e-Commerce Game Model

Balancing Platform Service Charges with Vendor Profitability

Zheng Jianya

1

, Daniel L. Li

2

, Li Weigang

1

, Zi-ke Zhang

3

and Hongbo Xu

4

1

TransLab, Department of Computer Science, University of Brasilia, Brasilia, 70910-900, Brazil

2

Coleman Research Group, Raleigh NC, U.S.A.

3

Insititute of Information Economy, Hangzhou Normal University, Hangzhou, China

4

AliResearch Center, Alibaba Group, Beijing, China

Keywords: e-Commerce, Service Charges, Game Theory, Nash Equilibrium.

Abstract: One of the biggest challenges in e-commerce is to utilize data mining methods for the improvement of

profitability for both platform hosts and e-commerce vendors. Taking Alibaba as an example, the more

efficient method of operation is to collect hosting service fees from the vendors that use the platform. The

platform defines a service fee value and the vendors can decide whether to accept or not. In this sense, it is

necessary to create an analytical tool to improve and maximize the profitability of this partnership. This

work proposes a dynamic in-cooperative E-Commerce Game Model (E-CGM). In E-CGM, the platform

hosting company and the e-commerce vendors have their payoff functions calculated using backwards

induction and their activities are simulated in a game where the goal is to achieve the biggest payoff. Taking

into consideration various market conditions, E-CGM obtains the Nash equilibrium and calculates the value

for which the service fee would yield the most profitable result. By comparing the data mining results

obtained from a set of real data provided by Alibaba, E-CGM simulated the expected transaction volume

based on a selected service fee. The results demonstrate that the proposed model using game theory is

suitable for e-commerce studies and can help improve profitability for the partners of an online business

model.

1 INTRODUCTION

With the development of information technology, E-

commerce has fundamentally reshaped the

customers' purchase behaviour through online

shopping service. Online shopping attracts more and

more people due to its convenience, wider range of

products and time-saving benefits, and also

significantly helps enterprises to reduce the cost of

sales – especially for the small and medium-sized

industrial groups. To cater the rising demand of e-

commerce, many companies such as Amazon, eBay

and Alibaba provide platforms with e-commerce

infrastructure service for small businesses and

individual entrepreneurs, allowing them to open

online retail stores. This kind of services has

significantly accelerated the growth of e-commerce,

as it builds a bridge between traditional retailers and

online shopping.

In 2012, online sales grew 21.1% to top $1

trillion for the first time according to the new global

estimates by eMarketer (2013). With e-commerce

and online shopping steadily growing up, it becomes

necessary to study and improve the profit model of

the platforms. Nowadays most platforms such as

eBay and Amazon charge the listing fees, referral

fees and variable closing fee. Apart from that,

Alibaba proposed an innovation e-commerce model

where the online trading platform is divided into two

domains. “Taobao Marketplace” (Taobao) which is

free admission, but only has grants access to basic

services such as product listing; “Tmall Shopping”

(Tmall) grants access to more privileges by

collecting paying service fees. Alibaba guarantees

the quality of its products by charging deposit from

e-retailers in Tmall, this service enhances the

customers’ confidence during the purchasing process.

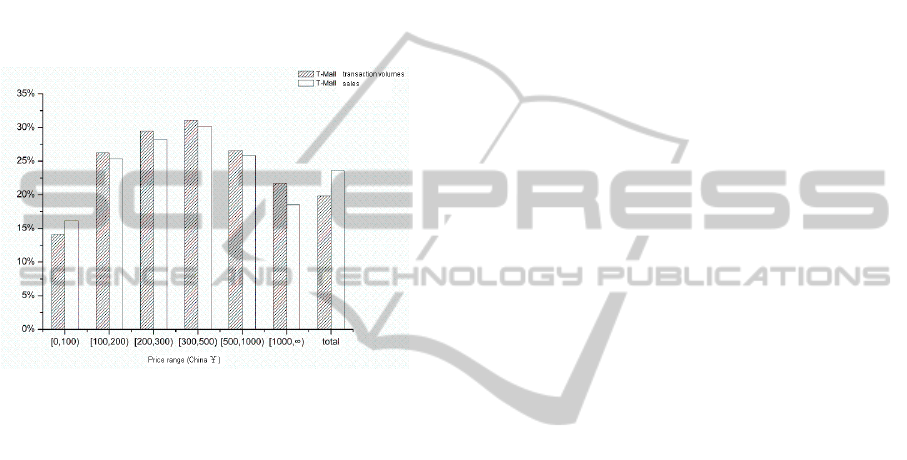

Figure 1 shows the percentage of gross trading

volume and sales of Tmall in the entire Alibaba

platform (includes Taobao and Tmall) in Nov. 2012.

There are 19.7% in gross trading volume and 23.6%

in sales respectively over all the transactions

(Alibaba, 2013). However, interesting results can be

observed when we group all products in different

613

Jianya Z., L. Li D., Weigang L., Zhang Z. and Xu H..

e-Commerce Game Model - Balancing Platform Service Charges with Vendor Profitability.

DOI: 10.5220/0004888406130619

In Proceedings of the 16th International Conference on Enterprise Information Systems (ICEIS-2014), pages 613-619

ISBN: 978-989-758-028-4

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

price ranges. Taobao dominated transactions in the

price range between ¥0.00 ~ ¥100.00 (US$1.00≈

¥6.20 in Nov. 2012), whereas Tmall observed a

volume almost 25% less than the average. When the

transaction price exceeds ¥100, the increase trading

volume for Tmall is evident. Transaction volume

and sales are both 25% more than average for the

price range from ¥100.00 to ¥1000.00, and for

certain price ranges it is 30% above average. This

statistical result demonstrates that added services of

platform can promote the transactions in e-

commerce.

Figure 1: Percentage of Tmall in transaction volumes and

sales.

This work focuses on the study of service

charges of e-commerce. We propose a E-commerce

Game Model (E-CGM) to calculate the best

estimation for optimal service charges while taking

into consideration both platform hosts and e-retailers.

In E-CGM, e-commerce platform and e-retailers are

modelled as players in full information dynamic

game, with the payoff functions defined in a real

business environment, the result, which is the Nash

equilibrium of game, can be achieved by backwards-

induction reasoning method.

The rest of this paper is organized as follows.

Section 2 presents related work regarding

relationship between traders and marketplaces in e-

commerce and Leontief model in game theory.

Section 3 depicts the details of E-CGM model and

mathematical procedures involved in the derivation.

Section 4 analyses the E-CGM and discusses Nash

equilibrium. For implementation purposes, section 5

conducts an empirical study with real data collected

from Alibaba e-commerce platform and makes a

comparison between our results and Alibaba’s

current charges. An expanded model is proposed to

enhance the applicability of E-CGM in section 6.

Conclusion is listed in section 7 with open remarks

on future work.

2 RELATED WORK

To the best of our knowledge, this work is the first

attempt to calculate optimal service charges in an e-

commerce platform. Although there is almost no

research regarding this topic, the study of

relationship between traders and marketplaces in

online business provides insight to our work.

Miller and Niu (2012) viewed the marketplace

selection as an N-armed bandit problem, authors

assessed four reinforcement algorithms by using the

JCAT double auction simulation platform. The

trader profit and global allocative efficiency were

discussed by comparing with the random

marketplace selection. The result showed that an

intelligent marketplace selection strategy is better

for both trader profitability and market efficiency.

Shi et al. (2010) proposed a framework for analyzing

competing double auction markets that vie for

traders. Authors game-theoretically analyzed the

equilibrium behaviour of traders’ market selection

strategies and adopt evolutionary game theory to

investigate how traders dynamically change their

strategies. The result indicated that it is possible for

the competing market to keep traders even when

charging higher fees if it already has a larger market

place. Also found that as the number of traders

increases, this became more difficult and traders

prefer the cheaper market. Sohn et al. (2009)

discussed the influence of pricing policy on the

trader migration. Their research demonstrated that

market policy and agent trading behaviour needed to

be aligned to perform effectively. They explored the

implications of a biased pricing policy that be able to

attract more market share and total profit.

The research of e-commerce taxation

complements the growth of online business. McLure

(1996) made a comprehensive and systematic study

of the taxation of electronic commerce as early as

1996, where he presented economic objectives,

technological constraints and tax laws in this field.

Laudon and Traver (2007) analyzed Amazon’s

charging system, but did not propose a concrete

model and the empirical study. Ahmed and Hegazi

(2007) proposed a dynamic model for e-commerce

taxation, which is used to derive a condition on the

number of e-commerce firms to avoid market

instability. Zeng et al. (2012) made a corresponding

research in the Chinese e-commerce market and

proposed solutions for this problem.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

614

In our study, we take the relationship between

traders and marketplaces as a game, and it fits well

into the Leontief model. In Leontief’s model (1946)

of the relationship between a firm and a monopoly

union, the union is the monopoly seller of labour to

the firm that has exclusive control over wages, but

the firm has exclusive control over employment. The

union’s utility function is U(w, L), where w is the

wage the union demands from the firm and L is

employment. Assume that U(w, L) increases in both

w and L. The firm’s profit function can be

represented as π(w, L) = R(L) – wL, where R(L) is

the revenue the firm can earn if it employs L

workers and makes the associated production and

product-market decisions optimally.

With the study of all the above literatures,

especially the Leontief’s model we proposed a

solution based game theory to treat the charging

problem in the e-commerce platform in the next

section.

3 e-COMMERCE GAME MODEL

A research model based on the game theory was

developed to calculate the optimal service charges

that would yield improved profit for both platform

hosts and e-retailers. Section 3.1 models the e-

commerce environment and specifications. Section

3.2 provides details on E-CGM, Section 3.3 analyzes

briefly the Nash equilibrium of E-CGM.

3.1 Model the Environment and

Specifications

The e-commerce platforms can be organized in

several different architectures, each of them has a

corresponding charging policy. For example, some

platforms charged based on listing fees and closing

fees, such as Amazon.com and eBay. Others charge

a fixed service fee based on a yearly rate, such as

Alibaba Tmall. In this paper, we focus on the latter

environment to calculate a optimal rate that benefit

both the platform and e-retailers. Here are some

assumptions applied in our research.

Assumption 1: The Platform is in a Dominant

Position in the Market, Raising or Setting the

Amount of e-retailers will not Affect its Sales or

Transaction Volumes. But More Sales or

Transaction Volumes Require More e-retailers.

Suppose that the market is dominated by a

certain platform in a region or a country, so raising

or setting the number of e-retailers within this

platform will not affect the customers’ choice. It’s

normal in the current e-commerce market, for

instances, the Alibaba in China and MercadoLivre in

Brazil. But the growth of sales or transaction

volumes would require more e-retailers to meet all

customers’ demand.

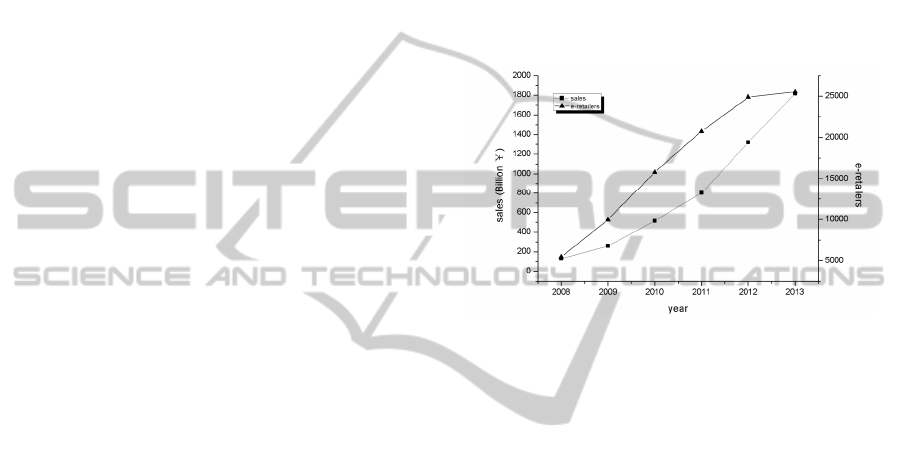

The following figure shows the e-commerce

sales and the number of e-retailers in China (Cao et

al., 2013). From the figure, we can see that although

the number of e-retailers is small in the initial stage,

it didn’t have any noticeable effect on e-commerce

growth. Along with the increase of e-commerce

sales, the number of e-retailers has greatly increased.

Figure 2: The e-commerce sales and the number of

e-retailers (the data of 2013 is estimate value).

Assumption 2: The Qualification of an e-retailer

Can be Obtained by Paying the Service Fee.

The objective of this assumption is to simplify

the unnecessary restrictions. In fact, e-retailers are

required to undergo tests and verifications by the

platform to ensure their qualifications. But the target

of this study is focus on the number of e-retailers, so

the procedure of verification is not considered

critical for the objective. We assume that all e-

retailers will attain qualification by paying the

charges.

Assumption 3: All the e-retailers Within a

Platform Form a Union and There is an Even

Distribution of Profit.

With this assumption, we can study the

relationship between e-retailer and platform based

on a macroscopic point of view. Although the result

would be an estimate for individuals, it has

important statistical significance to help the decision

making process for both sides.

3.2 e-Commerce Game Model Design

E-CGM models the relationship between the e-

commerce platform and its union of e-retailers. The

platform has exclusive control over the service

charges, but the union of e-retailers has exclusive

e-CommerceGameModel-BalancingPlatformServiceChargeswithVendorProfitability

615

control over the amount of paying e-retailers. The

platform can propose a service rate and the union

cannot negotiate this value. However, the union can

decide on how many e-retailers will comply with

such rate.

The platform’s profit is related to the number of

e-retailers and the service charges, so the payoff

function of platform P(ω, L) can be defined as

follows:

(,)

P

LL

(1)

where ω is the value of service charges and L the

number of e-retailers. We can calculate the profit of

a platform depending on its service charges and the

number of e-retailers. Although the platform has its

cost, the marginal cost will be reduced to 0 for an

increment of e-retailers. So the operational cost of

the platform is omitted in its payoff function.

Furthermore, this omission would not affect the

result of our proposed model.

Then, we can define the payoff function of a

union of e-retailers V(ω, L).

(,) ( )VL ALL L

(2)

where φ is the profit coefficient and is inversely

proportional to the number of e-retailers (based on

the assumption that the more e-retailers, the more

competition in the market). φ(A

-

L) is the profit of

every e-retailer. A is the demand of platform for the

e-retailers and the platform, it is stable during in a

short period of time and can be obtained using the

historical data, also considering the growth of e-

commerce.

Suppose that the timing of the game is:

(1) The platform standardizes a service rate, ω.

(2) The union observes ω and then a certain

number of the e-retailers choose to accept.

(3) Payoffs are P(ω, L) and V(ω, L).

3.3 Nash Equilibrium of E-CGM

The key features of this dynamic game of complete

and perfect information are (i) the moves occur in

sequence, (ii) all previous moves are observed

before the next move is chosen, and (iii) the players’

payoffs from each feasible combination of moves

are common knowledge.

It is possible to analyze this game mostly through

backward induction. First, one can characterize the

best response of e-retailers’ union in stage (2),

L*(ω), as an arbitrary service charge ω by the

platform in stage (1). Given ω, the union of e-

retailers chooses L*(ω) to solve

00

max ( , ) max ( )

LL

VL ALL L

(3)

which yields

/2VL A L

(4)

One can obtain the relation between Land ω with

the condition that equation (4) equals to 0.

*

() ( )/2LA

(5)

It is a common sense that L increases while ω is

reducing. However, the more e-retailers in the

platform, the less profit every e-retailer will expect

due to increased competition.

Next the platform’s problem at stage (1) is

studied. Because both the platform and the union can

solve the union’s second-stage problem, the platform

should anticipate that the union’s reaction to the

service charge ω will result in a number of e-

retailers L*(ω) to comply. Therefore, the platform’s

problem at the first stage amounts to

*

00

max ( , ( )) max ( ) / 2

LL

PL A

(6)

Similarly, the first-order conditions of equation

(6) yields

*

/2A

(7)

Thus, (ω*, L*(ω))is the backward induction

outcome of this e-commerce game. From the

equation (7), the service charge of a platform is

dependent on the demand from e-retailer and the

profit coefficient.

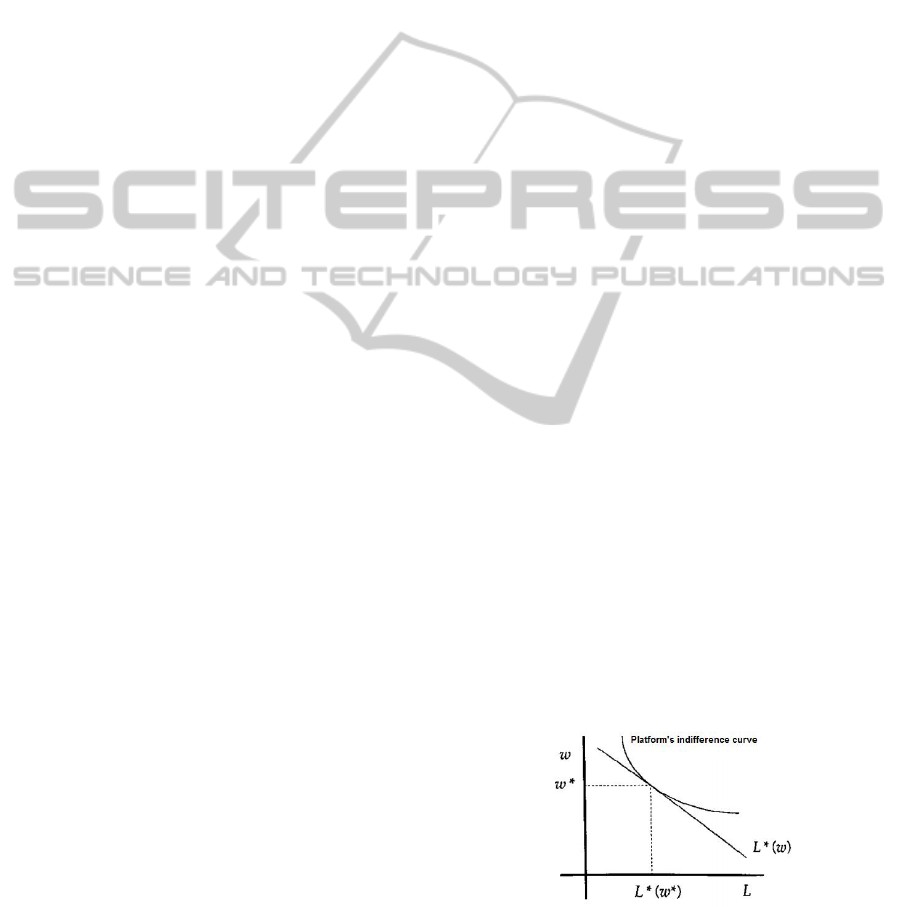

Figure 3 shows the indifference curve of a

platform. Horizontal axis represents the number of

e-retailers and vertical axis the value of the service

charge. The line L*(ω) is represent the pairs (ω, L)

which satisfy the Nash equilibrium of the model.

After the L*(ω) defined, it is possible to determine

the indifference profit curve of the platform which is

the highest possible curve tangent with line L*(ω).

Finally, the point (ω*, L*(ω)) is the Nash

equilibrium of this dynamic game.

Figure 3: The indifference curve of platform.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

616

4 ANALYSES ON THE

e-COMMERCE GAME MODEL

The correctness of the model and the concept are

discussed in this section.

4.1 The Service Charge ω and the

Amount of E-retailers L

According to the equation (7), the charging rate is

decided by the profit coefficient φ and the demand

of e-retailers L in the market. In order to obtain more

profit while maintaining the profit coefficient, the

platform needs to increase sales to raise the capacity

of e-retailers in the market. Besides of more e-

retailers, the charging rate is promoted by the raise

of amount of the e-retailers.

Substitute equation (7) into equation (5), the

optimal amount of e-retailers is A/4. This means that

market has a capacity of A e-retailers, by

concentrating selling into A/4 e-retailers, the

platform and these A/4 e-retailers both improve the

profitability.

4.2 The Profit of Platform and

e-Retailers

Based on the payoff functions for a platform and e-

retailers, we can calculate that the profit of a

platform P(ω*, L*) = φA

2

/8, and for e-retailers is

V(ω*, L*)= φA

2

/16.

Both sides in this game have the same common

interests based on these functions, and depend on

profit coefficient φ and amount of e-retailers L. With

a constant coefficient, the platform’s aim should be

to extend its market share, and the e-retailers’ to

provide high-quality products and good services to

attract customers into making purchases.

Furthermore, the profit of the platform is twice

that of the e-retailers. Suppose the profit of total

market is 10, the comparison between platform and

e-retailers is listed in the table below:

Table 1: The comparison of profit of e-retailers between

free service and charged service.

Charging

Value

Amount of

e-retailers

Profit

Free service 0 10 1

Charged service 8/3 2.5 4/3

The table 1 shows that the charged service adds

the cost of e-retailers apparently, but with the

decrease of e-retailers, the profit of each e-retailer

will achieve a promotion (from 1 to 4/3 in the table).

5 A CASE STUDY ON ALIBABA

This work chooses Alibaba as case study to verify

the E-CGM model because it is in a dominant

position in China’s e-market, according to the first

assumption in subsection 3.1. Alibaba is a company

of Internet-based commerce businesses managing

online web portals. In 2012, two of Alibaba’s portals

together hosted $170 billion in sales, more than

competitors Amazon.com and eBay combined

(Economist, 2013). Taobao Marketplace is the

China’s largest free-service online shopping

platform, and Tmall is platform providing e-

commerce opportunity at a service charge. Alibaba

has the largest market share with 52.1% in B2B,

B2C markets and 96.40% in C2C market (Cao et al.,

2013).

The data set applied in this study includes more

than 12 million transaction records from Alibaba

platforms during the Nov. 2012. The transaction

records have information on e-retailers, customers,

price of goods etc. And more importantly, every

record contains information as to which platform

hosted the transaction. Through all the records, there

were 10,189 e-retailers from Tmall and which

equates to 3.34% of all e-retailers, but the sales for

these e-retailers account for 25% of the total.

Therefore, the capacity of e-retailers in Alibaba is

A= 10,189 × 4.

The sales of Alibaba during this period is¥1.68

billion. Assuming the profit rate of e-commerce is

20% (Hoffman and Novak, 2000), the profit

coefficient can be calculated by the definition

/( ( ))

(1,680,000,000) 20% / ((3 10,189) 10 189)

1.08

Profit L A L

,

With the parameters A and

φ, the profit of both

the platform and e-retailers can be calculated by

payoff functions respectively. Because the data set

spans a month, the result of profits also reflects the

transactions for a specific month.

The service charge of Alibaba can be calculated

by the equation (7),

*

/ 2 22,008.24A

from the subsection 4.1,

*

/4 10,189LA

e-CommerceGameModel-BalancingPlatformServiceChargeswithVendorProfitability

617

The profits of the platform and e-retailers can be

obtained by their payoff functions. For platform,

** 2

( , ) / 8 224,241,957.36PL A

For e-retailers,

** 2

( , ) / 16 112,130,978.68VL A

According to Alibaba’s policy, every e-retailer in

Tmall has to pay ¥ 30,000 or ¥ 60,000 for the

service per year depend on sales. Applying the

average ¥45,000 as Alibaba’s service charge, we

can obtain the value corresponding to a month. Then

the profit of Alibaba platform is

' charging standard amount of e-retailers

=10,189 (45,000/12)

=38,208,750.00

P

In this dataset, the 10,189 e-retailers in Tmall

accomplish ¥ 397,393,537 in sales, so the total

profit of e-retailers

' 397,393,537 20% 79,478,707.40V

Based on the above results, this subsection

analyzes the correctness and efficiency of E-CGM

comparing with the actual profits of Alibaba for the

corresponding month.

According to the E-CGM, the profit of platform

is 5.87 times the factual profit of Alibaba.

Furthermore, the profit of e-retailers also increased

1.41 times. The profitability of platform improved

significantly. As such, applying the concept of game

theory, this research proposes a model that can assist

both platform and e-retailers in e-commerce achieve

improved profitability.

6 E-CGM EXPANDED VERSION

A real business environment is more complex and

requires the more precision from any analytical

results. The initial E-CGM model was proposed to

simply meet a part of the various requirements,

mainly focusing on the macroscopic point of view.

In this section, we expand the E-CGM model and

take into consideration the categorization of

products in order to better simulate an actual e-

commerce environment.

6.1 Payoff Functions of the Expanded

E-CGM

The context of the expanded E-CGM is mostly the

same as before, with the only difference being that

the marketplace is assumed to have various

categories of products. This change will improve the

performance of the model and enhance its

applicability.

Suppose there are K categories of products,

which are noted as i, i = 1, 2, …, K. The service

charges will then vary for e-retailers depending on

the category of their products, and are noted as ω

1

,

ω

2

, …, ω

K

. And knowing the total number of e-

retailers, it is possible to redefine the payoff

functions of the platform and e-retailers as follows.

1) Payoff function of platform

The platform’s profit is related to the number of

e-retailers and the service charges for different

categories, we can redefine the payoff function

withω

1

, ω

2

, …, ω

K

as follows:

12 12

1

( , ,..., , , ,..., )

K

K

Kii

i

P

LL L L

(8)

2) Payoff function of e-retailers

12 12

11

( , ,..., , , ,..., ) ( )

KK

K K i i ii ii ii

ii

VLLLALLL

(9)

Because the expanded form takes into

consideration different categories of products, it

becomes necessary to make small changes to the

parameters. The new parameters are:

A

i

is the potential product demand for i.

α

i

is the average number sales of i in a past time

period, which can be a month, a year, etc.

L

i

is the number of the e-retailers that sell i.

I

is the profit coefficient, defined as

i

L

ii

A

profit

i

Comparing with the equations (1) and (2), more

parameters are taken into consideration in payoff

functions of (8) and (9).

6.2 Nash Equilibrium of the Expanded

E-CGM

It is possible to obtain the Nash equilibrium of the

expanded E-CGM through backward induction using

the same steps shown in section 3.3. Because the

details regarding backward induction was previously

described, only the resulting Nash Equilibrium of

the expanded E-CGM is shown below.

The first step is to obtain the relationship

between L and ω.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

618

2

*

2

ii

iiii

i

A

L

(10)

Then, we consider two situations for ω*: First

where the platform charges all the e-retailers a

standard rate, the service charges are:

22

22

2

11

2

2

1

1

*

1

...

11

...

2

1

KK

K

K

AAA

(11)

On the other hands, the platform can charge the

e-retailers based on the category of product they sell,

ω* will be calculated as follows:

2

*

iii

i

A

(12)

7 CONCLUSIONS

This work proposed a game model E-CGM to find

out the optimal charging rate within an e-commerce

platform. Based on the game theory, a dynamic

game between two players, which are platform host

and union of e-retailers, was applied to model

behaviours in e-commerce. The Nash equilibrium of

this game was calculated utilizing backward

induction. And by applying this model in a case

study evaluating a real data set of Alibaba’s

transaction records, Alibaba’s profit was increased

5.87 times compared with the current profit value,

and the profit of e-retailers increased 1.41 times. To

increases the applicability of E-CGM, an expanded

form is also proposed to include the variability

caused by the existence of different categories of

products, thus taking into consideration additional

aspects of an actual business environment.

However, although the E-CGM model can

improve the profitability of both the platform and e-

retailers, it has its limitations. For example, the

platform must dominate its market so the e-retailers

have no other options and cannot negotiate service

charges. Another problem is that this model greatly

reduces the position of e-retailers, which could result

in a more social problem. To lessen the impact of

these problems, the Nash equilibrium can be

analyzed and calculated based on a percentage of

closing fee, which would lead to an improved

service charge calculation method and minimize

these limitations.

REFERENCES

Ahmed, E., Hegazi, A. S., 2007. A dynamic model for e-

commerce taxation. Applied mathematics and

computation, 187(2), 965-967.

Alibaba, 2013. Alibaba Huoshui Challenge. Available

from http://huoshui.aliresearch.com/. [Accessed in

Aug. 10, 2013].

Cao, L., Mo, D., Wang, Z., Yao, J., 2013. The 2012 annual

monitoring report of China e-market. Available from

http://www.100ec.cn/detail--6089726.html.

Economist, 2013. E-commerce in China: The Alibaba

phenomenon. Economist.

eMarketer, 2013. Ecommerce Sales Topped $1 Trillion for

First Time in 2012. Available from http://

www.emarketer.com/Article/Ecommerce-Sales-

Topped-1-Trillion-First-Time-2012/1009649.

[Accessed on July 10, 2013].

Gibbons R., 1992. A primer in game theory. Harvester

Wheatsheaf, New York.

Hoffman, D. L., Novak, T. P., 2000. How to acquire

customers on the web. Harvard business review, 78(3),

179-188.

Laudon, K. C., Traver, C. G., 2007. E-commerce. Pearson

Prentice Hall.

Leontief, W., 1946. The pure theory of the guaranteed

annual wage contract. The Journal of Political

Economy, 54(1), 76-79.

McLure Jr, C. E., 1996. Taxation of Electronic Commerce:

Economic Objectives, Technological Constraints, and

Tax Laws. Tax L. Rev., 52, 269.

Miller, T., Niu, J., 2012. An assessment of strategies for

choosing between competitive marketplaces.

Electronic Commerce Research and Applications,

11(1), 14-23.

Shi, B., Gerding, E. H., Vytelingum, P., Jennings, N. R.,

2010. A game-theoretic analysis of market selection

strategies for competing double auction marketplaces.

In Proceedings of the 9th International Conference on

Autonomous Agents and Multiagent Systems: volume

1-Volume 1, 857-864.

Sohn, J. W., Lee, S., Mullen, T., 2009. Impact of

misalignment of trading agent strategy across multiple

markets. In Auctions, Market Mechanisms and Their

Applications , 40-54. Springer Berlin Heidelberg.

Zeng, Y., Guo, X., Huang, H., 2012. E-commerce tax

collection and administration in China. In Information

Management, Innovation Management and Industrial

Engineering (ICIII). IEEE.

e-CommerceGameModel-BalancingPlatformServiceChargeswithVendorProfitability

619