COMBINATIONS OF OPTION SPREADS

Dmytro Matsypura and Vadim G. Timkovsky

The University of Sydney Business School, Sidney, NSW, Australia

Keywords:

Arbitrage, Box, Hedging, High-frequency, Leg, Margin, Offset, Option, Portfolio, Risk, Spread, Trading.

Abstract:

Having been constructed as trading strategies, option spreads are also used in margin calculations for offsetting

positions in options. All option spreads that appear in trading and margining practice have two, three or four

legs. It is well-known that the option spreads with three and four legs are combinations of two option spreads

with two legs, and that hedging mechanisms of these combinations consolidate hedging mechanisms of their

components. Although more complex combinations with similar properties can be traced in regulatory litera-

ture of 2003, they have not yet been studied and used. In this paper we develop a theory for the construction

of multi-leg option spreads as combinations of well-known option spreads with two, three and four legs. We

show how multi-leg option spreads with extreme properties can maximize arbitrage opportunities in trading

options and substantially reduce margin requirements for option portfolios.

1 INTRODUCTION

Option spreads with two, three and four legs such as

bull and bear spreads, butterfly, condor, iron butter-

fly, iron condor and box spreads have been known for

more than three decades and have become standard in

options trading; cf. (McMillan, 2002; Cohen, 2005;

Curley, 2008). Descriptions of more complex spreads

appeared as efficient means of margin reductions in

2003. It is important to explain how these spreads

were motivated.

1.1 Regulatory Breakthrough

By the end of the nineties, it was commonly recog-

nized that margin regulations impose excessively high

minimum margin requirements, especially for option

portfolios. This can be partially explained by the fact

that option spreads permitted for offsetting by mar-

gin regulations by that time had at most four legs.

1

However, it is well-known that the more legs an op-

tion spread has the more margin reduction it gives.

As shown in (Matsypura and Timkovsky, 2011), just

one additional leg can save several thousand dollars

on margin. Thus, the reduction of minimum margin

requirements can be achievedby constructing new op-

tion spreads with a larger number of legs.

1

A leg of an option spread or offset based on this spread

is a position in options with the same exercise price and

expiry date.

Option spreads with up to 12 legs appeared as

combinations of option spreads with two, three and

four legs in August 2003 when the CBOE

2

proposed

new margin rules based on these combinations that

were called complex spreads (CBOE, 2003). After

two revisions of this proposal (CBOE, 2004; CBOE,

2005), the SEC

3

approved these rules (SEC, 2005)

and added them to NYSE Rule 431 in December

2005. In August 2007, these rules were also recog-

nized in Canada (IDA, 2007).

1.2 Motivation

The regulatory breakthrough of 2005, however, re-

ceived a limited response of the brokerage industry by

the following two reasons: firstly, the definition of the

complex spreads was given in a text form that does

not allow for complete understanding of their struc-

ture, and hence how these spreads can be utilized;

secondly, the interest to multi-leg option spreads had

been lost because the risk-based margining methodol-

ogy that had become popular in the U.S. in 2005 of-

fered computationally easier solutions. Consequently,

option spreads with more than four legs are still not

being used, primarily because they have neither been

studied nor properly understood.

Multi-leg option spreads thus call for academic re-

search that shall explain how they can be constructed,

2

The Chicago Board Options Exchange.

3

The U.S. Securities and Exchange Commission.

321

Matsypura D. and G. Timkovsky V..

COMBINATIONS OF OPTION SPREADS.

DOI: 10.5220/0003798003210331

In Proceedings of the 1st International Conference on Operations Research and Enterprise Systems (ICORES-2012), pages 321-331

ISBN: 978-989-8425-97-3

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

what advantage they give, and how they can be uti-

lized in options trading and marginingpractice. To the

best of our knowledge, this kind of research has never

been attempted. As we show in this paper, 12 legs is

not the final step. We discover new multi-leg option

spreads that have the same hedging mechanism as that

of complex option spreads and propose a full charac-

terization of option spreads with any number of legs.

We also formulate integer programs that demonstrate

that multi-leg option spreads maximize arbitrage op-

portunities in options trading and substantially reduce

margin requirements in margin accounts with options.

2 MAIN SPREADS

A vector model of option spreads with up to four legs

was proposed in (Matsypura and Timkovsky, 2011).

In this section we give an extension of this model that

deals with option spreads of different width.

2.1 Vector Model of Option Spreads

Let d ≥ 2 be a positive integer. Option spreads of

dimension d are integer vectors

v = ( c

1

c

2

··· c

d

p

1

p

2

··· p

d

)

whose components are associated with positions in

options in a margin account as follows.

The component c

j

, 1 ≤ j ≤ d, is the number of

option contracts in the jth call option series, with the

exercise price e

j

. Similarly, the component p

j

is the

number of option contracts in the jth put option se-

ries, with the same exercise price e

j

.

Nonzero components represent legs. A positive,

negative or zero component means that it is a long,

short leg or a leg is absent, respectively. A zero

spread, denoted 0, is a spread without legs.

Let a be a nonnegativeinteger. Then av is a multi-

ple of v with factor a. A spread is said to be prime if

it is not a multiple of another spread with factor more

than one. Thus, 0 is a prime spread. If v is a prime

spread, then a is a multiplicity of av. If not stated

otherwise, we assume further only prime spreads.

Treating spreads as vectors we can add and sub-

tract them, multiply by an integer scalar, cyclicly shift

their components and take their transpositions, i.e.,

create the spreads ¯v, where the components c

i

and p

i

are transposed for all i = 1,2, . . . , d.

We assume that the exercise prices are all different

and placed in increasing order,i.e., e

1

< e

2

< ··· < e

d

.

The set {e

1

,e

2

,...,e

d

} is called an exercise domain.

If the exercise prices are separated by the same price

interval, then the length of the interval, D, is the ex-

ercise differential of the domain, and the exercise do-

main is said to be uniform.

4

In what follows, we consider only uniform exer-

cise domains and option spreads on the same exercise

domain. Therefore, it will be convenient to normal-

ize all prices and costs by divisor D. Thus, we will

further assume that all exercise prices and all option

prices have been normalized, and hence all exercise

domains have exercise differential 1.

Definition 1. Let w and k be positive integers such

that w < d and k ≤ 2d, and let v

1

,v

2

,...,v

k

be the

sequence of leg indices in a spread v of dimension d

such that

e

v

1

≤ e

v

2

≤ ··· ≤ e

v

k

If e

v

j+1

−e

v

j

= 0 or w for each j = 1,2,...,k−1, then

v is a uniform spread of width w.

We consider only uniform spreads because only

they are being used in practice. Besides, as we con-

sider only normalized prices, the width of spreads will

always be integer in the set {1,2,...,d −1}. Simplest

uniform spreads are basic spreads. They can be de-

fined as follows:

Definition 2. A basic spread is uniform and has two

legs, 1 and −1, such that both legs are on the same

side, call or put. A basic spread is a basic call/put

spread if all its legs are on the call/put side. A basic

spread is a basic bull spread if its first leg is long;

otherwise it is a basic bear spread.

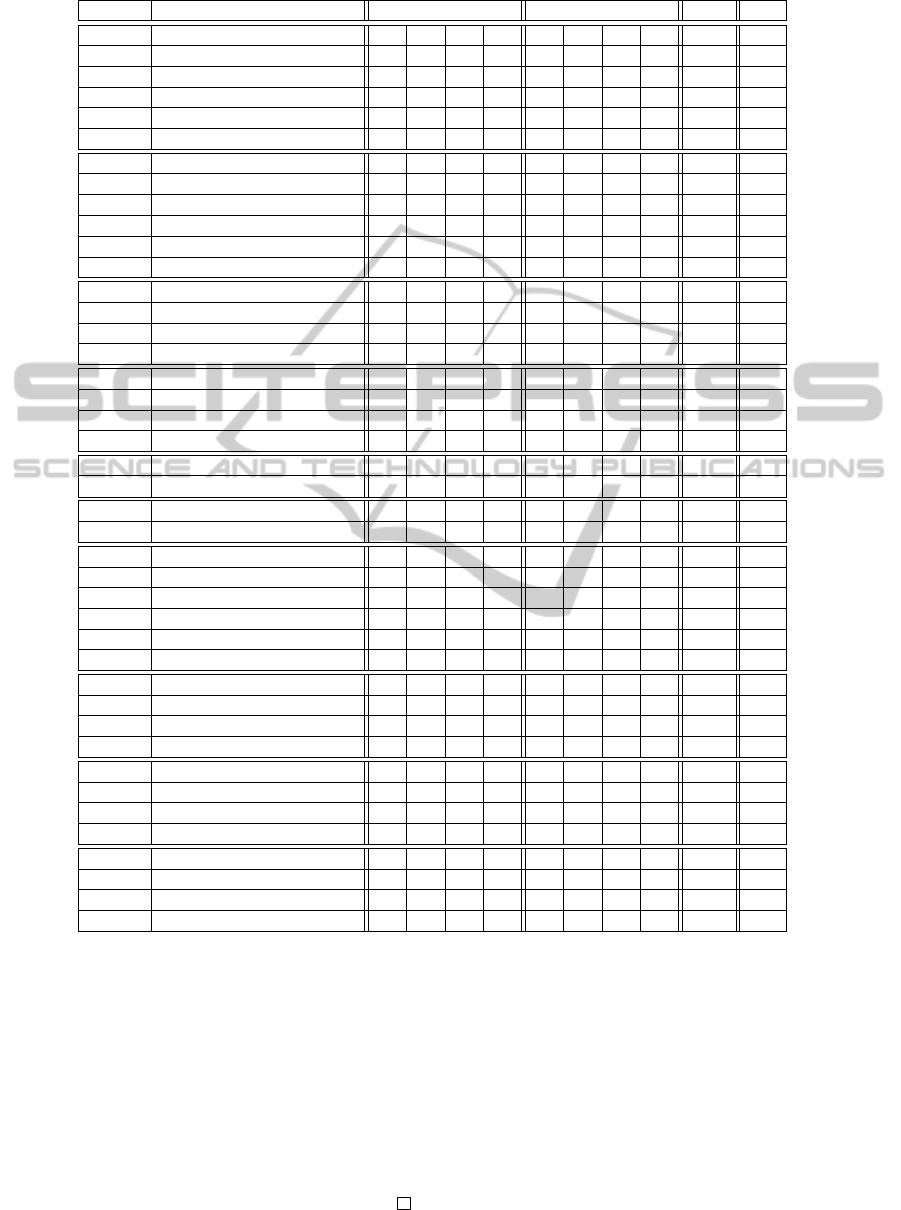

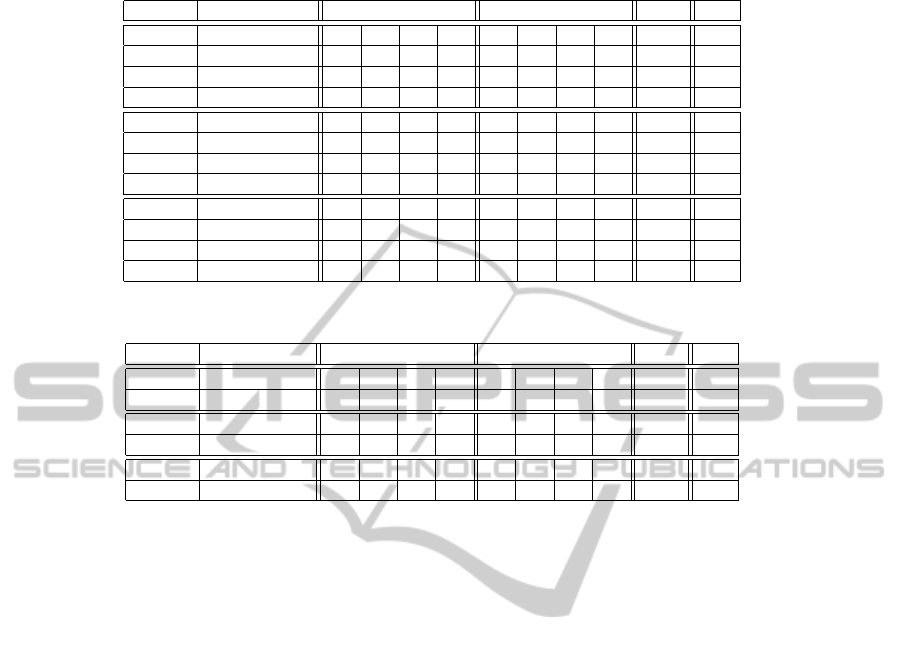

The first 12, 8, 4 spreads in Tables 1, 2, 3, present

all basic spreads of width 1, 2, 3 and dimension 4,

respectively. The abbreviations “dr” and “cr” mark

debit spreads and credit spreads.

5

Definition 3. All basic spreads are two-leg main

spreads. Let u and v, where u 6= −v, be a basic

bull spread and a basic bear spread, respectively, of

the same width w, and let u+ v be a uniform spread

of width w. Then u + v is a three- or four-leg main

spread of width w.

Although our attention will be focused on the case

of dimension four, all further results are valid for

any dimension higher than four. The set of all main

spreads of width 1, 2, 3 and dimension 4 is presented

in Tables 1, 2, 3, respectively. Note that butterfly and

4

Exercise prices of listed options of the same expiration

date generate a uniform exercise domain. For example, ac-

cording to http://finance.google.com, as of 02-AUG-2011,

5:50PM, exercise prices of options on the IBM stock listed

in NYSE and expiring on 20-AUG-2011 generated the uni-

form exercise domain {85,90,. .. , 270} of dimension 38.

5

The term debit/credit indicates that the spread is a re-

sult of a net debit/credit transaction, respectively.

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

322

Table 1: Main spreads of width 1 and dimension 4.

spread spread name calls puts legs net

a 1st bull call 1 -1 2 dr

b 2nd bull call 1 -1 2 dr

c 3rd bull call 1 -1 2 dr

e 1st bull put 1 -1 2 cr

f 2nd bull put 1 -1 2 cr

g 3rd bull put 1 -1 2 cr

-a 1st bear call -1 1 2 cr

-b 2nd bear call -1 1 2 cr

-c 3rd bear call -1 1 2 cr

-e 1st bear put -1 1 2 dr

-f 2nd bear put -1 1 2 dr

-g 3rd bear put -1 1 2 dr

a− b 1st long call butterfly 1 -2 1 3 dr

b− a 1st short call butterfly -1 2 -1 3 cr

b− c 2nd long call butterfly 1 -2 1 3 dr

c− b 2nd short call butterfly -1 2 -1 3 cr

e− f 1st long put butterfly 1 -2 1 3 cr

f− e 1st short put butterfly -1 2 -1 3 dr

f− g 2nd long put butterfly 1 -2 1 3 cr

g− f 2nd short put butterfly -1 2 -1 3 dr

a− c long call condor 1 -1 -1 1 4 dr

c− a short call condor -1 1 1 -1 4 cr

e− g long put condor 1 -1 -1 1 4 dr

g− e short put condor -1 1 1 -1 4 cr

a− e 1st long box 1 -1 -1 1 4 dr

e− a 1st short box -1 1 1 -1 4 cr

b− f 2nd long box 1 -1 -1 1 4 dr

f− b 2nd short box -1 1 1 -1 4 cr

c− g 3rd long box 1 -1 -1 1 4 dr

g− c 3rd short box -1 1 1 -1 4 cr

a− f 1st long call iron butterfly 1 -1 -1 1 4 dr

f− a 1st short call iron butterfly -1 1 1 -1 4 cr

b− g 2nd long call iron butterfly 1 -1 -1 1 4 dr

g− b 2nd short call iron butterfly -1 1 1 -1 4 cr

e− b 1st long put iron butterfly -1 1 1 -1 4 cr

b− e 1st short put iron butterfly 1 -1 -1 1 4 dr

f− c 2nd long put iron butterfly -1 1 1 -1 4 cr

c− f 2nd short put iron butterfly 1 -1 -1 1 4 dr

e− c long put iron condor -1 1 1 -1 4 cr

c− e short put iron condor 1 -1 -1 1 4 dr

a− g long call iron condor 1 -1 -1 1 4 dr

g− a short call iron condor -1 1 1 -1 4 cr

condor spreads, iron butterfly and iron condor spreads

of width 2 or 3 and dimension 4 do not exist.

Theorem 1. The number of main spreads of width w

and dimension d is n(w,d) =

6(d − w) + 8max{0,d − 2w} + 8max{0,d − 3w}.

Proof A direct count shows that for fixed w and

d the numbers of bull, bear or box spreads, but-

terfly or iron butterfly spreads, and condor or iron

condor spreads are 2(d − w), 4max{0,d − 2w}, and

4max{0, d − 3w}, respectively.

2.2 Portfolios and Linear Combinations

of Main Spreads

Let A denote the 2d × n matrix, where

n =

d−1

∑

w=1

n(w,d)

whose columns are all main spreads of dimension d.

If A(w, d) is the matrix of main spreads of width w

and dimension d, then

COMBINATIONS OF OPTION SPREADS

323

Table 2: Main spreads of width 2 and dimension 4.

spread spread name calls puts legs net

a 1st bull call 1 -1 2 dr

b 2nd bull call 1 -1 2 dr

e 1st bull put 1 -1 2 cr

f 2nd bull put 1 -1 2 cr

-a 1st bear call -1 1 2 cr

-b 2nd bear call -1 1 2 cr

-e 1st bear put -1 1 2 dr

-f 2nd bear put -1 1 2 dr

a− e 1st long box 1 -1 -1 1 4 dr

e− a 1st short box -1 1 1 1 4 cr

b− f 2nd long box 1 -1 -1 1 4 dr

f− b 2nd short box -1 1 1 -1 4 cr

Table 3: Main spreads of width 3 and dimension 4.

spread spread name calls puts legs net

a 1st bull call 1 -1 2 dr

e 1st bull put 1 -1 2 cr

-a 1st bear call -1 1 2 cr

-e 1st bear put -1 1 2 dr

a− e 1st long box 1 -1 -1 1 4 dr

e− a 1st short box -1 1 1 -1 4 cr

A = [ A(1,d) A(2,d) ··· A(d − 1, d) ]

In what follows, an integer column vector of size n

with nonnegative components will be associated with

the portfolio of main spreads taken in quantities equal

to the components of this vector. Such vectors consti-

tute a portfolio space.

An integer column vector of size 2d will be asso-

ciated with a spread, as we described in Section 2.1.

Such vectors constitute a spread space. Further, all

vectors in the portfolio/spread space will be denoted

by italic/direct bold letters.

Thus, the matrix A, as a left multiplier, transforms

portfolios of main spreads into linear combinations of

main spreads. As we show in Section 5, a portfolio of

main spreads can have multiple representations in the

form of linear combination of main spreads.

According to this assumptions, a main spread can

be presented in the following two forms:

• as a column vector of size n whose ith component

is 1 and the other components are 0s, that is de-

noted by e

i

(a presentation in the portfolio space);

the index i will be dropped if the main spread is

not specific; or

• as a column of A, i.e., as a column vector of size

2d, that is denoted by b

i

, if the main spread is the

ith column of A, or by b if the main spread is not

specific (a presentation in the spread space).

These forms are obviously related by the equation

Ae

i

= b

i

2.3 Market Risk of Main Spreads

It is well known that debit spreads are free of mar-

ket risk, i.e., they have no loss associated with un-

derlying instrument price changes, cf. (Cohen, 2005)

or (McMillan, 2002) for a detailed discussion. Credit

spreads, in contrast, are not free of market risk.

The maximum loss on a prime credit spread asso-

ciated with underlying instrument price changes is its

width in all cases except for a short call iron butterfly

and a short call iron condor for which the maximum

loss is two widths. Therefore, the market risk of a

main spread b is the integer

m(b) =

0 if b is a debit spread,

2w if b is

a short call iron butterfly

or short call iron condor

spread,

w otherwise.

(1)

In this paper, we consider the market risk of a main

spread to be its maintenance margin requirement.

Moreover, we consider only maintenance margin

requirements. Details related to a justification of the

market risk as a measure of maintenance margin re-

quirements and discussions on the relationship be-

tween maintenance and initial margin requirements

for main spreads can be found in (Matsypura and

Timkovsky, 2011). In what follows, the term “mar-

gin” will stand for a maintenance margin requirement.

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

324

3 COMPLEX SPREADS

The regulatory amendment of December 14, 2005,

initiated by the CBOE, was motivated by the obser-

vation that some combinations of main spreads have

the same risk profile as single main spreads. This can

be explained by the fact that the summation of main

spreads in such a combination turns out to be also a

main spread that is a resulting spread. These combi-

nations were named complex spreads. The margin of

a complex spread is exactly the margin of its resulting

spread (CBOE, 2003).

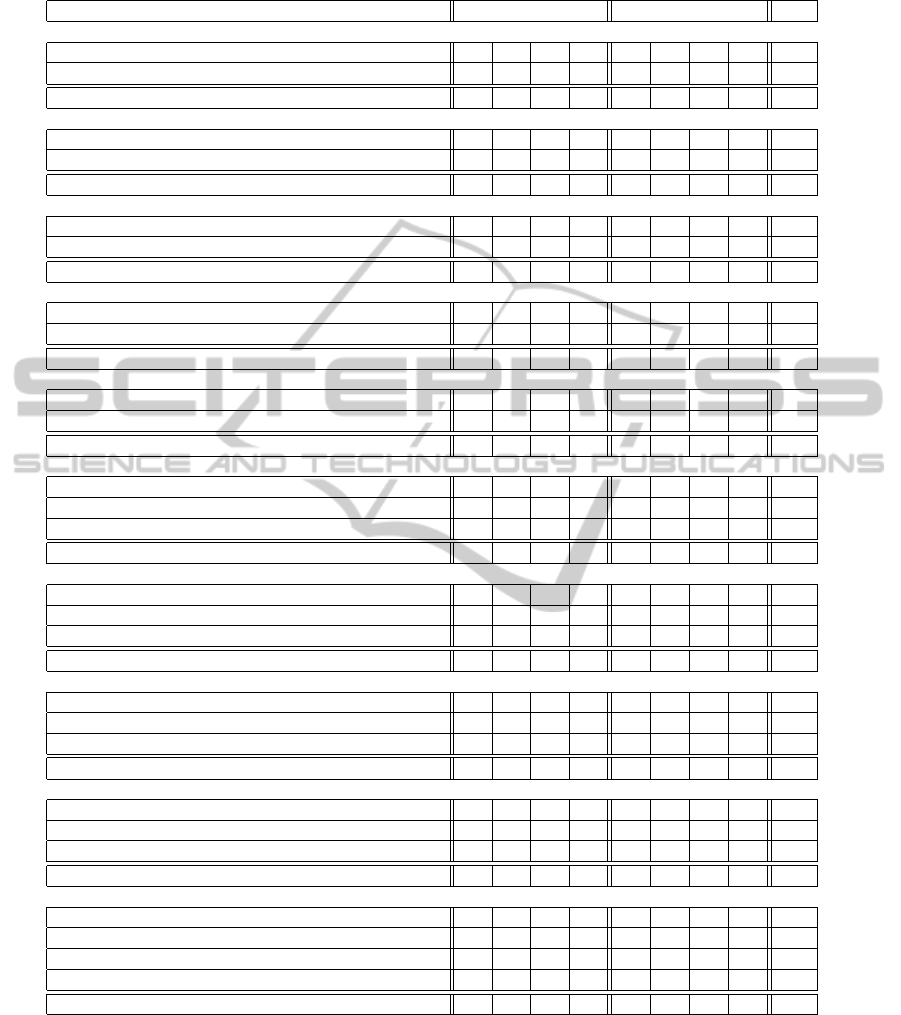

3.1 Table of Complex Spreads

Ten of the complex spreads are presented in Ta-

ble 4. The other ten are their transpositions, where the

names of the components have the words “call” and

“put” interchanged. Negations of these 20 produce

another 20, where the names of the components have

the words “long” and “short” interchanged. Thus, Ta-

ble 4 defines a total of 40 complex spreads. As com-

plex spreads 1 and 2, 4 and 5, 7 and 8 are isomorphic,

there exist only seven types of the complex spreads.

6

Note that there are no complex spreads of width

more than 1 and dimension 4 because otherwise they

would involve as components butterfly spreads of

width more than 1, which do not exist.

3.2 Advantage of Complex Spreads

The margins of complex spreads are exactly the mar-

gins of their resulting spreads, cf. (CBOE, 2003); and

a complex spread is an offset if its margin is less than

the total margin of its components. Hence, not all

complex spreads are offsets.

For example, the complex spread 6 in Table 4 has

three components: the 1st long call butterfly spreads

b− c, the 2nd long call butterfly spread a− b and the

3rd bull call spread c. All the three are debit spreads.

By formula (1), the market risks for these spreads are

zeros. The resulting spread is the 1st bull call spread

6

The regulatory definitions given in SEC Release 34-

52738, the CBOE Regulatory Circular and NYSE Rule 431

imply only these seven types. The CBOE gave some of

complex spreads the same names as those of their result-

ing main spreads. To avoid confusions, we do not use these

names. We should also emphasize that this paper presents

our mathematical interpretation of CBOE’s informal defini-

tions of complex spreads in a text form. Our goal was to

follow the idea given in the definitions as close as possible

and, at the same time, avoid inconsistencies that we found

in them. Any omission that someone may find in our math-

ematical interpretation of CBOE’s complex spreads will be

our responsibility.

a, which is also a debit spread. Therefore, the mar-

gin of the complex spread 6 is also zero. Thus, it is

not an offset, and there is no advantage of using it

for margin reductions. It is not hard to verify that all

complex spreads in Table 4 are not offsets. However,

their negations are offsets.

For example, since the bear call spread −a is a

credit spread, the margin of the negation of the com-

plex spread 6 is w, while the total margin of b− a,

c− b and −c, which are all credit spreads, is 3w.

Thus, the negation of the complex spread 6 is an offset

with advantage 2w.

In general, if a complex spread with the resulting

debit or credit spread is an offset, then it reduces the

total margin of its components by kw or (k− 1)w, re-

spectively, where k is the number of credit compo-

nents. Thus, the negations of the complex spreads 1

through 5, 6 through 9 and 10 reduce the margin by

w, 2w and 3w, respectively.

4 BEYOND COMPLEX SPREADS

Complex spreads are constructed as summations of

bull/bear spreads, long/short butterfly spreads and

long/short box spreads; cf. Table 4.

Developing the idea of complex spreads, we give

in this section definitions of other multi-leg spreads as

more general combinations of main spreads that we

call centipedes and millipedes.

7

4.1 Centipedes

Definition 4. A centipede is a set of main spreads

such that their linear combination with nonegative

integer coefficients is a nonzero multiple of a main

spread, which is the resulting spread of the centipede.

A nonzero multiple of a main spread, obviously,

generates a trivial centipede by itself. The margin rule

for complexspreads we formulated in the preamble of

Section 3 naturally applies to centipedes because they

have the same risk profiles as their resulting spreads.

Let a be a positive integer, 0 be a zero vector of

size n, and let b be a main spread. Then centipedes

7

Centipedes, as all other creatures, have even number of

legs (one pair of legs per body segment), and this number

can reach 200 and more. Centipedes usually do not bite hu-

mans but a few species, when provoked, can bite inflicting

painful wounds. Millipedes are creatures with number of

legs multiple of four (two pairs of legs per body segment).

Some species have over 400 legs. Millipedes are not preda-

tors as centipedes. – Wikipedia (terrestrial animals). It can

be observed that multi-leg spreads introduced in this section

have similar properties.

COMBINATIONS OF OPTION SPREADS

325

Table 4: CBOE’s complex spreads, their components and resulting spreads.

complex spread: component sum = resulting spread calls puts net

1. b+ (a− b) = a : 5 legs

2nd bull call 1 -1 dr

+ 1st long call butterfly 1 -2 1 dr

= 1st bull call 1 -1 dr

2. c+ (b− c) = b : 5 legs

3nd bull call 1 -1 dr

+ 2st long call butterfly 1 -2 1 dr

= 2nd bull call 1 -1 dr

3. (b− c) + (a− b) = a− c : 6 legs

2nd long call butterfly 1 -2 1 dr

+ 1st long call butterfly 1 -2 1 dr

= long call condor 1 -1 -1 1 dr

4. (a− b) + (e− a) = e− b : 7 legs

1st long call butterfly 1 -2 1 dr

+ 1st short box -1 1 1 -1 cr

= 1st long put iron butterfly -1 1 1 -1 cr

5. (b− c) + (f− b) = f− c : 7 legs

2nd long call butterfly 1 -2 1 dr

+ 2nd short box -1 1 1 -1 cr

= 2nd long put iron butterfly -1 1 1 -1 cr

6. c+ (b− c) + (a− b) = a : 8 legs

3rd bull call 1 -1 dr

+ 2nd long call butterfly 1 -2 1 dr

+ 1st long call butterfly 1 -2 1 dr

= 1st bull call 1 -1 dr

7. b+ (a− b) + (e− a) = e : 9 legs

2nd bull call 1 -1 dr

+ 1st long call butterfly 1 -2 1 dr

+ 1st short box -1 1 1 -1 cr

= 1st bull put 1 -1 cr

8. c+ (b− c) + (f− b) = f : 9 legs

3rd bull call 1 -1 dr

+ 2nd long call butterfly 1 -2 1 dr

+ 2nd short box -1 1 1 -1 cr

= 2nd bull put 1 -1 cr

9. (b− c) + (a− b) + (e− a) = e− c : 10 legs

2nd long call butterfly 1 -2 1 dr

+ 1st long call butterfly 1 -2 1 dr

+ 1st short box -1 1 1 -1 cr

= long put iron condor -1 1 1 -1 cr

10. c+ (b− c) + (a− b) + (e− a) = e : 12 legs

3rd bull call 1 -1 dr

+ 2nd long call butterfly 1 -2 1 dr

+ 1st long call butterfly 1 -2 1 dr

+ 1st short box -1 1 1 -1 cr

= 1st bull put 1 -1 cr

with resulting spread ab can be identified with integer

solutions to the system Ax = ab, x ≥ 0, where com-

ponents of x represent multiplicities of main spreads

in the centipede x.

If m is the margin of b, then the margin of x is am.

Note that multiplicities of main spreads involved in

complex spreads are 1 or 0. Centipedes with a result-

ing spread ab can be considered as synthetic coun-

terparts of ab that are possible to build from main

spreads. We will relate centipedes to the same type

b if their resulting spreads are multiples of the same

main spread b.

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

326

4.2 Millipedes

Now we consider combinations of main spreads that

are market risk-free. They are based on the concept

of a horizontal spread, i.e., a long option combined

with a short option on the same underlying security

of the same type and exercise price. It is well-known

that such a spread is invariant to underlying security

market price changes and therefore market risk-free.

Lemma 1. A horizontal spread is market risk-free.

Proof Let us consider a horizontal call spread where

the long position in a call option lC and the short posi-

tion in a call option sC have the same exercise price e.

Each option contracts, say, 100 underlying units.

If sC is exercised, then the spread holder is obliged

to sell 100 underlying units to the holder of sC at the

price e. In this case, the spread holder can exercise lC,

i.e., buy 100 underlying units at the same price, and

deliver them to the holder of sC with no loss. If sC is

not exercised and lC is out-of-the-money, then lC can

be kept unexercised. A horizontal put spread has the

same hedging mechanism except that exercising put

options triggers the sell of underlying units.

Definition 5. A millipede is a set of main spreads

such that their linear combination with nonegative in-

teger coefficients is a zero spread.

Thus, 0 is a trivial millipede. This definition im-

plies that millipedes can be found as integer solutions

to the system Ax = 0, x ≥ 0, where x is the same

variable vector as in Section 4.1. A submillipede is

a subset of a millipede which is also a millepede. A

submillipede y of a millipede x is proper if 0 6= y 6= x.

Theorem 2. A millipede is market risk-free.

Proof Using induction on the number of components

of a millipede and Lemma 1, it is easy to verify that

the set of legs of a millipede can be partitioned into

pairs such that each pair is a horizontal call or put

spread. Therefore a millipede is a market risk-free

option combination.

Thus, the margin of a millipede is zero. There ex-

ists a simple relationship between centipedes and mil-

lipedes: if x is a centipede with the resulting spread

ab

i

, where b

i

is the ith column of A, and Ae

i

= b

i

,

then x− ae

i

is a millipede.

Definition 6. A millipede is minimal if it does not

contain proper submillipedes. A centipede is minimal

if it does not contain nontrivial millipedes. A cen-

tipede obtained from another centipede by deleting a

nontrivial millipede is a subcentipede.

We should notice that the absence of linear combi-

nations with negative coefficients in the definitions of

centipedes and millipedes does not affect the gener-

ality of these multi-leg option spreads because nega-

tions of main spreads are also main spreads. Thus,

a main spread b with negative coefficient − c can be

replaced by −b with positive coefficient c.

As mentioned in Section 2.2, the matrix A de-

fines a linear transformation of vectors in the port-

folio space to vectors in the spread space.

It is important to observe that the set of millipedes

is the kernel, the set of centipedes with the same re-

sulting spread is an equivalence class, the set of linear

combinations of main spreads is the image, and the

set of coefficient vectors of these combinations is the

coimage of this transformation.

5 USING CENTIPEDES AND

MILLIPEDES

As we show in this section, centipedes, as synthetic

counterparts of main spreads, can increase their profit

if the set of options with the same expiration date is

mispriced; while millipedes represent “white holes”

of option portfolios, i.e. a group of positions whose

margin is zero because, as shown in Section 4.2, mil-

lipedes are market risk-free option combinations.

5.1 Maximizing Option Arbitrage

Opportunities

Let p be the column vector of the prices of main

spreads including the transaction costs. Assume that

a main spread b is chosen for trading with quantity a.

Then a solution to

min{p

⊤

x : Ax = ab} (2)

answers the question whether there exist a synthetic

counterpart x of ab that is less expensive than ab.

If the answer is positive, then it is probably better

to trade the synthetic counterpart. Note that if ab is a

credit spread, then its synthetic counterpart can give

an advantage only if the minimum (2) is negative.

If ab is a multiple of a box spread, then solving

the above integer program, as we show in this section,

can maximize an option arbitrage opportunity. We

should note here that known arbitrage strategies in-

volving only options are based on box spreads which

are market risk-free; cf. (Cohen, 2005).

A long box spread is a debit spread because its

long (buy) side is more expensive than its short (sell)

side. The difference between the prices of these sides

is the long box spread price. An arbitrage opportunity

appears when the long box spread price is lower than

COMBINATIONS OF OPTION SPREADS

327

we

−r(τ−t)

, where w is the box spread width. i.e., the

amount that can be invested in a risk-free asset paying

interest r, where τ is the expiration date of the options

involved in the long box spread, and t is the present

date; cf. (Ronn and Ronn, 1989; Bharadwaj and Wig-

gins, 2001; Benzion et al., 2005). Therefore, catching

the arbitrage opportunity implies finding a long box

spread in the options market with a minimum price.

A short box spread is a symmetrical image of a

long box spread in relation to adjectives “long” and

“short”. Therefore, a short box spread is a credit

spread, i.e. of a negative price, and hence gives a risk-

free profit right on entering into it. Thus, catching an

arbitrage opportunity by a short box spread implies

finding a short box spread in the options market with

also a minimum but negative price.

The box spread arbitrage has been well studied.

A recent study and literature review can be found

in (Benzion et al., 2005). It is well-known that a box

spread is a synthetic position in a short position in a

stock and a long position in the same stock. A box

spread can also be viewed as a synthetic position in

other option spreads as follows:

Definition 7. A synthetic box spread is a centipede

whose resulting spread is a multiple of a box spread.

Let p

b

be the price of a box spread b. We assume

that p

b

> 0 and then b is a long box (debit) spread,

or p

b

< 0 and then b is a short box (credit) spread.

We exclude the case p

b

= 0 which means an obvious

error in pricing of options.

Let x

∗

be the synthetic box spread with the result-

ing spread a

∗

b that is found by solving the integer

program (2) with variables x and 1 ≤ a ≤ a

max

, where

a

max

is a chosen multiplicity upper bound.

As a multiple of a box spread is a trivial synthetic

box spread, p

⊤

x

∗

≤ a

∗

p

b

. We assume that a

∗

p

b

> 0

implies p

⊤

x

∗

> 0; otherwise we have again an obvi-

ous error in pricing of options. Thus, if a

∗

b gives

an arbitrage opportunity, then its synthetic counter-

part x

∗

gives a better arbitrage opportunity only if

p

⊤

x

∗

< a

∗

p

b

.

While a box spread can find an arbitrage opportu-

nity by capturing only four mispriced options, a syn-

thetic box spread is a much more powerful tool be-

cause it captures mispriced options in the whole op-

tion chain.

5.2 Decompositions of Option Portfolios

Let us recall that, according to the definition given in

Section 2.2, a portfolio of main spreads is an in-

teger column vector of size n whose components q

i

represent quantities of main spreads. Thus, if m

i

is

the margin of main spread i, then m

i

q

i

is the margin

of the ith component of the portfolio, where 1 ≤ i ≤ n.

We assume that q

i

> 0 implies that the portfolio

has a position in main spread i with quantity q

i

and

that q

i

= 0 implies that the portfolio has no position

in the main spread i.

Let us introduce the following constant vectors:

m

⊤

= ( m

1

m

2

··· m

n

)

q

⊤

= ( q

1

q

2

··· q

n

)

1

⊤

= ( 1 1 ··· 1 )

and the followingnonnegativeinteger variablevectors

a

⊤

= ( a

1

a

2

··· a

n

)

x

i

⊤

= ( x

i1

x

i2

··· x

in

)

y

j

⊤

= ( y

j1

y

j2

··· y

jr

)

z

⊤

= ( z

1

z

2

··· z

r

)

where components of a are associated with multiplic-

ities of main spreads that are not necessarily in the

portfolio, components of x

i

and y

j

are associated with

multiplicities of main spreads in centipedes and milli-

pedes, respectively, that are in the portfolio, and com-

ponents of z are 0-1 variables for counting minimal

millipedes in the portfolio. We assume that r = ⌊n/2⌋

because a nontrivial millipede involves at least two

main spreads, hence 1 ≤ j ≤ r.

We also consider the nonnegative integer variable

vector

y

⊤

= ( y

1

y

2

··· y

r

)

instead of the vectors y

j

in portfolio decompositions

with a single millipede.

Now we show how the no-offset margin m

⊤

q of

the portfolio q can be reduced to obtain an offset mar-

gin of this portfolio using centipedes and millipedes

as offsets. As we show in this section, the reduction

follows from a decomposition of the portfolio into

centipedes and millipedes.

Let b be a main spread. We say that the portfo-

lio q contains a centipede or millipede x with the re-

sulting spread ab, where a > 0 or a = 0, respectively,

if Ax = ab and x ≤ q. Centipedes and/or millipedes

x

1

,x

2

,...,x

s

generate a decomposition of the portfo-

lio q if x

1

+ x

2

+ ... + x

s

= q.

If µ

i

denotes the margin of the ith component of

this decomposition, where µ

i

= 0 if x

i

is a millipede,

then µ

1

+ µ

2

+ ... + µ

s

is the decomposition margin.

Lemma 2. Any decomposition of an option portfo-

lio into centipedes and millipedes can be transformed

into a decomposition with at most n nonzero compo-

nents, at most one centipede of each type, and the

same decomposition margin.

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

328

Proof We can sum up centipedes of each type, arbi-

trarily add to these sums all nontrivial millipedes, if

any, and thus obtain a decomposition with at most n

nonzero components. The margin of the sum x

i

+ x

j

is µ

i

+ µ

j

, therefore the new decomposition has the

same margin.

To obtain a maximum reduction of the marginm

⊤

q

using centipedes and millipedes as offsets we can de-

compose the portfolio q as follows.

Let b

i

be the ith main spread, i.e., the ith column

of A, and let {a,x

1

,x

2

,...,x

n

,} be the variable set.

Then the set of solutions to the system

Ax

i

= a

i

b

i

, 1 ≤ i ≤ n

n

∑

i=1

x

i

= q

(3)

defines a set of decompositions of the portfolio q that

contains, by Lemma 2, a decomposition with a mini-

mum margin. Note that setting a = q and x

i

= q

i

e

i

for

all i gives a trivial solution to this system.

It is important to observe that a solution to the sys-

tem (3) defines a portfolio a from the coimage of the

transformation by the matrix A. The no-offset mar-

gin of a, i.e., m

⊤

a, is the offset margin of q. Since a

carries the same risk profile as q we call it a represen-

tative of q for the decomposition x

1

,x

2

,...,x

n

.

Note that a is not always a subportfolio of q be-

cause the inequality a ≤ q may not hold. If it holds,

then we call a a proper representative of q.

Lemma 3. If a is a representative of q, then q − a is

a millipede.

Proof Multiplying the lower equation in (3) by A

from the left and using the upper equation we obtain

Aa =

n

∑

i=1

a

i

b

i

= Aq

which implies A(q− a) = 0.

Obviously, if a is a proper representative of q, then

the millipede q− a is a subportfolio of q.

Definition 8. A solution a

∗

,x

∗

1

,x

∗

2

,...,x

∗

n

to the inte-

ger program of minimizing the objective

m

⊤

a (4)

under the constraints (3) defines a main decomposi-

tion x

∗

1

,x

∗

2

,...,x

∗

n

of the portfolio q and a main repre-

sentative a

∗

of q for this decomposition.

The following theorem establishes that the mar-

gin of a main decomposition cannot be reduced using

centipedes and millipedes as offsets.

Theorem 3. A main representative of a main repre-

sentative of q is also a main representative of q.

Proof Let a

′

be a main representativeof a

∗

for the de-

composition x

′

1

,x

′

2

,...,x

′

n

. Obviously, m

⊤

a

′

≤ m

⊤

a

∗

.

Then it is not hard to verify that a

′

is also a represen-

tative of q for the decomposition x

′′

1

,x

′′

2

,...,x

′′

n

, where

x

′′

i

= x

∗

i

+ x

′

i

− a

∗

i

e

i

for all i. Therefore, m

⊤

a

′

= m

⊤

a

∗

, and hence a

′

is a

main representative of q.

A main decomposition contains millipedes not

only among its own millipedes but also inside its cen-

tipedes which, therefore, may not be minimal. How-

ever, solving the following modified version of the

problem (3)(4) we can extract all millipedes from the

centipedes that are not minimal and collect all milli-

pedes in a single subportfolio we call a white hole.

Let {a,x

1

,x

2

,...,x

n

,y} be the variable set. Then

the set of solutions to the system

Ax

i

= a

i

b

i

, 1 ≤ i ≤ n, Ay = 0

n

∑

i=1

x

i

+ y = q

(5)

defines a set of decompositions of q that contains all

main decompositions.

Definition 9. A solution a

◦

,x

◦

1

,x

◦

2

,...,x

◦

n

,y

◦

to the in-

teger program of minimizing the objective

m

⊤

a−

1

⊤

y

1

⊤

q

(6)

under the constraints (5) defines a white-hole de-

composition of the portfolio q into centipedes, which

are nonzero vectors among x

◦

1

,x

◦

2

,...,x

◦

n

, and a milli-

pede y

◦

, which is a white hole in q.

As the following lemma and theorem state, a

white-hole decomposition is just an extension of a

main decomposition by one component collecting all

millipedes; hence, a white-hole decomposition has

only one millipede and only minimal centipedes.

Lemma 4. The vectors x

◦

1

,x

◦

2

,...,x

◦

n

are either mini-

mal centipedes or zero vectors.

Proof Let a centipede x

◦

i

be not minimal, and let v be

a nontrivial millipede in x

◦

i

. Then moving v from x

◦

i

to y

◦

adds value

−m

⊤

v−

1

⊤

v

1

⊤

q

to the objective (6). As 1

⊤

v > 0, the objective would

decrease, which is a contradiction.

Let x

◦

i

> 0 be not a minimal centipede. Then it is

a nontrivial millipede that could be added to y

◦

and

decrease the objective again.

COMBINATIONS OF OPTION SPREADS

329

Theorem 4. m

⊤

a

◦

= m

⊤

a

∗

, i.e., x

◦

1

,x

◦

2

,...,x

◦

n

is a

main decomposition, and hence a

◦

is a main repre-

sentative of q, where q− a

◦

± y

◦

is a millipede.

Proof If y

◦

= 0, then the equation m

⊤

a

◦

= m

⊤

a

∗

is

evident. Assume that y

◦

> 0.

Let y

∗

be the sum of all millipedes inside and

among x

∗

1

,x

∗

2

,...,x

∗

n

. Note that y

◦

> 0 implies y

∗

> 0

and that x

◦

1

,x

◦

2

,...,x

◦

n

+ y

◦

is a decomposition with

margin m

⊤

a

◦

≥ m

⊤

a

∗

; otherwise x

∗

1

,x

∗

2

,...,x

∗

n

is not

a main decomposition.

If m

⊤

a

◦

> m

⊤

a

∗

, then

m

⊤

a

∗

≤ m

⊤

a

◦

− 1 ≤ m

⊤

a

◦

−

1

⊤

y

◦

1

⊤

q

because y

◦

≤ q. As m

⊤

a

∗

−

1

⊤

y

∗

1

⊤

q

< m

⊤

a

∗

, we have

m

⊤

a

∗

−

1

⊤

y

∗

1

⊤

q

< m

⊤

a

◦

−

1

⊤

y

◦

1

⊤

q

Thus, x

◦

1

,x

◦

2

,...,x

◦

n

,y

◦

is not a white-hole decomposi-

tion, which is a contradiction.

By Lemma 3, q − a

◦

is a millipede, therefore

q − a

◦

± y

◦

is a millipede because it is a sum of two

millipedes, q− a

◦

and ±y

◦

.

A white-hole decomposition partitions a given

portfolio into two subportfolios that can be indepen-

dently closed without affecting the risk profiles of

each other. A white hole can be closed because the

residual portfolio can be more attractive for returns

or, vice versa, because the white hole is risk-free.

Providing the finest partition of the residual port-

folio into minimal centipedes (that can also be closed

independently), a white-hole decomposition leaves

the structure of the white hole unclear. Solving the

following integer program, however, decomposes a

white hole into minimal millipedes.

Let y

1

,y

2

,...,y

r

,z be the variable set. Then the set

of solutions to the system

Ay

j

= 0, 1

⊤

y

j

≥ z

j

, 1 ≤ j ≤ r

r

∑

j=1

y

j

= y

◦

(7)

defines all decompositions of the white hole y

◦

into at

most r millipedes.

A solution y

†

1

,y

†

2

,...,y

†

r

,z

†

to the integer program

of maximizing the score 1

⊤

z under the constraints (7)

defines a decomposition of the white hole y

◦

into

1

⊤

z nontrivial millipedes, which are nonzero vectors

among y

†

1

,y

†

1

,...,y

†

r

.

Definition 10. a

◦

, x

◦

1

,x

◦

2

,...,x

◦

n

, y

†

1

,y

†

2

,...,y

†

r

, z

†

de-

fine a main representative a

◦

and a prime decompo-

sition of the portfolio q into centipedes, which are

nonzero vectors among x

◦

1

,x

◦

2

,...,x

◦

n

, and 1

⊤

z non-

trivial millipedes, which are nonzero vectors among

y

†

1

,y

†

2

,...,y

†

r

.

The followingtheorem establishes that a prime de-

composition of an option portfolio is a finest decom-

position that completely reveals its structure in terms

of centipedes and millipedes.

Theorem 5. All centipedes and millipedes in a prime

decomposition are minimal.

Proof Lemma 4 implies that all centipedes in a prime

decomposition are minimal. Let us show that all non-

trivial millipedes in there are also minimal.

Let a nontrivial millipede y

†

k

be not minimal.

Then y

†

k

contains a proper submillipede v and hence

u = y

†

k

− v is also a proper submillipede.

Besides, there exists a positive integer l < r such

that y

†

l

= 0 and hence z

†

l

= 0; otherwise each milli-

pede among y

†

1

,y

†

2

,...,y

†

r

is minimal and contains two

components. Then we can construct a new decom-

position replacing y

†

k

, y

†

l

and z

†

l

with y

‡

k

= u, y

‡

l

= v,

and z

‡

l

= 1, where y

‡

k

+ y

‡

l

= y

†

k

. This replacement de-

creases the number of nontrivial millipedes by one,

which is a contradiction.

5.3 Decompositions with Proper

Representatives

It is not hard to verify that all results obtained in Sec-

tion 5.2 remain valid if the systems (3) and (5) are

complimented by the inequality a ≤ q. Thus, there

exist counterparts of main, white-hole and prime de-

compositions with proper representatives. The option

trader can be interested in this kind of decomposi-

tions because the conversion of the portfolio q into its

proper representative a requires only selling the sub-

portfolio q− a. While the conversion into a represen-

tative, which is not proper, requires selling quantities

q

i

− a

i

from positions i with q

i

> a

i

, buying quantities

a

j

− q

j

for positions j with a

j

> q

j

> 0 and open-

ing new positions k with quantities a

k

if a

k

> q

k

= 0.

Considering only proper main representatives, how-

ever, can reduce savings on margin; see Section 6.

6 COMPUTATIONAL

EXPERIMENT

Now we are conducting the computational study on

finding option arbitrage opportunities by synthetic

box spreads and the estimation of margin reductions

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

330

for portfolios of main spreads by white-hole decom-

positions using ILOG CPLEX 12.1 for solving integer

programs. We present here only preliminary results.

We experimented with the option chains for differ-

ent stocks provided by www.google.com/finance and

did not detect an option arbitrage. It is not surprising

because the price quotes in this web site are delayed

by 15 minutes, while option arbitrage opportunities

usually last for seconds; cf. (Bharadwaj and Wiggins,

2001; Benzion et al., 2005).

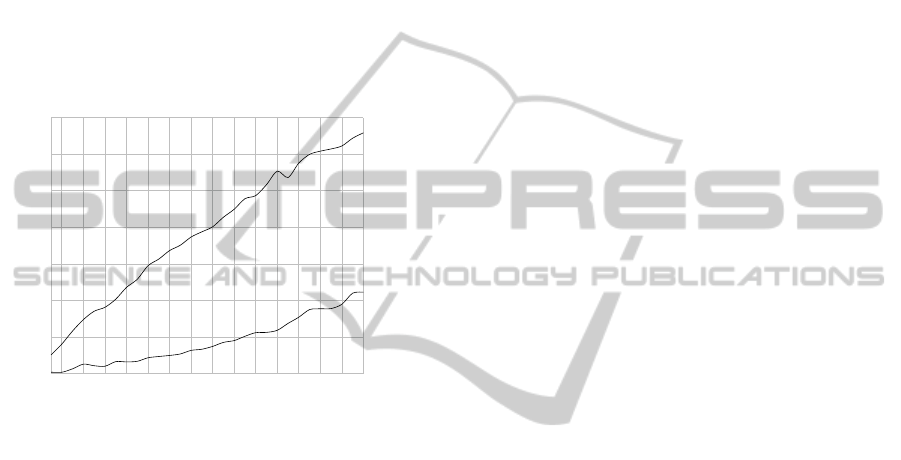

Using the same web site we also estimated the av-

erage savings on margin by replacing randomly gen-

erated portfolios of different sizes by their main rep-

resentatives. The results are presented on Fig. 1.

3 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32

10%

20%

30%

40%

50%

60%

70%

M

P

Figure 1: The percentage of average savings on margin by

main (M) and proper main (P) representatives of over 500

portfolios of main spreads of each size from 3 to 32. All the

main spreads were on the exercise domain of size 10 and ex-

ercise differential of $5USD. The portfolios were generated

by proportional random sampling with replacement based

on the trading volume of options on NASDAQ:AAPL ex-

piring on 22-OCT-2011. The options data were taken from

www.google.com/finance on 04-AUG-2011 when the under-

lying security price was at $377.37USD.

7 CONCLUSIONS

This paper takes only the first step in studying combi-

nations of option spreads and demonstrates how these

combinations can be used in trading and margining

practice. An important consequence of this study is

a sketch of a combinatorial theory of option port-

folios that we believe will be useful for developing

new techniques for high-frequency trading and new

margining methodologies.

Our next step will be devoted to computational ex-

periments for detecting option arbitrage opportunities

using live option price quotes and estimating margin

reductions for portfolios of main spreads with differ-

ent underlying stocks.

REFERENCES

Benzion, U., Danan, S., and Yagil, J. (2005). Box spread

strategies and arbitrage opportunities. J. Derivatives,

12(3):47–62.

Bharadwaj, A. and Wiggins, J. B. (2001). Box spread and

put-call parity tests for the S&P 500 index LEAPS

market. J. Derivatives, 8(4):62–71.

CBOE (2003). Regulatory Circular RG03-066. August 13.

CBOE (2004). Regulatory Circular RG04-90. August 16.

CBOE (2005). Regulatory Circular RG05-37. April 6.

Cohen, G. (2005). The bible of options strategies. Financial

Times Prentice Hall. Pearson, New Jersey.

Curley, M. T. (2008). Margin trading from A to Z. John

Wiley & Sons, New Jersey.

IDA (2007). Bulletin 3654.

Matsypura, D. and Timkovsky, V. G. (2011). Margining

option portfolios by network flows. Networks. DOI

10.1002/net.

McMillan, L. G. (2002). Options as a strategic investment.

Prentice Hall, 4 edition.

Ronn, A. G. and Ronn, E. I. (1989). The box-spread arbi-

trage: theory, tests and investment strategies. Review

of Financial Studies, 2(1):91–108.

SEC (2005). Release 34-52738.

COMBINATIONS OF OPTION SPREADS

331