SUCCESSFUL IMPLEMENTED THEORIES FOR REFERENCE

CLASS FORECASTING IN INDUSTRIAL FIELD

Dan Benţa, Lucia Rusu and Marius Ioan Podean

Faculty of Economics and Business Administration, Babeş-Bolyai University of Cluj-Napoca, Cluj-Napoca, Romania

Keywords: Risk management, Reference Class Forecasting, Utility function, Prospect theory, Implementation.

Abstract: Risk management process integration in project management plans is necessary to succeed in complex

projects. We structured our work in a conceptual background section and in our approach and results section

for a correct state of the problem and clearly present our implementation. The aim of this paper is to present

a deep literature review in terms of risk management roots and Reference Class Forecasting theories.

Results and analyzes from our industrial field are presented. This paper is the result of collaboration

between university and industrial field.

1 INTRODUCTION

Risk in plain usage is something going wrong and a

deviation from original plan. The Risk Management

Standard from Institute of Risk Management (PRM-

PMI®, 2009) defined risk as the combination of the

probability of an event and its consequences, with

risk management being concerned with both positive

and negative aspects of risk. Risk is gradually losing

the stigma of only being concerned with the negative

or downside. We now recognize the risk of us not

meeting our goals, a risk of missing an opportunity,

a risk of not recognising that something good is

happening. This is the positive, upside of risk,

evident in the widely used ‘risk/return’ tradeoff. If

there is no risk, there is often little return, and there

is often a higher return when the risk is higher

(Collier, 2009).

In this work we present risk management roots

and theories behind reference class forecasting.

Experimental results from our experience and

implementation are also presented.

After a brief overview of risk management

theories and roots, we present our approach and

implementation in a real business environement. In

our case, Reference Class Forecasting theories as

part of risk management field, helped in prognosis of

a current project based on past experiences in order

to deliver the project in predefined costs, time and

quality.

Our research focuses on probability theory and

makes a brief overview of utility theory (Bernoulli,

1954), (Hogarth, 1987) and prospect theory

(Kahneman, 1979a), (Kahneman, 1979b) as main

roots and influences for risk management.

As projects are unique in time and trajectory,

another main aspect of risk management is the

uncertainty which is inevitable in a project; from

this reason, a proactive risk management is the key

to succeed in complex projects.

In first part of this paper we provide conceptual

background and theories behind our work. Next

section is for our approach and implementation.

Finally, relevant conclusions and future work are

presented.

2 CONCEPTUAL BACKGROUND

In (Garvey, 2009), authors identify that probability

theory is the formal study of events whose outcomes

are uncertain. Its origins trace to 17th-century

gambling problems. Games that involved playing

cards, roulette wheels, and dice provided

mathematicians with a host of interesting problems.

The solutions for many of these problems

yielded the first principles of modern probability

theory. Today, probability theory is of fundamental

importance in science, engineering, and business

(Garvey, 2009).

2.1 Utility Function

In our previous work (Podean et al, 2010), we

43

Ben¸ta D., Rusu L. and Podean M..

SUCCESSFUL IMPLEMENTED THEORIES FOR REFERENCE CLASS FORECASTING IN INDUSTRIAL FIELD.

DOI: 10.5220/0003514200430046

In Proceedings of the International Conference on e-Business (ICE-B-2011), pages 43-46

ISBN: 978-989-8425-70-6

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

comprehensively described a structured

methodology that focuses on minimizing and

mitigating project specific delay risks and

highlighted that based on utility function, milestones

during project and/or the end of projects or

programme may be categorized in what are called

soft-deadline and hard-deadline (Podean et al, 2010).

In contrast with the soft-end projects, the hard-

end projects posses a decrease of utility function

with a vertical asymptote character around the

deadline for project completion. In extreme

situations, the utility function itself may fall under

zero (projects may generate losses to both

constructor and customer). Existing risk analysis

methodologies observe risks from monetary terms.

The typical risks are correlated with an increase in

final project costs. In order to estimate hard-deadline

milestones and/or end of projects or programme is

critical to employ the time dimension rather than the

typical cost-based risk analysis. Economists

distinguish between cardinal utility and ordinal

utility, the last being a rank-comparison of: options,

contracts, projects, execution quality etc. In risk

assessment activities, customer made already a

decision that company “YZ” is executing the

project. Therefore, the cardinal utility function over

time is more appropriate, while ordinal utility may

captures only ranking and not strength of

preferences (Podean et al, 2010).

2.2 Prospect Theory

The prospect theory was defined by Daniel

Kahneman and Amos Tversky (Kahneman, 1979a),

(Kahneman, 1979b) and is the basic theory in

Reference Class Forecasting.

Reference Class Forecasting for a particular

project requires the following three steps (Flyvbjerg,

2007):

Identification of a relevant reference class of

past, similar projects. The class must be broad

enough to be statistically meaningful, but

narrow enough to be truly comparable with

the specific project;

Establishing a Probability distribution for the

selected reference class. This requires access

to credible, empirical data for a sufficient

number of projects within the reference class

to make statistically meaningful conclusions;

Comparing the specific project with the

reference class distribution, in order to

establish the most likely outcome for the

specific project.

Those theories, that helped Kahneman win the

2002 Nobel Prize in Economics, are based on

some well-observed deviations from rationality,

including the following (Damodaran, 2008),

(Kahneman, 1979a), (Kahneman, 1979b):

Framing: Decisions often seem to be affected by

the way choices are framed, rather than the

choices themselves;

Nonlinear Preferences: If an individual prefers

A to B, B to C, and then C to A, she is violating

one of the key axioms of standard preference

theory (transitivity). In the real world, this type

of behavior is common;

Risk Aversion and Risk Seeking: Individuals

often simultaneously exhibit risk aversion in

some of their actions while seeking out risk in

others;

Source: The mechanism through which

information is delivered may matter, even if the

product or service is identical. For instance,

people will pay more for a good, based on how it

is packaged, than for an identical good, even

though they plan to discard the packaging

instantly after the purchase;

Loss Aversion: Individuals seem to feel more

pain from losses than from equivalent gains.

Individuals will often be more willing to accept a

gamble with uncertainty and an expected loss

than a guaranteed loss of the same amount, in

clear violation of basic risk-aversion tenets.

In his paper, (Flyvbjerg, 2007) agrees that when

contemplating what planners can do to improve

decision making, we need to distinguish between

two fundamentally different situations: (1) planners

and promoters consider it important to get forecasts

of costs, benefits, and risks right, and (2) planners

and promoters do not consider it important to get

forecasts right, because optimistic forecasts are seen

as a necessary means to getting projects started.

Kahneman and Tversky (Kahneman, 1979a),

(Kahneman, 1979b) replaced the utility function,

which defines utility as a function of wealth, with a

value function, with value defined as deviations

from a reference point that allows for different

functions for gains and losses. In keeping with

observed loss aversion, for instance (Damodaran,

2008), the value function for losses was much

steeper (and convex) than the value function for

gains (and concave) as presented in Figure 1.

The implication is that how individuals behave

will depend on how a problem is framed, with the

decision being different if the outcome is framed

relative to a reference point to make it look like a

gain as opposed to a different reference point to

ICE-B 2011 - International Conference on e-Business

44

Figure 1: A Loss Aversion Function (Damodaran, 2008).

convert it into a loss. Stated in terms of risk aversion

coefficients, Kahneman and Tversky assumed that

risk aversion coefficients behave differently for

upside than downside risk (Damodaran, 2008).

3 OUR APPROACH

AND RESULTS

Starting from Reference Class Forecasting theories

we developed a software application to estimate

delays in complex projects. We applied our

approach in industrial field, in energy sector. We

analyzes past projects, identify relevant features for

implemented projects and based on past experience

we provide realistic paths for a current project.

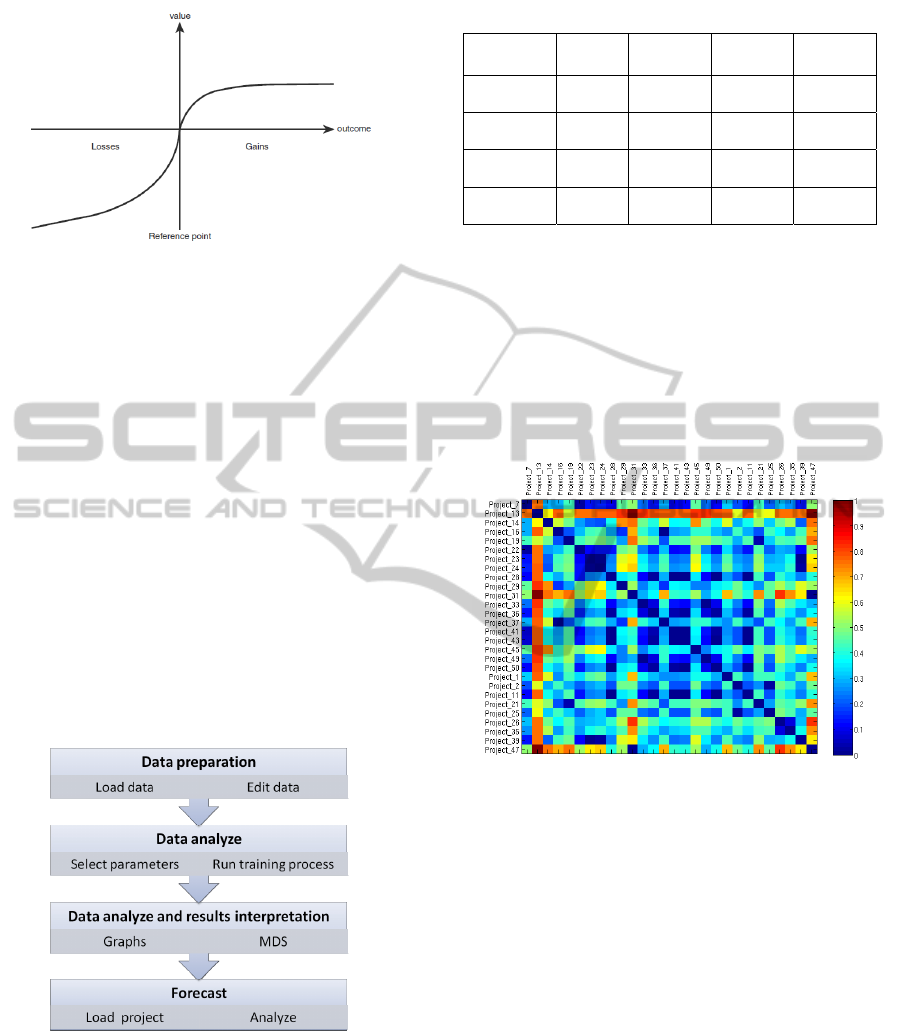

The application workflow is presented in the

following paragraphs.

Figure 2: Our application workflow.

We developed a modular UNIX based

application with high portability. Application

workflow is presented in Figure 2. In first step of the

application the user is allowed to load dataset with

projects and features. Our template for dataset is

presented in Table 1.

In this first step, minor modifications in dataset

Table 1: Dataset structure template.

Project

Name

Char1 Char2 … CharM

Project1 1x1 1x2 … 1xM

Project2 2x1 2x2 … 2xM

… … … … …

ProjectN Nx1 Nx2 … NxM

can be performed in order to have a clear dataset.

Next step is for data analyze where the training

process starts after a selection of max number of

neighbors and number of iterations of a random

assessment when using singular features. The

training process starts and relevant results and

graphics are presented. In our case, the algorithms

behind were implemented in Matlab and a relevant

graphic is presented in Figure 3.

Figure 3: Dissimilarity matrix.

Dissimilarity matrix displays the distance

between each two projects. The matrix is generated

after all features analyses and after identification of

most relevant features. In our case, a project was

defined by a set of hundreds of features and we

identified significant features for projects to correct

manage them.

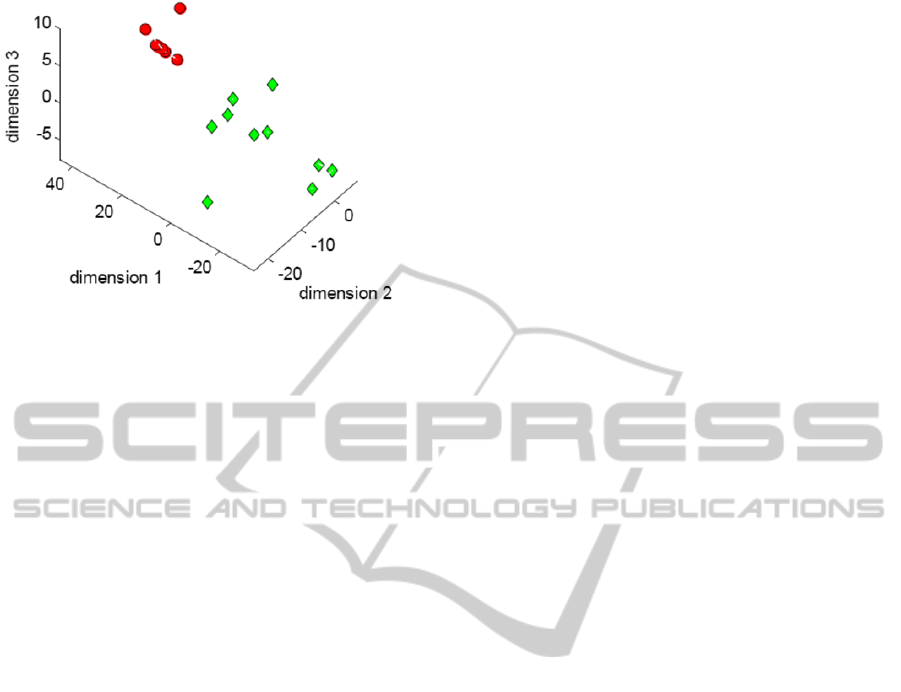

After data analyze and results interpretation step,

the application generates the Multidimensional

scaling (MDS) representation (Figure 4) with

projects grouped in on-time and delayed, and

provides tools to load a new “unknown” project to

compare and based on delays features it can be

positioned on closest class.

SUCCESSFUL IMPLEMENTED THEORIES FOR REFERENCE CLASS FORECASTING IN INDUSTRIAL FIELD

45

Figure 4: Multidimensional Scaling representation.

4 CONCLUSIONS

We consider our approach essential in order to

deliver projects in predefined costs and to avoid

delays by identifying relevant features that may

influence the project in a negative manner.

This approach supports Project and Risk

Management department to analyze and forecast

risks in future or existing projects in terms of delays.

Our approach improves the existing methodology by

introducing a feature selection learning step and this

tool is well designed to find the closest k

observations in the training set and to predict the

class of the "unknown" project profile by majority of

vote (the winning label of the neighbors).

A Reference Class Forecasting approach helps

project managers and stakeholders to estimate

potential risks and costs in a more realistic way and

to provide alternative paths.

Based on past experiences, this analyse provides

assistance in decisions on whether to implement or

not a project.

Results and interpretation for results are

presented in a detailed manner. We consider an

efficient approach that can be applied and adapted in

different fields.

We have developed a complex application for

risk management using reference class forecasting

that fits in the company structure and behaviour.

As subject for our future work, we intend to use

this approach in different fields. We also performed

several tests in financial sector and in large

investments projects to provide realistic paths, to

clearly identify things that can go wrong and to

highlight relevant features for a project to succeed.

ACKNOWLEDGEMENTS

This paper was supported by Romanian National

Authority for Scientific Research under the grant no.

PN2 92-100/2008 SICOMAP.

REFERENCES

Bernoulli, D., 1954. Exposition of New Theory on the

Measurement of Risk, Econometrica, 22, pp.23-36.

Collier, P. M., 2009. Fundamentals of Risk Management

for Accountants and Managers, Tools and Techniques,

Elsevier, ISBN–13: 978-0-7506-8650-1.

Damodaran, A., 2008. Why Do We Care About Risk?,

Strategic risk management. A Framework for risk

management, USA, New Jersey: Pearson Education,

Inc., pp.11-35.

Flyvbjerg, B., 2007. Eliminating Bias through Reference

Class Forecasting and Good Governance, Concept

Report No 17 Chapter 6, Concept-programmet.

Garvey, P. R., 2009. Elements of Probability Theory in

Analytical methods for risk management: a systems

engineering perspective, USA: Taylor & Francis

Group, LLC, pp.13-39.

Hogarth, R. M., 1987. Judgement and choice: The

psychology of decision. (2nd edition). Chichester,

England: John Wiley & Sons.

Kahneman, D., Tversky, A., 1979. Prospect theory: An

analysis of decisions under risk, Econometrica, 47, pp.

313-327.

Kahneman, D., Tversky, A., 1979. Intuitive Prediction:

Biases and Corrective Procedures, Studies in the

Management Sciences: Forecasting, 12, Amsterdam,

North Holland: S. Makridakis and S. C. Wheelwright,

Eds.

Podean, M.I., Benta, D., Mircean, C., 2010. Overlapping

boundaries of the project time management and

project risk management, Informatica Economică vol.

14, no. 4/2010, pp.156-163, Bucharest: INFOREC

Association.

PRM-PMI®, 2009. Practice standard for Project Risk

Management, Project Management Institute, Inc.

ICE-B 2011 - International Conference on e-Business

46