Hedging Cloud Energy Costs via Risk-free Provision Point Contracts

Owen Rogers

and Dave Cliff

Department of Computer Science, University of Bristol, Bristol, U.K.

Keywords: Pricing, Derivatives, Energy Market, Electricity Futures.

Abstract: The cost of electricity is a major concern to public providers of cloud computing services. On-demand

pricing, common amongst cloud providers, does not aid the provider in planning future demand and

therefore purchasing energy at discounted rates. In this paper, we describe a number of advance pricing

schemes for cloud computing resources based on provision-point contracts, commonly used by deal-of-the-

day websites such as Groupon. We propose three models – Group Provision Points, Contributory Provision

Points, and Variable Reward Forwards – that each reward consumers with reduced prices for advance

reservations, while allowing providers to make accurate forecasts of energy usage. Furthermore, we show

how the schemes are risk-free for the provider, guaranteeing to be at least as profitable as on-demand

schemes. We present results from a simulation of the schemes, and compare the results to our analytically

derived predictions.

1 INTRODUCTION

Consumers of cloud computing resources typically

pay a single price to access a virtual machine for a

specified period of time. This single price covers the

virtual machine’s fraction of the cost of the physical

server itself, maintenance and repairs, the physical

datacentre space, the electricity needed to power it,

and the cost of air conditioning to cool the

datacentre.

In on-demand pricing, consumers gain access to

the resource immediately and are charged for the

amount of time they use the resource.

In forward pricing, consumers gain access to the

resource at a specified time in the future, and have

access for a pre-agreed duration.

Air conditioning and datacentre space are

generally fixed costs. Regardless of how many

servers are placed in the datacentre, these costs will

essentially be the same.

Electricity costs for powering servers are

variable costs. The total electricity required by the

provider is proportional to the amount of virtual

machines demanded by the provider’s customers.

Energy costs are a significant cost for providers

of public cloud computing resources.

Estimates for the contribution of server

electricity to the total cost of ownership (TCO) of a

physical server vary between 3% and 15% (Barroso

and Hölzle 2009; Berl et al., 2009). Volume servers

account for 34% of datacentre electricity usage

(Brown, 2008). A full review of datacentre costs can

be found in (Patel and Shah, 2005).

This cost therefore impacts the price paid by

consumers to access virtual machines, and the profit

achieved by the provider. In a competitive

marketplace, keeping prices as low as possible is

critical for commercial success.

Currently, research is being focussed on reducing

the power consumption of computing technology

(Barroso and Holzle 2007; Lee and Zomaya, 2010).

The primary focus of this research is reducing

carbon footprint, but reducing expenditure is an

important factor too.

Typically, a cloud provider would purchase

electricity on-demand for a fixed price to power its

datacentre. This could be directly from an energy

supplier, or from a broker who hedges market-traded

instruments to offer fixed prices to its clients.

Larger cloud providers might purchase electricity

directly from the spot-market, where prices vary

over time to match supply with demand. These

larger providers may also generate their own

electricity and be able to contribute energy to the

grid as well as consuming it through bilateral

agreements.

Some research has been directed at moving

virtual machines between datacentres with the aim

244

Rogers O. and Cliff D..

Hedging Cloud Energy Costs via Risk-free Provision Point Contracts.

DOI: 10.5220/0004374502440252

In Proceedings of the 3rd International Conference on Cloud Computing and Services Science (CLOSER-2013), pages 244-252

ISBN: 978-989-8565-52-5

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

of finding the cheapest spot-price.

Qureshi et al. were the first to propose

dynamically assigning computational workloads in

distributed systems to locations where electricity

may be cheaper. They found savings of millions of

dollars could be achieved through a simulation

(Qureshi et al., 2009).

A similar method was suggested by Rao et al.,

but the dynamic allocation also takes into account

the latency between different locations, so that QoS

metrics would be met while electricity cost reduced

(Rao et al., 2010).

Buchbinder et al. extended these methods so that

only batch applications would be migrated to

cheaper markets (Buchbinder et al., 2011). In this

way, applications that could tolerate a delay would

use the cheapest electricity, and interactive

applications would not cause poor user-experience

as a result of the overhead involved in migrating the

application

Ding et al. also proposed that virtual machines

could be moved between datacentres based on

electricity prices (Guo et al., 2011).

However, little research has been conducted on if

providers can use derivative contracts to purchase

electricity in advance for a discount.

The cloud provider could potentially decrease its

costs by purchasing electricity futures directly (Hull,

2008). Futures contracts are a type of derivative that

give buyers guaranteed access to the resource in

advance of when it is delivered: the user is obliged

to take ownership of the resource on the delivery

date that the contract specified. The provider could

then engage a broker to provide fixed-price

electricity to top up its pre-bought electricity

capacity

A futures contract typically details the size of the

commodity being purchased. In electricity futures,

the commodity is a quantity of electricity delivered

for a fixed period of time, typically a month or a

quarter.

However, the use of electricity futures can have

significant associated risks. If the provider invests in

a future which is subsequently not fully utilised by

customers, then it is possible it will not cover the

investment. Electricity delivered to the cloud

provider cannot be stored; if it is not used as it is

delivered, then it is wasted.

Considering an electricity future for one months

delivery of 1MW costs over $35,000, this risk can be

sizeable

1

.

1

ICE UK Base Electricity Futures, November 2012

In this paper, we propose three pricing schemes that

allow the provider to purchase electricity futures

with no-risk that they will subsequently fail to utilise

their investment effectively. The provider is

guaranteed to be at least as profitable as using a

traditional on-demand pricing scheme.

Our schemes are based on provision-point

contracts (also known as assurance contracts). In a

provision-point mechanism, members of a group

pledge to contribute to an action if a threshold of

some order is met. If this threshold is met, the action

is taken and the public goods are provided;

otherwise no party is bound to carry out the action

and money paid is refunded (Bagnolli and Lipman

1989).

Such a mechanism is used by deal-of-the-day

website Groupon

2

. Users make requests for special

offers by purchasing a coupon. When a threshold is

reached, the deal is profitable to the provider and the

offer is confirmed.

In previous work, we showed how provision-

point contracts can be used to schedule virtual

machines more effectively on a large-scale cloud

infrastructure (Rogers and Cliff, 2012; Rogers and

Cliff, 2012).

In this paper, we amend traditional provision

points by changing the beneficiaries of the contract

and the value of the offer to create a number of new

pricing schemes.

Consumers of cloud computing resources can

purchase these in advance for discount, while

retaining the ability to purchase additional resources

on-demand. The cloud provider subsequently uses

this information to purchase electricity futures.

We show how Group Provision Points,

Contributory Provision Points, and Variable Reward

Forwards allow providers to make accurate forecasts

of energy usage and therefore reduce their costs

through the purchase of electricity.

We present results from a simulation of the

schemes, and show that our schemes have benefits

for both provider and consumer compared to

traditional on-demand and forward pricing.

2 PRICING SCHEMES

2.1 On-demand Pricing

In standard on-demand pricing there is a period of

duration N intervals, where resources are purchased

and then immediately available.

2

www.groupon.com

HedgingCloudEnergyCostsviaRisk-freeProvisionPointContracts

245

The provider charges customers a cost C

o

to use the

computing resource for an interval i. The total

demand experienced for resources in time interval i

is t

i

. In this case, the total revenue (REV) achieved

by the provider over the period is the total demand

experienced at the on-demand price:

The provider will be required to pay for

electricity for the duration of the interval that the

virtual machine is running at a cost E

o

from the

energy supplier or broker. The electricity required

per virtual machine for the interval is β. In this case,

the cost of electricity (COE) to the provider is the

total demand experienced, at the cost of on-demand

electricity per virtual machine:

Therefore, the provider’s profit using an on-

demand model is:

2.2 Forward Contracts

Consider a pricing model for cloud computing which

uses two periods, each period consisting of N time

intervals.

In the first period, ‘the reservation period’,

consumers purchase advance reservations (or

forwards) at a cost C

r

, which allows them to use a

resource at a specific interval i during the next

period. The total number of resources reserved in a

time interval i is r

i

.

In the second period, “the execution period”,

consumers gain access to their reservations at the

specified time interval. Consumers may also

purchase access to a resource for the duration of an

interval at a cost C

o.

The total demand experienced

for resources in time interval i is t

i

In this case, the revenue achieved over the period

is the sum of reserved resources bought at the

reserve price, plus the additional resources bought

on-demand at the on-demand cost:

As the provider has committed to deliver a number

of resources through the sale of forward contracts on

computing resources, she can use this information to

purchase forward contracts on electricity to obtain a

saving on consumption. The provider can choose to

buy θ forward electricity contracts, where each

contract entitles them to use I units of electricity for

a period of N time intervals at a cost E

r

per time

interval.

The cost over the period is the cost of purchasing

reserved electricity across the entire period, plus the

sum of the cost of purchasing on-demand electricity

required in addition to the reserved electricity.

Therefore the profit obtained via hedging

electricity consumption through the use of forward

contracts on electricity is:

,

For the model to be worth implementing for the

provider, it must offer a greater profit than using an

on-demand model:

∑

However, for the model to be beneficial to the

user, the user must be incentivised to provide a

forecast. Therefore, the cost of reserving a resource

must be less than the cost of buying a resource on-

demand:

So our conditions for the model to be beneficial to

all parties are:

1

∑

2

With forward pricing on computing resources, the

provider might choose to fix C

o

and C

r

so that

customers are fully aware of the pricing they will be

charged. In this case condition (1) is satisfied, and

consumers will use the service.

CLOSER2013-3rdInternationalConferenceonCloudComputingandServicesScience

246

However, as condition (2) is dependent on

∑

,

the provider is not aware of if the scheme will be

more profitable than on-demand pricing until all

users have purchased forward contracts and the

provider must deliver the resource.

The provider must provide users with access to

their reserved instances for smaller cost (and

therefore less revenue), but may not benefit from

cheaper electricity costs in all cases.

2.3 Group Provision Points (GPP)

This issue can be circumvented with a provision

point contract. We now introduce an additional,

intermediate phase – the ‘confirmation phase’:

1. Reservation Phase: Users request resources to

be consumed in the execution phase

2. Confirmation Phase: If the provider finds that

they will benefit as a result of the model by

conditions (1) and (2) being met, they will

confirm user’s requests and the contracts are

confirmed. If either condition is not met, all

contracts are cancelled.

3. Execution Phase: Users gain access to their

confirmed resources, and may also buy

additional on-demand resources.

If the requirements of the user population are

found not to produce an increase in profit, the

provider cancels all contracts and no revenue is lost

as a result. If the scheme is profitable, all contracts

are confirmed. This is equivalent to a traditional

provision-point contract used by deal-of-the-day

websites such as Groupon.

2.4 Contributor Provision Points (CPP)

The forward and GPP schemes are extremes. In the

forward scheme, all users who submit a reservation

benefit from reduced prices, in spite of it sometimes

not benefitting the provider. In the GPP scheme

either all, or no, users benefit from reduced prices

depending on whether an advantage is gained by the

provider or not.

A compromise might be to only confirm contract

requests to the consumers that contribute to the

purchase of advanced electricity during the

confirmation phase. This could be based on the

earliest consumers who request a reservation.

Customers who submitted a late reservation would

have their contract cancelled, as their discount

would not contribute to cheaper electricity.

The provider would typically determine how

much advance electricity θ to purchase based on

some function of the profile of the reserved

resources over the month.

⋯

If the provider chooses to purchase forward

contracts on electricity, this will provide the

provider with units of electricity each interval for

N intervals. Therefore, the total electricity available

to the provider over the period is. This will

support q contracts:

1

If we confirm only q contracts, and cancel all

others:

Substituting into (2):

1

3

The vulnerability of the forwards has now been

removed, as the conditions for profitability no longer

depend on the uncontrollable number of

reservations.

As long as prior to implementing the scheme

conditions (1) and (3) are met and E

r

is set to be the

maximum likely cost of an electricity future, the

scheme will generate a profit over on-demand

pricing.

This scheme also protects the provider against

changes in the cost of electricity forwards. If the cost

of a forward does not satisfy the following, the

provider should cancel all contracts:

2.5 Variable Reward Forwards (VR)

In the variable reward model, consumers are given

the guarantee that when purchasing a forward in the

reservation period, the price payable for the forward

will be the same, or less, than the cost of an on-

demand resource. The exact value of C

r

is not known

until the execution period and is determined on a

profit-sharing basis, where μ is the share desired by

the provider.

HedgingCloudEnergyCostsviaRisk-freeProvisionPointContracts

247

∑

Users pay the minimum C

r

to be profitable, plus

a share of the saving achieved:

1

If C

r

> C

o

then on-demand instances are cheaper

than reserved and the model will fail. In this case, no

discount is to be offered and C

r

= C

o

. The condition

for this is:

0

,0

1, 0

This will always be as least as profitable as on-

demand instances as users pay the on-demand price

if no saving can be made.

3 SIMULATION

3.1 Setup

A simulation was written in Python, the primary

aims being to verify that the models outperform

conventional on-demand and forward pricing

schemes when applied to practical applications, and

that users can make savings using a rational

approach to forecasting. Furthermore, a simulation

will aid comparing models where the cost of

electricity futures varies over time.

In our first simulation, we wish to determine which

contract model generates most profit in a monopoly

market where the broker is the only (or at least the

preferred) provider of cloud resources. Our objective

is to understand the profitability implications for the

provider of such schemes, and the cost implications

for the consumer.

For electricity, we assume that the broker may

purchase electricity futures for a period of a calendar

month, which supplies 1MWh of electricity per

hour. We obtain prices of ICE UK Base Electricity

Futures over a 39 month period from March 2012

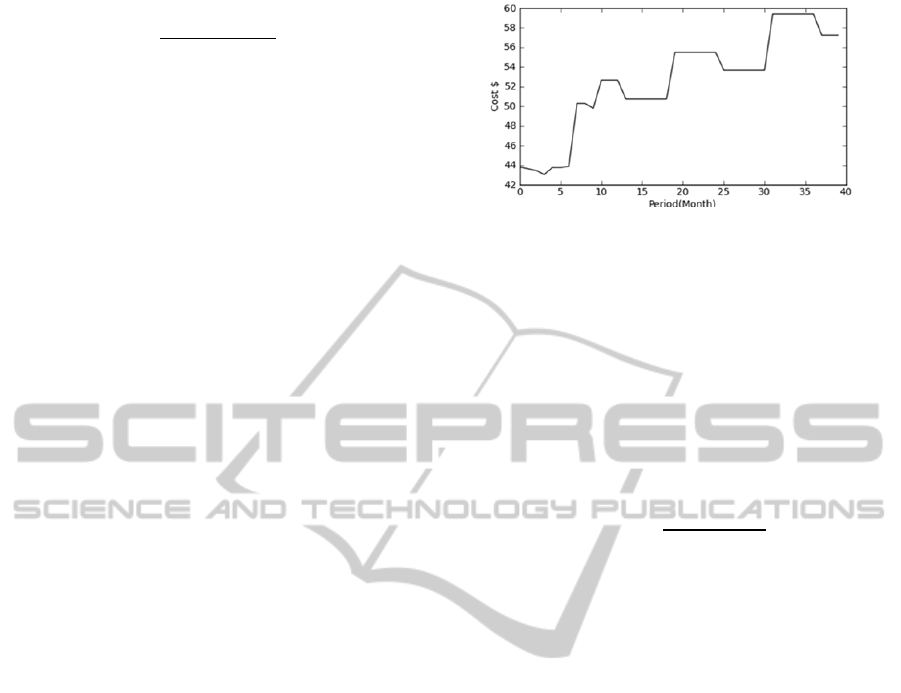

(Figure 1). The cost of electricity on-demand from

the grid is £0.01/kWh, based on (Barroso and Hölzle

2009) which is the most reliable source of this

information in current academic research.

Figure 1: Cost over electricity futures over time.

Group provision points (GPP), contributory

provision points (CPP) and standard forwards all

have the same prices for reservations and on-demand

instances. An on-demand instance is set at

£0.01/Computational-Unit/hour, which is a

reasonable figure in the current market.

The contributory provision point provider

believes that the maximum she will need to pay for

electricity in the foreseeable future is £55,

Therefore,

0.007863

The CPP provider sets C

r

= £0.007864. This will

guarantee her a benefit over on-demand pricing as

long as electricity does not go higher than £55.

The forward and GPP providers set C

r

to be the

same. The variable reward forward (VR) provider

sets C

o

= 0.01, but has no basis for determining a

reserved price. She decides that she requires 50% of

any saving used by the scheme to be retained as

profit, and the other 50% to be split to consumers

who reserved.

We simulated a demand curve varying over time

using a combination of 5 types of users:

Flat profile represents where demand is

constant, and hence trivially easy to predict;

Random profile represents stochastically

unpredictable demand, chosen randomly from a

normal distribution;

Sine profiles (with period of 24 hours) are an

approximation to daily rhythms, where demand

varies sinusoidally, peaking in the middle of

the day and at a minimum in the middle of the

night. More precisely, in our simulations this

sinusoidal demand pattern peaks around mid-

day, and demand can never be negative, so a

function of the form 1+cos(2πh/24) is used,

where h is the hour-number in the day. We

have explored three variations of these sinusoid

patterns:

CLOSER2013-3rdInternationalConferenceonCloudComputingandServicesScience

248

a. Flat Sine represents constant a constant

baseline of demand with periodic

variations across each day;

b. Growing Sine represents daily periodic

demand, with the baseline increasing

steadily across the month;

c. Shrinking Sine represents daily periodic

demand, shrinking through the month.

We create a demand curve by combining

different quantities of these users such that demand

is generally growing over time so that the benefit of

purchasing additional electricity futures can be seen

in our results. There are 2000 users in total using the

simulation.

The aim of the demand curve is to determine if

the scheme can be profitable in a heterogeneous

market of different users with different demands,

which follows an increasing trend. We are not aware

of any real-world data on public cloud demand

which we could use over such timescales, so this is a

suitable approximation in this preliminary study.

We assume the provider has servers that can

support 8 virtual machines, and each server uses

380W.

3.2 Results

3.2.1 Provider Cost Reduction

For clarity, figures 3-8 show data points averaged

over the last 2 months with the corresponding

standard deviation shown in error bars.

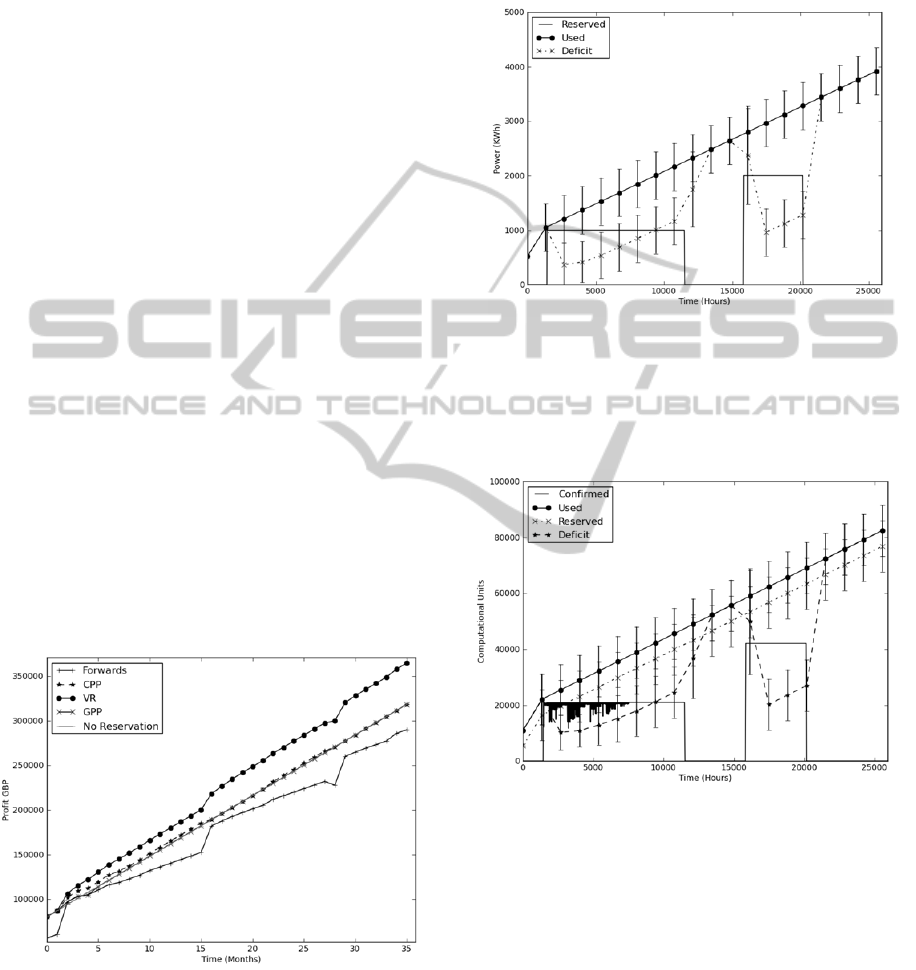

Figure 2: Profit achieved using pricing models.

Figure 2 shows that the CPP model does generate

more profit for the provider than on-demand pricing

alone. Initially this is around a 10% increase, but this

decreases as forward electricity prices increases. In

month 17 (hour 11424), electricity futures rise above

the point where our reserved pricing is profitable,

and so all contracts are cancelled. This can be seen

in Figure 3 where no energy resources are reserved

as the cost of electricity forwards goes higher than

our reserved pricing threshold.

Figure 3: Power used by CPP model.

In this case, the profit achieved is the same as

on-demand pricing. In Figure 4 it can be seen at this

point that no contracts are confirmed, and all users

must purchase on-demand resources.

Figure 4: Resource allocation in CPP model.

The VR model is the most profitable for the

provider, being up to 16% more profitable than on-

demand pricing. This is because the provider is not

committed to giving a specific discount to the

consumer. The fact that any benefit obtained through

advance reservations is shared means that the

provider gains when big savings are achieved, and

doesn’t lose out when a loss is likely. The VR model

is also not negatively impacted as a result of changes

in the price of electricity futures and, unlike the CPP

model, generates more profit than on-demand during

these price hikes. Figure 5 shows the purchase of

electricity by the provider. Figure 6 shows the

purchase of resources by consumers.

HedgingCloudEnergyCostsviaRisk-freeProvisionPointContracts

249

Figure 5: Power used by forwards and VR model.

Figure 6: Resource allocation using forwards and VR.

Forwards are generally less profitable than on-

demand resources, by quite a large margin. Clearly,

the pricing is too low for purchasing advance

reservations to be profitable, but determining this

price is not easy as the number of reservations is not

known until they have all been requested.

Figure 7: Power used by GPP model.

Figure 8: Resource allocation using GPP model.

The GPP model also fails to deliver significant

gains in profit. The model protects losses as a result

of not giving discounts when forwards are less

profitable than on-demand, but it doesn’t achieve

high profits when forwards are more profitable as

everyone receives the discount (figures 7 and 8).

3.2.2 Provider Cost Reduction

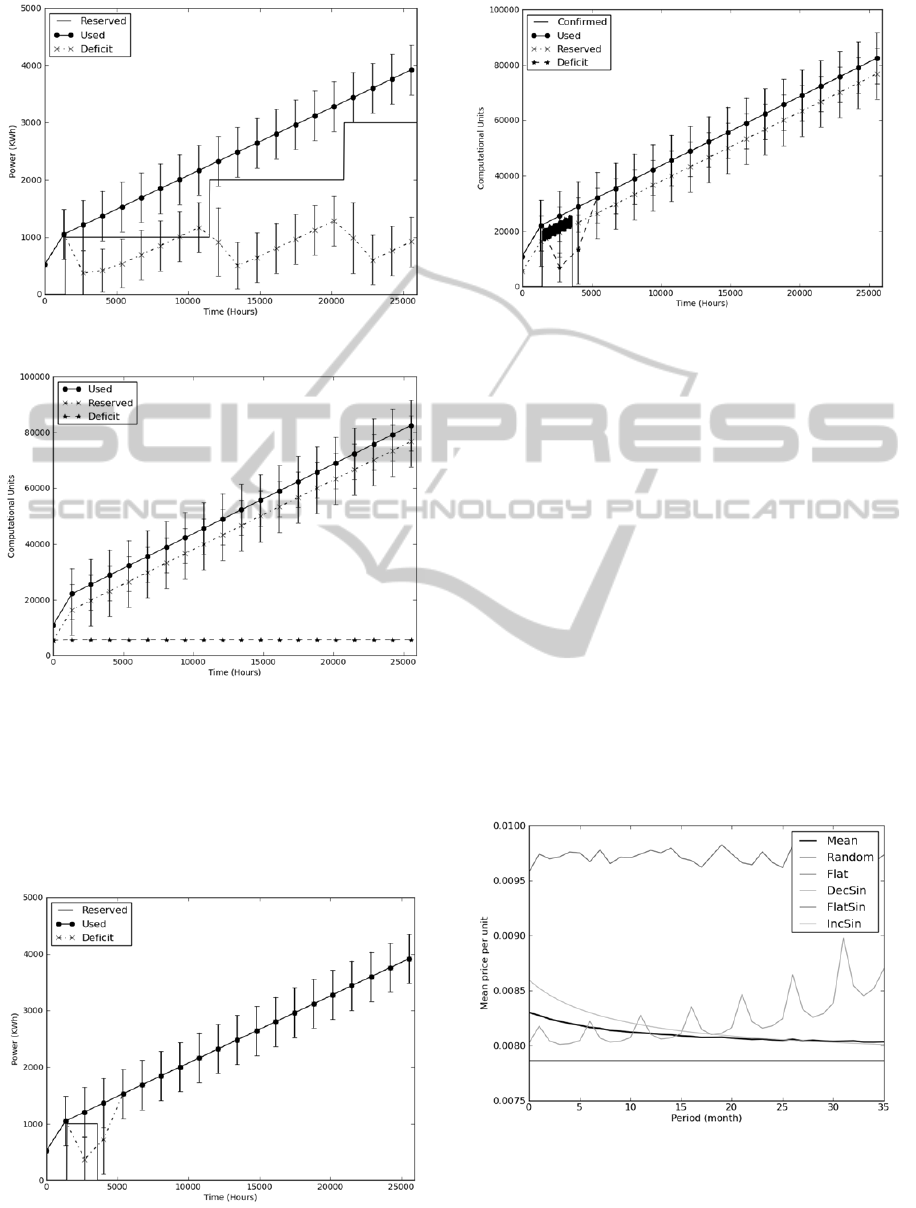

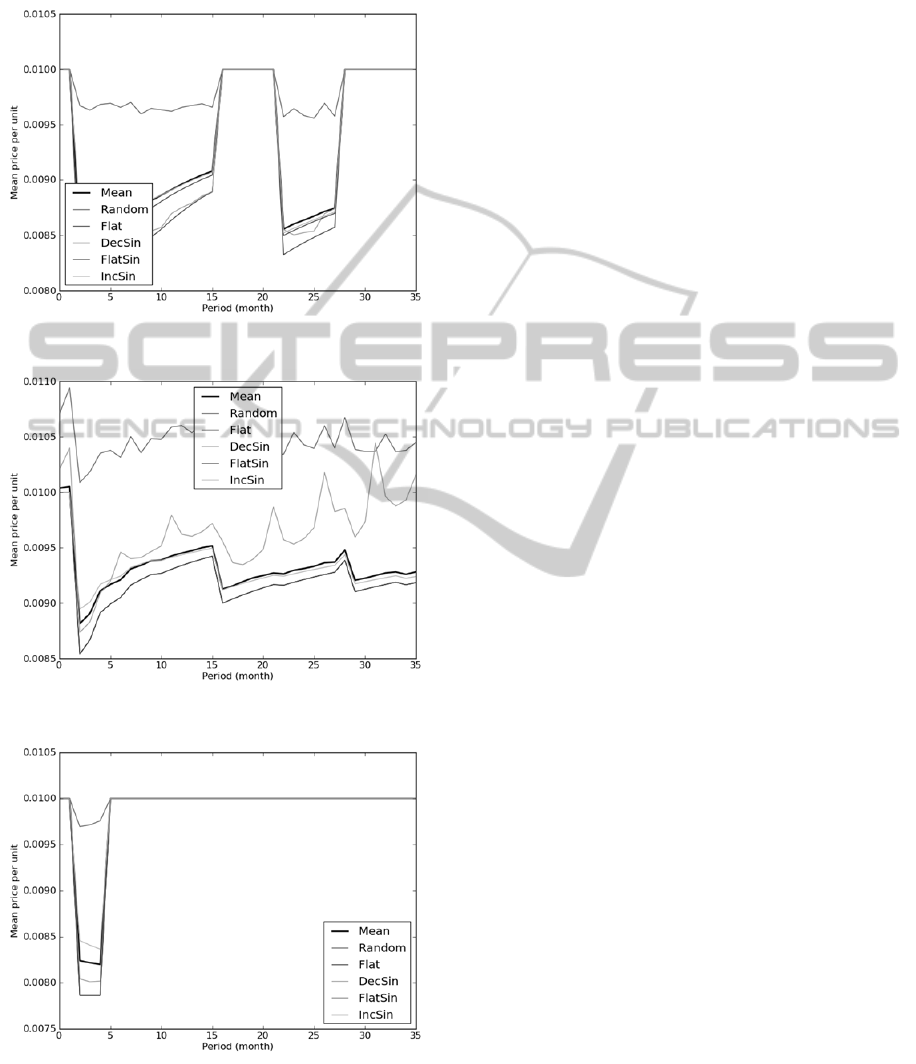

Forwards are generally the most beneficial to the

consumer achieving a mean saving of around 20%

the cost of an on-demand instance, and reducing

costs for all market demand profiles (Figure 9). This

is because the consumer always gains access to the

resource, and thus their net costs are reduced. The

mean price does not equal the cost of the reserved

resource in all situations because sometimes a user

purchases a resource that subsequently she does not

require, but which she has already agreed to pay for.

Figure 9: Mean price per computational unit using

forwards.

The CPP model rewards consumers with around

a 15-10% saving when a cost saving is achieved,

CLOSER2013-3rdInternationalConferenceonCloudComputingandServicesScience

250

with this rising to no discount when electricity prices

increase (Figure 10). All consumers make a saving

using the CPP model.

Figure 10: Mean price per computational unit using CPP.

Figure 11: Mean price per computational unit using VR.

Figure 12: Mean price per computational unit using GPP.

The VR model provides a discount of around 5%

on average (Figure 11). However, users with random

demand profiles spend more using the scheme than

if using just on-demand resources. This is as a result

of poor predictability, which results in the purchase

of advance resources which are subsequently not

used.

The GPP model is generally unattractive to

consumers (Figure 12). Only occasionally is a

discount awarded, and it is unlikely this would not

occur enough to be of interest.

4 CONCLUSIONS

In this paper, we have introduced and analysed a

number of novel pricing schemes for cloud

computing which we have shown to offer

opportunities for increasing profits by reducing the

cost of purchasing electricity.

Group Provision Points are unlikely to be

implemented in a commercial offering, as the

scheme does not take full advantage of information

acquired through the sale from consumers.

Consumers do not receive regular enough discounts

to make forecasting worthwhile, nor does the

provider benefit from reduced electricity costs.

We believe Contributory Provision Points and

Variable Reward Forwards are the most attractive of

the schemes discussed. Contributory Provision

Points will favour those who can predict their future

demands earlier. Variable Reward Forwards gives

everyone who contributed to a reduced cost with a

share of the saving. It is likely Variable Reward

Forwards would be seen as fairer by the user-base as

everyone is rewarded; not just those who contribute

to the discount, which cannot be established

beforehand.

Both of these schemes can be configured to

outperform on-demand pricing by setting reserved

pricing appropriately.

However, because of the size of the electricity

futures involved, only larger providers would be

able to take advantage of the schemes.

Further investigation should be conducted on

how these schemes can be used in bilateral

arrangements, where datacentres may produce their

own electricity which may be ploughed back into the

electricity grid. Furthermore, can these schemes be

enhanced through the use of cloud spot-markets, or

reserved instances?

In this work, we assumed air conditioning was a

fixed cost which doesn’t change with increasing

number of servers. However, a gradual increase in

air conditioning energy is likely to be seen as a

result of the increased heat generated by servers. In

HedgingCloudEnergyCostsviaRisk-freeProvisionPointContracts

251

future work, including air conditioning costs in the

model could further reduce expenditure.

A significant amount of work is still required to

determine if these schemes can be implemented

commercially. In future work, we plan to create a

simulation of a competitive market of providers

utilising the scheme. Our objective is to see if one

scheme becomes dominant in the marketplace. We

also wish to investigate if the providers can change

pricing with a view to acquire more business. This

could eventually lead to a market for provision point

contracts in cloud computing.

ACKNOWLEDGEMENTS

We thank the Large-Scale Complex IT Systems

Initiative (www.lscits.org) as well as HP Labs

Adaptive Infrastructure Lab for providing additional

financial support.

REFERENCES

Bagnolli, M, and B Lipman. 1989. “Provision of Public

Goods: Fully Implementing the Core Through Private

Contributions.” Review of Economics Studies 56: 583–

601.

Barroso, L. A., and U. Holzle. 2007. “The case for energy-

proportional computing.” Computer 40(12): 33–37.

http://ieeexplore.ieee.org/xpls/abs_all.jsp?arnumber=4

404806 (November 30, 2011).

Barroso, Luiz André, and Urs Hölzle. 2009. “The

Datacenter as a Computer: An Introduction to the

Design of Warehouse-Scale Machines.” Synthesis

Lectures on Computer Architecture 4(1): 1–108.

http://www.morganclaypool.com/doi/abs/10.2200/S00

193ED1V01Y200905CAC006.

Berl, a., E. Gelenbe, M. Di Girolamo, G. Giuliani, H. De

Meer, M. Q. Dang, and K. Pentikousis. 2009.

“Energy-Efficient Cloud Computing.” The Computer

Journal 53(7): 1045–1051. http://

comjnl.oxfordjournals.org/cgi/doi/10.1093/comjnl/bxp

080 (November 7, 2012).

Brown, R. 2008. “Report to congress on server and data

center energy efficiency: Public law 109-431.”

http://escholarship.org/uc/item/74g2r0vg.pdf (January

21, 2013).

Buchbinder, N., N. Jain, and I Menache. 2011. “Online

job-migration for reducing the electricity bill in the

cloud.” NETWORKING 2011. http://

www.springerlink.com/

index/86060362741H6X88.pdf (January 23, 2013).

Guo, Yuanxiong, Zongrui Ding, Yuguang Fang, and

Dapeng Wu. 2011. “Cutting Down Electricity Cost in

Internet Data Centers by Using Energy Storage.” In

2011 IEEE Global Telecommunications Conference -

GLOBECOM 2011, IEEE, p. 1–5. http://

ieeexplore.ieee.org/xpl/articleDetails.jsp?arnumber=61

34209 (January 23, 2013).

Hull, John C. 2008. Fundamentals of Futures and Options

Markets. 6th ed. Prentice Hall.

Lee, Young Choon, and Albert Y. Zomaya. 2010. “Energy

efficient utilization of resources in cloud computing

systems.” The Journal of Supercomputing. http://

www.springerlink.com/index/10.1007/s11227-010-

0421-3 (July 18, 2011).

Patel, C. D., and A. J. Shah. 2005. “Cost model for

planning, development and operation of a data center.”

Development 107: 1–36. http://www.hpl.hp.com/

techreports/2005/HPL-2005-107R1.pdf (November

30, 2011).

Qureshi, Asfandyar, Rick Weber, Hari Balakrishnan, John

V. Guttag, and Bruce Maggs. 2009. “Cutting the

Electric Bill for Internet-Scale Systems.”

http://dspace.mit.edu/handle/1721.1/62585 (January

21, 2013).

Rao, Lei, Xue Liu, Le Xie, and Wenyu Liu. 2010.

“Minimizing Electricity Cost: Optimization of

Distributed Internet Data Centers in a Multi-

Electricity-Market Environment.” In 2010

Proceedings IEEE INFOCOM, IEEE, p. 1–9.

http://ieeexplore.ieee.org/xpls/abs_all.jsp?arnumber=5

461933’ escapeXml='false'/> (January 7, 2013).

Rogers, O., and D. Cliff. 2012. “Options, forwards and

provision-point contracts in improving cloud

infrastructure utilisation.” Journal of Cloud

Computing: Advances, Systems and Applications

1(21).

Rogers, Owen, and Dave Cliff. 2012. “The Use of

Provision Point Contracts for Improving Cloud

Infrastructure Utilisation.” In Grid Economics and

Business Models,.

CLOSER2013-3rdInternationalConferenceonCloudComputingandServicesScience

252