OPTIMIZING PRICE LEVELS IN E-COMMERCE

APPLICATIONS

An Empirical Study

Burkhardt Funk

Leuphana Universität Lüneburg, Scharnhorststraße 1, 21335 Lüneburg, Germany

Keywords: Electronic commerce, Pricing strategy, Price optimization, Price tests, Price dispersion, Non-interactive

prices, Demand curve, Posted prices.

Abstract: Price dispersion in the Internet is a well studied phenomenon. It enables companies to adjust prices to a

level appropriate to their strategy. This paper deals with question how Internet retailers should do so. The

discussed method optimizes short-term profitability by determining the exact demand curve. The method

involves the application of empirical price tests. For this purpose visitors of an Internet retailer are divided

in statistically identical subgroups. Using the A-B testing method different prices are shown to each

subgroup and the conversion rate as a function of price is calculated. We describe the organizational

requirements, the technical approach, and the statistical analysis applied to determine the price optimizing

the per-order profit. A field study carried out with a large Internet retailer is presented and shows that the

company was able to optimize a specific price component and thus increase the contribution margin per

order by about 7%. We conclude that the discussed method could be applied to answer further research

questions such as the temporal variation of demand curves.

1 INTRODUCTION

Over the last years the pricing of products and

services in the online channel has attracted

significant attention from the research community

(Chernev 2003, Daripa 2001, Kannan 2001, Spann

2004). Due to data availability most work has been

done on interactive pricing schemes and auction

theory with respect to Internet business models

(Roth 2002). While interactive pricing schemes

mostly apply to consumer-to-consumer scenarios

(e.g. eBay) they are rarely used in business-to-

consumer scenarios in which fixed prices

(sometimes referred to as posted prices) dominate

successful business models. In the area of fixed or

non-interactive prices some work has gone into the

study of price dispersion (Baye 2004, Brynjolfsson

2000) and price discrimination in different

circumstances, for example under consideration of

privacy issues (Böhme 2007, Odlyzko 2003).

Brynjolfsson and Smith (Brynjolfsson 2000)

have shown empirically that the Internet cannot be

considered to be a frictionless market but that price

dispersion can be observed for a wide range of

products (e.g. prices for books differ by an average

of 33%). They argue that, with respect to prices,

competition in a specific market and brand as well as

trust in a specific company remain a source of

heterogeneity among Internet retailers.

This result leaves room for companies to adjust

their price level for specific products and services to

the profit maximizing level. Empirical price tests

have been suggested as the appropriate means for

finding optimal "one-for-all" fixed prices (Baker

2001). To do so we apply the A-B testing method

(Patzer 1996) and show that for standardized goods

and services this approach supports price

optimization.

The contribution of this paper is twofold. First, a

method for optimizing fixed prices in e-commerce

applications is proposed and discussed in detail for

the first time in the scientific literature. Even though

the potential of the method has been pointed out

before, there has been no such detailed discussion.

Second, results of and issues encountered during a

field study carried out with a large German Internet

retailer are presented.

The paper is organized as follows: in the next

chapter we review related work, focusing on aspects

of non-interactive pricing. In chapter 3 we describe

37

Funk B. (2009).

OPTIMIZING PRICE LEVELS IN E-COMMERCE APPLICATIONS - An Empirical Study.

In Proceedings of the International Conference on e-Business, pages 37-43

DOI: 10.5220/0002186700370043

Copyright

c

SciTePress

the method and the basic assumptions of our work.

Chapter 4 deals with the environment of the field

study and the organizational and technical

implementation. The results section (chapter 5)

presents sanitized data from the field study, shows

how to derive the optimal price level and discusses

the implications with respect to the average cost per

acquisition. The conclusion briefly summarizes the

major ideas of the paper and directs attention to

where further research is needed.

2 RELATED WORK

With the advent of e-commerce it was assumed that

the Internet would reduce consumer search costs and

switching costs and that this would finally lead to

more competition and lower prices. This argument

was expected to take markets closer to the

theoretical model of perfect competition (Daripa

2001). However, price dispersion is observed not

only for heterogeneous products but also for

homogeneous ones like books and DVDs.

This phenomenon has often been studied (see the

paper from Baye et al. (Baye 2004) and for an

overview (Bock 2007)) and a number of possible

reasons have been suggested. Product differentiation

among retailers is one explanation. Differentiation

can happen along features, qualities, and services

thus softening price competition. In addition the

brand of a company and the loyalty of customers to

it play an important role in avoiding price

competition.

Furthermore, searching and comparing offerings

of identical products from different sites is

associated with costs. Hann and Terwiesch (Hann

2003) define these frictional costs as “the disutility

related to learning to navigate through websites, the

disutility of keying in order and payment

information, the cognitive costs of comparing

different offerings, and the opportunity cost of time

for the online transaction”.

Price dispersion in the Internet enables (and

forces) companies to set their own prices while

taking into account their strategic goals. There is a

large body of knowledge on how this can be

accomplished in the offline world (Simon 1996).

Setting prices is based on a customer’s willingness

to pay, the cost structure of the company under

consideration and the pricing policies of relevant

competitors. In some cases “strategic” dumping

prices or communication reasons (e.g. being

perceived as a high quality provider) are involved

when setting prices. More often prices are set in

order to optimize short or medium-term profit. To do

so the demand as a function of price has to be

determined. Different methods have been employed

to determine the demand curve: (i) customer and

expert interviews, (ii) market observation, and (iii)

lab and field experiments. Field experiments have

two major problems in the offline world: (i) menu

costs forbid changing prices often, thus reducing the

possible granularity of price tests, (ii) price tests are

carried out either at different locations at the same

time or at the same location at different times –

therefore, interpreting results requires taking into

account potentially different environments. Online

price tests can overcome these difficulties and lead

to accurate and realistic demand curves, which can

then be used to find the optimal prices with respect

to profit maximization.

3 METHODOLOGY

3.1 Assumptions and Limitations

Visitors of an e-commerce site form a heterogeneous

group in terms of characteristics such as age, sex,

education, purchasing power, and, what is important

for our work, the willingness-to-pay for a given

product or service. However, provided that the group

of all visitors is sufficiently large, dividing visitors

randomly into subgroups (not necessarily of the

same size) leads to these subgroups having identical

characteristics as the base group. That means that for

example the fraction of persons between 20 and 30

years old is – within the margin of statistical error –

the same for each subgroup. To generate subgroups,

visitors are assigned to one of the subgroups

randomly (e.g. on a rolling basis) when they enter

the e-commerce site. This facilitates the application

of A-B tests for several purposes, e.g. the

optimization of click-through rates for different

landing pages.

The method works for standardized goods only

and assumes that the price sensitivity of customers

remains constant over time. It is obvious that this is

a simplifying assumption which should be examined

in more detail. Furthermore, the method requires the

e-commerce site to have enough visitors and

transactions (what ‘enough’ means is defined below)

as well as to offer enough technical flexibility to

vary posted prices. It should be emphasized that we

do not address or propose price discrimination and

visitor/customer segmentation based on accessible

properties such as the internet service provider, the

technical configuration of the browser, or the

ICE-B 2009 - International Conference on E-business

38

referrer URL, even though A-B tests could also

serve this purpose.

3.2 Method Description

An e-commerce service involves several price

components such as the prices for the product

ordered, a service charge, an express shipping fee, a

fee for using specific payment methods but also

posted discounts on all these components. At the

beginning of a study, using the method described in

this paper, it has to be decided what price

component should be observed and optimized and

what the appropriate price range for this component

might be. The price range may depend on e.g.

competitor’s prices and own cost structures.

During the study, customers from each subgroup

are provided with different (discrete) prices chosen

from the above price range. Then conversion rates –

that is the ratio of buyers to visitors – are calculated

for each subgroup. This allows us to find the

demand curve, which does not calculate the absolute

amount as a function of price as is usually done, but

instead the conversion rate as a function of price. If

we disregard temporal changes of the demand curve

due to, for example, seasonal or weather related

fluctuations (see assumptions and limitations) we

can determine the conversion rate with as much

precision as desired, with the only limit being the

statistical error which is related to the number of

visitors and buyers in each subgroup. Given a range

of prices to be tested the number of subgroups

corresponds to the granularity of the price test. The

number of possible subgroups in turn depends on the

number of visitors and buyers in the period of time

of the price test and the desired precision of the

conversion rate.

Online price tests overcome the two major

problems stated in the previous chapter: (i) once the

proposed method in this paper is technically

implemented the menu costs, and thus the cost of

changing prices, decrease substantially, (ii) since the

different prices are displayed virtually at the same

time in (with respect to their characteristics)

identical subgroups there are no differences between

the environments.

In principle this approach is able to optimize the

interplay of price components and use insights from

studies like the one by Hamilton and Srivastava 0.

For example, the interplay between the product

price P

i

and a standard service charge S

j

and how

these prices are perceived by customers might be

studied.

Table 1: P

i

und S

j

represent the different prices charged in

the price test. CR

i,j

is the observed conversion rate at

prices P

i

und S

j

. The price test involves using 16

subgroups.

P

1

P

2

P

3

P

4

S

1

CR

1,1

CR

1,2

CR

1,3

CR

1,4

S

2

CR

2,1

CR

2,2

CR

2,3

CR

2,4

S

3

CR

3,1

CR

3,2

CR

3,3

CR

3,4

S

4

CR

4,1

CR

4,2

CR

4,3

CR

4,4

This involves offering the subgroups a number of

combinations regarding the individual price

components and calculating the conversion rate

(Table 1). This also allows the study of price-

dependent substitution effects between products.

These studies are only limited by the number of

visitors and buyers per subgroup needed for a

statistically valid statement, and so the number of

possible subgroups.

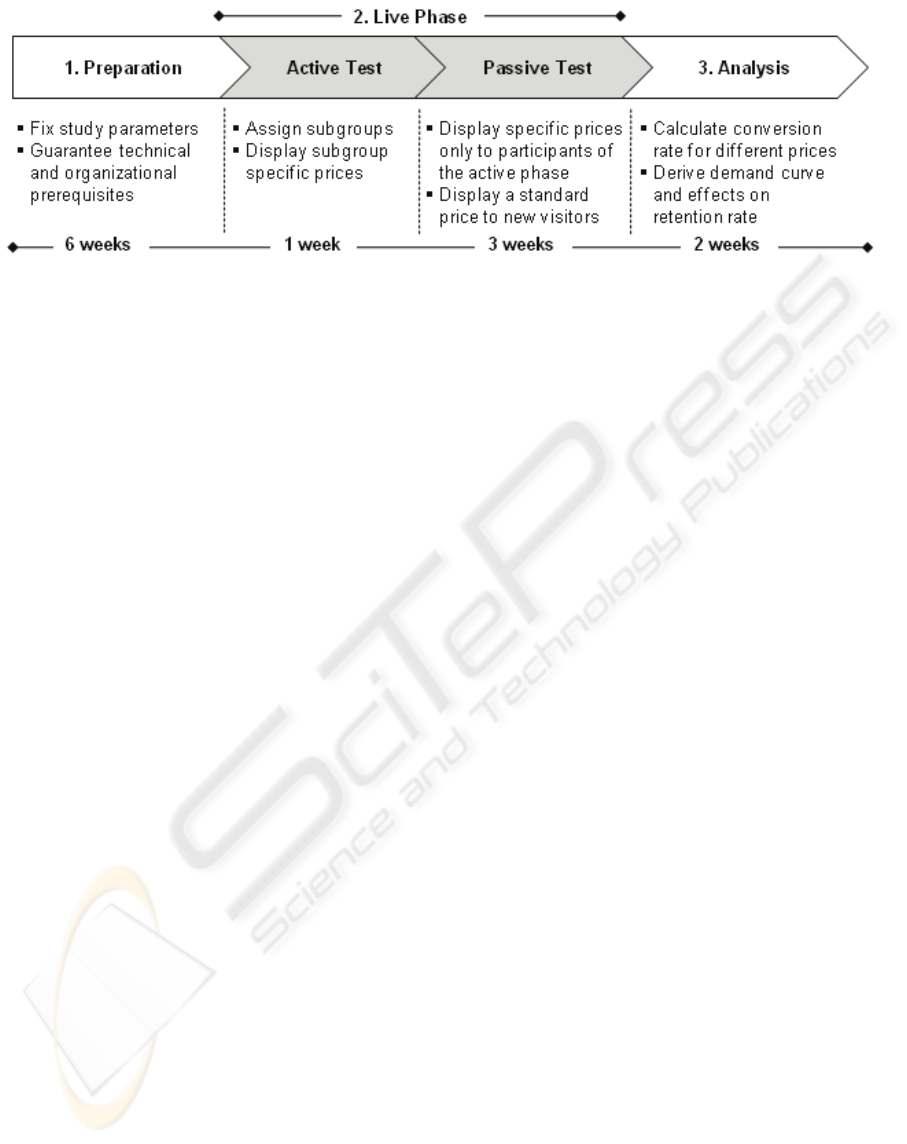

3.3 Phases

The price test is carried out in three phases (see

figure 1). In the first phase we fix the price

component to be studied, the range containing the

expected profit-maximizing price and the duration of

the test needed for statistical validity. In addition the

technical (generating subgroups, providing them

consistently with different prices, collecting data)

and organizational requirements (communication

policies, customer service training) have to be taken

care of. The second phase, which we call the live

phase, is subdivided into two time periods. In the

first period all visitors are assigned to one of the

subgroups at their first visit and are shown the

respective price for the subgroup. Alternatively, for

high traffic sites only a fraction of all customers are

selected to participate in the price test (as in the field

study), since this fraction is already large enough to

allow for valid conclusions. In the second period of

the live phase the changed prices are only shown to

those visitors who already visited the site during the

first period of the live phase (how visitors are

identified is discussed in the next chapter). Visitors

who ‘enter’ the store for the first time in the second

period are shown a standard price. This procedure

allows recording the effect of changed prices on the

customer retention rate. The third phase concerns

data analysis and interpretation.

OPTIMIZING PRICE LEVELS IN E-COMMERCE APPLICATIONS - An Empirical Study

39

Figure 1: Overview of the actions in the three main phases, the time periods refer to the field study.

4 IMPLEMENTATION

4.1 General Aspects

The kind and scope of technical changes required for

the price test depend on the technical system being

used in the front- and backend and its flexibility

The two most important technical requirements

for a successful price test consist of the reliable

identification of visitors (as far as possible) as well

as a consistent communication of the specific price

per subgroup based on their identification. These

requirements have to be fulfilled for both the front-

and the backend. In the frontend cookies and URL

encoded session IDs can be used for the

identification of visitors and their assignment to a

subgroup, in the backend only customers are

handled and thus, the identification is easy. Visitors

that does not permit persistent cookies should be

excluded from the price test and be showed a

standard price. If visitors delete cookies regularly

they may be quoted different prices for the same

product in consecutive visits. An alternative

approach to using cookies for identifying subgroups

is to use a so-called fingerprint, which is generated

based on the technical configuration of a visitor’s

browser (user agent, operating system, version,

resolution). This approach is robust against cookies

being deleted, but may lead to subgroups not being

identical in their characteristics. For example Firefox

users could share a greater willingness to buy a

given product than users of Internet Explorer and so

influence the conversion rate independently of the

price. To avoid displaying different prices to a

visitor who uses different computers is almost

impossible and would require the visitors to identify

themselves by login before seeing prices, which is

uncommon in B2C systems.

Besides ensuring the re-identification of visitors

the system must guarantee that the posted prices are

the ones that are actually processed in the financial

system and that a customer is charged accordingly.

The posted prices also have to be taken into account,

both in electronic (confirmation email, FAQs) and in

paper-based (invoice) communication with the

customer. Ensuring these technical requirements are

fulfilled can, depending on the technical platform

being used, involve considerable expense.

4.2 Field Study

We will illustrate the technical implementation of

the price test using our field study (Knoop 2004).

The research site is a German e-commerce site with

an annual revenue of about 100 million euros at the

time of the study. The site offers a large number of

products (>10,000), whose individual prices vary

only slightly between the company’s and its

competitors. The technical platform is a Java-based,

proprietary web application which is operated,

maintained and further developed by the IT

department of the company. The backend system

was also individually developed for the company.

In the preparatory phase (outlined in section 3),

we decided at the beginning of the project that rather

than test individual product prices we would study

the optimization of the service charge collected with

each order. With respect to the technical

implementation we decided to use cookies to

identify users participating in the price test. When a

visitor arrived on the web site during the live phase

it was checked whether he already had a cookie

related to the price test. If not, a cookie was set

containing information about which subgroup the

visitor had been assigned to. If there was already a

“price test cookie”, it was used to show the

appropriate service charge for the subgroup. In

addition to the cookie, a session ID was generated

that contained an ID referring to the appropriate

ICE-B 2009 - International Conference on E-business

40

subgroup (SGID). Since the shop system supported

URL rewriting (hence URLs contained the SGID),

users who bookmarked the site and deleted the

cookies could still be identified as belonging to a

particular subgroup. Furthermore the SGID was used

to communicate and use prices consistently

throughout the shopping process of the visitor, even

when cookies were not enabled by the user.

The first time the visitor saw the service charge

was in the electronic basket. Therefore the

conversion rate for each subgroup was not

determined as the plain ratio of buyers to total

visitors but as the ratio of buyers (with a certain

SGID) to visitors (with the same SGID) who entered

the electronic basket at least once during their

session and so were able to see the service charge (in

the following chapter this value is referred to as

CR

Basket

).

The first phase (including project set-up,

software design and implementation as well as

internal communication and preparation) took about

six weeks. The first part of the live phase took about

6 days, the second part about 3 weeks. Results were

presented 3 months after the beginning of the

project.

Alongside the technical requirements there are

also organizational ones. Obviously price tests

should be managed by the department/ people

responsible for price management in the company

taking into account what the limits with respect to

strategic positioning and competitors are.

Furthermore, before starting the price test employees

who actively enter into contact with customers of the

website (especially service staff) or who are

contacted by customers need to be informed and

trained in how to deal with price enquiries by

telephone and email, canceling orders and possible

complaints about different prices caused by the price

test. In the latter case the service staff was asked to

communicate the display of different prices as a

technical error and to apologize by sending out a €5

gift certificate to the complaining visitor/ customer.

As long as the number of gift certificates sent out is

small it does not impact the price test.

5 RESULTS

Before the price test the service charge was €2.50

per order. At the beginning we decided to investigate

the price range between €0.00 and €7.50. In order to

be able to reach valid conclusions after a short

period of time it was decided to test four values for

the service charge (€0.00/ €2.50/ €5.00/ €7.50).

Following basic statistics with respect to the

necessary sample size, the required time period for

the test can be estimated by:

()

2

1

B

in Basket Basket

Test

B

CI

NCRCR

e

T

V

⎛⎞

−

⎜⎟

⎝⎠

≈

where N

Bin

is the number of subgroups (=4), CI is

the chosen confidence interval (=1 σ),

e

is the

allowed error (=1%), CR

Basket

is the ratio of buyers to

visitors who have seen the electronic basket (~40%,

as an approximate value before the price test was

carried out), and V

B

is the number of visitors seeing

the electronic basket per day (=1,500 per day, here

only a fraction of all visitors to the website

participated in the price test). A calculation using

company data from the field study leads to necessary

time period for the study T

Test

of 6.4 days. The price

test was carried out on 6 consecutive days and

yielded the following results.

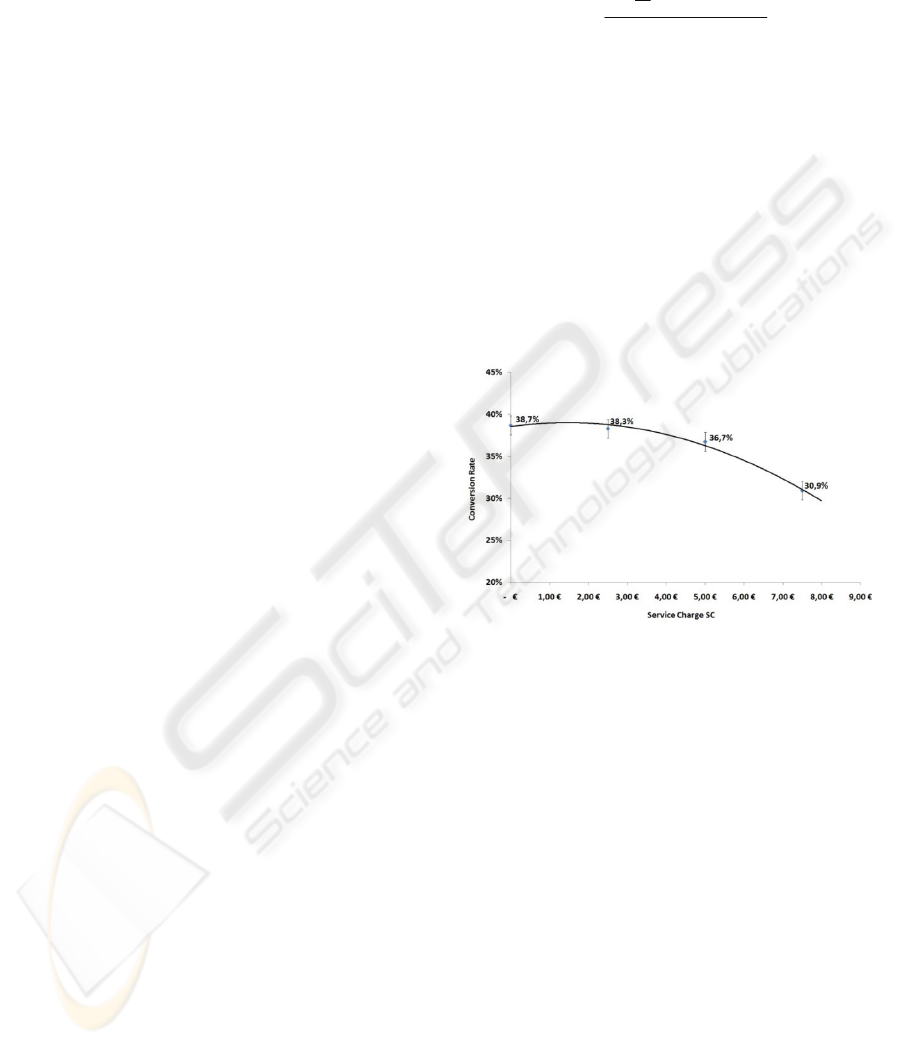

Figure 2: For each of the 4 subgroups there is one data

point shown in the figure above covering the range from

€0.00 to €7.50. The sample size is about 1,900 for each

data point and so the error is about +/- 1.1%, slightly

above the planned value of 1.0%, which is due to the fact

that the sample size turned out to be a bit lower than

expected.

5.1 Interpretation

Figure 2 shows the dependency of the basket

conversion rate CR

Basket

as a function of the service

charge SC. As expected, the conversion rate

decreases (statistically significant) with the service

charge, indicating the customer’s decreasing

willingness to pay the increasing service charge. It

should be emphasized that each data point (and the

corresponding samples) consists of sales with a wide

variety of products and a wide range of prices.

Nevertheless, allowing for standard deviation the

samples are identical. At this point the exact

functional dependency is not important for the

argument and thus we decided not to use theoretical

OPTIMIZING PRICE LEVELS IN E-COMMERCE APPLICATIONS - An Empirical Study

41

functions from microeconomics. For practical

purposes, in the field study the empirical data were

fitted using a second order polynomial function

CR

fit

:

32 3

( 2.2 0.6) 10 (6, 2 5.1) 10 (0, 385 0.008)

fit

CR SC SC

−−

=− ± ⋅ • + ± ⋅ • + ±

In order to find the optimal service charge the full

economics of the company under consideration had

to be taken into account. In this paper we initially

make the following simplifying assumptions (more

realistic assumptions would not change the main

results of the study): the service charge should be set

in such a way that it maximizes the average

contribution margin of a visitor who has seen the

electronic basket. We assume that the contribution

margin of a single order is given by CM

prod

+ SC –

C

S

, where CM

prod

is the average contribution margin

of the products sold in an average order and C

S

(=

€3.00) is the internal order fulfillment cost

(including e.g. postage, wages, machines). For our

analysis CM

prod

(= €18.00) is assumed to be

independent of SC, even though the average revenue

in a subgroup per visitor (and thus the contribution

margin) might be positively correlated with SC,

since it is likely that the willingness to accept a

higher service charge will rise with increasing

revenue. Formally, the problem is to find

:max

visitor

SC ACM

(

)

()

visitor fit prod S

A

CM CR SC CM C SC=−+

where ACM

visitor

is the average margin

contributed by each visitor who sees the electronic

basket at least once during his visit. Applying the

above values the optimal service charge is about

€5.50 compared to a service charge of €2.50 at the

beginning of the field study. By setting the service

charge to €5.50, the average contribution margin per

visitor ACM

visitor

could be increased by 7% from

€6.78 to €7.25.

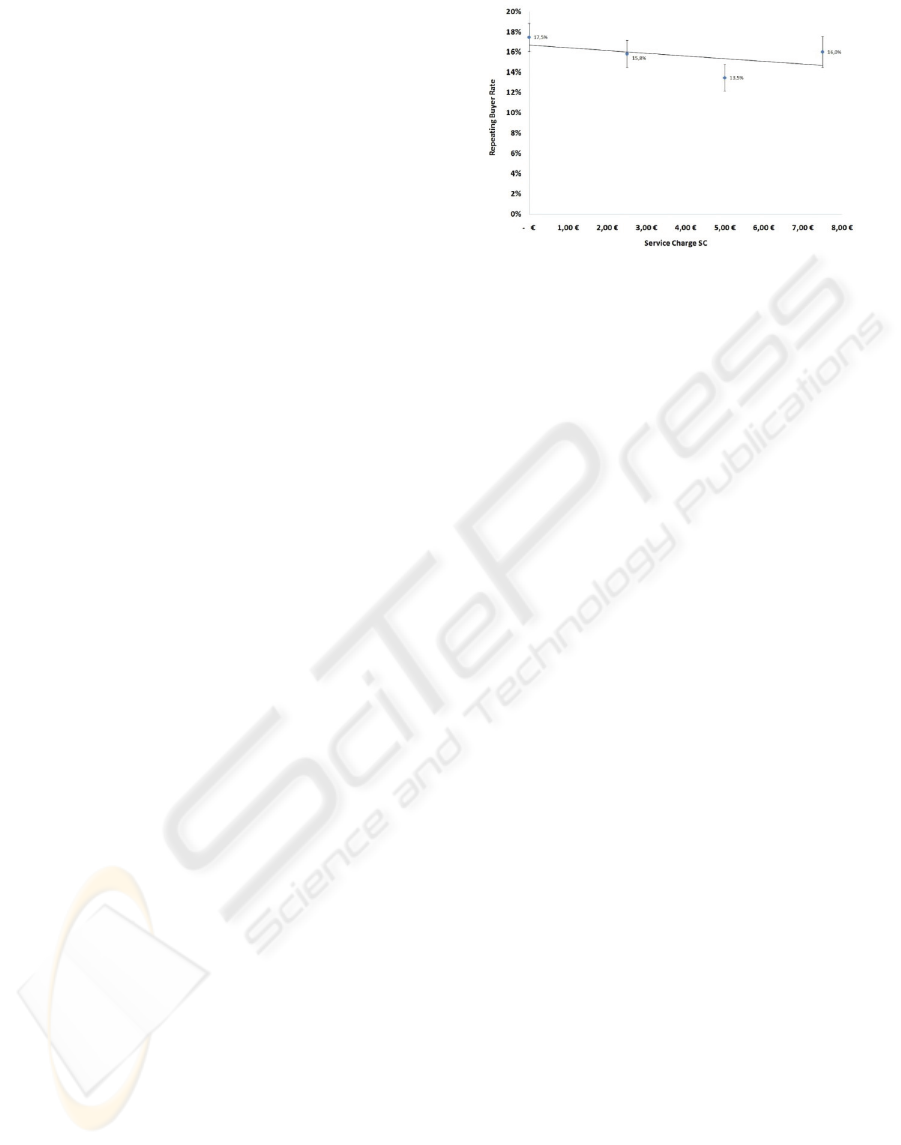

5.2 Long-term Impact

The procedure described above optimizes the

contribution margin of an individual visitor with

respect to his first order. As an indicator for the

long-term impact on customer retention we use the

repeat buyer rate (what fraction of customers comes

back after their initial order?) for the respective

subgroups. It should be emphasized that the repeat

buyer rates were calculated only for the test period.

Figure 3: For each subgroup the fraction of buyers that

bought again during the test period is determined.

Figure 3 shows only a slight dependency of the

repeat buyer rate on the service charge. The slope of

the linear function in fig. 3 is 0.27 ± 0,31 % per

EUR and thus not significantly different from 0.

More data would be needed to prove or exclude such

a dependency. A negative correlation between the

repeat rate and the service charge would indicate

that some customers are willing to buy once at a

higher service charge but subsequently use

alternative offerings. In order to optimize long-term

profit this relationship would have to be taken into

account in future studies.

5.3 Customer Complaints

During the study there were less than 10 complaints

from customers by email and telephone related to

the observation of different prices. The majority of

these complaints came from existing customers who

knew the original service charge and first noticed the

supposed increase after ordering. These customers

were not told the reason for the change but instead

received a €5.00 gift certificate. The overall

complaint rate was lower than that expected at the

beginning of the field study and had no influence on

the outcome.

6 CONCLUSIONS AND FURTHER

WORK

This paper deals with one of the fundamental

questions in economics: what is the optimal price of

products and services? The method described in this

paper enables e-commerce companies to determine

the exact demand curve represented by the

conversion rate as a function of price. The accuracy

of this method is only limited by statistical means.

The field study shows that employing the method

ICE-B 2009 - International Conference on E-business

42

involves only limited expense and effort while

significantly increasing the profitability of the

company under consideration.

There is a large body of research around the

topic of price dispersion in the Internet but only a

limited amount of work has gone into studying what

are the resulting degrees of freedom for companies

and how they should use them. This paper opens

substantial opportunities for future studies on this

topic. Research questions include for example: (i)

How does the demand curve change over time? (ii)

What impact do the brand awareness of a company

and the uniqueness of its products have on the

demand curve? (iii) What kinds of reciprocal

dependencies are there between price components of

an order (Hamilton 2008)? (iv) Can user groups be

identified that demonstrate varying degrees of

willingness to pay? (v) Do we have to take customer

life time value into account when optimizing the

long-term profitability?

This paper is meant as a starting point for

discussion and further research related to optimizing

prices in e-commerce by determining the exact

demand curve for products and services in different

circumstances.

ACKNOWLEDGEMENTS

The comments from the unknown referees are

gratefully acknowledged.

REFERENCES

Baker, W. L., Lin, E., Marn, M. V., Zawada, C. C.,

Getting prices right on the Web, McKinsey

Quarterly, no. 2, p. 54-63, 2001

Baye, M. R., Morgan, J., Scholten, P., Price Dispersion in

the small and in the large: evidence from an internet

price comparison site, Journal of Industrial

Economics, vol. 51, no. 4, p. 463-496, 2004

Böhme, R., Koble, S., Pricing Strategies in Electronic

Marketplaces with Privacy-Enhancing Technologies,

Wirtschaftsinformatik, vol. 49, no. 1, p. 16-25, 2007

Bock, G. W., Lee, S.-Y. T., Li, H. Y., Price Comparison

and Price Dispersion: Products and Retailers at

Different Internet Maturity Stages, International

Journal of Electronic Commerce, vol. 11, no. 4, p.

101, 2007

Brynjolfsson, E., Smith, M. D., Frictionless Commerce? A

Comparison of Internet and Conventional Retailers,

Management Science, vol. 46, no. 4, p. 563-585, 2000

Chernev, A., Reverse Pricing and Online Price Elicitation

Strategies in Consumer Choice, Journal of Consumer

Psychology, vol. 13, no. 1, p. 51-62, 2003

Daripa, A., Kapur, S., Pricing on the Internet, Oxford

Review of Economic Policy, vol. 17, p. 202-216, 2001

Hamilton, R. W., Srivastava, J., When 2 + 2 Is Not the

Same as 1 + 3: Variations in Price Sensitivity Across

Components of Partitioned Prices, Journal of

Marketing Research, vol. 45, no. 4, p. 450-461, 2008

Hann, I.-H., Terwiesch, C., Measuring the Frictional Costs

of Online Transactions: The Case of a Name-Your-

Own-Price Channel, Management Science, vol. 49, no.

11, p. 1563-1579, 2003

Kannan, P.K., Kopalle, P., Dynamic Pricing on the

Internet: Importance and Implications for Consumer

Behavior, International Journal of Electronic

Commerce, vol. 5, no. 3, p. 63-83, 2001

Knoop, M., Effective pricing policies for E-Commerce

Applications – a field study, internal thesis, University

of Applied Science Lüneburg, 2004

Odlyzko, A., Privacy, economics, and price

discrimination on the Internet, in Proceedings of the

5th international conference on Electronic commerce,

ACM, p. 355-366, 2003

Patzer, G. L., Experiment-Research Methodology in

Marketing: Types and Applications. Westport,

Connecticut: Quorum/Greenwood, 1996

Roth, A. E., Ockenfels, A., Last-Minute Bidding and the

Rules for Ending Second-Price Auctions: Evidence

from eBay and Amazon Auctions on the Internet, The

American Economic Review, vol. 92, no. 4, p. 1093-

1103, 2002

Simon, H., Dolan, R. J., Power Pricing: How Managing

Price Transforms the Bottom Line, The Free Press,

New York, 1996

Spann, M., Skiera, B., Schäfers, B., Measuring individual

frictional costs and willingness-to-pay via name-your-

price mechanisms, Journal of Interactive Marketing,

vol. 18, no. 4, 2004

OPTIMIZING PRICE LEVELS IN E-COMMERCE APPLICATIONS - An Empirical Study

43