

When a business process diagram is given, we

provide an inconsistency risk detection algorithm

that determines whether the business process has

inconsistency risks among transaction documents.

The inconsistency risk detection algorithm is

based on the equivalence relation of transaction

documents. Transitive closure for the checked

document matrix of the business process diagram is

calculated using the Floyd-Warshall algorithm.

(Cormen et al., 2009).

When the elements of the transitive closure

matrix are all 1, no risk of inconsistency is decided.

When the elements of the transitive closure matrix

are 0, a risk of inconsistency is decided.

3.1 Documents Check and Equivalence

Relation

“Documents check” compares common items of a

received document to archived documents in the

receiving division. Common items of transaction

documents in the business process are product name

and quantity, unit price, amount price, etc.

We determined that “documents check” serves as

an equivalence relation as the result of the following

analysis of “documents check.”

Document d

1

is naturally compared with itself

(reflexivity law). When document d

1

is compared

with document d

2

, document d

2

is compared with

document d

1

(symmetric law). In addition, if

document d

1

and document d

2

are compared, and

document d

2

and document d

3

are compared, then

document d

1

and d

3

have also been compared

(transitive law).

Comparing reflexivity law and symmetry law is

a convincing operation. For transitivity law, it has

also been determined that a convincing operation

can be assumed.

It should be noted that our discussion is based on

the assumption of the sameness between the sent

document and the received document, and the

transitive law of “documents check”.

3.2 Inconsistency Risk Detection

Algorithm

The state of the comparison with the entire set of

transaction documents of business process diagram

Doc = {d

1

, ・・・, d

n

} is represented by a matrix

(Checked Documents Matrix).

Checked documents matrix T(i, j) is set as 1 if

document d

i

and document d

j

are compared. T(i, j) is

set as 0 if they are not compared.

Since the checked documents have an

equivalence relation, the diagonal elements (i, i) are

consistently 1 by reflexivity law, and (i, j)

component and (j, i) component are equal by

symmetric law.

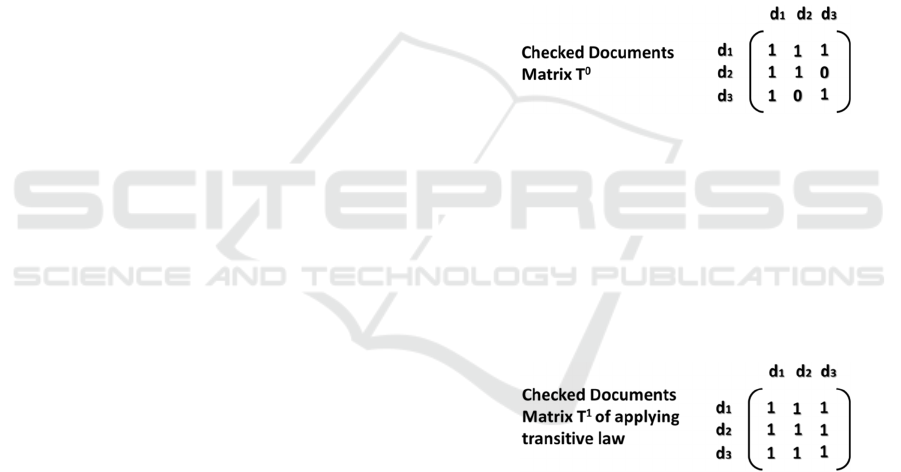

We will explain the Checked Documents Matrix

T using the following example. The entire set of

documents of the matrix are Doc = {d

1

, d

2

, d

3

}.

Checked Documents Matrix T

0

describes how

document d

1

is compared with d

2

and d

3

, but

document d

2

is not compared with d

3

.

However, document d

2

and d

1

are compared, and

document d

1

and d

3

are compared in T

0

, so document

d

2

and d

3

are also compared by transitive law.

At first glance, document d

2

and d

3

seemed not to

be compared in T

0

. But matrix T

1

applying the

transitivity law represents the true state of checked

documents.

As described above, continuing to apply the

transitivity law for initial checked documents matrix

T

0

, by calculating T

1

, T

2

・・・, transitive closure T

subsequently cannot be applied by the transitivity

law any more. Transitive closure T represents the

true state of checked documents.

Then, starting from the initial checked

documents matrix T

0

, by applying the transitivity

law, if the elements (i, j) of checked documents

matrix T (transitive closure) are all 1, all the

documents have been checked. Therefore, there is no

risk of inconsistency in the business process.

Conversely, if the elements (i, j) of transitive closure

T include zero, no documents are checked with each

other. Therefore, there is a risk of inconsistency in

Sixth International Symposium on Business Modeling and Software Design

42

the business process.

The inconsistency risk detection algorithm of the

business process diagram is as follows.

<Inconsistency Risk Detection Algorithm>

1) Set the initial checked documents matrix T0.

All elements of T

0

are set to 0, and for Checked

Documents Set Vi of the business process

diagram, when V

i

contains document d

i

and d

j

,

(i, j) of T

0

is set to 1 for all i.

Diagonal elements of T

0

are set to 1. When the

element (i, j) is 1, the symmetry element (j, i) is

set to 1.

2) Calculate the transitive closure of checked

documents matrix T

0

.

Calculate the T

n

by applying the Floyd-

Warshall algorithm (Cormen et al., 2009).

【Floyd-Warshall Algorithm (Cormen et al., 2009) 】

The (i, j) element of the matrix T

k

is t

k

ij

.

for k = 1 to n

T

k

= a (t

k

ij

) is a new matrix

for i = 1 to n

for j = 1 to n

t

k

ij

= t

k-1

ij

∨ (t

k-1

ik

∧t

k-1

kj

)

return T

n

.

3) When the elements of the transitive closure T

n

are all 1, there is no risk of inconsistency in the

business process. When the elements of T

n

are

not all 1, there is some risk of inconsistency in

the business process.

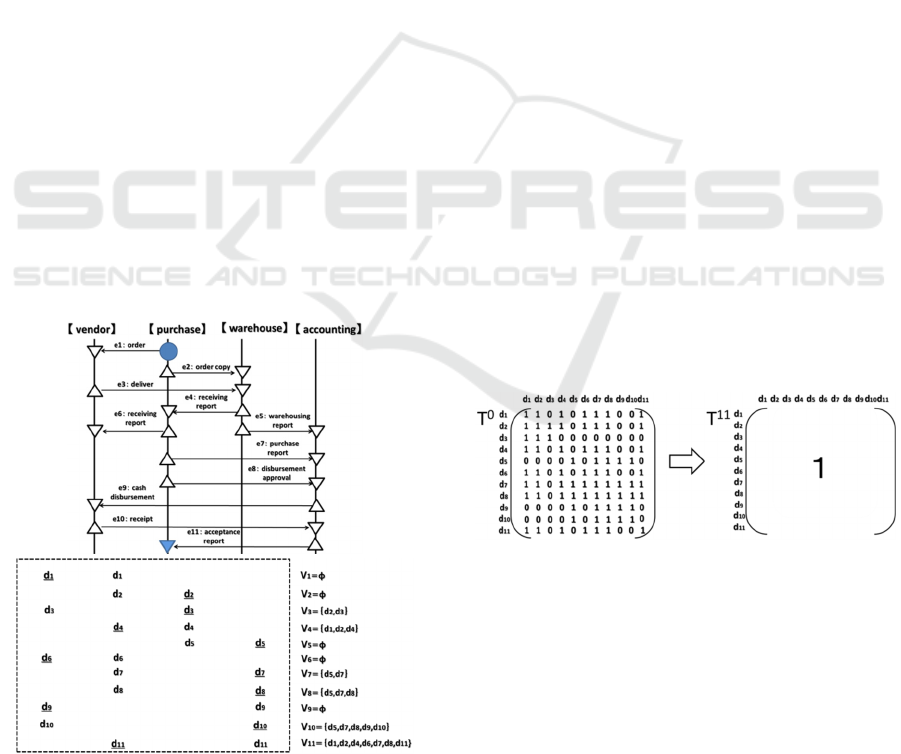

Figure 4: Standard Purchase Order Process Diagram.

4 CASE STUDY BY STANDARD

PURCHASE ORDER PROCESS

The assessment of the standard purchase order

process is performed in this case study. First, we

make the business process diagram of the standard

purchase order process (Figure 4) and extract the

checked documents matrix from the checked

documents sets V

i

(for all i). Next, the inconsistency

risk detection algorithm is applied for checked

documents matrix T

0

, and the inconsistency risk of

the process is judged.

4.1 Purchase Order Process Diagram

and Inconsistency Risk Judgment

In the standard purchase order process, the purchase

division orders goods from the vendor and notifies

the warehouse division of the order. The vendor

delivers the goods to the warehouse, and the

warehouse receives them and sends the receiving

report to the purchase division. The purchase

division requests the accounting division for the

payment in accordance with the invoice. The

accounting division completes the disbursement and

informs the purchase division about it to prevent

duplicate payments. (Sasano, 2006); (Kaneko 2001)

This standard purchase order process diagram is

shown in Figure 4.

The inconsistency risk detection algorithm is

applied to the checked documents matrix T

0

, as

shown in Figure 5. Since the elements of transitive

closure matrix T

11

are all 1, no risk of inconsistency

in the standard purchase order process is determined.

Figure 5: Transitive Disclosure Matrix T

11

of Checked

Documents Matrix T

0

.

5 RELATED WORK

We are currently unaware of any studies that model

the business process by focusing on the documents

generated in the business process and that assess the

business process for inconsistency risks.

From the perspective of specific practical

analysis of business rules and business processes,

Assessing Business Processes by Checking Transaction Documents for Inconsistency Risks

43

the study described in this paper is considered to be

unique.

Business process studies from the perspective of

law compliance and standards are part of the field of

business process compliance. These studies provide

a framework for internal control in accordance with

the Committee of Sponsoring Organizations of the

Treadway Commission (COSO) and in accordance

with health care privacy as established by the U.S.

Health Insurance Portability and Accountability Act

of 1996 (HIPPA) by analyzing the entire laws and

standards. (Breaux et al., 2006); (Siena et al., 2009)

However, this paper does not provide a specific

method that conforms to the standards established by

COSO and HIPPA.

We are aware of a Resources, Events, and

Agents (REA) study that analyzes and models

financial accounting systems. In that study, all

aspects of financial accounting are analyzed, but

specific proposals for accounting audits are not

provided. (McCarthy, 1982)

6 CONCLUSION

Comparison of received transaction documents with

archived transaction documents by a person in

charge of each division in a company is naturally

performed to prevent any errors in the operation of

each division. However, we cannot conclude that

such a simple check in each division is enough to

ensure consistency for the entire set of transaction

documents in the business process, despite

consistency in transaction documents belonging to

individual divisions.

As indicated above, if the business process is

properly designed, the consistency for the entire set

of transaction documents is ensured. This operation

approximately corresponds to auditing done by

CPAs to confirm the existence of transactions.

This paper proposes a method of assessing

business processes by checking transaction

documents for inconsistency risks. This method

consists of a “Business Process Diagram” and an

“Inconsistency Risk Detection Algorithm.”

Using the "Business Process Diagram" and the

"Inconsistency Risk Detection Algorithm,” business

processes can be classified in two categories. For

any process in the first category, the consistency of

any pair of transaction documents in the process is

checked, and there is no risk of inconsistency. For

any process in the second category, the consistency

of some pairs of transaction documents in the

process cannot be checked, and there is a risk of

inconsistency.

When a business process is properly designed to

meet the needs of the business process in the first

category, inconsistency risks can be reduced.

We confirmed in the case study that the standard

purchase order process established in the practices,

due to the accumulation of experience over many

years, is a business process in the first category.

This study aims to establish a high-quality

method for inconsistency risk evaluation that can be

incorporated into business rules and business

processes by analyzing documents that are created

on the basis of business rules and business processes.

In this study, we modeled the business processes of

transactions and assessed them for consistency risks.

We will pursue logical verification by using

CafeOBJ to refine our "Inconsistency Risk Detection

Algorithm."

We will research a method to investigate

mistakes and fraud in business processes in the

future.

ACKNOWLEDGEMENTS

We thank Prof. Syuji Iida and Dr. Yasuhito Arimoto,

Prof. Takao Okubo, Prof. Naoharu Kaiya, Mr.

Motoharu Hirukawa, Ms. Junko Torimitsu for their

valuable comments and feedback for our approach.

REFERENCES

K. Shimizu, M. Nakamura, 2007: Internal Control for IT

Professionals, Zeimukeiri Kyoukai (in Japanese).

M. Maruyama, S. Kamei and T. Miki, 2008: Readings

from Internal Control Environment, Shoeisha (in

Japanese).

M. Sasano, 2006: Introduction and Practice of Internal

Control, Chuokeizaisha (in Japanese).

A. Kaneko 2001: Business Seminar Company Accounting

Introduction, Third Edition, Nihon Keizai Shimbun,

Inc. (in Japanese).

H. Yamaura, 2002: Financial Auditing Theory, second

edition, Chuokeizaisha (2002) (in Japanese).

T. Cormen, C. Leiserson, R. Rivest and C. Stein, 2009:

Introduction to Algorithms [Volume 2], third edition,

MIT Press.

Travis D. Breaux, Matthew W. Vail, and Annie I. Anton,

2006: Towards Regulatory Compliance: Extracting

Rights and Obligations to Align Requirements with

Regulations. RE 2006: 46-55.

Alberto Siena, Anna Perini, Angelo Susi, and John

Mylopoulos, 2009: Towards a framework for law-

compliant software requirements. ICSE Companion

2009: 251-254.

Sixth International Symposium on Business Modeling and Software Design

44

McCarthy, E. W, 1982: The REA Accounting Model: A

Generalized Framework for Accounting Systems in a

Shared Data Environment. The Accounting Review,

(July 1982): pp. 554-578.

Assessing Business Processes by Checking Transaction Documents for Inconsistency Risks

45