INVESTOR-MANAGER HETEROGENEOUS BELIEFS

AND CORPORATE FINANCING DECISION

Jian Ma and Zhixin Liu

School of Economic and Management, BeiHang University, Beijing, China

Keywords: Investor-Manager, Heterogeneous belief, Financing decision.

Abstract: This paper considers a firm that may issue common stock or debt to undertake an investment opportunity

when the investors and the manager have different estimates of the expected return from the investment.

Firstly, an equilibrium model is developed to reveal the impact of investor-manager heterogeneous beliefs

on corporate financing decision, and the model concludes that the greater the investors’ belief relative to the

manager, the more likely the firm is to choose to issue equity rather than debt. Secondly, using a sample of

debt and seasoned equity issues from Chinese listed firms we empirically analyze the conclusion above. We

find empirical results support for the conclusion.

1 INTRODUCTION

Modigliani and Miller (1958) posited that in an ideal

world the value of a firm depends only on its

profitability, not on the debt-equity mix, so that the

choice between debt and equity is irrelevant. This

issue initiated a flood of work analyzing this choice

in a world of imperfect and incomplete capital

markets. Jensen and Meckling (1976) has

concentrated on agency costs as a determinant of

corporate financing choice, and argued that the firm

should issue debt in order to avoid the incentive

dilution. Ross (1977) argued that the firm will not

issue 100% with debt because of high bankruptcy

costs, and the optimal amount of debt-equity finance

occurs when the costs associated with incentive

dilution are equal to the costs associated with

increased risk. Myers and Majluf (1984) analyzed the

financing decision by firms according to the “pecking

order” hypothesis because of issues relating to

control and disclosure. A key assumption of the

above modern corporate financing decision is

homothetic expectation. The investor and manager

are assumed to have identical estimates of the

expected return from the investment.

However, Miller (1977) argued that it is

implausible to assume identical estimate although the

future is very uncertain and that men may differ in

their forecasts what Miller called divergence of

opinion or heterogeneous belief.

After Miller (1977), the heterogeneous belief is

explored by many scholars. Kreps (1990) argues that

heterogeneous priors are a more general specification

than homogeneous priors. Kurz (1994) provides the

foundations for heterogeneous but rational priors.

Harris and Raviv (1993) use differences of opinion to

explain empirical regularities about the relation

between stock price and volume. Kandel and Pearson

(1995) make the case that their evidence of trading

volume around public information announcements

can be best understood within a framework in which

agents interpret the same information differently.

Barberis and Thaler (2002) note that a key ingredient

of behavioral models that provide explanations for

asset pricing anomalies is disagreement among

market participants. Garmaise (2001) examines the

implications of heterogeneous beliefs for security

design. Coval and Thakor (2005) show that

heterogeneous priors can give rise to financial

intermediation.

But the heterogeneous belief is considered less in

corporate financing decision. Allen and Gale (1999)

examine how heterogeneous priors affect new firm

financing. Boot, Gopalan and Thakor (2006) use

heterogeneous priors to develop a theory of

“managerial autonomy” that characterizes the

allocation of control rights among financiers and its

capital structure implications. Dittmar and Thakor

(2007) predicts that managers use equity to finance

projects when they believe that investors’ views

about project payoffs are likely to be aligned with

theirs.

384

Ma J. and Liu Z..

INVESTOR-MANAGER HETEROGENEOUS BELIEFS AND CORPORATE FINANCING DECISION .

DOI: 10.5220/0003434203840388

In Proceedings of the 13th International Conference on Enterprise Information Systems (ICEIS-2011), pages 384-388

ISBN: 978-989-8425-56-0

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

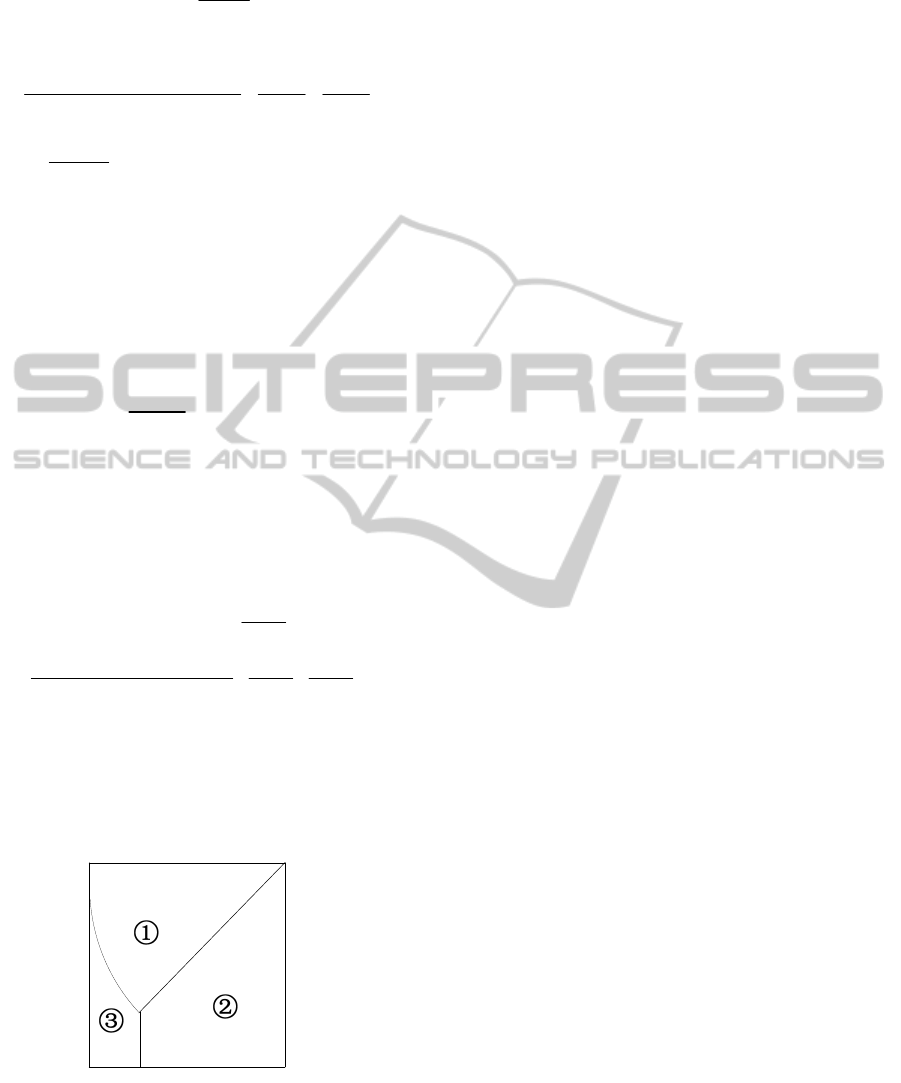

All-equity financed firm.•

y.opportunit investmentan of Arrival•

S. signal of Appearance•

Manager interprets signal as H with probility .

M

θ

•

0=t

1

=

t

2=t

Realization

of payoff

•

0

Assets in place have value .V•

Investors have the capital .a•

Investors interprets signal as H with probility .

I

θ

•

Figure 1: Sequence of events.

This paper develops a model and presents a new

prediction to reveal the impact of investor-manager

heterogeneous beliefs on corporate financing

decision, and tests the prediction using the data in

Chinese financial market. The rest of the paper is

organized as follow: Section 2 develops the model

and puts forwards a testable hypothesis. Section 3

describes sample selection procedure, and Section 4

discusses the empirical result. Section 5 concludes.

2 MODEL AND PREDICTION

2.1 Events and Time Line of Corporate

Financing decision

A model is developed briefly and the prediction is

presented in this section. There are three points in

time. The investors and the manager are risk-neutral,

the financial market is perfectly competitive, and the

risk-less rate and the debt rate are all zero. All

investors are assumed to have identical estimate of

the expected return from the investment. But the

manager and the investors have different estimate.

There are no transaction cost, asymmetry information

and tax.

At

0t =

, the firm is all-equity financed and has

an expected value of

0

V

. A new investment

opportunity arrives with the required investment

amount of

a

. The payoff of the investment is a

random amount of

{, }

Z

HL∈

, where

0LH<<

and

H

means high payoff and

L

means low payoff. The investors have the capital

value of

a

.

At

1t = , A public signal S about the investment

arrives. The manager will interpret the signal as

H

payoff with probability

M

θ

and the investors with

I

θ

. The manager decides to issue equity, debt or

desert the investment. If equity is chosen then a

fraction

λ

( 01

λ

<<) of the firm will be sold, so

the initial shareholders will have a claim to a

fraction

1

λ

−

of the terminal payoff. If debt is

chosen then repayment will have to be made at

2t

=

. If the manager deserts the investment then

the initial shareholders and the investors have zero

payoff.

At

2t

=

the payoff from the investment is

realized and the initial shareholders and the investors

get their own payoff.

2.2 The Predicted and Real Payoff of

the Manager and the Investors

If equity is issued then the manager predict that the

initial shareholder’s equity value is

0

()( (1 ))

E

MMM

VVaH L

λθ θ

=

++ ⋅ +− ⋅1-

and the

investors predict that their equity value is

0

((1))

E

III

VVaH L

λθ θ

=

++ ⋅ +− ⋅

. If debt is

issued then the manager predict that the initial

shareholder’s equity value is

0

(1 )

D

MM M

VV H L

θθ

=

+⋅+− ⋅

and the

investors predict that their debt value is

a

. If the

manager deserts the investment then the initial

shareholder’s equity value is

0

V

and the investors’

capital value is

a . The above results can be listed in

Table 1, where

(1 )

MM M

EH L

θ

θ

≡

⋅+− ⋅

,

(1 )

II I

EH L

θ

θ

≡

⋅+− ⋅

for simplicity.

Table 1: Predicted value of shareholder and investors.

Issue tape shareholder investors

Desert

0

V

a

Equity

0

()( )

M

VaE

λ

+

+1-

0

()

I

VaE

λ

++

Debt

0

M

VE

+

a

2.3 Corporate Financing Decision

under Heterogeneous Beliefs

When the following conditions are met the manager

will issue equity.

(1)

(2)

(3)

00

00

0

()( )

()( )

()

M

M

M

I

VaE VE

VaE V

VaE a

λ

λ

λ

++ > +

⎧

⎪

++ >

⎨

⎪

++ >

⎩

1-

1-

INVESTOR-MANAGER HETEROGENEOUS BELIEFS AND CORPORATE FINANCING DECISION

385

That is

IM

L

H

L

θθ

>>−

−

(4)

Or

00

2

()()()

I

M

Va V

L

H

LHLaLHLHL

θ

θ

>−−

−+−+ −−

,

M

L

HL

θ

>− >

−

(5)

When the following conditions are met the

manager will issue debt.

00

(1 )

MM

VH LV

θ

θ

+⋅+− ⋅>

, and

00

0

()( )

()

MM

I

VaE VE

VaE a

λ

λ

++ > +

⎧

⎨

++ >

⎩

1-

have no solution. That is

M

L

H

L

θ

>−

−

,

M

I

θ

θ

>

.

(6)

When the following conditions are met the

manager will desert the investment.

00

(1 )

MM

VH LV

θ

θ

+⋅+− ⋅<

, and

00

0

()( )

()

M

I

VaE V

VaE a

λ

λ

++ >

⎧

⎨

++ >

⎩

1-

have no solution. That is

M

L

HL

θ

<−

−

,

00

2

()()()

I

M

Va V

L

H

LHLaLHLHL

θ

θ

<−−

−+−+ −−

(7)

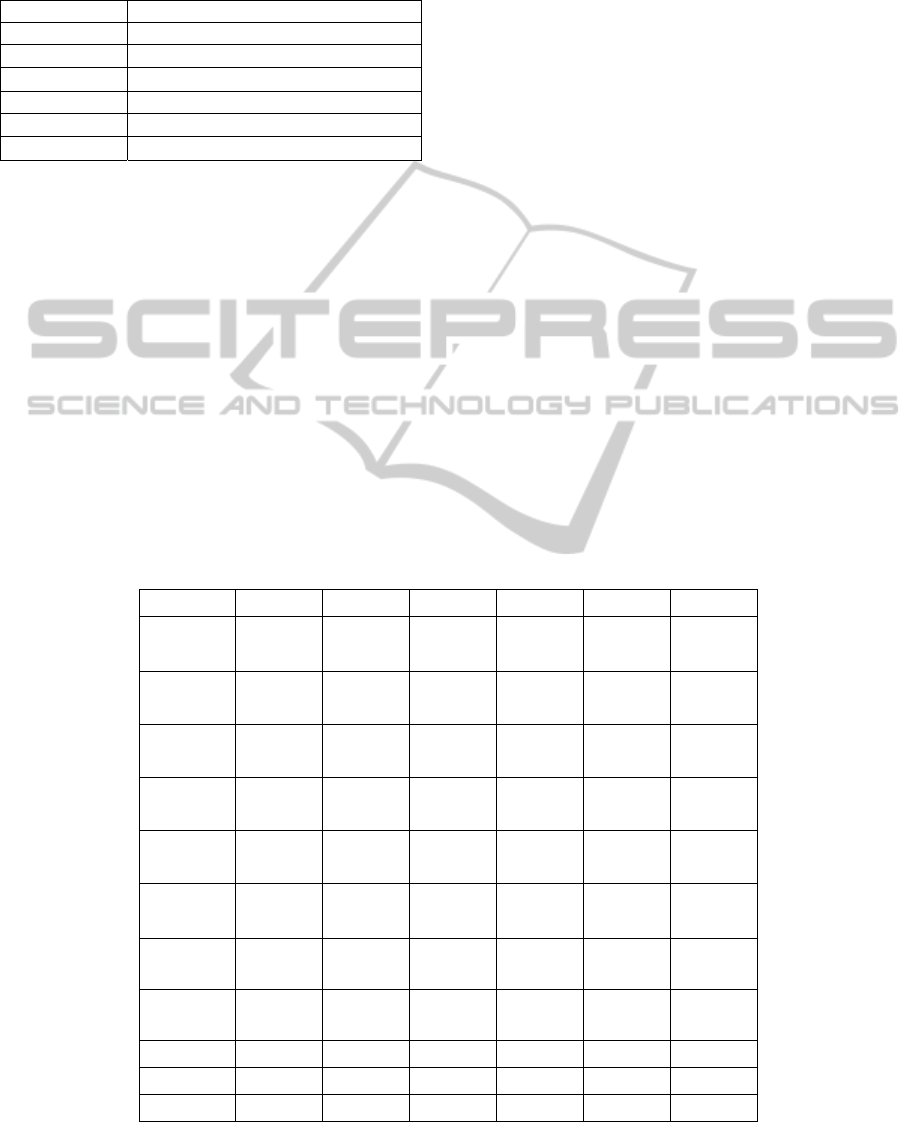

The above results can be expressed as Figure 2,

Where district ① means equity issue, district ②

means debt issue and district ③ means the manager

will desert investment.

I

θ

M

θ

E

D

F

G

1

0

1

Figure 2: Corporate financing decisions.

2.4 Testable Prediction

From the conditions (4)(5), we know that only the

investor’s predicted value is high enough can the

manager choose to issue equity. The condition (6)

shows that when the manager’s predicted value is

high enough the firm will issue debt. The condition

(7) shows that when the manager’s and the

investor’s predicted values are all low the firm will

desert the investment. So we have the following

prediction:

Prediction: The higher the difference between the

investor’s and the manager’s predicted value, the

more likely a firm tends to issue equity.

3 EMPIRICAL METHOD

3.1 Sample Selection and Source of

Data Description of Variable

We use a sample of firms that issue seasoned equity

or nonconvertible debt from Chinese A-share firms

listed in Shanghai and Shenzhen Stock Exchanges

between 2005 and 2010. This is because of the

absence of analysis earnings forecasts data and few

firms issue debt before 2005. All security issuance

data are from the Wind database. If a firm has

multiple issuances in a calendar year, we use only

the first issuance. We further delete the issues by the

following firms: (1) firms by ST, PT; (2) firms that

asset-liability ratio beyond 100%; (3) financial

firms. (4) firms with Chinese B-share, Honking-

share. This produces a sample of 443 seasoned

equity issuers and 431 nonconvertible debt issuers.

3.2 Description of Variable

(1) Dependent Variable (

TAPE

)

We use the discrete dependent variable

TAPE

to

describe manager’s issuance decision and assume

that

TAPE

equals 1 for an equity issuance and

equals 0 for a debt issuance.

(2) Independent Variable (

I

MHB

)

Following Lin, Hu and Chen(2005), Yu, Xia and

Zou(2006), we use the difference between the

analysts earnings forecasts and the announced

earnings by the firm at the fiscal year of the issue to

proxy the degree of heterogeneous beliefs between

the manager and investors.

(3) Control Variable

The other independent variables are described in

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

386

table 2. All control variables are measured at the end

of the year prior to the issue.

Table 2: This caption has one line so it is centered.

Variable name

Variable definition

L

nTA

log of total asserts

E

xTS

exchange-traded shares to total shares

RNA

return to net assets

InTS

institutional shares to total shares

TaTA

tangible assets to total asserts

DAMI

debt to assets minus the median

3.3 Methodology

We use Probit regression to test the theoretical

prediction due to the dummy independent variable.

The regression can be expressed as the following

equation (8), where individual firms are index

i

and

year

t

, and

)(⋅F

is the cumulative distribution

function of a standard normal variable. All the data

are disposed using the soft of eviews6.0 and

excel2003.

4 EMPIRICAL RESULT

Table 3 presents a series of Probit regression results

employing independent variables, such as

heterogeneous beliefs between the manager and

investors, log of total asserts, ratio of exchange-

traded shares to total shares, ratio of return to net

assets, ratio of institutional shares to total shares,

ratio of tangible assets to total asserts and the ratio

of debt to assets minus the median in its industry,

which may have impact on financing decision in

prior literature.

In terms of coefficient and significance of

variable, the coefficient of key variable

I

MHB

is

positive and significant at

%1

or 5% level in all

equations, which indicate that the higher the

heterogeneity of beliefs between the investors and

the manager, the more likely a firm is to issue

equity. The result empirically supports our

prediction and is consistent with Dittmar and

Thakor(2007) empirical result in American financial

market. Additionally, conclusions about control

variables are consistent with prior studies. We also

1,2,13,14,1

,

5,16 ,17 ,1

(1)

it it it it

rit

it it it

IMHB LnTA ExTS RNA

P TAPE F

InTS TaTA DAMI C

ββ β β

ββ β

−−−

−− −

⋅+⋅ +⋅ +⋅

⎛⎞

==

⎜⎟

⎜⎟

+⋅ +⋅ ++⋅ +

⎝⎠

(8)

Table 3: Probit regressions of the heterogeneous beliefs’ impact on corporate financing decision.

eq01 eq02 eq03 eq04 eq05 eq06

C

5.648***

(7.252)

5.698***

(6.547)

5.787***

(6.448)

5.294***

(5.759)

5.648***

(5.239)

5.661***

(5.651)

I

MHB

2.220***

(2.633)

2.205**

(2.542)

2.171**

(2.475)

2.327***

(2.599)

2.328***

(2.592)

2.328***

(2.589)

LnTA

-0.440***

(-7.313)

-0.473***

(-7.270)

-0.498***

(-7.374)

-0.459***

(-6.605)

-0.477***

(-6.360)

-0.486***

(-6.453)

ExTS

0.815**

(2.343)

1.003***

(2.720)

1.198***

(3.131)

1.148***

(2.937)

1.128***

(2.897)

RNA

1.139*

(1.647)

1.747**

(2.099)

1.707**

(2.041)

1.666**

(1.993)

I

nTS

-0.633*

(-1.933)

-0.620*

(-1.887)

-0.594*

(-1.794)

TaTA

-0.291

(-0.638)

D

AMI

0.467

(0.953)

2

M

cF R

0.120 0.143 0.155 0.158 0.159 0.160

LR

71.6*** 84.3*** 89.9*** 90.7*** 91.1*** 91.6***

.Obs

430 425 419 413 413 413

Note: *, **, *** indicate significance at 10%, 5%, 1%, respectively.

INVESTOR-MANAGER HETEROGENEOUS BELIEFS AND CORPORATE FINANCING DECISION

387

observe that

2

R McF

is increasing in the number of

variables, reaching its peak of 0.160, which supports

that every control variable has incremental

explanatory power over corporate financing

decision.

5 CONCLUSIONS

We present a model to investigate the relation

between corporate financing decision and the

heterogeneity of beliefs between the investors and

the manager. The model generates a new prediction

and we test it. Firstly, different values of the initial

shareholder and investors under the issues of equity,

debt and no financing are analyzed. Secondly, the

conditions on the issue of equity, debt and no

financing are confirmed respectively. Thirdly, the

prediction is presented based on the above two

conclusions. In the end, we empirically analyze the

impact of heterogeneity beliefs on security issuance

decision using a sample of issues from Chinese

financial market, and we find that heterogeneity

beliefs have explanatory power to security issuance

decision.

ACKNOWLEDGEMENTS

The authors thank National Natural Science

Foundation of China (Project No. 70821061).

REFERENCES

Modigliani, F., Miller, M. H., 1958. The cost of capital,

corporation finance and the theory of investment[J].

The American Economic Review, 48(6):261-297.

Jensen, M., Meckling, W., 1976. Theory of the Firm:

Managerial Behavior, Agency Costs and Ownership

Structure[J]. Journal of Financial Economics, 3(4):

305-360.

Scott, J. H. Jr., 1977. Bankruptcy, secured debt and

optimal capital structure[J]. Journal of finance,

32(1):1-19.

Myers, S. C., Majluf, N. S., 1984. Corporate financing and

investment decisions when firms have information

that investors do not have[J]. Journal of Financial

Economics, 13(2):187-221.

Miller, E. M., 1977. Risk, uncertainty and divergence of

opinion[J]. Journal of finance, 32(4): 1151-1168.

Kreps, D. M., 1990. A course in microeconomics[M].

Princeton, Princeton University Press.

Kurz, M., 1994. On the structure and diversity of rational

beliefs[J]. Economic Theory, 4(6): 877-900.

Harris, M., 1993. A Raviv. Differences of Opinion Make a

Horse Race[J]. Review of Financial Studies,

6(3):473-506.

Kandel, E., Pearson, Neil. D., 1995. Differential

interpretation of public signals and trade in

speculative markets[J]. Journal of Political Economy,

103:831-872.

Baker, M. P., 2002. Jeffrey Wurgler. Market timing and

capital structure[J]. Journal of Finance, 57(1):1–32.

Garmaise M. J., 2001. Rational beliefs and security

design[J]. Review of Financial Studies, 14(4):1183–

1213.

Coval J. D., Anjan V., 2005. Thakor. Financial

intermediation as a beliefs-bridge between optimists

and pessimists[J]. Journal of Financial Economics,

75(3):535–569.

Allen F., Gale, D. M., 1999. Diversity of opinion and

financing of new technologies[J]. Journal of

Financial Intermediation, 8(1):68~89.

Boot, A. W. A., Gopalan, R., Thakor, A. V., 2006. The

entrepreneur’s choice between private and public

ownership[J]. Journal of Finance, 61(2), 803–836.

Dittmar, A. K., Thakor, A. V., Why Do Firms Issue

Equity[J]. Journal of Finance, 2007, 62(1):1~54.

Lin, Y., Hu, S., Chen, M., 2005. Managerial Optimism

and Corporate Investment: Some Empirical Evidence

from Taiwan[J]. Pacific-Basin Finance Journal,

13(5):523-546.

Yu, M.G., Xia X.P., Zou Z.S., 2006. The Relationship

between Managers' Overconfidence and Enterprises'

Radical Behavior in Incurring Debts[J]. Management

World, (8):104-112,125. (in Chinese)

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

388