Online Banking Security and Usability

Towards an Effective Evaluation Framework

Mansour Alsaleh

1

, Abdulrahman Alarifi

1

, Ziyad Alshaikh

1

and Mohammad Zarour

2

1

King AbdulAziz City for Science and Technology, P.O. Box 6086, Riyadh 11442, Saudi Arabia

2

Prince Sultan University, College of Computer Science and Information System,

Rafha Street, P.O Box 66833, Riyadh 11586, Saudi Arabia

Keywords:

Security and Usability Evaluation, Online Banking, Online Consumers Trust.

Abstract:

Convenience and the ability to perform advanced transactions encourage banks clients to use online banking.

As security and usability are two growing concerns for online banking users, banks have invested heavily

in improving their web portals security and user experience and trust in them. Despite considerable efforts

to evaluate particular security and usability features in online banking, a dedicated security and usability

evaluation framework that can be used as a guide in online banking development remains much less explored.

In this work, we first extract security and usability evaluation metrics from the conducted literature review.

We then include several other evaluation metrics that were not previously identified in the literature. We argue

that the proposed online banking security and usability evaluation frameworks in the literature in addition to

the existing standards of security best practices (e.g., NIST and ISO) are by no means comprehensive and lack

some essential and key evaluation metrics that are of particular interest to online banking portals. In order to

demonstrate the inadequacy of existing frameworks, we use some frameworks to evaluate five major banks.

The evaluation reveals several shortcomings in identifying both missing or incorrectly implemented security

and privacy features. Our goal is to encourage other researchers to build upon our work.

1 INTRODUCTION

Internet technologies have experienceda rapid growth

over the last decades, as it became a major element

in almost every business. One of the most impor-

tant developments in this aspect is the banking in-

dustry. Online banking is a new business model and

development direction in banking industry in which

fixed operating costs are decreased by providing un-

interrupted set of banking services (YeeLoong Chong

et al., 2010). Online banking is expected to grow due

to the dramatical increase in using e-commerce ap-

plications in businesses by Internet users (Laukkanen

et al., 2008). Through online banking, banks compete

to increase loyalty of customers, gain a bigger share

of the market, improve services, provide value added

services, increase efficiency and decrease operational

cost (Lichtenstein and Williamson, 2006).

Most banks in the world provide online banking;

providing their customers with the ability to access

their bank accounts and make transactions anytime

and anywhere. Banks have been able to reach out

to millions of customers through online banking and

offer more products and a relatively better, conve-

nient and flexible banking experience relative to tra-

ditional, fixed-location branches. On the flip side, on-

line banking has revealed a set of security threats and

privacy concerns that can endanger the use of such fi-

nancial services (Weir et al., 2010) (Mannan and van

Oorschot, 2008). While most banks claim secure and

easy access through their websites to clients’ accounts

where they can perform most of their daily transac-

tions online, the balance between practical security

and reasonable usability of online banking is consid-

ered to be a vital question (Casalo et al., 2007).

Sixty-eight percent of consumers with regular In-

ternet access and a bank account used online banking

in the year prior to March 2012. New figures released

by Financial Fraud Action UK (FFA UK) show an in-

crease by 3 percent in online banking fraud in the UK

during 2013. Most online banking fraudsters are lo-

cated overseas which even harden more the way of

hold them accountable for their activities (Aladwani,

2001).

In this paper, we investigate existing frameworks

for evaluating online banking security and usability.

141

Alsaleh M., Alarifi A., Alshaikh Z. and Zarour M..

Online Banking Security and Usability - Towards an Effective Evaluation Framework.

DOI: 10.5220/0005493901410149

In Proceedings of the 11th International Conference on Web Information Systems and Technologies (WEBIST-2015), pages 141-149

ISBN: 978-989-758-106-9

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

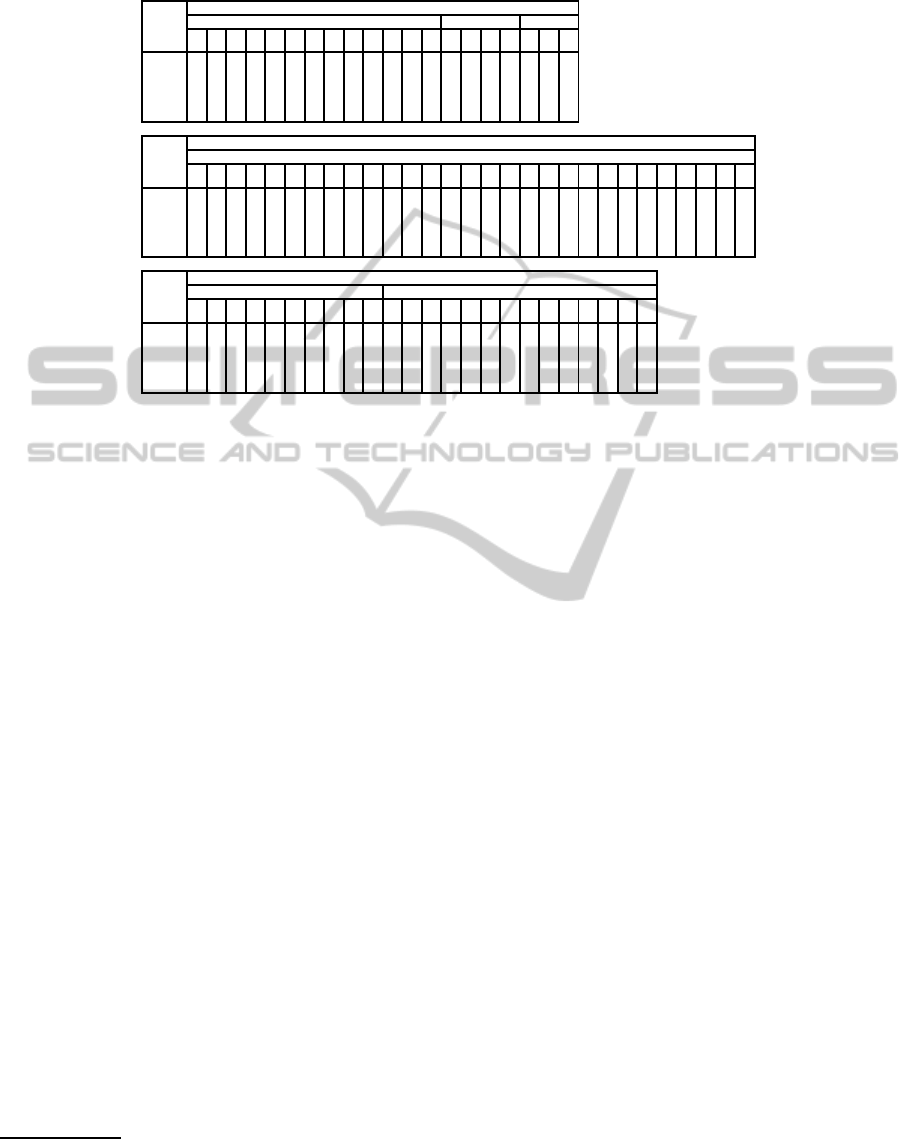

Table 1: Number of metrics for each security category.

Category Num. of

Metrics

1 General online security and privacy informa-

tion to the Internet banking customers

13

2 IT assistance, monitoring and support 4

3 Bank site authentication technology 3

4 User site authentication technology 29

5 Internet banking application security fea-

tures

10

6 Software and system requirements and set-

tings information

14

Table 2: Number of metrics for each usability category.

Category Num. of

Metrics

1 Interface 22

2 Navigation 23

3 Content 22

4 Services Offered 11

5 Reliability 8

6 Technical Aspects 2

7 Multi-factor Authentication Methods 9

We combine a set of frameworks that examine the re-

lated security properties in the following: (1) losses

compensation; (2) security monitoring, support, and

awareness; (3) authentication and encryption mech-

anisms; and (4) Internet banking application secu-

rity features. We also include those that examine the

related usability properties including: (1) interface;

(2) navigation; (3) content; (4) offered services; (5)

registration and transaction procedure; and (6) multi-

factor authentication methods. We argue that the pro-

posed online banking security and usability evalua-

tion frameworks in the literature in addition to the ex-

isting standards of security best practices (e.g., NIST

and ISO) are by no means comprehensive and lack

some essential and key evaluation metrics that are

of particular interest to online banking portals. We

demonstrate the inadequacy of existing frameworks

through evaluating five large international banks us-

ing a combination of some of these frameworks. Our

examination of the security properties is limited to

only the front-end interface of the online banking

portal as we do not have access to the back-end se-

curity mechanisms. The evaluation reveals several

shortcomings in these frameworks in identifying both

missing or incorrectly implemented security and pri-

vacy features.

We hope to inspire additional research efforts ad-

dressing the difficult problem of how to establish and

maintain a comprehensivesecurity and privacyframe-

work that can be used not just for the evaluation of

existing online banking portals, but also during the

design and development phases. We anticipate that,

should it be built particularly for online banking, a

carefully thought-out security and privacy framework

will not just enhance usability and security and elim-

inate many forms of fraud but it will also help online

clients to trust with confidence these services.

The remainder of the paper is organized as fol-

lows. In the next section, we present an online bank-

ing security and usability evaluation framework ex-

tracted from state-of-the-art evaluation metrics in the

literature. Section 3 provides an illustrative example

that first shows a comparative analysis of the security

and usability of the five examined banks using our

framework and then identifies the framework short-

comings. Section 4 provides further discussion and

concludes.

2 ONLINE BANKING SECURITY

AND USABILITY EVALUATION

FRAMEWORK

Including several evaluation metrics that were not

previously identified in the literature, we built

our framework on top of the Internet bank-

ing security checklist proposed by Subsorn and

Limwiriyakul (Subsorn and Limwiriyakul, 2011).

We have also included key usability features from

MoBEF, a banking portal evaluation framework(Zari-

fopoulos and Economides, 2009). The resulted

framework captures the most important features for

secure yet usable online banking. It considers all the

important factors from the first visit to the site, to the

registration process, authentications methods and up

to the completion of the transaction.

The framework consists of two large sets of met-

rics for (1) security evaluation; and (2) usability eval-

uation. The metrics are extracted and derivedfrom the

literature as well as several new ones. While we tried

to collect the best available evaluation approaches, we

believe that the resulted framework is by no means

comprehensiveand lacks some essential and key eval-

uation metrics that are of particular interest to online

banking portals.

2.1 Security Evaluation Metrics

The security evaluation part of the framework con-

sists of 73 metrics which are categorized into 6 main

categories (see Table 1). The framework examines

the current confidentiality policy that banks provide to

their clients. The provided information to the Internet

banking customers to increase their awareness of the

possible cyber attacks are evaluated in the framework.

It also examines the bank current guarantee policy in

which the bank is obliged to cover any losses in case

of unauthorized transactions committed by someone

WEBIST2015-11thInternationalConferenceonWebInformationSystemsandTechnologies

142

other than the customer, using the customer’s online

banking account. Furthermore, the security evalua-

tion part of the framework verifies the availability of

IT hotline and helpdesk services. Ideally, the banks

must provide various modes of communication with

their online banking clients.

The framework involves the identification of the

deployed authentication technology in the web por-

tal (i.e., login mechanism, login requirements, login

failure limitation, and transaction verification) and

the characteristics of the secure connection between

a client’s host and the bank server. The framework

also inspects whether the bank supports multi-factor

authentication and their ability to guarantee high level

of identity confirmation.

Internet banking applications are also examined

against a set of metrics that are intended to mitigate

the risk of security breaching and remote malicious

attacks, such as worms and viruses. For example, au-

tomatic timeout for inactivity is one of the examined

security features that sets a default inactivity period

after which the online client is logged off. Session

management is also evaluated from the perspective of

securing transactions execution during online bank-

ing sessions (e.g., session tokens, page tokens tech-

nologies, and deleting the corresponding cookie in-

formation in the user browser after the client logs off

or closes the Internet browser). In order to mitigate

the risk of impersonation attacks, the default allow-

able transfer amount should be limited and tied with

an additional factor authentication (e.g., PIN verifica-

tion through SMS).

In addition, the framework also examines the bank

portal support for various Internet browsers, the pro-

vided OS and browser settings by the banks for op-

timum and safe usage, and if there is any provided

Internet security software to the bank clients in order

to protect their machines. A summary of the metrics

used in the security evaluation part of the framework

is given in Table 1. Detailed description of the used

metrics is given in Table 5 in Appendix A.

2.2 Usability Evaluation Metrics

The usability of security features in online banking

is a key factor for their effectiveness in performing

the intended objectives. Unfortunately, many secu-

rity solutions place usability considerations as a sec-

ond priority as developers might not recognize the

tight relationship between them (Gutmann and Grigg,

2005) (Seffah et al., 2006) (Braz et al., 2007).

The usability evaluation part of the framework

inspects various key usability aspects of the online

banking web portal including interface, navigation,

content, service offered, reliability, authentication

methods and others (see Table 2 for a summary of

the used usability metrics; detailed description of the

used metrics is given in Table 6 in Appendix A). The

interface is evaluated against several design princi-

ples in order to maximize user task completion and

minimize interfering. Also, the framework examines

criteria related to the effective use of color, graph-

ics, and multimedia. Furthermore, it examines the

right use of the text and language, and the web pages’

adjustment to various situations. Navigation through

the online banking application is also evaluated from

convenience and easiness perspectives. For example,

the site organization, menus, site map and effective

search engine are all important factors as users should

easily navigate the site and find exactly what they are

looking for.

The content of banking web applications play an

important role in respect to usability. Information

about available banking services must be comprehen-

sive and clear. The web application should provide

sufficient recent information not only about financial,

accounting, and investment issues but also about tech-

nical requirements in accessing and using the site. Fi-

nally, the system must provide detailed technical help

for both expert and novice users. Beside the content,

it is important that the bank web application provides

multiple services and transactions types.

In general, the framework focuses on the usabil-

ity of security features such as the usability of the

deployed authentication and verification mechanisms.

While we include mainly security and usability met-

rics, the framework also examines: (1) the reliability

of the registration process and the transaction proce-

dure; and (2) the continuous availability of the online

banking services.

3 CASE STUDY: RESULTS,

ANALYSIS, AND IDENTIFIED

SHORTCOMINGS IN THE

FRAMEWORK

In this section, we apply the modified version of the

framework (see Sections 2.1 and 2.2) to evaluate the

security and usability of online banking for five large

banks in the MENA region (see Tables 3 and 4 for the

results of evaluating the five banks using our frame-

work, for the security and usability parts, respec-

tively). We start by opening chequing accounts in

these selected banks and then collect the related user

guides and information from the banks’ web portals.

We evaluate each bank against these metrics and com-

OnlineBankingSecurityandUsability-TowardsanEffectiveEvaluationFramework

143

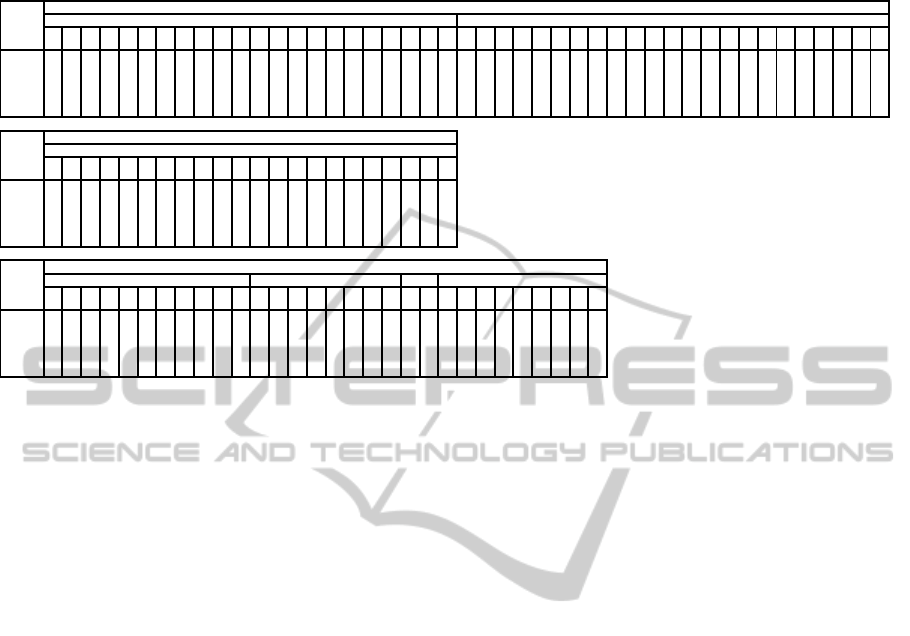

Table 3: The results of evaluating the five banks using the security part of the framework, where ni=no information, y=yes,

and n=no; Table 5 in Appendix A explains the corresponding metrics in each category

Banks

Categories

1 2 3

1.1

2.1

2.2

2.3

2.4

2.5

3.1

3.2

3.3

3.4

3.5

3.6

3.7

1.1

1.2

1.3

1.4

1.1

1.2

1.3

A y n y n n n n 1 1 0 5 3 5 y n y 0 y y y

B y n ni n n n y 5 5 0 5 5 5 y n n 2 y y y

C y n y n n n y 5 5 0 5 5 5 n y y 5 y y y

D y y n n n n ni 4 5 0 5 4 5 y n y 4 y y y

E y n y n n n y 3 3 0 5 5 3 y n y 3 y y y

Banks

Categories

4

1.1

1.2

1.3

1.4

2.1

2.2

2.3

2.4

2.5

2.6

3.1

3.2

4.1

4.2

4.3

4.4

4.5

4.6

4.7

5.1

5.2

5.3

5.4

5.5

5.6

5.7

6.1

6.2

6.3

A y y y n n y n y n y y n y y y n n n y y y n n n n n y y y

B y y n n n y n y y y y n y y y y n n y y y n y n n n y y y

C y y n n n y n y y y y n y y y n n n y y n y y n n n n y n

D y y n n n y n y y y y y y y y y n ni n y ni n ni n n n ni y ni

E y y n n n y n y y y y y y y y n n n n y y n n y n y y y n

Banks

Categories

5 6

1.1

1.2

2.1

2.2

2.3

3.1

3.2

3.3

3.4

3.5

1.1

1.2

1.3

1.4

1.5

1.6

2.1

2.2

2.3

2.4

3.1

3.2

3.3

3.4

A y y ni ni y n y y n n ni ni y ni ni ni n y y n n n n n

B y y ni ni y n y n n ni ni ni ni ni ni ni n ni n n n n n n

C y n ni ni y n y n y y y ni y ni ni y n y n n y n n n

D y y ni ni y n y n ni ni y y y ni y y y y n n n y n y

E y y ni ni y n y y y n y ni y ni ni y n ni n n y n n y

pare the banks against each other.

Although, the five banks have shown compliance

with the national privacy principles and laws as well

as the customer protection code; all the five banks are

not liable for any claim, loss, expense, delay, cost or

damage arising from or in connection with any in-

struction, request, inquiry or transaction made or af-

fected where any user identification or password has

been or is purported to have been used by unautho-

rized persons. An exception is when the bank website

has been hacked or has been accessed by an unautho-

rized access, in which the bank will be obligated to

compensate the clients after investigating the corre-

sponding attack. We notice that only some banks pro-

vide sufficient necessary information about threats,

attacks, general online security guidelines, security

alert issues, and password security tips. However,

there are some technical terms in the webpages that

are intended for expert users only. Also, all banks

did not provide information about key logger for their

clients that can be used to steal user identification and

password.

All banks employed SSL protocol with extended

SSL validation certificate. The results show that all

five banks offer tokens or SMS for two-factor authen-

tication for signing in, where the user chooses the pre-

ferred way. However, no banks uses SiteKey

1

which

is mainly used to detect phishing attacks. The banks

apply restriction rules on the number of failed logins

to prevent unauthorized users from attempting online

password guessing attacks. In order to strengthen the

1

A web-based security mechanism that provides one

type of mutual authentication between end-users and web

servers

password strength in terms of length, complexity, and

unpredictability against online password guessing at-

tacks, all banks request that the users must choose a

minimum of 8 digits that include both characters and

numbers. However, strict password composition po-

lices on users were not applied (e.g., using combi-

nation of lower and upper case and forcing users to

change the password periodically).

When a user loses or forgets her password, the

banks vary slightly in their password recovery meth-

ods. Although most of the banks require the user

to use ATM card number, ATM PIN number, and/or

their national ID number to reset their passwords on-

line, some banks require more rigorous verification

steps for the password recovery (e.g., accessing an

ATM machine to reset the online banking password).

One bank sends an automatic generated verification

code to the user’s registered mobile number through

an SMS and then the user types this verification code

in the password reset form in the online banking site.

The banks provide additional security features to

mitigate the risk of unwanted transactions. For exam-

ple, all banks have an automatic timeout feature for

inactivity that ranges from 2 minutes to 15 minutes for

others. In terms of session management, all banks do

clear the cookie information after logging off or clos-

ing the Internet browser. Also, all banks have a lim-

ited daily transfer amount to third party accounts to

reduce the impact of unauthorized transactions. Fur-

thermore, the international transfer limit is much less

than the national transfer limit in some banks.

Banks are expected to provide their clients with

detailed information about the required software set-

tings and how to use the online banking portal in

WEBIST2015-11thInternationalConferenceonWebInformationSystemsandTechnologies

144

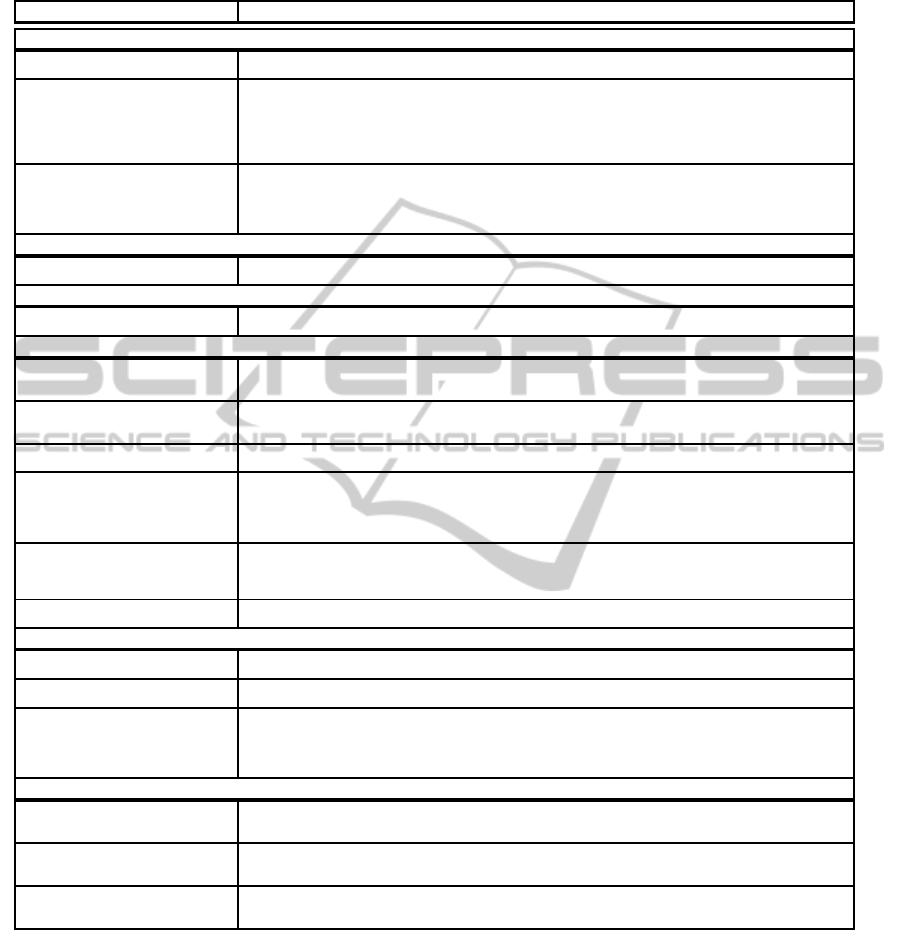

Table 4: The results of evaluating the five banks using the usability part of the framework, where ni=no information, y=yes,

and n=no; Table 6 in Appendix A explains the corresponding metrics in each category

Banks

Categories

1 2

1.1

1.2

1.3

1.4

1.5

2.1

2.2

2.3

2.4

2.5

3.1

3.2

3.3

3.4

3.5

3.6

4.1

4.2

4.3

4.4

4.5

4.6

1.1

1.2

1.3

1.4

1.5

1.6

2.1

2.2

2.3

2.4

2.5

3.1

3.2

3.3

4.1

4.2

4.3

4.4

5.1

5.2

5.3

5.4

5.5

A 5 5 5 5 5 4 5 y y y y y y y 5 5 y y n y n n 4 4 y y y y 5 4 5 y 4 4 y y 4 3 3 3 5 5 5 5 4

B 5 5 5 4 5 4 3 y y y y y y y 5 4 y y ni y n n 4 4 y y y y 5 4 5 y 3 4 y y 5 5 4 4 5 5 4 5 3

C 4 5 5 4 5 3 4 y n y y y y y 5 4 n y y y n n 4 3 y y y y 5 3 5 y 5 4 y y na na na na 5 5 5 5 3

D 5 5 5 4 4 3 4 y y y y y y y 5 5 y y ni y n n 4 4 y y y y 5 5 5 y 4 4 n y na na na na 5 5 5 5 3

E 4 4 5 4 4 4 4 y n n y y y y 5 4 n y ni y n n 4 3 y y y y 5 3 5 y 4 4 n y 5 0 0 0 5 5 4 5 3

Banks

Categories

3

1.1

1.2

1.3

1.4

1.5

2.1

2.2

2.3

2.4

3.1

3.2

3.3

3.4

4.1

4.2

4.3

4.4

4.5

5.1

5.2

5.3

5.4

A 3 5 2 3 y y y y y 4 y 5 5 y y y n 5 4 3 4 4

B 3 5 5 4 y y y y y 3 y 3 4 n y y n 4 2 4 3 5

C 5 5 5 4 y y y y y 3 y 4 5 y y n y 4 4 3 4 4

D 3 5 5 5 y y y y y 4 y 5 4 y y y y 4 3 4 3 3

E 5 5 5 4 y y y y y 4 y 4 4 y y y y 4 3 4 4 4

Banks

Categories

4 5 6 7

1.1

1.2

1.3

1.4

1.5

1.6

2.1

2.2

2.3

3.1

3.2

1.1

1.2

1.3

1.4

1.5

2.1

2.2

2.3

1.1

1.2

1.1

1.2

1.3

1.4

1.5

1.6

1.7

2.1

3.1

A 5 5 4 ni y n y y n y y 4 5 5 0 5 y y y 5 4 n y y y 2 5 y n 5

B 4 4 4 ni y y y y y y y 4 5 5 0 5 y y y 5 2 n y y y 3 5 y n na

C 5 5 5 y y y y y n y y 3 5 5 3 5 y y y 5 3 y n y y 2 5 y y na

D 5 5 5 ni y y y y y y y 5 5 5 5 4 y ni y 5 2 y n y y 2 5 y n 2

E 5 5 4 y y y y y n y y 4 5 5 5 5 y y y 5 4 y n y y 2 5 y n na

order to have a pleasant experience and to harden

their machines to become less vulnerable to security

breaches. Though, all the evaluated five banks did

not provide any information about operating system

requirements, security settings, and browser settings,

other than internet connection, and browser type with

the implicit assumption that the user knows how to

access and use the online banking safely. Some banks

offer their clients with links to download free/paid an-

tivirus and antimalware software.

From a usability perspective, the five banks have

followed good design principles in implementing

their we portals and have made an effective use of

white space, color, and graphics. Graphics and mul-

timedia are used moderately to make their websites

easier to navigate and more attractive without having

negative impact on loading time. Furthermore, the

banks show a consistent use of text and page format

as well as the use of plain language that users can un-

derstand. The pages capability to fit the browser win-

dow vary from one bank website to another; however,

printable versions of pages are available. Although

the banks offer their websites in two languages based

on the spoken languages in the corresponding hosted

country, unfortunately, their websites have not shown

any accommodation for users with special needs, nor

provided options for users with diverse levels of skill

and experience. The five banks’ websites can be in-

tuitively used by average users (e.g., the site map and

navigation bar). We also notice that some banks sep-

arate online banking pages from other bank informa-

tive (or non-functional) pages to simplify navigation.

Although the banks portals provide no broken links

or under-construction pages, good link labeling, clear

indicators of current position and an effective use of

frames, they either have failed to provide an effective

search feature or have no search feature at all.

The five banks have shown excellent scores in

providing information about their online services and

their charges, terms and conditions, and demo of on-

line services that shows how to use the bank’s site;

however, the user must go through various documents

to get all information. Also, the banks utilized their

online banking portals to effectively present adver-

tisements of their services and a controlled amount

of advertisements of other third-parties.

All the five banks have fairly simple registration

process and easy to use banking services as well as

excellent profile/account management. They provide

helpful tools and some extra services such as shop-

online and charities support. One of the banks re-

quires new users to visit an ATM machine or any

branch to verify her identity which negatively affects

the usability (although it increases the security of the

registration process). This is an example of the trade-

off between security and usability in which the evalu-

ation metrics in different frameworks may have nega-

tive relationship with each other. The five banks pro-

vide action history to view all the transactions.

Although several metrics have been evolved to

deal effectively with existing limitations in our pro-

posed framework, our study shows that the framework

needs further improvements. The framework must re-

flect a sound trade-off of having a secure and yet a us-

able portal. The existing framework does not provide

any prioritization for a long list of metrics in which

all of them are treated equally. Prioritization is essen-

tial for the decision makers to take the right steps to

improve their web services, find suitable remedies to

handle their weaknesses, and utilize their strengths.

OnlineBankingSecurityandUsability-TowardsanEffectiveEvaluationFramework

145

Prioritization also helps in establishing ranking lev-

els or classes of satisfaction levels that helps not just

in understanding the bank web portal current status

relative to other portals but also in encouraging the

bank to elevate to a more mature level through a set

of well-defined steps. The evaluation will be used as

an integral part of planning and hence should serve

their stakeholders. The evaluation framework should

be tailored to the evaluation purpose and stakehold-

ers intended objectives that include banks, customers,

and regulators. In fact, each evaluation framework

must have an associated set of well designed steps to

guide evaluation processes and activities.

Unfortunately, the current security and usability

frameworkneglects the web portal back-end solutions

which might play a key role in securing the online

banking services. The back-end solutions include the

adopted database servers, DMZ architecture, and core

network infrastructure components (e.g., firewall and

routers). All these solutions are integrated to form

the final system that provides the online banking ser-

vices to the customers. Furthermore, the used pro-

cesses during product and service development and

through service establishment, management, and de-

livery are not considered in the evaluation although

they are de facto components that affect the security

and usability of the final product or service. In short,

the framework is oriented towards the final product

rather than the used processes.

4 FURTHER DISCUSSION AND

FUTURE WORK

It is important to realize that the security and usabil-

ity are correlated and that it is preferable to evaluate

them as one block rather than separately in order to

capture their effects on each other. The evaluation

framework must be tailored to serve the needs of the

stakeholders without strong bias towards one over the

other. The stakeholders should be involve in all eval-

uation phases and should be part of any resolution.

Although such evaluations are considered milestones

for any quality improvement process, they should be

designed and tested within the quality improvement

process in order to ensure their coherence with other

parts in the process. With the online banking portals

evolving as an essential source for banking services

that are used by a majority of people, a more mature

security and usability evaluation framework is indeed

a necessity. In fact, in order to obtain an effective on-

line banking security and usability evaluation frame-

work, we need to leverage not just the existing frame-

works in the literature and the existing standards of

security best practices (such as NIST and ISO), but

also the feedback gathered by engaging the online

banking development and operational entities and the

corresponding stakeholders. Driven by the existing

needs and lessons learned from the conducted exper-

iment and the literature, we are looking to develop a

new effective and comprehensive framework that en-

compasses both essential and key evaluation security

and usability metrics.

ACKNOWLEDGEMENTS

We thank Mashael Almeatani, Nouf Alnufaie, Mona

Alsemayen, Njoud Alshehri, and Nora Alswailem for

helping in conducting the evaluation. We also thank

the anonymous reviewers for their comments which

helped improve this paper to its present form. This

work was supported in part by KACST.

REFERENCES

Aladwani, A. M. (2001). Online banking: a field study

of drivers, development challenges, and expectations.

International Journal of Information Management,

21(3):213–225.

Braz, C., Seffah, A., and M’Raihi, D. (2007). Designing

a trade-off between usability and security: A metrics

based-model. In Proceedings of the INTERACT07,

pages 114–126. Springer.

Casalo, L. V., Flavi´an, C., and Guinal´ıu, M. (2007). The

role of security, privacy, usability and reputation in the

development of online banking. Online Information

Review, 31(5):583–603.

Gutmann, P. and Grigg, I. (2005). Security usability. Secu-

rity Privacy, IEEE, 3(4):56–58.

Laukkanen, P., Sinkkonen, S., and Laukkanen, T. (2008).

Consumer resistance to internet banking: postpon-

ers, opponents and rejectors. International Journal of

Bank Marketing, 26(6):440–455.

Lichtenstein, S. and Williamson, K. (2006). Understanding

consumer adoption of internet banking: an interpre-

tive study in the australian banking context. Journal

of Electronic Commerce Research, 7(2):50–66.

Mannan, M. and van Oorschot, P. C. (2008). Security and

usability: the gap in real-world online banking. In

Proceedings of the 2007 Workshop on New Security

Paradigms, pages 1–14. ACM.

Seffah, A., Donyaee, M., Kline, R., and Padda, H. (2006).

Usability metrics: A roadmap for a consolidated

model. Journal of Software Quality, 14(2).

Subsorn, P. and Limwiriyakul, S. (2011). A comparative

analysis of the security of internet banking in aus-

tralia: A customer perspective.

WEBIST2015-11thInternationalConferenceonWebInformationSystemsandTechnologies

146

Weir, C. S., Douglas, G., Richardson, T., and Jack, M.

(2010). Usable security: User preferences for authen-

tication methods in ebanking and the effects of expe-

rience. Interacting with Computers, 22(3):153–164.

YeeLoong Chong, A., Ooi, K., Lin, B., and Tan, B. (2010).

Online banking adoption: an empirical analysis. Inter-

national Journal of Bank Marketing, 28(4):267–287.

Zarifopoulos, M. and Economides, A. A. (2009). Evaluat-

ing mobile banking portals. International Journal of

Mobile Communications, 7(1):66–90.

APPENDIX A

In this appendix, we give a detailed description of the

used security evaluation metrics (Table 5) and usabil-

ity evaluation metrics (Table 6).

OnlineBankingSecurityandUsability-TowardsanEffectiveEvaluationFramework

147

Table 5: The security evaluation part of the framework (most of the metrics are extracted from (Subsorn and Limwiriyakul,

2011))

Subcategory Metric

Category 1: General online security and privacy information to the Internet banking customers

1. Account aggregation or privacy

and confidentiality

1.1. Complied with the national privacy principles and privacy law

2. Losses compensation guarantee

2.1. Liability for any claim where the user identification or password used by unauthorized persons

2.2. Compensate client when bank website get hacked/unauthorized access

2.3. Compensate client when client computer get hacked/unauthorized access

2.4. Responsibility for losses or damages or expense incurred by the customer as a result of his

violation of the terms and conditions

2.5. Responsibility for all telecommunications expenses (internet services)

3. Online/Internet banking security

information that the banks provide

3.1. “Customer Protection Code” document by the country’s responsible authority

3.2. Threats: Hoax email, scam, phishing, spyware, virus and Trojan

3.3. Fraud Awareness 3.4. Key logger

3.5. General online security guidelines 3.6. Security alert/up-to-date issue

3.7. Provides Password security tips

Category 2: IT assistance, monitoring and support

1. Hotline/helpdesk service

availability

1.1. 24/7 customer contact center by phone 1.2. Not 24/7 customer contact center by phone

1.3. Messaging system (similar to an email) 1.4. FAQ/online support form

Category 3: Bank site authentication technology

1. Employed encryption and digital

certificate technologies

1.1. SSL encryption 1.2. Extended validation SSL certificates

1.3. Signing CA

Category 4: User site authentication technology

1. Two-factor authentication for

logon and/or for transaction

verification available

1.1. Tokens 1.2. SMS

1.3. SiteKey 1.4. Not in use

2. Logon requirements

2.1. Bank credit cards number 2.2. Bank register/customer ID

2.3. Email address 2.4. Password

2.5. Other ( e.g. personal code or security number) 2.6. Two-factor authentication

3. Logon failure limitation

3.1. Max. (times)

3.2. In use but does not specific maximum number of failure allowed

4. Password restriction/

requirement

4.1. Enforce good Password practice 4.2. Password length restriction (characters)

4.3. Combination of numbers and letters 4.4. Combination of upper and lower cases

4.5. Special characters

4.6. Different passwords as compared to any of previous used passwords

4.7. Automatically check password strength when creating or changing password

5. Password Recovery Method

(Using ATM card number and

PIN/username)

5.1. User ID, Card Number and PIN Number 5.2. Users can reset password online

5.3. Restore via ATM 5.4. SMS code

5.5. Answer Security Question 5.6. Restore via E-mail

5.7. Call customer service to complete this action

6. Transaction verification

6.1. All transactions required token/SMS 6.2. All external transactions required token/SMS

6.3. Other method e.g. password

Category 5: Internet banking application security features

1. Automatic timeout feature for

inactivity

1.1. Expiration time limit (Maximum minutes)

1.2. In use but does not specific maximum number of failure allowed

2. Session management

2.1. Session tokens 2.2. Page tokens

2.3. Clear session Cookie information after logoff or shut down the Internet browser

3. Limited default daily transfer

amount to third party

account/BPAY/ international

transactions

3.1. Less or up to 5,000 USD 3.2. More than 5,000 USD

3.3. The default maximum daily limit transfer is vary depend on the type of the Internet banking

customer

3.4. The maximum daily limit transfer may be increased with the approval by the banks

3.5. International transfer limit is different from the national transfer limit

Category 6: Software and system requirements and settings information

1. Compatibility best with the

popular Internet browsers (based

on the banks information provided)

1.1. Chrome 1.2. FireFox

1.3. Internet Explorer 1.4. Netscape

1.5. Opera 1.6. Safari

2. Internet banking user device

system and browser setting

requirement

2.1. Operating System 2.2. Type of browser

2.3. Browser setting 2.4. Screen resolution

3. Free/paid security software/tool

available to the Internet banking

customers

3.1. Antivirus/anti-spyware 3.2. Internet security suite

3.3. Browser setting

3.4. Provides Internet links to security software vendor(s)

WEBIST2015-11thInternationalConferenceonWebInformationSystemsandTechnologies

148

Table 6: The usability evaluation part of the framework (most of the metrics are extracted from (Zarifopoulos and Economides,

2009))

Subcategory Metric

Category 1: Interface

1. Design Principles

1.1. Home page is concise and clear 1.2. Effective use of white space

1.3. Effective and consistent use of color, color combination and backgrounds

1.4. Effective graphics

1.5. Aesthetics and Minimalist Design - apply appropriate visual representation of security elements and not provide

irrelevant security information

2. Graphics and

Multimedia

2.1. Site is visually attractive 2.2. Graphics and multimedia help the navigation

2.3. Icons are easy to understand 2.4. Not excessively used

2.5. No negative impact on loading times

3. Style and Text

3.1. Consistent use of pages style and format 3.2. Consistent use and easy to read fonts

3.3. Correct spelling and grammar 3.4. Text is concise and relevant

3.5. Purpose of site is made clear on home page

3.6. User Language - the use of plain language that users can understand with regard to security

4. Flexibility and

Compatibility

4.1. Pages sized to fit in browser window 4.2. Printable versions of pages are available

4.3. Text-only version is available 4.4. Options of many available languages

4.5. Accommodation made for users with special needs

4.6. User Suitability - provide options for users with diverse levels of skill and experience in security

Category 2: Navigation

1. Logical Structure

1.1. Intuitively progressing (proceeding) 1.2. Rational design of the content

1.3. Menus are understandable and straightforward 1.4. Sitemap is available

1.5. Consistent navigation throughout the site 1.6. Navigation bar is available

2. Ease Use of the Site

2.1. Easy to find the site 2.2. Easy to learn and navigate the site

2.3. Easy to use the navigation bar 2.4. Easy to return to main page

2.5. Easy to modify users settings

3. Ease Use of the

Online Banking Pages

3.1. Easy to access complete online banking range

3.2. Separation of online banking pages from the rest pages

3.3. Separation between individual and business customers, as well among various channels

4. Search Feature

4.1. Easy to use search engine 4.2. Search engine provides accurate and useful results

4.3. Good description of search engine findings 4.4. No search engine errors

5. Navigational

Necessities

5.1. No broken links 5.2. No under-construction pages

5.3. Links are clearly discernible, well labeled and defined 5.4. Clear label of current position on the site

5.5. Effective use of frames, non-frames version is available

Category 3: Content

1. Online Banking

Information

1.1. Full information about the purpose of each service 1.2. Full information about the charges

1.3. Terms and conditions are easily accessed 1.4. Full information about Technical Requirements

1.5. Familiarity programs and demo are available

2. Bank Information

and Communications

2.1. Full bank information is available

2.2. Different ways for communication with the banks employees are available

2.3. Telephone and fax numbers are available 2.4. Postal and physical addresses are available

3. Advertisement

3.1. Adequate advertisement of banks services 3.2. Controlled amount ofadvertisements by other companies

3.3. Careful advertisement use 3.4. Effective use of advertisement techniques

4. Website Users

Support

4.1. Feedback forms are available 4.2. Telephone and e-mail numbers for providing help

4.3. Round the clock support 4.4. Free or toll free telephone assistance

4.5. Security help are relevant and apparent to users

5. Competency of the

Provided Assistance

5.1. Detailed information about every step 5.2. Easily understandable assistance for amateur users

5.3. Assistance regarding settings is provided 5.4. Transaction guide is provided

Category 4: Services Offered

1. General Services

1.1. Information about banks announcements 1.2. Profile/ username/ password management

1.3. Ease use of services

1.4. Revocability - allow users to revoke security actions where appropriate

1.5. Tools such as organizer and calculator are available

1.6. Extra services such as ticket booking, shop on line, charity

2. Financial Services

2.1. Account and loan information 2.2. Credit card and check information

2.3. Loan request

3. Provided Transactions 3.1. Bill payments 3.2. Mobile phone bill or card recharge

Category 5: Reliability

1. Registration

1.1. Easy to register 1.2. Easy to log on to the site

1.3. Adjustable customer profile is stored 1.4. E-mail request for receiving offers or information

1.5. Easy modification of users profile

2. Transaction

Procedure

2.1. Foreign language support is available 2.2. Disconnection management

2.3. Actions history is available

Category 6: Technical Aspects

1. Loading Speed

1.1. Fast loading speed of the home page as well the rest pages

1.2. Consideration of non-broadband users

Category 7: Multi-factor Authentication Methods

1. Tokens

1.1. Hardware Tokens 1.2. Software Tokens

1.3. Easy to get the code from the device 1.4. Security and Stability

1.5. User Adoption 1.6. Total Cost of Ownership (TCO)

1.7. Replacement of the token in the event of defects

2. SMS 2.1. Multiple mobile numbers allowed (maximum)

3. Tokens 3.1. Effective use of Sitekey

OnlineBankingSecurityandUsability-TowardsanEffectiveEvaluationFramework

149