Combining Empirical Mode Decomposition with Neural Networks

for the Prediction of Exchange Rates

J. Mouton

and A. J. Hoffman

School of Electrical, Electronic and Computer Engineering, North-West University, Potchefstroom, South Africa

Keywords: Empirical Mode Decomposition (EMD), Artificial Neural Network, Foreign Exchange Rate Forecasting.

Abstract: This paper proposes a neural network based model applied to empirical mode decomposition (EMD) filtered

data for multi-step-ahead prediction of exchange rates. EMD is used to decompose the returns of exchange

rates into intrinsic mode functions (IMFs) which are partially recomposed to produce a low-pass filtered

time series. This series is used to train a neural network for multi-step-ahead prediction. Out-of-sample tests

on EUR/USD and USD/JPY rates show superior performance compared to random walk and neural network

models that do not employ EMD filtering. The novel approach of using EMD as a filtering technique in

combination with neural networks consistently delivers higher returns on investment and demonstrates its

utility in multi-step-ahead prediction.

1 INTRODUCTION

The prediction of foreign exchange rates presents

several known challenges, the foremost being the

wide variety of behaviours that are observable at

many different time scales. The optimal choice of

time scale and forecast horizon for profitable trading

is a nontrivial matter, as the parameters at which the

signal shows the most predictable and exploitable

behaviour have to be found. A further challenge is

introduced by the inherent nonlinearity in the

relationship between past and future behaviour of

foreign exchange rates (Hsieh 1989; Pavlidis et al.

2012; Nusair 2013) .

Empirical Mode decomposition (EMD) is a

technique designed to decompose a signal into its

intrinsic modes (Huang et al. 1996), and has seen

wide usage in the area of financial analysis. What

makes EMD attractive in financial analysis is that it

is an empirically based technique that is a posteriori

and adaptive, allowing the data to speak for itself.

No a priori assumptions are required, as is the case

with traditional time-frequency techniques such as

Fourier or wavelet analyses. Time series analysis

traditionally seeks for a suitable model to fit the

data; this is complicated by the fact that the data is

typically non-stationary, with non-linear

relationships between past and future values and

behaviour occurring simultaneously at different time

scales. The time-frequency components obtained

from EMD can simplify this task by allowing one to

investigate the series for one intrinsic mode function

(IMF) at a time and over time horizons that are

optimal for the respective IMFs. While EMD is

traditionally used to analyse the individual modes of

a time series, usage of the technique as a filter has

also been identified (Huang et al. 2003; Flandrin

2004). An advantage of EMD-filtering is that the

data still retains its nonlinearity and non-stationarity,

which is not the case when using conventional

filtering techniques.

Artificial Neural Networks (ANN’s) are a

widely used machine learning technique that

simulates the structure of a biological neural

network. The structure of the neural network

consists of nodes distributed across input, hidden

and output layers, connected by weighted

connections and activation functions (Laurene

Fausett 1994). This structure gives neural networks

the built-in property to identify nonlinear

relationships between input and output variables,

making it ideal for application to nonlinear domains

such as financial prediction.

This paper proposes an ANN model applied to

data filtered with a novel EMD-filtering technique

for multi-step prediction of foreign exchange rates.

The purpose of the prediction will be to maximize

the returns of an investor by identifying the most

exploitable sampling period and forecast horizon

244

Mouton J. and Hoffman A..

Combining Empirical Mode Decomposition with Neural Networks for the Prediction of Exchange Rates.

DOI: 10.5220/0005130702440249

In Proceedings of the International Conference on Neural Computation Theory and Applications (NCTA-2014), pages 244-249

ISBN: 978-989-758-054-3

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

using empirical methods. The training and input data

will be filtered to suit the forecast horizon with the

goal of improving the signal to noise ratio for the

appropriate time scale. The EMD-filtered ANN

model will be tested on out of sample exchange

rates, and will be compared with an ANN applied to

unfiltered data and a random walk model in terms of

accuracy of predictions and simulated returns on an

investment. The proposed model will give insight

into the ability of EMD-filters to improve

exploitable prediction accuracy by attempting to

increase the signal-to-noise ratio of the neural

network’s training data.

The rest of the paper is organized as follows: In

Section 2 a survey of the literature on EMD-based

machine learning is provided. Section 3 discusses

the methodology of the proposed model. Section 4

describes the data, pre-processing, performance

criteria and implementation of the proposed model.

The experimental results are also given and

discussed in Section 4. Section 5 concludes the

paper.

2 LITERATURE SURVEY

Machine learning techniques have been widely used

to forecast foreign exchange rates since the early

1990’s. For an overview of applications of machine

learning techniques to exchange rate prediction,

Imam’s survey article is recommended (Imam,

2012).

Our literature survey will focus on the use of

EMD in combination with machine learning in the

area of financial prediction. Huang et al. investigated

the use of EMD for analysis of non-stationary

financial time series (Huang et al., 2003). They

found that EMD with the Hilbert transform offered

better temporal and frequency resolutions than

Wavelet or Fourier analysis. The utility of EMD as a

filter to separate and extract variability on different

time scales was also noted. Wang examined the

predictive capability of an EMD-based Support

Vector Regression (SVR) model on the Shanghai

Securities Index. The EMD-based model performed

significantly better than the SVR model on its own

for both singe-step-ahead and multi-step-ahead

predictions (W. Wang et al., 2009). Several studies

focused on forecasting exchange rates using EMD-

based SVR models (Fu 2010; C. Lin et al., 2012;

Cheng and Wei 2014). For each case the EMD-

based model proved to have superior forecasting

accuracy compared to non-EMD-based or statistical

models. An EMD-based neural network was

designed in order to forecast financial crises using

exchange rate data (Yu et al., 2010). The EMD-

based model outperformed both statistical and neural

network models in correctly identifying crises. Yang

also used an EMD-based back propagation neural

network model to forecast the daily NTD/USD rate,

with the proposed model outperforming a random

walk model for all performance evaluation criteria

(Yang and H. Lin 2012). Two separate studies exist

on the application of EMD and neural networks in

order to forecast crude oil prices (Yu et al., 2008;

Xiong et al., 2013). Yu et al. noted superior accuracy

for one-step-ahead prediction, while Xiong found

that the EMD model also proved to be more accurate

for multi-step-ahead prediction.

3 METHODOLOGY

3.1 Empirical Mode Decomposition

EMD assumes that a signal is composed of a number

of intrinsic mode oscillations with distinct frequency

bands. These components, called Intrinsic Mode

Functions (IMFs), superimpose upon each other in

order to form the observable signal. An IMF is a

signal that satisfies the following two conditions:

1) For the whole data set the difference in the

number of extrema and zero crossings must be

less than or equal to one.

2) At any point, the mean value of the envelope

defined by the local maxima and the envelope

defined by the local minima must be zero.

The sifting procedure used to decompose a

signal

into IMFs can be described in terms of

the following steps:

1) Identify local extrema of x

t

2) Connect all local maxima using a cubic spline

interpolate to obtain the upper envelope x

t

and connect the local minima using a cubic

spline interpolate to obtain the lower envelope

x

t

3) Obtain the mean envelope:

/2 (1)

4) Extract the difference variable

(2)

5) Check whether

fulfils the above mentioned

IMF conditions. If the conditions are met then

is an IMF and

must be replaced with

the residual:

(3)

If the conditions are not met, replace

with

and repeat from step 1.

CombiningEmpiricalModeDecompositionwithNeuralNetworksforthePredictionofExchangeRates

245

6) Steps 1 through 5 are repeated until the residual

meets the stopping condition, SC:

(4)

where

is the j

th

iteration’s sifting result.

The sifting procedure described above

produces IMFs, each with a distinct frequency band.

This allows one to view the EMD technique as a

filter bank, where each IMF is the product of a band

pass filter that matches an inherent mode present in

the signal (Flandrin, 2004).

3.2 Artificial Neural Networks

This study will use a three layer feed-forward neural

network, which consists of the input, hidden and

output layers. The input layer receives historic

filtered exchange rate data. The hidden layer

consists of 10 nodes, and the output layer is a single

node for the predicted returns of exchange rate. The

network will be trained using the Levenberg-

Marquardt back-propagation algorithm. This

algorithms seeks to optimise performance based on

mean square error, and is accepted as one of the

fastest back-propagation training algorithms.

3.3 Proposed Model

The proposed EMD-filtered ANN model is

employed in order to do multi-step-ahead prediction

with the purpose of exploitable trading on exchange

rates. The procedure is shown in Figure 1 and

consists of the following steps:

Figure 1: The proposed EMD-filtered ANN model.

Empirical Mode Decomposition of the data will

decompose the time series into IMF’s. A low-pass

version of the signal is constructed by summation of

IMF

j

to IMF

n

and the residue, where IMF

j

is the IMF

with an oscillation period with at least half the

length of the forecast horizon. This filtered signal is

used to train the feed-forward neural network using

a Levenberg-Marquardt algorithm. The neural

network input data used for the out-of-sample

prediction will be filtered in similar fashion. The

predicted values will be compared to the actual

exchange rate values with the performance criteria

of root-mean-square-error, directional symmetry,

correlation and simulated returns generated by a

simple trading strategy.

4 EXPERIMENTAL RESULTS

4.1 Data and Pre-Processing

In order to evaluate the forecasting performance of

the proposed model, this study uses 30 minute

sampled EUR/USD and USD/JPY closing rates from

1 January 2013 to 31 December 2013. All the rates

are converted to normalised logarithmic returns,

which is the fraction by which the current sample

has changed compared to the previous sample, and is

given by:

ln

(5)

The data is divided into 12 months. The previous

month is used as the training set, with the

subsequent month used as the out of sample testing

set. This results in 11 training sets (January to

November) and 11 testing sets (February to

December), each with 1010 observations composed

of the 5 most recent available data samples. The

number of training observations was chosen to be at

least ten times the number of weighted connections

in the neural network, while the number of samples

to include per training observation was determined

using autocorrelation and mutual information

analyses. An average bid-ask spread for the period

was obtained from the Straighthold Investment

Group’s LiteForex server. The bid-ask spread is

used in the calculation of the simulated returns of the

predicted time series.

4.2 Performance Criteria

Following other research in the area of exchange

rate prediction (Tay and Cao 2001; Lu et al., 2009;

C. Lin et al., 2012), the following criteria are

evaluated in order to measure the performance of the

predictive model: root-mean-square-error (RMSE)

and directional symmetry (DS). Two further criteria

are used in order to measure the exploitable

NCTA2014-InternationalConferenceonNeuralComputationTheoryandApplications

246

predictability of the models. The first is the

percentage correlation between the actual and

predicted normalised returns (Corr). The second is

the simulated return percentage for the time period if

a trading strategy is implemented based on the

predictions. The simulation of the returns is

conducted in the following way, with an initial

balance of 100:

1) Check whether the next predicted sample is

expected to deliver a positive or negative return.

2) If the return is positive, take a long position. If

the return is negative, take a short position.

3) If the position in step 2 has changed from the

previous position, take into consideration the

bid-ask spread of the exchange rate.

4) If a long position has been taken in step 2,

calculate the returns for that step using the

actual returns and the current balance. If a short

position has been taken, the entire balance is

withdrawn from the security and is kept

unchanged, except for the bid-ask-spread where

applicable.

5) Repeat steps 1 through 5 with the updated

balance for the entire predicted series.

6) Calculate the percentage change between the

initial and final balance. This is the simulated

return for the time period.

The simulated returns (Ret) will give an

indication of the out-of-sample exploitability of the

model at the chosen sample rate and forecast

horizon. Finally, the t-statistics for the returns

generated by the prediction model are calculated

using a two sample t-test between the returns of the

models and the returns of the random walk.

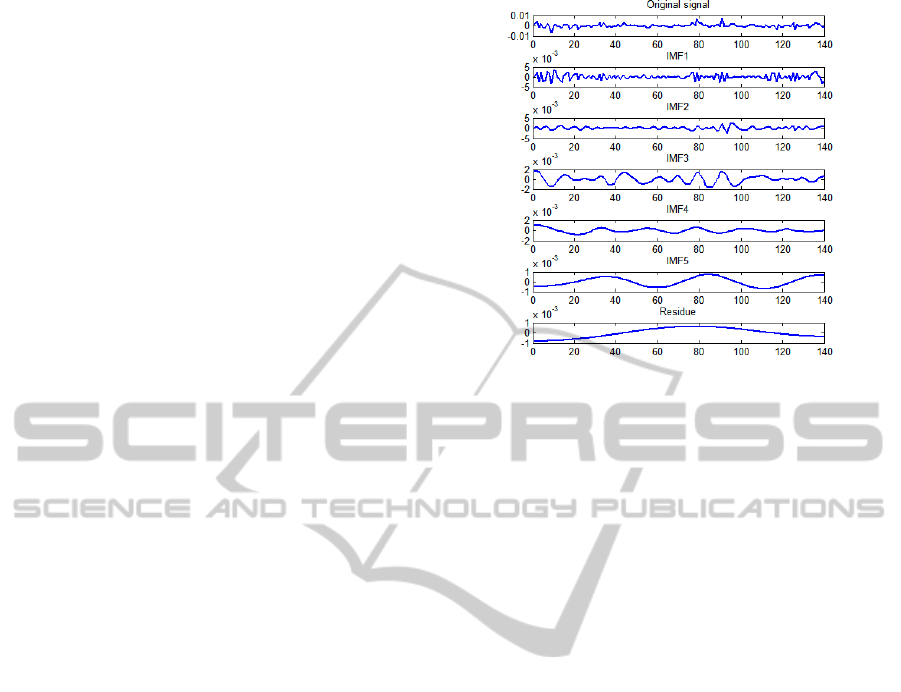

4.3 EMD Filter

The training and test input data must be filtered for

the EMD-filtered ANN model. Firstly the

normalised return time series is decomposed into

IMF’s using the EMD method described in Section

3.1. See Figure 2 for an example of a decomposed

segment of the normalised EUR/USD returns.

The EMD filter works on the principle of

recomposition of a subset of the IMFs. Each IMF

can be seen as a band-passed component of the

composite signal. For effective training of a neural

network for multi-step-ahead prediction, it is

necessary to design a Nyquist filter. This filter is a

low-pass filter that cuts off at an oscillation period

that is at least half the length of the forecast horizon.

The recomposition of the remaining IMFs in a

descending order will result in a low-passed filtered

version of the original signal, and is illustrated in

Figure 3.

Figure 2: EMD results for an extract of the normalised

EUR/USD returns.

4.4 Forecasting Results

The forecasting results of the proposed EMD-

filtered ANN model are compared to a random walk

and an unfiltered ANN model. The models are

compared based on the performance criteria of the

out of sample prediction of the EUR/USD and

USD/JPY exchange rates. Table 1 shows the

average monthly performance measurements that are

calculated by comparing the actual and the predicted

values of the EUR/USD exchange rate, while Table

2 shows the average monthly performance

measurements of the USD/JPY exchange rate. The

choice of forecast horizons stems from an analysis

of the frequencies found consistently in the IMFs at

the current sample rate.

4.5 Findings

After analysis of the experimental results, the

findings are as follows:

The EMD-filtered ANN model outperforms the

ANN and the random walk models in terms of

directional symmetry, correlation and simulated

returns for both exchange rates and all forecast

horizons.

The USD/JPY exchange rate offers higher

returns, which could indicate larger movements

or decreased market efficiency.

As the forecast horizon lengthens, some of the

exploitable price movements are lost due to less

frequent trading.

The t-test at a significance level of 0.05 rejects

the similarity in returns between the proposed

EMD-filtered ANN model and the random walk

model.

CombiningEmpiricalModeDecompositionwithNeuralNetworksforthePredictionofExchangeRates

247

Figure 3: Recomposition of EUR/USD IMFs at different levels resulting in different low-pass filtered versions of the

original signal.

Table 1: Average monthly exchange rate forecasting

results of the EMD-filtered ANN, ANN and random walk

models for the 30 minute EUR/USD exchange rate.

1.5 Hour forecast horizon

Average maximum possible

monthly returns(%)

9.8971

Model RMSE DS(%) Corr Ret(%) t-value

EMD-filter

ANN

0.0012 63.93 0.3503 1.9046

6.385

8

ANN

0.0013 56.28 -0.0174 -1.7120

2.913

8

Random

Walk

0.0014 40.40 -0.0044 -3.7652 0

4.5 Hour forecast horizon

Average maximum possible

monthly returns(%)

6.6964

Model RMSE DS(%) Corr Ret(%) t-value

EMD-filter

ANN

0.0021 65.18 0.2611 1.3721

5.987

5

ANN

0.0021 54.95 0.0417 -0.6215

1.894

1

Random

Walk

0.0022 45.29 -0.0376 -1.8045 0

11 Hour forecast horizon

Average maximum possible

monthly returns(%)

4.9623

Model RMSE DS(%) Corr Ret(%) t-value

EMD-filter

ANN

0.0032 66.87 0.3618 1.5141

3.039

0

ANN

0.0034 48.48 -0.0913 -0.4948

-

0.721

8

Random

Walk

0.0033 49.29 -0.0129 -0.0403 0

20 Hour forecast horizon

Average maximum possible

monthly returns(%)

3.9599

Model RMSE DS(%) Corr Ret(%) t-value

EMD-filter

ANN

0.0045 65.53 0.4852 1.5795

2.350

5

ANN

0.0044 54.55 -0.0518 -0.2013

-

0.283

1

Random

Walk

0.0042 53.03 0.0504 0.0014 0

Table 2: Average monthly exchange rate forecasting

results of the EMD-filtered ANN, ANN and random walk

models for the 30 minute USD/JPY exchange rate.

1.5 Hour forecast horizon

Average maximum possible

monthly returns(%)

20.0362

Model RMSE DS(%) Corr Ret(%) t-value

EMD-filter

ANN

0.0017 64.52 0.3647 5.8295

6.717

9

ANN

0.0018 52.75 0.0261 -2.2571

0.785

1

Random

Walk

0.0021 40.42 -0.0180 -3.004 0

4.5 Hour forecast horizon

Average maximum possible

monthly returns(%)

12.4100

Model RMSE DS(%) Corr Ret(%) t-value

EMD-filter

ANN

0.0029 62.66 0.38110 3.7767

4.692

6

ANN

0.0031 51.54 0.0304 0.0199

1.042

8

Random

Walk

0.0032 45.70 -0.0090 -1.0180 0

11 Hour forecast horizon

Average maximum possible

monthly returns(%)

8.5538

Model RMSE DS(%) Corr Ret(%) t-value

EMD-filter

ANN

0.0044 64.44 0.4526 3.5785

4.157

7

ANN

0.0048 49.4949 -0.0334 1.2897

0.957

6

Random

Walk

0.0047 42.02 0.0107 0.3441 0

20 Hour forecast horizon

Average maximum possible

monthly returns(%)

6.9709

Model RMSE DS(%) Corr Ret(%) t-value

EMD-filter

ANN

0.0078 68.18 0.4193 3.4000

2.306

9

ANN

0.0068 51.5152 0.0133 0.1846

-

0.656

4

Random

Walk

0.0033 50.00 0.0566 0.6990 0

NCTA2014-InternationalConferenceonNeuralComputationTheoryandApplications

248

5 CONCLUSIONS

Forecasting non-linear financial time series has

received increased attention in recent years. This

paper proposed a novel EMD-filter in combination

with a neural network in order to forecast exchange

rates with the purpose of profitable trading. The

proposed model is compared to an unfiltered neural

network and a random walk model for out-of-sample

prediction of the EUR/USD and USD/JPY rates of

2013.

The proposed EMD-filtered neural network was

the best performing model based on the criteria of

directional symmetry, correlation and simulated

returns. This can be attributed to the EMD-filter’s

ability to increase the signal-to-noise ratio for the

applicable forecast horizon. The results are in

accordance with previous studies on EMD-based

prediction models where the use of EMD has

improved the prediction accuracy.

The two sample t-test rejects the similarity

between the returns generated by the proposed

EMD-filtered ANN model and the random walk

model at a significance level of 99% in all cases

except for 20 hour prediction horizons, where the

significance level if 95%. This is an indication that

the proposed model can consistently deliver higher

returns than a random walk at all the forecast

horizons for both exchange rates.

In conclusion, the out-of-sample test results

reveal that EMD-filtered ANN forecasting can be an

effective tool for investors in predicting exchange

rates.

REFERENCES

Cheng, C.-H. & Wei, L.-Y., 2014. A novel time-series

model based on empirical mode decomposition for

forecasting TAIEX. Economic Modelling, 36, pp.136-

141.

Flandrin, P., 2004. Empirical mode decomposition as a

filter bank. IEEE signal processing letters, 11(2),

pp.112-114.

Fu, C., 2010. Forecasting exchange rate with EMD-based

support vector regression. IEEE submissions, pp.0-3.

Hsieh, D., 1989. Testing for nonlinear dependence in daily

foreign exchange rates. Journal of Business, 62(3),

pp.339-368.

Huang, N.E. et al., 1996. The empirical mode

decomposition and the Hilbert spectrum for nonlinear

and non-stationary time series analysis. In

Proceedings of the Royal Society London. pp. 904-

993.

Huang, N.E. et al., 2003. Applications of Hilbert-Huang

transform to non-stationary financial time series

analysis. Applied Stochastic Models in Business and

Industry, 19(4), pp.361-361.

Imam, T., 2012. Intelligent Computing and Foreign

Exchange Rate Prediction : What We Know and We

Don ’ t. Progress in Intelligent Computing and

Applications, 1(1), pp.1-15.

Laurene Fausett, 1994. Fundamentals of Neural Networks

1st ed., Upper Saddle River: Prentice Hall.

Lin, C., Chiu, S.-hsiung & Lin, T., 2012. Empirical mode

decomposition–based least squares support vector

regression for foreign exchange rate forecasting.

Economic Modelling, 29(6), pp.2583-2590.

Lu, C.-J., Lee, T.-S. & Chiu, C.-C., 2009. Financial time

series forecasting using independent component

analysis and support vector regression. Decision

Support Systems, 47(2), pp.115-125.

Nusair, S.A., 2013. Real exchange rate dynamics in

transition economies: a nonlinear analysis.

International Journal of Finance and Economics,

18(March 2012), pp.188-204.

Pavlidis, E.G., Paya, I. & Peel, D.A., 2012. Forecast

Evaluation of Nonlinear Models : The Case of Long-

Span Real Exchange Rates. Journal of Forecasting,

595(September 2011), pp.580-595.

Tay, F. & Cao, L., 2001. Application of support vector

machines in financial time series forecasting. Omega,

29, pp.309-317.

Wang, W. et al., 2009. A Novel Hybrid Intelligent Model

for Financial Time Series Forecasting and Its

Application. 2009 International Conference on

Business Intelligence and Financial Engineering,

pp.279-282.

Xiong, T., Bao, Y. & Hu, Z., 2013. Beyond one-step-

ahead forecasting: Evaluation of alternative multi-

step-ahead forecasting models for crude oil prices.

Energy Economics, 40, pp.405-415.

Yang, H. & Lin, H., 2012. Combining Artificial

Intelligence with Non-linear Data Processing

Techniques for Forecasting Exchange Rate Time

Series. International Journal of Digital Content

Technology and its Applications

, 6(April), pp.276-284.

Yu, L., Wang, S. & Lai, K.K., 2008. Forecasting crude oil

price with an EMD-based neural network ensemble

learning paradigm. Energy Economics, 30(5),

pp.2623-2635.

Yu, L. et al., 2010. A multiscale neural network learning

paradigm for financial crisis forecasting.

Neurocomputing, 73(4-6), pp.716-725.

CombiningEmpiricalModeDecompositionwithNeuralNetworksforthePredictionofExchangeRates

249