Transformation of Russian Legislation in the Field of Pension

Provision: Problems, Solutions

Olga A. Kuzmina

a

and Elena S. Vologdina

b

Federal State-Financed Educational Institution of Higher Learning "Komsomolsk-na-Amure state university",

Komsomolsk-na-Amure, Russia

Keywords: Pension Provision, Stages of Reforming, Legislation of the Russian Federation, Insurance Experience,

Welfare of Society.

Abstract: The national security strategy of our state was determined by Decree of the President of the Russian Federation

dated December 31, 2015 No. 683.The document points out the inextricable link between the national security

of the Russian Federation and the socio-economic development of the country. Among other things, socio-

economic development involves improving the social security system, the social structure of society. One of

the areas of activity through the process was the reform of the pension system in Russia. The study assumes

an analysis of the legal regulation of the pension system formation in Russia from the beginning of the 90s to

the present, its connection to the changes taking place in the state. It will make possible to formulate

recommendations for improving legislation in this area, and as a consequence, to improve the socio-economic

situation of certain categories of citizens. In the course of the study, the comparative legal, chronological,

sociological methods were used as the basis of methodological tools. The comparative legal method is based

on the study of the problem in the dynamics of legislative change. The application of this method made it

possible, to identify the positive and negative consequences of law-making reforms for Russian society,

compare the extent of government support at different time stages. The sociological method was used to

validate the authors' conclusions. The authors initiated the revision of the legislation, which establish the

provision of state old-age pensions, since it is focused on citizens who are objectively unable to participate in

social production and provide themselves with an independent income.

1 INTRODUCTION

Socio-economic changes taking place in Russia

dictate the need for changes in its regulatory legal

framework. The pension system is one of those

socially significant areas by which the social well-

being of society can be measured. Citizens’ right to

pension provision is reflected in the basic law of the

Russian Federation. Article 39 of the Constitution of

the Russian Federation, guarantees the provision of

social security by age to every citizen, in case of

illness, disability, loss of a breadwinner. In this norm,

the legislator has enshrined a variety of types of

pension and a guarantee for this type of assistance to

all citizens without exception, subject to an insured

event.

a

https://orcid.org/0000-0002-3263-1785

b

https://orcid.org/0000-0001-6082-7657

The pension system of our country has come a

long way of development. At the present, we cannot

talk about its final design. The needs of society are

changing, the socio-economic situation in our country

is not static, demographic indicators in Russia are

showing a decrease. All of these factors have an

impact on reformation of the pension legislation.

2 METHODOLOGY

The works of domestic and foreign authors formed

the methodological basis of the study: Feldstein

(2005), Barr, Diamond (2009), Mikhalkina, Pysanka

(2011), all of these authors devoted their research to

Kuzmina, O. and Vologdina, E.

Transformation of Russian Legislation in the Field of Pension Provision: Problems, Solutions.

DOI: 10.5220/0010597307690774

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 769-774

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

769

the directions of the modernization analysis of the

pension system.

The work is based on a comparative analysis of

regulatory legal acts, the effectiveness of their

adoption in conjunction with the data of sociological

research. The reform of the Russian pension system

is explained from a methodological point of view,

which is based on its institutional change.

3 RESULTS

It has been established that the modern pension

system needs to be improved. As an integral element

of the state's social policy, effective reform of this

sphere will allow avoiding social tension in society,

supporting economically weak categories of the

population.

4 DISCUSSION OF THE RESULTS

Over the past thirty years, starting in 1990, the

pension system in Russia has changed dramatically.

However, the reforms carried out in this area were

aimed at increasing the financial stability of the

pension system, increasing the size of pension

payments. Ultimately, the pension system should be

built on a parity basis, an insurance and a funded

basis.

Let us consider the main stages in the reform of

the pension sphere.

Step 1.Adoption of the Russian Federation Law

"On State Pensions in the Russian Federation".

According to the law, the estimation of pension rate

provision was implemented on grounds of service

length and the rate of wages. According to Article 16

of the mentioned document, the pension amount

would be 55 % of earnings. In addition, 1 % of

earnings was added to the calculated pension for each

full year of total length of service or special length of

service above the essential amount for a pension

establishment. While the pension could not exceed

75 % of earnings. Another innovation was the

establishment of the minimum and maximum

amounts of pensions (Articles 17, 18) (Consultant-

plus, 1990)

Step 2. Adoption of the federal law "On individual

(personified) accounting in the compulsory pension

insurance system". The law consolidated the concepts

of "insurance premiums", "insurance experience",

established the rules for digital accounting of

information on pension savings of citizens and made

it possible to ensure the correctness of the calculation

of pensions based on data on official labor activity

(Consultant-plus, 1996). The adoption of this law

formed the basis for the creation of a digital system

that ensures effective work in various fields,

including the field of social security (Starinov and

Tseveleva, 2020).

In addition, in order to implement the state

guarantee for pensions, the federal law "On tariffs of

insurance contributions to the Pension Fund of the

Russian Federation, the Social Insurance Fund of the

Russian Federation, the State Employment Fund of

the Russian Federation and to the compulsory

medical insurance funds for 1997" was adopted

February 05, 1997. The document changed the tax

system for citizens, established the insurance

contributions rates to non-state funds. Thus, the state

tried to increase pension payments.

Now, the rates of premiums for the state

compulsory pension insurance, compulsory medical

insurance, compulsory social insurance are

determined by the Tax Code of the Russian

Federation.

Step 3. Adoption of the law "On labor pensions in

the Russian Federation". This document established

the following types of work experience: insurance

experience, total work experience, work experience

in the relevant types of work (formerly - special work

experience) (Consultant-plus, 2001). The labor

pension included three parts: basic, insurance and

funded. The basic part of the pension was considered

as a state guaranteed payment from federal funding.

Essentially, this is a fixed amount, indexed every year

by the Government of the Russian Federation.

Citizens with a length of service of at least 5 years had

the right to apply for this payment. The insurance part

of the pension was forming at the expense of

employers' insurance contributions as part of the

unified social tax. The funded part was forming at the

expense of employers' insurance premiums – 6 % of

the employee's salary.

Now, the funded part of the pension is replenished

only for citizens under 1967. As such, the funded part

of the pension is established for men younger than

1953 and women younger than 1957, inclusive.

In fact, the 2002 reform became the first large-

scale pension reform in Russia since 1990. Citizens

excluded by age from the category of persons entitled

to the funded part of the pension turned out to be in a

disadvantageous position.

Step 4. Adoption of the federal law "On insurance

pensions". This normative legal document canceled

the effect of the above-mentioned law, with the

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

770

exception of the rules governing the calculation of

labor pension.

The adoption of the law has not changed the

structure of the pension (basic, insurance, funded).

The conditions for the emergence of the right to an

insurance old-age pension have changed:

1) age restrictions: as a general rule, 65 years old

- men, 60 years old - women;

2) the duration of the insurance experience - 15

years (starting from 2024);

3) restrictions on the minimum amount of pension

points - 30 points (starting from 2025).

Clauses 2 and 3 have references to Art. 35 of the

Federal Law "On Insurance Pensions", in which there

are transitional provisions regarding the duration of

the insurance period, the size of the individual

pension coefficient for persons applying for an

insurance old-age pension earlier than 2024

(Consultant-plus, 2013).

At the end of December 2015, the law “On the

suspension of certain provisions of legislative acts of

the Russian Federation, amendments to certain

legislative acts of the Russian Federation and the

specifics of increasing the insurance pension, fixed

payment to the insurance pension and social

pensions” dated December 29, 2015 was adopted No.

385 of the Federal Law. Which suspended the

indexing of pensions for working pensioners

(Consultant-plus, 2015). The legislator proceeded

from the consideration that a pensioner who has

additional income from wages is not afraid of

inflation and the loss of part of the income will not

affect the general financial well-being. Due to this

measure, the state planned to save funds for

increasing pensions to persons who, for objective

reasons, cannot participate in social production.

Indexing of pensions for working pensioners is

provided only after the termination of employment.

Pension rate for such pensioners is calculated

depending on the fixed payment effective at the date

of dismissal and the cost of the pension coefficient.

The attempt to save budgetary funds did not fully

justify itself, which is explained by the following

reasons. Firstly, for the present, it is impossible to

cover the planned costs at the expense of working

pensioners. Officially, employed pensioners are

mainly employed in state-owned enterprises or in

enterprises with a state share of at least 50%. In other

cases, employers do not make efforts to formalize

labor relations with old-age pensioners. Thus, there is

a situation when a pensioner actually continues

working, but without signing an employment

contract.

Secondly, the problem of the proportion between

the number of unemployed citizens and the number

of those employed in social production remains a

serious problem for the modern pension system. We

present statistical data from 2012 to 2019 (Table 1).

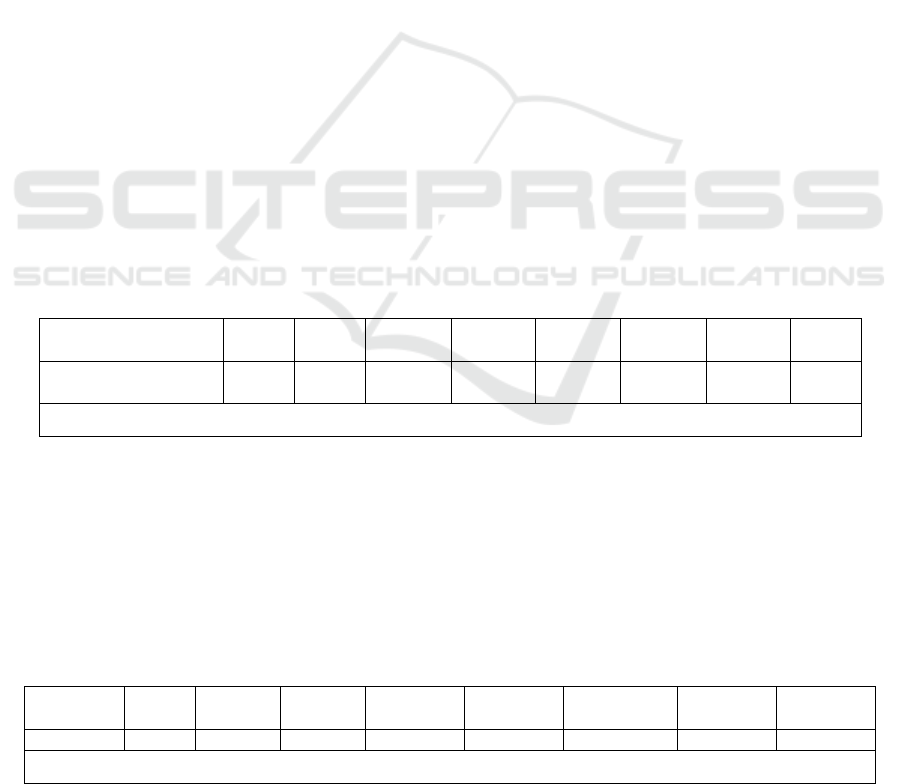

Table 1: The total number of pensioners in the Russian Federation in 2012-2019 for January 01, 2020, thousand people

(Rosstat-1, 2020).

2012 2013 2014 2015 * 2016 2017 2018 2019

The total number of

p

ensioners

42367 42837 43327 43797 45182 45709 46070 46480

* Presented without taking into account data for the Republic of Crimea and the city of Sevastopol

Source: Compiled by the author based on Rosstat data, Older generation.

The presented data indicate, firstly, a constant

increase of pensioners’ number in our country, and,

secondly, confirm the fact that this category accounts

for 1/3 of the number of people in the Russian

Federation. The total number includes all citizens

without exception, in the data presented, including

children and disabled people of group I, but they do

not participate in social production and, accordingly,

do not make a financial contribution to the country's

budget and state extra-budgetary funds, including the

Pension Fund of Russia.

Next, we present the statistical data on the

population of Russia for 2012-2019 (Table 2).

Table 2: The population of the Russian Federation in 2012-2019 for January 01, 2020, million people (Rosstat-2, 2020).

Years

2012 2013 2014 2015 2016 2017 2018 2019

Population 143 143,3 143,7 146,3 146,5 146,8 146,9 146,8

* Presented without taking into account data for the Republic of Crimea and the city of Sevastopol

Source: Compiled by the author based on data from Rosstat, Demography.

Transformation of Russian Legislation in the Field of Pension Provision: Problems, Solutions

771

Next, we present the data on the dynamics of the

working-age population of the Russian Federation in

2012-2019 (Table 3).

Table 3: Dynamics of the working-age population of the Russian Federation in 2012-2019 as of January 01, 2020, thousand

people (Rosstat-2, 2020).

Years 2012 2013 2014 2015 2016 2017 2018 2019

Working-age

p

o

p

ulation

87055 86137 85162 85415 84199 83224 82264 81362

* Presented without taking into account data for the Republic of Crimea and the city of Sevastopol

Source: Compiled by the author based on data from Rosstat, Demography.

As it can be seen from the data presented, the

percentage of working-age population in the overall

number of citizens has been steadily decreasing over

the past eight years in the Russian Federation, which

could not but affect many spheres and systems of

society.

Pension provision in Russia is currently being

built on a solidarity basis, when pension payments for

non-working citizens are financed from part of the

funds of working people. The unfortunate tendencies

in the demography have reduced the number of

working age people and, as a result, to amendments

to the pension legislation. The amendments to Part 1

of Article 8-Federal Law "On Insurance Pensions"

came into action From January 1, 2019.

These changes marked the beginning of the fifth

stage of pension reform. The decision to increase the

timescale of retirement in stages has been made by

the deputies of the State Duma of the Russian

Federation. Starting in 2019, the retirement age will

increase by one year every year. The exception will

be 2019 and 2020. During this period, preferential

treatments will be given for retirement, according to

the amendments to the law, 6 months minus from the

established period. The definitive changes in the age

of retirement will be set from 2023. Thus, the

"transitional period" of the new pension reform will

be five years, but it will affect all citizens of the

Russian Federation, without exception, who are able

to participate in social production without age and

health restrictions.

In addition, as a part of the reform of the system,

the changes in the timing of retirement for privileged

categories of citizens are in evidence. People who

work in the Far North and equivalent regions are also

now retiring five years later than the previously

established set time. Requirements for the total

duration of the insurance period and the value of

pension points for this category of persons remained

the same. The increase in the retirement age is being

carried out in stages as a part of overall reform.

Changes not affected:

1) women who have given birth to two or more

children who have an insurance experience of at least

20 years and have worked for more than 12 calendar

years in the Far North regions or at least 17 years in

equivalent areas. For this category of women, the

retirement age remained the same - 50 years;

2) reindeer herders, fishermen, hunters-traders at

the age of 50 and 45 (men and women respectively)

who are permanently residing in the the Far North and

equivalent regions, who worked for 25 and 20 years

in the above-named professions, respectively;

3) persons working in harmful industries with

hard working conditions, according to the Lists No.

1 and No. 2, approved by the Resolution of the

Cabinet of Ministers of the USSR No. 10 dated

January 26, 1991; individuals affected by radiation

and man-made disasters; flight test personnel, etc.

(Consultant-plus, 2013).

In addition, benefits have remained unchanged,

establishing an increased amount of a fixed payment

to pension. Subject to the availability of the required

length of service in the Far North and equivalent

areas, the amount of the fixed payment will be:

- 50 % of those who have worked for 15 years or

more in the Far North, while the duration of the

insurance period is 25 and 20 years (men and

women);

- 30 % of those who have had a period of work of

20 years or more in areas equated to the Far North,

while the duration of the insurance experience is 25

and 20 years (men and women) (Consultant-plus,

2013).

The concept of the pension reform to raise the

retirement age received positive feedback from 77

constituent entities of the Russian Federation, as

reported by the State Duma Committee on Labor,

Social Policy and Veterans Affairs in mid-July 2018.

However, in the long term, this reform may not have

the most favorable consequences for the northern

regions of our country. Historically, the settlement

and development of remote, with the country's harsh

climatic conditions territories, was realized with the

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

772

state’s support and participation. Support measures

varied: from the establishment of percentage

allowances for wages and additional leave-days, to

benefits for the age of retirement. All of which

stimulated the influx of the population into the

northern territories and contributed to their economic

development (Vologdina et al., 2019). To date,

residents of these localities have lost one of the

incentives that keep them in their place of residence.

Moreover, if we take into account the territorial

remoteness from the central areas of the country, due

to this factor, the high cost of goods and services, and

the relatively low salaries, then the question logically

arises about the expediency of further residence in

these areas. All of this, ultimately, will negatively

affect the economy of not only the northern

territories, but also the country as a whole. As a

confirmation of the relevance of the population

problem in individual constituent entities of Russia,

we present statistical data on the Khabarovsk

Territory (Table 4).

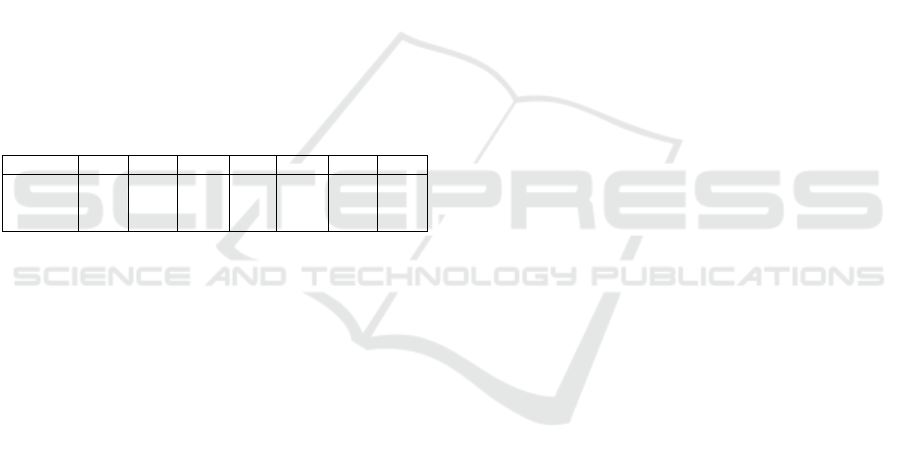

Table 4: Dynamics of the population of the Khabarovsk

Territory of the Far East of the Russian Federation in 2012-

2018, thousand people (Rosstat, 2019).

Years 2012 2013 2014 2015 2016 2017 2018

End of

year

estimate

1342 1340 1338 1334 1333 1328 1321

Source: Compiled by the author based on data

from Rosstat, 2019 “Regions of Russia Socio-

economic indicators”.

After the pension reform, the leaders of some of

the Russian Federation constituent entities began to

speak out about the need of establishing additional

measures to support citizens. First, this concerns the

development of the health care system and the

increase in workers' wages.

As noted above, for the moment, the pension

system in Russia is being built on a solidarity basis -

it is based on the insurance contributions of working

citizens. Accordingly, such system will be effective if

there is a natural increase in the population in the

country, when the number of employed is correlated

with the number of non-working citizens, recipients

of pension payments.

The increase of the retirement age is primarily

associated with demographic problems in the country.

N accordance with Rosstat, the number of births in

2018 was 1,604,344. From the previous year - 2017,

this figure decreased by 85,963 people (1,690,307

people). The natural decline was 224,566 people

(Rosstat, 2018). In these conditions, not only the

problems of maintaining the financial stability of state

extra-budgetary funds in order to support socially

vulnerable groups of the population become relevant,

but also the problems of increasing the birth rate in

our country, as well as reducing mortality rates.

Within the framework of pension provision,

several types of pensions can be discerned. One of

them is a survivor's pension. If we refer to the data of

official statistics, in 2018 the mortality rate was

1,828,910 people, 393,518 of them were of working

age (Rosstat, 2018). In comparison with the data of

2017, this indicator decreased by 6,554 people

(400,072 people) (Rosstat, 2017), however remains

quite high. This category of population includes

persons who are potentially capable of having

children, that is, those of reproductive age, who on the

day of death may have minor children. Children who

have lost their breadwinner can apply for an insurance

or social pension in the event of the death of their

breadwinner. The he type of payment will depend on

the breadwinner’s work experience availability. If, on

the day of death, the work experience of the deceased

breadwinner was at least 6 months, then the child will

be granted an insurance pension. In the absence of the

required length of service, a social pension.

Regardless of the kind of payment, children -

pension recipients, in case of loss of breadwinner,

anyway, are state dependent and it increases the

financial burden on the state.

Among the main causes of death in our country

are the blood circulatory system diseases and tumors.

They account for the number of deaths. In the context

of increasing the retirement age, the issue of

improving medical care is becoming urgent.

Thus, we see that the problems of pension

provision in our country are associated with problems

of a demographic nature, problems in the health

sector.

By increasing the retirement age, the state must

create all the necessary conditions for increasing the

birth rate and life expectancy of the Russian

population, reducing the number of deaths, especially

infant mortality and mortality among people of

working age.

The implementation of the constitutional rights of

citizens to pension provision is carried out according

to the Strategy for the pension system long-term

development of the of the Russian Federation,

authorized by the order of the Government of the

Russian Federation of December 25, 2012 No. 2524-

р. The specified normative legal act is intended to

prevent citizens’ pension rights violation in

accordance with the adopted legislation, “a socially

acceptable level of pension provision, ensuring the

balance and long-term financial stability of the

pension system” guarantee (Consultant-plus, 2012).

Transformation of Russian Legislation in the Field of Pension Provision: Problems, Solutions

773

5 CONCLUSION

The guarantee of citizens' rights to pensions is one of

the primary factors in the preservation of the country's

national security. Any state is interested in

maintaining social stability in society, economic well-

being in the country as well and in its individual

regions, in particular. In this regard, it seems

appropriate to amend Part 6 of Article 32 of the

Federal Law "On Insurance Pensions" and establish

the previously valid standards for the retirement age

for old-age citizens who have worked in the Far North

and equivalent regions. This will allow avoiding

migration losses of the able-bodied population in

these regions, and, as a consequence, economic

losses.

In addition, to supplement Part 1 of Art. 32 "On

Insurance Pensions", clause 1.3 in the following

content: "to women who gave birth to two children

and raised them until they reach the age of 8, who

have reached the age of 58, if they have an insurance

record of at least 15 years." Thus, to guarantee the

right of early assignment of an old-age pension and

thereby stimulate the birth rate for this category of

women.

REFERENCES

Barr, N. and Diamond, P. (2009). Reforming pensions:

principles, analytical errors and policy directions.

Journal of International Social Security Review, 62 (2):

5–29.

Consultant-Plus (1990). On State Pensions in the Russian

Federation. URL:

http://www.consultant.ru/document/cons_doc_LAW_

28/.

Consultant-Plus (1996). On individual (personified)

accounting in the mandatory pension insurance system.

URL:

http://www.consultant.ru/document/cons_doc_LAW_

9839/.

Consultant-Plus (2001). On Retirement Pensions in the

Russian Federation. URL:

http://www.consultant.ru/document/cons_doc_LAW_

34443/.

Consultant-Plus (2012). On Approving the Strategy for the

Long-Term Development of the Pension System of the

Russian Federation. URL:

www.consultant.ru/document/cons_doc_LAW_13998

1/.

Consultant-Plus (2013). On Insurance Pensions. URL:

http://www.consultant.ru/document/cons_doc_LAW_

156525/.

Consultant-Plus (2015). On the suspension of certain

provisions of legislative acts of the Russian Federation,

amendments to certain legislative acts of the Russian

Federation and the specifics of increasing an insurance

pension, a fixed payment to an insurance pension and

social pensions.

http://www.consultant.ru/document/cons_doc_LAW_

191264/.

Martin Feldstein (2005). Structural Reform of Social

Security. Journal of Economic Perspectives, American

Economic Association, 19(2): 33-55.

Mikhalkina, E.V. and Pysanka, S.A. (2011). Directions for

the modernization of the pension system in Russia.

Journal of Actual problems of economic practice, 9 (4):

29-34.

Rosstat (2017) Natural movement of the population of the

Russian Federation.

https://gks.ru/bgd/regl/b17_106/Main.htm.

Rosstat (2018). Natural movement of the population of the

Russian Federation.

https://gks.ru/bgd/regl/b18_106/Main.htm.

Rosstat (2019). Regions of Russia Socio-economic

indicators. URL:

https://gks.ru/bgd/regl/b19_14p/Main.htm (data

accessed: 25.01.2021).

Rosstat-1 (2020). Older Generation.

https://www.gks.ru/folder/13877.

Rosstat-2 (2020). Demography.

https://www.gks.ru/folder/12781.

Starinov, G.P. and Tseveleva, I.V. (2020). Exercising

Digital Rights in Procedural Law of Russian

Federation. Journal of Advances in Economics,

Business and Management Research, 138: 469-473.

DOI: 10.2991/ aebmr.k.200502.077

Vologdina, E.S, Kuzmina, О.А. and Matyuschko, A.V.

(2019). Experience of Implementing State Policy on

Life and Adaptation of Families of Agricultural

Migrants from the European Part of Russia to the Far

East in the 20-30s of the 20th Century. Journal of

Advances in Economics, Business and Management

Research, 128: 584-588. DOI: 10.2991 /

aebmr.k.200312.084

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

774