A Game-theory based Model for Analyzing E-marketplace

Competition

Zheng Jianya

1

, Li Weigang

1

and Daniel L. Li

2

1

TransLab, Department of Computer Science, University of Brasilia, Brasilia, Brazil

2

Coleman Research Group, Raleigh NC, U.S.A.

Keywords: Asymmetric Competition, Cost of Changing Strategies, E-marketplace, Evolutionary Game Theory.

Abstract: The current e-marketplace provides many tools and benefits that bring sellers and buyers together, and

promote trading within cyberspace. And due to certain unique features of e-commerce, the competition also

takes on characteristics different from those found in traditional commerce. This paper analyses both the

competition between sellers, and the stable state in e-marketplace through a proposed model that applies

evolutionary game theory. The purpose is to better understand these relations and the current state within e-

marketplace, as well as provide a tool for sellers to increase their profits. Here, the sellers are divided into

four categories based on their scale (Large, Small) and sales strategy (Aggressive, Conservative). By

developing Asymmetrical Competition Game Model in E-Marketplace (ACGME) in Nash Equilibrium, we

analyze the composition of different sellers and how this proportion is affected by asymmetry among

sellers. Finally, we conduct a simulation experiment to verify the effectiveness of our proposed model.

1 INTRODUCTION

e-Commerce is rapidly developing thanks to the

advance in information technology and widespread

use of Internet. The sales of the largest e-

marketplace Alibaba reached $240 billion in 2013,

and eBay also ran up to $83.33 billion during the

same period. B2C e-commerce giant Amazon.com,

understanding the potential of this industry, also

started its e-marketplace service in 2000. E-

marketplaces play an important role in the e-

commerce, as it helps overcome geographical

limitations, connect with new customers through

search engine visibility and reduce costs. And most

importantly, e-marketplace provided access to e-

commerce for ordinary people and small shops. This

feature tremendously accelerated the development of

online shopping. As result, e-commerce has attracted

increasing attention in the field of computing science

and information technology. The relationships

between three players in e-commerce: sellers,

customers and e-marketplaces, have been a research

hotpot.

The nature and structure of competition in e-

marketplace is considerably different from the

traditional marketplace. Traditionally, sellers usually

competed in a single industry and competition is

limited geographically. Nowadays, e-marketplace

offers opportunities for all individuals who are

interested in the ability to break these boundaries.

More and more individual sellers entered the digital

space, greatly increasing the competition. As such, it

is necessary to analyze this new form of competition

in e-marketplace in order to help the sellers’

decision making process. For this purpose, we

conduct this work to analyze the competition

between sellers by applying evolutionary game

theory. The sellers are divided into four categories

based on their scale (Large, Small) and sales strategy

(Aggressive, Conservative). By applying game

theory and analysing asymmetry between sellers, we

can model the competition in the e-marketplace

using table 1. And using the Nash equilibrium of the

proposed game model, we can obtain the

composition for each type of seller and study the

stable state of e-marketplace.

Table 1: Four competition models in the e-marketplace.

Large vs. Large Large vs. Small

Small vs. Large Small vs. Small

The rest of this paper is structured as follows.

The next section references and discusses literature

650

Jianya Z., Weigang L. and L. Li D..

A Game-theory based Model for Analyzing E-marketplace Competition.

DOI: 10.5220/0005467706500657

In Proceedings of the 17th International Conference on Enterprise Information Systems (ICEIS-2015), pages 650-657

ISBN: 978-989-758-096-3

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

related to the focus of our study. Section 3 describes

the asymmetry between different sellers and

strategies they can adopt against competition. The

stable state of e-marketplace is introduced in section

4, and an analysis of the result is presented in section

5. In section 6 we conduct a simulation to verify the

effectiveness and performance of this model.

Finally, section 7 concludes this paper with a

summary, and explains the potential applications of

this study.

2 LITERATURE

Evolutionary game theory (Maynard Smith, 1982)

applied game theory to evolving populations of life

forms in biology. Despite its original use,

evolutionary game theory has become of increasing

interest to other fields, and many researchers

examined the applications of evolutionary game

theory in economics. An extended analysis of

‘Prisoners’ Dilemma’ by Daniel et al., (2005)

identified four conditions of the game and observed

that each condition has different evolutionary and

informational requirement for cooperation. Witt

(2008) studied the differences between major

approaches in evolutionary economics, and analysed

details of “evolutionary” aspects within the

economy. Hodgson and Huang (2012) inquired both

the differences and similarities between evolutionary

game theory and evolutionary economics, and

proposed potential for mutual emulation in these two

fields. In recent years, the evolutionary game theory

observed significant development, and is now

applied to assist decision-making processes. Altman

et al., (2008), Niyato and Hossain (2009) used

evolutionary game approach in their wireless

network selection study. Barari et al., (2012)

proposed a decision framework that employed

evolutionary game approach in the analysis of green

supply chain contracts. Lee et al., (2010) proposed

an evolutionary game theory based mechanism for

adaptive and stable application in cloud computing.

The classic game models focus on symmetric

competition between players. However, the players

are usually different from each other in real

scenarios, which is the case for our research on e-

marketplaces. The sellers are heterogeneous, varying

in size, location and service level etc. There are less

literature that focus on asymmetric competition but

the following studies provide insight towards our

work. Fishman (2008) extended the analytical

framework of evolutionary game theory to games

that have two distinct types of players, where the

type-specific payoff functions are nonlinear. That is,

asymmetric games where the payoffs for interactions

are influenced by strategies from both types of

players. Liu et al., (2012) proposed a game model

considering the asymmetric interaction and the

selection pressure of resources. Combining

evolutionary game theory with dynamic stability

theory, they concluded that evolutionary results

depend on the asymmetric relation between players,

and on the cost-to-benefit ratio of conflict.

There are also studies on evolutionary game

theory focusing on the economic market. Although

their content does not directly relate to our research,

it still provides context and ground for this study. Ba

et al., (2000) investigated the risk of frauds in e-

marketplace and identified different equilibrium in

the market using an evolutionary game theory

approach. Then the authors explored the best method

to effectuate transactions within the market, and

justified the necessity of trusted third parties for e-

marketplaces. Zheng et al., (2014) provided us

insight into the charging mechanism in e-

marketplaces, as they studied this topic by adopting

the Leontief’s model and drew interesting

conclusions that less sellers generate more profit for

e-marketplace service providers. After studying

previous literature, we base our research on the

hawk-dove game and study the asymmetric between

sellers in e-marketplace. By employing evolutionary

game theory we study the competition between

vendors in the e-marketplace environment and

analyse the optimal profit of the e-marketplace

service providers.

3 SETUP OF ASYMMETRIC

COMPETITION GAME MODEL

IN E-MARKETPLACE (ACGME)

The Hawk-Dove Game is a classic example of

evolutionary game theory applied in animal

behaviour. In this model, we have two animals (not

necessarily birds) that are capable of choosing from

two strategies when in conflict with each other. An

animal can choose the "hawk" strategy and escalate

conflict to a fight or the animal can choose the

"dove" strategy and peacefully back down. Hawk

type animals will always choose to fight, so if two

hawks meet, there will always be a fight. Winners

receive the benefit, while losers be charged with the

cost of the fight. Dove type animals always choose

to flee, and will never be involved in a fight. There

is no cost to be a dove, there is only the possibility

AGame-theorybasedModelforAnalyzingE-marketplaceCompetition

651

of receiving no payoff.

This research analyzes the competition between

sellers in e-marketplace based on the hawk-dove

game. First, the asymmetric relation between sellers

is introduced and modelled. Then, the strategies of

sellers are described. Lastly, the proposed

evolutionary game model is formally introduced.

3.1 Asymmetrical Parameter between

Sellers: h

Asymmetry between sellers is a natural occurrence

within the e-marketplace competition. Although

various criteria can be employed to evaluate this

asymmetry, we choose probability of purchase as the

initial criteria. For the traditional market, two

models have been proposed for analyzing consumer

purchase probability. “Marketing Effort Model”

believes that the probability of purchase depends on

the sellers’ marketing effort, as well as quality of

product, price and customer relationship etc.

However, the e-marketplace has distinctive

characteristics. For example, because the business

between sellers and customers is not held in person,

many prefer to pay more just to minimize risks. For

example, in the Brazilian e-marketplace

“MercadoLivre”, the exact same product, a book

sold by two separate vendors from Sao Paulo, there

are 100 consumers who chose the higher priced

seller (R$ 109.80) while only nine chose the seller

with the lower price, R$ 69.90. The only apparent

difference we found in this case is that the higher

priced vendor has a better reputation.

A different model, “Attraction model” is

considered more suitable for studying online

consumers’ purchase probability. “Attraction model”

indicated that the probability is directly related to the

attraction of a product from consumers’ perspective.

This model defined an “attraction” value to measure

asymmetry between sellers. Given a finite set of

sellers, S = {s

1

, …, s

n

}, for each seller s

i

∈

S, an

“attraction” value is calculated. We assume that

competition can be defined by the vector of

attraction:

12 12

(a( ),a( ),...,a( )) (a ,a ,...,a )

nn

ss sa

(1)

That is, the consumer purchase probability h is fully

defined by a. The attraction may be a function of the

seller’s investment in marketing, the price of the

product, and the reputation of the seller, among

other factors. If a purchase probability is assigned to

each seller based only on the attraction vector, the

consumer purchase probability for each seller can be

calculated using the following equation:

1

a( )

, for = 1, 2, ...,

a( )

i

i

s

n

j

j

s

hin

s

(2)

In this paper, the competition is analysed at a

macroscopic level. All sellers of an e-marketplace

are divided into two categories, Large and Small.

Using this assumption, h represents the purchase

probability of large sellers, while (1 - h) represents

the small sellers.

We should note that, the role of large and small

sellers is not unchangeable. They can be changed

under specific conditions. For example, a large seller

that loses the majority of its market share to a small

competitor would result in an exchange in roles.

Other external factors can also alter roles within a

market, as sellers can obtain investments or business

partnerships.

3.2 Strategies for Sellers

With basis on the hawk-dove game, we model the

sellers in e-marketplace into two categories based on

their business strategies {Aggressive,

Conservative}, and all sellers can choose their

strategy. A description of each strategy is listed

below:

Aggressive: The sellers prefer to invest and

stimulate sales, but risk losing money due to

diminished returns as result of their investment.

The sellers who choose the aggressive strategy

can choose to invest money on marketing, customer

relationship, search engine optimization, etc.

Although this strategy may increase sales volume, it

can cost the sellers if the benefits do not correspond

to the amount of investment.

Conservative: The sellers choose to not invest and

receive no benefits as result of their lack of action.

The conservative sellers expect a normal profit.

This strategy won’t cost the seller, because they are

not spending more on the business. But when in

competition with aggressive sellers, they will always

lose and receive no payoff.

Considering only these two strategies, we can

expect three different competitive scenarios in the e-

marketplace.

1) Aggressive vs. Aggressive: Both aggressive

sellers choose to invest to increase sales volume.

But in this scenario, one will win and the other

will lose and see no return on the investment.

2) Aggressive vs. Conservative: In this case, the

aggressive seller wins, as the investment

increases its attractiveness to consumers.

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

652

Combined with a lack of competition from the

conservative seller, the aggressive seller observes

increased sales as result of added investment.

3) Conservative vs. Conservative: When two

conservative sellers compete, the profit is

divided equally among them.

4 ACGME AND STABLE STATE

OF E-MARKETPLACE

A game can be described using three values

{players, set of strategies for every player, payoff of

every player}. In this paper, these values are {{large

sellers, small sellers}, {aggressive, conservative},

{π

L

, π

S

}}, where π

L

, π

S

represent the profits for large

and small sellers, respectively. Additionally, we

define the cost of competing as

.

In addition, we define a few competition rules

here:

1) The consumers choose to buy a product from an

advertised seller based on available information.

2) When different sellers advertise the same

product, the probability of purchase is the same

for all advertised sellers.

3) If no sellers advertise the product, the probability

of purchase depends on h.

With the competition rules and all the parameters

defined, we now introduce the payoff matrices for

all the competition scenarios.

4.1 Large vs. Large and Small vs.

Small

In this scenario, the competition between sellers is

actually symmetrical. The payoff matrix is listed in

table 2.

Because competition between sellers with the

same strategy follows the same format, the scale of

the sellers does not affect the result.

Table 2: Payoff matrix for symmetrical competition.

Large sellers (Small)

Aggressive Conservative

Large sellers

(Small)

Aggressive

,

22

VV

, 0V

Conservative

0 , V

,

22

VV

When two sellers are both aggressive, the profit

will be distributed evenly among players, that is

,

22

VV

. The cost of competing is subtracted

from the profit, and we obtain the result shown in

the upper left cell. In the case an aggressive seller

competes with a conservative one, following the

rules in Section 3, the aggressive seller will receive

all the profit. This is the result show in the upper

right and lower-left cells. When two conservative

sellers meet, because they don’t involve themselves

in a competition, the profit is divided among them,

and no cost is taken from the profit either.

4.2 Large vs. Small

In this subsection, the competition between large

and small players is analysed in more detail. When

two different types of sellers compete, an

asymmetrical relation occurs.

Table 3: Payoff matrix for asymmetrical competition.

Samll sellers

Aggressive Conservative

Large

Sellers

Aggressive

(),(1)()hV h V

, 0V

Conservative

0 , V

,(1 )hV h V

Here, we take into consideration the

asymmetrical parameter defined as purchase

probability h in the previous section. When a large

and a small aggressive seller compete, the profit is

be divided between sellers based on their

asymmetric proportion, in addition to removing the

competition cost, which means that the large player

would receive hV, and the small (1-h)V. The results

remain the same for when an aggressive seller

competes with a conservative one. The lower-right

cell represents the profit division between a large

conservative seller and a small conservative seller.

Again, we account for the asymmetrical parameter

but there is no competition cost in this case. The

payoff matrix is depicted in table 3.

4.3 An Overall Perspective

In order to simplify this analysis and our

representation, we combined scale and strategy for

sellers as one single category. The sellers in this case

are equal, but the number of strategies for each seller

has been expanded to four, which are {Large

Aggressive, Large Conservative, Small Aggressive,

Small Conservative}. This way, an asymmetric

competition has been transformed into a symmetric

one.

AGame-theorybasedModelforAnalyzingE-marketplaceCompetition

653

Table 4: An overall perspective of payoff matrix in

ACGME.

Player II

LA LC SA SC

Pla

y

er I

LA

(V-

)/2, (V-

)/2

V,0

h(V-

),

(1-h)(V-

)

V,0

LC 0,V V/2, V/2 0,V hV, (1-h)V

SA

(1-h)(V-

), h(V-

)

V,0

(V-

)/2, (V-

)/2

V,0

SC 0,V (1-h)V, hV 0,V V/2,V/2

*Note: L = large seller, S= small seller; A = aggressive seller and C =

conservative seller. So SA means the small seller with aggressive

strategy.

Table 4 illustrate the payoff matrix of two

competing players from an overall perspective. This

matrix lists all competition scenarios in the e-

marketplace for our proposed categories. Rows

represent the first seller and columns represent the

second. All elements in matrix are two-tuples where

the first value is player I’s payoff, and the second

value is player II’s payoff.

Once we defined all possible types of

competition in the marketplace for our proposed

categories, we proceed to calculate the equilibrium

of this game in the following section.

4.4 Mixed Evolutionary Stable

Strategy

As show in the previous section, we have now

obtained the payoff function for all types of sellers.

Next, we study the Evolutionary Stable Strategy

(ESS) for our proposed game model. An ESS is an

equilibrium refinement of the Nash equilibrium. It is

a Nash equilibrium that is evolutionarily stable, once

it is reached in a population; natural selection

prevents alternative strategies from appearing in the

system. Thus, the evolutionary stable state of our

proposed game provides insight into the stable state

and competition dynamics within the e-marketplace

in the real world.

Defining {x

LA

, x

LC

, x

SA

, x

SC

} as the proportions of

every type vendor in e-marketplace, we can derive

the profit for all type of sellers based on the payoff

matrix.

()

2

(1 )

00

22

(1 )( )

2

(1 )

00

22

LA LA LC SA SC

LC LA LC SA SC

SA LA LC SA SC

SC LA LC SA SC

V

Vx xVxhV xV

hV h V

Vx x x x

V

Vx hV xVx xV

hV hV

Vx x x x

(3)

According to evolutionary game theory, the sellers

in e-marketplace reach stable state when profits for

every type of vendor are equal. As result, we obtain

the following equations:

1

LA LC

SA SC

SA WA

LA LC SA SC

VV

VV

VV

xxxx

(4)

Solving the above equations (4), we obtain the

proportion of all four types of sellers in an e-

marketplace at its stable state.

3

2

22 4

LA SA

VhV

xx

Vh hV

(5)

1

()()

2

22 4

LC SC

Vh

xx

Vh hV

(6)

(5) and (6) represent the proportion for different

types of sellers in an e-marketplace when it achieves

the stable state.

Note that, there is an important condition when

we study the evolutionary game: the cost of

competition must be greater than the profit (V <

).

If this condition is not fulfilled, then the game only

has a pure strategy Nash equilibrium, the

“aggressive” strategy. In this situation, all players

will act as “aggressive” sellers because this strategy

definitively yields more profit than the

“conservative” strategy. When V <

, “aggressive”

sellers are presented with the risk of loss, then part

of sellers choose the “conservative” strategy, while

others risk for the opportunity to win.

5 ANALYSIS OF STABLE STATE

IN E-MARKETPLACE

From the results obtained in section 4, we could find

that the stable state of e-marketplace is dependent on

values V,

, and asymmetrical parameter h. In this

section we analyse the correlations between

equilibrium and such parameters.

5.1 ESS with Cost

and Profit V

Since both

and V are characteristic to the e-

marketplace and are similar, we define k =

/V and

study the correlation between k and final stable state.

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

654

Based on equations (5) and (6), we obtain:

1

12

2

+2+2 4

SA WA

hhk k

xx

khkh

(7)

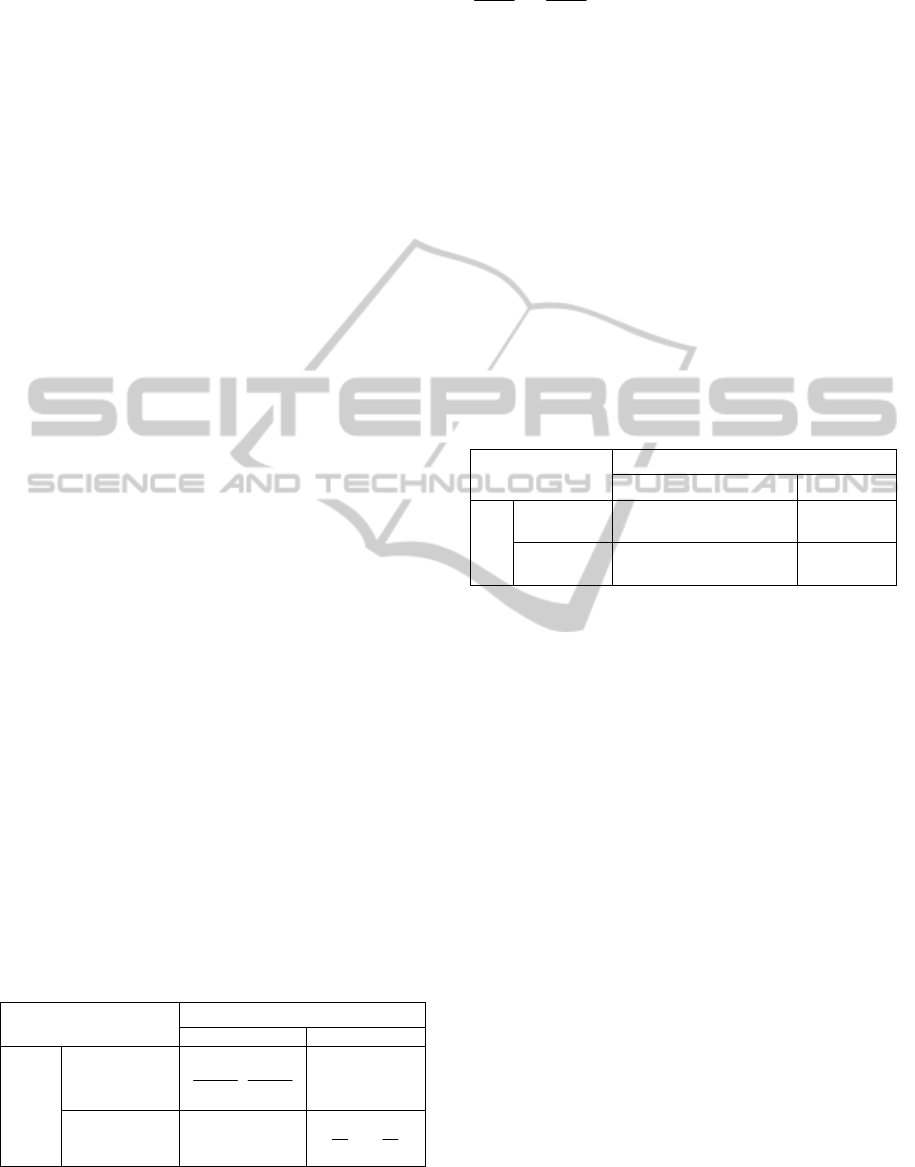

Setting h as a series of constants, we generate figure

1. From the figure, we observe that the growth of

aggressive sellers is inversely proportional to k. This

means that when the cost is similar in value to the

profit, then most sellers choose the aggressive

strategy as they expect to receive profit at little risk.

But when the cost is far more than profit, then few

people takes the risk of a loss.

Figure 1: The correlation between aggressive strategists /

conservative strategists and k = C/V.

Also from figure 1, we observe that the growth

of aggressive sellers is proportional to asymmetrical

parameter h. When the difference between types of

vendors is small, the probability of wining is also

not significantly different, and then most people

shift towards competition.

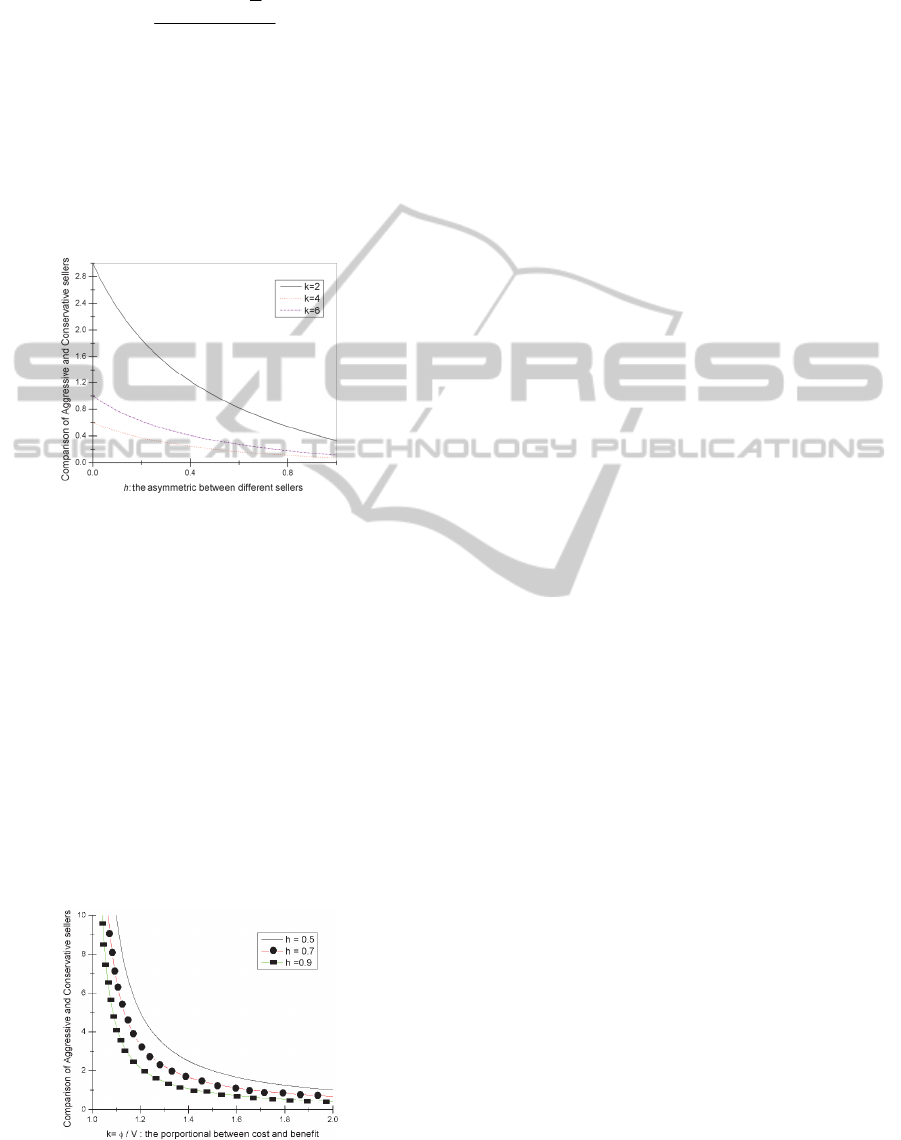

5.2 ESS with Asymmetrical Parameter

The asymmetrical parameter is another important

factor that can affect the final stable state of e-

marketplace. In this paragraph, we set k as a constant

in order to study the relationship between stable

state and asymmetrical parameter h.

Figure 2: The correlation between aggressive sellers /

conservative sellers and asymmetrical parameter h.

With equation (3), we find the proportion of

aggressive sellers increases by decreasing the

asymmetrical parameter h, which is shown in figure

2. This means that small sellers of e-marketplace

perceive a big gap between them and the large

sellers, which results in their adoption of the

aggressive strategy.

6 A SIMULATION CASE STUDY

This section analyses the effectiveness of the

proposed model through a simulation study. In the

field of e-commerce, it is difficult to obtain real data

from an e-marketplace because it is proprietary.

Thus, we create a simulation experiment to test our

model.

In our model, the stable state of e-marketplace is

dependent on k =

/V (defined in section 5), and the

asymmetrical parameter h. So we set different values

to these two factors and verify the final result.

For asymmetric parameter, we set h as three

different levels:

a. High asymmetry: h = 0.95.

b. Medium asymmetry: h = 0.75.

c. Low asymmetry: h = 0.55.

This classification allows us to observe a complete

picture of the competition in different asymmetrical

scenarios. When h = 0.95, the asymmetry between

sellers is high, which means large sellers dominate

the marketplace. Then when h is closer to 0.5, the

sellers are more comparable in number, which in

turn means the marketplace has a highly competitive

mechanism.

Additionally, we categorized the e-marketplace

into two classes.

i. High profit.

V/

= 5/6.

ii. High risk.

V/

= 1/2.

In a high profit marketplace, an aggressive seller can

compete at a reasonable cost. But in a high risk

market, the competition cost is much higher than the

profit, which presents a big risk for sellers that chose

the “aggressive” strategy.

In addition to using these values in our

simulation experiments, to calculate the proportion

of different sellers in a stable state e-marketplace,

we introduce a new element. To be more precise,

90% confidence interval is used to capture the

interval for the real expected value and the

simulation-generated value. Using the formula

proposed in Law and Kelton (1991) and Choi et al.,

AGame-theorybasedModelforAnalyzingE-marketplaceCompetition

655

(2004), the 90% confidence interval is calculated

using equation (8):

90% 1.645CI ER VR

(8)

where ER and VR denote the expected result and the

variance of result respectively. CIEP is defined to

represent the bounds of the deviation of the real

expected result from the simulation in the 90%

confidence interval.

Table 5: The proportion of aggressive sellers in a high

profit e-marketplace according to different asymmetric

levels.

h ER CIEP SD

High 0.95 65.48% 1.65% 12.21%

Medium 0.75 75% 1.59% 12.23%

Low 0.55 81.90% 1.60% 12.23%

Table 5 shows the stable state of a high profit e-

marketplace at different asymmetric levels. We find

that the proportion of aggressive sellers decreases

with a higher asymmetric level. The reason is that

when the asymmetric level is high, the small sellers

choose the conservative strategy to avoid risk of

competition, and thus the expected result in a high

asymmetric e-marketplace (h = 0.95) is 65.48%.

Alternatively, market competition becomes larger as

the opportunity to win the competition is greater, so

the expected result is 81.90% when h = 0.55.

Table 6: The proportion of aggressive sellers in a high risk

e-marketplace according to different asymmetric level.

h ER CIEP SD

High 0.95 27.50%

±

1.44%

9.76%

Medium 0.75 37.50%

±

1.42%

9.76%

Low 0.55 47.50%

±

1.49%

9.77%

Table 6 illustrates the high-risk scenario for an e-

marketplace. Under these conditions, most sellers

tend to choose the conservative strategy. Where the

asymmetric level between sellers is high, the

aggressive sellers compose only 27.50% of the

marketplace sellers. Even when the conditions are

more competitive (h = 0.55), this value only reaches

47.50%, compared to 81.90% in the high profit

simulation.

With the results from tables 5 and 6, we obtain

the following observations:

1) The proportion of aggressive sellers decrease as

the asymmetry between sellers increase. From

the perspective of a seller, the opportunity to win

in a competition is greater when the difference

between sellers is smaller. Thus, sellers tend to

choose the aggressive strategy under these

conditions as they expect a positive outcome.

2) The decrease in aggressive sellers is significant

when the marketplace is high-risk. Although the

k value is only changed from 5/6 to 1/2, the

proportion of aggressive sellers decreases by

almost 50%. This demonstrates that sellers are

very sensitive to this factor.

This observation is important to e-marketplace

administrators as it provides insight when

deciding the fees / cost mechanism. When the

service fee is high (high risk scenario), the

number of aggressive sellers decreases. Thus, it

is important to study the optimal cost structure in

an e-marketplace to maximize profit for market

hosts.

3) According to tables 5 and 6, the e-marketplace is

more stable when it is in a high-risk scenario.

But this is majorly due to the adoption of a

conservative strategy for all sellers.

7 CONCLUSION

Following the rise of e-commerce, the emergence of

e-marketplaces such as Alibaba, eBay and

MercadoLivre creates new platforms for individuals

to conduct business and effect transactions. Given

the rapid growth of this market, it becomes

important to study the relationships between all

participants in an e-marketplace, in order to

maximize profitability and efficiency, and

understand potential advances. This work studied the

e-marketplace as a population, and applied the

evolutionary game theory to analyse the stable state

of a marketplace.

Learning from the classic “Hawk-Dove” game

model, we divided sellers into two categories,

{Aggressive, Conservative}. Additionally, the

sellers were classified by their scale, {Large, Small}.

Based on this setup, we proposed an Asymmetrical

Competition Game Model in E-marketplace

(ACGME) to study competition in the e-marketplace.

The contributions of this study include:

1) Applied the evolutionary game theory to the

research of e-commerce, studied the competition

between different types of sellers, and

demonstrated the effectiveness of applying

evolutionary game theory in the area of e-

commerce.

2) Classified the sellers based on their scale {Large,

Small}, which is a more realistic approach to

mimic a real world e-marketplace

3) Conducted simulation experiments to examine

the performance and effectiveness of our

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

656

proposed model and obtained satisfactory results.

Although some assumptions were included in our

research, they were within reasonable range and

would not significantly impact the effectiveness our

model. There are also some limitations to this

research; we will continue this study to improve

ACGME. As we move our focus to studying e-

marketplace charging mechanisms, we use this

research as basis and groundwork.

REFERENCES

Altman E, Elazouzi R, Hayel Y, et al., 2008. An

evolutionary game approach for the design of

congestion control protocols in wireless networks[C]

WiOPT 2008.6th International Symposium on. IEEE,

547-552.

Ba S., Whinston A. B., Zhang H., 2000. The dynamics of

the electronic market: An evolutionary game

approach[J]. Information Systems Frontiers, 2(1): 31-

40.

Barari S., Agarwal G., Zhang W. J. C., 2012. A decision

framework for the analysis of green supply chain

contracts: An evolutionary game approach[J]. Expert

systems with applications, 39(3): 2965-2976.

Beatty P., Reay I., Dick S., 2014. Consumer trust in e-

commerce web sites: a meta-study[J]. ACM

Computing Surveys (CSUR), 43(3): 14.

Clemons E. K., Jin F., Wilson J., 2013. The Role of Trust

in Successful Ecommerce Websites in China: Field

Observations and Experimental Studies[C]//System

Sciences (HICSS), 46th Hawaii International

Conference on. IEEE, 4002-4011.

Daniel G., Arce M., Sandler T., 2005. The dilemma of the

prisoners’ dilemmas[J]. Kyklos, 58(1): 3-24.

Fang Y., Qureshi I., Sun H., 2014. Trust, Satisfaction, and

Online Repurchase Intention: The Moderating Role of

Perceived Effectiveness of E-Commerce Institutional

Mechanisms[J]. Mis Quarterly, 38(2): 407-427.

Fishman M. A., 2008. Asymmetric evolutionary games

with non-linear pure strategy payoffs[J]. Games and

Economic Behavior, 63(1): 77-90.

Hodgson G. M., Huang K., 2012. Evolutionary game

theory and evolutionary economics: are they different

species?[J]. Journal of Evolutionary Economics, 22(2):

345-366.

Lee C., Suzuki J., Vasilakos A., 2010. An evolutionary

game theoretic approach to adaptive and stable

application deployment in clouds[C]//Proceedings of

the 2nd workshop on Bio-inspired algorithms for

distributed systems. ACM, 29-38.

Liu Qi-Long, H. E. Jun-Zhou, Yangyan, Wangya-Qiang,

Gaolei, Li Yao-Tang, WANGRui-Wu., 2012.

Evolutionary stability analysis of asymmetric hawk-

dove game considering the impact of common

resource. Zoological Research, 33(4): 373-380.

Niyato D., Hossain E., 2009. Dynamics of network

selection in heterogeneous wireless networks: an

evolutionary game approach[J]. Vehicular Technology,

IEEE Transactions on, 58(4): 2008-2017.

Maynard Smith, 1982. Evolution and the Theory of

Games[M]. Cambridge university press.

Witt U., 2008. What is specific about evolutionary

economics?[J]. Journal of Evolutionary Economics,

18(5): 547-575.

Zheng J., Li D., Weigang L., et al., (2014). e-Commerce

Game Model-Balancing Platform Service Charges

with Vendor Profitability[C]//Proceedings of 16th

International Conference on Enterprise Information

Systems (ICEIS), 613-619, Lisbon, Portugal.

AGame-theorybasedModelforAnalyzingE-marketplaceCompetition

657