Models to Aid Decision Making in Enterprises

Suman Roychoudhury, Asha Rajbhoj, Vinay Kulkarni and Deepali Kholkar

Tata Research Development and Design Centre, Tata Consultancy Services, 54b Hadapsar Industrial Estate,

Pune, 411013, India

Keywords: Modeling, Enterprise Adaptation, Simulation.

Abstract: Enterprises are complex heterogeneous entities consisting of multiple stakeholders with each performing a

particular role to meet the desired overall objective. With increased dynamics that enterprises are

witnessing, it is becoming progressively difficult to maintain synchrony within the enterprise for it to

function effectively. Current practice is to rely on human expertise which is time-, cost-, and effort-wise

expensive and also lacks in certainty. Use of machine-manipulable models that can aid in pro-active

decision-making could be an alternative. In this paper, we describe such a prescriptive decision making

facility that makes use of different modeling techniques and illustrate the same with an industrial case study.

1 INTRODUCTION

Globalization forces and increased connectedness

have led to rise in business dynamics and shortened

time-to-market window for business opportunities.

Modern enterprises are subject to several change

drivers such as opportunities in a new market,

technology advance and/or obsolescence, regulatory

compliance etc. Current practice is to rely solely on

human expertise, which is largely a synthesis of past

experience, in order to arrive at a suitable response

to a change in the operating environment. This is an

effort-, time- and cost-intensive endeavour and is

also error-prone. Arriving at a response involves

addressing issues like: many a time it is not clear

which of the available options is the best option for a

given evaluation criterion, what would be the ripple

effect of taking that option and what is the best way

of implementing that option. As the cost of taking a

potentially incorrect decision is prohibitively high, it

is highly desirable to have aids that can support pro-

active (semi-) automated decision making, where it

would be possible to play out various what-if (and

if-what) scenarios to arrive at the right response,

feasibility of the response, and ROI of the response

(Kulkarni et al., 2013).

Typically, enterprises can be viewed as large-

scale distributed systems characterized by high

complexity, heterogeneity and intense dynamism

leading to complex interactions among humans,

business processes, IT systems and IT infrastructure.

Therefore the key idea is to model an enterprise

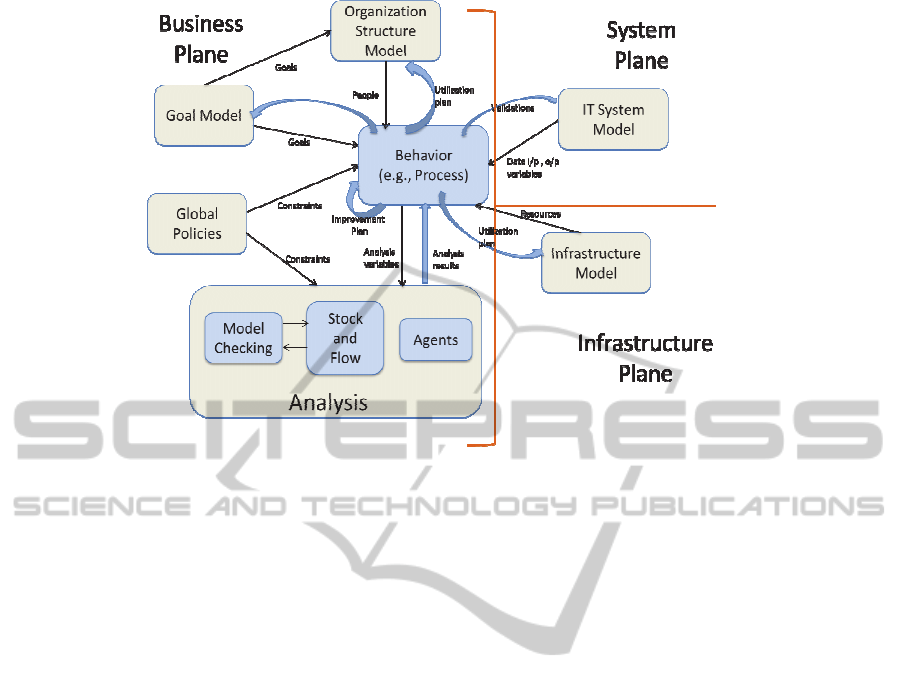

across various planes (see Fig. 1) namely,

Infrastructure plane concerning hardware

infrastructure and firmware managing it, Systems

plane concerning IT systems and their inter-

relationships and Business plane concerning

organization’s vision-mission-goals, structure and

operational processes (Kulkarni et al., 2013).

Furthermore, each plane of the enterprise is

amenable for specification in terms of various kinds

of models. For instance, intentional model for

specifying enterprise objectives and goals; business

process and/or event based models for specifying

workflows; various UML models for specifying

business applications; system dynamical model for

specifying the stocks of interest, their flows and

variables influencing the flows etc. These models

need to be relatable to each other so as to ensure

consistency and completeness within a plane and

alignment across adjoining planes. Therefore, we

believe a holistic model-centric approach will enable

organizations improve agility leading to better

adaptive responsiveness.

The rest of the paper is organized as follows.

Section 2 of the paper presents a motivating

example. Section 3 explains our modeling approach

in the light of the motivating example. Finally, we

discuss some of the key issues and present the

related work in Section 4 before concluding in

section 5.

465

Roychoudhury S., Rajbhoj A., Kulkarni V. and Kholkar D..

Models to Aid Decision Making in Enterprises.

DOI: 10.5220/0004966504650471

In Proceedings of the 16th International Conference on Enterprise Information Systems (ICEIS-2014), pages 465-471

ISBN: 978-989-758-029-1

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

Figure 1: Modeling Approach.

2 MOTIVATING EXAMPLE

In this section we introduce a motivating example

that sets the context for the rest of the paper. Let us

consider a large financial company (FinCom) whose

earnings model is based on the number of financial

products (e.g., loans, mutual funds, insurance etc.) to

be sold to potential customers. To sell its products,

the company needs to acquire a large customer base.

Customer acquisition is an expensive process that

involves investment in advertisement, promotions,

publicity etc. However, instead of incurring such

financial expenditure, FinCom intends to maintain a

minimal customer acquisition cost by partnering

with large retail chains selling consumer durable

products such a televisions, refrigerators etc.,to a

sizeable customer base. FinCom targets this

customer base by providing attractive loans at 0%

interest for 1-2 years duration. In this manner,

FinCom acquires new customers, then cross-sells

other financial products to them. FinCom works on a

very thin margin for individual clients; however,

their overall profitability remains high due to high

volume sell to a substantial customer base. FinCom

business model works for the retailers too who can

offer their clientele attractive third party credit

facilities.

The business model of FinCom seemed to have

worked very well. The company is able to hook

increasingly large number of customers at a faster

growth rate of 20% Quarter_on_Quarter. They are

also able to convert a healthy chunk of prospects to

customers with minimal selling cost. Cost of

servicing customers is also quite low. Thus, overall

their business is growing at a pretty fast pace.

However, the company has identified new

challenges that are vital for their future growth and

expansion into new markets. The company aims to

scale up revenues by a factor of 10 without having to

increase the associated cost. In other words, FinCom

would like to have a non-linear revenue growth. As

the company ventures into emerging markets, most

of the IT intensive business processes need to scale

and seamlessly integrate with newer systems.

Currently the IT operations are managed by FinCom

itself but the company is finding it increasingly

difficult as managing IT is not their primary forte.

Instead they would like to concentrate on developing

new financial products, perform various market

analyses and focus on diverse data-centric analytics

on its existing customer base.

FinCom is looking for able IT service providers

who can manage their end-to-end IT operations

including guidance towards future IT expansion. For

example, to remain competitive, FinCom would like

their gadget savvy customers to avail new channels

like smartphones, tablets and other ubiquitous

devices for making payments towards their loans or

mortgage products. Similarly the company would

like to evaluate whether some of their IT services

could be moved to a cloud-based infrastructure

without compromising any security issues or

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

466

Figure 2: Intentional Model to capture Stakeholder goals.

Figure 3: Customer Acquisition Business Process Flow.

degradation of quality of service (QoS). However,

their internal IT is not well equipped to provide

these additional pervasive channels or move to a

cloud-based infrastructure at a rapid pace. Therefore

FinCom would like to outsource their non-core

business to external IT service providers.

3 MODELING APPROACH

In the context of the above business case, Fig. 1

presents our holistic modeling approach aimed at

pro-active data-driven decision making. The goal is

to capture various facets of an enterprise belonging

to each of its plane (i.e., Business, System and the

Infrastructure plane) with precise modeling

techniques and finally analyzing the result by

simulating them in concert. For example, in Fig. 1,

the goal model captures the business objectives of

the enterprise, while the organization structure

model describes the people/role aspect of the

enterprise along with vision, mission, local policies

etc. Similarly, the IT System model describes the

overall IT need of an enterprise from a system

perspective i.e. which steps of operational processes

are being automated using which application

services and what data needs to be monitored. Apart

from the structural aspects of the enterprise, the

general behaviour of the enterprise is realized in the

form of a behavioural model. Currently this is

realized using Business Process Modeling Language

(Scheer, 1996) but in future will be extended to a

ModelstoAidDecisionMakinginEnterprises

467

Figure 4: Stock-n-Flow model to analyze peak season load.

more general modeling language such as event based

modeling (Clark et al., 2011).

Once the structural and behavioural aspects of

an enterprise across multiple planes are captured,

different what-if scenarios are played out and the

results so obtained are provided as feedback to fine

tune the models in each of these planes. For

example, analysis of workflow can lead to

restructuring of business process and/or task

assignment resulting in improved resource

utilization. Similarly one can validate if none of the

critical business goals are compromised or the IT

system model is in conformance with the perceived

IT needs of the enterprise. The analysis models are

chosen such that they are best suited for what-if

analysis, for instance, stock-n-flow, agent-based,

petri-nets and event-based models (Forrester, 1958;

Reisig, 1991; Bresciani, 2004). In the following

section, we demonstrate use of various models and

their relationships with an objective of automated

analysis. We start with an intentional model that

captures the overall goals of the enterprise (Yu et al.,

2006).

3.1 Modeling Goals with Intentional

Model

In Fig. 2, the ovals represent the strategic rationales

(SR) for the two primary stakeholders (i.e., FinCom

and SP). Each SR is further decomposed into goals,

soft-goals and tasks that are means by which the

goals can be reached. For example, the root-level

goal ‘Manage Business’ can be achieved by defining

business strategies, acquiring customers, making

profit, and scaling up business. The links between

the stakeholders represent strategic dependencies.

For example, FinCom is dependent on SP to

automate some of their business processes, while SP

is dependent on FinCom to define appropriate SLAs.

The highlighted part in Fig. 2 shows specifically

the customer acquisition process that is one of our

primary point of interest. Some of the sub-tasks of

Acquire Customers are Credit History Check, Cross-

Sell products etc., while Market Analysis helps to

acquire new customers. Although Intentional model

can capture goals, tasks and their dependencies, it

does not capture the sequence of events that truly

describes the process.

Therefore to capture such event-oriented process

behaviour, we use standard BPM language as

depicted in Fig. 3. The process model shows two

primary stakeholders, namely the consumer durable

Retailer who offers customer with various products

along with attractive financial schemes and the

Service Provider who facilitates the customer loan

request process. Fig. 3 describes the process, i.e., the

customer fills the loan request form, which is then

scanned and send to SP for credit check. Loan is

approved if the customer has a good credit score,

otherwise it is denied. However there are SLAs that

guarantees that the entire approval process from loan

application to approval/rejection should not take

more than 3 minutes. Moreover, during peak festive

season, there is a sudden increase in number of

customers to be serviced. Keeping this concern in

mind, the business process must be able to adapt to

changing business scenario without any significant

increase in cost or deviation in SLAs. Since it is not

possible to analyze such a scenario using standard

BPM time, cost and resource analysis techniques

(Scheer, 1996; IBM RSA, 2014), we use stock-n-

flow model which provides quantitative analytical

modeling abilities to play out various what if-

scenarios, the results of which are used by the

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

468

process models for further optimization. The next

section demonstrates use of stock-n-flow model for

this purpose.

3.2 Analyzing Peak Season Load

Stock-n-Flow Model

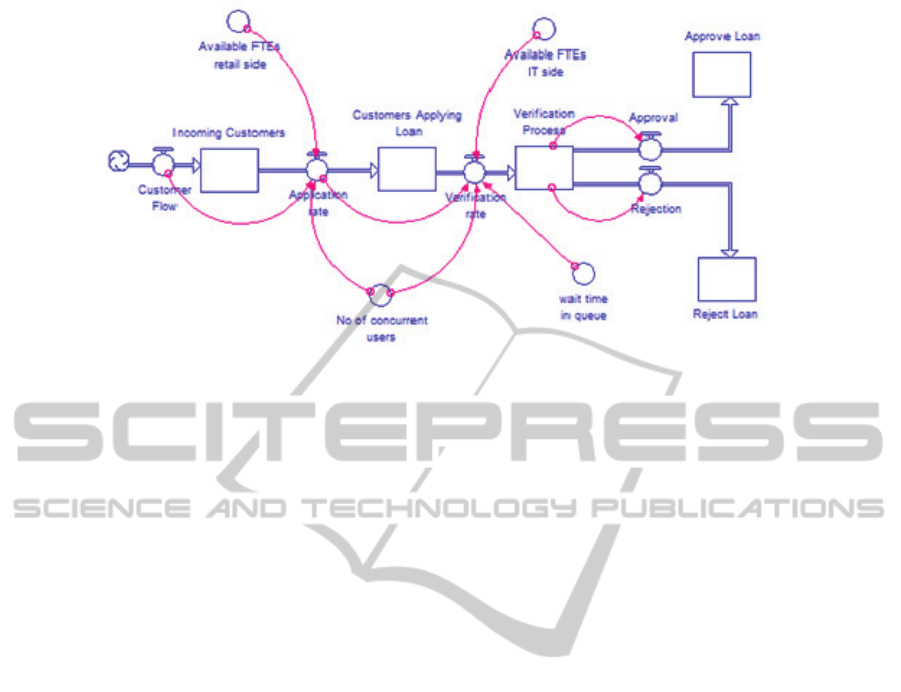

Stock-n-flow models (Forrester, 1958) typically

capture the temporal behaviour of an enterprise. For

example, during peak season (e.g., festive holidays),

there is a steady rush in sale of consumer durable

products. As a result the number of consumers

applying for loan increases. To ensure there is no

bottleneck, FinCom would like to know whether

they can still manage their loan approval business

process with existing manpower without

compromising on QoS. Fig. 4 shows the stock-n-

flow model to analyze peak season load. The stocks

are typically the Incoming Customers, Customers

Applying Loan etc., while the flows are Application

rate, Verification rate, Customer flow etc. Some of

the key variables that are used to analyze the peak

season load are Available FTEs, wait time in queue,

no. of concurrent users etc. Using stock-n-flow

model one can parameterize and then refine the

values of the variables to play out various what-if

scenarios for pro-active decision making. For

example, the model can simulate the impact on

verification rate or loan application rate during peak

season (i.e., when customer flow increases).

Consequently, one can reason about the number of

FTEs required at the retailer side or IT side or both.

Similarly, additional questions like how many

concurrent requests can still be handled without

significant degradation in QoS (e.g., wait time in

queue). All such questions and scenarios can be

played out in advance and thereby help both the

service provider and the enterprise to arrive at more

informed decisions.

Although stock-n-flow models helped us to

simulate various what-if scenarios, however, one

needs to refine the values of the stocks, flows and

variables to arrive at an optimum solution. That is, to

carry out the simulation, an initial set of valid input

values from the sample space is required. This is a

manual time consuming process because one needs

to keep all the dependency constraints in mind while

assigning values to variables. For example, FTE

productivity can be increased with improved training

and additional incentives like increase in salary.

However, this increases FTE cost. FTE cost can also

increase with increase in total number of FTE, which

in turn increases administration cost and as well

impacts on Service Provider profitability. Similarly,

Retailer and FinCom profit increases with increase

in total number of customers. Thus one can observe

that there is a dependency relationship among

various parameters and considerable manual effort is

required to assign right values to all the parameters

without breaking any of the pre-defined

organizational policy constraints. Also, there are

pre- and post-condition constraints from the business

process model and business rule constraints that

need to be considered. In order to remove such

manual intervention, we have introduced model

checking (Merz, 2001), by which we automatically

obtain values that satisfy the given constraints in the

stock-n-flow model.

Once a valid set of input values from the model

checker is automatically obtained, the stock-n-flow

model is then simulated and the results so obtained

are used as feedback to other models in the three

planes. For example, using stock-n-flow we obtained

the optimal number of FTEs for managing peak

season load and feed these results back to

infrastructure and organization structure model as

the new utilization plan (see Fig. 1).

3.3 Discussion and Future Work

So far we have seen how each of the models

belonging to Business, System and Infrastructure

planes of Fig. 1 captures a specific problem of the

enterprise. However, it is important to relate the

analysis results and percolate them across different

planes to get a more holistic view of the enterprise.

For example, using intentional models we captured

business objectives or tasks. But these tasks were not

ordered or sequenced. Therefore, by using BPM

language we were able to describe the sequence or

ordering of events as well as associate cost, time and

resources to these events. However, since BPM

models were not sufficient to play out certain

analyses, other suitable modeling techniques were

employed. For instance, stock-n-flow models were

used for analyzing peak customer load. Moreover

we related the key variables used in the stock-n-flow

models with the “data” variables available from the

BPM and System models. Thus, we were able to

establish an initial relationship between these

disparate models.

4 RELATED WORK

Enterprise Architecture modeling is prevalent for a

number of years (Lankhorst, 2005). There are a quite

a few EA frameworks like FEA (FEA, 2006),

ModelstoAidDecisionMakinginEnterprises

469

Zachman (Zachman, 1987) TOGAF (TOGAF,

1995), Archimate (Archimate, 2012), that provide

holistic blueprints for the organizational and

architectural models. However, a key aspect that is

missing is machine processability analyzability,

which is the core contribution of this paper. MEMO

(Frank, 2002) provides a method to support the

development of enterprise models. Abstractions for

various interrelated aspects like corporate strategy,

business processes, organizational structure and

information models are provided, but, with limited

support for automated analysis. Other key topics like

Business-IT alignment, landscape mapping etc, are

covered in detail over the past (Schekkerman, 2006),

however the focus of this paper is more on

automated machine-dependent (i.e., minimum

human dependency) decision making using a variety

of appropriate modeling techniques. From a tooling

perspective, various tools exist for enterprise

architecture and business process modeling (Scheer,

1996; IBM RSA, 2014; iGrafx, 2014; MEGA,

2014), however analysis support is limited to

simulation of business processes so as to identify

process bottlenecks and suggest optimization in

terms of resources, time and cost. These tools do not

provide support for taking forward analysis results

of one model onto another. Moreover, analysis

capability of these tools is limited to business

process models only. Existing literature on

enterprise modeling research (Schekkerman, 2006)

also does not include evidence of use of multiple

modeling techniques in conjunction, or of model

checking to verify multiple modeling paradigms. To

this respect, our previous work on mapping

Intentional models with System Dynamic models in

the context of EA (Sunkle et al., 2013) was an early

start. In this paper, we have extended that work by

introducing the concept of modeling across various

layers of the enterprise with suitable techniques that

are appropriate for that layer and finally we propose

to orchestrate them in concert to get a holistic view

of the enterprise.

5 CONCLUSIONS

In this paper, we discussed a model-centric approach

to enable enterprises improve their agility and

prepare them for better adaptive responsiveness. We

proposed a layered architecture for modeling

enterprises wherein the adjoining layers have a well-

defined relationship and each layer addresses a set of

coherent concerns as seen from the perspectives of a

set of stakeholders. The key idea is to specify each

layer in terms of a model which can be viewed as a

set of relatable models each constituting an intuitive

and closer-to-problem-domain specification of a

concern – as advocated by separation of concerns

principle. We argued the case for these models to be

relatable, analyzable and simulatable. We illustrated

the rationale behind the proposed model-centric

approach through a motivating example. We

described several modeling techniques (e.g.,

intentional, stock-n-flow, agent-based) that best

match an underlying problem scenario. We

described how each one of the models caters to

specific goals and how they relate to and

complement each other. We further described how

our proposed solution percolates analysis results

from one model to another model either in the same

or in a different enterprise layer. Until now, we have

found very little evidence of such an approach in the

existing literature and believe that the enterprise

engineering community can largely benefit from the

investigations and position taken in this paper.

REFERENCES

ArchiMate 2. 0 Specification 2012. Van Haren Publishing

Series. Bernan Assoc.

Bresciani, P., Giorgini, P., Giunchiglia, F., Mylopoulos, J.,

Perini, A., 2004. Tropos: An Agent-Oriented Software

Development Methodology,In Autonomous Agents

and Multi-Agent Systems, Vol. 8, No. 3, pp. 203–236,

Springer.

Clark, T., Barn, B., 2011. Event driven architecture

modelling and simulation, In SOSE’11, pp. 43-54,

IEEE Computer Society.

FEA 2006. Federal Enterprise Architecture Program EA

Assessment Framework 2.1.

Frank, U., 2002. Multi-perspective enterprise modeling

(MEMO) conceptual framework and modeling

languages," In HICSS., pp.1258-1267. IEEE

Computer Society.

Forrester, J., 1958. Industrial Dynamics--A Major

Breakthrough for Decision Makers, In Harvard

Business Review, Vol. 36, No. 4, pp. 37–66.

IBM RSA 2014. http://www-03.ibm.com/software/

products/us/en/ratisystarchfami.

iGrafx 2014. http://www.igrafx.com.

Kulkarni, V., Roychoudhury, S., Sunkle, S., Clark, T.,

Barn, B., 2013. Modeling and Enterprises - The Past,

the Present, and the Future, In MODELSWARD’13,

SCITEPRESS.

Lankhorst, M., 2005. Enterprise Architecture at Work:

Modeling, Communication and Analysis, Springer.

MEGA EA Tools, 2014. http://www.mega.com/en/

solution/enterprise-architecture.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

470

Merz, S., 2001. Model Checking: A Tutorial Overview”,

In Proc of the 4th Summer School on Modeling and

Verification of Parallel Processes, pp. 3-38.

Scheer, A., 1996. ARIS-Toolset:Von Forschungs-

Prototypen zum Produkt" Informatik-Spektrum 19:

71–78, Springer-Verlag.

Schekkerman, J., 2006. How to Survive in the Jungle of

Enterprise Architecture Frameworks: Creating or

Choosing an Enterprise Architecture Framework,

ISBN-13: 978-1412016070.

Sunkle, S., Roychoudhury, S., Kulkarni, V., 2013. Using

Intentional and System Dynamics Modeling to

Address WHYs in Enterprise Architecture, In

ICSOFT-EA, SCITEPRESS.

TOGAF Version 9.1, 1995. http://pubs.opengroup.org/

architecture/togaf9-doc/arch/

Reisig, W., 1991. Petri Nets and Algebraic Specifications.

Theoretical Computer Science Vol. 80, No. 1, pp. 1-

34, Elsevier.

Yu, E., Strohmaier, M., Deng, X., 2006. Exploring

Intentional Modeling and Analysis for Enterprise

Architecture, In EDOC Workshop on Trends in

Enterprise Architecture Research.

Zachman, J. A., 1987. A Framework for Information

Systems Architecture. In IBM Systems Journal, Vol.

26, No. 3.

ModelstoAidDecisionMakinginEnterprises

471