A Case of the Container-Vessel Scheduling Problem

Selim Bora

1

, Endre Boros

2

, Lei Lei

3

, W. Art Chaovalitwongse

4

, Gino J. Lim

5

and Hamid R. Parsaei

1

1

Mechanical Engineering, Texas A&M University at Qatar, Doha, Qatar

2

RUTCOR, Rutgers University, New Jersey, U.S.A.

3

SCMMS, Rutgers University, New Jersey, U.S.A.

4

Industrial&Systems Engineering, University of Washington, Washington, U.S.A.

5

Industrial Engineering, University of Houston, Texas, U.S.A.

Keywords:

Vessel Scheduling, Bender’s Decomposition, Dynamic Programming.

Abstract:

We study a difficult real life scheduling problem encountered in oil and petrochemical industry, involving in-

ventory and distribution operations, which requires integrated scheduling. The problem itself is NP-complete,

however we show some special cases, and propose polynomial time solution methods. These could be used

as a starting point for a heuristic making use of these simplified cases. This study proposes two alternative

approaches for the main problem, one of them making use of one of the special cases using minimum cost

flow formulation, and the other one using Benders Decomposition once the problem is reformulated to make it

easier to handle. Both results show promising results and computation time. Benders Decomposition approach

allows exact solutions to be found in a much faster fashion.

1 INTRODUCTION

This study is focused on the demand-supply coordina-

tion problem encountered in petrochemical industry

such as oil and gasoline. The cost to produce and de-

liver gasoline products to the market consists of three

major components: the transportation cost of crude

oil to refiners, the operation cost of refinery process-

ing, and the cost of marketing and distribution. An

oil company typically operates many tens of refiner-

ies, with several million barrels of crude oil per day

and several billion dollars on crude transportation per

year. As the retail gasoline prices continue to rapidly

elevate around the world, effectively coordinating the

demand and supply of gasoline products has there-

fore become even more crucial to oil companies. Par-

ticularly in this study, the company uses its own and

chartered vessels to distribute the gasoline products to

discharging/demand locations. Each discharging lo-

cation carries its own inventories and serves as a de-

pot of distribution for the local market. Since vessels

are expensive in both variable and fixed costs, any in-

efficiency in the supply process could result in a sub-

stantial operating cost. The distribution scheduling

problem encountered in this process is very compli-

cated due to the involvement of heterogeneous vessels

(e.g., in terms of their loading capacities, discharging

and berthing times, and operating costs) and the fact

that each vessel has multi-level of loading capacities

such that a load beyond the normal/base capacity will

result in an extra overload cost. Practical issues faced

include which vessel should deliver to which depot

in which time period, whether a particular vessel trip

should carry an extra load and by how much, and what

should be the ending inventory at a depot in a par-

ticular period, etc. Due to high distribution cost of

gasoline products, an effectively distribution schedule

could help the company to further improve the profit

of its supply chain and to strengthen its competitive

advantage in the market place.

Our goal is to minimize the operating costs related

to shipping and handling of goods. The fleet size is

not fixed, nor an initial amount is set, so one of the

tasks we have at hand is to determine the number of

vessels that will be used within the planning horizon.

Shipping costs can be divided into two categories:1)

The fixed cost related to either purchase or lease of a

vessel, 2) the overloading cost which is incurred if the

vessels carry above a certain capacity. There are two

more costs that we need to watch out for. Each ship-

ment made to a port may incur a holding or penalty

cost based on the demand. If the demand is not met

63

Bora S., Boros E., Lei L., Art Chaovalitwongse W., J. Lim G. and R. Parsaei H..

A Case of the Container-Vessel Scheduling Problem.

DOI: 10.5220/0004831400630071

In Proceedings of the 3rd International Conference on Operations Research and Enterprise Systems (ICORES-2014), pages 63-71

ISBN: 978-989-758-017-8

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

on time, it cannot be satisfied at a later time period,

and therefore we need to pay penalty for each unit.

Also, if the port is forced to hold some inventory, then

a holding cost is charged. In addition to all these cost

factors, we also need to consider the fact that each

vessel is available for a certain amount of time within

a period, and therefore even if a vessel has enough

capacity, it may not have enough time to visit all the

ports we desire.

Optimally solving distribution operations schedul-

ing problem is not an easy task. Previous work related

to industrial shipping varies a lot. Here, we focus

on the existing results that are closely related to our

work. A large summary of works related to various

types of vessel scheduling and routing problem can be

found in the literature survey by (Christiansen et al.,

2004). Two more recent surveys can be found more

specifically in the area of combined inventory man-

agement and routing ((Andersson et al., 2010)) and

on fleet composition and routing ((Hoff et al., 2010)).

The most recent literature survey is by (Christiansen

et al., 2012), which takes a look at the publications in

the last decade, and list possible research areas that

could be pursued in this area.

(Xinlian et al., 2000) presents an algorithm which

combines the linear programming technique with that

of dynamic programming to improve the solution to

linear model for fleet planning. Even though their ap-

proach is similar, the problem they are dealing with

requires demand satisfaction and initial fleet is al-

ready given, and the decision is to whether add new

vessels to the existing fleet or not.

(Cho and Perakis, 2001) presented a better formu-

lation to the original fleet deployment problem pro-

posed by (Ronen, 1986). In this formulation, just like

we do, there is a single loading port, finite number of

customer ports, and a finite planning horizon. How-

ever, they require the demand to be met, and the fleet

size is constant. The costs incurred are due to routes

chosen, shipping cargoes, and unloading time. They

show that this formulation is better for computational

efficiency.

(Cho and Perakis, 1996) present a study regarding

fleet size and design of optimal liner routes for a con-

tainer shipping company. The problem is solved by

generating a number of candidate routes for the dif-

ferent ships first, and then, the problem is formulated

and solved as a linear programming model, where the

columns represent the candidate routes. They extend

this model to a mixed integer programming model

that also considers investment alternatives to expand-

ing fleet capacity. (Bendall and Stent, 2001) also

present a model for determining the optimal number

of ships and fleet deployment plan.

On the other hand, (Nicholson and Pullen, 1971)

were the first ones to propose dynamic programming

application to ship fleet management. The problem

they dealt with was to determine the sequence in

which the currently owned ships should be sold and

the extent to which charter ships should be taken on.

They tackle the problem in two stages. The first stage

determines a good priority ordering for selling the

ships regardless of the rate at which charter ships are

taken on. The second stage uses dynamic program-

ming to determine an optimal level of chartering given

the priority replacement order. This first stage pri-

ority ordering essentially reduces the dynamic pro-

gramming calculation from a problem with as many

as states as number of ships in fleet to a 1 state vari-

able problem which is computationally manageable

by dynamic programming methods. Several authors

use benchmark instances to compare the results of

different strategies and heuristics. (Gheysens et al.,

1984) define 20 test instances with 12100 nodes for

the standard fleet size and mix vehicle routing prob-

lem. (Wu et al., 2005) deals with trucks that vary in

capacity and age are utilized over space and time to

meet customer demand. Operational decisions (in-

cluding demand allocation and empty truck reposi-

tioning) and tactical decisions (including asset pro-

curements and sales) are explicitly examined in a lin-

ear programming model to determine the optimal fleet

size and mix. The method uses a time-space network,

common to fleet-management problems, but also in-

cludes capital cost decisions, wherein assets of dif-

ferent ages carry different costs, as is common to re-

placement analysis problems. A two-phase solution

approach is developed to solve large-scale instances

of the problem. Phase I allocates customer demand

among assets through Benders decomposition with a

demand-shifting algorithm assuring feasibility in each

subproblem. Phase II uses the initial bounds and dual

variables from Phase I and further improves the so-

lution convergence through the use of Lagrangian re-

laxation.

A network optimization approach has been

proposed by (Bookbinder and Reece, 1988), where

they formulate a multi-commodity capacitated

distribution-planning problem as a non-linear mixed

integer programming model, and solve it as a gener-

alized assignment problem within an algorithm for

the overall distribution/routing problem based on a

Bender’s type decomposition.

(Lei et al., 2009) proposes an approach to a bi-

directional flow problem where each iteration starts

with a given planning horizon, which is then parti-

tioned into three planning intervals, where each inter-

val consists of consecutive time periods in the given

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

64

planning horizon. Afterwards, some constraint relax-

ations are applied to the problem in which all the for-

ward demand and all the backward demand of the

time periods in the third planning interval are con-

solidated into a single forward demand and a single

backward demand, which is an idea we use in one of

our approaches.

(Choi et al., 2012) focuses on minimizing total tar-

diness, rather than the operating costs, and the routes

for vessels are observed under three different cases,

one of them being arbitrary, just like in our problem.

Later on, they talk about the other problems in the lit-

erature and how their approach is related to them.

2 PROBLEM DEFINITION

This paper, brings together some of the ideas that

were proposed in the literature before. We are given

a fleet |V | of container vessels, v ∈ V that distributes

the goods from a main distribution center to a

number of customer ports over a |T |-period planning

horizon. Each vessel has two loading capacities:

the regular loading capacity u

0

v

, and the maximum

loading capacity u

max

v

so that carrying a load beyond

u

0

v

will impose an over loading charge g

0

v

/unit and

carrying a load beyond u

max

v

violates the feasibility.

In addition to this limitation, for every vessel there

is total available time τ

v

which is used up by the

berthing time b

v,p

at ports which vary depending

on vessel type. There are |p| customer ports on the

network, each port p ∈ P has a demand, d

p,t

≥ 0

in period t ∈ T. For every port, unsatisfied demand

are penalized at p

p,t

/unit based on the unsatisfied

demand and no backlogging is allowed. On the

other hand, end of period inventory incurs a holding

cost of h

n

/unit. Let c

f

v

denote the fixed cost if the

vessel is being dispatched in a period. The problem

is finding a feasible vessel dispatching schedule to

minimize the total shortage and overage penalty plus

the vessel overloading and fixed cost.The minimum

cost flow network formulation proposed guarantees

optimality when the number of vessels dispatched in

every period is known. To define our problem more

formally, we define the following set of variables:

S

p,t

∈ Z

+

: amount of shortage at port p in period t

Q

v,p,t

∈ Z

+

: amount of supply delivered to port p in

period t via vessel v’s regular capacity

O

v,p,t

∈ Z

+

: amount of supply delivered to port p in

period t via vessel v’s overloading capacity

I

p,t

∈ Z

+

: ending inventory at port p in period t

Y

v,p,t

∈ {0,1}: Y

v,n,t

= 1 if vessel v delivers to port p

in period t

Z

v,t

∈ {0,1}: Z

v,t

= 1 if vessel v is dispatched in

period t

Based on this, the constraints to the problem will

include the following:

A vessel must not be carrying anything if it’s not

dispatched, nor visiting ports:

Q

v,p,t

+ O

v,p,t

≤ u

max

v

Y

v,p,t

∀ v ∈ V, p ∈ P, t ∈ T

(1a)

Y

v,p,t

≤ Z

v,t

∀ v ∈ V, p ∈ P, t ∈ T

(1b)

Vessels dispatched must not be used over their

time and regular/maximum capacity:

∑

p∈P

b

v,p

Y

v,p,t

≤ τ

v

∀ v ∈ V, t ∈ T (2a)

∑

p∈P

Q

v,p,t

≤ u

0

v

∀ v ∈ V, t ∈ T (2b)

∑

p∈P

(Q

v,p,t

+ O

v,p,t

) ≤ u

max

v

∀ v ∈ V, t ∈ T (2c)

The last group of constraints is to help to formu-

late our objective, which is a compositions of all ex-

penses (penalties, etc.).

Vessel dispatching costs:

c

D

=

∑

v∈V

∑

t∈T

c

f

v

Z

v,t

(3a)

Early arrival penalties:

c

H

=

∑

p∈P

∑

t∈T

h

p

I

p,t

(3b)

Unsatisfied demands’ penalties:

c

U

=

∑

p∈P

∑

t∈T

p

p,t

S

p,t

(3c)

Overloading penalties:

c

O

=

∑

v∈V

∑

p∈P

∑

t∈T

g

0

v

O

v,p,t

(3d)

Then our problem is to minimize c

D

+ c

H

+ c

U

+

c

O

, subject to the constraints (1)-(3) and the sign and

type restrictions in the definitions of the decision vari-

ables.

If the dispatching information is already available,

i.e. |V

1

| vessels for t=1, |V

2

| for t=2, . . . , |V

T

| for t=T,

then there becomes no need for the binary variables.

In addition, define new variables, x

v,k,n,t

and r

v,k,n,t

,

which are the normal and over flows shipped by ves-

sel v dispatched in period k for port n to satisfy the

ACaseoftheContainer-VesselSchedulingProblem

65

demand on period t. Based on this definition, the fol-

lowing can be established:

Q

v,p,t

=

T

∑

k=t

x

v,t,p,k

∀ v ∈ V, p ∈ P, t ∈ T (4a)

O

v,p,t

=

T

∑

k=t

r

v,t,p,k

∀ v ∈ V, p ∈ P, t ∈ T (4b)

S

p,t

= d

p,t

−

∑

k∈T

∑

v∈V

k

(x

v,k,p,t

+ r

v,k,p,t

)

∀ p ∈ P, t ∈ T (4c)

I

p,t

=

∑

k∈T

T

∑

w=t+1

∑

v∈V

k

(x

v,k,p,w

+ r

v,k,p,w

)

∀ p ∈ P, t ∈ T (4d)

Based on the above assumptions and definitions, we

get the following model. Objective function is the

same except that the last part is now a constant based

on vessel dispatching information, i.e. Z

v,t

values are

known. Constraints (5b) and (5c) assure that normal

and over capacity are not exceeded, where as con-

straint (5d) prevents shipments for a specific demand

to be more than the demand itself, therefore making

the first part of the objective function always nonneg-

ative.

min

∑

p∈P

∑

t∈T

p

p,t

(d

p,t

−

T

∑

k=1

∑

v∈V

k

(x

v,k,p,t

+ r

v,k,p,t

))

+

∑

v∈V

∑

p∈P

∑

t∈T

g

0

v

T

∑

k=t

r

v,t,p,k

+

∑

v∈V

∑

t∈T

c

f

v

Z

v,t

+

∑

p∈P

∑

t∈T

h

p

t

∑

k=1

T

∑

w=t+1

∑

v∈V

k

(x

v,k,p,w

+ r

v,k,p,w

)

(5a)

s.t.

∑

p∈P

b

v,p

Y

v,p,t

≤ τ

v

∀ v ∈ V, t ∈ T (5b)

T

∑

k=t

∑

n∈N

(x

v,t,n,k

+ r

v,t,n,k

) ≤ u

max

v

∀ v ∈ V, t ∈ T

(5c)

T

∑

k=t

x

v,t,n,k

+ r

v,t,n,k

≤ u

max

v

Y

v,n,t

∀ v ∈ V, p ∈ P, t ∈ T (5d)

∑

n∈N

T

∑

k=t

x

v,t,n,k

≤ u

0

v

∀ v ∈ V, t ∈ T (5e)

t

∑

k=1

∑

v∈V

k

(x

v,k,n,t

+ r

v,k,n,t

) ∀ p ∈ P, t ∈ T (5f)

Y

v,n,t

≤ Z

v,t

∀ v ∈ V, p ∈ P, t ∈ T (5g)

Figure 1: An example of the network for |V

1

| = 2, |V

2

| = 1,

|V

3

| = 2, |N| = 3, and |T | = 3.

Lemma 2.1. The above problem can be reformulated

without the berthing time constraint and solved as a

minimum cost flow problem by assuming the knowl-

edge of the number of vessels dispatched in each time

period.

Proof. First, we construct a dummy source node S,

and a dummy sink node F. Associate to each vessel

v ∈ V

k

, 2 nodes (v,k)

P

and (v,k)

O

, one for normal and

other for over capacity. These nodes are connected to

the source node with 0 and g

0

v

costs, a lower bound of

0 and an upper bound u

0

v

and u

max

v

− u

0

v

respectively.

Add another set of |P| nodes (p

p

) for case of short-

age at each port with 0 costs, 0 lower bounds and no

upper bounds. Next, take care of the ports by adding

|P| ∗ |T | nodes denoted (p,t) for each port n at every

period t. The arcs between nodes corresponding to

vessels and ports incur a holding cost of h

p

(t −k), has

a lower bound of 0 and no upper bound. Also, there

will be arcs between shortage nodes, (p

p

), and ports,

(p,t), where the shortage costs p

p,t

will be charged.

Finally, add arcs between ports and the sink, with a

lower and upper bound of d

p,t

and no cost.This net-

work will have 2|V ||T |+|P|+|P||T | many nodes, and

|V ||P||T

2

| + |P

2

| many arcs, making minimum cost

flow approach practical for problems of reasonable

size. An example network is shown in Figure 1.

Lemma 2.2. The objective function values and con-

straints for both problems above are the same, assum-

ing we guessed the right number of vessels.

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

66

Proof. First of all, the fixed cost due to vessels for

both problems will be the same. Next, assume x

∗

v,k,n,t

and r

∗

v,k,n,t

are the optimal flow vectors correspond-

ing to the minimum cost flow problem. Then, us-

ing the equalities corresponding the variables of two

problems, the objective function value of the original

problem becomes:

∑

p∈P

∑

t∈T

p

p,t

(d

p,t

−

∑

k∈T

∑

v∈V

k

(x

v,k,p,t

+ r

v,k,p,t

))+

∑

v∈V

∑

p∈P

∑

t∈T

g

0

v

∑

T

k=t

r

v,t,p,k

+

∑

v∈V

∑

t∈T

c

f

v

Z

v,t

+

∑

p∈P

∑

t∈T

h

p

∑

k∈T

∑

T

w=t+1

∑

v∈V

k

(x

v,k,p,w

+ r

v,k,p,w

)

=

∑

p∈P

∑

t∈T

p

p,t

S

∗

p,t

+

∑

v∈V

∑

p∈P

∑

t∈T

g

0

v

O

∗

v,k,p,t

+

∑

v∈V

∑

t∈T

c

f

v

Z

∗

v,t

+

∑

p∈P

∑

t∈T

h

p

I

∗

p,t

(6)

The first 2 lines of this equality (6) and the objective

function of the minimum cost flow are exactly the

same, which only leaves us with the inventory part.

The w index is for shipments that are on a future date

than current period t, and the k index is taking into

account all shipments that have been made up to pe-

riod t. Therefore, a shipment made on period k for

period t will appear in the summation (t − k) many

times, allowing us to replace index w with t, remove

the summation regarding w, and charge the holding

cost as many times as necessary. This shows that both

objective function values are the same.

As far as the constraints are concerned, first re-

alize that in the original problem, (2a) is no longer

required while berthing times are large enough. Sim-

ilarly, (1a) and (1b) were associated with the fact that

dispatching information was not available, so now,

they could be dropped as well. (2b) in the original

problem is the same constraint as (5d) in the reduced

problem, and they are both concerned with normal ca-

pacity of a vessel. (5c) and (5d) of the reduced prob-

lem, added together, imply the same restriction on

maximum vessel capacity as (2c) of the original prob-

lem. On the other hand, the flow balance constraint in

the original problem is taken care of by two means:

1) the new index k for the variables, tells us when

shipment was made, so we now whether a shipment

is held at inventory or used immediately, 2) in the re-

duced problem, shipment for a specific demand will

not be more than the demand itself, therefore short-

age never becomes negative according to the relation

between S

n,t

and x

v,k,n,t

, r

v,k,n,t

.

3 SPECIAL CASES

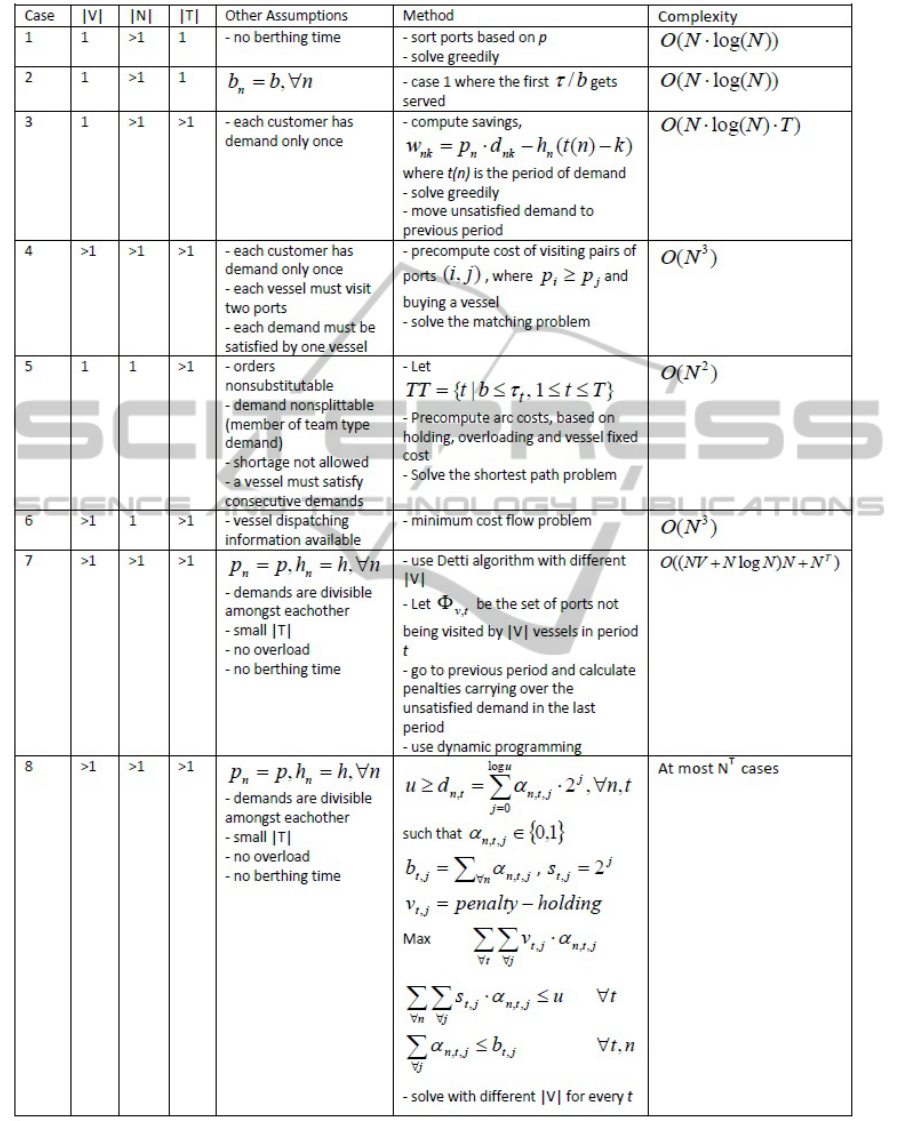

Figure 2 is a list of special cases deduced from the

general problem, for which we propose efficient so-

lution approaches. Case 7 makes use of the method

proposed by (Detti, 2009), used for solving knapsack

problems with divisible item sizes.

Based on our minimum cost network flow ap-

proach, we propose the following two heuristics for

no berthing time case:

3.1 Backward Heuristic

1. Divide the planning horizon into two groups, pri-

mary and secondary, for each port, the new de-

mand is equal to sum of the individual demands

in each group, holding cost is the minimum and

penalty cost is the maximum of individual penal-

ties.

2. Start with |P| ∗ |T | vessels in that group in total,

solve the minimum cost flow problem iterating

through all vessel dispatching combinations avail-

able for a group.

3. Once the optimal number of vessels required for

each group are determined, repeat the procedure

of dividing into groups and solving as a minimum

cost flow problem for the individual groups. De-

mand belonging to ports in the other individual

group is also added to the demand of the ports in

the secondary period of the group under consider-

ation.

4. Once the primary group has only 1 period remain-

ing, optimal number of vessels have been deter-

mined for that group, start over.

3.2 Greedy Heuristic

1. Start with no vessels assigned to each period.

2. Add a vessel to any period and solve the prob-

lem. Remove the vessel, and add to another pe-

riod, and solve again. Once the best vessel addi-

tion has been determined, move on to next vessel

addition.

3. Keep determining the best vessel to add until ob-

jective function no longer improves.

Going back to the original problem with berthing con-

straints, we propose modified greedy heuristics and

a decomposition based exact method. We first intro-

duce the algorithms and then compare them with state

of the are integer programming solver, XpressMP.

3.3 Improved Greedy Heuristic

1. Start with no vessels assigned to each period.

ACaseoftheContainer-VesselSchedulingProblem

67

Figure 2: Special cases deduced from the general problem under different assumptions.

2. For each vessel type, compute maximal subsets of

ports such that no further port can be added to a

set due to berthing time constraint.

3. For each vessel type, in every period, sort the

subset of ports in decreasing order based on

∑

n∈Maximal

v

d

n,t

p

n,t

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

68

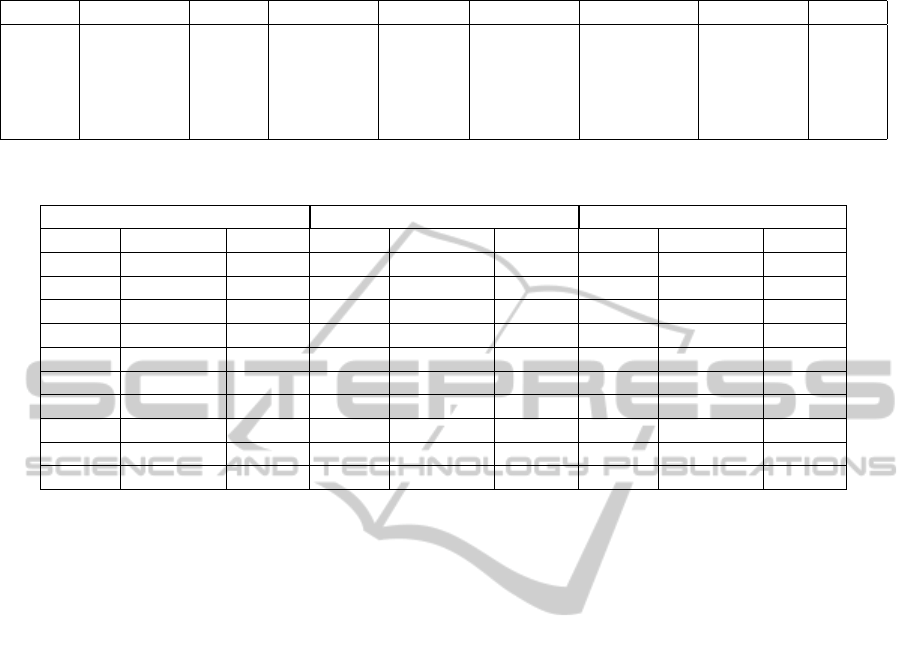

Table 1: |N|=3, |T |=4, vessel type same, number of vessels in each period shown, as well as the optimal objective function

value for each case, indicating that even a much simpler version of the original problem is not submodular.

Case 1 Obj. Func. Case 2 Obj. Func. Case Int Obj. Func. Case Union Obj. Func. Comp.

(3,2,2) 170 (2,1,3) 390 (2,1,2) 540 (3,2,3) 50 Lower

(1,2,1) 840 (2,1,3) 390 (1,1,1) 1140 (2,2,3) 90 Equal

(2,2,1) 580 (2,1,3) 390 (2,1,1) 880 (2,2,3) 90 Equal

(1,2,3) 350 (2,1,3) 390 (1,1,3) 650 (2,2,3) 90 Equal

(1,3,2) 390 (2,1,3) 390 (1,1,2) 800 (2,3,3) 50 Lower

Table 2: |N|=10, |T |=10, 3 different vessel types, number of vessels each method solves for vary for XpressMP, Backward

and Greedy as 10, 100, 1 in respect. Runs are terminated after 2 hours or when 0.1% gap from the best bound is reached.

Time (sec) Objective Function Gap (%)

Xpress Backward Greedy Xpress Backward Greedy Xpress Backward Greedy

7200 412.50 435.8 7503 7799 7733 1.7384 5.47 4.66

7200 420.40 435.20 8141 8314 8298 2.1557 4.20 4.01

7200 393.30 420.60 8270 8483 8450 0.9988 3.48 3.11

7200 332.30 390.70 7759 7806 7800 0.3519 0.95 0.88

7200 289.90 316.80 7316 7395 7375 0.1414 1.20 0.94

7200 310.30 336.60 8412 8494 8487 3.2309 4.16 4.09

7200 345.2 347.6 8270 8356 8338 3.8278 4.82 4.62

7200 429.50 443.30 7918 8159 8112 1.1641 4.08 3.53

7200 421.8 425.8 7475 7825 7768 1.4574 5.87 5.17

7200 306.70 321.10 7448 7661 7600 2.4489 5.16 4.40

4. Next, add any vessel to any period allowing it to

only serve the top ranked subset of ports and solve

the problem. Try different vessel types, for differ-

ent periods in the same manner. Determine the

best vessel to add to which period.

5. Once a vessel assignment has been determined,

update remaining demand and sort subsets of

ports accordingly.

6. Keep determining the best vessel to add until ob-

jective function no longer improves.

3.4 Bender’s Type Decomposition

Approach

1. Choose a feasible assignment of ports to a vessel

to start with.

2. Solve the master problem to obtain a new objec-

tive function value and new port assignments to

other vessels.

3. Keeping port assignments fixed, solve the dual

problem.

4. STOP, if master and dual objective values are

close enough, otherwise go back to the master

problem.

4 COMPUTATIONAL RESULTS

With the minimum cost flow network formulation

proposed, one question that arose was whether it

was worth investing more resources into finding a

dispatching information, and maybe go from there.

However, as can be seen at 1, the minimum cost

flow problem is not submodular. Case 1 and Case 2

are random dispatches, where as Case Int refers to

the scenario where minimum of number of vessels

dispatched in each latter case is used, and Case

Union refers to of Case 1 and Case 2 are random

dispatches, where as Case Int refers to the scenario,

where minimum of number of vessels dispatched in

each latter case is used, and Case Union refers to

the scenario, where maximum of number of vessels

dispatched in each latter case is used.

Backward and Greedy Heuristic both performed

well, however, as can be seen in Table 2, Backward

Heuristic always takes shorter, where as Greedy

Heuristic performs better by a slight margin.

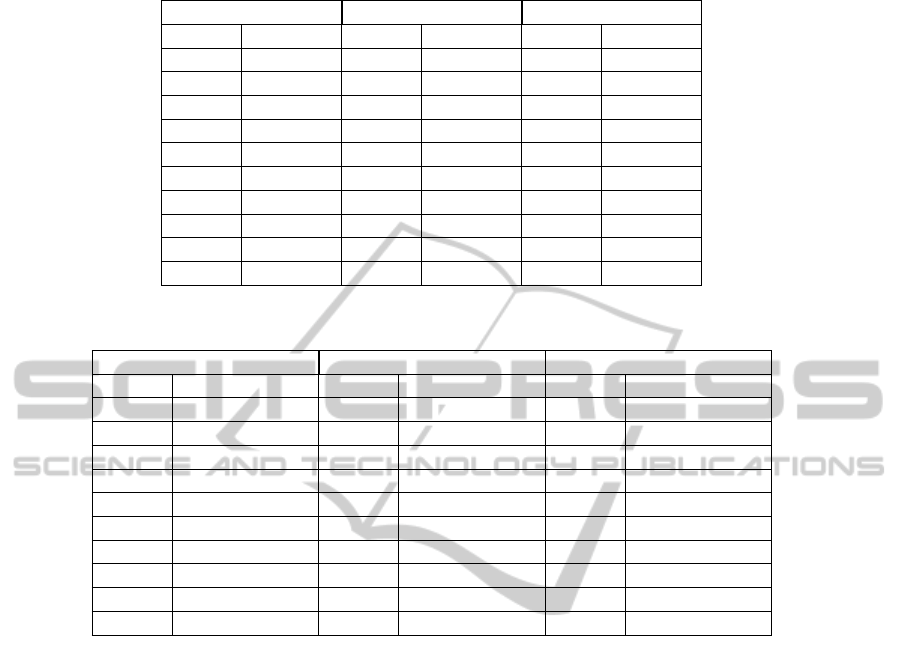

However, it must be kept in mind that Table 2

reflects results for the version of the problem with no

berthing time constraint. Improved Greedy Heuristic

designed to deal with this issue performs a bit slower

than the previously mentioned heuristics, but gives

good bounds for the solution of the original problem

as can be seen in Table 3.

ACaseoftheContainer-VesselSchedulingProblem

69

Table 3: |N|=10, |T |=10, 3 different vessel types, number of vessels each method solves for vary for XpressMP and Improved

Greedy as 10 and 1 in respect. All runs are terminated after 2 hours or when 0.1% gap from the best bound is reached.

Time (sec) Objective Function Gap (%)

Xpress I. Greedy Xpress I. Greedy Xpress I. Greedy

7200 593.9 7503 7533 1.74 2.13

7200 582.2 8141 8226 2.16 3.17

7200 635.3 8270 8381 1.00 2.31

7200 678.2 7759 7921 0.35 2.39

7200 668.6 7316 7436 0.14 1.75

7200 594.4 8412 8548 3.23 4.77

7200 649.3 8270 8353 3.83 4.78

7200 667.3 7918 8092 1.16 3.29

7200 641.1 7475 7513 1.46 1.96

7200 662.1 7448 7565 2.45 3.96

Table 4: |N|=10, |T |=10, 3 different vessel types, number of vessels each method solves for vary for XpressMP and Improved

Greedy as 10 and 1 in respect. All runs are terminated after 2 hours or when 0.1% percent gap from the best bound is reached.

Time (sec) Objective Function Gap (%)

Xpress Decomposition Xpress Decomposition Xpress Decomposition

7200 767.1 7503 7380 1.74 0.10

7200 757.5 8141 7973 2.16 0.10

7200 905.8 8270 8196 1.00 0.10

7200 1291.4 7759 7739 0.35 0.10

7200 1420.4 7316 7313 0.14 0.10

7200 959 8412 8148 3.23 0.10

7200 1183.5 8270 7961 3.83 0.10

7200 907.4 7918 7834 1.16 0.10

7200 1032.8 7475 7373 1.46 0.10

7200 1349.4 7448 7273 2.45 0.10

The formulation proposed for Bender’s type ap-

proach is computationally efficient, as can be on Ta-

bles 4 and 5. The running time is a bit longer, but

we’re able to get exact solutions.

5 CONCLUSIONS

In this study, we studied a difficult real life sup-

ply chain scheduling problem encountered in oil and

petrochemical industry, which involves production,

inventory, and distribution operations, and requires

an integrated scheduling to minimize the total oper-

ation cost. We showed the hardness of this prob-

lem, and showed that some of its special cases are

polynomial time solvable. A minimum cost flow

based heuristic, motivated by the observations from

one of the special cases, was proposed and demon-

strated to have a promising performance under the

set of test cases considered in this study. Also, a

new formulation of the model was developed, which

made Bender’s type decomposition method computa-

tionally efficient. Therefore, we’re now able to get

really good(exact) results for big problems at a much

faster fashion then solver XpressMP.

There are several interesting extensions of the

work presented here. These include integrating the

inland production with single or multiple refineries at

different locations on the network, and multiple prod-

ucts needed by the same customer port. This inte-

gration would cause the supply chain to become big-

ger, and therefore more complex, however closer to

reality, as inland production and demand satisfaction

are activities that need synchronization. Furthermore,

the involvement of multiple refineries and multiple

products introduces the new optimization issues due

to assigning refineries to customer ports and allocat-

ing vessel capacity for different products. This will

make the modeling and the design of search proce-

dures more interesting and challenging.

Also, for the simplicity of modeling, in this study,

we assumed a linear penalty function for vessel over-

loading. However, this penalty cost is in reality very

complex and is affected by many factors such as the

level of overloading and navigation conditions. A

nonlinear cost function would be more meaningful in

this case.

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

70

Table 5: |N|=15, |T |=10, 3 different vessel types, number of vessels each method solves for vary for XpressMP and Improved

Greedy as 10 and 1 in respect. All runs are terminated after 2 hours or when 0.1% percent gap from the best bound is reached.

Time (sec) Objective Function Gap (%)

Xpress Decomposition Xpress Decomposition Xpress Decomposition

7200 805 7764 7619 1.98 0.10

7200 777.9 8652 8448 2.46 0.10

7200 990.5 8326 8245 1.07 0.10

7200 1401.1 8001 7978 0.39 0.10

7200 1544.6 7464 7461 0.15 0.10

7200 1015.4 8789 8496 3.43 0.10

7200 1216.9 9423 9026 4.30 0.10

7200 984.8 8128 8035 1.24 0.10

7200 1114.2 7849 7727 1.66 0.10

7200 1413.5 7652 7455 2.67 0.10

ACKNOWLEDGEMENTS

This report was made possible by a National Priori-

ties Research Program grant from the Qatar National

Research Fund (a member of The Qatar Foundation).

The statements made herein are solely the responsi-

bility of the authors.

REFERENCES

Andersson, H., Hoff, A., Christiansen, M., Hasle, G.,

and Løkketangen, A. (2010). Industrial aspects and

literature survey: Combined inventory management

and routing. Computers & Operations Research,

37(9):1515–1536.

Bendall, H. and Stent, A. (2001). A scheduling model for

a high speed containership service: A hub and spoke

short-sea application. International Journal of Mar-

itime Economics, 3(3):262–277.

Bookbinder, J. and Reece, K. (1988). Vehicle routing con-

siderations in distribution system design. European

Journal of Operational Research, 37(2):204–213.

Cho, S. and Perakis, A. (1996). Optimal liner fleet route-

ing strategies. Maritime Policy and Management,

23(3):249–259.

Cho, S. and Perakis, A. (2001). An improved formulation

for bulk cargo ship scheduling with a single loading

port. Maritime Policy & Management, 28(4):339–345.

Choi, B., Lee, K., Leung, J., Pinedo, M., and Briskorn, D.

(2012). Container scheduling: Complexity and al-

gorithms. Production and Operations Management,

21(1):115–128.

Christiansen, M., Fagerholt, K., Nygreen, B., and Ronen, D.

(2012). Ship routing and scheduling in the new mil-

lennium. European Journal of Operational Research.

Christiansen, M., Fagerholt, K., and Ronen, D. (2004).

Ship routing and scheduling: Status and perspectives.

Transportation Science, 38(1):1–18.

Detti, P. (2009). A polynomial algorithm for the multiple

knapsack problem with divisible item sizes. Informa-

tion Processing Letters, 109(11):582–584.

Gheysens, F., Golden, B., and Assad, A. (1984). A compar-

ison of techniques for solving the fleet size and mix

vehicle routing problem. OR Spectrum, 6(4):207–216.

Hoff, A., Andersson, H., Christiansen, M., Hasle, G., and

Løkketangen, A. (2010). Industrial aspects and litera-

ture survey: Fleet composition and routing. Comput-

ers & Operations Research, 37(12):2041–2061.

Lei, L., Zhong, H., and Chaovalitwongse, W. (2009). On the

integrated production and distribution problem with

bidirectional flows. INFORMS Journal on Comput-

ing, 21(4):585–598.

Nicholson, T. and Pullen, R. (1971). Dynamic program-

ming applied to ship fleet management. Operational

Research Quarterly, pages 211–220.

Ronen, D. (1986). Short-term scheduling of vessels for

shipping bulk or semi-bulk commodities originating

in a single area. Operations Research, 34(1):164–173.

Wu, P., Hartman, J., and Wilson, G. (2005). An integrated

model and solution approach for fleet sizing with het-

erogeneous assets. Transportation Science, 39(1):87–

103.

Xinlian, X., Tengfei, W., and Daisong, C. (2000). A dy-

namic model and algorithm for fleet planning. Mar-

itime Policy & Management, 27(1):53–63.

ACaseoftheContainer-VesselSchedulingProblem

71