Sensitivity Estimation by Monte-Carlo Simulation

Using Likelihood Ratio Method with Fixed-Sample-Path Principle

Koji Fukuda and Yasuyuki Kudo

Central Research Laboratory, Hitachi, Ltd., 1-280, Higashi-Koigakubo, Kokubunji-shi, Tokyo, Japan

Keywords: Monte-Carlo Simulation, Sensitivity, Likelihood Ratio, Score Function, Fixed-Sample-Path Principle.

Abstract: The likelihood ratio method (LRM) is an efficient indirect method for estimating the sensitivity of given

expectations with respect to parameters by Monte-Carlo simulation. The restriction on application of LRM

to real-world problems is that it requires explicit knowledge of the probability density function (pdf) to cal-

culate the score function. In this study, a fixed-sample-path method is proposed, which derives the score

function required for LRM not via the pdf but directly from a constructive algorithm that computes the sam-

ple path from parameters and random numbers. The boundary residual, which represents the correction as-

sociated with the change of the distribution range of the random variables in LRM, is also derived. Some

examples including the estimation of risk measures (Greeks) of option and financial flow-of-funds networks

showed the effectiveness of the fixed-sample-path method.

1 INTRODUCTION

Given a system of interest, it is a major concern for

engineers and designers to understand how to make

the system behaviour “desirable” by changing pa-

rameters. To this end, knowledge about the relation-

ship (or the sensitivity) between the system parame-

ters and the system behaviours is required. However,

for complicated and probabilistic systems, the rela-

tionship between parameters and system behaviour

is often unclear, so Monte-Carlo simulation is need-

ed to estimate the relation.

Let X denote a random variable describing sys-

tem behaviours under consideration and x denote its

sample value (sample path). Here, X can be a multi-

dimensional vector and/or a family of random varia-

bles indexed by “time” t (random process). There-

fore, X should be denoted as t in nature, but we

henceforth use X to avoid cumbersome notation.

Assume X is dependent on the system parameters ,

where

z

...

is an N-dimensional vector, and

let fx, be the probability density function (pdf) of

X. There exists a behaviour evaluation function ax

that maps the system behaviour x to a real value

ax. We call the expectation value A of aX, i.e.

Aa

X

ax

f

x,dx

(1)

a “system evaluation function”.

To calculate A of real interesting systems, the

fact that density function fx, is often unknown

becomes an obstacle. However, even if fx, itself

is unknown, in many cases, the system behaviour,

which makes the distribution of X, is known and

modelled, and Monte-Carlo simulation is applicable.

Let W

…

denote an M-dimensional

vector of random numbers and w

…

denote its sample value. We suppose that the

simultaneous probability density function g

of

is well-known, and we can easily generate

random numbers of this distribution on computers.

Examples of include M number of independent

random numbers from a uniform distribution on

0,1

or the standard normal distribution N

0,1

.

Assuming that there exists a function xx

,

,

i.e., a constructive algorithm to compute x from the

parameters and random numbers w

…

,

Aa

X

ax,gd

(2)

holds, whereΩ⊂

denotes the support of g

.

Using the L set of random numbers

…

w

…,…

, we can estimate A by

A≅

1

L

ax

,

.

(3)

309

Fukuda K. and Kudo Y..

Sensitivity Estimation by Monte-Carlo Simulation Using Likelihood Ratio Method with Fixed-Sample-Path Principle.

DOI: 10.5220/0005001603090320

In Proceedings of the 4th International Conference on Simulation and Modeling Methodologies, Technologies and Applications (SIMULTECH-2014),

pages 309-320

ISBN: 978-989-758-038-3

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

Now, our goal is to estimate the sensitivity

∂A

∂

∂A

∂z

…

(4)

of the behaviour evaluation function with respect to

all of the N numbers of parameters by Monte-

Carlo simulation. A direct method to this end is the

finite differential method (FDM), which re-runs a set

of Monte-Carlo simulations under a small variation

∆z

of the parameter z

and approximates

∂A

∂z

≅

A

∆z

A

∆z

≅

1

∆z

1

L

a

x

,∆z

1

L

a

x

,

.

(5)

where ∆z

z

,z

,…,z

∆z

,…,z

. The

problem of FDM is that the convergence speed of Eq.

(5) is slow. The variance of estimation value A

by Eq. (3) is proportional to L

, whereas that of

estimation value

by Eq. (5) is proportional to

L

/

(for indepent sampling) or L

/

(for common

sampling) (Glynn, 1989).Moreover, since the re-run

of a set of Monte-Carlo simulations is needed for

each parameter z

, the computational time might be

impractical if the number of parameters N is large.

There exist two known indirect methods for es-

timating the sensitivity more efficiently than FDM:

the pathwise derivative method (PDM) (Glasserman ,

2003, Rubinstein and Kroese, 2007, Ho and Cao,

1991, Bettonvil, 1981) and the likelihood ratio

method (LRM) (Glasserman, 2003, Rubinstein and

Kroese, 2007, Glynn, 1987). PDM (also called the

“infinitesimal perturbation method”) is based on the

idea of differentiating Eq. (2) with respect to the

parameters ,

∂A

∂

∂

∂

ax,gd

,

gd

.

(6)

Assuming this holds, we estimate the sensitivity by

∂A

∂

≅

1

L

∂ax

,

∂

.

(7)

PDM is quite effective in term of its small variance

and fast convergence speed. However, it has limited

range of application because interchanging the order

of integration and differentiation in Eq. (6) requires

that ax, is (almost surely) continuous with

respect to , which is often not the case.

In comparison, LRM (also called the “score

function method”) is based on the idea of

differentiating Eq. (1) with respect to the parameters

,

∂A

∂

∂

∂

axfx,dx

ax

∂fx,

∂

dx

axhx,fx,dx,

(8)

where

hx,

∂fx,

∂

fx,

∂log

fx,

∂

(9)

is called a “score function”. Assuming this holds, we

estimate the sensitivity by

∂A

∂

≅

1

L

ax

,h

,

.

(10)

LRM has a wider range of application than does

PDM because the pdf fx, is typically a smooth

function with respect to the parameters

, whereas

ax, is not. An exception that does not satisfy

Eq. (8) will be discussed later in Section 2.3.

The restriction on the application of LRM to real

systems is that it requires explicit knowledge of the

pdf fx, to calculate the score function hx,

from Eq. (9). This restriction might seem not to be a

problem because we know the pdf of the random

numbers g

and the constructive algorithm,

which computes the sample path xx

,

from

, and fx, can be calculated from these in theory.

In fact, pdf fx, can be decomposed to the prod-

ucts of some conditional probability density func-

tions for some systems, such as Markov chains, and

discrete event systems without agent loop (Glasser-

man, 2003, Rubinstein and Kroese, 2007). Neverthe-

less, considering that we apply Monte-Carlo simula-

tion due to the lack of explicit knowledge on the pdf

fx,, the derivation of the score function from Eq.

(9) is an intrinsically problematic approach.

In this study, we propose a “fixed-sample-path”

method. Using this method, we can derive the score

function not via the pdf fx, but directly from the

constructive algorithm that computes the sample

path xx

,

from the parameters and the

sample values of the random numbers.

The paper is organized as follows. In Section 2,

we describe the idea of the fixed-sample-path meth-

od and its formulation. In Section 3, the fixed-

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

310

sample-path method is applied to two simple sys-

tems: a system with 2-dimensional uniform random

variables and the estimation of risk measures

(Greeks) of option pricing in finance. Section 4 is a

description of a more complicated example: a finan-

cial flow-of-funds network of 25 companies. Finally,

Section 5 is the conclusion.

2 LRM WITH

FIXED-SAMPLE-PATH

PRINCIPLE

2.1 Basic Idea

The reason the calculation of the score function

hx,requires explicit knowledge of the pdf fx,

is that LRM in Eq. (8) is derived by differentiating

Eq. (1), which depends on fx,. In comparison, Eq.

(2), which is used to derive PDM in Eq. (6), only

depends on g

and x,, which we know

explicitly. Can we not derive LRM from Eq. (2)

instead of Eq. (1)?

Let us consider sensitivity with respect to the i-th

parameter z

. The key idea is, given a sample path

xx, and a small variation ∆z

of the

parameter z

, to consider the small variation ∆ of

the sample values of random variables that

cancels the parameter variation, i.e, ∆ satisfying

Aa

X

ax,gd

(11)

Since ∆ is, of course, not distributed with pdf

g

, the expectaion A∆z

is no longer

calculable with simple expectation Eq. (3). However,

using the importance sampling method, we can

estimate A∆z

by averaging up x

,

x

∆,∆z

with appropriate weights.

Concretely speaking, given a sample path

xx,, we consider a “fixed-sample-path”

derivative of the random variables with respect to

the parameter z

under the condition of fixing the

sample path x:

∂

∂z

∂x

∂z

∂x

∂

.

(12)

We note that the right-hand side of Eq. (12) is a

formal expression because x might be a multi-

dimensional vector. As discussed later in Section 2.3,

the fixed-sample-path derivative

can be

calculated relatively easily from the constructive

algorithm of the function xx

,

. We use

to calculate the score function hx,.

2.2 Formulation of LRM

Let ∆z

be a small variation of the i-th parameter z

.

Then, the expectation A∆z

under the parame-

ter values ∆z

z

,z

,…,z

∆z

,…,z

is

∆z

x

,∆z

g

d

a

x

g

∆

d

d

d

a

x

g

∆

d

d

∂

∂z

∆z

d

≅

a

x

g

∂g

∂

⋅

∂

∂z

∆z

1tr

d

d

∂

∂z

∆z

d,

(13)

where

is the ratio between the small pa-

rameter variation ∆z

and the small variation ∆ of

the random variable, which keeps x constant, i.e.

xx

,

x

∆,∆z

holds. Here,

is an identity matrix, tr denotes the trace of a matrix,

and a centered dot “⋅” denotes the inner products of

vectors. Also,

is the Jacobian determinant

corresponding to the change of variables from to

∆, and Ω

is the image of Ω under this

transform. To get from line 5 to line 6, we use the

following relation. For a matrix B

ε

b

εD with a matrix Dd

and a small real number

ε≪1, the first-order Taylor approximation around

ε0 leads to

1

|

εC

|

1

|

B

ε

|

≅

1

|

B

0

|

ε

|

B

0

|

c

∂b

∂ε

,

1

|

|

ε

|

|

δ

d

,

1εtr

C

,

(14)

where c

is the inverse matrix of B

ε

and (δ

is

an

identity matrix.

Using Eq. (13), we obtain

a

x

′

∆,∆z

i

g

′

∆

′

′

Ω

′

SensitivityEstimationbyMonte-CarloSimulationUsingLikelihoodRatioMethodwithFixed-Sample-PathPrinciple

311

∂A

∂z

lim

∆

→

A

∆z

A

∆z

a

x

∂

∂w

∂w

∂z

g

∂g

∂w

∂w

∂z

dR

a

x

h

,

g

d

R

a

X

h

,

R

.

(15)

Therefore, the score function h

,

can be written

as

h

,

∂

∂w

∂w

∂z

∂

∂w

∂w

∂z

(16)

In addition, R

is a term that is equivalent to the

correction amount associated with the changing

integration range

Ω

of Eq. (13) to Ω. We call R

a

“boundary residual”.

From Eq. (13) and Eq. (15), we

obtain

(17)

where Ω

Ω and ΩΩ

are the differential sets,

∂Ω is the boundary of Ω,

is the outward pointing

unit vector of ∂Ω, and div denotes the divergence

with respect to . From Eq. (10), if

is

zero (vector) on the boundary ∂Ω, then

∂A

∂z

a

x

h

,

g

d

a

X

h

,

(18)

holds.

Here, we calculate the score function h

,

for the typical distributions g

of random

variables with Eq. (16) for future convenience. For

random variables following the M-dimensional

uniform distributions, considering

0, we obtain

h

,

∑

.

(19)

For random variables following the M-

dimensional independent standard normal

distributions

, considering that pdf is written as

g

∏

g

w

, where g

x

√

e

is the

pdf of (1-dimensional) standard normal distributions

and

w holds, we obtain

(20)

Once the score function h

,

is calculated,

we can estimate the sensitivity

∂A ∂z

⁄

by Monte-

Carlo simulation by using the LRM method:

∂A

∂z

a

X

h

,

R

≅

1

L

ax

,

h

,R

(21)

2.3 Discussion

The range in application of the fixed-sample-path

method depends on the existance (and

computability) of the fixed-sample-path derivative

. In other words, given a sample path x

and a small variation ∆z

of the parameter z

, the

existance of the small variation ∆ of the sample

values of random variables that satisfies Eq. (11)

is the key to the fixed-sample-path method. This in

general is not necessarily the case because the

dimension of x, which we must keep fixed, can be

bigger than the dimension of the random variables .

Nevertheless, for many applications, especially for

the case in which the system behaviour X is a time

series t, the fixed-sample-path mathod is

applicable. Here, we exemplify two cases. The first

is the case in which the system behaviour t can

be written as

t

f

t,

,

,

(22)

i.e.,

t

follows a deterministic function ft,

identified by a random variable

of which distribution

is determined by the parameter . Clearly,

∂

∂

∂

∂

(23)

holds in this case. The second is the case in which the

time evolusion of the system behaviour t is

detemined by the relation

t1

f

X

0

,X

1

,…,X

t1

,

, ,

(24)

R

i

lim

∆z

i

→0

1

∆z

i

a

x

1h

i

,

∆z

i

g

ΩΩ

′

a

x

1h

i

,

∆z

i

g

Ω

′

Ω

a

x

g

∂

∂z

i

xconst

⋅

∂Ω

div

a

x

g

∂

∂z

i

xconst

Ω

1

g

div

a

x

g

∂

∂z

i

xconst

h

i

,

∂

∂w

j

∂w

j

∂z

i

xconst

w

j

∂w

j

∂z

i

xconst

M

j1

.

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

312

i,e., t1 at t1 is determined by the past history

of before t, a random variable

that is newly

generated at each time t, and the parameter . In this

case, given a small variation ∆z

of the parameter,

the small variation ∆

of the random variables

that cancells out ∆z

can be determined sequencially

from the initial time t0 to the ending time tT

from the relation

fX

0

,X

1

,…,X

t1

,

,

(25)

Another point we want to note is the boundary

residual R

. An exception that the conventional LRM

with Eq. (8) is not applicable includes the case

where the integral range of Eq. (1) depends on the

parameter z, i.e., the distribution range of the system

behaviour X varies depending on the parameter z.

The boundary residual R

explicitly represents the

correction amount associated with the change of the

distribution range of X, and we can extend the range

of application of LRM to this case using R

as seen

in Eq. (21). However, there would be considerable

difficulty in numerical calculation of R

by (17).

Numerically efficient method for calculating R

is

one of the future works of this study.

3 EXAMPLE CALCULATIONS

In this section, we apply the calculation method

proposed in section 2 to simple examples.

3.1 2-Dim. Uniform Distribution

As the first example, we consider a simple system

consisting of a single parameter, N1, and two

random variables, M2. Let w

,w

be 2-

dimensional uniform random numbers on

0,1

0,1

, i.e., g

,

1 on Ω

w

,w

;0

w

,

1

, and otherwise, g

,

0, and let

z be a real-valued parameter. Assuming the system

behavior as

x

,x

sin

4

,

2z

w

and the behavior evaluation function as

a

x

x

, let us consider the sensitivity of the

parameter value z to the expectation A

z

a

.

Note that since the distribution range of x

2zw

depends on the parameter z, the

boundary residual R is, as we look later, not zero for

this example.

3.1.1 Direct Calculation

We can easily calculate the expectation A

z

and its

sensitivity A′z by direct integration:

(26)

3.1.2 Calculation with Fixed Sample Method

Let us calculate A′z by using LRM with the score

function calculated by the fixed-sample-path method.

Step 1: Generating random numbers

Generate 2L number of random numbers under the

uniform distribution on an interval

0,1

, and repre-

sent them as

w

,

…

.

Step 2: Performing Monte-Carlo simulation

Calculate the system behaviour

x

,x

…

from w

,

…

.

Although this is quite easy for this simple example,

this step might be computer-intensive for real-world

problems.

Step 3: Calculating

For all w

,

…

, calculate

(27)

If an analytical calculation is impossible, we can

adopt numerical approaches. For example, consider-

ing a small ∆z (e.g. ∆z0.01), find numerically

∆w

,∆w

, which satisfies

w

,w

,z

w

∆w

,w

∆w

,z∆z , and approxi-

mate

by

∆

∆

, (j1,2.

From Eq. (27),

turns out to be non-

zero on the boundary ∂Ω, and therefore, considera-

tion of the boundary residual R is required.

Step 4: Calculating

Calculate the derivatives of

with respect

to w

:

fX

0

,X

1

,…,X

t

1

,

t

∆

t

,∆.

A

z

sin

4

1

z

2

w

2

1

Ω

w

1

w

2

sin

2

2

2z

4z

2

2z

5

6

,

A

′

z

4zsin

4z

cos

4z

8z

2

4z1

1

4z

2

.

w

1

z

xconst

x

1

z

x

1

w

1

w

1

z

,

w

2

z

xconst

x

2

z

x

2

w

1

w

1

z

xconst

x

2

w

2

1

4

2

8

2

4

2

2

2

.

SensitivityEstimationbyMonte-CarloSimulationUsingLikelihoodRatioMethodwithFixed-Sample-PathPrinciple

313

∂

∂w

∂w

∂z

1

,

∂

∂w

∂w

∂z

2

2

.

(28)

We can also calculate them numerically by finding

under a small variation of w

.

Step 5: Calculating the score function h

,

From Eq. (19), which is the case for uniformally

distributed random variables, we obatin

(29)

Numerically, calculate the sum of

.

Step 6: Calculating the sensitivity A′z

To derive A′z, the boundary residual R is required.

R is calculated by using line 2 of Eq. (17):

R

a

x

s

,z

|

s

,z

|

dw

a

x

s

,z

|

s

,z

|

dw

1

192

21

16

61

48

32

71

3

128

64

1

sin

4

12cos

4

.

(30)

Calculation using line 3 of Eq. (17) leads to the same

result. Once R is obtained, we can calculate A

z

using Eq. (8):

A′

z

a

h

,z

g

dR

sin

4

z

1

2

2

dw

dw

R

4zsin

4z

cos

4z

8z

4z1

1

4z

,

(31)

which is the same result of direct calculation Eq.

(26), as expected. Numerically, apply the Monte-

Carlo LRM method with the score function s

,

:

A

z

≅

1

L

a

h

,z

R

.

(32)

3.2 Risk Measures (Greeks) in Finance

Currently, financial engineering is one of the most

active fields of investigation that uses the Monte-

Carlo method, and option pricing and designing

hedge strategies are especially important

applications.

Let us calculate some typical risk measures

(Greeks), Delta Δ, Vega ν, and Rho ρ for an Asian

European call option by using LRM with the fixed-

sample-path method. We suppose the underlying

asset price

X

t

of the option follows a geometric

Brownian motion (GBM) under a risk-neutral prob-

ability measure,

dX

t

rX

t

dtσX

t

dB

t

,

(33)

with the spot (initial) price X

0

X

0, where r

is a risk-free interest rate, σ is the volatility of the

asset price, and Bt is a standard Brownian motion.

Equation (33) has an explicit solution:

X

t

X

0

exp

r

tσB

t

.

(34)

The discounted value C

of an Asian (average-price)

European call option derived from this asset with

expiration date T and strike price K satisfies

C

e

max

Xt

dtK,0,

(35)

where

⋅

denotes the expectation under the risk-

neutral probability measure. Dividing T into M seg-

ments, we discretize Eq. (34) to

X

X

expr

∆tσ

√

∆tw

,

(36)

where X

X

j∆t

is the system behaviour, where

j1,…,M and ∆tT/M , and w

…

are inde-

pendent standard normal random variables. Then,

approximating continuous-time integral of Eq. (35)

by discrete-time summation leads to

C

e

max

1

M

X

K

,0

e

aX

e

A

X

,σ,ρ

,

(37)

where we define the behaviour evaluation function

as a

X

max

∑

X

K,0, which equals the

payoff function of the option, and its expectation as

A

X

,σ,ρ

aX

.

On the basis of the above preparations, let us cal-

culate three typical risk measures (Greeks), Delta Δ,

Vega ν, and Rho ρ, defined as

Δ

∂C

∂X

e

∂A

∂X

ν

∂C

∂σ

e

∂A

∂σ

ρ

∂C

∂

r

e

∂A

∂

r

TC

.

(38)

We note that since the distribution range Ω of

W

…

covers the whole

, the boundary re-

sidual R

equals ZERO.

h

,z

∂

∂w

j

∂w

j

∂z

i

xconst

2

j1

1

w

1

2

2

2

2

.

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

314

3.2.1 Delta

⁄

Delta Δ, which represents the sensitivity of option

value C

with respect to the spot price of the under-

lying asset, called “Delta Δ ”, is the most

fundamental Greek in option trading. Considering

the small variation of random variables w

…

that cancel out a given small variation of the spot

price X

, we easily obtain the fixed-sample-path

derivative

∂w

∂X

X

X

X

w

1

σ

√

∆

t

X

,

∂w

∂X

0j2.

(39)

The score function can be calculated by Eq. (20):

h

w

σ

√

∆tX

.

(40)

Therefore,

Δe

∂A

∂X

e

a

h

e

aX

√

∆

(41)

holds. We can estimate Δ by Monte-Carlo expecta-

tion (LRM) by using Eq. (41) with a large number of

sample paths generated by Eq. (35).

3.2.2 Vega

⁄

The sensitivity of option value C

with respect to the

volatility

σ of the asset price is called “Vega ν”. The

fixed-sample-path derivative with respect to

σ is

∂w

∂σ

X

σ

X

w

√

∆

t

w

σ

,

(42)

and the score function is

(43)

where we use the notations w

∑

w

and

w

∑

w

. Therefore, we obtain LRM

estimator

νe

∂A

∂σ

e

a

X

h

e

aX

√

∆

.

(44)

3.2.3 Rho

⁄

The sensitivity of option value C

with respect to the

risk-free interest rate

r is called “Rho ρ ".

Considering the small variation of random variables

w

…

that cancel out a given small variation of

the risk-free interrest r, the fixed-sample-path

derivative is

∂w

∂r

co

n

st

X

r

X

w

√

∆

t

σ

(45)

The score function calculated by Eq. (20) is

h

√

∆

t

w

σ

√

∆

t

Mσ

w

.

(46)

Therefore, we obtain the LRM estimator

ρe

∂A

∂r

TC

e

a

h

T

e

a

X

√

∆

W

T .

(47)

As might be expected, the score functions and

LRM estimators of Delta Δ, Vega ν, and Rho ρ

derived from the fixed-sample-path method in this

section are the same as those derived from the

conventional method by differentiating the

probability density function (Glasserman, 2003,

Broadie and Glasserman, 1996). It is noteworthy that

the conventional method requires explicit knowledge

of the relevant probability density function, whereas

the fixed-sample-path method requires the

knowledge of the time evolution of individual

sample paths x only.

4 ANALYSIS OF FINANCIAL

FLOW-OF-FUNDS NETWORK

The calculation examples of Section 3 were aimed at

pretty simple systems. In this section, we address a

network model of the financial flow of funds among

companies as an example of the relatively compli-

cated system that shows the effectiveness of the

fixed-sample-path method.

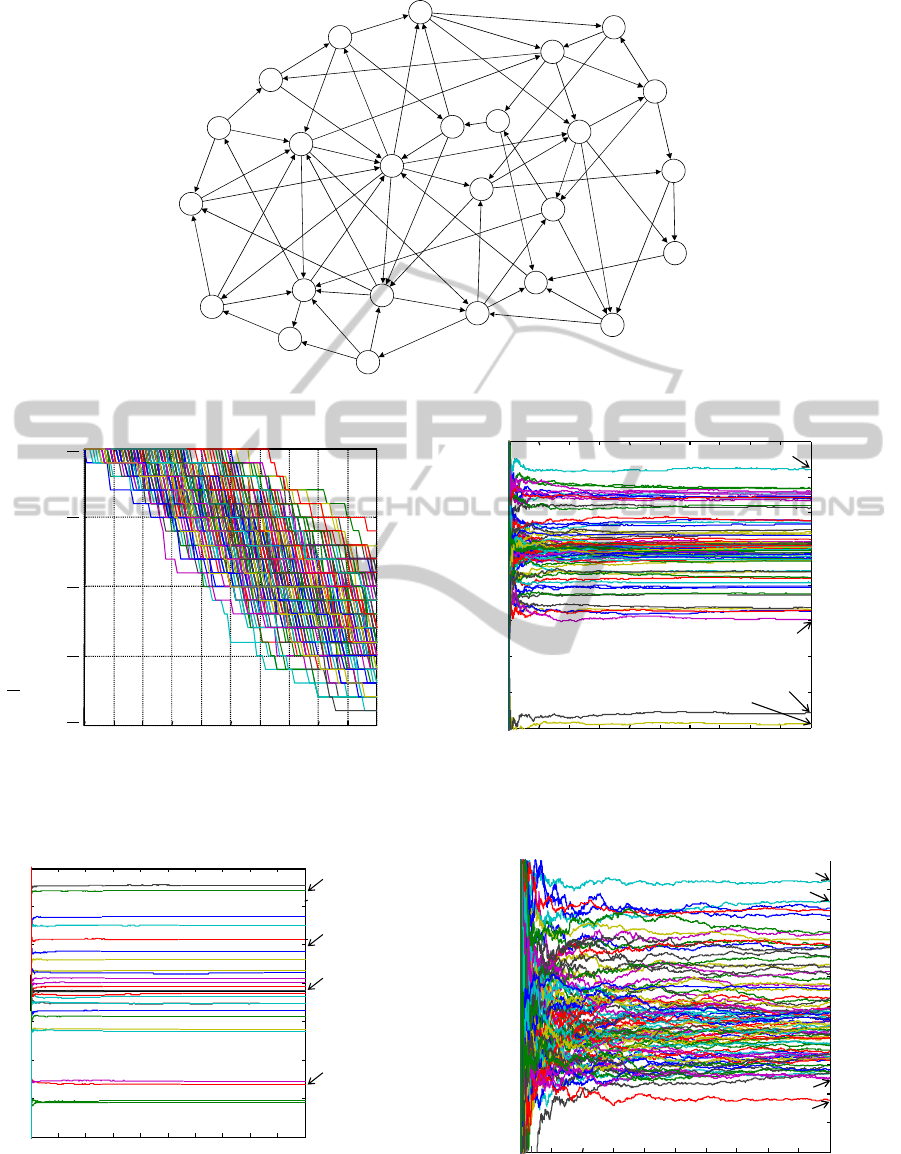

4.1 Outline of the Problem

Let us consider a network of the financial flow of

funds among 25 companies, labeled 1 to 25, as

shown in Figure 1. While a network consisting of 25

companies is not too complicated to understand and

discuss the results, it is fairly complicated to perform

h

σ

∑

w

j

2

1

σ

√

∆

t

w

j

M

j1

w

j

2

σ

√

∆

t

w

j

M

2

Mσ

,

SensitivityEstimationbyMonte-CarloSimulationUsingLikelihoodRatioMethodwithFixed-Sample-PathPrinciple

315

sensitivity analysis with the conventional LRM

method. In Figure 1, the nodes represent each com-

pany, where the numbers written in the nodes repre-

sent the company’s label. The edges represent the

existence of the financial flow of funds along the

edge directions. For simplicity, we suppose that the

average amounts of fund transfers per unit period

equals one for all edges. We suppose, in addition,

that the assets of each company increase or decrease

by an average amount per unit period denoted by

parenthetical numbers beside each node, whereas the

assets of the companies of which corresponding

nodes have no parenthetical numbers do not change.

This increase or decrease in assets represents the

fund transfers from/to companies other than those of

the 25 companies depicted in Figure 1. As a result,

the average net incomes and outgoings per unit peri-

od of each of the 25 companies are balanced.

We suppose the actual amounts of fund transfers

through the edges to be random variables distributed

around the above average amounts. The assets of

each company increase or decrease depending on the

variation of the difference between incomes and

outgoings. As a result, there is the possibility for

"company bankruptcy”, i.e., the assets of a certain

company go negative at a certain time. Here, we

suppose that companies in bankruptcy and the edges

(funds transfer) related to them cease to exist. If

company 1 in Figure 1, for example, goes bankrupt

at time t, we delete four edges: from Co. 1 to Co. 3,

Co. 1 to Co. 20, Co. 17 to Co. 1, and Co. 18 to Co. 1.

As a consequence, companies 3 and 20 become

increasingly likely to go bankrupt because of an

unfavourable balance without fund transfers from

company 1, whereas companies 17 and 18 become

less likely to go bankrupt because of a favourable

balance. Bankruptcy of a company has an effect on

the bankrupt probabilities of the other companies

through the connection structure of the network in

this way.

Now, we are interested in the relationship be-

tween the flow of funds of the edges and the bank-

rupt probabilities of the companies. If the average

flows of each edge slightly change from 1, what

happens in the bankrupt probability of company 1 or

the average bankrupt probability of all 25 compa-

nies? Conversely, which edge is the most effective at

reducing the bankrupt probability of company 1 if

we change the average flow of funds? The edges

linked directly from/to company 1 might naturally

have a large influence, but is there a possibility that

edges located away from company 1 have a large

influence on its bankrupt probability by network

effect? Given this awareness of the problems, the

aim of this section is to estimate the sensitivities of

the bankrupt probabilities of each company and the

sensitivity of the average bankrupt probability of the

all companies with respect to the average flow of

funds of each edge by Monte-Carlo simulation by

using LRM with the fixed-sample-path principle.

4.2 Formulation

Let us consider a network of the financial flow of

funds among 25 companies, shown in Figure 1. We

call the “outside” of the network as “company 0” for

notational convenience, i.e., the fund transfers

from/to companies outside the network (denoted by

parenthetical numbers beside each node) are consid-

ered to be the fund transfers from/to company 0. Let

X

t

denote the total assets of company i (where

i1…25) at time t. We suppose the initial assets

X

0

25 for all 25 companies. The existence

function of company i is defined as

S

t

1, X

t

0

0, ,

(48)

i.e., S

t

equals 1

if company i exists at time t, and

S

t

equals 0

if company i has been bankrupt. We

define S

t

1 for all t for notational simplicity.

Let F

t

denote the amount of the transfer of funds

from company i to company j at time t. F

t

are

random variables with mean μ

1 for i,j (where

i1,…,25 and j1,…,25) for which there exists

an edge between company i and j, while μ

equals

zero for i,j for which there exists no edge between

them. In addition, F

t

and F

t

, which denote

the transfer of funds from/to the outside of the net-

work, are random variables with mean μ

, μ

=1–3,

shown in parentheses in the figure. Here, we sup-

pose F

t

to be under log-normal distribution with

mean μ

and variance

μ

. The assets X

t

of

company (where i1…25) satisfy the relation

X

t1

X

t

F

t

S

t

S

t

F

t

S

t

S

t

(49)

On the basis of the above premises, let us esti-

mate the existence probabilities

S

T

of

each company at T100 and the average existence

probability

S

T

of all 25 com-

panies by Monte-Carlo simulation. In addition, we

estimate ∂

∂μ

⁄

and ∂

∂μ

, i.e., the sensitivity

of

and

with respect to the average flow of

funds of each edge, by using the fixed-sample-path

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

316

method. There exist 86 numbers of μ

, which are

non-zero, that is, 71 edges plus 15 parenthetical

numbers. We can estimate ∂

∂μ

⁄

and ∂

∂μ

for all 86 μ

simultaneously.

4.3 Derivation of Score Functions

To estimate ∂

∂μ

⁄

and ∂

∂μ

, the score func-

tions h

are required. The log of a random varia-

ble under log-normal distribution with mean μ and

variance σ is under normal distribution with mean

and variance :

log

μ

μ

σ

log1

σ

μ

.

(50)

Therefore, F

t

, which is under log-normal distri-

bution with mean μ

and variance

μ

, can be writ-

ten as

(51)

where w

is a random variable with the standard

normal distribution.

Let us apply the fixed-sample-path method. Con-

sidering the relationship between a small variation of

w

and a small variation of μ

under the condition

of keeping F

t

fixed satisfies

∂w

∂μ

dF

t

dμ

∂F

t

∂w

w

32μ

log1

1

μ

2μ

1μ

log1

1

μ

(52)

and the fact that the system behaviour X

t

stays

fixed if and only if all fund flows F

t

S

t

S

t

are fixed, we obtain the fixed-sample-path derivative

w

32μ

log1

1

μ

2μ

1μ

log1

1

μ

,

0,.

(53)

Therefore, from Eq. (20), he score function

h

with respect to μ

is

(54)

where τ

is the last time that company i exists:

τ

argmax

S

t

1

.

(55)

4.4 Simulation Result

We performed a Monte-Carlo simulation with two-

million sample paths and estimated

(56)

Figure 2 shows an over-drawn time series of 200

typical Monte-Carlo sample paths of

∑

S

t

,

the average existence probability of the 25 compa-

nies. Figures 3 - 5 show the convergence of the es-

timated values: Fig. 3 for

and

, Fig. 4 for

∂

∂μ

, and Fig. 5 for ∂

∂μ

⁄

. All of the esti-

mated values are converged. As is known, the con-

vergence speeds of the sensitivities when using the

LRM method are slower than those of the expecta-

tions themselves (Glasserman, 2003).

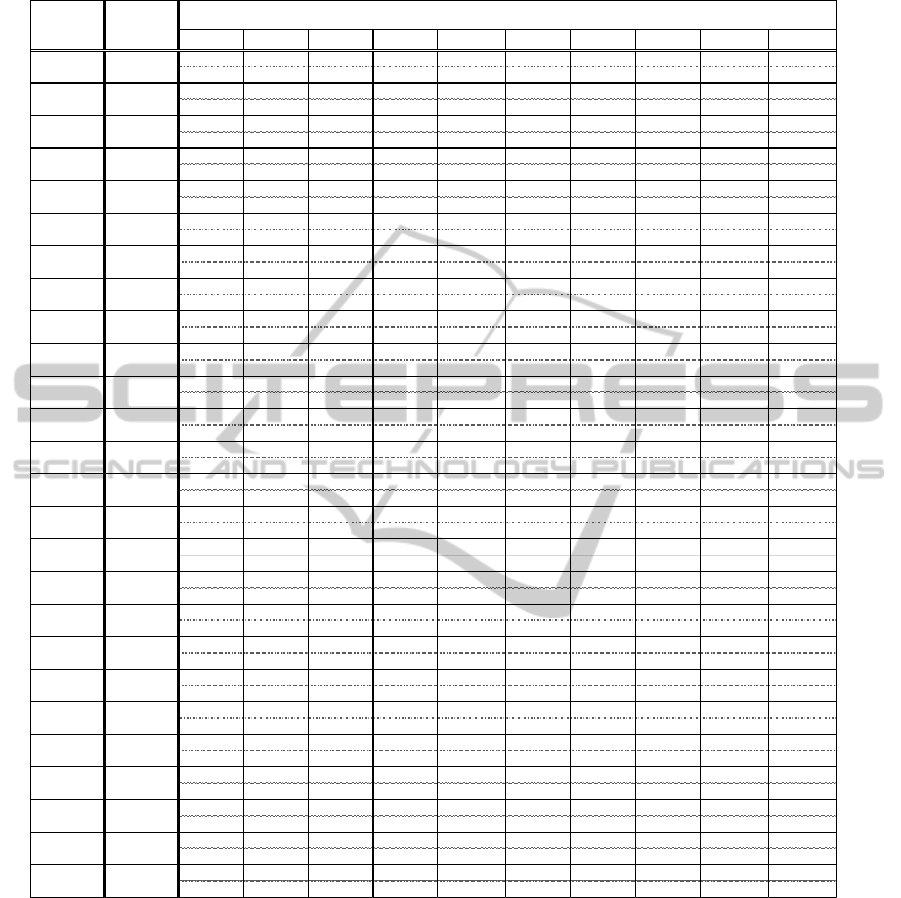

Table 1 shows the estimated values of

and

and their sensitivities ∂

∂μ

and ∂

∂μ

⁄

. The

leftmost col umn of the table shows the estimated

value of

(the average existence probability of the

25 companies) and the 25 estimated values of

(the

existence probabilities of company i). The right ten

columns of the table show the sensitivities (differen-

tial coefficients) of

and

with respect to the

average funds flow μ

of edges. Due to limited

space, the sensitivities with respect to only ten edges,

arranged in descending order of their absolute values,

are shown respectively, where the upper rows identi-

fy the edges, and the bottom rows show the estimat-

ed values of the differential coefficients.

F

ij

t

exp

ij

ij

w

ij

t

μ

ij

2

log11/μ

ij

exp

log11/μ

ij

w

ij

t

μ

ij

1μ

ij

h

μ

ij

∂

∂w

ij

t

∂w

ij

t

∂μ

ij

xconst

w

ij

t

∂w

ij

t

∂μ

ij

xconst

minτ

i

,τ

j

t1

1w

ij

t

2

w

ij

t

32μ

ij

log11/μ

ij

2μ

ij

1μ

ij

log11/μ

ij

minτ

i

,τ

j

t

1

i

S

i

100

≅

1

L

S

i

k

100

L

k

1

i

1

25

S

i

100

25

i1

≅

1

L

1

25

S

i

100

25

i1

L

k

1

∂

i

∂μ

ij

S

i

100

h

μ

ij

≅

1

L

S

i

k

100

h

μ

ij

k

L

k

1

∂

i

∂

μ

ij

1

25

∑

S

i

100

h

μ

ij

25

i1

≅

1

L

∑

1

25

∑

S

i

k

100

h

μ

ij

k

25

i1

L

k1

.

S

i

t

S

j

t

1

SensitivityEstimationbyMonte-CarloSimulationUsingLikelihoodRatioMethodwithFixed-Sample-PathPrinciple

317

Figure 1: Financial flow-of-funds network with 25 companies.

Figure 2: Over-drawn time series of the average existence

probability by Monte-Carlo simulation.

Figure 3: Estimated value of existence probabilities vs

number of simulations.

Figure 4: Estimated value of ∂

∂μ

vs number of

simulations.

Figure 5: Estimated value of ∂

∂μ

⁄

vs number of simu-

lations.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

[1]

[-1]

[1]

[-1]

[-2]

[1]

[-1]

[2]

[1]

[2]

[-1]

[1]

[-3]

[1]

[-1]

0102030405060708090100

t

5

25

10

25

15

25

20

25

25

25

Average existence probability

1

25

S

i

t

25

i1

Time

0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

Number of simulations

×10

6

1

0.6719

i

0.4769

2

0.7415

3

0.2376

Estimated value of existence probabilities

-1

-0.8

-0.6

-0.4

-0.2

0

0.2

0.4

0.6

0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0

×10

6

∂

1

∂μ

ij

⁄

∂

1

∂μ

1,3

0.9747

⁄

∂

1

∂μ

1,20

0.9134

⁄

∂

1

∂μ

3

,

21

0.4447

⁄

∂

1

∂μ

18

,

19

0.3927

⁄

Number of simulations

Estimated value of

-0.1

-0.08

-0.06

-0.04

-0.02

0

0.02

0.04

0.06

0.08

0.1

0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0

Estimated value of

∂

i

∂μ

3,12

0.04944

∂

i

∂μ

10,23

0.06462

∂

i

∂μ

23,3

0.08596

∂

i

∂μ

0,7

0.07176

∂

i

∂μ

i

j

×10

6

Number of simulations

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

318

Table 1: the estimated values of

and

and their sensitivities ∂

∂μ

and ∂

∂μ

⁄

.

From Table 1, for example, edge 233 (the edge

from company 23 to company 3) turned out to have

the largest sensitivity of 0.08596 to

. Edge 07

(the flow of funds from the outside of the network to

company 7) and edge 010 (from the outside to

company 10) also had large sensitivities to

. It is

interesting that edge 233, which is an inner flow

of the network, had larger sensitivity to the average

existence probability

than did the inward flows

from the outside of the network, which increased the

total assets within the network. This would be ex-

plained by the fact that company 23 has four inward

edges, while it has only one outward edge 233. An

increasing flow of funds for 233, which clearly

had an adverse effect on the survival of company 23,

might be desirable for the survival of the many other

companies in the network.

We turn attention to the existence probability

of company 1. The top three edges having a large

effect on

were edge 13, edge 120, and edge

321 in descending order of the (absolute value of)

sensitivities. We are convinced that edge 13 and

edge 120, which are directly outward from node 1,

had large and negative sensitivities to

. It is inter-

i

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

#1 #2 #3 #4 #5 #6 #7 #8 #9 #10

23

→

30

→

70

→

10 0

→

18 10

→

23 0

→

17 0

→

20 0

→

23

→

12 3

→

24

0.08596 0.07176 0.06742 0.06573 -0.06462 0.06146 0.05095 0.04989 -0.04944 -0.04906

1

→

31

→

20 3

→

21 18

→

19 17

→

63

→

11 17

→

718

→

418

→

117

→

12

-0.9747 -0.9134 0.4447 -0.3927 -0.3461 0.3424 -0.3414 -0.3368 0.3345 -0.3238

2

→

32

→

52

→

21 0

→

23

→

20 20

→

21 6

→

220

→

26

→

23 20

→

4

-0.8100 -0.7856 -0.7707 0.6345 0.4148 -0.3370 0.3240 0.3066 -0.2995 -0.2838

3

→

21 3

→

11 3

→

20 3

→

12 3

→

24 20

→

43

→

52

→

21 1

→

20 20

→

2

-0.5485 -0.5407 -0.5334 -0.4134 -0.3956 0.3719 -0.3607 -0.2965 -0.2859 0.2798

4

→

10 4

→

94

→

17 4

→

04

→

39

→

18 24

→

95

→

95

→

10 19

→

4

-0.7510 -0.7464 -0.7339 -0.6120 -0.4982 0.4884 -0.4323 -0.3803 -0.3614 0.3497

5

→

19 5

→

45

→

95

→

10 4

→

319

→

39

→

33

→

24 3

→

12 3

→

21

-0.7143 -0.7053 -0.6733 -0.6124 0.4746 0.4496 0.4455 -0.4150 -0.3834 -0.3569

6

→

23 6

→

216

→

13 23

→

317

→

12 16

→

917

→

123

→

00

→

17 12

→

16

-1.0721 -1.0054 -0.4793 0.4554 -0.4080 -0.4065 -0.4058 0.3542 0.3474 0.3396

7

→

16 7

→

15 7

→

22 0

→

722

→

17 12

→

16 17

→

117

→

616

→

90

→

17

-1.0488 -1.0205 -0.9594 0.7789 0.5961 -0.4402 -0.4348 -0.3906 0.3893 0.3809

8

→

23 8

→

023

→

315

→

13 12

→

13 23

→

012

→

16 15

→

83

→

512

→

8

-1.0896 -0.8440 0.6284 -0.5632 -0.5147 0.4214 -0.4110 0.3514 -0.2901 0.2867

9

→

25 9

→

18 9

→

025

→

24 9

→

314

→

25 18

→

424

→

19 14

→

95

→

19

-0.5920 -0.5796 -0.4650 0.3994 -0.3581 -0.3199 0.3104 -0.2640 0.2539 -0.2515

10

→

23 10

→

16 10

→

11 10

→

14 0

→

10 11

→

513

→

23 16

→

13 14

→

55

→

9

-0.8638 -0.8049 -0.7756 -0.7606 0.6648 0.4750 -0.4707 0.4213 0.4069 -0.3430

11

→

15 11

→

12 11

→

55

→

10 12

→

13 22

→

17 3

→

12 15

→

13 10

→

14 3

→

11

-0.9037 -0.8759 -0.8294 0.4712 0.4209 -0.3898 -0.3650 0.3629 -0.3574 0.3462

12

→

712

→

16 12

→

812

→

13 7

→

22 17

→

716

→

90

→

78

→

23 3

→

5

-0.6790 -0.5719 -0.5492 -0.5186 0.3617 -0.3588 0.2915 -0.2793 0.2644 -0.2593

13

→

10 13

→

23 13

→

010

→

16 10

→

11 12

→

823

→

315

→

816

→

63

→

5

-0.8373 -0.8043 -0.6842 0.5073 0.4574 -0.4472 0.4331 -0.4145 -0.3261 -0.3106

14

→

914

→

514

→

25 0

→

14 5

→

10 10

→

16 10

→

11 10

→

23 0

→

10 9

→

18

-0.8365 -0.7869 -0.7464 0.6162 0.3702 -0.3328 -0.3267 -0.3026 0.2715 0.2418

15

→

815

→

13 12

→

711

→

12 7

→

16 13

→

10 8

→

23 13

→

23 0

→

77

→

22

-1.1379 -1.1117 0.5564 -0.5426 -0.5284 0.4491 0.4376 0.4156 0.4036 -0.3907

16

→

616

→

13 16

→

913

→

10 12

→

13 10

→

14 9

→

310

→

11 9

→

18 0

→

10

-0.8364 -0.8072 -0.8043 0.5246 -0.4697 -0.4008 0.3846 -0.3574 0.3417 0.3259

17

→

12 17

→

617

→

117

→

70

→

17 21

→

12 12

→

822

→

17 12

→

13 7

→

22

-0.9313 -0.8432 -0.8264 -0.7960 0.6776 -0.5995 0.3746 0.3744 0.3742 0.3387

18

→

19 18

→

418

→

10

→

18 4

→

99

→

25 9

→

05

→

924

→

99

→

3

-0.9755 -0.9174 -0.9007 0.7450 0.5324 -0.4179 -0.3943 0.3700 0.3544 -0.3315

19

→

419

→

019

→

318

→

424

→

45

→

418

→

19 24

→

19 4

→

17 5

→

19

-1.1736 -0.8793 -0.7153 -0.6266 -0.6078 -0.5807 0.4290 0.4074 0.4007 0.3902

20

→

21 20

→

220

→

40

→

20 21

→

17 3

→

21 2

→

34

→

34

→

17 1

→

20

-0.9482 -0.9310 -0.8908 0.7290 0.4338 -0.4250 0.3988 0.3926 0.3468 0.3327

21

→

17 21

→

22 21

→

12 3

→

12 17

→

12

→

21 17

→

612

→

16 20

→

412

→

13

-0.9103 -0.8803 -0.8600 -0.4702 0.4002 0.3791 0.3728 0.3541 -0.3444 0.3119

22

→

11 22

→

17 17

→

721

→

17 7

→

16 7

→

15 11

→

12 0

→

717

→

12 11

→

5

-1.0411 -0.9813 0.6397 -0.5667 -0.5137 -0.4763 0.4563 0.4280 0.3974 0.3369

23

→

023

→

33

→

12 6

→

213

→

010

→

14 8

→

06

→

23 0

→

10 10

→

23

-0.5486 -0.4449 0.2889 -0.2859 -0.2788 -0.2577 -0.2489 0.2269 0.2241 0.2192

24

→

19 24

→

40

→

24 24

→

919

→

34

→

33

→

53

→

20 3

→

11 3

→

21

-0.8424 -0.7966 0.6685 -0.6268 0.5091 0.5016 -0.4815 -0.4246 -0.4240 -0.4064

25

→

24 25

→

024

→

99

→

39

→

18 9

→

024

→

40

→

14 4

→

314

→

25

-0.9278 -0.7619 0.5972 -0.5229 -0.4131 -0.3888 0.3871 0.3564 -0.3078 0.2978

0.1888

0.6154

0.3755

0.5610

0.4799

0.5839

0.4926

0.6510

0.5141

0.7548

0.5260

0.4141

0.4483

0.2472

0.3799

0.4284

0.1940

0.4711

0.5024

0.5322

0.4482

0.7415

0.2376

0.4635

0.4769

0.6719

Existence

Probability

The estimated sensitivities with respect to each edge

μ

ij

SensitivityEstimationbyMonte-CarloSimulationUsingLikelihoodRatioMethodwithFixed-Sample-PathPrinciple

319

esting that edge 321, which does not link to com-

pany 1 directly, had the third largest sensitivity. This

would be explained if we note that edge 321 had

the largest (and negative) effect on the survival of

company 3 and edge 13 the largest (and negative)

effect on the survival of company 1.

As seen above, we can estimate the sensitivity of

and

with respect to all 86 numbers of μ

by

Monte-Carlo simulation by using the LRM method

with the score functions derived by using the fixed-

sample-path principle. Although this example net-

work is pretty small, the LRM method with fixed-

sample-path principle can be applicable and practi-

cal for much more complicated systems with numer-

ous parameters, such as for systematic risk analysis

of complicated financial networks, traffic flow on a

complicated roadway network, and emerging “big-

data” analysis.

5 CONCLUSION

In this study, a fixed-sample-path method was pro-

posed, which derives the score function of LRM not

via the pdf fx,. The key idea is to consider the

fixed-sample-path derivative of the random variables

with respect to the parameter z

under the condi-

tion of fixing the sample path x. The boundary re-

sidual R

, which represents the correction associated

with the change of the distribution range of the ran-

dom variables in LRM, was also derived. Some

examples including the estimation of risk measures

(Greeks) of option and financial flow-of-funds net-

works showed the effectiveness of the fixed-sample-

path method.

REFERENCES

Bettonvil, B., 1989. ‘A formal description of discrete

event dynamic systems including infinitesimal pertur-

bation analysis’, European Journal of Operational Re-

search, vol. 42, no. 2, pp. 213-222.

Broadie, M., Glasserman P., 1996. ‘Estimating security

price derivatives using simulation’, Management Sci-

ence, vol. 42, no. 2, pp. 269-285.

Ho, YC., Cao XR., 1991. Simulation and the Monte Carlo

Method, Springer, 1991 edition.

Glasserman, P., 2003. Monte Carlo Methods in Financial

Engineering (Stochastic Modelling and Applied Prob-

ability), Springer, 2003 edition.

Glynn, PW., 1987. ‘Likelihood ratio gradient estimation:

an overview’, Proceedings of the 19th Winter Simula-

tion Conference, pp. 366-374.

Glynn, PW., 1989. ‘Optimization of stochastic systems via

simulation’, Proceedings of the 21th Winter Simula-

tion Conference, pp. 90-105.

Rubinstein, RY., Kroese, DP., 2007. Simulation and the

Monte Carlo Method, Wiley-Interscience, 2

nd

edition.

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

320