A DRM Architecture for

Securing User Privacy by Design

?

Daniel Kadenbach, Carsten Kleiner and Lukas Grittner

Department of Computer Science, University of Applied Sciences and Arts Hannover, Germany

Abstract. Privacy considerations are one serious point against current DRM sys-

tems, because they would allow the License-Issuers to collect large amounts of

user data, up to the the time a user listens to a song or which users are read-

ing which kind of books. This sort of data could be used for marketing purposes

but also for malicious deeds. This paper addresses this threat and establishes a

DRM architecture which protects user privacy by the core of its design by adding

a third trusted party and an appropriate communication protocol. The work was

influenced by a project in mobile DRM b ased on the OMA specification [1].

1 Introduction

Privacy is a fundamental right in a free society, therefore its protection should be an

integral part of every new technology which could be used to harm it.

Digital Rights Management (DRM), or Digital Restrictions Management as referred

to by its critics [2], covers technologies for enforcing access and usage rules on digi-

tal content by encrypting the content objects and the use of licenses which contain the

decryption-key and usage-rules. In times of global connectivity even with mobile de-

vices DRM systems implemented without an eye upon protecting user privacy by fun-

damental design aspects can easily harm personal information rights of the customer or

even be used to facilitate user surveillance.

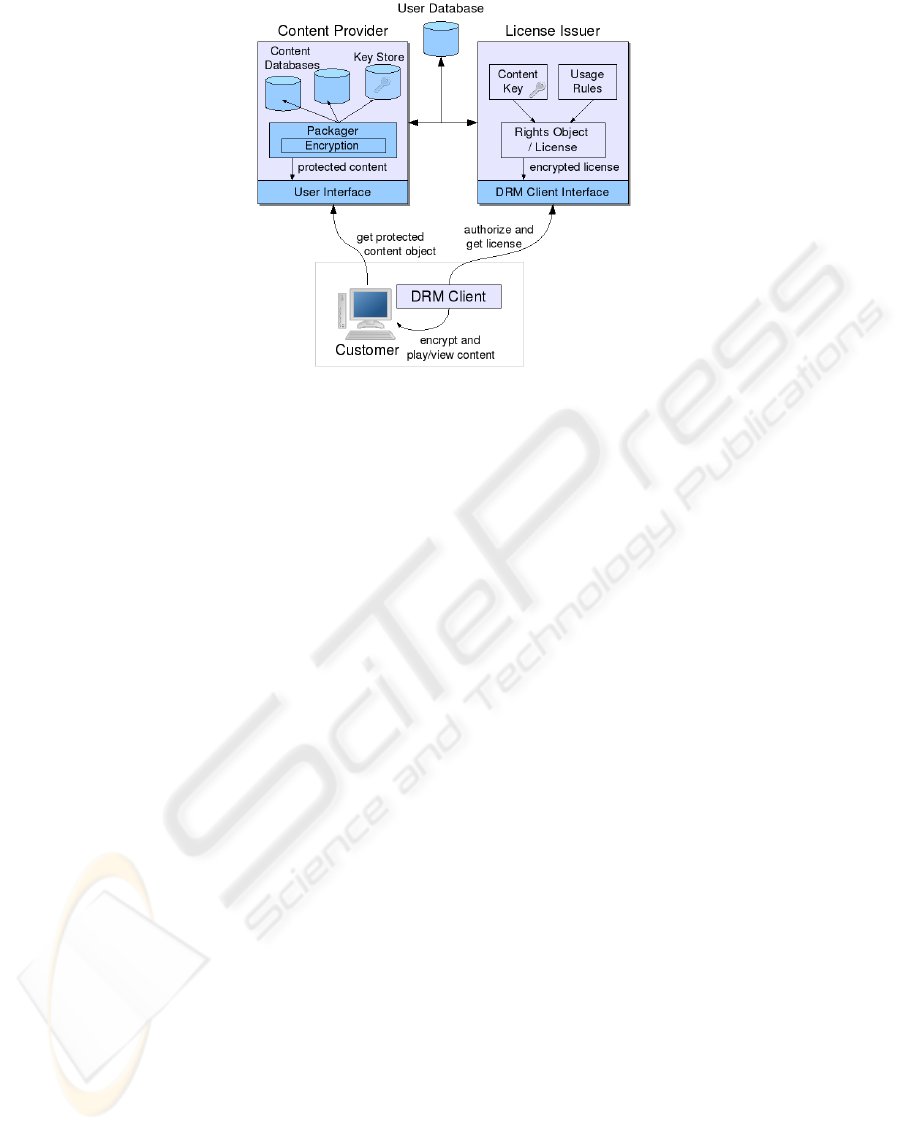

A typical DRM architecture can be seen in Figure 1. The content provider pack-

ages content objects from its databases and encrypts them before offering them to the

customer through a specified interface. The customer can download the content and

acquire a license from the License-Issuer with the help of the local DRM client. The

license includes the necessary key to decrypt the content along with usage rules which

are enforced by the DRM client.

Because the content has to be decrypted on the client-side one can actually see that

this sort of system can in the end only seriously be secured against local attacks if the

DRM software is secured by means of hardware, which could be solved by the use

of trusted computing (see [3] and [4] for more information about trusted computing

concerning DRM).

?

This project has been funded by the Lower Saxony Ministry for Science and Culture under

grant no AGIP FA 2005.692.

Kadenbach D., Kleiner C. and Grittner L. (2007).

A DRM Architecture for Securing User Privacy by Design.

In Proceedings of the 5th International Workshop on Security in Information Systems, pages 188-195

DOI: 10.5220/0002422301880195

Copyright

c

SciTePress

Fig. 1. Typical DRM Scenario.

In the case of DRM privacy may be harmed because the License-Issuer in recent im-

plementations is e.g. able to obtain detailed personalized usage profiles. But privacy is

not incompatible with this new technology [5]. In this paper we want to draft a possible

architectural solution which protects user privacy in a DRM system by design, so that

buying a song on the internet would be like buying a CD in a shop by cash again as far

as privacy protection is concerned. After all the shopkeeper should only be interested in

being paid, and no customer would want to leave his/her address and bank data at every

shop or even inform the shopkeeper every time before consuming the product. Also it

should not be possible for the vendor to create named purchase statistics without the

explicit affirmation of the consumer.

In the following we want to draft an architecture which not only secures user privacy

and thus enhances the chance of user acceptance for DRM but which also has additional

benefits for the other involved participants. In particular we will shortly investigate

current DRM systems and their handling of user privacy in section 2. After that we will

establish concrete requirements for a DRM architecture which protects user privacy in

section 3 and discuss our solution to it in section 4. Closing we will discuss the pros

and cons of the drafted architecture.

2 Current DRM Systems and User Privacy

In one of the leading DRM specifications for mobile devices used currently, the OMA

DRM v2.0 specification, it is exclusively stated that privacy aspects are not covered and

had to be investigated and integrated further by its implementers [1]. This seems to be

a serious shortfall, because especially in the privacy field an open specification which

protects user rights could do a lot to let users feel more comfortable.

In a survey on behalf of the German Federal Ministry of Education and Research

different DRM systems were examined concerning their privacy protection and user

friendliness [6] among them were iTunes, Musicload with Microsoft Windows Media

Rights Manager, Sony DRM and Adobe Digital Media Store.

189

The survey revealed that nearly none of the systems offered an anonymous rights

acquisition, that most of the time customers had to reveal personal information which

was not necessary for the transaction, and that the systems stealthy gathered additional

information without notifying the user. In purchased iTunes-files there were even un-

encrypted personal details of the customer; the other systems encrypted additional data

in the files, so it could not be analysed further if they compromise user privacy. The

conclusion of the survey is that the examined DRM systems are unhandy, intransparent,

even threateningly and isolate users because they are not interoperable.

In [7] it is exclusively stated that transparency for personal data is recommended for

a better practice and thus for a greater user acceptance.

For other work in this field see Michiels et al [8] for a view into the design of DRM

architectures, Arnab and Hutchison [9] which examine how to improve the fairness to

the end user of DRM systems, Cohen [5] which examines aspects concerning the law

and user privacy in DRM systems or [10] for a position paper of the W3C on privacy

and DRM.

3 Requirements for a Privacy-Protected DRM System

From the preceding considerations the following requirements can be deduced for a

privacy protected DRM environment:

o The user should only enter as little information as is absolutely necessary to conduct

the requested services.

o Information shall only be given to parties which can be trusted by the user. Ideally

user information should only be kept at one central place entrusted in the care of a

respectable institution.

o It should be well-known to the user which data is send over the network.

o The decision if the vendors can survey purchase statistics per user should be in the

control of the user.

o Data should always be send encrypted in a way so that only the designated recipient

can decrypt it.

o The system should be designed and implemented in an open manner, so that its

privacy protection can be proven and trusted.

4 Architectural Draft

To secure user privacy we have to introduce a third trusted party in the content and rights

acquisition scheme of the DRM scenario. This party is some sort of financial institution

which offers services for the user and the DRM provider and is trusted by both of them.

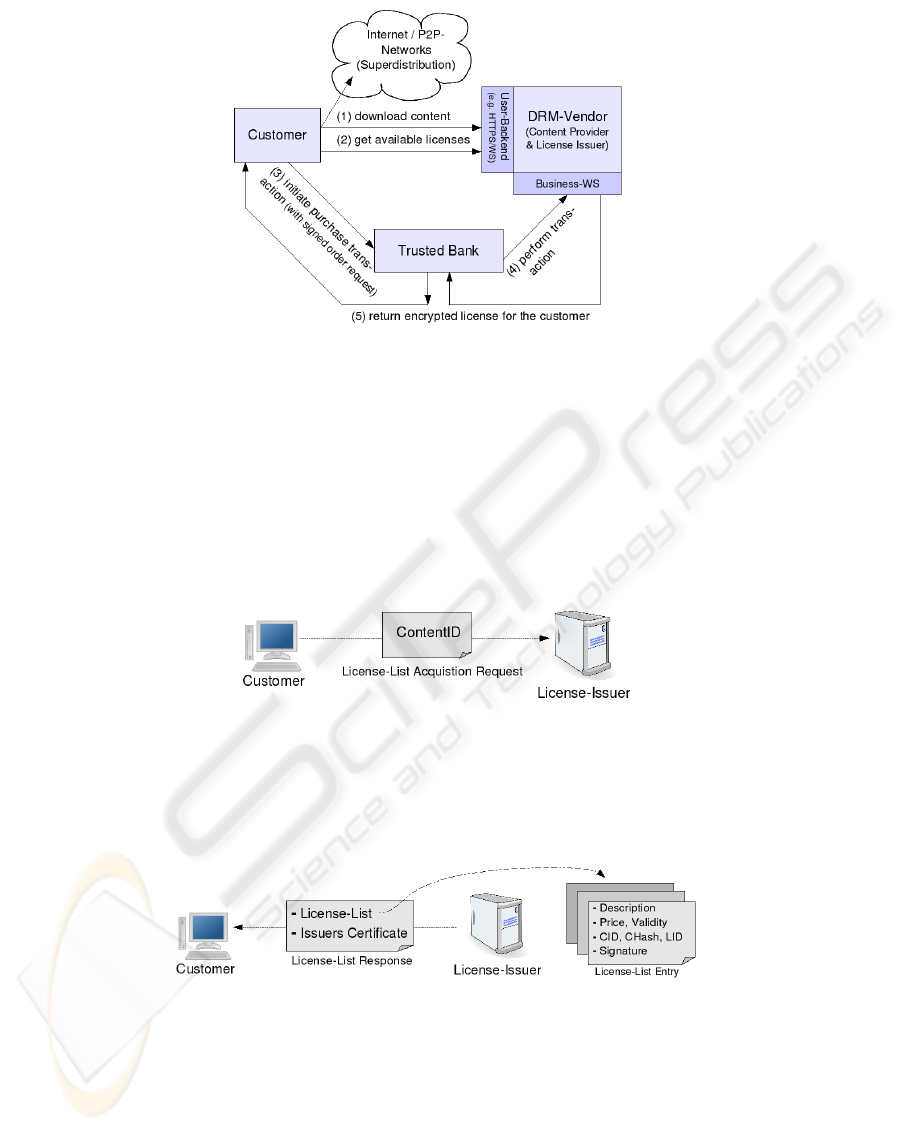

The new architecture can be seen in Figure 2 and is described in detail below.

4.1 Communication between Customer and License-issuer

The first message which is sent in the whole scenario is issued by the Customer and

directed at the License-Issuer to get the possibly different licenses related to a speci-

fied content object (as seen in Figure 3). The content acquisition itself is not part of

190

Fig. 2. Overview of the Architectural Draft.

the process because it can be done in arbitrary ways like direct download from the

Content-Provider or super-distribution through a peer-to-peer network, which is possi-

ble because the content objects are encrypted.

The ContentID and the URL of the License-Issuer which is needed to address this

message correctly can be read out from the content object. The ContentID in this mes-

sage specifies a content object in a unique way for which the License-Issuer offers

corresponding licenses.

Fig. 3. Consumer Message to Acquire a License-List.

As a response to this request, the License-Issuer sends its certificate to authenticate

itself and an asymmetrically encrypted list of the available licenses seen in Figure 4.

The contained descriptions should be human readable.

Fig. 4. License-List Response from License-Issuer.

The concrete implementation of this message exchange can be chosen conforming

with given requirements. Preferably it shall be implemented with Web Services, because

of their standardized security extensions and because their design fits very well into this

191

kind of service oriented architecture, but it could also be implemented using standard

HTTP(S)-technology to ease operating system integration.

4.2 Communication between Customer and Bank

To ensure the anonymity of the customer to other persons who might intercept the com-

munication there is a need to encrypt the data which is sent. Furthermore the customer

has to authenticate herself to the bank and the other way round. This is essential because

the bank must determine the identity of the customer for choosing the right account

which should be charged. Moreover the customer wants to know if she really commu-

nicates to the real bank-server. If she was not doing so she could expose private data. A

widely accepted solution for such needs is a PKI (Public Key Infrastructure). For more

information on PKIs see [11].

The bank has to administrate its own Certification Authority and give out a certifi-

cate for each of its online users. The certificate could be used both for authentication

and for encryption. The key-pair for a customer should be generated on the customers

computer and her private key must not be known by the bank. Otherwise the user would

not be secured against being spoofed by the bank.

However, even if every part of the certificate would be generated from the bank this

would still not be worse than the current situation where customers are trusting their

financial institutions. But it would not make use of the full potential of the described

architecture.

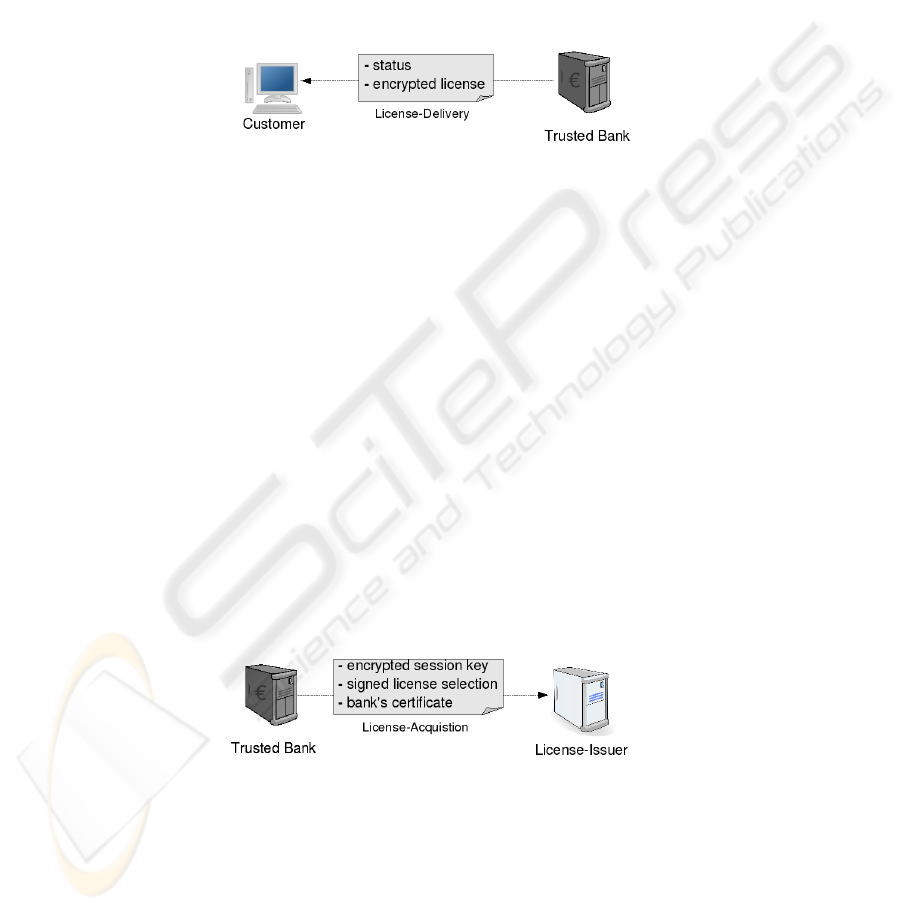

Customer and Bank have to exchange two messages. The first one, the License-

Request Initiation message (seen in Figure 5) is sent from the customer to the bank

as an order to start a license acquisition process. The message contains an encrypted

session key, which is encrypted with the public key of the License-Issuer so that it can

only be decrypted with the corresponding private key by the Issuer. With this session

key the Issuer afterwards encrypts the license object which is returned, so that only

the customer is able to decrypt it. Additionally the License-Request Initiation message

contains one license option from an afore acquired list, which the customer wants to

buy. To this license option a current time stamp is attached and then signed by the

customer.

Fig. 5. License-Request Initiation Message.

This signed license option can be regarded as a contract between the DRM vendor

and the customer, it contains the validity of the product, its price and description, the

time of the customer request and is signed by both the customer and the DRM vendor,

so none of them could reject it.

192

The last information in this message is the Issuer’s URL or other identification, so

the bank knows how to communicate with the Issuer.

After receiving and processing this message the bank contacts the License-Issuer

and tries to acquire the specified license for the customer which is shown in section 4.3

which describes the bank to License-Issuer communication. The second message then

is the response from the bank to the customer seen in Figure 6. If the status contains

“success” the request has been successful and a license has been provided which is then

forwarded to the customer. Otherwise the status contains a failure description.

Fig. 6. License-Delivery Message.

4.3 Communication between Bank and License-issuer

This communication has to be secured, too, but in this case in two ways. In this case

it is impossible to use a specific Certification Authority on either the bank’s or the

Issuer’s side (e.g. the bank could not be demanded to manage certificates for all possi-

ble Issuers). Both bank and Issuer have to acquire a certificate from one of the public

certification authorities. Even though this is coupled with spending money the effort

is negligible in comparison to the possible benefits. They will most probably already

have such certificates nowadays. The certificates could then be used as in the previous

scenario to authenticate and encrypt data.

The first message in this context is sent by the bank after it has received a License-

Request Initiation from the customer (see Figure 7). This message contains the license

selection, which the bank received from the customer and the certificate of the bank.

Before forwarding the license selection the bank removes the signature of the customer

to preserve the customer’s privacy. The bank then signs the license request to ensure its

authenticity.

Fig. 7. Trusted-Bank Requesting a License from the Issuer.

As a reply to the license-acquisition message the Issuer sends the message shown

in Figure 8 to the bank. The account data is needed for the bank to transfer money

for the license. By sending this message the contract is closed and after forwarding

the license to the customer (as described in section 4.2) the bank should carry out the

193

cash remittance to the License-Issuer. At this point it can also be seen clearly, that the

concrete implementation of this protocol has to ensure that no message could become

lost. In a Web Service scenario this can be accomplished by the use of WS-Reliable

Messaging [12].

Fig. 8. License-Response from Issuer.

5 Conclusion

To further investigate our drafted architecture and to proof our concepts we imple-

mented a prototypical scenario with the described components and the proposed proto-

col. Technically our implementation uses Web Services for the communication and the

security related requirements are solved by the use of Web Service Security functional-

ity like encryption, signing and certificates.

Summing up we found the following benefits of the drafted architecture:

+ Privacy-protection of the customer. Only the Trusted Bank needs to know the cus-

tomers data (and the banks already have the necessary data of their customers).

Vendors do not need and have no chance to know who is buying their goods. Just if

the customer chooses to use the same session key for one or more vendors repeat-

edly, it would be possible for the vendors to collect anonymous purchase-statistics.

Additionally there is just one point where customer data is stored, so it is easier to

protect user privacy at this point through an independent party and by sophisticated

technical and organisational means.

+ Digitally signed contracts. They provide an evidence for both customer and seller

and thus ensure the non-repudiation of the transaction.

+ Trust in being paid. License-Issuers can be sure they are actually paid, because they

only have to trust a few banks, in contrast to thousands different users and the bank

is able to check the accounts of its users before the acquisition.

+ Unique way for money transfers. The billing for all transactions is handled in the

same way. The customer and the vendors are not burdened anymore to handle dif-

ferent money transfer schemes. The Issuers do not have to build their own account-

ing interface as today.

+ Bank advantage. As central service provider in online trade with digital goods.

+ Usability. Better usability for the customer, because it is not necessary anymore to

create different accounts (for each vendor) or give away personal information more

than one time.

One can see that there are certain benefits not only for the customer, but also for

banks and Content-Owners/License-Issuers. On the other hand this solution would im-

pose the following burdens, which however should be far more than compensated by

the afore mentioned points:

194

– Additional infrastructure. The banks have to set up a highly accessible service in-

terface, but they already have similar services e.g. for online-banking.

– Single point of failure. The trusted-bank is the bottleneck of the architecture. Even

if data-throughput should be low because of the simple protocol and the small mes-

sages which are exchanged, the servers have to be secured against denial of ser-

vice, but the same issues are already addressed in recent classical online banking

systems.

– Effort to establish PKIs. Additional effort has to be considered to establish the

Public-Key-Infrastructure for the trust relationships.

6 Future Work

We need to further proceed with our prototypical implementation of this architecture

and therefore exactly define the needed Web Service interfaces and setup the PKI-

infrastructure to examine the benefits and challenges of this architecture in a greater

detail and to perform a detailed security assessment. We also want to investigate possi-

ble ways to improve user experience and acceptance of DRM systems even further.

References

1. Open Mobile Alliance: OMA Digital Rights Management V2.0 Specifications (2006)

http://www.openmobilealliance.org/release program/drm v2 0.html.

2. Free Software Foundation: Digital restrictions management and treacherous computing

(2006) http://www.fsf.org/campaigns/drm.html.

3. Erickson, J.S.: Fair use, drm, and trusted computing. Commun. ACM 46 (2003) 34–39

4. Cooper, A., Martin, A.: Towards an open, trusted digital rights management platform. In:

DRM ’06: Proceedings of the ACM workshop on Digital rights management, New York, NY,

USA, ACM Press (2006) 79–88

5. Cohen, J.E.: DRM and privacy. Commun. ACM 46 (2003) 46–49

6. Grimm, R., Puchta, S., M

¨

uller, M.: privacy4drm (2005)

https://www.datenschutzzentrum.de/drm/privacy4drm.pdf.

7. Grimm, R.: Privacy for digital rights management products and their business cases (2005)

http://www.uni-koblenz.de/ grimm/texte/Privacy4DRM Tech-Axmedis-Grimm-final.pdf.

8. Michiels, S., Verslype, K., Joosen, W., Decker, B.D.: Towards a software architecture for

drm. In: DRM ’05: Proceedings of the 5th ACM workshop on Digital rights management,

New York, NY, USA, ACM Press (2005) 65–74

9. Arnab, A., Hutchison, A.: Fairer usage contracts for drm. In: DRM ’05: Proceedings of the

5th ACM workshop on Digital rights management, ACM Press (2005) 1–7

10. Vora, P., Reynolds, D., Dickinson, I., Erickson, J., Banks, D.: Privacy and digital rights

management. In: In Proceedings of the W3C Workshop on Digital Rights Management

(Sophia-Antipolis, France, Jan. 22–23, 2001). (2001)

11. Choudhury, S.: Public Key Infrastructure Implementation and Design. Wiley & Sons (2002)

12. Iwasa, K., Durand, J., Rutt, T., Peel, M., Kunisetty, S., Bunting, D.: Web ser-

vices reliable messaging tc, ws-reliability 1.1 (2004) http://docs.oasis-open.org/wsrm/ws-

reliability/v1.1/wsrm-ws reliability-1.1-spec-os.pdf.

195