The Predictor Impact of Web Search Media on Bitcoin Trading Volumes

Martina Matta, Ilaria Lunesu and Michele Marchesi

Universita’ degli Studi di Cagliari, Piazza d’Armi, 09123 Cagliari, Italy

Keywords:

Bitcoin, Web Search Media, Google Trends, Cross Correlation Analysis.

Abstract:

In the last decade, Web 2.0 services have been widely used as communication media. Due to the huge amount

of available information, searching has become dominant in the use of Internet. Millions of users daily interact

with search engines, producing valuable sources of interesting data regarding several aspects of the world.

Search queries prove to be a useful source of information in financial applications, where the frequency of

searches of terms related to the digital currency can be a good measure of interest in it. Bitcoin, a decentralized

electronic currency, represents a radical change in financial systems, attracting a large number of users and a

lot of media attention. In this work we studied the existing relationship between Bitcoin’s trading volumes and

the queries volumes of Google search engine. We achieved significant cross correlation values, demonstrating

search volumes power to anticipate trading volumes of Bitcoin currency.

1 INTRODUCTION

Internet has been one of the most revolutionary tech-

nologies in the last decades. The majority of daily

activities radically changed, moving towards a “vir-

tual sector”, such as Web actions, credit card trans-

actions, electronic currencies, navigators, games, etc.

In recent years, web search and social media have

emerged online. On one hand, services such as blogs,

tweets, forums, chats, email have gained wide popu-

larity. Social media data represent a collective indica-

tor of thoughts and ideas regarding every aspect of the

world. It has been possible to assist to deep changes in

habits of people in the use of social media and social

network (Kaplan and Haenlein, 2010).

Social media technologies have produced com-

pletely new ways of interacting (Hansen et al., 2010),

bringing the creation of hundreds of different social

media platforms (e.g., social networking, shared pho-

tos, podcasts, streaming videos, wikis, blogs). On

the other hand, due to the huge amount of available

information, searching has become dominant in the

use of Internet. Millions of users daily interact with

search engines, producing valuable sources of inter-

esting data regarding several aspects of the world.

Recent studies demonstrated that web search

streams could be used to analyze trends about sev-

eral phenomena (Choi and Varian, 2012) (Rose and

Levinson, 2004) (Bordino et al., 2012). In one of

the most interesting works, Ginsberg et al. proved

that search query volume is a sophisticated way to de-

tect regional outbreaks of influenza in USA almost 7

days before CDC surveillance (Ginsberg et al., 2009).

There are also studies that report another use in a

search engine, namely as a possible predictor of mar-

ket trends. Bollen et al. show that search volumes on

financial search queries have a predictive power. They

compared these volumes with market indexes such as

Dow Jones Industrial Average, trading volumes and

market volatility, demonstrating the possibility to an-

ticipate financial performances (Bollen et al., 2011).

In this work, Granger causality analysis and a Self-

Organizing Fuzzy Neural Network are used to inves-

tigate the hypothesis that public mood states, as mea-

sured by the OpinionFinder and GPOMS mood time

series, are predictive of changes in DJIA closing val-

ues. Bordino et al. prove that search volumes of

stocks highly correlate with trading volumes of the

corresponding stocks, with peaks of search volume

anticipating peaks of trading volume by one day or

more (Bordino et al., 2012).

Search queries prove to be a useful source of infor-

mation in financial applications, where the frequency

of searches of terms related to the digital currency

can be a good measure of interest in the currency and

it has a good explanatory power (Kristoufek, 2013).

Mondria et al. proved that the number of clicks on

search results stemming from a given country corre-

lates with the amount of investment in that country

(Mondria et al., 2010). Further studies showed that

changes in query volumes for selected search terms

mirror changes in current volumes of stock market

620

Matta, M., Lunesu, I. and Marchesi, M..

The Predictor Impact of Web Search Media on Bitcoin Trading Volumes.

In Proceedings of the 7th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2015) - Volume 1: KDIR, pages 620-626

ISBN: 978-989-758-158-8

Copyright

c

2015 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

transactions (Preis et al., 2010).

Technology always had a strong impact on finan-

cial markets and it has favored the emergence of Bit-

coin, a digital currency created in 2008 by Satoshi

Nakamoto (Nakamoto, 2008). It has been created

for the purpose to replace cash, credit cards and

bank wire transactions. It is based on advancements

in peer-to-peer networks (Ron and Shamir, 2013)

and cryptographic protocols for security. Due to its

properties, Bitcoin is completely decentralized and

not managed by any governments or bank, ensur-

ing anonymity. It is based on a distributed register

known as ”block-chain” to save transactions carried

out by users. Like any other currency, a peculiar-

ity of Bitcoin is to facilitate transactions of services

and goods with vendors that accept Bitcoins as pay-

ment(Grinberg, 2012), attracting a large number of

users and a lot of media attention.

The Bitcoin represents an important new phe-

nomenon in financial markets. Mai et al. examine

predictive relationships between social media and Bit-

coin returns by considering the relative effect of dif-

ferent social media platforms (Internet forum vs. mi-

croblogging) and the dynamics of the resulting rela-

tionships using auto-regressive vector and error cor-

rection vector models (Mai et al., 2015).

Matta et al. examined the striking similarity be-

tween Bitcoin price and the number of queries regard-

ing Bitcoin recovered on Google search engine (Matta

et al., 2015). In their work, Garcia et al. (Garcia et al.,

2014) proved the interdependence between social sig-

nals and price in the Bitcoin economy, namely a social

feedback cycle based on word-of-mouth effect and a

user-driven adoption cycle. They provided evidence

that Bitcoins growing popularity causes an increasing

search volumes, which in turn result a higher social

media activity about Bitcoin. A growing interest in-

spires the purchase of Bitcoins by users, driving the

prices up, which eventually feeds back on the search

volumes.

There are several works that present predictive

relationships between social media and bitcoin vol-

ume

1

where the relative effects of different social me-

dia platforms (Internet forum vs. microblogging) and

the dynamics of the resulting relationships, are ana-

lyzed using cross-correlation (Constantinides et al.,

2009) or linear regression analysis (Bollen et al.,

2011) (Mittal and Goel, 2012). Social factors, that

are composed of interactions among market actors,

may strongly drive the dynamics of Bitcoin’s econ-

omy (Garcia et al., 2014).

In this work we study the relationship that exists

between trading volumes of Bitcoin currency and the

1

https://markets.blockchain.info/

queries volumes of search engine. The frequency of

searches of terms about Bitcoin could be a good ex-

planatory power, so we decided to examine Google,

one of the most important search engine. We studied

whether web search media activity could be helpful

and used by investment professionals, analyzing the

search volumes power of anticipate trading volumes

of the Bitcoin currency.

We compared USD trade volumes about Bitcoin

with those in a media, namely, Google Trends. This

is a feature of Google search engine that illustrates

how frequently a fixed search term was looked for.

Following this kind of approach, we evaluated how

much bitcoin term, for the specific time interval, is

looked for using Google’s search engine.

The body of this paper is organized in five major

sections. Section 2, describes the research steps of

our study, section 3 summarizes and discusses our re-

sults and, finally, section 4 presents conclusions and

suggestions for future works.

2 METHODOLOGY

2.1 Google Trends

Google Trends

2

is a feature of Google Search engine

that illustrates how frequently a fixed term is looked

for. Through this, you can compare up to five topics

at one time to view their relative popularity, allow-

ing you to gain an understanding of the hottest search

trends of the moment, along with those developing in

popularity over time. The system provides a time se-

ries index of the volume of queries inserted by users

into Google.

Query index is based on the number of web

searches performed with a specific term compared to

the total amount of searches done over time. Abso-

lute search volumes are not illustrated, because the

data are normalized on a scale from 0 to 100.

Google classifies search queries into 27 categories

at the top level and 241 categories at the second level

through an automatic classification engine. Indeed,

queries are given out to fixed categories due to natural

language processing methods.

The query index data are available as a CSV file in

order to facilitate research purposes. Figure 1 depicts

an example from Google Trends for the query “Bit-

coin”. We downloaded data about how much the term

“Bitcoin” was referred to last year.

2

http://trends.google.com

The Predictor Impact of Web Search Media on Bitcoin Trading Volumes

621

Figure 1: Example of Google Trends usage for the query “Bitcoin”.

2.2 Blockchain.info

Blockchain.info

3

is an online system that provides de-

tailed information about Bitcoin market. Launched

in August 2011, this system shows data on recent

transactions, plots on the Bitcoin economy and sev-

eral statistics. It allows users to analyze different Bit-

coin aspects:

• Total Bitcoins in circulation

• Number of Transactions

• Total output volume

• USD Exchange Trade volume

• Market price (USD)

We decided to study a time series regarding the

USD trade volume from top exchanges, analyzing its

trends.

2.3 Data Collection

Search query volumes regarding Bitcoin were col-

lected from Google Trends website, capturing all

searches, inserted from June 2014 to July 2015, with

“Bitcoin” word as keyword .

Trading volume data were acquired from

blockchain.info website, in order to evaluate daily

trends of Bitcoin currency. We assessed the rela-

tionship over time between number of daily queries

related to the trading volume of Bitcoin.

To better understand whether search engine can be

seen as a good predictor of trading volumes, we ap-

plied an analysis of correlation between these data ex-

3

http://www.blockchain.info

pressed in time series, a time-lagged cross-correlation

study, concluding with a Granger-causality test.

3 RESULTS

In order to decide the correct strategy of analysis for

studying the relationship among Bitcoins trading vol-

ume and others meaningful parameters, the available

related literature has been examined in depth. Most

of articles (Bollen et al., 2011) (Kaminski and Gloor,

2014) (Rao and Srivastava, 2012) reports analysis

about the existent relationship between volume of

media and market evolution. In general, Bollen et

al. proved that tweets can predict market trend 3-4

days in advance, with a good chance of success. We

extract from both data sources time series composed

by daily values in the time interval ranging from

June 2014 to July 2015 in order to evaluate their

relationship and the capability of prediction. We run

statistical analysis and the computation of correlation,

cross-correlation and Granger causality test yielded

interesting results.

3.1 Pearson Correlation

Pearson’s correlation r is a statistical measure that

evaluate the strength of a linear association between

two time series G and T. We assumed G as query data

and T as trading volumes.

r =

∑

i

(G

i

− G)(T

i

− T )

q

∑

i

(G

i

− G)

2

q

∑

i

(T

i

− T )

2

(1)

DART 2015 - Special Session on Information Filtering and Retrieval

622

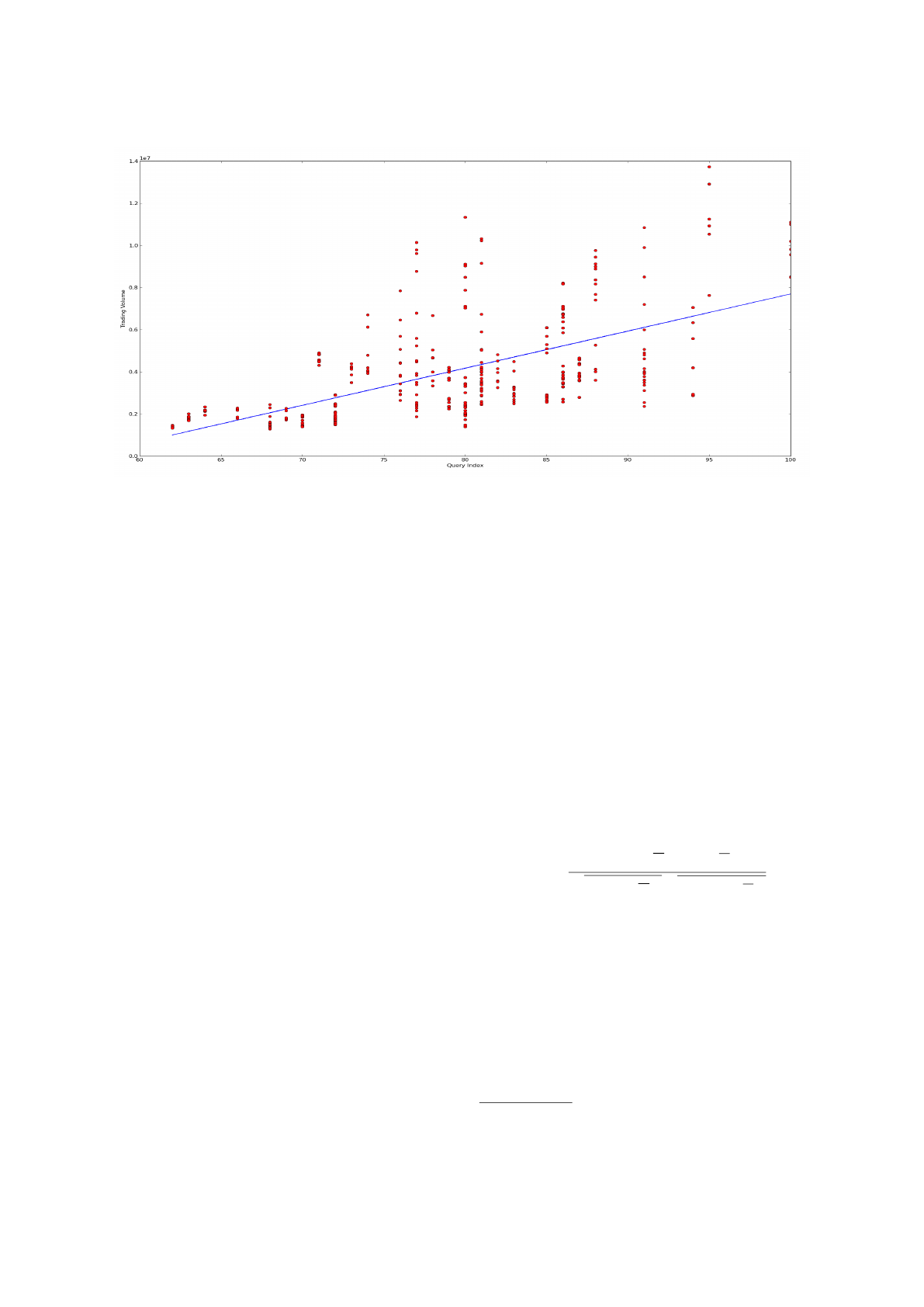

Figure 2: Correlation between Trading Volume and Queries Volume about Bitcoin.

The correlations have values between -1 and +1,

the bounds indicate maximum correlation and 0 in-

dicating no correlation. A high negative correlation

indicates a high correlation but of the inverse of one

of the series. We calculated the Pearson correlation

between queries search data and trading volume and

we found a result equal to 0.60. This similarity is also

clearly visible in the figure 2.

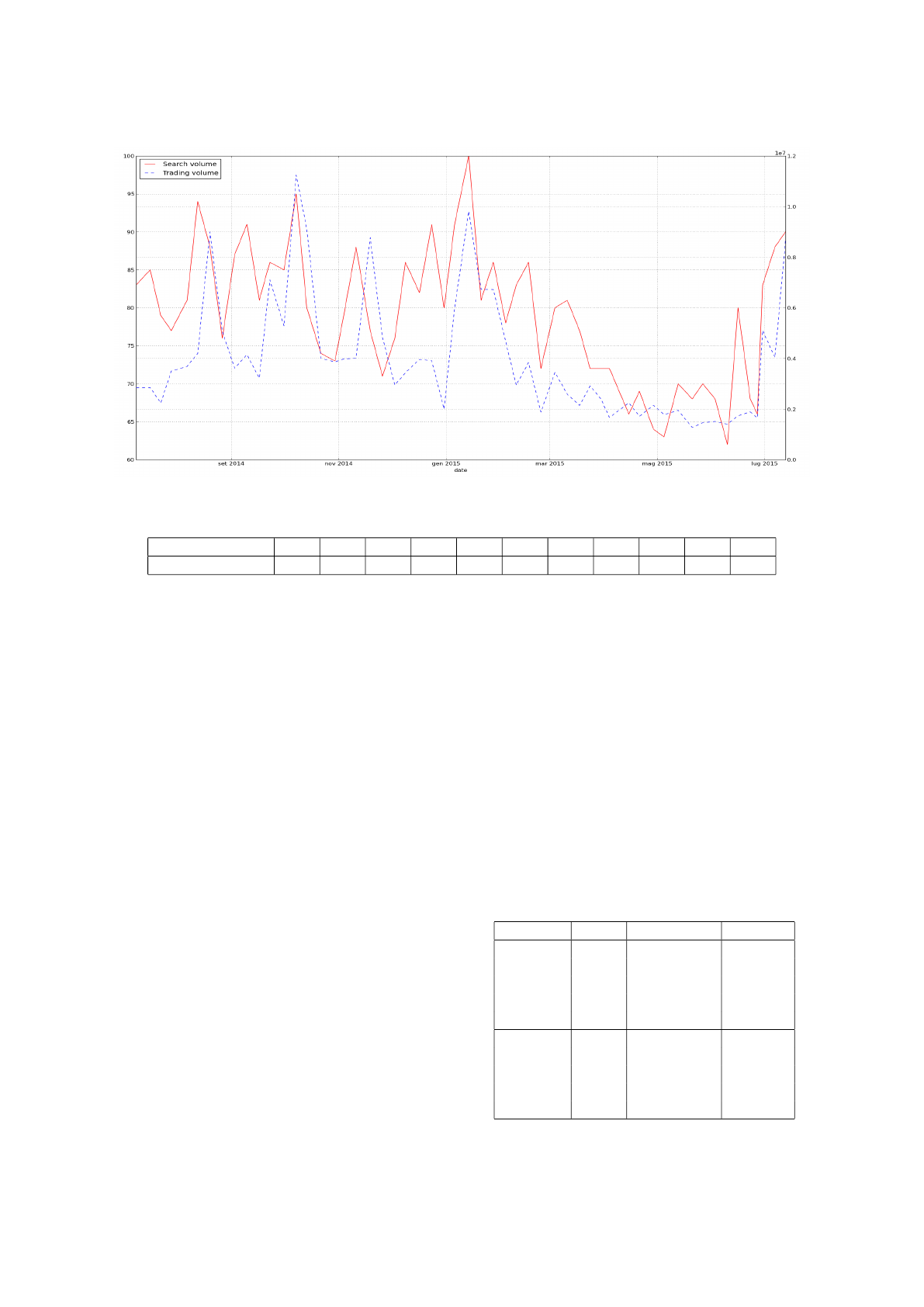

Following this kind of analysis, we demonstrated

the striking similarity existing between the time se-

ries. This result means that the trading volumes fol-

lows the same direction pace of queries volumes. Fig-

ure 3 reveals an obvious correlation due to peaks

in one time series that occur close to peaks in the

other. In this Figure it is possible to see that solid

line, correspondent to search volumes, very often an-

ticipated the dotted line correspondent to trading vol-

umes. The most significant peaks occurred in the in-

terval between August and September 2014, between

September and October 2014, between November and

December 2014 and between January and February

2015. During other periods the same phenomenon is

less evident but anyway present.

Radical changes in peaks are due to several fac-

tors. One of the most evident peak is visible in Figure

3 corresponding to the interval between end of June

and beginning of July. This is the period of the greek

crisis acme, that causes changes also in the Bitcoin

market. Indeed, a lot of people already started to in-

vest in Bitcoin business. When people try to move

money out of the country the government blocks this

process, thus Bitcoin are the only way to transfer their

wealth. In fact Greeks would use bitcoin to protect the

value of their money at home. Ten times more Greek

than usual are being recorded at the company ’Ger-

man Bitcoin.de’

4

to buy electronic currency. This sit-

uation is clearly visible in the right part of Figure 3,

where curve correspondent to queries index volumes

regarding Bitcoin considerably grew up, followed by

an increase of curve correspondent to trading volumes

after some days. In these mentioned cases it is clear

how search volumes predict trading volumes preced-

ing it, as confirmed by correlation values.

3.2 Cross Correlation

We investigated whether query volumes can antici-

pate trading volume of Bitcoin. We calculated the

cross correlation values between query data G and

trading volumes T as the time lagged Pearson cross

correlation between two time series G and T for all

delays d=0,1,2,..5.

r(d) =

∑

i

(G

i

− G)(T

i−d

− T )

q

∑

i

(G

i

− G)

2

q

∑

i

(T

i−d

− T )

2

(2)

We chose to evaluate a maximum lag of five days

and, also in this case, the correlation ranges from -1

to 1. In Table 1, the results obtained from these ex-

periments are reported. Each column shows the cross

correlation result corresponding to different time-lag.

We can observe that cross correlation results for pos-

itive delays are always higher than the ones with neg-

ative time lag. Indeed, the results with positive delays

achieve values always higher than 0.64 and with neg-

ative delays report values always lower than 0.55. It

4

https://www.bitcoin.de/

The Predictor Impact of Web Search Media on Bitcoin Trading Volumes

623

Figure 3: Correlation between Trading Volume and Queries Volume about Bitcoin.

Table 1: Cross-correlation results.

Delay -5 -4 -3 -2 -1 0 1 2 3 4 5

Cross-Corr Value 0.36 0.40 0.44 0.50 0.55 0.60 0.64 0.67 0.68 0.67 0.64

means that query volumes is able to anticipate trading

volumes in almost 3 days.

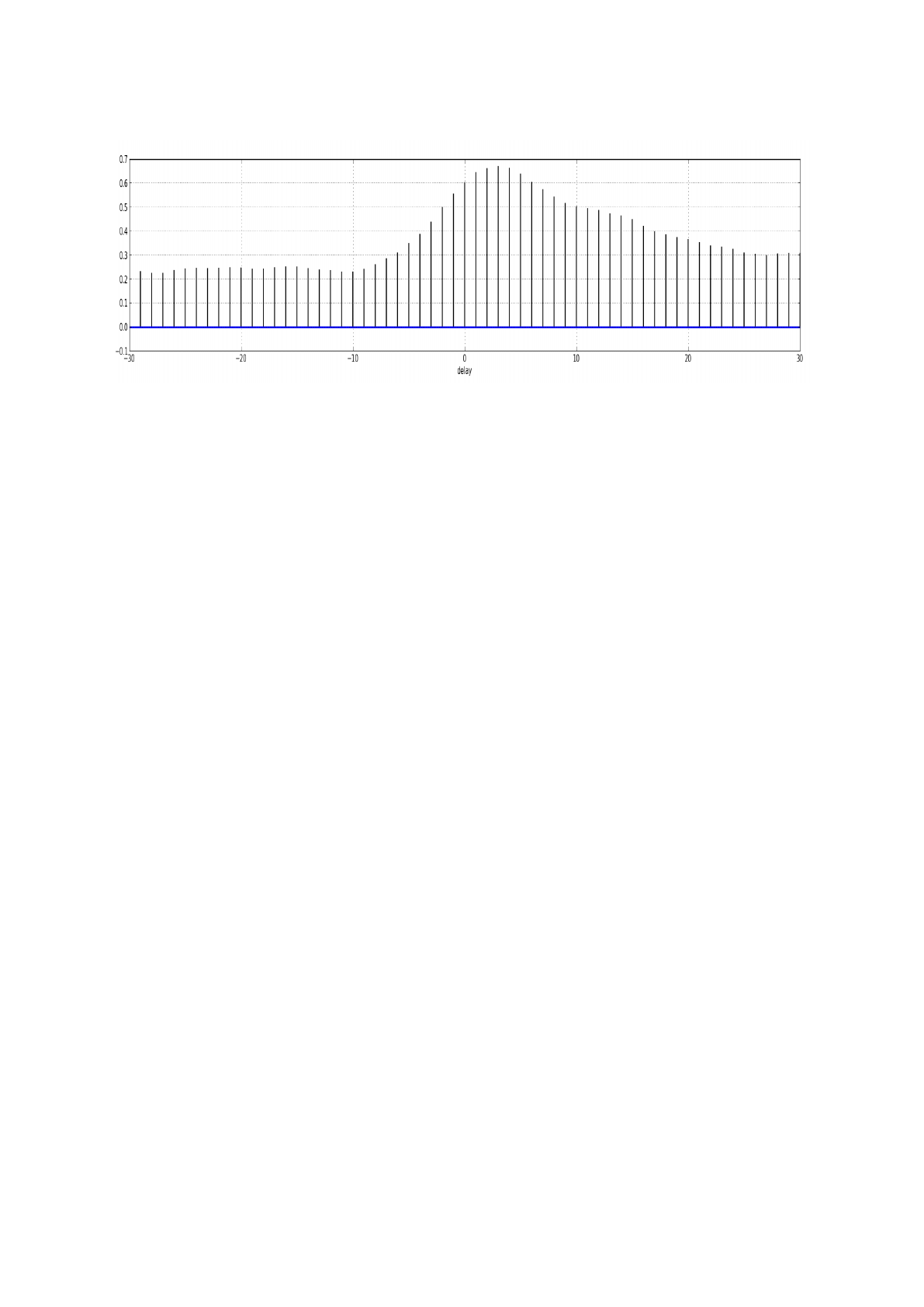

Figure 4 shows the cross correlation results with

a maximum lag of 30 days, just to highlight that the

best result is given by a lag of almost 3.

3.3 Granger Causality

We performed a Granger causality test in order to ver-

ify whether web search queries regarding Bitcoin are

able to anticipate particular trends in some days. The

Granger-causality test is used to determine whether a

time series G(t) is a good predictor of another time

series T(t) (Granger, 1969). If G Granger-causes T,

then G

past

should significantly help predicting T

f uture

via T

past

alone. We compared query volumes G with

trading volume T with the null hypothesis being that

T is not caused by G. An F-test is then used to deter-

mine if the null hypothesis can be rejected.

We performed two auto-regression vectors as fol-

lows in the formula 3 and 4, where L represents the

maximum time lag.

T (t) =

L

∑

l=1

a

l

T (t − l) + ε

1

(3)

T (t) =

L

∑

l=1

a

0

l

T (t − l) +

L

∑

l=1

b

0

l

G(t − l) + ε

2

(4)

We can affirm that G causes T if eq(4) is statistically

better significant than eq(3). We applied the test in

both directions, as an instance G → T means that the

null hypothesis is “G doesn’t Granger-cause T”.

Table 2 shows the results of the Granger causality

test, where the first column represents the direction of

the applied test, the second one the delay, and then the

F-test result with its p-value. This parameter repre-

sents the probability that statistic test would be at least

as extreme as observed, if the null hypothesis were

true. So, we reject the null hypothesis if p-value is

inferior to a certain threshold (p<0.05). Our analysis

demonstrated that trading volumes can be considered

Granger-caused by the query volumes. It is clearly

shown that time-series G influences T, given by the p-

value <0.001 for lags ranging from 1 to 5. So, the null

hypothesis is completely rejected. On the other hand,

the F-value test applied to the direction T→G reported

Table 2: Granger-causality tests.

Direction Delay F-value Test P-value

G→T

1 41.8135 p<0.001

2 15.1435 p<0.001

3 12.9332 p<0.001

4 15.1546 p<0.001

5 12.9279 p<0.001

T→G

1 0.5450 p=0.46

2 2.3006 p=0.10

3 1.4878 p=0.21

4 1.5336 p=0.19

5 1.2297 p=0.29

DART 2015 - Special Session on Information Filtering and Retrieval

624

Figure 4: Cross Correlation results between Trading Volume and Queries Volume about Bitcoin with a maximum lag of 30

days.

a p-value always greater than 0.1. Trading volume T

doesn’t have significant casual relations with changes

in queries volumes on Google search engine G. So,

null hypothesis cannot be rejected.

4 CONCLUSIONS

In this paper, we evaluated whether the information

extracted by web search media could be helpful and

used by investment professionals in Bitcoins. Since

the use of Bitcoins is increasingly widespread, we de-

cided to analyze the market, in order to predict trading

volume.

To this purpose, we presented an analysis of a

corpus of queries index about Bitcoin compared to

its trading volume. We selected a corpus that cov-

ers a period of almost one year, between June 2014

and July 2015. We chose Google Trends media to

analyze Bitcoins popularity under the perspective of

Web search. We examined the Bitcoin tradings be-

havior comparing its variations with Google Trends

data. From results of a cross correlation and Granger

causality analysis between these time series, we can

affirm that Google Trends is a good predictor, because

of its high cross correlation value. Our results con-

firm those found in previous works, based on a differ-

ent corpus and referred to a different Bitcoin market

trend.

As future advancement, we are thinking about the

possibility to apply this kind of approach to differ-

ent contexts in order to better understand the predic-

tive power of web search media. An other likelihood

could be to consider not only search media but also

social media like Twitter, Facebook and Google+.

ACKNOWLEDGEMENTS

This research is supported by Regione Autonoma

della Sardegna (RAS), Regional Law No. 7-2007,

project CRP-17938 LEAN 2.0.

REFERENCES

Bollen, J., Mao, H., and Zeng, X. (2011). Twitter mood

predicts the stock market. Journal of Computational

Science, 2(1):1–8.

Bordino, I., Battiston, S., Caldarelli, G., Cristelli, M.,

Ukkonen, A., and Weber, I. (2012). Web search

queries can predict stock market volumes. PloS one,

7(7):e40014.

Choi, H. and Varian, H. (2012). Predicting the present with

google trends. Economic Record, 88(s1):2–9.

Constantinides, E., Romero, C. L., and Boria, M. A. G.

(2009). Social media: a new frontier for retailers? In

European Retail Research, pages 1–28. Springer.

Garcia, D., Tessone, C. J., Mavrodiev, P., and Perony, N.

(2014). The digital traces of bubbles: feedback cy-

cles between socio-economic signals in the bitcoin

economy. Journal of the Royal Society Interface,

11(99):20140623.

Ginsberg, J., Mohebbi, M. H., Patel, R. S., Brammer, L.,

Smolinski, M. S., and Brilliant, L. (2009). Detecting

influenza epidemics using search engine query data.

Nature, 457(7232):1012–1014.

Granger, C. W. (1969). Investigating causal relations

by econometric models and cross-spectral methods.

Econometrica: Journal of the Econometric Society,

pages 424–438.

Grinberg, R. (2012). Bitcoin: an innovative alternative dig-

ital currency. Hastings Sci. & Tech. LJ, 4:159.

Hansen, D., Shneiderman, B., and Smith, M. A. (2010). An-

alyzing social media networks with NodeXL: Insights

from a connected world. Morgan Kaufmann.

The Predictor Impact of Web Search Media on Bitcoin Trading Volumes

625

Kaminski, J. and Gloor, P. (2014). Nowcasting the bit-

coin market with twitter signals. arXiv preprint

arXiv:1406.7577.

Kaplan, A. M. and Haenlein, M. (2010). Users of the world,

unite! the challenges and opportunities of social me-

dia. Business horizons, 53(1):59–68.

Kristoufek, L. (2013). Bitcoin meets google trends and

wikipedia: Quantifying the relationship between phe-

nomena of the internet era. Scientific reports, 3.

Mai, F., Bai, Q., Shan, Z., Wang, X. S., and Chiang, R. H.

(2015). From bitcoin to big coin: The impacts of so-

cial media on bitcoin performance.

Matta, M., Lunesu, I., and Marchesi, M. (2015). Bitcoin

spread prediction using social and web search media.

Proceedings of DeCAT.

Mittal, A. and Goel, A. (2012). Stock prediction using twit-

ter sentiment analysis. Standford University, CS229.

Mondria, J., Wu, T., and Zhang, Y. (2010). The determi-

nants of international investment and attention allo-

cation: Using internet search query data. Journal of

International Economics, 82(1):85–95.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic

cash system. Consulted, 1(2012):28.

Preis, T., Reith, D., and Stanley, H. E. (2010). Complex

dynamics of our economic life on different scales: in-

sights from search engine query data. Philosophi-

cal Transactions of the Royal Society of London A:

Mathematical, Physical and Engineering Sciences,

368(1933):5707–5719.

Rao, T. and Srivastava, S. (2012). Analyzing stock mar-

ket movements using twitter sentiment analysis. In

Proceedings of the 2012 International Conference on

Advances in Social Networks Analysis and Mining

(ASONAM 2012), pages 119–123. IEEE Computer

Society.

Ron, D. and Shamir, A. (2013). Quantitative analysis of the

full bitcoin transaction graph. In Financial Cryptog-

raphy and Data Security, pages 6–24. Springer.

Rose, D. E. and Levinson, D. (2004). Understanding user

goals in web search. In Proceedings of the 13th inter-

national conference on World Wide Web, pages 13–19.

ACM.

DART 2015 - Special Session on Information Filtering and Retrieval

626