Multiagent Model of Stabilizing of Petroleum Products Market

Leonid Galchinsky

Department of Management and Marketing, National

Technical Universiry of Ukrain, Peremohy 37 Street, Kyiv, Ukrain

Keywords: Multi-Agent Models, Oligopolistic Market, Asymmetry in Prices, Tacit Collusion, Petroleum Products,

Price Stabilization.

Abstract: The problem of developing of multi-agent models of stability in market prices of petroleum products is

presented. The problem of price stabilization occurs due to external factors: the result of sudden changes of

crude oil on world markets or exchange rate changes. In addition the market price dynamics is also

influenced by internal factors such tacit collusion sellers. Shown the theoretical possibility to reduce of

asymmetry in prices through the use stabilization fund of petroleum products, which the public body can use

at the moment when there is a of price jump through the sale of petroleum products by stable prices.

1 INTRODUCTION

The behavior of fuel prices has a global impact on

the whole economy of a particular country. Increases

in fuel prices automatically lead to higher prices of

commodities with high demand and transportation

services. The result is the decrease in purchasing

power and reduction in profitability of companies,

especially those with energy-intensive production.

The expenses for petroleum products are

involved in the consumer market prices;

transportation costs also affect the prices of all

goods of consumer market.

This question is particularly important in

emerging economies, especially in such countries as

Ukraine, where practically immediate reaction of all

industries to changing prices occurs. This factor

affects not only the economy, but also the social

situation of the general public and political processes

in it.

The modern market of oil products in Ukraine is

characterized by the large number of economic

entities, acting alone or co-operating, in conditions

dissimilar to classical equilibrium markets. In this

market the main sources of equilibrium disturbance

are external factors, primarily world prices of crude

oil and exchange rates. Due to non-stationarity of

these factors and cooperative actions of market

agents, prices of petroleum products, including retail

gasoline prices, are changing daily.

Retail gasoline prices in Ukraine depend on

many factors; the main ones are the national

currency fluctuations, changes in world oil prices,

the activities of oil producing and refining

companies, oil traders, government policy etc. Thus,

the problem of finding the mechanism for stabilizing

oil prices arises. The ways of price stabilization –

from direct administrative methods to the market-

based approaches – have long been known. This

paper deals with the mechanism for smoothing oil

price shocks through targeted interventions of oil

products, provided by the state, in moments of

disturbance in fuel prices threatening to destabilize

the market.

2 RELATED WORKS

The intensive research of price dynamics in the oil

market as well as research of multi-agent approach

to modeling price competition in oligopolistic

markets was held over the last 20 years. The

asymmetry of prices for petroleum markets in

different countries was studied in (Bacon, 1991),

(Borenstein et al., 1992); (Matt Lewis, 2003),

(Veremenko and Galchinsky, 2010); (García, 2010).

In (Kephart et al., 2000); (Tsvesovat and Carley,

2002); (Happenstall et al., 2004); (Levin et al.,

2009); (Ramezani et al., 2011) the possibilities and

properties of applying multi-agent approach to

modeling the competition in oligopolistic markets

were explored.

314

Galchinsky L..

Multiagent Model of Stabilizing of Petroleum Products Market.

DOI: 10.5220/0003972203140317

In Proceedings of the 14th International Conference on Enterprise Information Systems (ICEIS-2012), pages 314-317

ISBN: 978-989-8565-10-5

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

3 MODEL

In oligopolistic markets, the decisions of each firm

don’t only affect their own profit but also the profit

of their competitors. Therefore, firms react to the

actions of their competitors and in every decision the

companies consider not only the direct impact on

their income, but also the reaction effects of

competitors. This so-called oligopolistic

interdependence lays the foundation in modeling the

market behavior as a multi-agent system. There are

several reasons for choosing the multi-agent

approach, although the game theory was about to be

chosen as the theoretical basis. However, for games

with more than two players the results of the game

theory approach are far from building a constructive

design scheme. Even in games with no coalitions

there is no exact algorithm for finding equilibrium in

general, because it is very difficult to consider the

real constraints on the strategy of all players

analytically. For coalition games claim the existence

of equilibrium was not even proven, so we will find

the solution of the problem in another way, with the

agent modeling method.

Let us determine the following factors in the

model:

- Consumer - a vehicle with the driver. It is

characterized by the type of fuel being used and fuel

tanks capacity, the use of fuel per 100 km, the

frequency and range of travel, the propensity to

traveling and saving money.

- Gas Station - a gas station that provides services

to consumers and the companies, which buy fuel for

their vehicles. It is characterized by the volume of

containers for storage, type of fuel, its availability,

and geographical location.

- Refinery station, which is characterized by type

of fuel it produces, volumes of containers for

storage, fuel prices.

- Country is an agent that displays activity of the

state and sets a number of rules for the market

functioning and import-export operations.

- Trader is a mediator between refineries and gas

stations. Sells fuel in bulk, making transportation to

the appropriate object. Characterized by means of

transportation and storage facilities for fuel.

The environment also holds information about the

concentration and location of agents in the country,

the transport grid, grid with railroad connections.

Each agent has its own program behavior based

on finite-state machines, which describes its

condition and the conditions of transition from one

state to another.

Each agent can communicate with any other

agent through the messaging mechanism. Thus the

«consumer», that is within visibility range of certain

agent of a «station» will be able to receive notice of

the price on its fuel. Similarly «station» agents will

be able to receive data available in the region traders

and their prices. Also, each agent has a specific set

of actions with which he manipulates the state of the

environment. For example, for the «consumer»

agents they are: go (move around the environment),

refuel and wait. In case of failure of any agent to act

in the market (the agent goes bankrupt) he is

removed from the model. Similarly, agents may also

enter the model. Inputs for the model are:

{

}

SLOCPNPZM ,,,,

,

where

m

t

PZ

- For purchases of fuel by network S in t

time;

m

PN

- The original retail price of network m;

m

k

LOC

- The location of station k of network m;

ji

S

,

- Number of consumers of fuel in the square

with coordinates (i,j);

M

- The number of retail networks;

The main mechanism for the distribution of fuel

consumed is the function of demand, taking into

account not only for a particular network, but also

the maximum possible demand.

max

,

i

AZS

ij

ji

DN

D

A

Bp C p

≠

⎧

⋅

⎪

=

⎨

−+

⎪

⎩

∑

The model of agents’ behavior relies on rule-based

algorithm, proposed in [1]. Variables and logical

conditions were added in the implemented algorithm

to model collusion between the agents. The

collusion is valid until significant changes happen in

the agent’s input parameters.

In account of this it is possible to make an algorithm

for the agent:

1. Set the price specified in the preceding period

2. Collect data for neighbors

3. Get prices for fuel

4. Get on the environment of consumers for the

current period

5. Determine the cost of 1 liter fuel, taking the fixed

costs into account

6. Forecast fuel demand, given the cost of fuel, the

current price and the price of neighboring agents to

forecast demand for fuel

MultiagentModelofStabilizingofPetroleumProductsMarket

315

7. Check messages from neighboring agents for

available collusion suggestions.

8. Decide on pricing, using a set of rules.

9. Put the price set in the next period.

The printed form should be completed and signed by

one author on behalf of all the other authors, and

sent on to the secretariat either by normal mail, e-

mail or fax.

4 MARKET SIMULATION

The basis of the algorithm is the set of rules for

changing prices, which also contains rules for

checking the usefulness of the collusion. The main

indicator, appearing in the rules is

1

int

1

1

n

i

i

i

n

j

j

p

l

P

l

=

=

=

∑

∑

,

where

i

p

is price of agent i in the neighborhood,

and

i

l

is the distance between this agent and the i-th

agent.

The numerical constants for price change rates

were determined basing on real data in the studied

region and on the characteristics of prices

asymmetry. For this purpose the initial values based

on expert judgments were taken and then specified

through minimizing the residual function with the

help of Nelder-Mead method on a set of historical

data in Kyiv region for the period 2010-2011.

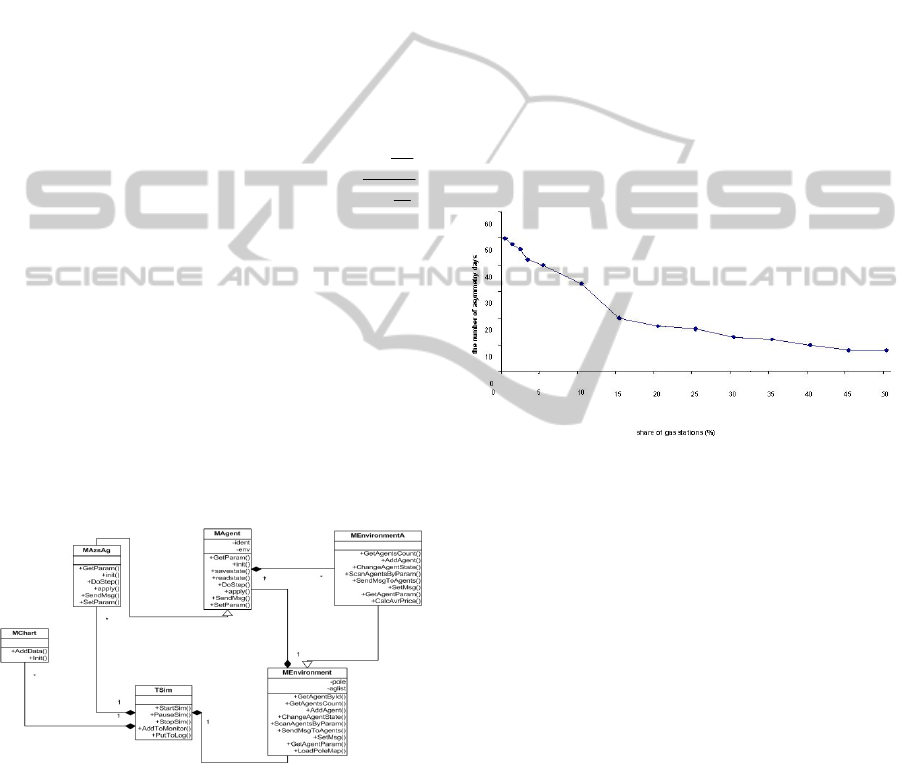

Figure 1: The class diagram in UML notation.

The diagram of classes shows, that the main

class which provides the entire program is the class

TSim. It is a kind of the experimental abstraction,

and it includes instances of the agent model classes.

Agent model is represented by two classes: MAzsAg

and MEnvironment. According to the paradigm of

agent modeling, MAzsAg is a software agent which

can receive messages, react to the environment

changes and interact with other agents through the

environment. MEnvironment class is the agents’

environment which provides their identification,

messaging and performs a mechanism for interaction

between agents and between agent and environment.

5 EXPERIMENTAL RESULTS

Since the agent-based model relies on the interaction

between retailing petroleum products networks, it is

firstly needed to consider the opportunity for the

state to intervene in the retail market in order to

prevent collusions between the agents. Thus, the

state petroleum retail network can be considered as

such regulator. Taking into account, that the

oligopolists have significant market shares, the state-

owned market share, sufficient for the desired effect

on the market, must be determined.

Figure 2: Dependence of the length of the return prices to

normal levels of the market share of the state regulator.

As you can see, the effect is noticeable when the

market share exceeds 15-20%. Further increase in

market share slightly increases this effect. In respect

that that the cost of a public network can be quite

high (the cost of building a gas station is estimated

at 0.5 million.), the regulator may be too expensive.

Analysts estimate the total costs could reach up to $2

billion. These costs are currently estimated as too

high in order to implement.

Due to the fact that it is difficult to enact the

above-mentioned type of controller, government can

bring such regulator to the wholesale market. Given

that during the jump in prices some retailers do not

have enough fuel, the state can sell their stocks to

reduce the effects of the shock. Thus, signing

contracts with the network stations and having their

margin on the sale of petroleum products restricted,

is a way to indirectly affect the price situation in the

market.

ICEIS2012-14thInternationalConferenceonEnterpriseInformationSystems

316

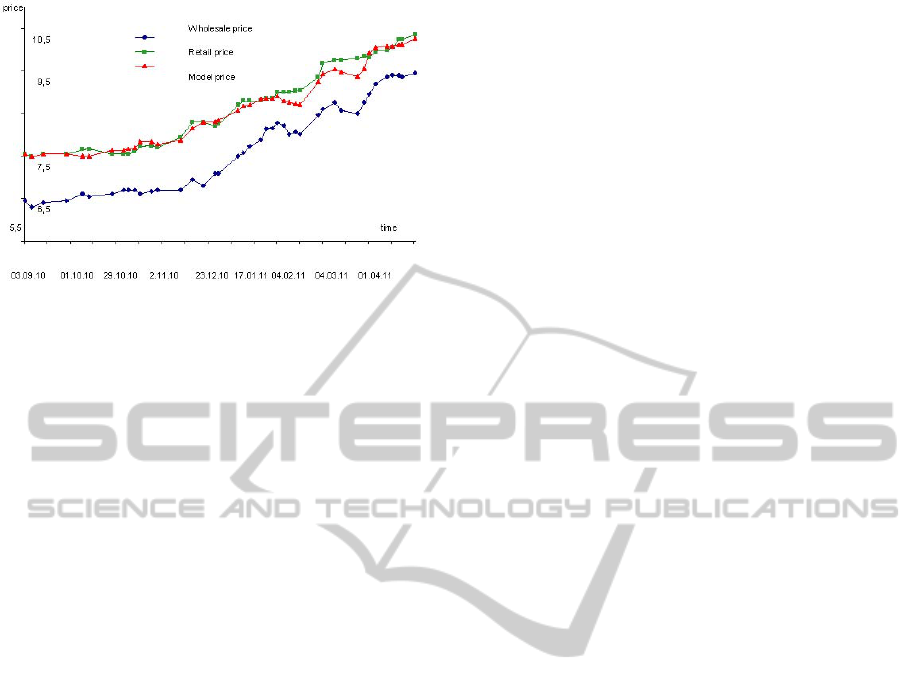

Figure 3: The behavior of the gasoline prices with

regulation and without.

So the state can enter the wholesale market with

stabilization reserve during the prices’ jumps and

sell fuel under contracts to station networks, which

have demand for fuel. The need for profitability of

such fund should be taken into account. To evaluate

the effectiveness of control, the scheme, rearranged

in Figure 3, can be used. The comparison of price

without regulator and with the presence of the

regulator clearly indicates the effect of stabilization.

6 CONCLUSIONS

The results indicate that basing on the proposed

multi-agent model, the implementation of the

regulator, which can effectively reduce the level of

asymmetry in oil prices, is possible in principle. The

state agency, acting not administratively, but

through market-based control methods, might play a

role of such regulator. Further research in this area

should be aimed at clarifying the mechanism of

influence on prices by the state regulator.

REFERENCES

Bacon, R. W., 1991, Rockets and Feathers; the

Asymmetrical Speed of Adjustment of UK Retail

Gasoline Prices to Cost Changes, Energy Econ. 1, pp.

211 – 218.

Borenstein S, Cameron A and Gilbert R, “Do Gasoline

Prices Respond Asymmetrically To Crude Oil Price

Changes?” National Bureau of Economic Research,

1992, Working Paper No. 4138.

Matt Lewis. “Asymmetric Price Adjustment and

Consumer Search: An Examination of the Retail

Gasoline Market” University of California, Berkeley

Department of Economics November 13, 2003.

Veremenko I, Galchinsky L., Modeling the dynamics of

retail prices for oil products market of Ukraine,

“Business Inform” № 1, 2010, pp. 20-26.

Perdiguero García, Jordi, 2010. “Dynamic pricing in the

spanish gasoline market: A tacit collusion

equilibrium,” Energy Policy, Elsevier, vol. 38(4),

pages 1931-1937, April.

Alison Heppenstall, Andrew Evans and Mark Birkin

Using Hybrid Agent-Based Systems to Model

Spatially-Influenced Retail Markets Journal of

Artificial Societies and Social Simulation vol. 9, no. 3.

Tsvetovat, M. and Carley, K., 2002, Emergent

Specialisation in a Commodity Market: A Multi-Agent

Model, Computational and Mathematical

Organisation Theory, 8, pp. 221 – 234.

Dynamic pricing by software agents Jeffrey O. Kephart,

James E. Hanson, Amy R. Greenwald. Computer

Networks 32 (2000) 731-752.

S. Ramezani, P.A.N. Bosman, J.A. La Poutré. Adaptive

Strategies for Dynamic Pricing Agents. Proceedings of

the 23rd Benelux Conference on Artificial Intelligence,

423–424, 2011.

Y. Levin, J. McGill, and M. Nediak. Dynamic pricing in

the presence of strategic consumers and oligopolistic

competition. Management Science, 55(1):32–46, 2009.

MultiagentModelofStabilizingofPetroleumProductsMarket

317