Exploring Assignment-Adaptive (ASAD) Trading Agents

in Financial Market Experiments

Steve Stotter, John Cartlidge and Dave Cliff

Department of Computer Science, University of Bristol

Merchant Venturers Building, Woodland Road, Bristol BS8 1UB, U.K.

Keywords:

Software Agents, Auctions, Financial Markets, Automated Trading, Computational Finance, ExPo.

Abstract:

Automated trading systems in the global financial markets are increasingly being deployed to do jobs previ-

ously done by skilled human traders: very often a human trader in the markets simply cannot tell whether

the counter-party to a trade is another human, or a machine. Clearly, automated trading systems can easily

be considered as “intelligent” software agents. In this paper we report on experiments with software trader-

agents running the well-known “AA” and “ZIP” strategies, often used as reference benchmarks in previously

published studies; here we suggest disambiguated standard implementations of these algorithms. Then, using

Exchange Portal (ExPo), an open-source financial exchange simulation platform designed for real-time be-

havioural economic experiments involving human traders and/or trader-agents, we explore the impact of intro-

ducing a new method for assignment adaptation in ZIP. Results show that markets containing only assignment-

adaptive (ASAD) agents equilibrate more quickly after market shocks than markets containing only “standard”

ZIP agents. However, perhaps counter-intuitively, in mixed heterogeneous populations of ASAD agents and

ZIP agents, ZIP agents outperform ASAD agents. Evidence suggests that the behaviour of ASAD agents act

as a new signal in the market that ZIP agents then use to beneficially alter their own behaviour, to the detriment

of the ASAD agents themselves.

1 INTRODUCTION

In 2001, a team of researchers at IBM reported on

a series of experiments to test the efficiency of two

adaptive trading-agent algorithms, MGD (Gjerstad &

Dickhaut, 1998) and ZIP (Cliff, 1997), when com-

peting directly against human traders (Das, Hanson,

Kephart, & Tesauro, 2001). Previous studies using

homogeneous trader populations of all-humans or all-

agents had indicated that, in both cases, trading in-

teractions within the populations rapidly and robustly

converged toward theoretically optimal, and stable,

dynamic equilibria. IBM’s results demonstrated for

the first time that, in heterogeneous populations mix-

ing human traders with trader-agents, both MGD and

ZIP consistently out-performed the human traders,

achieving greater efficiency by making more prof-

itable transactions. The IBM authors concluded with

a prescient statement, predicting that “in many real

marketplaces, agents of sufficient quality will be de-

veloped such that most agents beat most humans”.

Hindsight shows that they were correct: in many of

the world’s major financial markets, transactions that

used to take place between human traders are now

being fulfilled electronically, at super-human speeds,

by automated trading (AT) and high frequency trad-

ing (HFT) systems. AT and HFT systems are typ-

ically highly autonomous and dynamically adapt to

changes in the market’s prevailing conditions: for

any reasonable definition of software agent, it is clear

that AT/HFT systems can be considered as software

agents, even though practitioners in the finance indus-

try typically do not make much use of the phrase.

However, as the number of AT and HFT systems

has increased, and as the billions of dollars worth

of daily transaction volumes that they control has

steadily risen, a worrying gap has emerged between

theory and practice. Commercial deployments of

AT/HFT continue to proliferate (some major financial

markets are currently reporting that 50% or more of

transactions are now executed by automated agents),

yet theoretical understanding of the impact of trading

agent technologies on the system-level dynamics of

financial markets is dangerously deficient. To address

this problem, in 2010 the UK Government’s Office for

Science (UKGoS) launched a two year “Foresight”

77

Stotter S., Cartlidge J. and Cliff D..

Exploring Assignment-Adaptive (ASAD) Trading Agents in Financial Market Experiments.

DOI: 10.5220/0004248000770088

In Proceedings of the 5th International Conference on Agents and Artificial Intelligence (ICAART-2013), pages 77-88

ISBN: 978-989-8565-38-9

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

project entitled “The Future of Computer Trading in

Financial Markets”.

1

One report commissioned by that project (and

published by UKGoS as De Luca, Szostek, Cartlidge,

& Cliff, 2011) attempted a replication of IBM’s study,

but with two extensions: firstly, trading agents used

the Adaptive Aggressive (AA) strategy, developed

by Vytelingum (2006), which had previously been

shown by De Luca and Cliff (2011b) to outperform

both MGD and ZIP; secondly, to increase the exper-

imental “realism”, order assignments to trade were

continuously replenished, thus producing a contin-

uous “drip-feed” market that more closely approx-

imates the real world, rather than a discrete, peri-

odic market as had been used in almost all prior ex-

perimental studies (De Luca et al., 2011). Results

showed that, under these experimental conditions,

agents were less efficient than human traders, with

slower markets hindering agent performance but en-

hancing human performance.

In this paper, we perform two sets of experiments.

Firstly, we replicate the continuous replenishment ex-

periments of De Luca et al. (2011) using ExPo: The

Exchange Portal (ExPo, 2012), an open-source plat-

form designed to facilitate financial trading experi-

ments between humans, agents, or both. However,

unlike De Luca et al. (2011), we study agent-only

markets. Perhaps surprisingly, we believe that this

is the first time agent-only markets have been studied

using continuous replenishment of order assignments.

For our trading agents, we use two well-known “ref-

erence” algorithms from the trading-agent literature,

AA (Vytelingum, 2006) and ZIP (Cliff, 1997).

In our second set of experiments, we introduce

“market shocks” to the system and explore a novel

extension to the reference algorithms, designed to

enable agents to take advantage of market shocks

(assignment-adaptive, or ASAD, agents). We demon-

strate that if all agents in the market are ASAD, then

the market is more efficient in the presence of mar-

ket shocks than if all agents are non-ASAD. However,

somewhat counter-intuitively, when the market is a

heterogenous mixture of ASAD and non-ASAD, non-

ASAD agents outperform ASAD agents by adapting

to the new price signals generated by ASAD agents.

The paper is organised as follows. In Section 2 we

review the literature on financial trading agent experi-

ments and the agent algorithms. In Section 3 we intro-

duce ExPo, our experimental platform, and describe

our experimental design. In Section 4 we present the

results from our two sets of experiments. Conclusions

are drawn in Section 5.

1

The final report from that investigation was published

in Oct. 2012, and is available at: http://bit.ly/UvGE4Q.

2 BACKGROUND

2.1 The Continuous Double Auction

An auction is a mechanism whereby sellers and buy-

ers come together and agree on a transaction price.

Several different auction mechanisms exist, each gov-

erned by a different set of rules. In this paper, we

focus on the Continuous Double Auction (CDA), the

most widely used auction mechanism and the one

used to control all the world’s major financial ex-

changes. The CDA enables buyers and sellers to

freely and independently exchange quotes at any time.

Transactions occur when a seller accepts a buyer’s

“bid”, or when a buyer accepts a seller’s “ask”. Al-

though it is possible for any seller to accept any

buyer’s bid, and vice-versa, it is in both of their inter-

ests to get the best deal possible at any point in time.

Thus, transactions execute with a counter party that

offers the most competitive quote.

Vernon Smith (1962) explored the dynamics of

CDA markets in a series of Nobel Prize winning ex-

periments using small groups of human participants.

Splitting participants evenly into a group of buyers

and a group of sellers, Smith handed out a single card

(an assignment) to each buyer and seller with a sin-

gle limit price written on each, known only to that

individual. The limit price on the card for buyers

(sellers) represented the maximum (minimum) price

they were willing to pay (accept) for a fictitious com-

modity, with strict instructions that they could not bid

(ask) a price higher (lower) than that shown on their

card. They were encouraged to bid lower (ask higher)

than this price, regarding any difference between the

price on the card and the price achieved in the market

as profit.

Experiments were split into a number of “trad-

ing days”, each typically lasting a few minutes. At

any point during the trading day, a buyer or seller

could raise their hand and announce a quote. When

a seller and a buyer agreed on a quote, a transaction

was made. At the end of each trading day, all stock

(sellers assignment cards) and money (buyer assign-

ment cards) was recalled, and then reallocated anew

at the start of each new trading day. By control-

ling the limit prices allocated to participants, Smith

was able to control the market’s supply and demand

schedules. Smith found that, typically after a couple

of trading days, human traders achieved very close to

100% allocative efficiency; a measure of the percent-

age of profit in relation to the maximum theoretical

profit available (see Section 2.2.2). This was a signif-

icant result: few people had believed that a very small

number of inexperienced, self-interested participants

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

78

could effectively self-equilibrate.

2.2 Measuring Market Performance

An “ideal” market can be perfectly described by the

aggregate quantity supplied by sellers and the ag-

gregate quantity demanded by buyers at every price-

point (i.e., the market’s supply and demand sched-

ules). As prices increase, in general there is a ten-

dency for supply to increase, with increased poten-

tial revenues from sales encouraging more sellers to

enter the market; while, at the same time, there is a

tendency for demand to decrease as buyers look to

spend their money elsewhere. At some price-point,

the quantity demanded will equal the quantity sup-

plied. This is the theoretical market equilibrium. An

idealised theoretical market (and many real ones) has

a market equilibrium price and quantity (P

0

, Q

0

) de-

termined by the intersection between the supply and

demand schedules. The dynamics of competition in

the market will tend to drive transactions toward this

equilibrium point.

In the real world, markets are not ideal. They will

always trade away from equilibrium at least some of

the time. We can use metrics to calculate the “perfor-

mance” of a market by how far from ideal equilibrium

it trades, allowing us to compare between markets. In

this report, we make use of the following metrics:

2.2.1 Smith’s Alpha

Following Vernon Smith (1962), we measure the

equilibration (equilibrium-finding) behaviour of mar-

kets as α, the root mean square difference between

each of n transaction prices, p

i

(for i = 1. . . n) over

some period, and the P

0

value for that period, ex-

pressed as a percentage of the equilibrium price:

α =

1

P

0

s

1

n

n

∑

i=1

(p

i

− P

0

)

2

(1)

In essence, α captures the standard deviation of trade

prices about the theoretical equilibrium. A low value

of α is desirable, indicating trading close to P

0

.

2.2.2 Allocative Efficiency

For each trader, i, the maximum theoretical profit

available, π

∗

i

, is the difference between the price they

are prepared to pay (their “limit price”) and the the-

oretical market equilibrium price, P

0

. Efficiency, E,

is used to calculate the performance of a group of n

traders as the mean ratio of realised profit, π

i

, to the-

oretical profit, π

∗

i

:

E =

1

n

n

∑

i=1

π

i

π

∗

i

(2)

As profit values cannot go below zero (traders in

these experiments are not allowed to enter into loss-

making deals), a value of 1.0 indicates that the group

has earned the maximum theoretical profit available,

π

∗

i

, on all trades. A value below 1.0 indicates that

some opportunities have been missed. Finally, a value

above 1.0 means that additional profit has been made

by taking advantage of a trading counterparty’s will-

ingness to trade away from P

0

. So, for example, a

group of sellers might record an allocative efficiency

of 1.2 if their counterparties (a group of buyers) con-

sistently enter into transactions at prices greater than

P

0

; in such a situation, the buyers’ allocative effi-

ciency would not be more than 0.8.

2.2.3 Profit Dispersion

Profit dispersion is a measure of the extent to which

the profit/utility generated by a group of traders in the

market differs from the profit that would be expected

of them if all transactions took place at the equilib-

rium price, P

0

. For a group of n traders, profit disper-

sion is calculated as the root mean square difference

between the profit achieved, π

i

, by each trader, i, and

the maximum theoretical profit available, π

∗

i

:

π

disp

=

s

1

n

n

∑

i=1

(π

i

− π

∗

i

)

2

(3)

Low values of π

disp

indicate that traders are extracting

actual profits close to those available if all trades take

place at the equilibrium price P

0

; while higher values

of π

disp

indicate that traders’ profits differ from those

expected at equilibrium. The attraction of this statistic

is that it is not masked by zero-sum effects between

buyers and sellers (Gode & Sunder, 1993).

2.3 Algorithmic Traders

2.3.1 Zero-Intelligence Plus (ZIP)

Zero-Intelligence-Plus (ZIP) traders were developed

to overcome the provable shortcomings of Gode and

Sunder’s (1993) ZI-C agents (Cliff, 1997). ZIP agents

are profit-driven traders that adapt using a simple

learning mechanism: adjust profit margins based on

the price of other bids and offers in the market, and

decide whether to make a transaction or not. When a

decision to raise or lower a ZIP trader’s profit margin,

µ

i

(t), is taken, ZIP modifies the value using market

data and an adaptation rule based on the Widrow and

Hoff (1960) “delta” rule:

ExploringAssignment-Adaptive(ASAD)TradingAgentsinFinancialMarketExperiments

79

∆

i

(t) = β

i

(τ

i

(t) − p

i

(t)) (4)

where β

i

is the learning rate, p

i

is the quote price and

τ

i

is the target price (based on the price of the last

quote in the market). At time t, an update to the profit

margin, µ

i

, takes the form:

µ

i

(t +1) =

p

i

(t) + Γ

i

(t +1)

l

i

− 1

(5)

Γ

i

(t +1) = γ

i

(t) + (1 − γ

i

)∆

i

(t) (6)

where Γ

i

(t + 1) is the amount of change on the tran-

sition from t to t + 1, and γ

i

is the momentum coeffi-

cient. Given the limit price, l

i

, of the current assign-

ment, ZIP then updates its profit margin, µ

i

(t), based

on these trading rules, where the final quote price, p

i

,

is given as:

p

i

= l

i

(1 + µ(t)) (7)

The ZIP strategy has become a popular bench-

mark for CDA experiments. In their IBM study, Das

et al. (2001) concluded that ZIP was a dominant strat-

egy, beating humans in experimental trials and match-

ing the performance of their own modified GD (Gjer-

stad & Dickhaut, 1998) algorithmic trader. More re-

cently, ZIP has again been shown to outperform hu-

mans (De Luca & Cliff, 2011a, 2011b). However, it

is no longer considered the dominant agent strategy

(having been shown to be beaten by AA; see Sec-

tion 2.3.2). ZIP has also been tested against humans

in a continuous “drip-feed” market, where ZIP was

shown to be less efficient than humans (a result that

surprised the authors: De Luca et al., 2011; Cartlidge,

De Luca, Szostek, & Cliff, 2012). However, we be-

lieve that De Luca’s implementation of ZIP (OpEx,

2012) may have played some part in this result.

The original implementation of ZIP (Cliff, 1997)

was designed to handle only one limit price, had no

explicit notion of time and no persistent orders. So,

when Das et al. (2001) used ZIP to conduct their hu-

man vs. agent experiments, they adapted ZIP for their

platform. ZIP was altered to handle persistent orders,

and implemented an out-bid (for buyers) or under-cut

(for sellers) decision when an order remained open

for a certain amount of time without being traded.

Perhaps more importantly, ZIP was further modified

to have a vector of internal price variables, allow-

ing profit to be made at different values for differ-

ent assignments. This modification was similar to the

implementation that Preist and van Tol (1998) had

independently proposed in a previous study. Both

of these experiments also introduced a “sleep-time”,

where if no trade took place within a given time pe-

riod, they facilitated an automatic competitive price

movement, i.e., a price movement towards the best

value on the other side of the order book. Other ver-

sions of ZIP also appear in the literature. Vytelingum

(2006) forced ZIP (and presumably, also AA) algo-

rithms to update only the most profitable bid (for buy-

ers) or ask (for sellers) at any one time. This approach

was replicated in De Luca’s open-source implementa-

tion of ZIP and AA (OpEx, 2012).

Here, we test to see whether a ZIP implementa-

tion with multiple profit margins, ZIP

M

, is more ef-

ficient than a ZIP trader with a single profit margin,

ZIP

S

. As far as we are aware, this comparison has not

been directly tested before. We use ZIP

S

to describe

Vytelingum’s (2006) implementation, where only the

most profitable order is updated on every wakeup;

and ZIP

M

to denote an implementation of ZIP simi-

lar to that used by Tesauro and Das (2001), Das et al.

(2001), and Preist and van Tol (1998), such that ZIP

M

is capable of updating all profit margins for all orders

simultaneously. Every unique limit price received is

given a new µ and γ (the values of µ and γ are decided

at random when the agent is started) and all ZIP pa-

rameters are the same as those used in Cliff (1997).

2.3.2 Adaptive-Aggressive (AA)

Developed by Vytelingum (2006), the Adaptive-

Aggressive (AA) agent explicitly models “aggressive-

ness”; trading the opportunity of extra profit for the

certainty of transacting. Aggressive agents enter com-

petitive bids (or asks) for a quick trade, while passive

agents forgo the chance of a quick trade in order to

hold out for greater profit. To control the level of ag-

gressiveness, AA uses the Widrow and Hoff (1960)

delta learning rule that is also used in ZIP (equa-

tion 4). However, whereas ZIP uses learning to up-

date profit margin, AA updates an aggression param-

eter based on previous market information. At time,

t, AA estimates the competitive equilibrium price, p

∗

,

based on a moving window of historic market trans-

action prices; p

∗

is then used in AA’s long-term adap-

tivity component, which updates θ, a property of the

aggressiveness model. In this long-term adaptivity

component, an internal estimate of Smith’s α is cal-

culated, enabling the agent to detect and react to price

volatility. AA was developed to perform well in dy-

namic markets. Short-term learning is used to react to

the current state of the market, while long-term learn-

ing is used to react to market trends. AA has been

shown to dominate other agent strategies in the liter-

ature (Vytelingum, 2006; De Luca & Cliff, 2011b),

however, unlike ZIP, which has been independently

re-implemented by many different researchers, we be-

lieve the only replication of AA in the literature is De

Luca’s OpEx implementation (OpEx, 2012).

In Vytelingum’s original AA implementation, it

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

80

is unclear how an agent should quote when the mar-

ket first opens and is empty. However, De Luca uses

the maximum bid or ask price allowed in the mar-

ket, P

max

= 400, to determine an agent’s initial quote

price, p

t=0

, such that p

t=0

is a random variable from a

uniform distribution with range [0.15P

max

, 0.85P

max

].

In the absence of any “real” market data, the value

p

t=0

acts as a proxy for the initial estimate of market

equilibrium. But, since p

t=0

is artificially constrained

by the arbitrary market value P

max

, we believe that

this method of generating p

t=0

is not domain indepen-

dent and may present AA with an unfair “equilibrium

finding” advantage when compared with other agent

strategies, such as ZIP, which do not have access to

this parameter. For this reason, we introduce a modifi-

cation to AA whereby agents set their own internal es-

timation of P

max

such that P

max

equals twice the maxi-

mum assignment limit price an agent holds.

2

Readers

should note that agents can only submit a quote once

they have received an assignment to trade. Moreover,

for their first quote price, De Luca’s OpEx agents do

not make use of the limit prices of their internal as-

signments (other than to maximally bound the quote

at the bid limit and minimally bound at the ask limit).

We believe this to be unrealistic: since, at the begin-

ning of the market, the only information agents have

available for price discovery are their own personal

assignments, it is intuitive that agents should try to

benefit from any information contained therein.

As we were designing our experiments (in March

2012), a contemporary publication exposed an un-

expected “max spread rule” in De Luca’s AA code

of OpEx version 1 (see Cartlidge & Cliff, 2012,

for a lengthy discussion on the consequences of this

“rule”). This rule states that an agent should auto-

matically execute against the best quote on the other

side of the book if the relative spread (the differ-

ence between best quotes on either side of the book)

is within a threshold, maxSpread (and within limit

price range). Although this rule is not described in

the definition of AA, we believe that it is a vesti-

gial morph of a spread rule appearing in Risk-Based

(RB) agents (Vytelingum, Dash, David, & Jennings,

2004), a previous trader agent that Vytelingum even-

tually developed into AA. The max spread rule en-

courages De Luca’s AA agents to “jump the spread”

for a quick transaction. However, in OpEx version 1,

maxSpread was hard-coded to a value of 15%. Fol-

lowing Cartlidge and Cliff (2012), we believe that

this value is unrealistically large and therefore casts

2

We do not suggest that two is the optimum multiplier

for this equation; rather we aim to investigate the effect

of introducing this modification and select two as a simple

heuristic estimate.

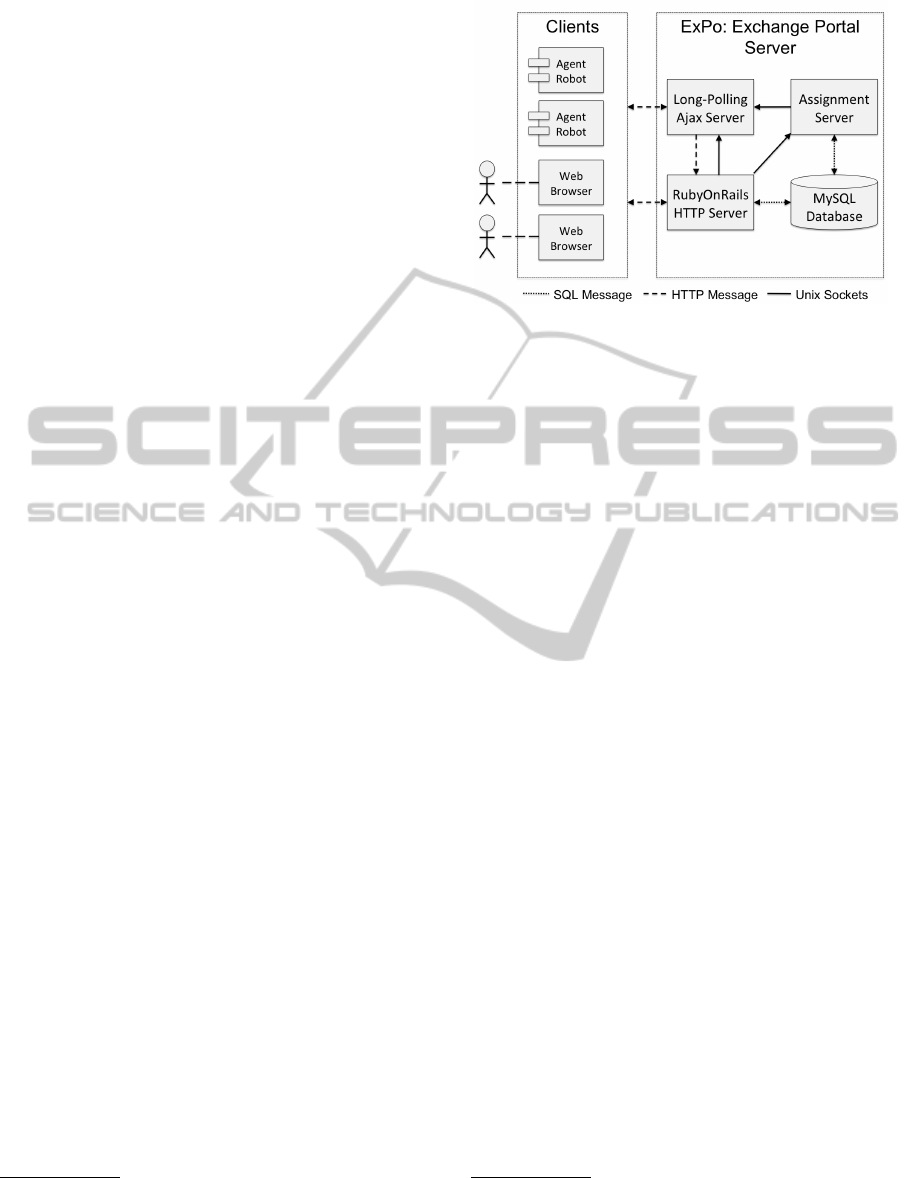

Figure 1: ExPo Architecture. The ExPo exchange is a Ruby

on Rails web server application with RESTful architecture,

using a MySQL database for storage. Clients (automated

trader agents, or human traders using a web browser) con-

nect and message the server using HTTP messaging. ExPo

internal servers communicate via unix sockets.

a question of doubt on the validity of previous ex-

perimental results gathered using these agents.

3

In

this paper, we explore the effect of the spread jump-

ing rule. Unless otherwise stated, we remove the

maxSpread condition (i.e., set maxSpread = 0% for

our AA agents). All other AA parameters are set to

those suggested by Vytelingum (2006). Following the

literature, we also use the rule of updating only the

most profitable bid (for buyers) or ask (for sellers) at

any one time (similar to ZIP

S

).

3 METHODOLOGY

3.1 ExPo: Exchange Portal Platform

Exchange Portal (ExPo, 2012) is a real-time online

financial trading exchange platform designed to run

controlled scientific trading experiments between hu-

man traders and automated trader robots (see Fig-

ure 1). ExPo was developed at the University of

Bristol as both a teaching and research platform and

has been open-sourced as a gift to the wider research

community. ExPo can be run across a network (e.g.,

the internet), with human and/or automated trader

agents messaging the exchange via HTTP. Alterna-

tively, ExPo can be run on a single machine, with all

clients running locally. For all experiments detailed

in this paper, we run ExPo and the agent traders on

the same physical machine. Prior to running experi-

3

Since this issue was raised by Cartlidge and Cliff

(2012), the spread jumping rule has subsequently been

classified as a bug and removed from release version 2

(http://sourceforge.net/p/open-exchange/tickets/1/).

ExploringAssignment-Adaptive(ASAD)TradingAgentsinFinancialMarketExperiments

81

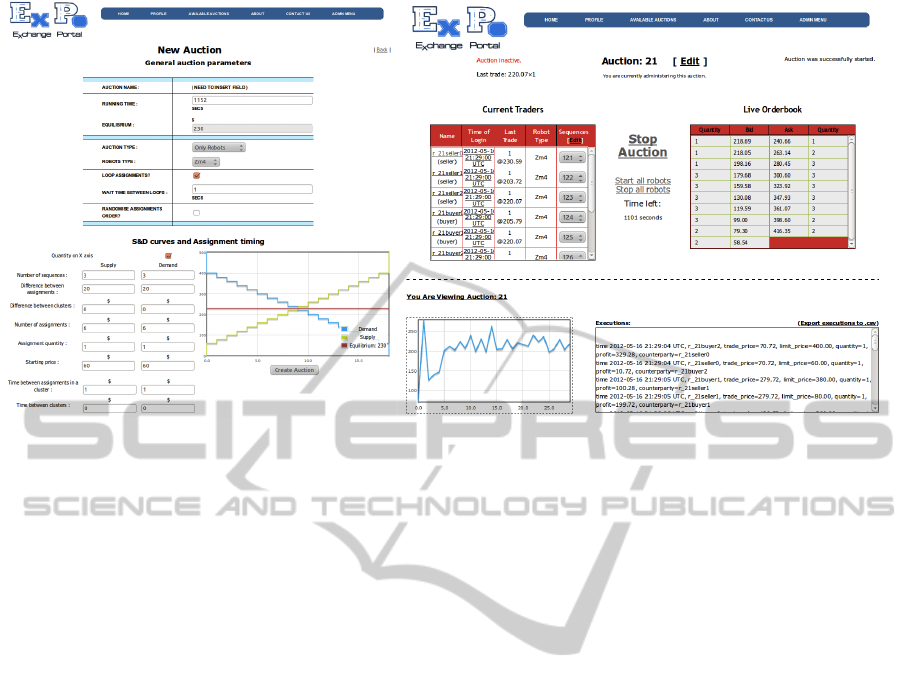

Figure 2: Left: A screenshot of the auction configuration GUI of ExPo. The assignment sequences for participants are

illustrated by the graph, with the blue line indicating aggregate market demand and the yellow line indicating aggregate

market supply. Right: A working auction from the admin screen. Traders’ details are displayed, top-left. The current public

limit order book is displayed top-right. Execution prices of transactions are plotted, bottom-left, and an exportable list of

transactions are detailed, bottom-right.

ments, ExPo was stress-tested through a rigorous se-

ries of agent-only experiments (see Stotter, 2012).

Figure 2 shows a typical set up for an auction us-

ing the admin GUI (left); and an example of ExPo in

operation (right). The assignment sequences for par-

ticipants are looped until the end of the auction. When

competitors are added to an auction through the au-

tomation scripts, they are put on the same assignment

sequences as already exist in the market. This is de-

signed to avoid accidentally introducing an asymmet-

rical advantage for any one group.

3.2 Experiment Design

Typical market environments used in previous exper-

iments typically follow the “trading day” model of

Smith’s original experiments (notable exceptions in-

clude De Luca et al., 2011; Cartlidge et al., 2012;

Cartlidge & Cliff, 2012, 2013). The problem with this

is that it assumes traders only get new assignments at

the start of each trading day – typically only one as-

signment each. Platforms like ExPo help to model

markets in a more realistic way. By modelling a mar-

ket as a continuous replenishment auction, we are able

to model in real time, allowing assignments to drip

feed into the market like they would if you were a

sales trader on a financial trading desk, receiving as-

signments from clients throughout the day.

Each agent strategy in the market was split into 3

buyers and 3 sellers. The running time for each auc-

tion was 1152 seconds, similar to the 20 minute length

of time that was used in De Luca et al. (2011). In that

time, exactly 64 trading rounds would occur, with 3

seconds between each assignment in the market. Only

one assignment was supplied at a time, and assign-

ment schedules were looped – i.e. continuously re-

plenished. There were exactly 6 assignments per loop

distributed to each agent, with exactly 3 buyer assign-

ment sequences and 3 seller assignment sequences.

All assignments arrived sequentially and were exactly

20 apart in price from each other. As assignments be-

longing to an agent are grouped by limit price, when

an agent receives a new assignment the assignment

quantity for that limit price was incremented. All

agents treat current holdings of assignments as a sin-

gle entity, increasing or decreasing their quote price

as a group. However, one or multiple assignments

may be traded from a group at any time if only a cer-

tain number are able to transact on the order book.

No retraction of assignments was permitted, and once

assignments were distributed, their limit prices could

not be modified. For all experiments, equilibrium

was set at 230, and raised to 300 when a “market

shock” occured. We do not use the NYSE spread-

improvement rule, thus enabling traders to submit

quotes at any price.

When a new assignment is provided to an agent,

that agent has the ability to put it straight on the order

book. Although agents can create new orders imme-

diately, each agent can only update their orders once

a sleep-time, s, has expired. While the agent is asleep

(we can think of this as a “thinking” period), it is

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

82

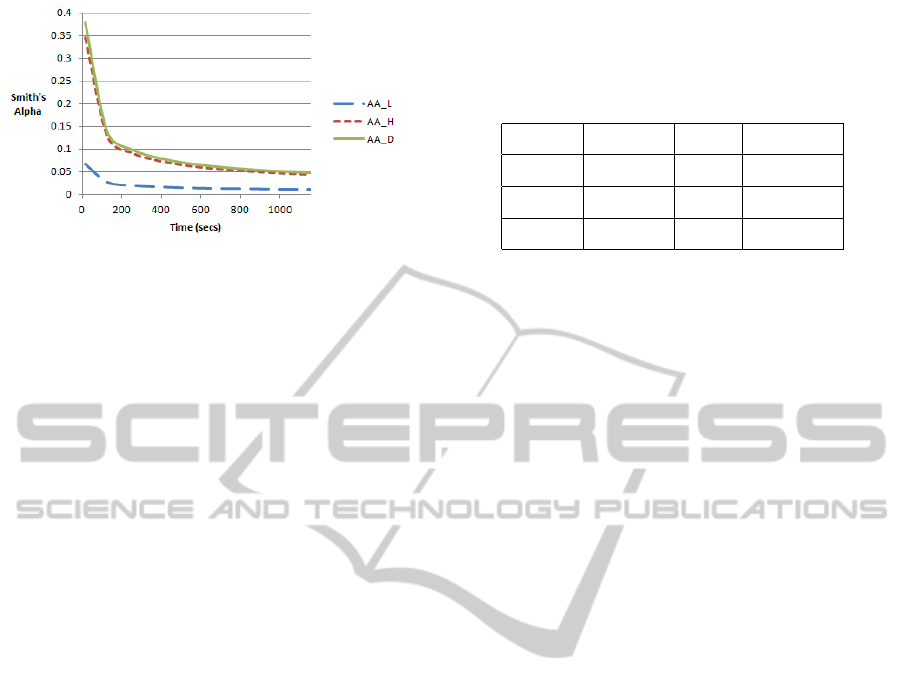

Figure 3: Smith’s α over time for each homogeneous AA

market. AA

L

produces lower alpha than AA

H

, demonstrat-

ing that lower values of P

max

artificially encourage equili-

bration.

still actively able to calculate a new order price us-

ing shouts and transactions in the marketplace. Once

sleep-time has elapsed, an agent is able to update their

order price. The ability to put new assignments on the

order book as soon as they are received is an impor-

tant difference to previous implementations of sleep-

time. An order placed immediately on the book is

more advantageous than delaying a trade by waiting.

The sleep-time of each agent was set randomly within

a boundary of ±(0− 25)% of the sleep-time provided.

This is the same “jitter” setting implemented by Das

et al. (2001). For all experiments reported here, we set

sleep-time s = 4 seconds. While it is not strictly nec-

essary to enforce a period of sleep time in agents (on

the scale of human reaction times) when the market

contains no humans, we do this to replicate the exper-

imental method of De Luca et al. (2011) and Cartlidge

et al. (2012). This enables us to directly compare re-

sults, and hence challenge or confirm any of their con-

clusions.

All experiments were repeated 5 times and re-

sults analysed using the non-parametric Robust Rank-

Order (RRO) statistical test (Feltovich, 2003, 2005).

The number of trials was necessarily restricted due

to the real-time nature of experiments, with each run

taking approximately 20 minutes.

4 RESULTS

4.1 AA Modifications

Here, we present results from a series of experiments

between the “reference” AA agents from the liter-

ature, and the modifications we suggested in Sec-

tion 2.3.2.

Table 1: Performance of AA with varying values of P

max

.

While efficiency varies little between the three settings, AA

L

produces significantly lower Smith’s alpha and profit dis-

persion. This verifies that market dynamics are affected by

the spurious variable P

max

.

Strategy Efficiency Alpha Profit Disp.

AA

L

0.999372 0.0114 97.3

AA

H

0.999365 0.0436 204.4

AA

D

0.999323 0.0469 253.4

4.1.1 The Effect of P

max

on AA

In De Luca’s implementation of AA (OpEx, 2012),

agents use the OpEx system parameter P

max

= 400.

For the majority of OpEx experiments, markets were

engineered to have an equilibrium value of P

0

= 200,

exactly half the value of P

max

(e.g., De Luca et al.,

2011; Cartlidge et al., 2012). We believe that the use

of this system parameter by AA agents may produce

artifactual dynamics and favourably bias AA agents

(when compared with other agents, such as ZIP, that

do not make use of this system parameter). Here, we

test three implementations of AA to observe the ef-

fect P

max

has on AA dynamics: AA

L

, with low value

P

max

= 500; AA

H

with high value P

max

= 2000; and

AA

D

, with dynamic P

max

= 2 × max(limit price). The

value used for AA

L

was purposely set to be approx-

imately twice equilibrium (set to P

0

= 230 in all ex-

periments, here) to enable comparison with OpEx re-

sults. Note that, since limit price is exogenously as-

signed to agents via the supply and demand permit

schedules, P

max

will vary between AA

D

agents. For

example, if an agent, a, receives 2 sell assignments

with limit prices 250 and 350, then P

max

= 700 for

that agent, a. For buy assignments, quote prices are

implicitly bounded by zero.

Figure 3 displays mean Smith’s α across 5 runs of

homogeneous AA

L

, AA

H

and AA

D

markets. We see

that a lower value of P

max

encourages better market

equilibration by constraining the “exploration” of ini-

tial equilibrium values. This suggests that P

max

intro-

duces an artificial system bias. In heterogeneous mar-

kets (containing 3 AA

L

and 3 AA

H

on each side) AA

L

agents gained greater efficiency in 4 of the 5 exper-

iments. However, using Robust Rank Order (RRO;

Feltovich, 2005) this result was not statistically sig-

nificant at the 10.3% level.

Table 1 summarises the performance of homoge-

neous AA

L

, AA

H

and AA

D

markets. We see that P

max

has virtually no effect on efficiency, but has a large

effect on Smith’s α and profit dispersion. There is no

significant difference between the efficiencies or al-

pha of homogeneous AA

D

and AA

H

markets. We be-

ExploringAssignment-Adaptive(ASAD)TradingAgentsinFinancialMarketExperiments

83

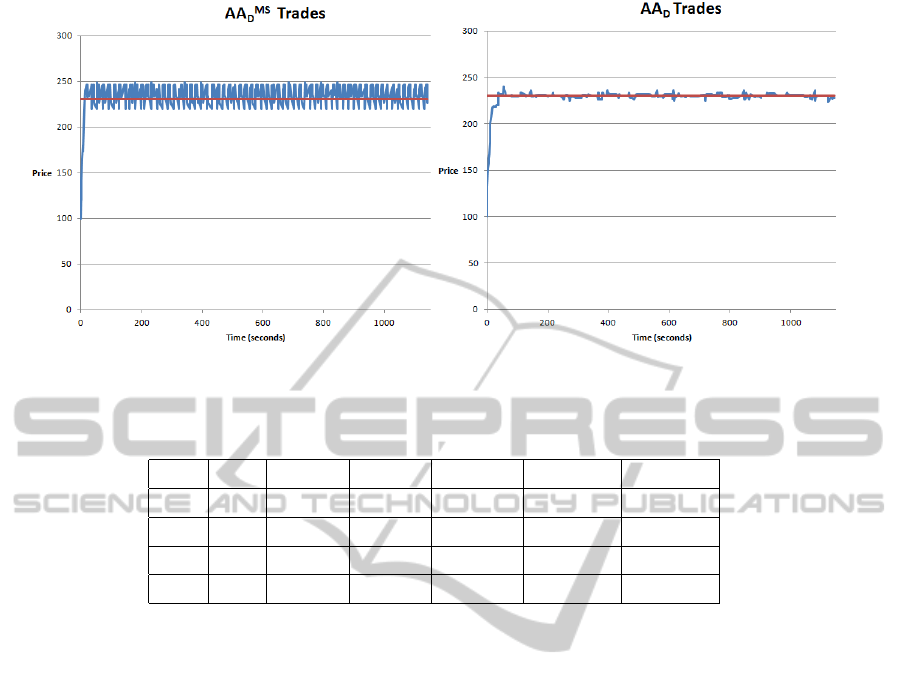

Figure 4: Trades in homogeneous markets. Left: AA

MS

D

agents (maxSpread = 15%). Right: AA

D

agents (maxSpread = 0%).

Table 2: Mean results summary (5 runs) of fast homogeneous markets, allocating assignments every 3 seconds. ZIP

M

performs

significantly better than ZIP

S

across all measures. AA

D

outperforms AA

MS

D

, and significantly dominates overall.

Agent Trials Efficiency Smith’s α Profit Disp. Total Shouts Total Trades

ZIP

S

5 0.974 0.0664 678.6 4245 582

ZIP

M

5 0.995 0.0529 308.6 7479 594

AA

MS

D

5 0.988 0.0658 530.5 4036 639

AA

D

5 0.999 0.0469 253.4 4104 577

lieve the reason AA

D

did not outperform AA

H

on these

metrics is due to the assignment distribution pattern.

In all experiments, assignments are distributed in de-

scending order, such that buy assignments with the

highest limit prices are always allocated first. There-

fore, initial values of P

max

for AA

D

agents are higher

than they would be otherwise.

Having shown that AA agents are sensitive to the

system value P

max

, we propose that AA agents should

be modified to dynamically adapt their own internal

value of P

max

. For the remainder of this paper, unless

stated otherwise, we use the dynamic AA

D

version of

AA.

4.1.2 The Effect of maxSpread on AA

In OpEx (2012), version 1, AA agents had a fixed

parameter value maxSpread = 15%. These agents

were used in De Luca et al. (2011) and Cartlidge

et al. (2012). Here, we test the effect of this param-

eter by comparing homogeneous and heterogeneous

markets containing two AA versions: AA

D

with no

maxSpread condition; and AA

MS

D

with maxSpread =

15%.

Figure 4 displays the time series of trade prices

from one example run of a homogeneous AA

MS

D

mar-

ket (left) and homogeneous AA

D

market (right). As

we would expect, AA

MS

D

markets have greater price

volatility and less equilibration to P

0

, with AA

MS

D

happy to “jump” a spread of 15%. Conversely, AA

D

agents will post quotes closer to equilibrium and wait

to be “hit”. Table 2 summarises mean results (5

runs) across all homogeneous markets. Comparing

AA

MS

D

with AA

D

, we see that the “spread jumping”

behaviour of AA

MS

D

results in lower efficiency, higher

α (less equilibration) and greater profit dispersion.

AA

MS

D

markets also execute roughly 10% more trades

than AA

D

, producing the most liquid markets of all

strategies tested. However, it should be noted that al-

though AA

MS

D

made more trades, they were not more

profitable. In heterogeneous markets containing 2

agent types (with 3 agents of each type on each side),

AA

D

gained significantly higher efficiency than AA

MS

D

(RRO, p ≤ 0.004).

4.2 ZIP Modifications

4.2.1 Single vs. Multiple Profit Margins

We test multi-profit margin, ZIP

M

, and single-profit

margin, ZIP

S

, in a series of homogeneous markets.

Table 2 summarises mean results (5 runs). ZIP

M

is significantly more efficient than ZIP

S

in fast con-

tinuous replenishment markets, with 3 seconds be-

tween assignments (RRO, p ≤ 0.004). However,

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

84

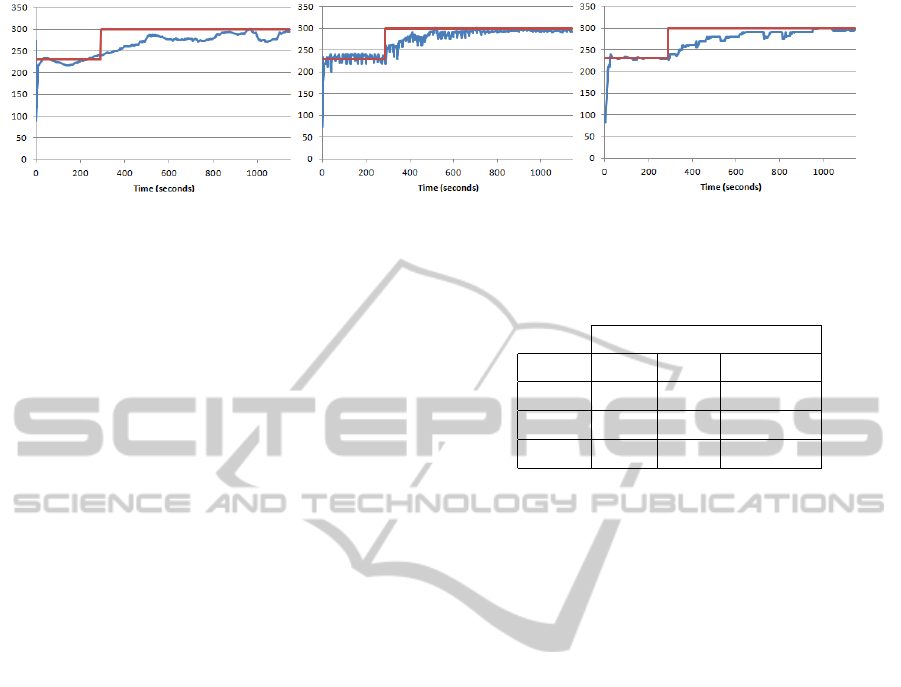

Figure 5: Illustrative example of a positive market shock, from P

t

0

= 230 to P

t+1

0

= 300. Markets containing only ZIP

M

agents

(centre) re-equilibrate after a market shock more quickly than ZIP

S

(left) and AA

D

(right). Results for negative market shocks

(P

0

falls) are symmetrically similar.

this superiority diminishes as the market slows (re-

sults not shown). With 6 seconds between assign-

ments, ZIP

M

also has significantly greater efficiency

(RRO, 0.004 ≤ p ≤ 0.008), but with 12 and 24 sec-

onds between assignments, ZIP

M

are no longer more

efficient. This suggests that holding a vector of

simultaneously-adjustable profit margins is more ef-

fective in markets where a quick response is neces-

sary.

Overall, AA

D

is the dominant strategy of the four

tested (see Table 2), with significantly higher alloca-

tive efficiency and significantly lower Smith’s α than

both ZIP

M

and ZIP

S

across all market speeds (RRO,

p < 0.048). This confirms the dominance of AA over

ZIP reported in the literature (for the full set of de-

tailed results, see Stotter, 2012).

4.3 Market Shocks

Thus far, we have assessed the performance of agents

in static markets with a fixed theoretical equilib-

rium, P

0

. Here, we test the performance of agents in

dynamic markets that experience a market “shock”;

where P

0

changes value mid-way though an experi-

ment. For brevity, we only present results for shocks

where the market equilibrium, P

0

, increases. How-

ever, the reader should note that shocks where P

0

de-

creases are equally likely and lead to symmetrically

similar results, i.e., where buyers benefit from a shock

in one direction, sellers will equally benefit from a

shock in the other. When a market shock occurs, new

assignments entering the market are perturbed by the

same value as the shock. For example, if a market

shock moves P

0

from 150 to 200, all new assignment

allocations are given an increased limit price 50 units

higher than they were before the shock. Real-world fi-

nancial markets are inherently dynamic, experiencing

continual supply and demand fluctuations. By explor-

ing dynamic markets we aim to better understand the

dynamics of agent traders in real-world markets.

When a market shock occurs, assignments that

have already been allocated into the market are not

Table 3: Mean profit in +shocked homogeneous markets.

Average Profit Per Trade

Strategy Buyers Sellers % difference

ZIP

S

97.08 71.65 35.50%

ZIP

M

90.62 72.50 24.99%

AA

D

98.28 69.46 41.49%

recalled. Thus, the actual market equilibrium P

0

0

does

not immediately move to the new theoretical market

equilibrium P

0

. Rather, P

0

0

asymptotically tends to-

ward P

0

, only reaching P

0

when all assignments allo-

cated before the market shock have executed. We use

this model of assignment persistency since we assume

agents are acting as sales traders; assigned to buy (or

sell) based on the requirements of a client. Figure 5

illustrates example markets containing, from left to

right, ZIP

S

, ZIP

M

and AA

D

agents. In each case, we

see transaction prices gradually tend toward the new

equilibrium after a market shock. These results are

different to those seen in discrete trading day experi-

ments presented in the literature; where markets tend

to re-equilibrate much quicker. However, we believe

the setup we use to be a more accurate model of real

markets.

Table 3 summarises the mean profits of traders

across 5 experiments with positive market shocks;

i.e., shocks in which P

0

increases. Results for neg-

ative market shocks are symmetrically similar. For

brevity, we do not present results for negative shocks,

since all conclusions drawn are the same as those

for positive shocks. We see that, in all cases, posi-

tive shocks benefit buyers (similarly, negative shocks

benefit sellers). This is because, for the period that

P

0

0

is below P

0

, buyers have the opportunity to trade

at a “cheap” price. In Figure 5, the area between

the new equilibrium line (in red) and the transaction

time-series (in blue) is additional profit that buyers are

making, and that sellers miss out on. We can quan-

tify this by the percentage difference in the average

profit per trade of buyers and sellers (Table 3). We

ExploringAssignment-Adaptive(ASAD)TradingAgentsinFinancialMarketExperiments

85

see that ZIP

M

markets have significantly lower profit

spread (RRO, 0.071 < p < 0.089), indicating quicker

re-equilibration after market shock. There is no sig-

nificant difference in profit spread between ZIP

S

and

AA

D

markets. We believe shocked homogeneous mar-

kets containing ZIP

M

agents are able to re-equilibrate

more quickly due to agents’ ability to update multi-

ple orders each time they “wake”. Thus, if we ran

further experiments using AA

D

agents with multiple

profit margins, we would similarly expect a decrease

in re-equilibration time.

However, while both AA and ZIP agents are able

to re-equilibrate after equilibrium, neither algorithm

is specifically designed to anticipate price movements

following a shock. In the following section, we ex-

plore the effects of adding such a novel mechanism.

4.4 Assignment-Adaptive Agents

If an agent is capable of analysing their own assign-

ments, to see if there is an inherent rise (or fall) in

value, then it may be possible to infer that a market

shock has occurred, and thus anticipate a rise (fall)

in transaction prices. By adjusting profit margins ac-

cordingly, the agent may be able to secure greater

profit. Here, we introduce a preliminary method for

agents to adapt their profit margins using information

contained in their own assignment orders. We call

these agents Assignment Adaptive (ASAD). This is

exploratory work and is not intended to be a defini-

tive solution. Rather, we are more interested in the

dynamics of markets that contain such agents. For all

experiments, we use ZIP

M

agents, previously shown

to most quickly re-equilibrate after market shocks.

Once again, we present results for positive market

shocks only. However, results for negative shocks are

symmetrically similar and the same conclusions can

be drawn for shocks in both directions.

ASAD agents store assignment prices in a rolling

memory window containing the last 20 prices, or-

dered oldest to youngest. Agents only begin acting

on these prices once the window is filled (i.e., once an

agent has received and stored 20 assignment prices).

ASAD agents then calculate the gradient of change

in assignment prices by using Ordinary Least Squares

(OLS) regression (Stock & Watson, 2012), such that

gradient, ∇, is:

∇ =

∑

x

i

y

i

−

y

∑

x

i

∑

x

2

i

− x

∑

x

i

(8)

where x

i

is the index position of assignment limit

price y

i

in the assignment price window, ordered

chronologically. This gradient value, ∇, is then trans-

formed using a simple logarithm function, in order to

Figure 6: Illustrative example of a positive market shock in

a homogeneous ASAD market. The market quickly reacts

to the shock, but initially overshoots the new equilibrium.

return a value greater than 1 for positive gradients and

a value less than 1 for negative gradients:

φ =

(

−ln(1 − ∇) if ∇ < 0

ln(∇ + 1) otherwise

(9)

We call this value the shock indicator, φ. Values of

φ > 1 indicate prices in the market may increase; val-

ues of φ < −1 indicate prices in the market may fall.

ASAD agents use φ to alter profit margin accord-

ing to the following two rules:

if (seller & phi>1) increase profit margin

if (buyer & phi<-1) increase profit margin

While φ > 1 for sellers (or φ < −1 for buyers),

agent calculated quotes are increased, or inflated, by

20%. To prevent ASAD agents from returning to mar-

ket clearing price (P

0

0

) too early after a shock is de-

tected, the cumulative value of φ is used to “wind-

down” ASAD price inflation from 20% to 0% over

time. This decline in percentage over time is propor-

tional to the size of the cumulative value of φ, reduced

(increased) by 0.5 every time the ASAD agent can up-

date its orders (subject to no current shock occurring),

until cumulative φ, and therefore percentage, equals

zero.

Results from one illustrative homogeneous mar-

ket containing ASAD agents is shown in Figure 6.

We see that immediately following a positive mar-

ket shock, prices begin to rise. Prices then overshoot

the new equilibrium value, before returning to near-

equilibrium value. This suggests that ASAD agents

are sensitive to market shocks, but require tuning. In

homogeneous markets with all ASAD agents, sellers

benefit from a positive market shock, being able to

either match or beat buyers’ average profit. This is

in stark contrast to ZIP

M

markets, where sellers con-

sistently lose out by a margin of ≈ 25%. Further,

very little profit is lost in the market itself, suggesting

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

86

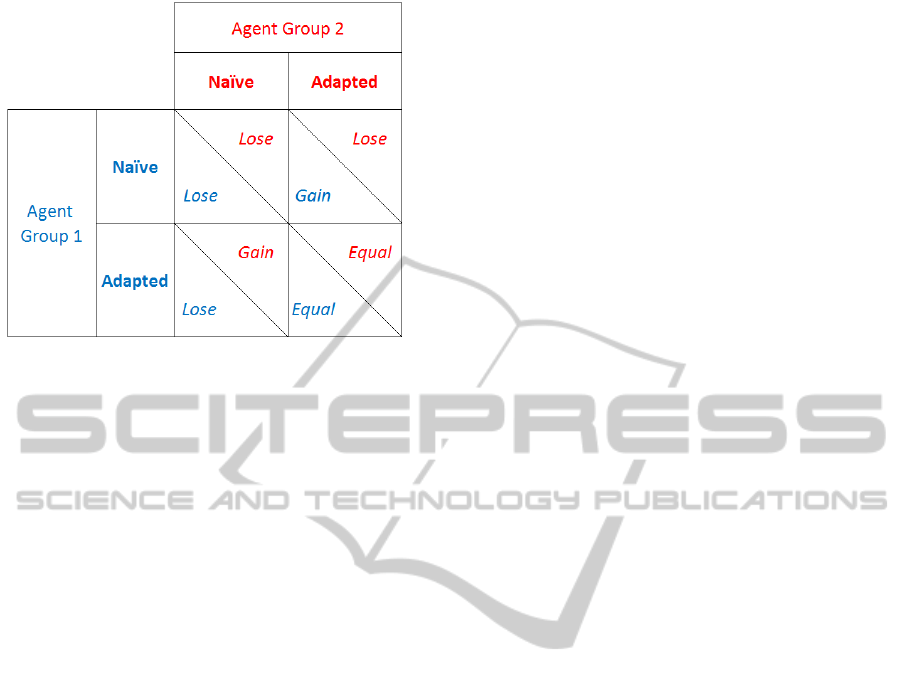

Figure 7: Normal form matrix of results between compet-

ing ASAD (adapted) and non-ASAD (na

¨

ıve) agents. Ho-

mogeneous markets of adapted agents perform better than

homogeneous markets of na

¨

ıve agents. However, in het-

erogeneous markets, na

¨

ıve agents gain and adapted agents

lose.

that assignment adaptivity can equalise profit between

buyers and sellers during a market shock.

However, when testing ASAD (adapted ZIP

M

)

agents in positive shock markets containing na

¨

ıve

ZIP

M

agents, results were somewhat surprising:

• In heterogeneous markets containing six ASAD

and six ZIP

M

agents, ASAD sellers performed

significantly worse than ZIP

M

sellers. Surpris-

ingly, ZIP

M

sellers also outperformed all buyers.

• In heterogeneous markets containing eleven ZIP

M

agents and only one ASAD seller, once again the

profits of every ZIP

M

seller was increased, while

the ASAD agent significantly under-performed.

• The profit spread between buyers and sellers of

homogeneous markets containing twelve ZIP

M

agents was significantly higher than in markets

containing at least one ASAD agent; although in

every case the ASAD agent(s) suffered.

These findings suggest that ASAD agents generate a

new price signal to which price sensitive ZIP

M

agents

can react and benefit. However, ASAD agents them-

selves suffer from the resulting behaviour of ZIP

M

agents. If we consider longer term market evolution,

a population of ASAD agents can be easily invaded

by ZIP

M

. If the entire market is ASAD then every-

one benefits, but if any non-ASAD agent enters the

market, it parasitically benefits from the behaviour of

ASAD and will flourish, eventually exterminating the

ASAD agents from the marketplace. We summarise

these outcomes in Figure 7. Potentially, these find-

ings could be due to the simple ASAD strategy im-

plemented here. For example, ASAD agents are not

designed to consider the rate of change of prices in

the market. Perhaps a more suitable approach would

be to implement an adaptive learning rule, such as the

“delta rule” introduced by Widrow and Hoff (1960),

which is the basis of the adaptation mechanism in ZIP

(Cliff, 1997). We reserve this extension for future

work.

5 CONCLUSIONS

We have used the Exchange Portal (ExPo) platform

to perform a series of agent-based computational eco-

nomics experiments between populations of financial

trading agents, using continuous replenishment of or-

der assignments.

In the first set of experiments, we exposed sev-

eral idiosyncrasies and ambiguities in AA and ZIP,

two of the standard “reference” algorithms from the

literature. First, we showed that ZIP performs better

in fast markets when agents contain a vector of profit

margins that they can update simultaneously. In AA

agents, we demonstrated how P

max

and “spread jump-

ing” negatively affects market dynamics, and sug-

gested alternative implementations that improve per-

formance.

In the second set of experiments, we introduced

market “shocks” and presented a novel exploratory

Assignment Adaptation (ASAD) modification to ZIP.

Results showed that homogeneous populations of

ASAD agents perform better than homogeneous pop-

ulations of ZIP agents. However, in heterogeneous

ASAD-ZIP populations, ZIP agents perform better

and ASAD agents perform worse, suggesting that

ASAD agents provide a novel price signal that bene-

fits ZIP, to the detriment of ASAD agents themselves.

This work naturally suggests further extensions.

Firstly, to expose the benefits of dynamically select-

ing a value of P

max

, we selected a multiplier value of

2 × max(limit price). The value 2 was arbitrarily se-

lected and should be optimised for performance. Sec-

ondly, it is likely that the introduction of an adaptive

learning algorithm (similar to that used by ZIP) could

improve the performance of ASAD. We reserve both

of these avenues of research for further work.

Perhaps more interestingly, however, we also re-

serve more general open questions for future explo-

ration. Firstly, in the work presented here, all market

shocks are exogenous: it would be very interesting to

see if results are similar when shocks are endogenous

to the market. However, to answer this, it is first nec-

essary to have agents acting as “prop. traders”, buying

and selling on their own behalf for profit, rather than

“sales traders” (trading on behalf of a client). This is a

ExploringAssignment-Adaptive(ASAD)TradingAgentsinFinancialMarketExperiments

87

more difficult challenge, but one that is pertinent if we

are to further our understanding of the global finan-

cial markets. Secondly, since real financial markets

include human traders and “robot” automated trad-

ing agent systems, we hope to explore the dynamic

interactions between these groups by introducing hu-

man participants into our experiments. ExPo has been

specifically designed to enable human participation;

and further, since ExPo participants (whether human,

or robot) connect to the exchange using HTTP mes-

saging across a network, ExPo allows geographically

dis-located human participants to sign in via a web

browser and then leave or return at will. Theoretically,

this enables us to run experiments with large num-

bers of participants, over long time periods of days,

weeks, or even months. As far as we are aware, this

has never been done before and has the potential to

provide valuable insight into real world financial mar-

kets.

ACKNOWLEDGEMENTS

The authors would like to thank Tomas Gra

ˇ

zys for

significant development of the ExPo platform. Pri-

mary financial support for Dave Cliff’s research

comes from EPSRC grant number EP/F001096/1;

John Cartlidge is supported by EPSRC grant number

EP/H042644/1.

REFERENCES

Cartlidge, J., & Cliff, D. (2012). Exploring the “robot phase

transition” in experimental human-algorithmic mar-

kets. Foresight, The Future of Computer Trading

in Financial Markets, Driver Review DR25, Crown

Copyright. Available [online] bitly.com/SvqohP.

Cartlidge, J., & Cliff, D. (2013). Evidencing the “robot

phase transition” in experimental human-algorithmic

markets. In 5th Int. Conf. Agents & Art. Intell.

(ICAART-2013) Barcelona, Spain. SciTePress.

Cartlidge, J., De Luca, M., Szostek, C., & Cliff, D. (2012).

Too fast too furious: faster financial-market trading

agents can give less efficient markets. In Filipe, J., &

Fred, A. (Eds.), 4th Int. Conf. Agents & Art. Intell.,

Vol. 2 (ICAART-2012), pp. 126–135. SciTePress.

Cliff, D. (1997). Minimal-intelligence agents for bargaining

behaviors in market-based environments. Tech. rep.

HPL-97-91, Hewlett-Packard Labs.

Das, R., Hanson, J., Kephart, J., & Tesauro, G. (2001).

Agent-human interactions in the continuous double

auction. In Nebel, B. (Ed.), 17th Int. Joint Conf. Art.

Intell. (IJCAI-01), pp. 1169–1176. Morgan Kauf-

mann.

De Luca, M., & Cliff, D. (2011a). Agent-human in-

teractions in the continuous double auction, redux:

Using the OpEx lab-in-a-box to explore ZIP and

GDX. In Filipe, J., & Fred, A. (Eds.), 3rd Int. Conf.

Agents & Art. Intell. (ICAART-2011), pp. 351–358.

SciTePress.

De Luca, M., & Cliff, D. (2011b). Human-agent auction

interactions: Adaptive-aggressive agents dominate.

In Walsh, T. (Ed.), 22nd Int. Joint Conf. Art. Intell.

(IJCAI-11), pp. 178–185. AAAI Press.

De Luca, M., Szostek, C., Cartlidge, J., & Cliff, D. (2011).

Studies of interactions between human traders and

algorithmic trading systems. Foresight, The Future

of Computer Trading in Financial Markets, Driver

Review DR13, Crown Copyright. Available [online]

http://bit.ly/RoifIu.

ExPo (2012). The Exchange Portal. Download available.

http://sourceforge.net/projects/exchangeportal/.

Feltovich, N. (2003). Nonparametric tests of differences

in medians: Comparison of the Wilcoxon-Mann-

Whitney and robust rank-order tests. Experimental

Economics, 6, 273–297.

Feltovich, N. (2005). Critical values for the robust rank-

order test. Communications in Statistics - Simulation

and Computation, 34(3), 525–547.

Gjerstad, S., & Dickhaut, J. (1998). Price formation in dou-

ble auctions. Games and Economic Behavior, 22(1),

1–29.

Gode, D., & Sunder, S. (1993). Allocative efficiency of

markets with zero-intelligence traders: Markets as a

partial substitute for individual rationality. Journal

of Political Economy, 101(1), 119–137.

OpEx (2012). Open Exchange software download available.

http://sourceforge.net/projects/open-exchange/.

Preist, C., & van Tol, M. (1998). Adaptive agents in a per-

sistent shout double auction. In 1st Int. Conf. Inform.

& Comput. Economies, pp. 11–18. ACM Press.

Smith, V. (1962). An experimental study of comparative

market behavior. J. Political Economy, 70, 111–137.

Stock, J. H., & Watson, M. M. (2012). Introduction to

Econometrics (3rd edition)., chap. 4. Pearson.

Stotter, S. (2012). Improving the strategies of algorithmic

traders and investigating further realism in their mar-

ket environment. Master’s thesis, Dep. Comp. Sci.,

Univ. Bristol, UK.

Tesauro, G., & Das, R. (2001). High-performance bidding

agents for the continuous double auction. In ACM

Conference on Electronic Commerce, pp. 206–209.

Vytelingum, P. (2006). The Structure and Behaviour of the

Continuous Double Auction. Ph.D. thesis, Sch. Elec-

tron. and Comput. Sci., Univ. Southampton, UK.

Vytelingum, P., Dash, R. K., David, E., & Jennings, N. R.

(2004). A risk-based bidding strategy for continuous

double auctions. In 16th Europ. Conf. Art. Intell., pp.

79–83.

Widrow, B., & Hoff, Jr., M. E. (1960). Adaptive switching

circuits. Inst. Radio Engineers, Western Electron.

Show and Conv. (IRE WESCON), Conv. Rec., 4, 96–

104.

ICAART2013-InternationalConferenceonAgentsandArtificialIntelligence

88