A Secure Universal Loyalty Card

S

´

ebastien Canard

1

, Fabrice Clerc

1

and Benjamin Morin

2

1

France Telecom R&D, 42, rue des Coutures, BP6243, 14066 Caen Cedex 4, France

2

Supelec Rennes, Avenue de la Boulaie, BP 81127, 35511 Cesson-S

´

evign

´

e Cedex, France

Abstract. In this paper, we propose a generic loyalty system based on smart

cards which may be implemented in existing devices like cell phones or PDAs.

Our loyalty system is secure and offers some desirable features both to customers

and vendors, and may further the adoption of such win-win marketing operations.

In particular, the system, reliable for both parties, is universal in the sense that

there is a one-to-many relationship between a customer’s loyalty card and the

vendors.

1 Introduction

A loyalty program is a win-win marketing operation which consists in rewarding cus-

tomers’ loyal behavior. Both parties benefit from loyalty strategies: vendors conceive

loyalty programs as an interesting opportunity to improve customers spending and re-

tention while customers benefit from discounts as they purchase goods. Loyalty strate-

gies typically rely on loyalty cards or coupons used to register customers purchases.

Customers are awarded when some conditions on their past purchases is met, depend-

ing on the vendor’s specific loyalty strategy. In this paper, we propose an electronic

loyalty system, whose features support several factors which influence the success of

loyalty strategies [8], both from the customers’ and vendors’ point of view. We place a

great emphasis on the security of the system, which is based on smart cards technology.

We identify four desirable features.

– Universality: vendors generally propose their own loyalty card, which is not prac-

tical for customers, who are reluctant to burden with several loyalty cards. Allow-

ing customers use the same loyalty card to register their purchases at any vendor’s

may encourage them to become new customers. This characteristic is interesting

for vendors because it is more challenging to obtain a new customer than to keep a

current one [8].

– Security and privacy: the system should be reliable for both parties, i.e. prevent

actors from cheating. We then consider various security properties such as trans-

action unforgeability and non repudiation, multiple dipping prevention and protec-

tion of transactions. Users are also more and more concerned about their privacy

and fear that such systems infringe it. Indeed, merchants use loyalty strategies to

customize their offers by performing customer profiling, i.e. record their past pur-

chases, and data about their preferences and behavior. Thus, the system should pre-

serve customers’ privacy, while allowing vendors to perform pseudonymous profil-

ing. Security requirements are described more accurately thereafter.

Canard S., Clerc F. and Morin B. (2006).

A Secure Universal Loyalty Card.

In Proceedings of the 4th International Workshop on Security in Information Systems, pages 13-22

Copyright

c

SciTePress

– Partnerships support: the loyalty system should allow merchants to organize part-

nerships, i.e common loyalty operations, in order for customers to benefit from

discounts when purchases are made at any of the partnership participants’ shop.

This feature also naturally supports corporation-wide loyalty strategies, because

corporations can be seen as a specific kind of partnership. This allows customers

to benefit of their discounts, independently of the shop where their purchases are

made.

– Loyalty strategy independence: loyalty strategies define which conditions should

be fulfilled by customers so as to benefit from their advantages. Several possibili-

ties exist, depending on the vendor’s objectives (e.g. maximize the number of pur-

chases). Because of the universality feature, the loyalty system should support any

loyalty strategy. In our approach, a loyalty strategy is implemented in a loyalty

program, which is considered as a parameter of the system, so any kind of loyalty

strategy shall be used, provided that the data required to compute the discount are

available.

– Low cost and ease of use: it is important that the loyalty system be cheap, simple

to install and administrate. If the loyalty system entails a management overhead

and is too costly, then vendors will not use it. The universality of the loyalty system

also contributes to this feature.

The aim of our paper is to create a system where each customer owns a loyalty

device such as a mobile phone which permits her to participate to a loyalty operation

defined by some merchant and such that this system is secure both from the merchant

and the customer’s viewpoint.

The paper is organized as follows: we first describe the security requirements we

identified, and give an overview of our solutions. Section 3 sketches the architecture

and the interactions of our system. Before concluding, we discuss the limitations of our

approach and evoke related work.

2 Security Properties of the Loyalty System

The universality feature reinforces the security requirements of a loyalty system. In-

deed, by using a universal loyalty system, merchants do not have the hand over the

loyalty program as a whole, so they need to trust the loyalty system. Moreover, cus-

tomers are more and more concerned about their privacy and want their personal data

to be kept secret, so they also need to trust the loyalty system. Our loyalty system basi-

cally consists in storing the transactions between a customer and a merchant on the cus-

tomer’s loyalty device. Rewards are computed from the past transactions stored on the

customer’s loyalty device. In order to guarantee the security of our system, the storage

and access to the transactions on the loyalty device requires some specific properties.

We have identified five main security requirements. In the remainder of this section, we

describe each of them and sketch our solution.

2.1 Transaction Unforgeability

Requirement. This states that a customer should not be able to create fake transactions

to benefit from discounts illegitimately. Creating fake transactions includes 1) creating

a transaction from scratch, 2) duplicating a legitimate transaction in order to benefit

from a better reward and 3) make a third party customer benefit from discounts.

Solution. Eeach transaction stored on a loyalty device should be signed by the mer-

chant in order to prevent a customer from creating fake transactions from scratch.

Thereby, a merchant can check that the transactions are legitimate before awarding a

customer. To prevent a customer from duplicating an existing entry, transactions in-

clude a unique identifier so that a merchant can check that several transactions with the

same identifier do not exist on the customer’s loyalty device. A customer could still

copy her own transactions on another customer’s loyalty device to let her benefit from

her advantages. To prevent this, transactions also include a customer’s identifier that

is stored in the loyalty device. This way, a merchant can check that a customer is the

owner of a transaction stored on her loyalty device by verifying that the corresponding

identifier is the same as the one embedded in the loyalty device.

2.2 Non Repudiation of a Transaction

Requirement. A merchant should not be able to deny the fact that she has made a

transaction with a customer. Notably, together with the unforgeability of transaction,

non repudiation allows us to use the loyalty system as an estimates and receipts secure

storage device (see Section 5).

Solution. Non repudiation is easily verified by the signature of the merchant in all

transactions. We can imagine that the customer’s terminal can verify this signature on-

line. Nevertheless, in the case of a partnership (i.e. a group of merchants organizing a

common loyalty strategy), one should notice that a customer can only prove that he has

purchased a goods at one of the vendor’s involved in the partnership, but cannot identify

it. In other words, this is not an individual non repudiation.

2.3 Customers’ Privacy

Requirement. This requirement states that the loyalty system should disclose as little

information as possible in order not to infringe the customers’ privacy. We may distin-

guish two kinds of information to be protected.

– Customer transactions: a merchant should solely have access to the transactions

made between a given customer and himself or one of its partners. The owner of a

loyalty card should have access to all her transactions stored on the loyalty device,

in order to check whether she can benefit from a reward.

– Customer personal data: the system should provide anonymity of transactions, while

still allowing merchants to perform “anonymous profiling”. In some cases, cus-

tomers may accept to disclose some of their personal data (e.g. name, address, etc.)

in order to receive special offers from the merchant for instance. However, in this

case, the system must still prevent a merchant from disclosing the customer’s per-

sonal data to a third-party merchant.

Solution. Transactions are stored twice in the loyalty device. One version is encrypted

by the merchant, the other by the customer. This way, a customer can decrypt any trans-

actions and any merchant of a given partnership shall only decrypt the transactions pre-

viously encrypted by any merchant of this partnership. We assume that the customer’s

personal data are encrypted on the loyalty device. Thus, accessing these data requires an

authentication of the customer (e.g. a PIN code). As stated above, transactions contain a

customer identifier. Actually, a customer owns one distinct identifier for each merchant,

called a pseudonym. Pseudonyms are used to prevent merchants from sharing the links

between customers’ identity and their personal data (e.g. name and address) with other

merchants. Merchants can perform anonymous profiling since a customer always has

the same pseudonym for a given merchant (see also Section 4).

2.4 Multiple Dipping Prevention

Requirement. This requirement states that a customer should not be able to take advan-

tage of the same transaction to benefit from a discount multiple times. This requirement

is optional because some loyalty strategies allow multiple dipping.

Solution. In our system, a transaction includes a counter which allows merchants to

check how many times a transaction has been used to take advantage of a reward. An

illegitimate multiple dipping is not possible since the customer cannot modify a trans-

action to change the counter, which would imply to forge the merchant’s signature. The

merchant updates the counter every time a transaction is used. Another possibility for

the customer to fraud would be to backup a list of transactions before taking advantage

of a reward, and copy them back on her loyalty device. This kind of fraud can be avoided

if we assume that the loyalty device has some access control embedded which only al-

lows a merchant to store transactions on a loyalty device (a customer is not allowed to

write on her memory’s device). Thus, merchant’s terminal has to be authenticated by

the loyalty device for a transaction to be stored (see also Section 4).

2.5 Transaction Deletion

Requirement. This requirement states that a merchant should not be able to remove

transactions from a customer’s loyalty card in order no to let customers enjoy their

advantages. Only the owner of the loyalty card is allowed to remove transaction records

from her loyalty device.

Solution. Using the access control mechanism evoked above, deleting transactions

requires an authentication by the owner of the loyalty device. Another possibility for

a customer would be to sign a print of all transactions stored in her device using a

Message Authentication Code (MAC) with a secret key embedded in the smart card,

each time a new entry is written in her device.

3 A Loyalty Card System

Our system needs the use of some basic (standard) cryptographic tools, such as a sig-

nature scheme [7] and a symmetric encryption scheme [1]. In this section, we give

some definitions, we present the global architecture and the interactions to create a new

transaction and to obtain an advantage.

3.1 Actors and Components of the System

Actors. There are two main actors in our system: the customer and the merchant. A

merchant may be an individual or a group of vendors organizing a common loyalty oper-

ation together, called a partnership. Merchants are identified using an identifier denoted

by M. In the case of partnerships, merchants share a common identifier. Thus, each

merchant owns at least her own identifier, plus the identifiers of the partnerships she

is involved in. As stated above, customers have one identity per merchant. A customer

identity for a given merchant M (i.e. a pseudonym) is denoted by C

M

. Pseudonyms

are randomly generated the first time a customer makes a purchase at a vendor’s and

stored in the customer’s loyalty device in order to be re-used for the next purchases.

This allows merchants to perform pseudonymous profiling.

Loyalty strategies and programs. A loyalty strategy is a set of rules that must be

satisfied for a customer to enjoy her advantages and the nature of the corresponding

discount, e.g. 5% of the last 10 purchases. A loyalty program is an implementation of a

loyalty strategy which takes as input a set of transactions and outputs a discount.

Transactions. A transaction is an interaction between a merchant and a customer. A

transaction is modeled as a tuple which contains at least a unique transaction identifier

T , a customer identifier C

M

, a merchant identifier M and a counter s. The counter s is

used to indicate how many times a given transaction has been dipped into by a customer

to benefit from a reward. A transaction may also contain additional data related to the

characteristics of goods purchased by the customers, such as a good identifier (e.g.

the bar code), a number of goods, the amount of the transaction and the date of the

transaction. These data are used by a loyalty programs to compute discounts.

Customer’s loyalty device. We assume that a customer owns a loyalty device, which is

composed of a memory and a smart card that can perform cryptographic operations. We

assume that this memory is protected in such a way that the customer cannot write on

it and a merchant cannot delete any entry (see also Sections 3.2 and 4). We also assume

that the access to the personal data (name, address, etc.) are protected by a PIN code,

only known by the customer. A loyalty device contains a symmetric encryption keys

C

K

, a table of pseudonyms (M, C

M

), a list of transaction records made by the cus-

tomer (see below), as well as some personal data of the customer that can be encrypted

using C

K

. We here use a symmetric encryption scheme since, in the solution described

below, only the loyalty device has to encrypt and decrypt transactions. A loyalty card

may be implemented in an ad-hoc card or a cell phone.

Merchant’s terminal. A merchant owns a terminal equipped with a memory and a

processor in order to run loyalty programs. A terminal may host several loyalty pro-

grams so that the merchant can choose, when a customer can benefit from an advantage

and which loyalty strategy is the best or the most relevant. Terminals are equipped

with some means to interact with the customers’ loyalty device, such as a smart card

reader, or NFC device. In the remainder, we also assume that terminals are able to

authenticate themselves with customer’s devices, using standard techniques such as a

PKI. Terminal authentication is required to control access to the memory of the loyalty

devices. The terminal’s memory stores, in a secure way (e.g. using a TPM) a set of tu-

ples P = {(M

1

, M

K

s

1

, M

K

p

1

, M

K

1

), · · · , (M

n

, M

K

s

n

, M

K

p

n

, M

K

n

)}, where M

i

is a

partnership identifier, M

K

s

i

is the partnership’s shared signature key, M

K

p

i

is the cor-

responding verification public key and M

K

i

is the partnership’s symmetric encryption

key. P contains at least one such triple, composed of merchant’s personal identifier and

keys. Creation of the shared keys can either be performed by a designated server or by

the participation of all the merchants [4].

Transaction records. A transaction record is a quadruple (M

i

, m, c, σ), where M

i

is

the partnership identity under which the transaction is made (chosen by the merchant),

m is the transaction encrypted with M

K

i

so that the merchant and his partners only

have access to the transactions made with the customer, not to other transactions, c is

the transaction encrypted with C

K

so that the loyalty device owner has access to all his

transactions and σ is the signature of the transaction produced by M

K

s

i

in order for

merchants to authenticate the transaction. This signature also provides non repudiation

and integrity of the transaction (non forgeability).

3.2 Procedures

In this section, we describe how a new transaction is stored in the loyalty card, how a

loyalty program is executed so that a customer obtains an advantage and how a customer

can check her transaction. For each procedure, we assume that the customer has to make

an action (such as entering a PIN code or pressing the keypad of the reader) before each

interaction with the merchant’s terminal. This is a way to “authenticate” the customer

and to prevent attacks such as denial of service.

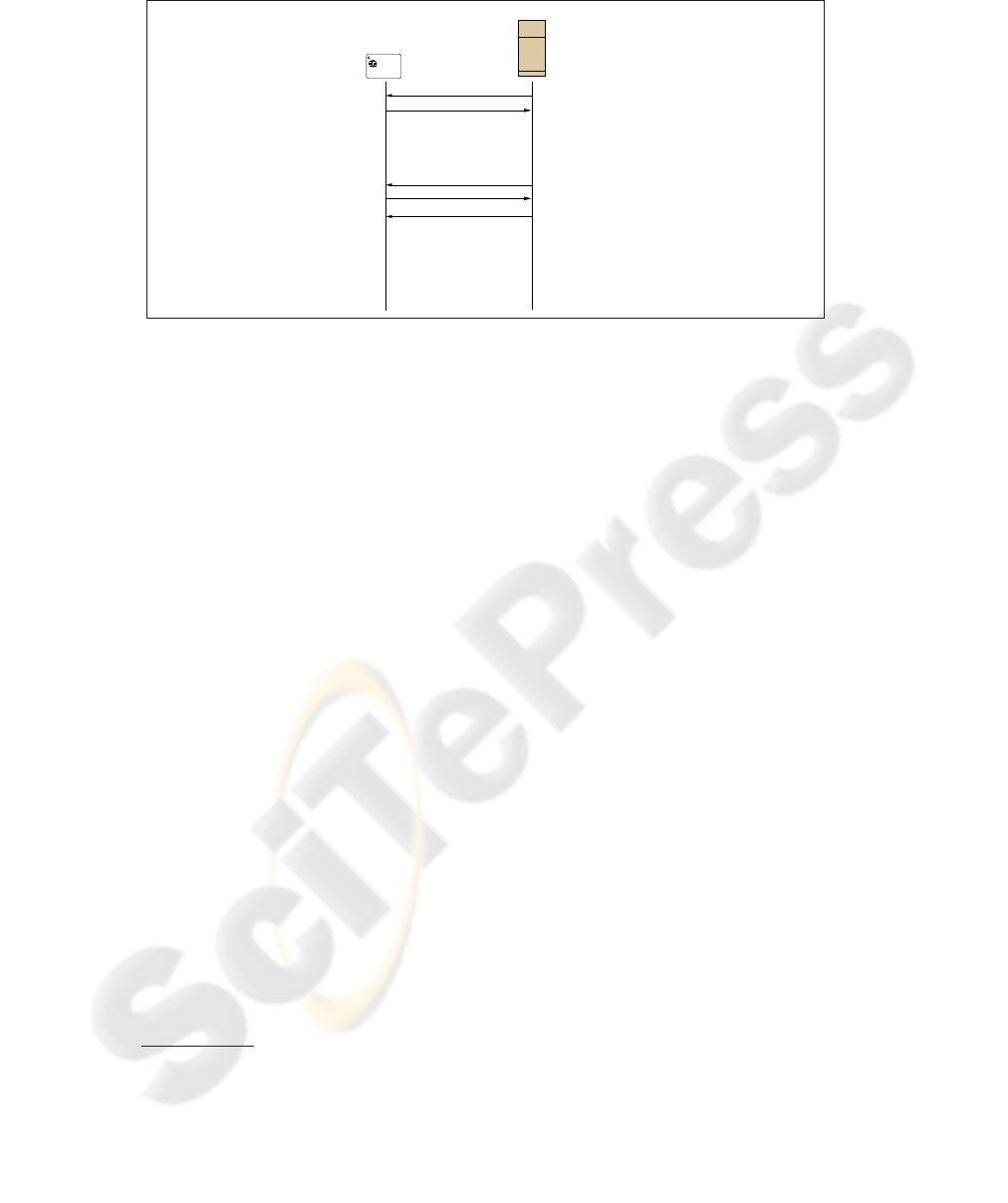

Writing a new transaction. The recording protocol between the loyalty device and the

merchant’s terminal is sketched in Figure 1. When a customer makes a transaction T

with a merchant M

i

, the merchant’s terminal first requests the customer’s pseudonym

C

M

i

to the loyalty device by providing M

i

to it. If necessary, the loyalty device gener-

ates a new pseudonym and records it. Upon reception of C

M

i

, the terminal compiles the

new transaction t = (T , C

M

i

, M

i

, 0, · · · ), where “· · · ” denotes the additional transac-

tion attributes, such as the amount of the transaction and the goods identifiers. The

terminal then performs the following tasks:

1. Signs the transaction t using M

K

s

i

to obtain σ.

2. Encrypts the transaction t and the signature σ using the chosen M

K

i

to obtain m.

3. Authenticates himself with the loyalty card.

Identifiant : 1202 2547 2364

MR PIERRE DUPONT

Vendor’s terminal

Loyalty Device

Build transaction record tr

′

= (M

i

, m, t, σ)

Compute c = cypher(C

K

i

, (t, σ))

Request(M

i

)

Compute σ = sign(M

K

s

i

, t)

Compute m = cypher(M

K

i

, (t, σ))

Build transaction record tr = (M

i

, m, t, σ)

Answer

Send tr

Build transaction t = (T , C

M

i

, M

i

, 0, · · · )

Authentication request

C

M

i

Store tr

′

Fig.1. Recording a transaction.

4. Sends the transaction record tr = (M

i

, m, t, σ) to the loyalty device.

Upon reception, the loyalty device encrypts transaction t and the signature σ using

the customer’s encryption key C

K

to obtain c, and stores the resulting transaction record

tr

′

= (M

i

, m, c, σ). It should be noticed that the loyalty device records a transaction

only if the transaction is indeed signed with one of the M

K

s

i

keys. This prevents a

terminal owner (e.g. a merchant acting as a customer) to use a terminal to copy past

transactions on her own loyalty card in order to benefit from discounts illegitimately.

In our system, we have chosen to add a merchant identifier in clear in each transaction

record. This permits the loyalty program to only have the transaction that concerns

the belonging merchant and, consequently, it does not have to treat all transactions

in the loyalty device, but only the ones it is concerned with. This has the drawback of

permitting a merchant to know the number of transactions the customer have performed

with other merchants and potentially the identity of these merchants.

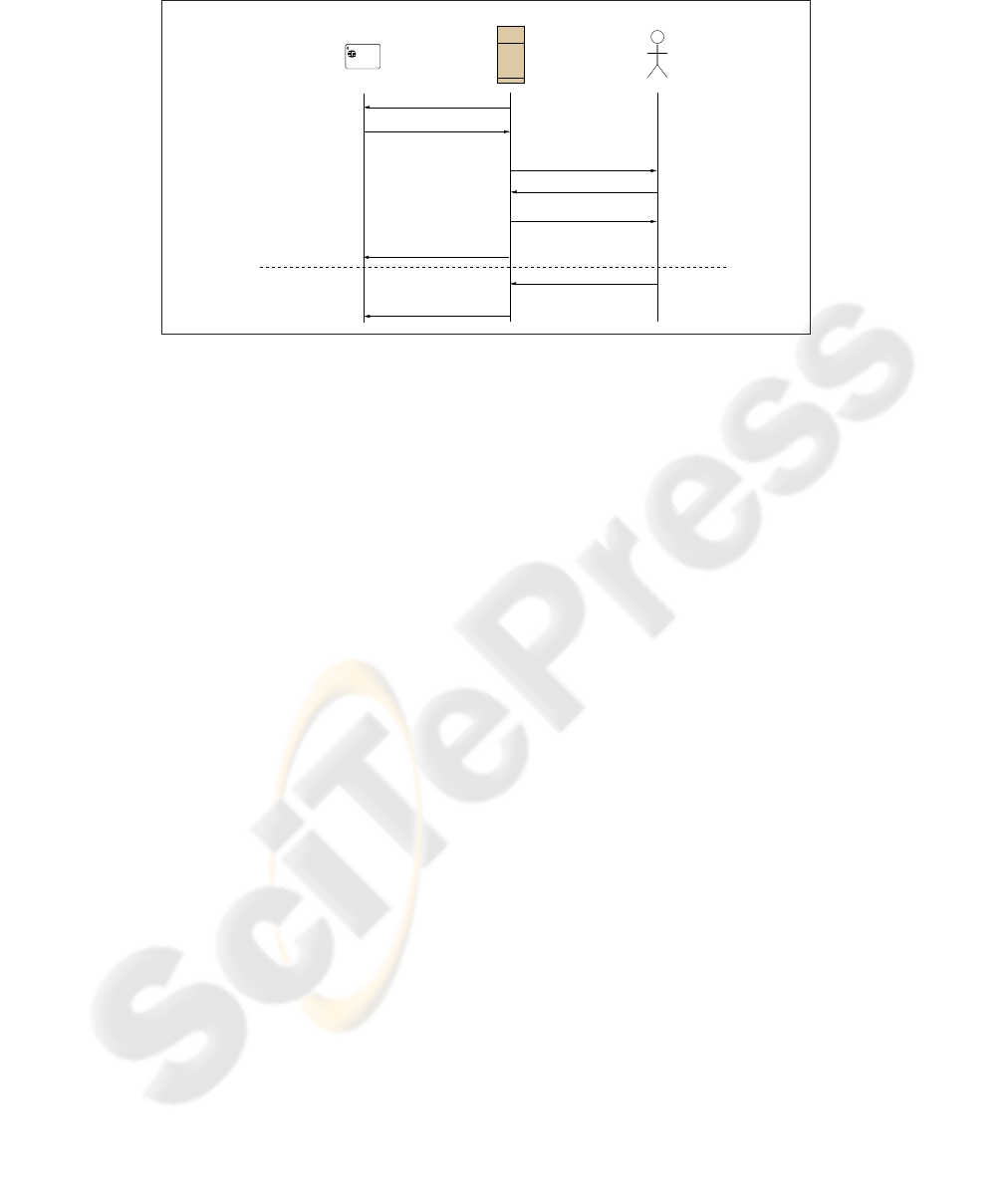

Awarding a discount. The awarding protocol between the loyalty program, the cus-

tomer’s device and the merchant is sketched in Figure 2. This protocol is independent

of the merchant’s loyalty strategy.

When requested by the terminal, the loyalty device returns transaction records whose

merchant identifier field belongs to the set P of partnerships in which the merchant is

involved. Each transaction is decrypted with the correct M

K

i

and verified with the at-

tached signature with the correct verification key M

K

p

i

. All transactions are then dis-

played to the merchant and the customer so that they can choose 1) which transactions

will be used for the advantage and 2) which advantage

3

. The loyalty program then takes

as input the above transactions, the description of the advantage and outputs the result

of the advantage. The loyalty program sends the result to the merchant and optionally

3

Depending on the strategy of the merchant, these choices can be made in cooperation with the

customer or not.

MR PIERRE DUPONT

Identifiant : 1202 2547 2364

Loyalty Device Vendor’s terminal Vendor

Encrypt transactions

Request(C

M

)

Choice

Display transactions

Transactions

Result

New transaction

Decrypt transactions

Verify transactions

Encrypt transactions

Modified transactions

Compute result

Sign transactions

Encrypt transaction

Sign transaction

Encrypt transactions

New transaction

transactions

Retrieve all

concerning C

M

Fig.2. Awarding a discount.

modifies all used transactions by updating their transaction counter s, depending on

the loyalty strategy regarding multiple dipping. These transactions are then re-signed

(using M

K

s

i

), re-encrypted (using M

K

i

) and sent back to the customer’s device that

re-encrypt itself the signed transaction (using C

K

). As for the storage of new transac-

tions, the alteration of a transaction record is allowed only if the modified transaction is

signed by the merchant’s personal signature key.

Checking. A customer may check her transactions and advantages, assuming that she

has access to a device reader. She first has to authenticate using e.g. a PIN code and the

device then decrypts the transactions with the customer’s decryption key C

K

.

4 Discussion

We now make a discussion of some problems and propose some solutions that we have

not included in the global loyalty card system.

4.1 On the Privacy of Customers

In a way, this system provides a weak protection of identity, because external customer

identifiers (e.g. a credit card number) might be used by merchants to link a customer

identity with her personal data. Thus, as long as a customer uses a non-anonymous

payment system, our system does not provide any practical gain in privacy. In fact, we

simply assume that the merchant is honest and will not do anything else than record-

ing information about the customer. Customer collusion is another problem. Multiple

customers could collude to derive more benefits from sharing of a single system iden-

tity. This might be controlled if customers have to prove their identity when using

their loyalty device, but would contradict our privacy-protecting objective. One solu-

tion for these problems is to use privacy protecting cryptographic tools such as the

Direct Anonymous Attestations [3,2] of the TPM (Trusted Plateform Module) or the

TPD (Trusted Personal Device [6]) if we assume that the loyalty card can be protected

by such modules. These tools also prevent the merchant to trace a customer, that is to

link all transactions made by a particular user.

4.2 Preventing a Backup

In Section 2.4, we explain that a customer can fraud by backing up a list of transactions

and copy them back on her loyalty card. We also said that a solution is to prevent the

customer to write on her memory’s device. This solution might be restrictive because it

requires strong assumptions on the capabilities of the loyalty device. Another solution

can be to add a merchant’s identifier in clear in each transaction record and, for all

transactions in which a merchant is involved and each time a transaction is added or

modified, to have these transactions signed in only once by the concerned merchant.

A MAC can be used here, instead of an asymmetric signature, to reduce the cost of

this operation. Using this, the customer’s device consequently contains a list of prints

of all transactions that the customer has made with the same merchant. The case of a

partnership does not imply any extra problem, a transaction being included in several

prints.

4.3 Related Work

As much as we know, few papers have been published on the security side of loyalty

cards. In [5], Enzmann et al. propose a privacy friendly loyalty system, which guaran-

tees the unlinkability of loyalty points to transactions. One of the authors’ objectives

is to prevent vendors from generating customer profiles by linking customers’ transac-

tions through the loyalty program. The privacy protection side of our approach is not

as restrictive, because it allows vendors to perform anonymous profiling. Patents have

been proposed on loyalty solutions, but those claiming to bring security features mainly

focus on the privacy issues. Several commercial solutions for loyalty system exist but it

is unclear which security characteristics are proposed.

5 Conclusion

In this paper, we proposed an open and generic loyalty system based on smart cards

which may be implemented in devices like ad-hoc smart cards or cell phones. The

security properties of the system guarantee the security of the parties involved in loy-

alty strategies, i.e. that prevents dishonest customers and vendors from cheating and

preserves users privacy. Our system presents some desirable features such as the possi-

bility for customers to use one single loyalty card with any merchant, and for vendors

to use a customized loyalty strategy, possibly in partnerships with other merchants. The

features of the proposed loyalty system, together with the security properties allow to

extend it to various fields of applications. For instance, customers can use the loyalty

card as a reliable electronic receipt and estimates container with no modification.

References

1. National Institute of Standards and Technology. FIPS-197: Advanced Encryption Standard.

November 2001.

2. F.C. Bormann, L. Manteau, A. Linke, J.C. Pailles, J. van Dijk. Concept for Trusted Personal

Devices in a mobile & networked environment. 15th IST Mobile & Wireless Communication

Summit, 2006.

3. E.F. Brickell, J. Camenisch, and L. Chen. Direct anonymous attestation. In V. Atluri, B.

Pfitzmann, and P.D. McDaniel, editors, ACM Conference on Computer and Communications

Security, pages 132–145. ACM, 2004.

4. R. Dutta and R. Barua. Overview of key agreement protocols. In Cryptology ePrint Archive:

Report 2005/289, 2005.

5. M. Enzmann, M. Fischlin, and M. Schneider. A privacy-friendly loyalty system based on

discrete logarithms over elliptic curves. In Financial Cryptography, pages 24–38, 2004.

6. IST-2002-507894, InspireD: Integrated secure platform for Trusted Personal Devices,

http://www.inspiredproject.com.

7. RSA Laboratories. PKCS#1 v2.1: RSA Cryptography Standard. 2001.

8. W. Brian, and S. Seed. Making brand loyalty programs succeed. In Journal of Brand Man-

agement, pages 211–222, 2001.