E-COMPLEMENTARITY

The Link to e-Business Value

Pedro Soto-Acosta and Angel L. Meroño-Cerdan

Department of Management & Finance, University of Murcia, Campus de Espinardo, Murcia, Spain

Keywords: e-Business, Resource-based theory, Internet, business value, Information technology.

Abstract: In recent years, much debate about the value of e-Business and information technology (IT) has been raised.

Although the macro-level effect of IT and e-Business is undisputed, a question remains on whether e-

Business can provide differential benefits to individual firms. In this sense, there is a need to further

investigate whether and how e-Business creates value. To respond to this challenge, this paper develops a

conceptual model, grounded in the resource-based theory, which analyzes the complementarity of Internet

resources and e-Business capabilities as source of business value. This model posits three relationships:

Internet resources and business value, internal e-Business capabilities and business value, and the

complementarity of Internet resources and internal e-Business capabilities. To test hypotheses, a sample

comprising 1,010 Spanish firms is employed. The results show that, as hypothesized, Internet resources per

se are not positively related to business value and that internal e-Business capabilities have a positive

significant impact on business value. In addition, the results offer support for the complementarity of

Internet resources and internal e-Business capabilities as source of business value.

1 INTRODUCTION

The relationship between information technology

(IT) and business value has been the subject of much

research over the past decade. The results of these

studies were varied and the term “productivity

paradox” was coined to describe such findings.

Nonetheless, recent studies have found positive and

stronger linkages, and have attributed the

productivity paradox to variation in methods and

measures (Devaraj and Kohli, 2003)

Today IT is surpassing its traditional “back

office” role and is evolving toward a “strategic” role

with the potential not only to support chosen

business strategies, but also to shape new business

strategies (Henderson and Venkatraman, 1999).

However, much debate about the value of IT and e-

Business has been raised, due to the gap between e-

Business investment and the lack of empirical

evidence on e-Business value. Although showing

recent signs of advance, much of the existing e-

Business literature still relies, to a great extent, on

case studies, anecdotes, and conceptual frameworks,

with little empirical research directed to assessing

the impact of IT on firm performance – especially in

traditional companies (Brynjolfsson and Kahin,

2002). Case studies on firms such as eBay and

Amazon show e-Business can create business value,

but there is a question as to whether the lessons

learned from these “Internet giants” are more widely

applicable. At the same time, Carr’s assertions

(2003), in his article “IT Doesn’t Matter”, have

raised the discussion about the value of IT. Carr’s

argument, in a few words, is that because every firm

can purchase IT in the marketplace and because IT is

now a commodity based on standards that all

companies can freely use, IT is no longer a

differentiating factor in organizational performance.

What makes a resource truly strategic – what gives it

the capacity to be the basis for a sustained

competitive advantage - is not ubiquity but scarcity.

Carr argues that no firm can use IT to achieve a

competitive advantage over its competitors.

Therefore, Carr concludes, firms should reduce

spending on IT, follow rather than lead IT in their

industry, and avoid deploying IT in new ways.

Most management information systems experts

disagree with Carr’s assertions. However, his

argument is appropriate when he points out that not

all IT investments have strategic value. Some IT

investments only allow firms to stay in business. The

technology itself will rarely create superiority. For

that reason, some research studies found that IT

spending rarely correlates to superior financial

405

Soto-Acosta P. and L. Meroño-Cerdan A. (2008).

E-COMPLEMENTARITY - The Link to e-Business Value.

In Proceedings of the International Conference on e-Business, pages 405-412

DOI: 10.5220/0001912504050412

Copyright

c

SciTePress

results (Hoffman, 2002). However, even though

competitors may copy an IT innovation, relative

advantage can be created and sustained where the

technology leverages some other critical resource.

Kettinger et al. (1994) draw a number of such

complementary resources, such as size, structure,

culture, and so on, that could make it difficult for

competitors to copy the total effect of the

technology. This complementarity of resources is a

corner stone of the resource-based theory and has

been offered as an explanation of how IT has largely

overcome its paradoxical nature and is contributing

to business value (Bhatt and Grover, 2005; Clemons

and Row, 1991).

Consequently, to respond to these challenges,

this paper develops a conceptual model, grounded in

the resource-based view (RBV) firms, to analyze the

complementarity of Internet resources and

capabilities as source of business value at the level

of an individual firm. The analysis employs a large

sample of companies from different industries for

hypothesis testing. Moreover, although recent

studies (Zhu, 2004; Zhu and Kraemer, 2005) have

analyzed the relationship between e-Business

capabilities and firm performance, very little work

has been undertaken to identify Internet resources

and capabilities. Similarly, the complementarity of

Internet resources and capabilities has not been

studied. The present study attempts to cover these

gaps in the research.

The paper consists of six sections and is

structured as follows: The next section reviews the

relevant literature. In Section 3, hypotheses and

research models are specified. Following that, the

methodology used for sample selection and data

collection is discussed. Then, data analysis and

results are examined. Finally, the paper ends with a

discussion of research findings, limitations and

concluding remarks.

2 LITERATURE REVIEW

2.1 The RBV and e-Business

The RBV suggest that the effects of individual, firm-

specific resources on performance can be significant

(Mahoney and Pandian, 1992). The RBV generally

tends to define resources broadly and include assets,

infrastructure, skills, and so on. While resources

serve as the basic units of analysis, firms create

competitive advantage by assembling resources that

work together to create organizational capabilities.

Grant (1991) suggests that the capabilities of a firm

are what it can do as a result of teams of resources

working together. Teece et al. (1997) argued that

capabilities cannot easily be bought; they must be

built. Thus, building capabilities is not only a matter

of combining resources; capabilities are rooted in

processes and business routines. Also capabilities

involve complex patterns of coordination between

people and between people and other resources

(Grant, 1991), and between an organization and

other organizations. In this respect, Day (1994)

describes capabilities as complex bundles of skills

and accumulated knowledge, exercised through

organizational processes, which enable firms to

coordinate activities and make use of their assets.

Day argues that capabilities and organizational

processes are closely entwined, because capabilities

enable the activities in a business process to be

carried out. More recently, Makadok (2001)

considers capability as a special type of resource.

More specifically, he defines capability as an

organizationally embedded non-transferable firm-

specific resource whose purpose is to improve the

productivity of the other resources possessed by the

firm.

For the purposes of the present study, the above

definitions of capability permit the identification of

three important characteristics:

Capabilities are rooted in processes and

business routines, because it is capability that

enables the activities in a business process to

be carried out.

Capabilities are firm-specific, while an ordinary

resource is not. Because of this

embeddedness, ownership of a capability

cannot easily be transferred from one

organization to another.

The primary purpose of a capability is to

enhance the productivity of the other

resources that the firm possesses.

2.2 e-Business Resources and

Capabilities

The RBV provides a solid foundation to differentiate

between IT resources and IT capabilities and to

study their separate influences on performance

(Santhanam and Hartono, 2003). Based on this

analysis, Bharadwaj (2000) suggested that if firms

can combine IT related resources to create unique IT

capabilities, they can improve their performance. IS

researchers have followed this consideration of IT

capability because competition may easily result in

the duplication of investment in IT resources, and

companies can purchase the same hardware and

ICE-B 2008 - International Conference on e-Business

406

software to remove competitive advantage

(Santhanam and Hartono, 2003). In this respect, IS

research offers a useful distinction between IT

resources and IT capabilities. The former is asset-

based, while the latter comprises a mixture of assets

formed around the productive use of IT.

In general, IT resources are not difficult to

imitate; physical technology is by itself typically

imitable. However, firms may obtain competitive

advantages from exploiting their physical

technology in a better (and/or different) way than

other firms, even though competing firms do not

vary in terms of the physical technology they

possess. IT resources are necessary, but not a

sufficient condition, for competitive advantages

(Clemons and Row, 1991). IT resources rarely

contribute directly to competitive advantage.

Instead, they form part of a complex chain of assets

(IS capabilities) that may lead to better performance.

Thus, some researchers have described this in terms

of IT capabilities and argue that IT capabilities can

create uniqueness and provide organizations a

competitive advantage (Bhardwaj, 2000, Bhatt and

Grover, 2005; Mata et al., 1995; Ross et al., 1996;

Santhanam and Hartono, 2003).

Consequently, the present study seeks to

demonstrate that although Internet resources

(considered as physical IT) are not responsible for

the creation business value, their complementarity

with e-Business capabilities is critical to firm value.

2.3 Business Value from a Process

Perspective

Although much research using the RBV has focused

on an aggregated dependent variable, namely, firm

performance, this may not be the best way to test the

RBV (Ray et al., 2004). For example, because firms

can have competitive advantage in some business

activities and competitive disadvantage in others,

examining the relationship between resources and

capabilities associated with different processes

within a firm and its overall performance can lead to

misleading conclusions. Ray et al. (2004) proposed

examining the effectiveness of business processes as

a way to test the RBV logic. Another issue is that

some IT investments may provide benefits after a

certain period but increase operating costs in the

short term. Thus, using firm performance at the

macro level is meaningless and can again lead to

misleading conclusions. These arguments lead to the

conclusion that a process approach should be used to

explain the generation of e-Business value within the

RBV, and this is the approach adopted in the present

study. The present research uses the effectiveness of

online procurement to measure e-Business value.

The business value of this process is discussed

below.

e-Procurement, or buying online, can potentially

provide distinct value propositions to the firm. These

come from the reduction of procurement and

inventory costs, as well as strategic networks with

suppliers that allow effective and efficient supply

chain management (SCM). With regard to

procurement costs, Kaplan and Sawhney (2002)

indicated that buying in e-marketplaces considerably

reduces transaction costs. With regard to strategic

links and SCM, Internet technologies can enhance

SCM decision making by enabling the collection of

real-time information, and access to and analysis of

this data in order to facilitate collaboration between

trading partners in a supply chain. In this sense,

Frohlich and Westbrook (2002) showed the

importance of linking customers and suppliers

together in tightly integrated networks. As a result of

e-Procurement, the collection of real-time

information on demand is possible and, more

importantly, products and services are delivered

quickly and reliably when and where they are

needed (Frohlich, 2002).

In sum, e-Business value may lead to improved

performance on the part of the firm in procurement.

Although it could be argued that customers,

suppliers and/or the firm’s wider value network can

benefit from online procurement, this study focuses

on analyzing business value at the level of an

individual firm.

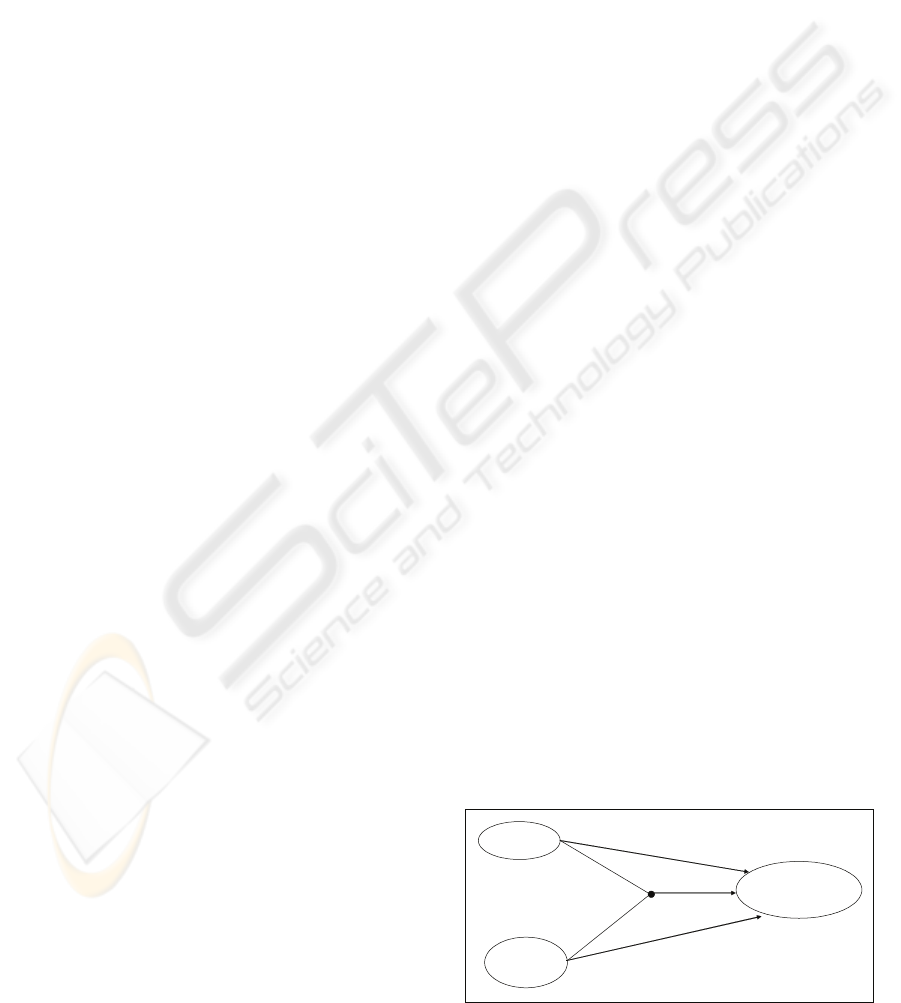

3 DEVELOPMENT OF

HYPOTHESES

This section develops hypotheses for the present

study, drawing on the existing information systems

and e-Business literature. Three relationships will be

explored: Internet resources and business value,

internal e-Business capabilities and business value,

and the complementarity of Internet resources and

internal e-Business capabilities (see Figure 1).

H3

INTERNET

RESOURCES

INTERNAL

E-BUSINESS

CAPABILITIES

BUSINESS VALUE

e-Procurement effectiveness

H1

H2

Figure 1: Research model.

E-COMPLEMENTARITY - The Link to e-Business Value

407

3.1 Internet Resources and Business

Value

Firms obtain competitive advantages on the basis of

corporate resources that are firm specific, valuable,

rare, imperfectly imitable, and not strategically

substitutable by other resources (Barney, 1991). IT

resources are easy to duplicate, and, hence, IT

resources per se do not provide competitive

advantages (Santhanam and Hartono, 2003).

Although IT infrastructure is argued to be valuable,

it is not a source of competitive advantage (Bhatt y

Grover, 2005). Thus, IT infrastructure will rarely

lead to superior performance. Similarly, Internet

resources – as defined above – are not difficult to

imitate. In general, Internet technology is by itself

imitable. If one firm can purchase certain Internet

technologies and thereby implement some strategies,

then other firms should also be able to purchase

these technologies, and thus such tools should not be

a source of competitive advantage. Furthermore, as

the diffusion of the Internet continues, the ability of

proprietary IT to be a source of competitive

advantage continues to be eroded. These arguments

suggest that Internet resources may not have a

significant impact on business value. Thus, the

following hypothesis is proposed:

Hypothesis 1: There is no relationship between

Internet resources and business value

3.2 Internal e-Business Capabilities

and Business Value

Investing in IT is not a necessary nor sufficient

condition for improving firm performance, since IT

investments might be misused (Tallon et al., 2000).

In this sense, IT assets cannot improve

organizational performance if they are not used

appropriately. However, when used appropriately IT

is expected to create intermediary effects, such as IT

being embedded in products and services,

streamlined business processes, and improved

decisions, which can be expected to have an

influence on the performance of the firm

(Ravichandran and Lertwongsatien, 2005).

Grant (1991) and Makadok (1991) emphasize

that while resources by themselves can serve as

basic units of analysis, firms create competitive

advantage by assembling these resources to create

organizational capabilities. Makadok states that

these firm-specific capabilities, embedded in

organizational processes, provide economic returns

because that firm is more effective than its rivals in

deploying resources. IS researchers have adopted

this capability logic of resources by arguing that

competitors may easily duplicate investments in IT

resources by purchasing the same hardware and

software and, hence, IT resources per se do not

provide competitive advantages. Rather, it is the

manner in which firms leverage their IT investments

to create unique capabilities that impact firm

performance (Clemons and Row, 1991; Mata et al,

1995). Thus, it is expected that internal e-Business

capabilities are positively associated with business

value. The following hypothesis incorporates these

expectations:

Hypothesis 2: There is a positive relationship

between internal e-Business capabilities and

business value

3.3 The Complementarity of Internet

Resources and Internal e-Business

Capabilities

Although there is research that posit a direct

relationship between IS resources/capabilities and

firm performance (Bharadwaj, 2000; Feeny and

Willcoks, 1998; Santhanam and Hartono, 2003),

others have questioned the direct-effect argument

and emphasized that IS resources/capabilities are

likely to affect firm performance only when they are

deployed to create unique complementarities with

other firm resources (Clemons and Row, 1991;

Powell and Dent-Micallef, 1997).

Firm resources are considered complementary

when the presence of one resource enhances the

value or effect of another resource (Ravichandran y

Lertwongsatien, 2005; Zhu, 2004). For example, the

complementarity between online offerings and

offline assets is the essence of “clicks-and-mortar”

companies. Customers who buy products over the

Internet value the possibility of getting support and

service offered through bricks-and-mortar retail

outlets, including the convenience of in-store pickup

and return (Zhu, 2004). Hence the RBV highlights

the role of complementarity as a source of value

creation in e-Business, though is not the only source

as suggested by Amit and Zott (2001). As mentioned

earlier, Internet resources are not difficult to imitate

and per se do not provide competitive advantages.

However, having a proper Web infrastructure may

facilitate the internal processing of online operations

and this way influence positively firm performance.

That is, the fact of possessing an adequate Web

infrastructure can be critical for the influence of

internal e-Business capabilities on business value.

Thus, the following hypothesis is proposed:

ICE-B 2008 - International Conference on e-Business

408

Hypothesis 3: The complementarity between

Internet resources and internal e-Business

capabilities explains variations in business value

4 METHODOLOGY

4.1 Data

The data source for the present study is the e-

Business W@tch survey 2004, an initiative launched

by the European Commission for monitoring the

adoption of IT and e-Business activity. The

decision-maker targeted by the survey was normally

the person responsible for IT within the company,

typically the IT manager. Alternatively, particularly

in small enterprises without a separate IT unit, the

managing director or owner was interviewed.

The population considered in this study was the set

of all enterprises which are active at the national

territory of Spain and which have their primary

business activity in one of ten sectors considered.

The sample drawn was a random sample of

companies from the respective sector population

with the objective of fulfilling strata with respect to

business size. A share of 10% of large companies

(250+ employees), 30% of medium sized enterprises

(50-249 employees) and 25% of small enterprises

(10-49 employees) was intended. The number of

firms totalled 1 010. 91.1% of firms were small and

medium-sized enterprises (less than 250 employees)

and each sector considered had a share of around

10% of the total sample.

With regard to respondents’ titles, 54.4% were IS

managers, nearly 20% were managing directors, and

12.1% were owners. The dataset was examined for

potential bias in terms of the respondents’ titles.

Since respondents included both IT managers and

non-IT managers, one could argue that IT managers

may overestimate e-Business value. To test this

possible bias, the sample was divided into two

groups: IS managers (head of IT/DP and other IT

senior managers) versus non-IS managers (owner,

managing director, strategy development and

others). One-way ANOVA was used to compare the

means of factor scores between the two groups. No

significant differences were found, suggesting that

the role of the respondents did not cause any survey

biases.

4.2 Measures of Variables

Measurement items were introduced on the basis of

a careful literature review. Confirmatory factor

analysis (CFA) was used to test the constructs.

Based on the CFA assessment, the constructs were

further refined and then fitted again. Constructs and

associated indicators are listed in the Appendix and

discussed below.

Internet resources construct. This construct

represents the adoption of physical Internet

technologies. In this sense, respondents were

required to assess the presence of four Internet

tools: website, Intranet, Extranet and LAN

(local area network).

Internal e-Business capabilities. This construct

represents the use of online technologies for

supporting internal business processes.

Business value. As discussed earlier in section

2.3, the present research uses the effectiveness

of e-Procurement for measuring business

value. That is, business value is assessed

through the business impact of purchasing

online.

4.3 Instrument Validation

CFA using AMOS 4.0 was conducted to assess

empirically the constructs theorized. Multiple tests

on construct validity and reliability were performed.

Model fit was evaluated using the maximum

likelihood (ML) method. The measurement

properties are reported below.

Construct reliability. All constructs had a

composite reliability over the cut-off of 0.70 (Straub,

1989), and also the average variance extracted for all

exceeded the preferred level of 0.5 (Churchill,

1979).

Content and construct validity. Content validity

was verified by checking the meanings of indicators

and by a careful literature review. Construct validity

is the extent to which a construct measures the

concepts that it purports to measure (Straub, 1989).

It has two components: convergent and discriminant

validity. After dropping insignificant items, all

estimated standard loadings were significant,

suggesting good convergent validity. To assess the

discriminant validity Forell and Larcker’s (1981)

criterion was used. All constructs met this criterion.

Table 1 lists several goodness-of-fit statistics to

assess how well specified models explain the

observed data. The insignificant p-value (p = 0.187)

for the chi-square statistics implied good absolute

fit. The root mean square error of approximation

(RMSEA) is was below the cut-off value 0.08

suggested by Browne and Cudeck (1993). Five

incremental fit indices were all above the preferred

level of 0.9 (Gefen et al., 2000).

E-COMPLEMENTARITY - The Link to e-Business Value

409

Table 1: Measurement Model Fit indices.

Goodnesss-of-Fit Indices

Chi-Square 66.054

p-value 0.246

RMSEA 0.032

Normed Fit Index (NFI) 0.971

Relative Fit Index (RFI) 0.955

Incremental Fit Index (IFI) 0.997

Tucker-Lewis Index (TLI) 0.995

Comparative Fit Index (CFI) 0.997

5 EMPIRICAL RESULTS

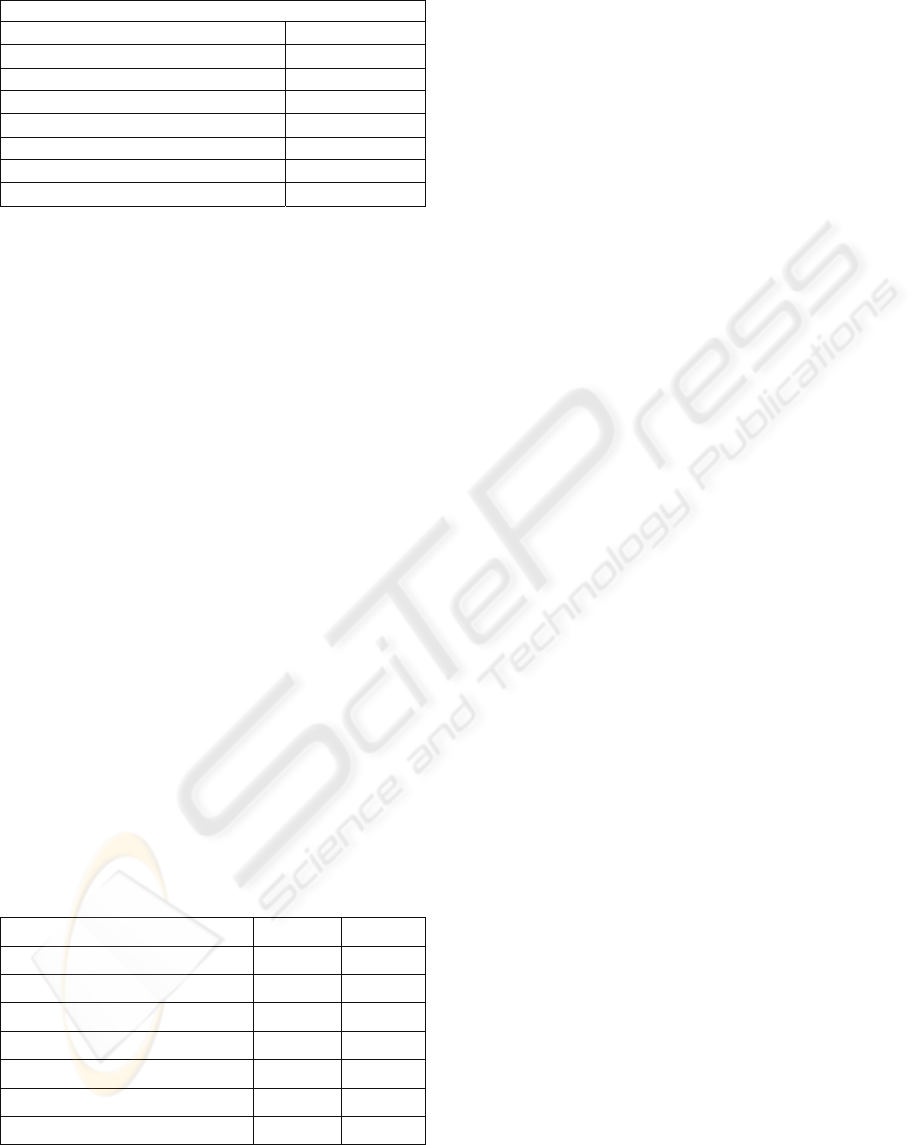

Hypotheses were tested using hierarchical regression

analysis. Table 2 shows Internet resources construct

is not statistically significant, whereas e-Business

internal capabilities construct is positive and

significant (regression 1), as predicted. Regression 2

includes both main and the interaction effect. The

interaction effect between Internet resources and

internal e-Business capabilities was found

significant, thus, supporting the complementarity of

Internet resources and internal e-Business

capabilities. To further test the significance of the

interaction effect, the incremental R2 between the

full model (with interaction term) and the partial

model (without the interaction terms) was compared.

The result is reported in the lower rows of table 7. In

regression 2, the incremental R2 was 0.026, meaning

that approximately an additional 3 percent of

explained variance has resulted from the inclusion of

the interaction effect with respect to regression 1. To

compare the partial model against the full models, a

Wald test was performed and the differences were

found to be statistically significant. Based on this,

the partial model was rejected in favour of the full

model (Greene, 2000).

Table 2: Complementarity results: Impact on procurement.

Independent variables Regr. 1 Regr. 2

Internet resources (IR) 0.083

0.099

Internal EB capabilities (IEBC)

0.196

*** 0.151**

IR * IEBC

-

0.167**

F 6.595*** 6.633***

R2 0.047 0.069

∆R2 0.026**

p<0.1*; p<0.05**; p<0.01***

Through this analysis, hypotheses H1, H2 and H3

found support.

6 DISCUSSION

The results showed that Internet resources are not

positively related to business value. This finding is

not surprising, since competitors may easily

duplicate investments in IT resources by purchasing

the same hardware and software, and hence IT

resources per se do not provide better performance

(Santhanam and Hartono, 2003). This can be

explained through the RBV, because IT is not

considered a resource that is difficult to imitate; IT is

by itself typically imitable. This result supports the

findings of recent research (Batt and Grover, 2005)

that did no find evidence of a positive link between

IT quality and firm performance. Similarly, Powell

and Dent-Micallef (1997) showed that IT by itself

cannot be a source of competitive advantage. Thus,

our results confirm that Internet technology by itself

will rarely create business value.

Furthermore, results demonstrate that there is a

positive relationship between internal e-Business

capabilities and business value. Our findings

confirm the existing empirical literature. Bharadwaj

(2000) and Santhanam and Hartono (2003) found

that firms with superior IT capability do indeed

exhibit superior firm performance. Ravichandran

and Lertwongsatien (2005) showed that an

organization’s ability to use IT to support its core

competences depends on IS capabilities. Thus, even

though competing firms do not vary in terms of the

IT they possess, IS capabilities are rooted in

processes and business routines and provide

competitive advantage. In this sense, the results of

the present study support the proposition that

internal e-Business capabilities are positively

associated with business value.

Finally, the empirical results offer support for the

complementarity of Internet resources and internal

e-Business capabilities. The RBV highlights the role

of complementarities between resources as a source

of business value. Researchers such as Steinfield et

al. (1999) suggest that e-Business value can come

from synergies between online and offline presence.

In this sense, using case studies, they showed the

lack of exploitation of these synergies in SMEs. Zhu

(2004) developed a study which evaluates the impact

of e-commerce and IT on firm performance

(financial measures), studying both the main effects

and the interaction effect of e-commerce and IT on

firm performance. Our results support the RBV and

e-Business literature, therefore, it can be concluded

that having an adequate Internet infrastructure can

be critical for the impact of internal e-Business

capabilities on business value.

ICE-B 2008 - International Conference on e-Business

410

7 CONCLUSIONS, LIMITATIONS

AND FUTURE RESEARCH

In recent years, much debate about the value of IT

and e-Business has been created, due to the gap

between e-Business investment and the lack of

empirical evidence on e-Business value. Thus, today

IS researchers face pressure to answer the question

of whether and how e-Business creates value.

The complementarity of resources is a corner stone

of the resource-based theory and has been offered as

an explanation of how IT has largely overcome its

paradoxical nature and is contributing to business

value (Bhatt and Grover, 2005; Clemons and Row,

1991). Thus, to respond to these challenges, this

study developed a conceptual model, grounded in

the resource-based view (RBV) firms, to analyze the

complementarity of Internet resources and e-

Business capabilities as source of business value at

the level of an individual firm. The analysis

employed a large sample of companies from

different industries for hypothesis testing. Broadly,

this research offers several contributions: (1) it

identifies Internet resources and internal e-Business

capabilities; (2) it shows that Internet technology by

itself will rarely create business value; (3) it sheds

light on the complementarity of Internet resources

and internal e-Business capabilities as source of

business value.

While the contributions of the present study are

significant, it has some aspects which can be

addressed in future research. First, the sample used

was from Spain. It may be possible that the findings

could be extrapolated to other countries, since

economic and technological development in Spain is

similar to other OECD Member countries. However,

in future research, a sampling frame that combines

firms from different countries could be used in order

to provide a more international perspective on the

subject. Second, the business value measure is

subjective in the sense that it was based on Likert-

scale responses provided by managers. Thus, it

could also be interesting to include objective

performance data for measuring business value.

Third, the key informant method was used for data

collection. This method, while having its

advantages, also suffers from the limitation that the

data reflects the opinions of one person. Future

studies could consider research designs that allow

data collection from multiple respondents within an

organization. Fourth, this research takes a static,

cross-sectional picture of capabilities, which makes

it difficult to address the issue of how capabilities

are created over years. A longitudinal study could

enrich the findings.

REFERENCES

Amit, R. and Zott, C. (2001) Value creation in e-Business.

Strategic Management Journal, 22, 493-520.

Barney, J.B. (1991) Firm Resources and Sustained

Competitive Advantage. Journal of Management, 7,

99-120

Bharadwaj, A.S. (2000) A resource-based perspective on

information technology capability and firm

performance: an empirical investigation. MIS

Quarterly, 24, 169-196.

Bhatt, G.D. & Grover, V. (2005) Types of information

technology capabilities and their role in competitive

advantage: an empirical study. Journal of Management

Information Systems, 22, 253-277.

Boudreau, M., Gefen, D. & Straub D. (2001) Validation in

IS research: A state-of-the-art assessment. MIS

Quarterly, 25, 1-24.

Browne, M.W. & Cudeck, R. (1993) Alternative ways of

assessing model fit. In: Testing structural equation

models, Bollen, K.A. & Long, J.S. (ed.), pp. 136-162.

Beverly Hills: Sage.

Brynjolfsson, E. & Kahin, B. (2002) Understanding the

digital economy. Cambridge, MA: MIT Press.

Carr, N. (2003) IT doesn’t matter. Harvard Business

Review, May 2003, 41-49.

Churchill, G. A. (1979) A paradigm for developing better

measures of marketing constructs. Journal of

Marketing Research, 16, 64-73.

Clemons, E.K. & Row, M.C. (1991) Sustaining IT

advantage: the role of structural differences. MIS

Quarterly, 15, 275-292.

Day, G.S. (1994) The capabilities of market-driven

organizations. Journal of Marketing, 58, 37-52.

Devaraj, S. & Kholi, R. (2003) Performance Impacts of

Information Technology: Is Actual Usage the Missing

Link?. Management Science, 49, 273-289.

Feeny, D.F. and Willcocks, L.P. (1998) Core IS

capabilities for exploiting information technology,

Sloan Management Review, 39, 9-21.

Fornell, C. & Larcker, F.D. (1981) Evaluating structural

equation models with unobservable variables and

measurement error. Journal of Marketing Research,

18, 39-50.

Frohlich, M.T. (2002) e-Integration in the supply chain:

barriers and performance. Decision Sciences, 33, 537-

555.

Frohlich, M.T. & Westbrook, R. (2002) Demand chain

management in manufacturing and services: web-

based integration, drivers and performance. Journal of

Operations Management, 20, 729-745.

Gefen, D., Straub, D.W. & Boudreau, M.C. (2000)

Structural equation modeling and regression:

Guidelines for research practice. Communications of

the AIS, 4, 1-78.

E-COMPLEMENTARITY - The Link to e-Business Value

411

Grant, R.M. (1991) The resource-based theory of

competitive advantage: implications for strategy

formulation. California Management Review, 33, 114-

135.

Greene, W. (2000) Econometric analysis, Upper Saddle

River, 4th edition, NJ: Prentice Hall.

Gunasekaran, A., Love, P.E.D., Rahimi, F. & Miele, R.

(2001) A model for investment justification in

information technology projects. International Journal

of Information Management, 21, 349-364.

Henderson, J. & Venkatraman, N. (1999) Strategic

alignment: Leveraging transforming organizations”,

IBM Systems Journal, 31, 472-484.

Hoffman, T. (2002) Frugal IT investors top best-performer

list. Computerworld, December 6.

Kaplan, S. & Sawhney, M. (2000) E-hubs: the new B2B

marketplaces. Harvard Business Review, 70, 71-79.

Kettinger, W.J., Grover, V., Guha, S. and Segars, A.H.

(1994) Strategic information systems revisited: a study

insustainability and performance, MIS Quarterly, 18,

31-58.

Mahoney, J.T, Pandian, J.R. (1992) The resource-based

view of the firm within the conversation of strategic

management. Strategic Management Journal, 13, 363-

380.

Makadok, R. (2001) Toward a synthesis of the resource-

based and dynamic-capability views of rent creation.

Strategic Management Journal, 22, 387-402.

Mata, F.J., Fuerst, W.L. & Barney, J.B. (1995)

Information technology and sustained competitive

advantage: a resource-based analysis. MIS Quarterly,

19, 487-505.

Powell, T.C. & Dent-micallef, A. (1997) Information

technology as competitive advantage: the role of

human, business, and technology resources. Strategic

Management Journal, 18, 375-405.

Ravichandran, T. & Lertwongsatien, C. (2005) Effect of

Information Systems Resources and Capabilities on

Firm Performance: A Resource-Based Perspective.

Journal of Management Information Systems, 21, 237-

276.

Ray, G., Barney, J.B. & Muhanna, W.A. (2004)

Capabilities, business processes and competitive

advantage: choosing the dependent variable in

empirical tests of the resource-based view. Strategic

Management Journal, 25, 23-37.

Ross, J.W., Beath, C.M. & Goodhue, D.L. (1996) Develop

long-term competitiveness through IT assets. Sloan

Management Review, 38, 31-42.

Santhanam, R. & Hartono, E. (2003) Issues in linking

information technology capability to firm

performance. MIS Quarterly, 27, 125-153.

Steinfield, C., Mahler, A. & Bauer, J. (1999) Electronic

commerce and the local merchant: opportunities for

synergy between physical and Web presence,

Electronic Markets, 9, 51-57.

Straub, D.W. (1989) Validating Instruments in MIS

Research. MIS Quarterly, 13, 147-169.

Tallon, P., Kraemer, K. & Gurbaxani, V. (2000)

Executives’ perceptions of the business value of

information technology: a process-oriented approach.

Journal of Management Information Systems, 16, 137-

165.

Teece D.J, Pisano G. & Shuen A. (1997) Dynamic

capabilities and strategic management. Strategic

Management Journal, 18, 509-533.

Zhu, K. (2004) The complementarity of information

technology infrastructure and e-commerce capability:

a resource-based assessment of their business value.

Journal of Management Information Systems, 21, 167-

202.

Zhu, K. & Kraemer, K.L. (2005) Post-adoption variations

in usage and value of e-Business by organizations:

cross-country evidence from the retail industry.

Information Systems Research, 16, 61-84.

APPENDIX: MEASURES

Internet Resources:

Does your company have a website? (Y/N)

Does your company use an Intranet? (Y/N)

Does your company use an Extranet? (Y/N)

Does your company use a LAN? (Y/N)

Internal e-Business capabilities:

Do you use online technologies to share documents

between colleagues or to perform collaborative work

in an online environment? (Y/N)

Do you use online technologies to track working

ours and production time? (Y/N)

Do you use online technologies to support human

resources management? (Y/N)

When an online order comes, is the order fully

integrated with the back-end system? (Y/N)

Business value: e-Procurement effectiveness

What effect has online procurement on the

procurement costs? (1-5)

What effect has online procurement on your

relations to suppliers? (1-5)

What effect has online procurement on the costs of

logistics and inventory? (1-5)

Note. (Y/N), dummy variable; (1-5), five-point

Likert-type scale.

ICE-B 2008 - International Conference on e-Business

412