FORMULATING ASPECTS OF PAYPAL IN THE LOGIC

FRAMEWORK OF GBMF

Min Li and Chris J. Hogger

Department of Computing, Imperial College London, U.K.

Keywords: GBMF, Business model, PayPal, Prolog.

Abstract: Logic-based modelling methods can benefit business organizations in constructing models offering flexible

knowledge representation supported by correct and effective inference. It remains a continuing research

issue as to how best to apply logic-based formalization to informal/semi-formal business modelling. In this

paper, we formulate aspects of the general business specification of PayPal in logic programming by

applying this in logic-based GBMF which is a declarative, context-independent, implementable and highly

expressive framework for modelling high-level aspects of business. In particular, we introduce the primary

PayPal business concepts and relations; specify simple but essential PayPal business processes associated

with a knowledge base, and set core business rules and controls to simulate the PayPal case in a fully

automatic manner. This specific modelling method gives the advantages of general-purpose expressiveness

and well-understood execution regimes, avoiding the need for a special-purpose engine supporting a

specialized modelling language.

1 INTRODUCTION

Business changes fast, so do business rules/logic. No

company can guarantee an ever-effective structure

which requires no further change. The research

methods on how best to model or describe a business

organization should also advance with the times.

However, the majority of business models in the

market are comparatively weak in dealing with fast-

changing businesses, because a certain number of

them are purpose-built with a short lifetime. In this

circumstance, we believe it is necessary to abstract

the commonality of various businesses with different

types and scales, and then build a generic modelling

framework, on which any given business could be

further specified and modelled. We also argue that

an admissive formal method should be used to build

this framework in order to make it extensible, fault-

tolerant, easy to understand, and expressive.

Our related work in the field of formal business

modelling focuses on conceptual and logical aspects

of business of a general nature. As the foundation of

our work, we established a Generic Business

Modelling Framework (named GBMF) which is

mostly declarative, implementable, context-

independent, and of high expressiveness for

modelling high-level aspects of business. In the

implemented GBMF, business plans and action sets,

dynamically spawned processes, ontological

variables and manageable assets with rich

information are expressible transparently using an

economical repertoire of primitive constructs,

without requiring overly-burdensome programming

effort. To better demonstrate the beauty of GBMF

and its expressive power, we introduce the PayPal

case study. We firstly define those core business

plans aiming for personal users and corresponding

action knowledge base to interpret those plans. We

also build a small number of controls which are

required to ensure the main program continuously

and automatically output a certain amount of data

for analyzing business further.

The contributions of this paper can be

summarized as follows:

It introduces GBMF, an all-round framework

for representing diversified generic business

entities and their relations;

It implements an executable simulator upon

GBMF to simulate given business instances in

a automatic way;

It applies the PayPal case to GBMF. The

further analysis enables users to retrieve

essential information from ontological

variables and assets.

39

Li M. and Hogger C. (2009).

FORMULATING ASPECTS OF PAYPAL IN THE LOGIC FRAMEWORK OF GBMF.

In Proceedings of the 11th International Conference on Enterprise Information Systems - Artificial Intelligence and Decision Support Systems, pages

39-44

DOI: 10.5220/0001858600390044

Copyright

c

SciTePress

In section 2 we discuss the related work. Section

3 outlines the basic structure and key concepts of

GBMF. We introduce the PayPal business protocol

in Section 4. Section 5 simply analyzes the

implementation of PayPal simulation. Finally, in

section 6 we present conclusions.

2 RELATED WORK

Existing business models vary from the abstract

level, investigating macroscopic business concepts

or general axiomatizations, down to the concrete

level, working on context specific implementations.

At the abstract level, many recommendations

exist as to the macroscopic concepts that need to be

considered in modelling business (Fox, 1998)

(Affua, 2003). There are clearly intersections and

exclusions among these works, but ascertaining it

precisely is difficult since not all of them are given

sufficiently formal anchorage. Whilst there are many

others intended for facilitating their design and

implementation, categorized as the concrete level.

Early exemplars include the business process

modelling methods IDEF0 (NIST, 1993) and PSL

(Schlenoff, 1997).

More recently, there emerges a community

exposing detailed commitments to representation,

formalization, logic and behaviours of business

models, whose research can be classified as a mid-

level in between abstract and concrete levels. From

their views, concepts and behaviour formulation,

logical transparency and expressivity power are all

subtle factors for a business company in choosing

their models. (Chen-Burger, 2002) expresses

conditions and actions of business processes,

relationships between them and constraints on the

data they deal with. Gordijn proposes an ontology-

based conceptual model named e3value, focusing on

modelling conceptualization and e-business

ontology, which is compared in detail by (Gordijn,

2005) with BMO (Osterwalder, 2005). The FBPML

(Chen-Burger, 2002; Kuo, 2003), as a sophisticated

amalgamation and extension of features drawn from

PSL and IDEF3, is declarative, using logic to

describe features of, and relations over, business

processes. Although sharing similarities with

GBMF’s basic representations of actions, entities

and process logic and behaviour, FBPML is a

purpose-built language requiring its own custom-

built engines and tools. GBMF is written directly in

the general-purpose Prolog language and so freely

inherit all the representational and execution power

of that formalism, including the well-understood

model semantics of normal-clause logic.

If we view business modelling, particularly the

formalization of modelling, in the context of AI, it is

inevitable to refer to business analysis and design.

Early approaches included the Vienna Definition

Method (Bjorner, 1978) and Structured Analysis

(Yourdon, 1989). GBMF borrows the idea in early

system engineering to further explore the semantic

foundation by performing reification and

decomposition to layers with acceptable details.

When facing the task of balancing deterministic

controls over ontological variables and declarative

controls expressed as business rules, a good

reference is the classical "logic+control" interplay

first emphasized by (Kowalski, 1979).

In short, inspired by most of the state-of-art

research on generic business modelling, GBMF not

only represent and simulate high-level business to

help users to better understand it, but also serve as a

formal and simple specification of a prototype-

supported method for quick business modelling.

3 GBMF

In principle, the business of an enterprise can be

formulated as a purely declarative theory expressing

various business entities, their properties, inter-

relationships and controls (Hogger, 2004).

Achievable goals of the business can then be

identified with logical consequences of the theory,

and derivations of those goals can be interpreted as

particular simulations of the enterprise. A more

practical approach is to replace parts of that theory

by business plans and associated interpretation

which, though still expressed declaratively, are

inherently more deterministic to the extent that they

embody some preconceived commitments to the

control and interdependence of events.

3.1 An Overview of GBMF

Based on the above ideas in design, GBMF is built

upon the general notion of activities operating upon

any typical business entities. Activities are

composed from atomic basic actions organized into

action sets, which are in turn organized into larger

programmatic hierarchies called business plans. A

plan might, for example, embody the actions

entailed in a production process from inception to

delivery, with attendant impacts on strategy,

financial and temporal aspects of the business.

During manipulation of a business, such a plan could

be applied on multiple occasions, possible

concurrently. GBMF therefore treats a plan as a

ICEIS 2009 - International Conference on Enterprise Information Systems

40

template capable of spawning distinct instances

called processes, each acting upon its own vector of

business entities.

Many entities in a process will have a transient

existence, being only intermediates for creating the

eventual deliverables of that process. Those entities

to which this does not apply are the deliverables that

must survive, referred to as business assets. Thus the

macroscopic behaviour of an executing GBMF

instance is the transformation of an asset space,

when various processes are dynamically spawned,

possibly exploiting existing assets, copying or

acquiring its required assets and creating new assets.

The instigations and progressions of processes

are governed by business process rules, whilst the

internal relationships between their entities are

governed by the underlying procedures that define

the basic actions. A well-structured GBMF instance

should take a general form of self-controlling its

progression by consulting the asset space about the

required assets in advance. But in practice,

additional controls are usually required in order to

ensure that business process automation can be

simulated in a more reasonable and interactive way.

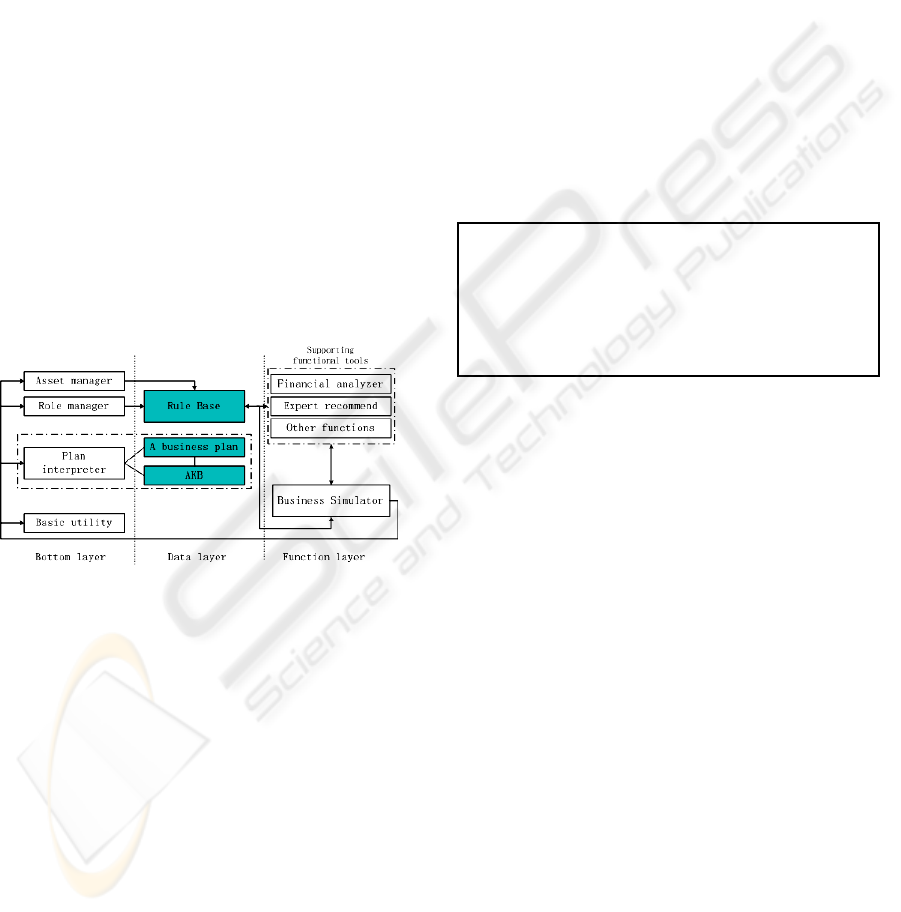

Figure 1: Overview of GBMF.

Figure 1 shows a structural view of GBMF.

There are three layers involved in modelling a

business with GBMF. The bottom layer contains

modules to deal with generic assets, to manage role

relations, and to parse business plans. independent of

concrete business data, serving as an interpretation

to make low level Prolog understand GBMF and

execute given business plans smoothly. The bottom

layer is treated as a minimum GBMF in semantic,

based on which we develop a function layer to

enhance the power of GBMF, in terms of managing

functional assets and implementing advanced

functional supporting tools.

In between these two layers, there is a data layer

in which a modeller needs to provide concrete

business data as GBMF input. GBMF can also be

viewed as interdependency of functional sub-

modules from a pure business perspective as

described in (Li, 2007).

3.2 Plans and Processes

GBMF represents each basic action as a term of the

form Action-name(Ontvars) in which Ontvars is a

vector of ontological variables. Each basic action A

appears within an action declaration whose general

syntax is as:

action(R, S, I, X).

or action(R, S, I, C, X)

or action(R, S, I, C, X1, X2)

R represents the role holder of this action, S

names an action set and I is a position index for A

within S. Each of X, X1, X2 is a basic action or an

action set name and C is a predicate, over one or

more ontological variables, expressing a condition.

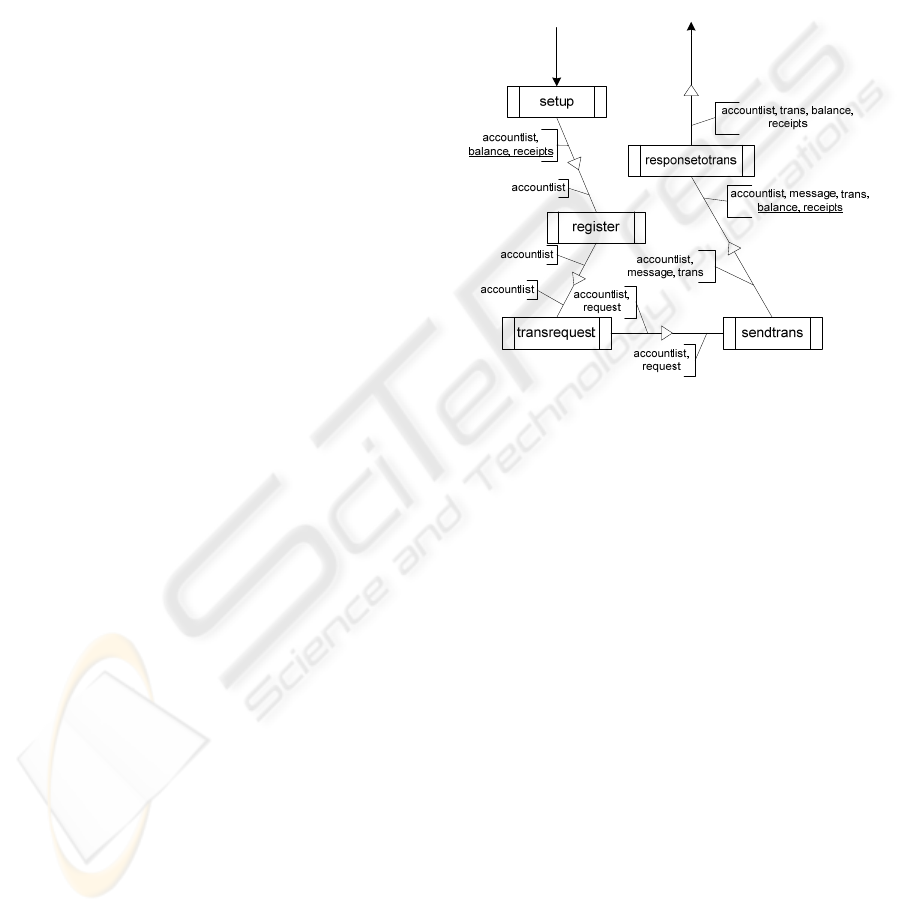

Figure 2: The ‘register’ plan.

Figure 2 shows a fragment of the ‘register’

business plan formulated from the PayPal data file.

The ability of one action set to invoke others

inherently organizes a complete business model into

a set of plans. A plan comprises a root action set,

being invokable by no other, together with all those

other action sets that it may invoke directly or

indirectly. Some act sets could be repeatedly

invoked by other plans, to economize on the use of

common knowledge. Each action set has an

associated control declaration which is either of the

assertions control(A, seq) or control(A, con). This

specifies whether the basic action A is to be

performed sequentially or concurrently. The former

case uses the action declarations’ indices to

determine the temporal order, whilst the latter case

ignores them.

A GBMF process is an executing instance of a

plan. At any time in the animation of a model there

may exist zero or more active instances of each plan,

at various stages in their executions. A process is

denoted by P

i

where P is the plan name and i is a

unique instance identifier. P

i

has its own binding

environment

β

(P

i

) containing a pair (V, Val) for

each V

∈ont(P) signifying that V is bound to the

value Val. As P

i

executes, its variables become

% plan "register"

action([accountadmin],register,1,

copy(accountlist, t1)).

action([accountadmin],register,2,

checkacv(newemail,accountlist,tag, t2)).

action([accountadmin],register,3,yes(tag),

doregister(newemail)).

……

FORMULATING ASPECTS OF PAYPAL IN THE LOGIC FRAMEWORK OF GBMF

41

instantiated by various ways - clock-binding, action

performing and constraint evaluation. Performing A

entails consulting an Action Knowledge Base

(AKB) containing an associated procedure for each

basic action type. If A is user-defined then its

procedure will have been supplied in the AKB by

the modeller. The primary effect of executing the

procedure is to update

β

(P

i

).

3.3 Assets

By default, the termination of a process would leave

no trace of its prior existence, since its bindings will

be automatically garbage-collected. Instances of

relations between its ontological variables would

have been constructed or verified by the effects of

actions and constraints, but would not survive to the

lasting benefit of the modelled business as a whole.

In order to enable processes to manipulate

business entities of greater permanency, GBMF

allows the modeller to declare for any basic action

type that some of its arguments denote durative

assets. Concretely, such an asset is a value Val - a

compound structure conforming to a schema

declared in the AKB for any particular asset type,

tagged with a unique identifier, a type, a status

S and

an origin. The general schema of an asset is:

asset(Id,Name,Class,Type,Val,S,Origin)

This schema makes it possible for the modeller

to represent any meaningful entity as an asset by

freely defining its value Val in AKB. The status of

the asset is either public or process-owned. Its origin

identifies the process π

o

from which it originated.

Besides the action-defining procedures, the AKB

contains asset declarations specifying any asset-

handling entailed in each action type, which can add

value to the fine controls over assets management.

For example, it will help to infer plan-asset

dependency or actionset-asset dependency.

Assets may serve many purposes, including

message-passing, information-displaying, process-

triggering etc. Our last remark about assets is that if

any assets are required to survive through its serving

process π’s termination then π must beforehand

make them public, by performing a system-defined

basic action ‘publish’. When a complete process

terminates, what survives is the set of public assets

still remaining in the asset space. These are the only

observable deliverables of the real time processes.

3.4 Plan-asset Dependency

The plans and the AKB’s asset declarations in a

model induce a plan-asset dependency which can be

treated as the fundamental logic to drive a business

progression in GBMF. Plan-asset dependencies are

logical consequences of the model and can be

inferred by the asset manager based on asset

declarations, however it serves the modellers’

interests to assert them explicitly in a component of

the model called the Business Process Rulebase

(BPR), independent of the business data. They

contribute to the formulation of business process

rules regulating process creation and behaviour.

Figure 3: Plan-asset dependency graph.

The plan-asset dependency can be demonstrated

as a graph whose nodes are plan names. Figure 3

outlines a small fraction of the plan-asset

dependency graph for the PayPal business model,

which is indeed a single thread of a successful

sending transaction. In Figure 3 two solid arrows

represent the entry and exit of a single money-send

thread. Each edge directed from one plan P to

another Q is labelled by two sets of variables in

ont(P), in which the set at the upper end of hollow

arrows are P’s produced assets, the other at the

lower end indicate those assets required by Q. For

example, the ‘setup’ plan produces three assets in

which only accountlist is required by its subsequent

plan ‘register’. The other two have a free existence

in the asset space for further use by other plans.

More generally and importantly, the BPR’s

process rules can express any user-defined controls

about the behaviours of the process pool if these are

expressible as logical conditions over existing

processes, or their binding environments, or the

existing assets. They are consulted by the model’s

execution manager to drive the model forwards and

to ensure that each process is spawned to serve a

declared purpose and that its subsequent behaviour

ICEIS 2009 - International Conference on Enterprise Information Systems

42

satisfies any declared conditions. The user-defined

controls and the intrinsic plan-asset dependencies

are both stored in a rule base.

4 PROTOCOL OF PAYPAL

The PayPal service allows a customer to pay in

various ways, including through credit cards, bank

accounts, buyer credit or account balances, without

sharing financial information (PayPal.com). The

popularity, the simplicity and the conveniences it

can bring to online payment are reasons why we

choose PayPal as one of our case studies.

In practice, we are not able to exploit a complete

business of PayPal because some derivative business

processes, designed for company customers, are

hard to obtain. However, there are some primary

business processes of PayPal for normal customers,

serving as our main target in this paper.

Based on (Burchell, 2004) and our practices, we

describe the business protocols of PayPal as follows:

1. Two roles are involved: user and server. We

further distinguish user into sender and receiver,

server into general admin, account admin,

transaction server and accountant.

2. All users should be authenticated by registering

and logging into PayPal system before they use.

3. A sender can send a transaction request by

providing minimum information such as sender

id, receiver id, amount and payment method.

Payment can be made through an existing

account or a valid credit card. The request will

be validated before it is set as ‘pending’ and

stored into the transaction database. The

requested money will then be debited from the

sender’s account and a message will be

generated to notify the receiver.

4. After log in, a receiver can either accept, by

crediting money into account and finishing the

transaction, or reject a transaction by setting as

‘rejected’ and returning money to sender.

5. Senders can cancel their pending transaction by

raising a cancel request. Any transaction older

than 30 time units will be removed from the

transaction database if it has not been claimed

by receiver or not been cancelled by sender.

6. Senders can claim money within 30 time units

from the completion date of the transaction if:

the sender didn’t claim on this transaction

before; the sender has less than two claims in

that year; the sender’s claim has been approved

by PayPal as legal by satisfying given claim

conditions. If the claim is successful, the money

will be transferred from receiver to sender.

PayPal business makes profit by charging a fee

comprised of a proportion of transaction amount and

a constant administration fee for every successful

transaction. The primary functions involved in the

above protocols make up the basic business

knowledge for our PayPal case design. We also

define some additional functions, such as transaction

query for modellers in exploring more information

through the PayPal simulation.

5 SIMULATING PAYPAL

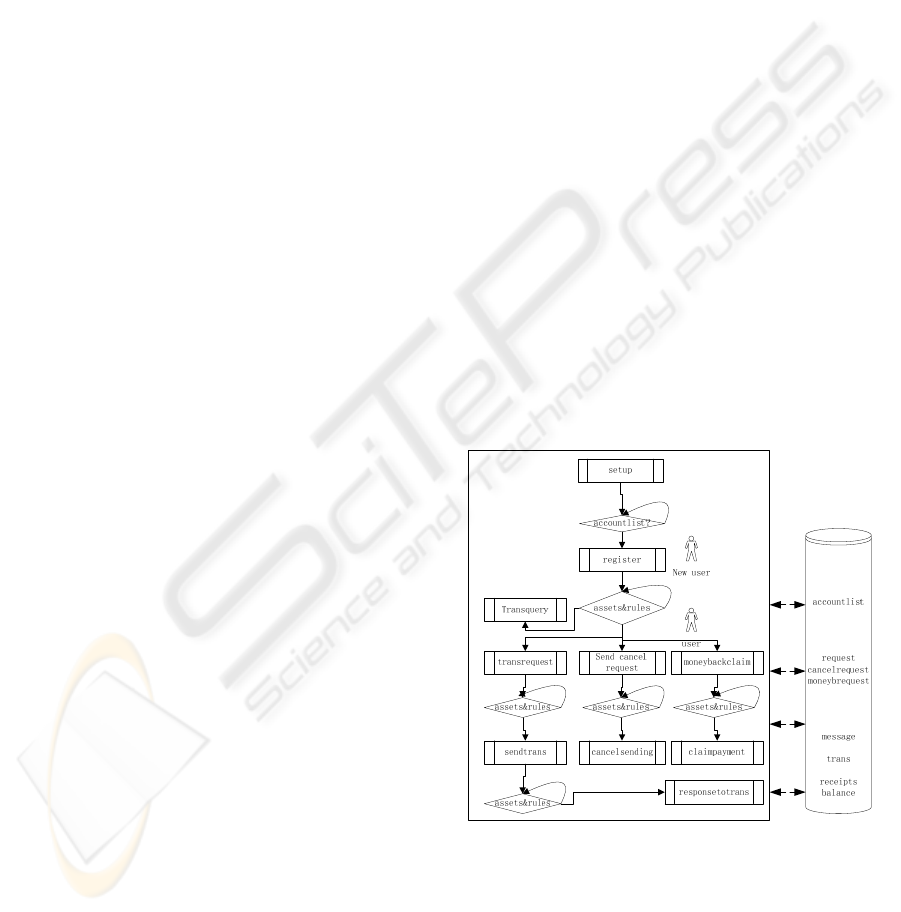

A general view on how the PayPal business

processes run under GBMF is shown in Figure 4. To

clearly describe and model the primary PayPal

business activities discussed earlier, we define 10

business plans in the data layer, represented by

rectangles in the graph. The plan ‘register’ shown in

Figure 2 is one of them in the form of source codes,

conforming to the plan schema. The defined assets

are listed in the cylinder in Figure 4, including three

types of customer requests, detailed transaction

information, several types of messages, PayPal’s

financial account balance, inventory of receipts and

records for all registered user accounts.

Figure 4: PayPal simulation in GBMF.

The simulation starts from ‘setup’, which is a

special type of plan to initialize the PayPal business

environment by clearing up the buffer and setting

three empty assets, including the accountlist. Then

the ‘register’ plan will actively look for accountlist,

whether empty or not, by searching the asset space

FORMULATING ASPECTS OF PAYPAL IN THE LOGIC FRAMEWORK OF GBMF

43

in a given time. Once accountlist is found, it will be

reserved and registered by the ‘register’ plan. Then

‘register’ will be triggered and executed, by

inserting a new list into the asset accountlist and

recording information of a new user. Along with the

advance of the system clock, the main simulation

will carry on. Thus, for all PayPal plans except

‘setup’, they will continuously and repeatedly check

the asset space, competing for assets they need. At

the same time, the additional trigger conditions

defined by users will be evaluated, as further

constraints. We use the tag assets&rules in

diamonds to denote controls, including plan-asset

dependencies and additional trigger conditions. The

one-way arrows in Figure 4 generally indicate the

ordinal relation between plans, conforming to plan-

asset dependencies we discussed earlier.

PayPal simulator runs over a timer controlled by

the execution manager. From bindings of temporal

variables, users are free to view business at a

specific time point or during a defined time interval.

Insofar as we want to automate the whole simulation

process as much as possible, we assume some

information is given, such as registration details of a

new PayPal user. Certain other information should

be generated in run-time, such as various requests

sent by customers in real-time.

Through the simulation of the PayPal use case,

users can understand the basic logic of PayPal as to

how different business processes compete for assets

needed, how a new business process is triggered

when all its required assets exist in asset space, how

an active process produces assets required by others

before they die with garbage-collecting, how the

business make profit by charging an administration

fee for some types of transaction. It is also possible

for the modeller to achieve high-level business goals

by either defining them in original business plans or

implementing them in advanced functional modules

in function layer.

6 CONCLUSIONS

GBMF facilitates business specifications by

establishing a generic business modelling framework

which offers logical formulations and reasoning

mechanisms aiming to provide a high-level,

transparent and flexible means of expressing the

diverse entities and constraints typically encountered

in business. Our case study in formulating aspects of

the PayPal business demonstrates the rich

expressiveness of GBMF in representing business

activities and goals. It is also shown in PayPal

business simulation that intrinsic plan-asset

dependencies and user-defined controls can easily

guild execution manager to manipulate various

ontological entities including ontological variables

and generated assets during the run time.

The ultimate purpose of GBMF is to provide an

alternative modelling method with a sound logical

structure and simple semantics, hence a synthesis to

support business consultation, validation and

prototype. The rich extensibility of GBMF enables

modellers to develop advanced functions to support

high level analysis for more complex business.

REFERENCES

Afuah, A., Tucci, C.L., 2003. Internet business models

and strategies. McGraw Hill. Boston.

Bjorner, D. et al, 1978. The Vienna Development Method:

The Meta-Language. LNCS Vol. 61, Springer.

Burchell, D., Nielsen, D., Sofield, S., 2004. PayPal Hacks,

Publisher: O’Reilly.

Chen-Burger, Y-H., et al, 2002. Enterprise Modelling: A

declarative approach for FBPML. In ECAI: Workshop

on Knowledge Management and Organizational

Memories.

Fox, M.S., Gruninger, M., 1998. Enterprise modeling. In

AI Magazine 19(3).

Gordijn, J., Osterwalder, A., Pigneur, Y., 2005.

Comparing two business model ontologies for

designing e-business models and value constellations.

In 18

th

Bled e-Conference on e-Integration in Action.

Hogger, C.J. and Kriwaczek, F.R. 2004. Constraint-guided

enterprise portals, Proc. of 6th Int. Conf. on Enterprise

Information Systems, pp. 411-418.

Kowalski, R., 1979. Logic for Problem Solving, North

Holland Elsevier.

Kuo, H-L., Chen-Burger, Y-H., Robertson, D., 2003.

Knowledge management using business process

modeling and workflow techniques. In IJCAI’03,

Workshop on Knowledge Management and

Organizational Memories.

Li, Min and Hogger, C. J., 2007. Generic constraints-

based framework for business modelling. In Trends in

Enterprise Application Architecture, LNCS, Vol.

4473, Springer Verlag, pp.241-254.

NIST - National Institute of Standards and Technology,

1993. Integration Definition for Function Modelling

(IDEF0). NIST. Gaithersburg.

Osterwalder, A., Pigneur, Y., Tucci, C.L., 2005. Clarifying

business models: origins, present, and future of the

concept. In Communications of the Association for

Information Systems, 16.

Schlenoff, C., Knutilla, A., Ray, S., 1997. In Proceedings

of the Process Specification Language (PSL)

Roundtable. NIST. Gaithersburg.

Yourdon, E., 1989. Modern Structured Analysis. Yourdon

Press, Englewood Cliffs, New Jersey.

ICEIS 2009 - International Conference on Enterprise Information Systems

44