DATA MINING OF CRM KNOWLEDGE BASES FOR

EFFECTIVE MARKET SEGMENTATION

A Conceptual Framework

Jounghae Bang, Nikhilesh Dholakia, Lutz Hamel, Ruby Roy Dholakia

University of Rhode Island, 7 Lippit Road, Kingston, RI 02881, USA

Ke

ywords: CRM, KDD, Data Mining, Knowledge Management, Market Segmentation, Relationship Marketing

Abstract: This paper illustrates the linkages between CRM systems, data mining techniques, and the strategic notions

of market segmentation and relationship marketing. Using the hypothetical example of a consumer bank, the

data in a relationship based marketing environment are illustrated and guidelines for knowledge discovery,

data management and strategic marketing are developed.

1 INTRODUCTION

The importance and benefits of customer

relationship management (CRM) have been well

recognized (Kotler, 1997; Reichheld and Sasser,

1990). Customer acquisition costs exceed customer

retention costs by factors of 5 to 7 (Kotler, 1997). A

mere 5% reduction in customer defections can

improve profits by 25 to 85% (Reichheld and Sasser,

1990).

Besides cost savings, CRM technologies, other

allied information technologies, and data mining

techniques offer amazing possibilities for creating

and sustaining ideal, highly satisfying customer

relationships (Goodhue, 2002; Ives, 1990).

The processes of implementing and executing

CRM, however, are complex (Abbott, 2001; Winer,

2001). According to a Gartner Group study, 55% of

CRM projects during 2002-2006 may fail.

Given high costs of deployment and

maintenance (Caulfield, 2001), such drastic failure

rates represent huge financial risks for CRM

adopters. What is worse, 20% of long-standing

customer relationships are soured by these CRM

failures (Mello, 2002).

Without understanding who the valuable

customers of a company are, what CRM is, and how

it works, the huge investments in CRM resources

simply push up the level of risk.

A major premise of CRM is that it could help

companies leverage the continuous stream of

customer-related data collected through various

touchpoints, facilitating individual-level marketing

decisions (Libai, Narayandas, & Humby, 2002).

Therefore, analytical CRM techniques using data

mining and knowledge discovery in databases

(KDD) play important roles. Not much research has

been done, however, about data mining from the

perspective of understanding customers better for

CRM practice.

This paper investigates how data mining can be

used to understand customers better, from CRM

perspectives. It explores ways to use data mining to

find segments of customers who want a relationship

with a firm and who have potential for loyalty. The

bases of segmentation are the customers’ needs and

wants implied in their transactions with a firm.

Starting with the review of channel preference of

customers, a framework for market segmentation is

developed. A pivotal point of data mining is its

ability to discover previously unknown and

unsuspected patterns. Here we leverage this ability

by using data mining algorithms to perform the

customer segmentation rather than performing the

segmentation based on some preconceived notions.

The next sections are brief reviews of CRM and

KDD, followed by a framework for data mining

technique for effective market segmentation.

2 CRM: BRIEF REVIEW AND

EMERGING CHALLENGES

To define CRM, we need to first address the

customer. The broad definition of customer includes

suppliers, buyers, consumers, and employees – as

internal customers (Gamble, 1999). In the proposed

framework, however, the definition of customer is

335

Bang J., Dholakia N., Hamel L. and Roy Dholakia R. (2004).

DATA MINING OF CRM KNOWLEDGE BASES FOR EFFECTIVE MARKET SEGMENTATION - A Conceptual Framework.

In Proceedings of the Sixth International Conference on Enterprise Information Systems, pages 335-342

DOI: 10.5220/0002616303350342

Copyright

c

SciTePress

limited to buyers of the product or service that a firm

provides.

Having narrowed the scope of the term

“customer” to the product/service buyer,

understanding what is CRM and what elements

constitute CRM is the next step.

CRM represents a variety of things to different

groups (Goodhue, Wixom, and Watson, 2002;

Winer, 2001; Wright, 2002); hence CRM

implementations tend to vary also. For example, to

some, CRM means direct email or database

marketing. For others, it refers to OLAP (online

analytical processing) and CICs (customer

interaction centers). Wright (2002) argued that the

understanding of concepts such as ‘customer

retention’ and ‘cross-selling’ and their application in

practice is often weak (Wright, 2002).

Even though the definition of CRM is not

consistent among researchers, based on the review

of previous frameworks of CRM, three core

dimensions characterize a buyer-focused CRM

system:

Customers at the center (CMO 2002;

Gamble, Stone and Woodcock, 2002;

Greenberg, 2002; Newell, 2003)

Management’s articulation and

tracking of customer relationship goals, plans,

and metrics (Ang and Buttle, 2002; Day and

Van den Bulte, 2002; Greenberg, 2002)

Technologies for facilitating

collaborative, operational, and analytical

CRM activities (Goodhue, 2002)

First, as an organizational strategy (Ang and

Buttle 2002; Smith 2001; Day and Van den Bulte

2002), CRM systems should deal with various

management levels. Strategies should be established

to accomplish corporate-level goals. Specific plans

have to be crafted and the performance of these

plans has to be tracked and evaluated thoroughly.

These goals, strategies, and plans should reflect the

corporate philosophy regarding customer orientation

and inculcate a customer-responsive corporate

culture.

Second, the technological structure needs to be

worked out, including analytical CRM systems,

operational CRM systems, and collaborative CRM

systems.

Analytical CRM systems help a firm to analyze

the huge amount of customer data so that the firm

can find some patterns of customers’ purchasing

behavior (Goodhue, Wixom, and Watson, 2002).

Operational CRM systems entail the integration of

all the front-end customer-facing functions of the

business. For example, since the sales process

depends on the cooperation of multiple departments

performing different functions, the systems to

support the business processes must be configurable

to meet the needs of each department (Earl, 2003;

Greenberg, 2002). Collaborative CRM systems

refer to CRM functions that provide points of

interaction between the customer and the channel –

the so-called “touchpoints” (Greenberg, 2002).

Third and finally, the raison d’être of any CRM

system is the customer. Customer service and related

issues must be included in the design,

implementation, and operation of any CRM system.

Davids (1999) emphasized that viewing CRM as a

sales or customer service solution is the surest way

to fail. The only way to benefit the organization is to

first benefit their customers (Davids, 1999). CRM

software needs to pay attention to not only users

within the implementing organization, but also to the

end customer (Earl, 2003). While enhancing the

operational efficiency of the organization is an

important goal of using CRM technology, servicing

and delighting the customers are the ultimate end-

goals as well as the ultimate determinants of success.

Each level has to be coordinated for successful

CRM implementation and performance outcomes. It

is important to note that placing customers in the

center should be the first. And then every other

activity can be done to understand and satisfy the

customers.

With these components in place, CRM can be

defined as follows:

CRM is a core business strategy that integrates

internal processes and functions and external

business networks to interact, create, and deliver

value with personalized treatment to targeted

customers to improve customer satisfaction and

customer retention at a profit. It is grounded in

high quality customer data and enabled by

information technology (Day and Van den Bulte,

2002; Ang and Buttle, 2002).

With this CRM definition, we turn next to a

review of how new technologies and techniques are

used to understand customers in the CRM practices.

3 CRM-FOCUSED KDD

With improving technologies of information

collection, transmission, processing and storage,

companies can obtain timely, valid, and reliable

information for solving important customer

relationship problems (Moorman,

Zaltman, &

Deshpande

, 1992). Hardware and database

technologies allow efficient, inexpensive, and

reliable data storage and access (Fayyad, Piatetsky-

Shapiro, & Smyth, 1996). The web – the emergent

ICEIS 2004 - ARTIFICIAL INTELLIGENCE AND DECISION SUPPORT SYSTEMS

336

channel for promotion, transactions, and business

process coordination – is an important and

convenient source of customer data (Shaw et al.,

2001). Huge warehouses of customer data exist,

and companies face the challenge of generating

insightful customer knowledge for competitive

advantage (Kim et al., 2002).

Many useful marketing insights into customer

characteristics and their purchase patterns, however,

remain hidden and untapped (Shaw et al., 2001).

New computational techniques and tools for

extraction of useful knowledge from the rapidly

growing volumes of data are emerging. It is

increasingly critical for companies to be acquainted

with what, when, and how to use such data and

tools.

As a tool to analyze CRM-related customer data,

data mining has received the most attention

(Mackinnon, 1999; Fayyad, Piatetsky-Shapiro, and

Smyth, 1996). Systematic combining of data mining

and knowledge management techniques can be the

basis for advantageous customer relationships (Shaw

et al., 2001).

Data mining can be seen as one step of

knowledge discovery in databases (KDD): the

iterative process of data selection, sampling, pre-

processing, cleaning, transformation, dimension

reduction, analysis, visualization, and evaluation

(Mackinnon, 1999). Data mining is often defined as

the process of searching and analyzing data in order

to find hidden and potentially valuable, information

(Shaw et al., 2001).

Data mining methods allow marketers to

understand better their customers from the

increasing volumes of data. Kim, Kim, and Lee

(2002) found that companies are eager to learn about

their customers by using data mining technologies,

but due to the diverse situations of such companies,

it is very difficult to choose the most effective

algorithm for their specific problems. In their study,

they proposed a methodology to enhance the

accuracy in predicting the tendency of customer

purchase behavior by combining multiple classifiers

based on genetic algorithms, which can be

considered to be a data mining techniques (Kim et

al., 2002).

Shaw et al. (2001) introduced three major areas

of application of data mining for knowledge-based

marketing – (1) customer profiling, (2) deviation

analysis, and (3) trend analysis.

Customer profiling: It is a model of the

customer. The marketer decides on the right

strategies and tactics based on the customer

profiles. Data mining tools can be dependency

analysis, class identification, and concept

description.

Deviation analysis: It is an analysis of

deviation from norms. Data mining tools provide

powerful means such as neural networks for

detecting and classifying such deviations.

Trend analysis: Trends are patterns that

persist over a period of time. Data mining tools

such as visualization can be used to detect trends,

sometimes very subtle and hidden in the database.

Also, Jackson (2002) noted that data mining can

be used as a vehicle to increase profits by reducing

costs and/or raising revenue. Some of the common

ways to use data mining are eliminating expensive

mailings to customers who are unlikely to respond to

an offer during a marketing campaign and facilitating

one-to-one marketing and mass customization

opportunities in customer relationship management.

In sum, many organizations use data mining to

help manage all phases of the customer lifecycle,

including acquiring new customers, increasing

revenue from existing customers, and retaining good

customers. CRM systems can benefit from well-

managed data analysis based on data mining.

4 REQUIREMENTS FOR

EFFECTIVE MARKET

SEGMENTATION

Data mining studies have mainly focused on

strategies based on customers’ purchasing behaviors

(Berry and Linoff, 2000):

Profiling: By determining characteristics of

“good” customers, a company can target

prospects with such characteristics.

Cross-selling: By profiling customers who

bought a particular product, a firm can focus

attention on similar customers who have not

bought that product.

Reducing churn or attrition: Profiling also

enables a company to identify customers who are

at risk for leaving and act to retain them.

Based on the high failure rate of CRM, however,

critics have raised questions about how companies

define customers and how they manage the

relationship.

Newell (2003) argues that relationship building

must start with an understanding of the customer’s

needs. A firm should make customers manage the

relationship, rather than try to manage customers

(Newell, 2003).

In line with this notion, Fournier, Dobscha, and

Mick (1998) have pointed out that consumers may

DATA MINING OF CRM KNOWLEDGE BASES FOR EFFECTIVE MARKET SEGMENTATION: A CONCEPTUAL

FRAMEWORK

337

not be willing to enter into a relationship with many

businesses, because most relationships are initiated

by the businesses. If consumers target the businesses

and control the relationship, it will more likely

increase involvement and participation (Fournier,

Dobscha, & Mick, 1998).

In fact, three different possible situations of

forming a relationship between the businesses and

customers are identified in the consumers and the

businesses relationship (Dowling, 2002):

First, some consumers may associate a personality

with a brand and want a relationship with the

brand.

Second, consumers may still value a relationship

with the retailer that sells the product or service

even though they don’t want a relationship with

the brand.

Third, consumers may not want any relationship at

all. If a company tries to provide the best value to

them, they would respond to the offers with such

type of loyalty as repeat purchase and positive

recommendations to others. These ‘transaction’

customers will also cost less to serve than many

other ‘relationship’ customers.

Therefore, clear understanding about who the

customers are, whether they want from any

relationship with a business, and, if yes, what they

want from the relationship – these should be the

cornerstones of CRM systems and customer service

policies. Therefore, the proposed framework

attempts to find a way to understand customers best

by using data mining techniques based on the

customers’ perspective of relationship.

One of the chief ways of understanding

customers is segmentation. Market segmentation has

been used as a good way to find a group of

consumers to target. Many studies have been

conducted to find superior ways of segmenting

customers. Consumers’ decision-making styles

(Walsh, Henning-Thurau, Wayne-Mitchell, &

Wiedmann, 2001), consumers’ shopping styles

(Papatla & Bhatnagar, 2002), and consumers

attitudes towards unsolicited direct mail and

telesales (Mitchell, 2003) have recently been used as

bases for segmentation.

Not many studies, however, have been conducted

for deep understanding of customers from their

perspectives and preferences even though Dowling

(2002) argued that the simple way to check the

relationship and a nature of a brand is to segment

customers according to the strength of relationship

customers would like to have with the brand (from

strong to none) and then for the “willing” segments,

determine the type of relationships they have with

the brand.

Identifying valuable customers and their needs

and wants is critical for successful CRM, and the

proposed approach attempts to provide a framework

to find the customer segments in terms of their

perspectives. Data mining techniques are shown as

paths to better market segmentation based on the

channel and mode preferences as well as

permissions.

5 TOWARDS BETTER

CONCEPTUAL INTEGRATION

5.1 Data Mining for Effective Market

Segmentation

From the previous literature review, it is clear that –

before analyzing any patterns in the purchasing

behaviors – a company should be sensitive to the

very basic questions such as who its valuable

customers are, how they want to structure their

relationships with the businesses, what they want

from any relationship, and what they like.

Since profitable customers and prospects may not

be apparently revealed, there have been many

studies focused on customer lifetime value (CLV).

CLV is defined as the present value of all future

profits generated from a customer (Gupta and

Lehmann, 2003). Based on the assumptions that the

information about how long a customer will be with

a firm is known, one common approach is generate a

discounted cash flow for that time period (Gupta and

Lehmann, 2003).

Since the focus of the proposed framework,

however, is on showing how data mining can be

used to find the hidden, valuable customers in terms

of their willingness to get involved in a relationship,

rather than calculating financial value of customers,

the study investigates only current status of

transaction record (financial record), and the

interaction mode (banking transaction, support,

education, promotion) and channel preferences

(branch, online, etc.) form the core bases for

segmentation.

A relationship could start with any interaction,

and the importance of managing multi-channel

marketing has increased since the Internet and other

technologies provide many more touchpoints than

before.

Butler (2000) pointed out that companies use the

online channel to increase their visibility,

accessibility, and sales to the growing customer base

on the Internet, and to enhance customer

relationships. It is possible, however, that the online

channel can suffocate the growth of other channels

ICEIS 2004 - ARTIFICIAL INTELLIGENCE AND DECISION SUPPORT SYSTEMS

338

(Butler, 2000). Therefore, while most companies use

a variety of distribution and service channels,

companies should skillfully manage potential

channel conflicts in ways that allow channels to

complement one another (Johnson, 2002).

Berry and Britney (1996) argued that small banks

can use several combinations of segmentation

themes to segment customers instead of using one

theme. One of the themes is channel preference,

which classifies customers into segments based on

their relative use of the bank’s services and sales

channels.

Therefore, segmenting the customers based on

their implied channel preferences and interaction

modes is the first essential step towards building any

type of relationship with valuable customers. Here,

we propose that this essential step can be

accomplished using data mining techniques.

A retail banking scenario is used to illustrate the

procedures of market segmentation. CRM in

financial services is exceptionally challenging

(Rigley, 2003). Therefore, benefits from data mining

would be correspondingly large. Financial services

are very data intensive, complex businesses and

traditional financial services business models are

product-centric rather than customer-centric. Rigley

(2003) argued that focusing the organization on

customers in addition to the products, focusing

targeted marketing efforts on the customer rather

than “pushing” products, and understanding which

customers are most profitable and taking action to

grow and retain these relationships are the ways to

improve CRM practice in the financial services

arena. The retail banking scenario sets up the

operating context of a typical financial service firm.

Channel preference is usually the starting point

and therefore the data used for the analysis should be

collected through all touchpoints and integrated into

a single integrated data warehouse.

We turn next to the scenario to illustrate the

market segmenting process.

5.2 Illustrative Scenario

Let us consider the hypothetical case of a retail

bank, Gemstone Bank, with 15,000 customers each

having at least one bank account. Gemstone

provides ATMs, online banking services, 1-800 call

center, and many branches in its geographical

market area.

In the past, Gemstone Bank has rolled out

several campaigns that involved getting a priori

permissions. Each campaign used different set of

channels to interact with customers. The bank

collected permission consents from the customers.

Some customers have been contacted several times

through multiple campaigns while some others may

not have been contacted at all. Now Gemstone has

the information about customers and the permission

related data.

Gemstone maintains a data warehouse for the

information collected on all the touch points. The

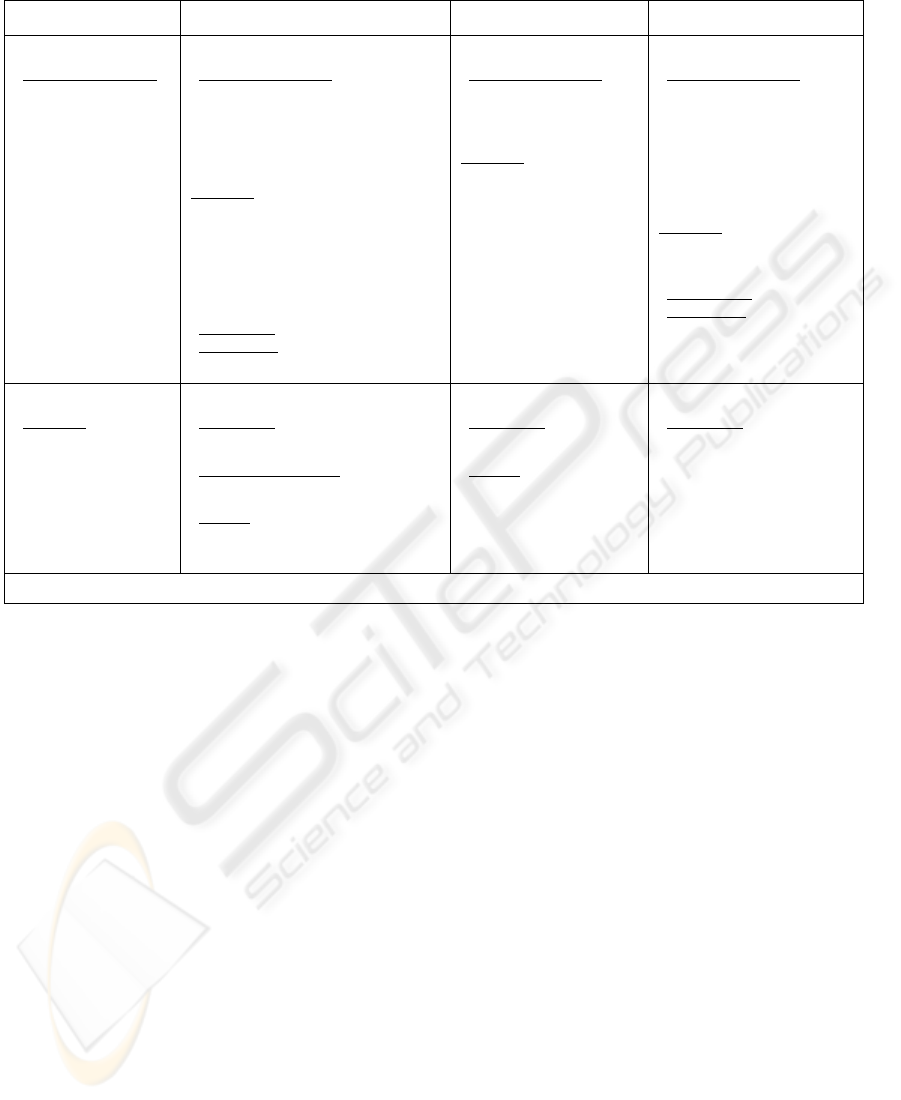

structure of such data is shown in Table 1.

Gemstone would like to use the information

deposited in the data warehouse to find out who the

valuable customers are and how to interact with

them.

Table 1 includes four different channels – call

center, online, walk-in, and ATM – and interaction

modes such as banking transaction, support, or

promotional interaction. Each interaction mode by

each channel has different sets of activities, and

therefore, different data are collected. Such data

comprise the data warehouse. The data shown has

been simplified to visibly illustrate this analysis.

As shown, various interaction channels can be

used and the data collected through such channels

are rich and diverse, and yet it is possible that some

customers may use only one or two specific

channels while others may want to use them all.

Therefore, it is important to note that the analysis

based solely on the data collected with a subset of

channels may be limited and biased and that the

analysis needs to take all available channels into

account.

5.3 Framework

With the scenario provided above, a framework is

developed and proposed for customer segmentation.

We argue that although the bank might have some

intuitive understanding and insight of which

customers to target and how, it is worthwhile to

explore the channel preferences and interaction

modes in greater depth. We propose a two tiered

clustering scheme to segment the customer base as

follows:

(1) Compute individual customer summary

information based on the interaction

records in the data warehouse which

includes channel usage, most frequent

transactions, mode preferences, etc. In

general, only use attributes which

describe customer/bank interactions.

(2) Based on this summary information, segment

customer base using clustering.

Standard data mining algorithms such as

self-organizing maps or k-means seem

appropriate here (Berry & Linoff, 1997).

DATA MINING OF CRM KNOWLEDGE BASES FOR EFFECTIVE MARKET SEGMENTATION: A CONCEPTUAL

FRAMEWORK

339

Table 1: Channels and Data collected

ATM Online Call Center Walk-in

Interaction Mode

*Banking Transaction

:

Withdraw

Deposit

Inquiry

Transfer

Maintain

Interaction Mode

*Banking transaction:

Transfer

Inquiry

Maintain

Bill paying

Portfolio mgt.

*Support:

_Transfer problem

_General support

.Location of banks

.Products

.ATM/Online

.Credit card support

*Educational

*Promotional

Interaction Mode

*Banking transaction:

Transfer

Inquiry

Maintain

*Support:

_Transfer problem

_General support

.Location of banks

.Products

.ATM/Online

.Credit card support

Interaction Mode

*Banking transaction:

Transfer

Inquiry

Maintain

Deposit/ Withdrawal

Portfolio

Bank checks

Travelers’ check

*Support:

_Transaction

_General

*Educational

*Promotional

Information

*Transactn

:

Date/ Time/c_ID/

Transaction Type/

Transaction related data

Information

*Transaction:

Date/c_ID/Transaction Type/data

*Promotion/ Education

:

Date/c_ID/ promotionID/ Response

*Support

:

Date/c_ID/ categories of questions –

FAQ/ live chat

Information

*Transaction

:

c_ID/Time/Type/ data

*Support

:

c_ID/Time/ Categories

(Transaction vs. support)

Information

*Transaction

:

c_ID/Time/Type/ data

*c_ID: customer ID

(3) Break out the obtained clusters, enrich the

above summary information with bank

product information such as average

running account balances, mortgage or

personal loan principals, etc. and perform

yet another cluster analysis on each of the

previously obtained clusters. Here we

consider only attributes which describe

the customer in terms of financial

characteristics.

(4) Enrich the obtained clusters with previously

obtained permissions data.

(5) Use customer profiling (including the

permission related information) to

investigate the final clusters.

As one can see in Figure 1, we postulate that

individuals within the clusters obtained in the first

analysis share strong channel and mode preferences,

in other words interaction preferences. It is

postulated that each of the clusters obtained in the

second analysis describes a set of customers with

varying degrees of value to the bank but who share

the same interaction preferences. Some of these

clusters describe high-value customers; others

describe customers that are not interesting from the

banks point of view.

Furthermore, the degree of permissions data

available for customers within the nested clusters is

expected to vary substantially. Some customers

may have given very recent positive responses to

permission requests; for other customers no

permissions data may exist. Also, for some

customers there may be recent negative responses to

permission requests. In Figure 1 permissions data is

represented as a color coding.

Due to the fact that nested clusters represent

customers of varying value with a particular set of

channel and mode preferences, it should be possible

to design particular relationship strategies, including

the channels to use and the messages to send out,

around the preferences of the customers within these

clusters.

Customer profiling performed in each of the

clusters will shed light on understanding customers

in terms of their value to the bank as well as the

willingness to accept permissions based offers.

ICEIS 2004 - ARTIFICIAL INTELLIGENCE AND DECISION SUPPORT SYSTEMS

340

Figure 1

For example, even the valuable customers –

those who have a record of good running balance in

their account, have a mortgage with the bank, and

use online banking most often – may exhibit low

willingness to accept the bank’s offers through

emails. Rather, they may show higher acceptance

level when the bank approaches them by face-to-

face methods. Or they may not want any message

asking for their permission at all.

Therefore, the clustering and profiling analyses

based on the value and permission responses provide

insights about the relationship strategy necessary for

effective CRM.

Questions about to whom a message should be

sent out, which channel should be used to contact,

whether and what promotional incentive to offer,

whether and how to ask for permissions – these

could be answered by finding the channel used most

often when a bank got the permission from the

customers. For future campaigns, an immediate

consequence of this approach is that permissions

based relationships can be initiated by the bank via

the customers’ preferred channels and modes of

contact, thereby reducing the chances that the

customer will perceive the communication by the

bank as unwanted and inappropriate.

The strength of this approach lies in the fact that

we use the knowledge discovery abilities of data

mining algorithms to guide the CRM strategy rather

than using preconceived ideas about ideal or not-so-

ideal customers.

5.4 Data analysis

We need to test our propositions and at the

preliminary stage we propose to test it in an

idealized setting. We will generate the customer

database. The data for each field in the database will

be preset with certain statistical properties such as

mean, standard deviation, skewness, kurtosis, etc.,

so that the generated data represents approximations

to real customers both ideal and not-so-ideal. By

using such data with known patterns, it should be

possible to confirm whether the data mining

techniques and algorithm used for the customer

segmentation are effective in finding the hidden

patterns.

Once we acquire an actual dataset we expect the

same kind of patterns to emerge as in the idealized

setting. If not, we will have to investigate how the

idealized setting differs from the actual dataset and

adjust our data mining strategy accordingly.

We feel that these two tests would provide

sufficient evidence of employing data mining

methods for making CRM systems more customer-

centric. Such testing is currently under way.

Here we do not consider performance

characteristics of the CRM system, we are really

only interested if the system can reconstruct the

artificial population of customers segments

generated for our testing purposes. Once we have

shown that the theoretical underpinnings of our

framework are intact we will consider looking at

other performance characteristics. A true measure

of our framework will be if we can discern

customers more successfully with our staged

clustering, rather than with a single segmentation

step.

6 CONCLUDING REMARKS

Relationship marketing and CRM have been popular

issues in business settings due to their strategic

importance and customer service benefits.

With the advent of new technologies, companies

are able to collect a variety of data about customers

and to analyze such data to understand customers.

CRM could help companies leverage the continuous

stream of customer-related data collected through

various touchpoints (Libai et al., 2002). Data mining

techniques offer strong possibilities for creating and

sustaining ideal, highly satisfying customer

relationships.

Companies should be careful, however, in

conducting any analysis on customers, since it is

reported that sometimes the analysis is not insightful

enough and may result in letting valuable customers

slip away, while not attracting new prospects. The

critical issue for successful CRM is to understand

customers and their preferences based on the

customers’ perspectives. Marketing approaches

relying solely on preferences for products, without

understanding anything about relationships and

interactions, may not yield fruitful results. Given the

Cluster 1

Cluster 2

Channel&

Interaction

mode

High value

of

customers

Degree of

permission

DATA MINING OF CRM KNOWLEDGE BASES FOR EFFECTIVE MARKET SEGMENTATION: A CONCEPTUAL

FRAMEWORK

341

high cost of CRM, such shot-in-the-dark

misadventures become risky.

In this framework, it is argued that companies

should be aware of the importance of comprehensive

knowledge about their customers for successful

CRM. By using data mining, effective market

segmentation is possible especially via in-depth

understanding of customers.

A retail banking scenario is provided to illustrate

a situation for such datamining-based CRM practice.

The scenario also indicates that there may be many

different channels used by customers, and that the

richness of data collected through all the channels

needs to be tapped into. A framework was proposed

along with this scenario to show how data mining

can be used to obtain better understanding about

customers.

This study is ongoing and will provide insights

on how data mining can be used for effective market

segmentation. The study highlights the importance

of basic understanding of customers and

segmentation based on such understanding. Also, the

importance of managing multi-channel interactions

becomes evident, even in the relatively simple

scenario that was presented.

The major benefits of the proposed framework to

the managers would be closer matching of CRM

technology and CRM goals. In order to satisfy

customers it is argued that better understanding

about customers should precede service and CRM

strategy formulation, and data mining can have the

potential to discover the hidden patterns from the

behaviors and reported preferences of customers.

The results will provide guidelines for using data

mining to design customized/personalized services

that delight the customers.

REFERENCES

Abbott, J., Stone, M., & Buttle, F. 2001. Customer

Relationship Management In Practice - A Qualitative

Study. Journal of Database Marketing, 9(1).

Davids, M. 1999. How to avoid the 10 biggest mistakes in

CRM. The Journal of Business Strategy, 20(6).

Dowling, G. 2002. Customer Relationship Management:

In B2C Markets, often Less is More. California

Management Review, 44(3).

Fayyad, U., Piatetsky-Shapiro, G., & Smyth, P. 1996. The

KDD process for extracting useful knowledge from

volumes of data. Association for Computing

Machinery. Communications of the ACM, 39(11).

Goodhue, D. L., Wixom. B.H., & Watson, H.J. 2002.

Realizing Business Benefits through CRM: Hitting the

right target in the right way. MIS Quarterly Executive,

1(2).

Gupta, S. & Lehmann, D. 2003. Customers as Assets.

Journal of Interactive Marketing 17(1).

Kim, E., Kim, W., & Lee, Y. 2002. Combination of

multiple classifiers for the customer's purchase

behavior prediction. Decision Support Systems,

34(2002).

Libai, B., Narayandas, D., & Humby, C. 2002. Toward

and individual customer profitability model: A

segment-based approach. Journal of Service

Research : JSR, 5(1).

Mitchell, S. 2003. The new age of direct marketing.

Journal of Database Marketing, 10(3).

Papatla, P., & Bhatnagar, A. 2002. Shopping Style

Segmentation of Consumers. Marketing Letters, 13(2).

Reichheld, F.F. & Sasser, W. E. 1990. Zero defections

quality comes to services, Harvard Business Review,

Sept/Oct, 301-307

Shaw, M. J., Subramaniam, C., Tan, G. W., & Welge, M.

E. 2001. Knowledge management and datamining for

marketing. Decision Support Systems, 31(2002).

Winer, R. S. 2001. A Framework for Customer

Relationship Management. California Management

Review, 43(4), 89-105.

Wright, L. T., Stone, M., & Abbott, J. 2002. The CRM

imperative - Practice vs theory in the

telecommunications industry. Journal of Database

Marketing, 9(4).

Further References available upon request

ICEIS 2004 - ARTIFICIAL INTELLIGENCE AND DECISION SUPPORT SYSTEMS

342