The Impact of Digital Presence on Competitive Advantage

A Study Applied to Brazilian Bank Industry

Claudio Luis Cruz de Oliveira, Veranise Jacubowski Correia Dubeux and Vinicius Andrade Pereira

ESPM Media Lab, Escola Superior de Propaganda e Marketing, Rua Doutor Álvaro Alvim, 123, São Paulo, Brazil

Keywords: Digital Presence Index, e-Metrics, e-Business, Bank, Internet Banking.

Abstract: This pilot study analyses the impact of Digital Presence on the competitive advantage of the Brazilian banks.

The research reinforces previous findings. It verifies high correlations of digital variables and business results.

The study also introduces the Digital Presence Index (DPI) to consolidate the digital metrics. Additionally,

the paper proposes new forms to visualize the variables. These contributions may improve the decision-

making process of marketing analysts, business executives, and Internet professionals.

1 INTRODUCTION

The impact of digital presence on sales, brand recall

and profit has often been confirmed (Pauwels et al.

2012; Harrison, 2013; Westerman et al. 2012).

However, the executives face difficulties to make

decisions based on complex online metrics (Kaushik,

2007). The objective of this paper is to describe the

steps in the construction of a simplified digital

presence index (DPI). We intend to clarify the

following research questions:

How can we measure the digital presence and

business results of the largest Brazilian banks?

Which variables of the digital presence affect

the business results most?

Is it possible to consolidate these variables in a

DPI representing the competitive advantage of

banks?

This pilot study aims to analyze the relationship

between digital presence (Haj-Bolouri et al., 2014;

Thibeault, 2012) and competitive advantage (Porter,

2001), considering a limited set of the largest banks

in Brazil. We chose the Brazilian banking industry

because 40.6% of the Brazilian online users accessed

internet banking in 2013 vs. 32.7% of the users

worldwide (ComScore, 2014). Moreover, almost half

of the banking transactions happens on the site or

mobile applications in Brazil (Febraban, 2014).

Future studies must include a larger set of companies

from different industries.

A research with the 12 leading banks in Brazil

suggests that the digital presence variables have high

correlation with business results as profits, assets and

deposits. The DPI captured these correlations as well

as the performance of each bank. Additionally, we

represented the DPI of a bank in an importance-

performance matrix (Martilla and James, 1977, Slack,

1994) as a recommendation to a decision-making

process to improve the digital presence.

2 RELATED WORK

Brands and companies aim to be exposed in the

digital world. The digital presence is a broad concept

that encompasses the company exposure as a whole

on the Internet, whether controlled by the corporation

or not (Haj-Bolouri et al., 2014; Thibeault, 2012).

Interactive marketers define the digital presence as a

set of channels with the consumer on the Internet and,

furthermore, such conversation between consumers

about brands and companies. They classify the

channels as paid, owned and earned media (Pauwels

et al., 2012; Corcoran, 2009). The owned media are

the channels controlled by the company (e.g., website

applications). The paid media are communication

efforts to leverage the enterprise channels (e.g.,

display ads, paid search). The earned media occurs

when consumers become the channel (e.g., social

networks, blogs) (Corcoran, 2009).

The digital presence is compounded by three

levels of media: paid, owned and earned (Pauwels et

al., 2012; Corcoran, 2009). The owned media is

controlled by the companies; it is formed by the

80

Luis Cruz de Oliveira C., Jacubowski Correia Dubeux V. and Pereira V..

The Impact of Digital Presence on Competitive Advantage - A Study Applied to Brazilian Bank Industry.

DOI: 10.5220/0005546900800087

In Proceedings of the 12th International Conference on e-Business (ICE-B-2015), pages 80-87

ISBN: 978-989-758-113-7

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

website, mobile apps, blogs and social media

accounts. The paid media is the investment to

leverage an owned channel as displays ads, paid

search, and sponsorships. The buzz and viral

replication of messages, when consumers become the

channel is earned media (Corcoran, 2009), as well as

the trend of the searches of the brand in search

engines as Google; this trend represents the unaided

brand recall (Kaushik, 2012).

Pauwels et al. (2012) observed that paid, owned,

and earned media metrics add explanatory power to a

sales response model that already includes marketing

mix actions. Harrison (2013) measured the impact of

these metrics on brand recall.

Westerman et al. (2012) observed the most

digitally mature companies are 26% more profitable

than their industry competitors This digital maturity

is compound by digital intensity, the investment in

technology-enabled initiatives to change how the

company operates, and the transformation

management intensity, the leadership capabilities

necessary to drive digital transformation in the

organization. Westerman et al. (2012) also described

the possibility of executives in every industry for

gaining digital advance.

Executives analyze multiple information systems

to monitor the market and prepare the company for

competition (Davenport and Harris, 2007). Although,

only a few companies capable to analyze the

increasingly amount of information (Kaushik, 2007;

Goes, 2014). The importance-performance matrix

helps executives to make better decisions based on

multiple indicators (Martilla and James, 1977; Slack,

1994).

3 METHODOLOGY

The research is descriptive in nature, and we used the

following methodological procedures: bibliographic

research, access to multiple databases, interviews,

workshops and multivariate analyses.

We used bibliographic research to explore the

concept of digital presence, its variables and to

exploit its link with business strategy.

The data about digital presence variables was

collected in multiple databases as Brazilian Central

Bank, ComScore, Google Trends and Social Bakers.

We interviewed six banking executives and two

social media researchers to explore the digital

presence and business results variables of banks.

These interviews were complemented with

workshops about e-metrics with marketing

executives of 10 companies.

We used multivariate analyses to measure the

correlation between variables. Finally, we developed

a quantitative model to consolidate and calculate the

DPI based on these correlations.

Despite efforts to produce a scientific

contribution, this research has some limitations:

the study represents the result of banking, not

allowing generalizations for other industries.

the Brazilian bank market is formed by large

companies, not allowing the comparison with

small and medium business;

it was not possibly to monitor the broad historic

of internet buzz of banks due to budget

limitations, so we used Google Trends data

about searches on Google;

for the same reason, we monitored only number

of likes and followers on Facebook and

Instagram. However, there are other relevant

social media sites as Instagram and Youtube;

the number of likes on Facebook is

questionable because fake users inflate the

statistics (Krombholz et al., 2012)

4 IMPLEMENTATION

4.1 The Digital Presence and Business

Results of Banks

To clarify the first question “how can we measure the

digital presence and business results of the largest

Brazilian banks?”, we need to problematize the

digital presence concept (Haj-Bolouri et al., 2014;

Thibeault, 2012) classifying its channels as paid,

owned and earned media (Pauwels et al., 2012;

Corcoran, 2009). We selected the banking industry

considering the massive use of these channels.

The owned media of banks have an expressive

role. About 28 million people use the internet banking

applications in Brazil (ComScore, 2014). The internet

is the main channel for banking transactions, 41% of

the transactions occur on the Internet. Mobile

operations correspond to 6% according to the

Brazilian Federation of Banks (Febraban, 2014).

These numbers show that internet banking is a critical

tool to maintain a competitive advantage in Brazil.

Brazilians use 8% more internet banking than the

global average (ComScore, 2014). There are some

historical reasons to explain this difference. Due to

hyperinflation in the 90s, the banks invested in

automated teller machines (ATM) to deal with the

huge movement of Brazilian branches. This

TheImpactofDigitalPresenceonCompetitiveAdvantage-AStudyAppliedtoBrazilianBankIndustry

81

technology platform boosted internet banking sites.

Brazilian consumers trust the security of internet

solutions because they are used to performing virtual

operations at ATM’s.

Brazilian banks are heavy media buyers. They are

the third industry in communication investments in

Brazil, buying almost USD 700 million in media in

the first semester of 2014 (Ibope, 2014). An

expressive share of this investment is destined to

online paid media.

The importance of earned media is fostered by the

Brazilians’ behavior on social media. Brazilians

spend 13 hours per month on social networks vs. 6

hours of users worldwide (ComScore, 2014). The

buzz about banks is expressive; one million tweets

mentioned the term “bank” in February of 2015

(Topsy, 2015).

The DPI aims to reinforce this contribution by

calculating the contribution of each e-metric to the

business results. The importance of each variable will

be proportional to the correlation between the e-

metric performance, and business results; comparison

with the company and other players will form the

performance scale of the variables.

4.2 Variables of Digital Presence

To address the second question: “Which variables of

the digital presence affect the business results most?”,

we accessed the performance data of banks on the site

of the Brazilian Central Bank . We collected data

about 10 business results indicators. After interviews

with bank executives, we seleceted 3 indicators:

B1 - Net profit: the net profit generated by all

banking operations.

B2 - Total assets: the size of a bank is usually

associated with the total assets managed

(Exame.com, 2014).

B3 - Total deposits: representing the funding

capacity of the bank;

This set of bank results indicators are defined as

the independent variables in the multivariate analyses

(Johnson and Wichern, 2002).

The dependent variables came from the

workshops with marketing executives and consulting

of online researchers as ComScore, Social Bakers,

and Google Trends. ComScore is a market research

that follows almost 150 thousand internet users in

Brazil to monitor websites audience behavior and

media investment. Social Bakers is a global

monitoring company that collects data on social

media for a diversity of industries. Google Trends is

the tool to monitor trends in terms searched on

Google. As Google does not provide absolute

numbers about the searches in its engine, it is

necessary to compare the companies to know which

one is the top of mind for users of Google Searches.

We selected metrics we could compare with all

institutions in order to calculate the performance ratio

of the players (1).

Regarding paid media, two variables that were

included in the model came from ComScore:

V1 – Media Investment: the amount of

investment in online media.

V2 – Media impressions: the number of times

the bank ads appeared to internet users.

We considered 4 variables (V3 to V6) to owned

channels because of the complexity of this kind of

media. The variables represent owned presence in

websites and social media. The reports of audience of

ComScore offered 22 metrics about the website

audience, although, we selected 2 representative ones

in order not to overestimate the role of site audience

in the model:

V3 – Average visits per month: the total of

visits (sessions) on the website per month.

V4 – Average visits per visitor: the number of

visits per unique visitor, it is a hint of usability,

because the user returned to the site.

We did not find any metrics about mobile

applications use in Brazil; however, the executives

consider important to measure the user behavior on

mobile apps.

The owned presence in social media was

represented by two variables, the number of followers

in Twitter, and the number of fans on Facebook page,

both measured by Social Bakers. We selected these

two social network sites because of their audience in

the Brazilian market:

V5 – Facebook likes: number of likes in the

company page. When the company had two or more

pages, we considered the pages with more

followers.

V6 – Twitter followers: the number of followers

of the company Twitter account. The same

procedure used for Facebook was used for Twitter

in the case of multiple accounts.

The marketing executives cited the

importance of the volume of buzz and the feelings

expressed in the posts. However, we did not include

these variables due to the difficulty in monitoring

them. Interviews with social media researchers

indicated that a reliable monitoring of the posts

would encompass the buying of an enormous

volume of data and a task force to classify the posts

by feeling. Considering the volume of posts for the

banking industry, almost 1 million per month, this

ICE-B2015-InternationalConferenceone-Business

82

monitoring was not possible for the scope of this

study. However, we included the variable searches

in Google to indicate the brand recall (Kaushik,

2012):

V7 – Searches in Google: the number of brand

searches performed in Google by internet users.

This variable may also be a proxy for the buzz,

because it can capture social phenomena with

precision, being used even to forecast 7 to 10 das

before conventional centers (Carneiro &

Mylonakis, . When some topic is broadly

commented on social media, the same trend can be

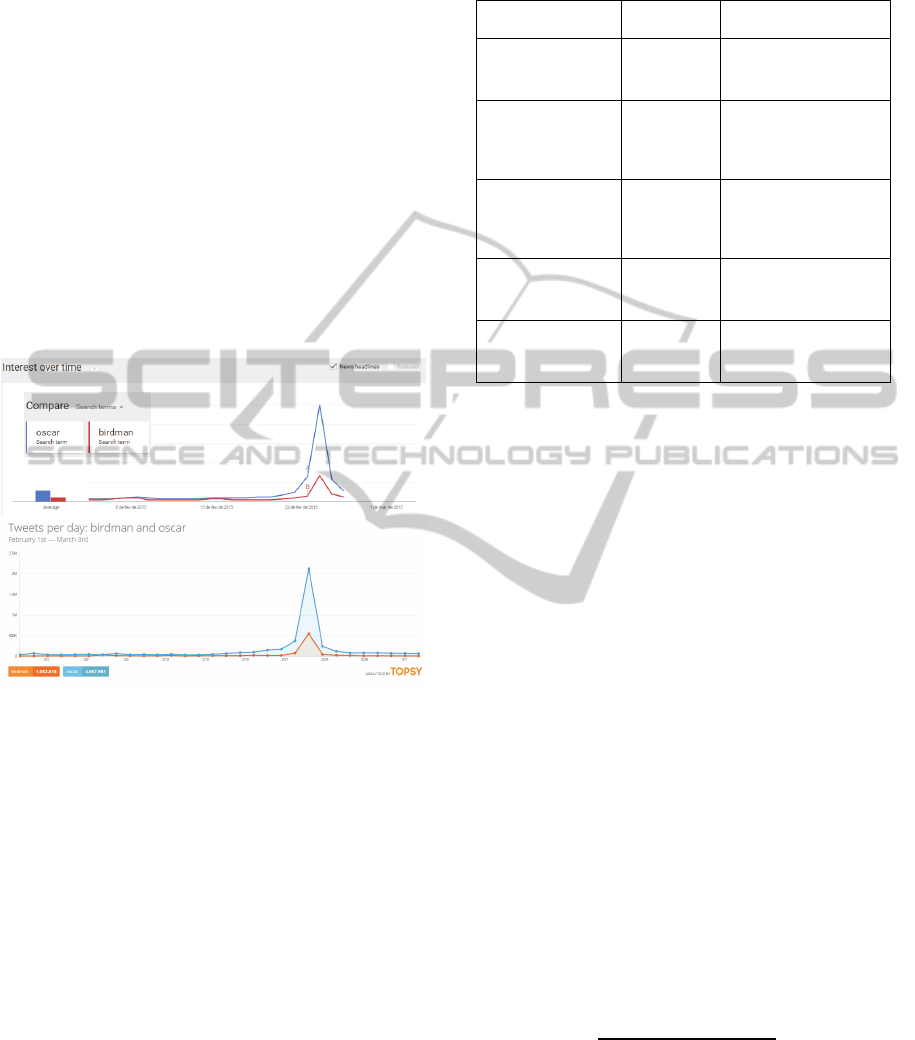

noted on Google. For example, comparing the

Oscar related terms, the Oscar 2015 winner

“Birdman”, and the term “Oscar” on google

searches and tweets (Topsy, 2015), we see similar

trends (Figure 1).

Figure 1: Google searchs monitored by Google Trends and

Tweets by Topsy for the terms “Birdman” and “Oscar”

We tracked these 7 variables for 9 months from

January 2014 to September 2014. Although we have

data from the entire 2014, the Brazilian Central Bank

provided data until the quarter closed on September

2014. Table 1 shows the way the data was collected

and consolidated, each variable has an specific

periodicity, points of measure, and aggregation. For

example, the number of visits is collected monthly

counting 9 points of measure from Jan/15 to Sep/15,

the average of these points is variable 3 – Average

number of visits per month. The Brazilian Central

Bank shows the results of the 50 largest banks, from

the original list we excluded the banks that had no

digital presence data or those that missed too many

data in the nine months. The final list contains 12

banks.

After data consolidation, we performed the

multivariate analyses using the SPSS software. We

used statistic descriptive analyses calculating the

Table 1: Summary of earned, owned and paid media

variables.

Variable Data source Consolidation

procedure

B1 Net Profit

B2 Total assets

B3 Total deposits

Central

Bank of

Brazil

Periodicity: quarterly

Points of measure: 3

Agregation: sum

V1 Media

Investment

V2 Media

impressions

ComScore Periodicity: monthly

Points of measure: 9

Agregation: sum

V3 Average visits

per month

V4 Visits per

visitor

ComScore Periodicity: monthly

Points of measure: 9

Agregation:Average

V5 Facebook likes

V6 Twitter

Followers

Social

Bakers

Periodicity: daily

Points of measure: 1

Agregation: None*

V7 Searches in

Google

Google

Trends

Periodicity: daily

Points of measure: 270

Agregation: Average

Bn (Independent variables)

Vn (Dependent variables)

* Registered only the last day of year representing the total of

likers/followers of the page/profile

correlation matrix. We also tried to produce a

regression analysis; however, we did not achieve

trustworthy results in the regression due to the limited

sample of 12 companies.

4.3 The Digital Presence Index (DPI)

To answer the third question “Is it possible to

consolidate these variables in a DPI representing the

competitive advantage of banks?”, we create an

equation to calculate the DPI. This equation combines

the performance of the bank in each variable (Pnx)

with the weight of the variable (Wn). We calculated

the bank performance for each variable using

equation 1. The weight of the variables is the average

of the correlations of the 3 business results variables.

The weights are balanced so that the DPI result varies

from 0 to 10 (equation 2). We learned with the

executives that an index from 0 to 10 is easier to

communicate, perhaps because of a similarity to a

school grade. Other advantage, by maintaining the

index within a range, it is easier to compare the

present result with a time series.

Pnx

Vnx

Max

Vn

Min

Vn

(1)

Pnx: Performance of variable n for bank x

Vnx: Value of variable n for bank x

Vn: Variable n

TheImpactofDigitalPresenceonCompetitiveAdvantage-AStudyAppliedtoBrazilianBankIndustry

83

DPIx

∑

10

∑

(2)

DPIx: Digital Presence Index of bank x

Wn: Average of the correlation of Vn to R1, R2, R3

Figure 2 summarizes the method to calculate the DPI.

For a better visualization of the competitive

advantage of a bank, we propose to plot the data in an

importance-performance matrix to exploit the

performance and relevance of each variable.

5 RESULTS

5.1 Multivariate Analyses

To validate the relationship between the digital

presence variables (Vn) and business results variables

(Bn), we considered the following assumptions for

the Pearson correlation test:

• Null hypotesis (H0): there is no correlation

between the variables.

• Alternative hypotesis (H1): there is a

significative correlation.

Figure 2: The DPI calculation.

The Pearson correlation indicates strength and

direction of (positive or negative) of the correlation,

the correlation value can vary from -1 to 1. For

example, a correlation of 0,943 between V3 -

Average number of visits per month and the variable

B2 – Total Assests is very strong, because the value

is close to 1.

The Sig. (2-tailed) is the probability in which you

would see a correlation of this size just by chance. If

the Sig. (2-tailed) is less than 0.05, it means that the

correlation is significant at the 0.05 level. We

consider only correlations with Sig. (2-tailed) less

than 0.05, because smaller values indicates more

confidence.

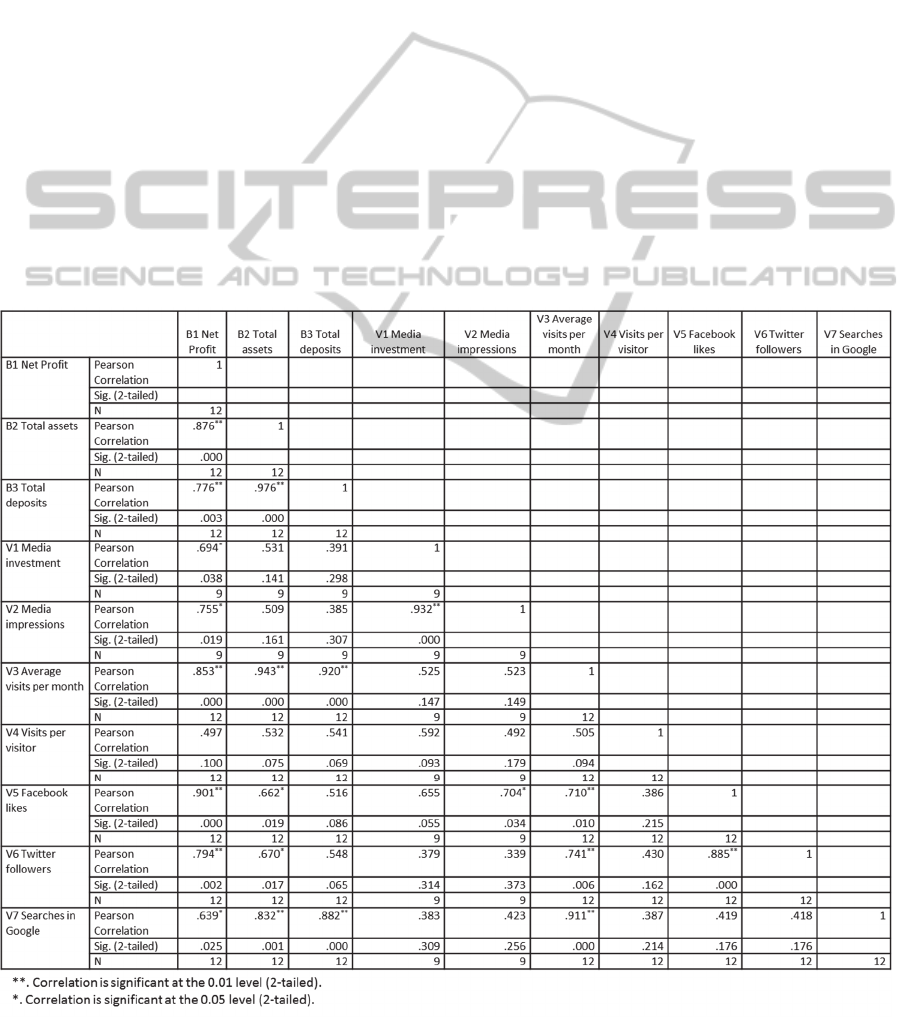

The correlation matrix (table 2) shows the value

of the Pearson correlation and the Sig. (2-tailed) for

each pair of variables. The N value indicates the

considered sample with valid values.

The “B1 – Net Profit” variable correlates with all

the Digital Presence values with the exception of “V4

– Average number of visits per visitor”. It could

indicate that returns to the website could not be so

important to net profit. On the other hand, the

remaining 6 digital presence variables have a strong

relationship with profits indicating the digital

presence is crucial for the net profit in every channel:

paid, owned and earned. “V5 – Facebook likes”

represents the strongest relationship (0.901), altought

it is considered by literature as an owned channel

(Corcoran, 2009), the Facebook likes may indicate a

good brand reputation as the user demonstrates his

appreciation by liking the Facebook brand page. “V3

- Average number of visits” has the second highest

correlation (0.853), indicating that high audience is

important for business. “V6 – Twitter followers” has

the third highest correlation (0.794), maybe by the

same reasons of the correlation of “V5 – Facebook

likes” because the variables are very similar. “V2 –

Media impressions” has a correlation of 0.782,

problably because campaign efforts bring more visits,

and more visits are correlated with more profits. “V1

Media Investment” and “V7 Searches on Google”

have high correlations, but not at the same level of the

variables mentioned before.

Variables “B2 – Total Assets” and “B3 - Total

Deposits” have a strong relationship with “V3 –

Average visits” as expected beause a large audience

means more operations and consequently more

deposits, more assets and more profits. However, the

correlations of “V7 – Searches on Google” with B2

and B3 (0.832 and 0.882) are slightly different from

the correlation from V7 to “B1 – Net Profit” (0.639).

It could mean that brand recall on Google (Kaushik,

2012) is very relevant for new businesses (total

deposits) and consequently for total assets, as B2 and

B3 are closely correlated (0.976).

5.2 DPI Calculation

As exposed in the methodology, the next step is the

DPI calculation. The DPI is based on the weight and

performance of each variable. The weight is

ICE-B2015-InternationalConferenceone-Business

84

proportional to the variables correlation with business

results (table 2). The bank performance is comparable

to the performance of its competitors.

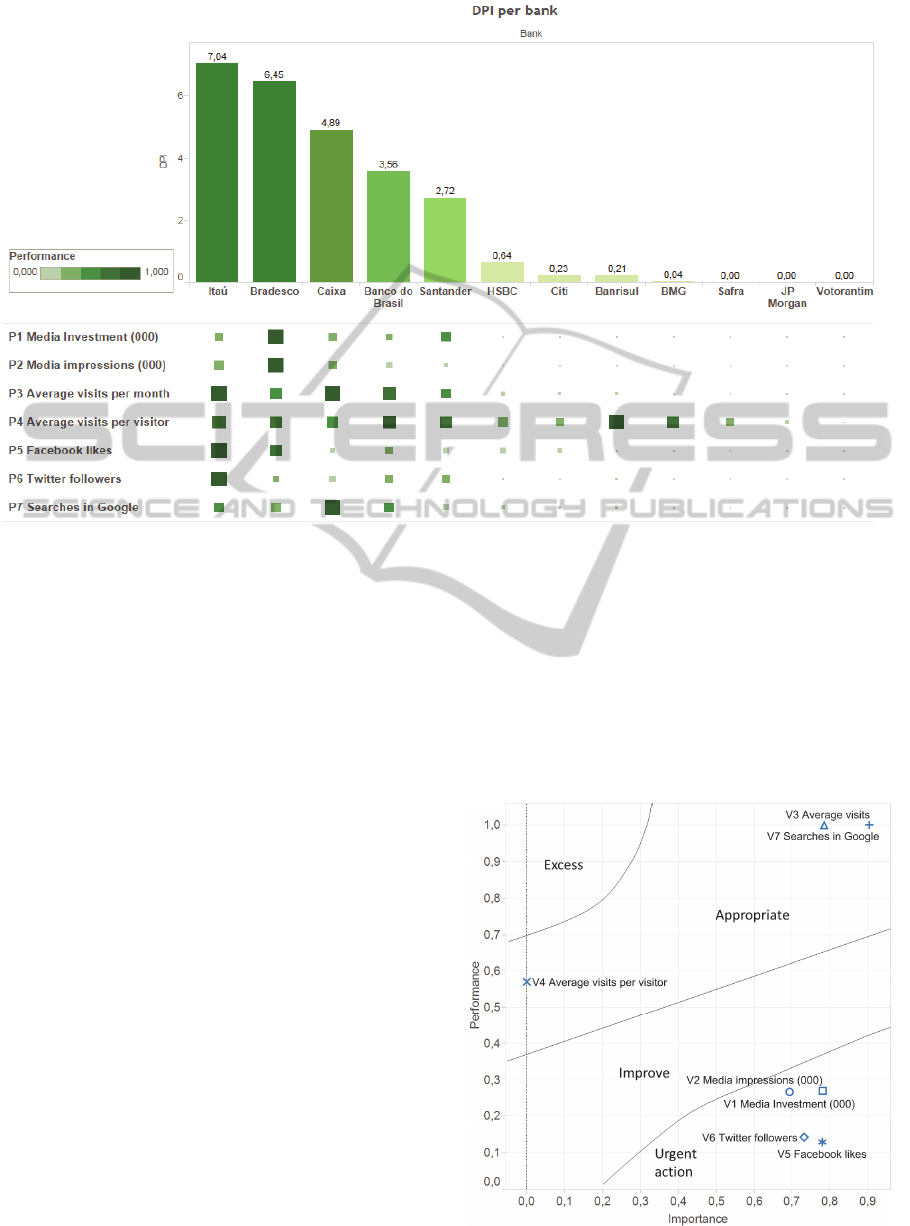

The DPI demonstrates the ranking of the digital

presence of banks with grades from 0 to 10. Each

grade is detailed in the 7 variables that measure the

digital presence . The colors expose the performance

of the banks and ease the visualization of a

comparative picture (figure 3).

Itaú is the first bank in digital presence followed

closely by Bradesco. Caixa, Banco do Brasil and

Santander compose an intermediary set. The other

banks had DPI’s lower than 1. This classification

illustrates the concentrated competitive scenario of

Brazilian banks.

The DPI can be updated every month because

some variables have monthly consolidation (table 1).

The dynamic process of monitoring and continuous

improvement of digital variables can contribute to

competitive advantage.

5.3 The Importance-performance

Matrix

In order to produce a clear picture of the DPI

contribution to competitive advantage we used the

classic reference of the importance-performance

matrix used in relavant fields as marketing (Martilla

and James, 1977) and operations management (Slack,

1994).The matrix explores the DPI of each bank,

presenting the importance of each variable and the

performance based on a comparative evaluation.

To illustrate the matrix application, we used the

example of “Caixa Econômica Federal”, a

government bank simply referred to as Caixa. The

majority of variables are on the urgent actions region

(figure 4). Variables related to social media followers

and likers (v5 and V6) are important and low

performance, so are the variables related to

campaigns (V1 and V2); it suggests improvements in

social media management and the necessity of best

investments in paid media. On the other extreme, “V3

Table 2: The correlation matrix of digital variables and business results.

TheImpactofDigitalPresenceonCompetitiveAdvantage-AStudyAppliedtoBrazilianBankIndustry

85

Figure 3: The DPI ranking of Brazilian banks.

Average visits” and “V7 Searches on Google” are in

the appropriate area, because these are important

high-performance variables comparable to the other

banks. However, the performance of “V4 Average

number of visits per visitor” is not so good, it is also

plotted in the appropriate region because of its low

importance to the DPI model; actually, the correlation

of this variable with business results has a low level

of confidence. As we can see, the matrix can be used

as a practical tool to help executives in the decision-

making process to improve the digital presence.

6 CONCLUSIONS

The DPI was calculated based on two factors: (i) the

correlations of each variable to business results

(Table 2); (ii) the performance of each company

compared to the other players.

The high correlations observed were expected due

to previous studies (Westerman et al. 2012; Pauwels

et al. 2012). The impact of digital presence on

business results is especially noted on banking

because of the high digital maturity of this market

(Westerman et al. 2012).

However, these results must be observed with

caution because only one industry was analysed

encompassing 12 companies. We intend to develop

further studies including other industries to reach

more consistent results, preferable, industries

combining large, medium and small companies, to

observe the importance of digital variables in

different sizes of business. The data collection must

be broadened to include buzz monitoring and other

social media sites like youtube and Instagram. Some

procedures must also be implemented to avoid

counting fake users of social media.

Figure 4: The importance-performance matrix.

ICE-B2015-InternationalConferenceone-Business

86

Although the necessary improvements, the study

verified the possibility to calculate a Digital

Performance Index for the banking industry. It is a

contribution to the decision-making process because

consolidate the diversity of variables in a unified

index. On the other hand, the DPI shows the perform

of each variable comparatively to competitors.

Complementary, the importance-matrix (figure 4)

showed a clear vision of the digital variables that must

be prioritized.

ACKNOWLEDGEMENTS

We thank the Center for Higher Studies of ESPM

(CAEPM) for sponsoring this research.

REFERENCES

Carneiro, H. A.; Mylonakis, E. Google Trends: A Web-

Based Tool for Real-Time Surveillance of Disease

Outbreaks. Clinical Infectious Diseases, V.49, No. 10,

pp. 1557-1564.

ComScore, 2014. 2014 Future Digital in Focus. Available

at http://pt.slideshare.net/jacquelinee/2014-brazil-

digitalfutureinfocuspt, accessed: Mar, 01, 2015.

Corcoran, S. 2009. Defining Earned, Owned and Paid

Media. Forrester Blog. Available at

http://blogs.forrester.com/interactive_marketing/2009/

12/defining-earned-owned-and-paid-media.html,

accessed: Jan, 13, 2015.

Davenport, T. H.; Harris, J. G. 2007, Competing on

Analytics: the new science of winning. Harvard

Business School Press. Boston, 1

st

edition.

Exame 2014. Os 50 maiores bancos do Brasil em 2013,

Exame.com. Available at http://exame.abril.com.br/

revista-exame/noticias/os-50-maiores-bancos-brasil-

em-2013, accessed: Jan, 12, 2015.

Febraban, 2014. Pesquisa FEBRABAN de Tecnologia

Bancária 2013. Available at

http://www.febraban.org.br/7Rof7SWg6qmyvwJcFwF

7I0aSDf9jyV/sitefebraban/RPSP-6021-

14%20FEBRABAN_Pesquisa%20Tecnologia%20Ban

c%E1ria_2013%207.5.2014_vf.pdf, accessed: Jan, 12,

2015.

Goes, P. B. 2014. Big Data and IS Research, MIS Quarterly,

(38:3), pp. 3-8.

Haj-Bolouri, A.; Flensburg, P.; Svensson, L. 2014,

Conceptualizing the Essence of Presence in Distance

Education through Digital Dasein. Proceedings of E-

Learn 2014, New Orleans. Available at

http://www.editlib.org/p/148904/proceeding_148904.p

df/. Accessed: Jan, 13, 2015.

Harrison, F. 2013. Digging deeper down into the empirical

generalization of brand recall: adding and Earned

Media to Paid-Media Touchpoints. Journal of

Advertising Research, Jun., pp.181-185.

Ibope, 2014. Categorias – 30 maiores – 1º semestre.

Available at http://www.ibope.com.br/pt-

br/conhecimento/TabelasMidia/investimentopublicitari

o/ Paginas/CATEGORIAS---30-MAIORES---1%C2%

BA-SEMESTRE-2014.aspx, accessed: Jan, 13, 2015.

Johnson, R. A., Wichern, D.W. 2002. Applied Multivariate

Statistical Analysis, Prentice Hall, New Jersey.

Kaushik, A. 2007. Web Analytics: An Hour a Day. Wiley

Publishing, Indianopolis, 1

st

edition.

Kaushik, A. 2012. Excellent Analytics Tip #20: Measuring

Digital "Brand Strength", available at.

http://www.kaushik.net/avinash/analytics-measuring-

digital-brand-strength/, accessed in Mar, 03, 2015.

Krombholz, k.; Merkl, D.; Weippl, E. 2012. Fake identities

in social media: A case study on the sustainability of the

Facebook business model. Journal of Service Science

Research, V.4, No.2, pp. 175-212.

Martilla, J.A.; James, C.J. 1977. Importance-Performance

Analysis. Journal of Marketing, V. 41, No. 1 Jan., pp.

77-79.

Pauwels, K.; Srinivasan, S.; Rutz, O.; Bucklin, R. 2012. The

Hierarchy of Effects HOE Meets Paid, Earned, and

Owned POE: How Do Internet Media Work to Drive

Brand Sales?, Working Paper, Boston University.

Available at http://pages.stern.nyu.edu/~atakos/

MMP2P/presentations/ssrinivasan.pdf in Jan, 1th,

2015.

Porter, M., 2001, Strategy and the Internet. Harvard

Business Review, (79:3), pp.63-78.

Slack, N. 1994. The importance-performance matrix as a

determinant of improvement priority. International

Journal of Operations and Production Management,

(14:5), 59–75.

Topsy, 2015. Search and Analyze the Social Web. Available

at http://topsy.com/, accessed: Mar, 03, 2015.

Thibeault, J. 2012. What is a digital presence? In the

limelight blog. Available at http://blog.limelight.com/

2012/07/what-is-a-digital-presence, accessed: Jan, 13,

2015.

Westerman, G,; Tannou, M.; Bonnet; D.; Ferraris, P., 2012;

McAfee, A. The Digital Advantage: How digital

leaders outperform their peers in every industry.

Capegimi.com. Available at https://www.capgemini.

com/resource-file-access/ resource/ pdf/ The_Digital_

Advantage__How_Digital_Leaders_Outperform_their

_Peers_in_Every_Industry.pdf, accessed: Mai, 26,

2015.

TheImpactofDigitalPresenceonCompetitiveAdvantage-AStudyAppliedtoBrazilianBankIndustry

87