Structuring of Growth Funds with the Purpose of SME’s Evolution

under the JEREMIE Initiative

George L. Shahpazov and Lyubka A. Doukovska

Institute of Information and Communication Technologies, Bulgarian Academy of Sciences

Acad. G. Bonchev str., bl. 2, 1113 Sofia, Bulgaria

atlhemus@abv.bg, doukovska@iit.bas.bg

Keywords: Growth Funds, SME, JEREMIE Initiative, Energy Efficiency

Abstract: Recent surveys in regards to Country’s economy development and especially SME’s progress in the past

few years, shows the decline in development. The recovery and restructuring of the economy would go

through rehabilitation and modernization of long-term value creating industries. Continuous development of

already established SME’s in some of the analysed sectors of the economy is backed by the identified

potential for above average growth. Initially targeted favourable sectors, subject of investments would be

under the main focus for investments in the upcoming future by any structured fund under the JEREMIE

initiative, but will not limit the exploration of other opportunities depending on market developments.

1 INTRODUCTION

Between 2000 and 2008 Bulgaria faced its first real

boom period for the last 25 years. The EU accession

plan, the currency board and western oriented

governments combined with booming banking

industry and cheap credit resources created an

investor friendly business environment that attracted

in total more than EUR 25 billion of FDI and

assured steady growth of the economy with rates

double than the EU average. Unfortunately more

than 70% of these investments went into non-

productive, highly speculative and cyclical

businesses or were triggered by arbitrage

opportunities in privatisation deals. Manufacturing

and service industries (excl. financial services) did

not benefit proportionally from the growth. Looking

back in a period of 25 years Bulgaria has lost more

than 50% of its light and heavy industry production

and more than 60% of agriculture production,

turning from a net exporter into net importer for

many goods.

Statistics show that the next growth wave in the

country will be driven by the rehabilitation and

modernization of long-term value creating industries

led by the manufacturing sector, which will profit

from a boost in the local agriculture sector and

foreign demand (e.g. exports are surpassing pre-

crisis levels). Modernization of production assets is

closely related to the implementation of

Government’s initiative for energy affiances

improvements. Service industries, excluding

financial services and telecom, are currently

underdeveloped, and will grab higher share of the

economy and outperform.

Manufacturing was heavily hit in the last few

years due to strongly decreased internal and external

(export) demand, out of date business processes and

weak financial management. The liquidity reserves

of the sector decreased significantly, fresh liquidity

is scarce on the local market and hinders the fast

recovery of the sector from the crisis. This situation

creates good entry opportunity at low-to-reasonable

valuations enabling investors to extract maximum

return on the provided capital.

Bulgaria slowly recovers from the crisis; signs of

recovery in selected industries are already visible.

The Bulgarian government expected GDP to rise by

3.7% in 2011; foreign institutions and banks were

more moderate and forecasted an average annual

growth of 1.5%. Even though prognoses for a new

Recession in Europe is close to becoming a

reality, our expectancy is that after 2013 a partial

recovery and additional growth of the export goods

demand from Western Europe will be anticipated.

Combined with recovery of local consumption and

resumed capital inflows this should result in an

average GDP growth of 5.0% yoy over the next 10

years.

159

Shahpazov G. and Doukovska L.

Structuring of Growth Funds with the Purpose of SMEâ

˘

A

´

Zs Evolution under the JEREMIE Initiative.

DOI: 10.5220/0004462301590164

In Proceedings of the Second International Symposium on Business Modeling and Software Design (BMSD 2012), pages 159-164

ISBN: 978-989-8565-26-6

Copyright

c

2012 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

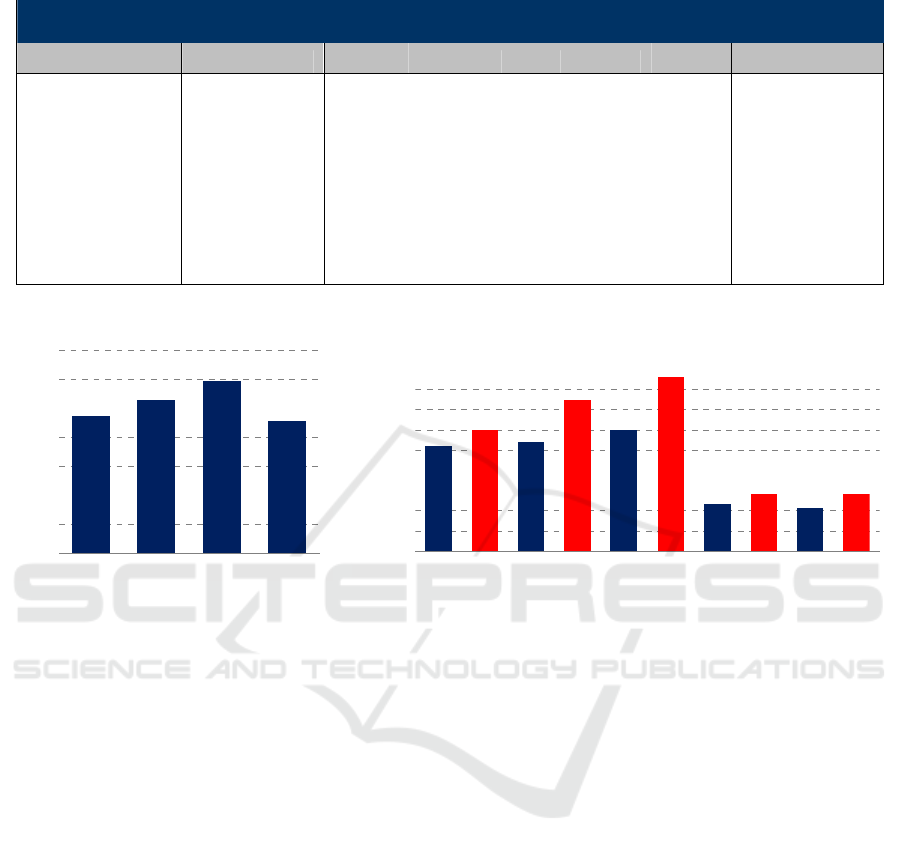

Table 1: Development and future Economic Forecasting of most Sectors of Economy of Bulgaria.

Forecast by Sectors

2004-2008 2009 2010f 2011f 2012f 2013f 2014-2019f

Agriculture -4.3% -4.2% 2.6% 2.6% 2.6% 2.6% 2.6%

Production 5.6% -8.1% 2.0% 8.8% 9.6% 8.0% 5.8%

Extraction

1.5% -18.6% 4.8% 6.6% 7.6% 6.5% 4.7%

Manufacturing

6.7% -8.2% 3.5% 9.6% 10.3% 8.2% 5.8%

Utilities

2.4% -4.8% -3.5% 6.3% 7.0% 7.5% 5.8%

Construction 12.4% -6.4% -8.9% 5.5% 9.1% 8.7% 6.3%

Services 6.9% -1.7% -1.5% 1.6% 4.6% 6.6% 5.9%

Exports 2006-2009 (BGN bln)

23

26

30

23

‐

5

10

15

20

25

30

35

2006 2007 2008 2009

Expor t s Q1' 09 - Nov ' 10 (BGN bln)

5.2 0

5.97

5.36

7.43

5.98

8.61

2.34

2.84

2.13

2.83

‐

1.00

2.00

3.00

4.00

5.00

6.00

7.00

8.00

9.00

10.00

Q1'09 Q1'10 Q2'09 Q2'10 Q3'09 Q3'10 Oct'09 Oct'10 Nov'09 Nov'10

Figure 1: Data of BG export.

Manufacturing output growth is forecasted to be

faster than GDP growth over the next decade.

Manufacturing output is expected to rise by 9.6% in

2012 and on average by 7% yoy over the next 10

years.

As a result, the share of manufacturing output in

GDP is projected to rise from 18.0% in 2009 to

20.9% by 2014 and rise to 21.1% by 2019. Over the

same period, the share of service sector output in

GDP is expected to fall from 63.4% in 2009 to

61.0% in 2014 and rise to 61.5% in 2019. (Oxford

Economic Forecasting)

Figures show that the timing for investment in

Bulgarian SME’s growth from the manufacturing

sector is perfect for the following reasons:

•

Rising external demand for the

manufacturing sector is already visible in the

increase of exports which surpassed pre-crisis peak

levels. The decrease in local demand is slowing

down to zero, and the reverse trend is already visible

in the past year, along with pick up process expected

to continue in 2012. This means that the economic

cycle will support the investments.

• Most of the companies in the targeted

industries have been privatized or established in the

period 2001-2007, which makes them attractive for

different kinds of growth investments categorised

mainly into 2 types: a) expansion – e.g. in

production or product range, b) developing the

company to the next level – e.g. vertical or

horizontal integration or new markets strategy.

The service sector growth prior to the credit

crunch was dominated by financial services,

telecommunications, and real estate related

activities. This led to disproportionate allocation of

capital and investments leaving other promising

segments of the sector underinvested. Each fund’s

management should see the potential for above

average growth coupled with demand for capital in

two major industries, namely: energy efficiency and

healthcare.

2 TARGETED MARKET

SEGMENT AND ENERGY

EFFICIENCY

The analysis seeks to locate and target the most

attractive for investments, important and

Second International Symposium on Business Modeling and Software Design

160

underdeveloped segment of all sectors of the

economy, including several major industries within

these sectors. The development of these industries

will support sustainable growth in the country’s

economy in general. The segment will be in the

main focus for investments in the upcoming future

by any structured fund under the Jeremie initiative,

but will not limit the exploration of other

opportunities depending on the market

developments.

The Energy Efficiency space is an attractive

investing segment due to the enormous lag of

Bulgaria to achieving EU-wide standard and the

active supporting policies implemented over the last

years. The government, in line EU targets and

initiatives, has provided financial and legislative

incentives for improving energy affiance, lowering

overall energy consumptions and increasing

renewable energy in the total consumptions mix.

The country occupies one of the places in terms of

energy intensity in Europe with energy intensity

coefficients of the GDP standing approximately 90%

above EU averages.

The latest Energy Strategy drafted by the

government in line with European 20/20/20 goals

envisages reduction in green-house emissions,

raising the share of RES contribution to 16% of the

final consumption, and reducing energy intensity of

GDP by 50% by 2020. The interim target for

reducing energy intensity of GDP is 25% reduction

by the year 2013. The state plans to reduce the

energy intensity of GDP from 913 toe/M€05 in 2005

to 456 toe/М€05 by 2020. According to different

estimates, the country needs to invest approximate

BGN 4.2-4.5 billion to reach the outlined targets and

to lower the overall energy intensity of the economy.

The achievement of the targets requires

implementations efficiency and savings solutions

and investments in industry (38% share in total

consumption), households (21.8%), transportation

(28%), and services (9.4%) and it has opened a

market niche for business with above average

growth opportunities.

Energy efficiency in Bulgaria is a segment,

which is below the average in the EU, not only

because it has not received the much needed

improvement, but also because priority development

was given to targeted industries that are generally

energy intensive.

The market of energy efficiency solution

providers and services companies is relatively

fragmented and consists primarily of SMEs in earlier

stages of development, thus offering ample

opportunities for investment in innovative

technology applications, engineering companies, and

complex service providers specialized in the

household and industry projects.

Prioritized SMEs in terms of energy efficiency

improvement will be businesses, focusing on

investments into new machinery, equipment,

technologies of higher-energy class, аnd reduced

emissions, along with companies looking for energy

efficiency achievement by switching fuel

consumptions (gas, etc.). (Bulgarian Small and

Medium Enterprise Promotion Agency)

3 INVESTMENT STRATEGY

The individual investments in each fund’s portfolio

should be selected based on the combination

between the mandatory and at least on of the

optional criteria:

Mandatory Criteria:

• Management team and human resources’

potential;

• Profound market and industry knowledge;

• Business model scalability;

• Distinctive competitive advantages;

• Double digit growth potential of the companies

revenues;

• Clear Exit Route.

Optional Criteria:

• Value-adding opportunities through process

optimization, strategy fine-tuning;

• Market scalability of the products (export);

• Potential for horizontal or vertical integration.

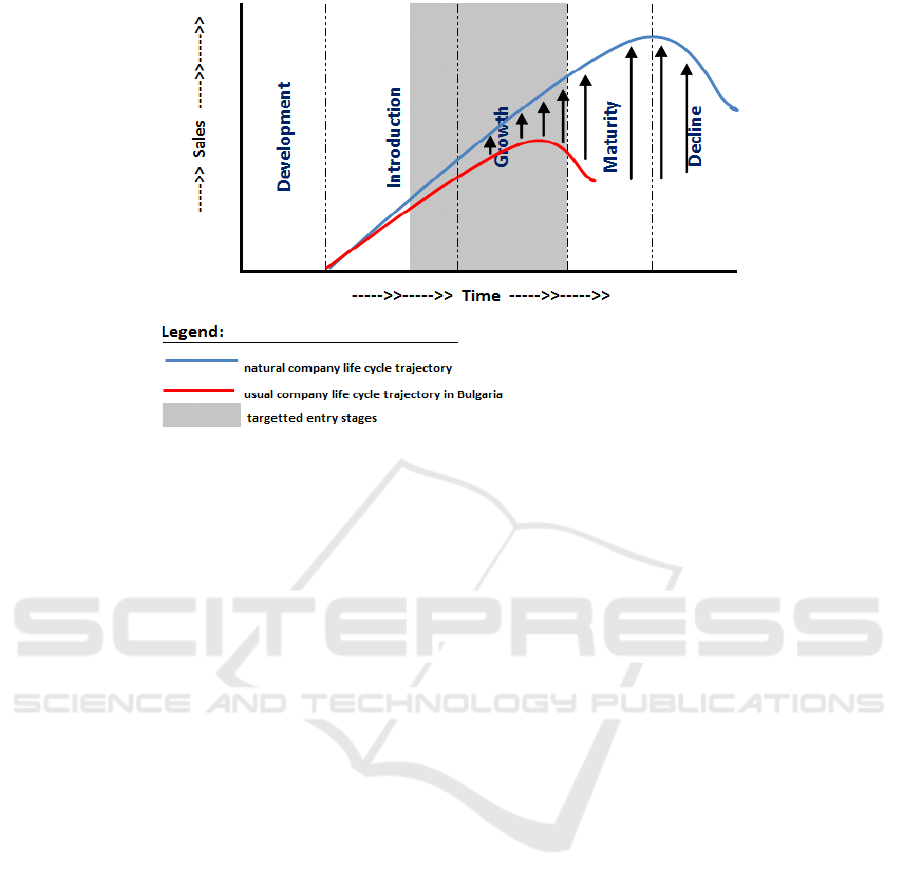

The majority of SME companies in Bulgaria

experience difficulties in maintaining a normal life

cycle and tend to suffer from early maturity and

decline without being able to materialize its full

potential. There are many reasons for this, with the

most common being – poor management and lack of

financing. The Fund will aim in this cases at

eliminating these factors with different optimization

strategies, so the company converges to its natural

development path and then seek expansion

opportunities. Companies that have already

accomplished this stage of their life cycle will be

prepared for the next level.

Business cycle stage of the investment targets:

By providing equity financing, business

expansion and optimization can be achieved

primarily through the implementation of various

strategies: production capacity expansion; new

product or a new line of products launch;

Structuring of Growth Funds with the Purpose of SME’s Evolution under the JEREMIE Initiative

161

Figure 2: Expansion and optimization.

commercial network development, process

improvement and efficiency.

More than 80% of the companies are managed

with outdated structures, based on personal skills

and single person’s authority. We believe that

implementation of modern business processes and

process management would increase significantly

profitability.

Optimization of the marketing strategy and

establishment of adequate financial management

will be in most of the investment cases the other

substantial driver for successful expansion.

• Upgrading to the next level

The step to the next lifecycle stage of the

company will be achieved by providing equity

capital and financial structuring of the

implementation of one or several of the following

strategies:

o Organic growth for companies with

interesting and multipliable business models;

o Non-organic growth, horizontal

integration;

o Non-organic growth, vertical integration

across the value chain;

o Creating regional leaders and

consolidation plays.

4 EXPECTED NUMBER OF

INVESTEE COMPANIES

PLANNED INVESTMENT

RATE INCLUDING FOLLOW-

ON POLICY AND ENVISAGED

STRATEGY FOR RISK

DIVERSIFICATION OF FUND’S

CAPITAL

The size of established Funds under the JEREMIE

initiative should be between EUR 45-60 million,

thus utilizing the whole amount available from the

OP Competitiveness. The amount of the funds

should be planned to be at the maximum level in

order to fulfill the main targets of each Fund

manager, with a main focus on:

• Fund diversification to be aimed at

mitigating the various risks.

• Private investor commitment – based on the

already confirmed participation by private

investors (Banks, Insurance Companies,

Mutual Fund and local companies) – the

indication should be that the overall

commitment of Private Investors will

exceed EUR 30 million for each fund.

• Built – in Pipeline- the fund managers will

dispose with an immediate pipeline of 15

potential deals with total investment of near

EUR 70 million, which should be the base

Second International Symposium on Business Modeling and Software Design

162

for the first few executed deals in the first

year. In our case the pipeline is partially

represented by the described investment

cases.

• The demand for financial growth

instrument in the SME segment is at its

peak. Traditional bank financing remains

currently hardly accessible for SMEs, due

to the ongoing cautious approach by the

banks to lend investment loans with longer

tenors following the continuing process of

deterioration of the banks’ loan portfolios.

Banks are currently predominantly focusing

their efforts in consumer and mortgage

lending.

Therefore, it is considered that managers of each

fund should be in a position to grow private equity

portfolio of companies within 3 years surpassing the

set target of the growth fund of EUR 60 million.

Investing in growth capital in the SME sector

involves substantial risk in general and particularly

in emerging markets like Bulgaria.

A significant portion of this risks results from the

lack of business ethics in the market and a

legislation, which doesn’t support in particular this

kind of investments. Several cases from the

experience of international PE players in Bulgaria

have shown that even a complete loss of the

investments is possible due to fraud and weak legal

execution. We believe that the combination between

the accumulated experience in each fund’s team,

combined with previous successful financial deals in

the local business environment and the necessary

understanding of the peculiarities of the execution of

financial deals in Bulgaria will be crucial for

mitigating the legislative and fraud risk.

In order to mitigate the business and industry

risks, it is necessary to achieve a relative

diversification in stages/ types of investment,

industries, size and number of portfolio companies.

We believe that each fund needs to be able to invest

in no less than eight companies in its total lifetime

and not more than twelve at any moment of it.

The main purpose of these funds per definition is

to support SME growth and not to takeover

companies. Therefore the general intention under the

initiative of the fund is to hold not more than 50% of

the company’s equity. Although, as the mentioned

negative experience of other PE investors in the

country shows, even as minority shareholder it is

appropriate to implement irrevocable control

mechanisms over the decisions process of the

company’s management as guarantee that the

invested capital is used for its original goals.

Attendance in the management board meetings of

each company will be just one of these mechanisms.

Generally the management processes of the

companies will be reviewed and if needed adjusted.

Preferable to invest in companies that have already

existing or are willing to implement modern

business and management processes, which are

detached and independent from individual talent

skills and single persons authority. The latter is

unfortunately still the business standard for the

majority of SMEs in Bulgaria, and bares a high

potential business risk in the cases of disloyalty of

this key people. (Bulgarian Small and Medium

Enterprise Promotion Agency, Bulgarian National

Bank).

As funds will be investing in growth, the equity

investments as a general rule should be done as a

capital increase and not as a partial or full

shareholders exit. Exceptions to this rule can be

evaluated if one or some of the shareholders hinder

the development of the company.

Considering the required experience of each

developed structure and the targeted industries, the

ideal investment sizes should be between EUR 1.5

million (smaller investments) and EUR 8 million

(large). This numbers show the initial investment

size. For follow-up capital increases funds are

advised to keep special reserves of 10% to 15% of

the total fund capital. Ideally, capital injections

should be scheduled in tranches tied to performance

and/or investment cornerstones.

The general holding period of an investment is

projected to be around 5 years, depending on the

industry, life cycle of the company and the general

economic cycle. Overall targets should be an IRR of

18%. Some of the companies might need to be

prepared for acquisition by international buyers due

to the natural limitation of the local market. Such

companies need to have grown to a size and stage

that will make such acquisitions possible.

Additional investment rules have to be made

applicable, in order to cover the principles described

above:

• A single investment should not exceed

EUR 10 million, and if it does, then a

decision of the supervisory board will be

needed. Single investments below EUR 1.5

million will be not evaluated.

• To assure diversification of companies, Top

4 investments should not exceed EUR 30

million.

• To assure diversification in the targeted

industries, the limit per single industry will

be 30% of one funds capital.

Structuring of Growth Funds with the Purpose of SME’s Evolution under the JEREMIE Initiative

163

• A balance (50/50) between the two types of

investment will be targeted.

Each fund is to aim and complete at least 3 deals

from different industries and different investment

types within the first year of structuring. The

investment cases show a generalized summary of

some of the existing projects/ deals under the

specific pipeline. In the following years,

performance speed should be kept at 3-4 deals per

year (set as target). (Bulgarian Small and Medium

Enterprise Promotion Agency, Investor.bg)

5 CONCLUSIONS

It’s been proven that given the development stage

and nature of the SMEs in Bulgaria the most suitable

instruments created by Funds management have to

be as plain and simple as possible. Sophisticated

financial products generally create mistrust on the

local market. Thus each Fund must intend to use for

its investment needs primarily direct participation in

the companies via investing in common stock and in

certain cases trough a combination with investments

in preferred stock of the company.

Structured Funds under JEREMIE most likely

will aim at purchasing a significant portion of a

particular company in order to be able to have a

larger influence in its governing and to speed up its

growth via the experience and know-how of its

investment team. Typically Funds will seek to

participate via a capital increase aiming at further

strengthening the shareholder’s equity, and support

the continued growth through acquisitions as well as

organic growth.

In order to protect its investment each Fund

might seek also participation trough preferred stock

as it has many advantages including a greater claim

of the assets than common stock thus limiting the

downside of the investment. Buying preferred stock

could include the option of converting them into

common stock at any point of time, in which case

the owners will lose the right of a dividend, but will

gain the ability to participate in the decision taking

process. Preferred stocks could be flexible in terms

of the dividend rates that they hold, which could be

adjusted along the way so that it does not interfere

with the company’s sustainable growth.

In limited number of cases each Fund have to

aim at lending different types of hybrid loan

products, suited to best fit the business needs of each

company. A common type of debt product that

Funds will be looking at will be the convertible debt,

where the loan is secured via the right to convert it

to common stocks at certain predetermined

conditions. This will reduce both the risk to each

Fund and the requirement to the company to provide

collateral, which as we have mentioned before

proves to be a major obstacle for the SMEs on their

way to receiving a proper financing.

Each structured Fund must target an investment

with a clear potential to generate above 30% internal

rate of return (IRR). As some of them could be

expected to not realize their full potential and reach

all financial targets at the predefined time horizon,

managers should expect that the overall performance

that one Fund will be able to achieve will be

equivalent to IRR of 18%.

REFERENCES

Oxford Economic Forecasting

www.oxfordeconomics.com

BNB (Bulgarian National Bank) - www.bnb.bg

Bulgarian Small and Medium Enterprise Promotion

Agency – www.sme.government.bg

www.Investor.bg

Second International Symposium on Business Modeling and Software Design

164