DAY OF THE WEEK EFFECT IN

SMALL SECURITIES MARKETS

Virgilijus Sakalauskas and Dalia Kriksciuniene

Department of Informatics, Vilnius University, Muitines 8, 44280 Kaunas, Lithuania

Keywords: Day-of-the-week effect, securities markets, return index, Kolmogorov-Smirnov test, Stock Index.

Abstract: In this article statistical investigation of the day-of-the-week effect was explored for the case of small

securities market. By applying statistical analysis of Vilnius Stock OMX Index return data, the effect was

not observed. After rearranging data to the meaningful subsets of return variable the significant difference

among Monday and Friday compared pairwise to the other days of the week, has been observed. The

hypothesis of equality of the higher moments across days of the week could be rejected by indicating that a

weekly pattern on the higher moments exists.

1 INTRODUCTION

Many research studies address the problem of stocks

profitability by using wide variety of methods. One

group of authors use methods of technical analysis

for investigating influence of historical prices

deviations (Achelis, 2000), the others concentrate to

the fundamental analysis of the stock market, aimed

to development of financial indicators, which could

reveal stock price changes (Thomsett, 2006). No

method has any significant preference over the

others, thus some price change phenomena or

anomalies of the stocks can be explained only by

integrative application of both methods groups. One

of such phenomena is the influence of day-of-the-

week for the profitability and risk of investment.

Day-of-the-week effect indicates the anomaly of

the return of stocks, which occurs during the specific

days of the week. The traditional understanding of

return is presented by expression, where return on

time moment t,

t

R

is evaluated by logarithmic

difference of stock price over time interval (t-1,t]:

)ln()ln()ln(

1

1

−

−

−==

tt

t

t

t

PP

P

P

R

,

(1)

where

t

P

indicates the price of financial

instrument at time moment t.

Day-of-the-week effect has attracted attention of

many investigators. Fama (1965) and many other

authors (Jaffe and Westerfield, 1989; Gregoriou et al

2004; Gordon and Tang, 1998) have substantiated

that mean return and variance of investment

significantly differs across days of the week. In these

works the significance of „ Monday anomaly“ was

indicated. This means that the volatility of return of

Mondays is significantly higher, than during the

other days, and the mean return is lower. Other

articles (Syed and Basher, 2006; Tong, 2000) have

verified the hypothesis about the exclusive shape of

the return function at the first and last days of the

week in different financial markets of US, European

and Asia-Pasific exchange. In these research works

the day-of-the-week effect analysis was based on the

first two return distribution moments. Gordon and

Tang (1998), Galai and Kedar-Levy (2005) have

tested the effect of higher moments (e.g. skewness

and kurtosis) of return and concluded that the

hypothesis of equality of the higher moments across

days of the week can be rejected, indicating that a

weekly pattern on the higher moments exists.

The anomalies of the first trading day can be

explained by the influence of institutional traders,

also by the abundance of stock market news during

the weekend, comparing to other days of the week.

The effect of the last trading day can probably be

explained by the psychological factor.

All these investigation have been made in

developed securities markets. Some new research

sources indicate that the influence of day of week

effect is fading (Syed et al, 2006). There is no

research presented, if similar dependencies are still

important in the small securities markets with low

turnover and comparatively small number of market

players.

In this work we shall analyse the day-of-the-

week effect in the small markets with low liquidity.

432

Sakalauskas V. and Kriksciuniene D. (2007).

DAY OF THE WEEK EFFECT IN SMALL SECURITIES MARKETS.

In Proceedings of the Ninth International Conference on Enterprise Information Systems - AIDSS, pages 432-435

DOI: 10.5220/0002383404320435

Copyright

c

SciTePress

The research methods, used in the article include

traditional analysis, where the differences of first

moments, calculated for the days of the week, will

be investigated, and the methods, based on analysis

of the higher moments.

The research outcomes and conclusions are

presented in section 3. All calculations are made

with the STATISTICA 6.0 for Windows software.

2 DATA AND METHODOLOGY

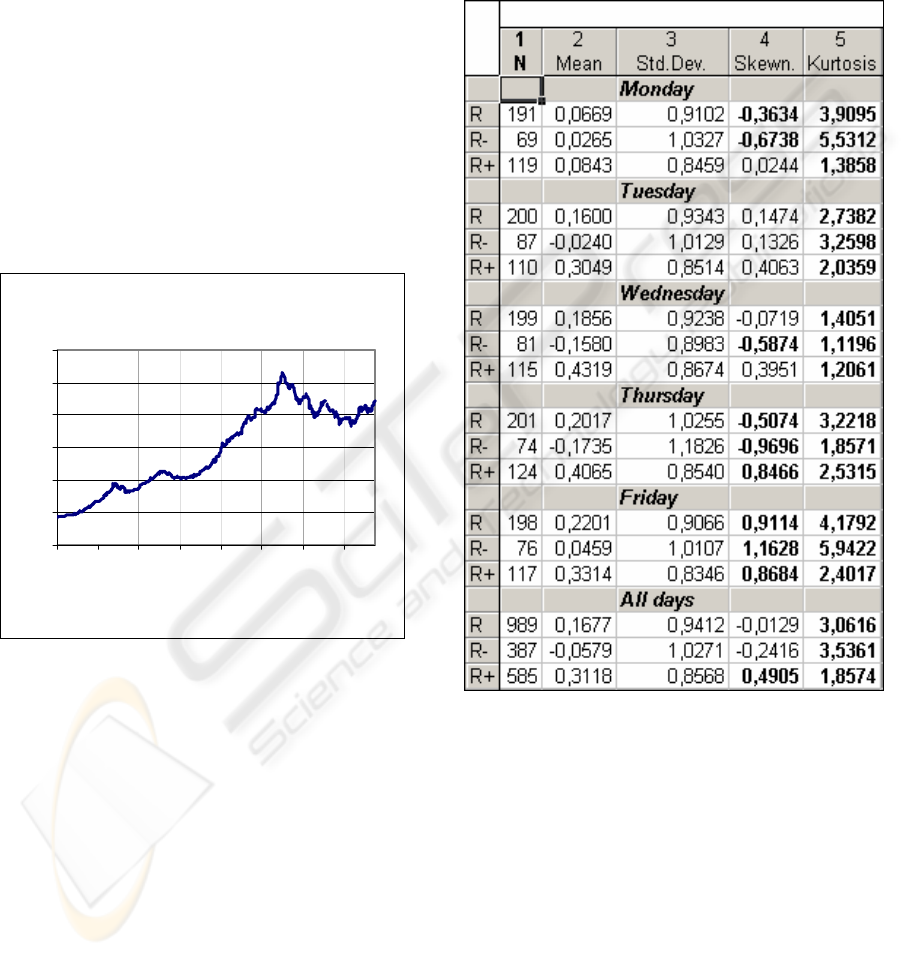

Data was taken from Vilnius Stock Exchange

information (The Nordic Exchange, 2006). The

OMX Vilnius Stock Index is a capitalization

weighted chain linked total-return index. For the

further calculations in this research we used the

OMX Vilnius Stock Index values of the time

interval from 2003-01-01 to 2006-11-21 on daily

basis (Figure 1).

The OMX Vilnius Stock Index values

0

100

200

300

400

500

600

03.01.01

03.07.01

04.01.01

04.07.01

05.01.01

05.07.01

06.01.01

06.07.01

Figure 1: The OMX Index values.

Return on investment to this index was

calculated by applying formula (1). For analysis of

the day-of-the-week effect the collected return data

has been processed in the following way.

The primary data set was assigned to the variable

RETURN (or R). Then two additional data sets

were derived from it. The first data set RETURN+

(or R+) was combined of those values of data set

RETURN, which had positive return on the prior

trading day. The data set RETURN- (or R-) was

made of RETURN values, which had negative

returns on the prior trading day. The prepared sets of

data, used for the further research consisted of 984

values for variable R; the derived data sets had 580

values of R+ and 382 values of the R- variable.

Similar method for splitting the initial data set was

used by Galai (2005). This method of data

rearrangement more clearly highlighted presence of

the day-of-the-week effect.

The three data sets were initially analysed by

presenting their Summary Statistics (Table 1).

Table 1: Day-of-the-week Summary Statistics (Bold

numbers indicate 5% significance).

From this table we observe that the average

return R+ values exceed significantly the return

values of other variables. One of possible reasons to

explain this effect could be psychological drive for

investment under the conditions of raising market

index. The effect of Friday increase return is

explained psychologically, by good moods of traders

before weekend.

By analysing standard deviation we noticed, that

there is no difference in volatility between days of

the week and among volatility the variables R, R+,

R-. The difference of daily rates of return

distribution from normal distribution is most evident

by analysing high moments (skewness and kurtosis).

Significant difference of skewness and kurtosis from

zero value indicates deviations from a normal

DAY OF THE WEEK EFFECT IN SMALL SECURITIES MARKETS

433

distribution. In the Table 1, the estimations of

skewness and kurtosis were statistically significant

at 5% level (printed in bold numbers) for almost all

weekdays and all three variables. In this way we

had to reject hypothesis about normality of return

distribution.

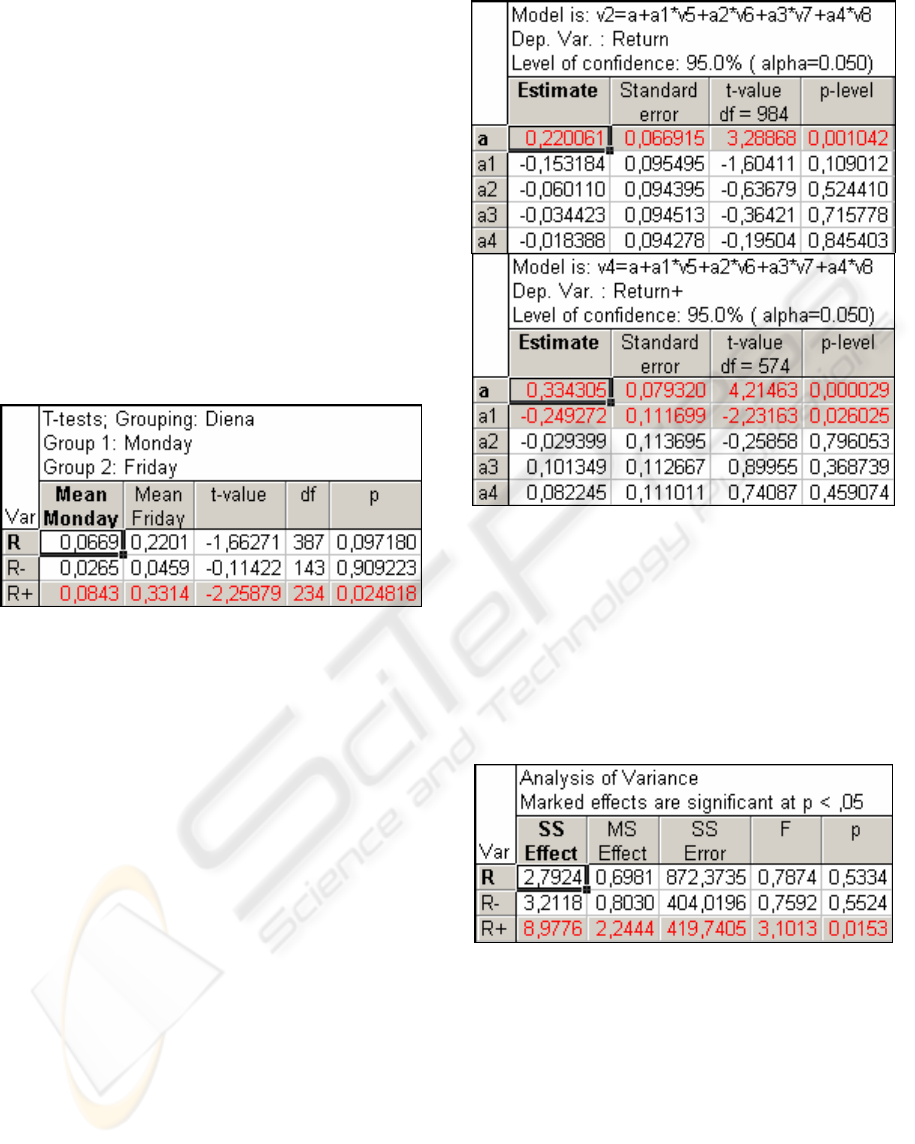

Further, the day-of-the-week effect was be

explored by applying the t-test for differences

between mean returns for Monday and the other

days of the week.

In the Figure 2 we can see that only the variable

R+ had statistically significant difference between

Monday and Friday mean returns (grey background).

By performing t-test for the other days of the week,

similar results were obtained - only R+ had a

statistically significant difference between Monday

and those on any other day.

Figure 2: T-test between returns on Monday and Friday.

Further for the research of the day-of-the-week

effect we shall use the regression model. Generally it

is defined it with the help of the following equation:

t

ε

,t

Da

,t

Da

,t

Da

,t

Daa

t

R

+++

+

+

+=

4433

2211

(2)

where a estimates the average return on Friday,

i

a

estimates the average difference between the return

on Friday and the i-th (i=1,2,3,4) trading day‘s

return,

ti

D

,

is the dummy variable for the i-th

trading day on date t,

0>

t

ε

is for random

regression error.

The null hypothesis for this model

0

H

stated the

equality of average daily rates of return:

0:

43210

=

=== aaaaH

. The results of

application of the regression model for R and R+

variables are presented Figure 3. The analysis of the

variable R revealed, that only subset the of data for

Friday (grey background) had the statistically

significant difference from other days of the week.

Figure 3: Regression model for R and R+ variables

The R+ indicates the significance difference for

Friday and Monday (grey background). The R- had

no statistically significant difference among those

days. The comparable results for big security

markets can be found in (Kohers et al, 2004, Tong,

2000).

Very similar results we obtained using analysis

of Variance method.

Figure 4: ANOVA results.

As we can see on Figure 4, only the analysis of

variable R+ indicates significant difference between

days of the week. Application of F criteria to R+,

allows us to reject the hypothesis of absence of

average differences among the return of the different

days of the week.

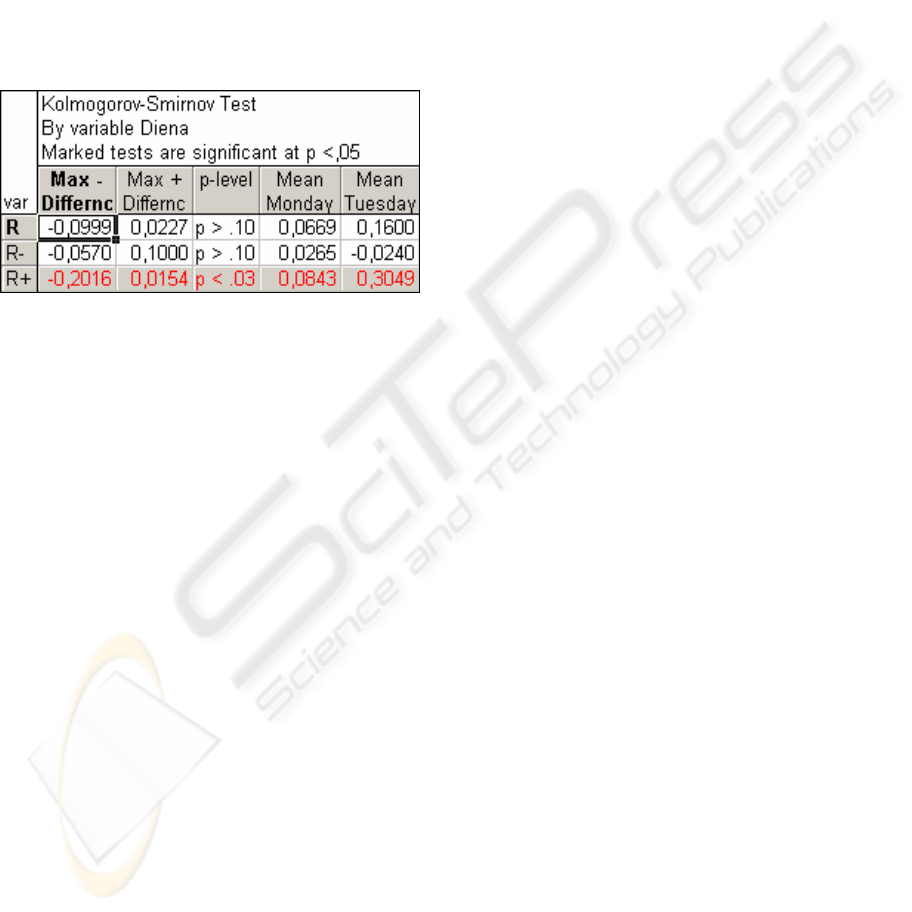

By applying the Kolmogorov-Smirnov test we

tested hypothesis, that two samples were drawn from

the same population. This test is sensitive to the

differences of the general shapes of the distributions

of the two samples (i.e., to differences of variance,

ICEIS 2007 - International Conference on Enterprise Information Systems

434

skewness, kurtosis etc.). It is generally applied for

testing the influence of higher moments for the

distribution (StatSoft Inc., 2006). In our case, for

investigation of the day-of-the-week effect, we

applied Kolmogorov-Smirnov test for different days

of the week. It was defined, that the variable R+ has

significant pairwise difference of the days of the

week only for Monday and Friday, what means, the

value of return index of first and last trading day of

the week differed from the other weekdays. In the

Figure 5, the Kolmogorov-Smirnov test values for

indicating difference among Monday and Tuesday

distributions was presented.

Figure 5: Kolmogorov-Smirnov test.

Similar tendency was valid for the other days of

the week. Even more significant influence could be

observed among Monday and Friday distributions.

By applying Mann-Whitney U test, used to

explore location characteristics of two samples

(means, average ranks, respectively), we also

observed significant difference of variable R+

values of Monday, compared to the other days of the

week.

3 CONCLUSIONS

In this article the statistical analysis of data of the

week effect was explored for the case of Lithuanian

stock market. The application of traditional

statistical analysis methods, such as regression

analysis, t-test, ANOVA, Levene and Brown-

Forsythe test of homogeneity of variances gave the

results, which allowed us to conclude, that only the

data set R+ had a statistically significant difference

between Monday and other days of the week. We

have noticed that the average return of Monday

trading was the lowest, and Friday trading was the

highest during the week. As stock market news flow

during the weekend is generally very low for small

securities markets, it does not influence much the

Monday trading turnover. We could rather conclude

the effects of ‘Monday somnolence’ and ‘Friday

uplift’ for the return of emerging markets.

The application of nonparametric Kolmogorov-

Smirnov test, based on analysis of the higher

moments of return distribution, did not indicate the

day-of-the-week effect for the full set of historical

data (variable R). This effect was indicated only for

the variable R+, where significant difference among

Monday and Friday compared pairwise to the other

days of the week, has been observed.

The differences of the days of the week effect,

studied in this article can advice us for further

research directions: investigation of the differences

between developed and emerging markets and to

research more precisely the derived sets of variables

R+ and R-. This type of research could give us

better insight to the behaviour of return data, and

could lead us to more precise outcomes of analysis.

REFERENCES

Achelis, S.B., 2000. Technical Analysis from A to Z,

McGraw-Hill Professional. 2nd Editon.

Fama, E.F., 1965. The behaviour of stock market prices,

J.Busin. 38, 34-105.

Galai, D. and Kedar-Levy, H., 2005. Day-of-the-week

Effect in high Moments, Financial Markets,

Institutions & Instruments, 14:3, 169-186.

Gordon, Y.N. Tang, 1998. Weekly pattern of exchange

rate risk: evidence from ten Asian-Pasific currencies,

Asia_Pacific Financial Markets, 5, 261-274

Gregoriou, A., Kontonikas, A. and Tsitsianis, N., 2004.

Does the day-of-the-week effect exist once transaction

costs have been accounted for? Evidence from the UK.

Applied Financial Economics, 14, 215–220.

Jaffe, J.F., Westerfield, R. and Ma, C., 1989. A twist on

the Monday effect in stock prices: evidence from the

U.S. and foreign stock markets. Journal of Banking

and finance 13, 641-650.

Kohers, G., Kohers N., Pandey V. and Kohers T., 2004.

The disappearing day-of-the-week effect in the

world’s largest equity markets. Applied Economics

Letters, 11, 167–171.

StatSoft Inc., 2006. Electronic Statistics Textbook. Tulsa,

OK: StatSoft. WEB:

http://www.statsoft.com/textbook/stathome.html.

Syed, A. Basher and Sadorsky, P., 2006. Day-of-the-week

effects in emerging stock markets. Applied Economics

Letters, 13, 621–628.

The Nordic Exchange. Retrieved November 25, 2006,

from http://www.baltic.omxgroup.com/.

Thomsett Michael, C., 2006. Getting started in

fundamental analysis. Wiley, pp.232.

Tong, W., 2000. International evidence on weekend

Anomalies. Journal of fin. research 23:4, 495-522.

DAY OF THE WEEK EFFECT IN SMALL SECURITIES MARKETS

435