Development of a Model of Financial Stability of Universities

Tatyana Miroshnikova

1a

and Natalia Taskaeva

2b

1

Vladivostok State University of Economy and Service, 41, Gogolya str., Vladivostok, Russia

2

National Research Moscow State University of Civil Engineering, 26, Yaroslavskoye Shosse, Moscow, Russia

Keywords: Financial Stability of the University, Financial Stability Indicators, Education System, Educational Quality.

Abstract: The financial stability of state universities is the basis for the sustainable progressive development of this area.

The most important direction of the strategic policy of state administration is the management of the

educational process. The relevance of the topic of the work is due to the need to ensure the financial stability

of educational organizations, which seems to be an important task in the framework of increasing the

efficiency and effectiveness of the activities of organizations subordinate to the Ministry of Science and

Higher Education in terms of financial and economic activities. The subject of the research is the development

of a model of financial stability of a public institution. The existing methods for assessing the financial

condition of commercial organizations cannot be applied to the analysis of the financial condition of budgetary

structures. The information base of budgetary institutions differs in many respects in the content of a number

of indicators of the balance sheet from commercial organizations. The authors used an analytical approach in

the study of existing approaches to assessing financial stability. The result of the work is a model for assessing

the financial stability of universities. It allows you to determine the level of financial stability of any university

and identify those areas of activity where there are negative results that have affected the indicators of

financial stability in general. This will ensure effective planning in the formation and allocation of resources.

The methodological basis of the study was methodological recommendations for the analysis and diagnostics

of financial stability, as well as publications of leading experts in the field of economics.

1 INTRODUCTION

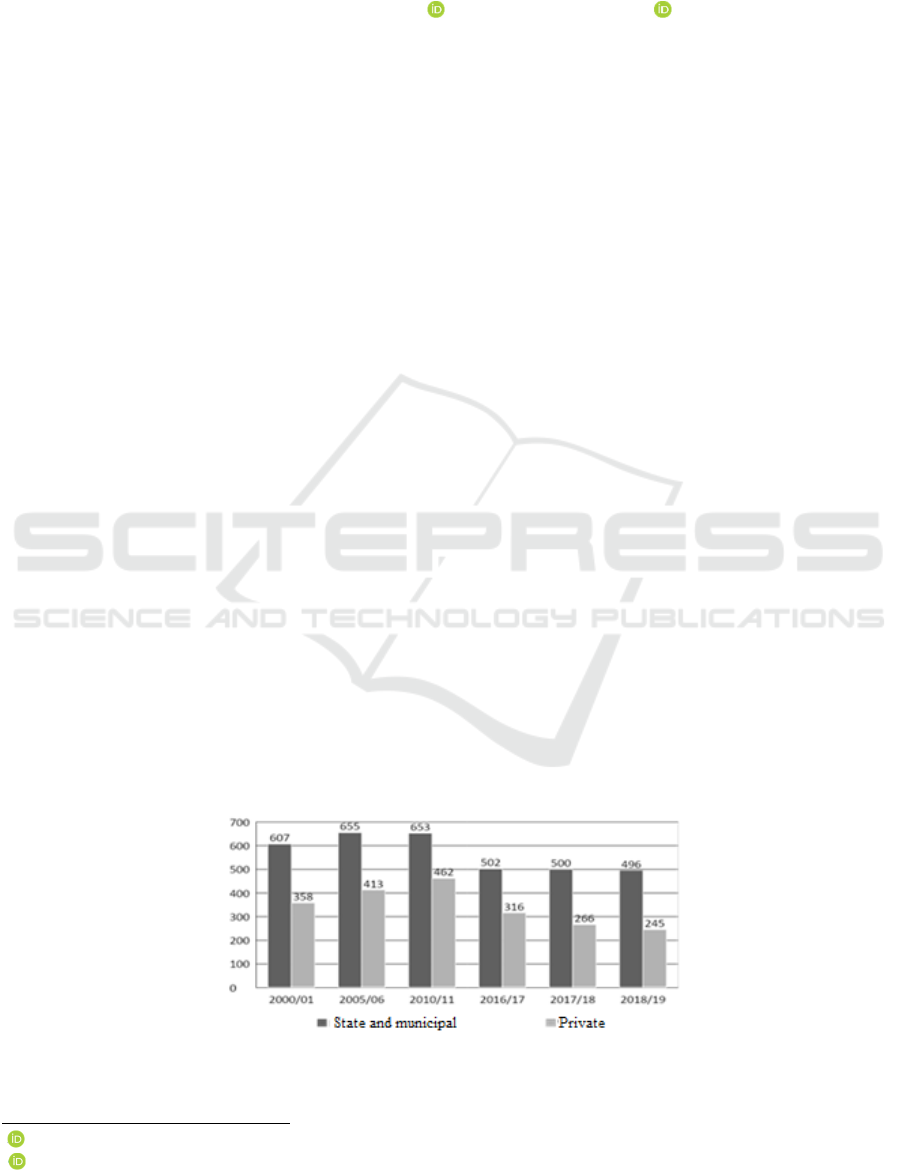

According to the Ministry of Science and Higher

Education of the Russian Federation, the Federal

State Statistics Service and the National Research

University "Higher School of Economics", the

dynamics of the number of state, municipal and

private universities in 2000–2019 changed as follows

(Figure 1). During the period under review, the

number of state and municipal Russian universities

exceeded the number of private ones by 1.4 - 2 times

(Bondarenko, 2019).

Figure 1: Change in the number of state, municipal and private universities in Russia in 2000–2019.

a

https://orcid.org/0000-0003-3998-3633

b

https://orcid.org/0000-0002-1792-0562

Miroshnikova, T. and Taskaeva, N.

Development of a Model of Financial Stability of Universities.

DOI: 10.5220/0010597007490756

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 749-756

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

749

Statistics of the last twenty years confirm that

Russian higher education is provided largely by state

and municipal universities. Higher education in the

Russian Federation is one of the priority areas for the

state.

The financial stability of state universities is the

basis for the sustainable progressive development of

this sphere. The efficiency of the formation and

distribution of resources, financial results and the

level of solvency determine financial stability.

Considering the essence of financial stability, it

should be noted that it implies not only maintaining a

positive level of indicators characterizing it, but also

includes development, which is manifested in

economic growth. Namely, there are tendencies of

positive changes taken together indicators of the

economic and financial development of the

organization over a certain period (Kovaleva, 2019).

The object of our research is to assess the financial

sustainability of public universities.

The most important direction of the strategic

policy of state administration is the management of

the educational process. The scientific, industrial,

ecological, cultural and political potential of the

country directly depends on the quality of education

of the population.

Along with organizations and commercial

enterprises, budgetary institutions, based on the

results of work for the reporting period, determine

economic or financial indicators (results) of

economic activity. The economic indicators of the

activities of budgetary institutions are used for

economic planning of the activities of the institution

in the analysis of economic activities, as well as to

determine the tax base.

The most important indicators of the activities of

a budgetary institution include:

receipts by income;

payments for expenses;

the amount of subsidies for the fulfillment of

the state assignment.

When making managerial decisions and

conducting financial and economic activities of state

institutions, its directions may change, and as a result,

they may face the problem of ensuring and

maintaining financial stability.

2 MATERIALS AND METHODS

The technology of the process of managing a

budgetary organization includes closely interrelated

functions: planning, accounting, analysis and

regulation (Aidemirova, 2017).

The instability of the financial state of the budget

of a state organization is characterized by a low level

of its own sources of budgeting, imbalance, inability

to correctly distribute revenues and a low share of

social spending in their total amount.

With a stable financial condition, there is a

sufficient amount of own sources of income, the

budget is balanced; the priority is to finance the social

and cultural sphere.

In terms of its structure, the information base of

budgetary institutions differs in many respects in the

content of a number of balance sheet indicators from

the base of commercial organizations, and it should

be noted that in order to improve financial stability, it

is necessary to take into account changes in the

structure of property and sources.

In this regard, it should be noted that the methods

for assessing the financial condition of commercial

organizations could not be applied to the analysis of

the financial condition of budgetary structures in a

more or less long-term perspective. This is largely

due to the restrictions related to the specifics of

budgetary institutions, and is expressed in the fact

that:

when calculating the autonomy ratios (the ratio

of own and borrowed sources), the cost of

equity capital is used, whose value is displayed

as part of the liability of the balance sheet of a

commercial organization. The state budgetary

institution does not form its own capital, and

the liabilities of its balance sheet include only

two sections: "Liabilities" and "Financial

result".

the calculation of financial stability ratios (the

ratio of own and borrowed sources of

financing) is carried out on the basis of the

classical methodology, using the value of long-

term liabilities. Nevertheless, relying on clause

14 of Article 9.2 of the Federal Law of

12.01.1996 No. 7-FZ (as amended on

08.06.2020) "On non-profit organizations":

"Budgetary institutions are not entitled to place

funds on deposits with credit institutions, as

well as make transactions with securities,

unless otherwise provided by federal laws”

(Frolkin, 2016).

Based on the proposed methods for calculating

financial stability indicators applicable for a state

university, we can propose an integrated approach

that combines all methodological approaches, but

excludes duplication.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

750

3 RESULTS

To develop a model of financial stability, we present

the absolute and relative indicators borrowed from the

models of the Ministry of Education, as well as the

methods used to analyze the financial stability of

commercial organizations (Financial sustainability,

2016). Table 1 presents the absolute indicators

applicable to characterize the financial stability of a

public university.

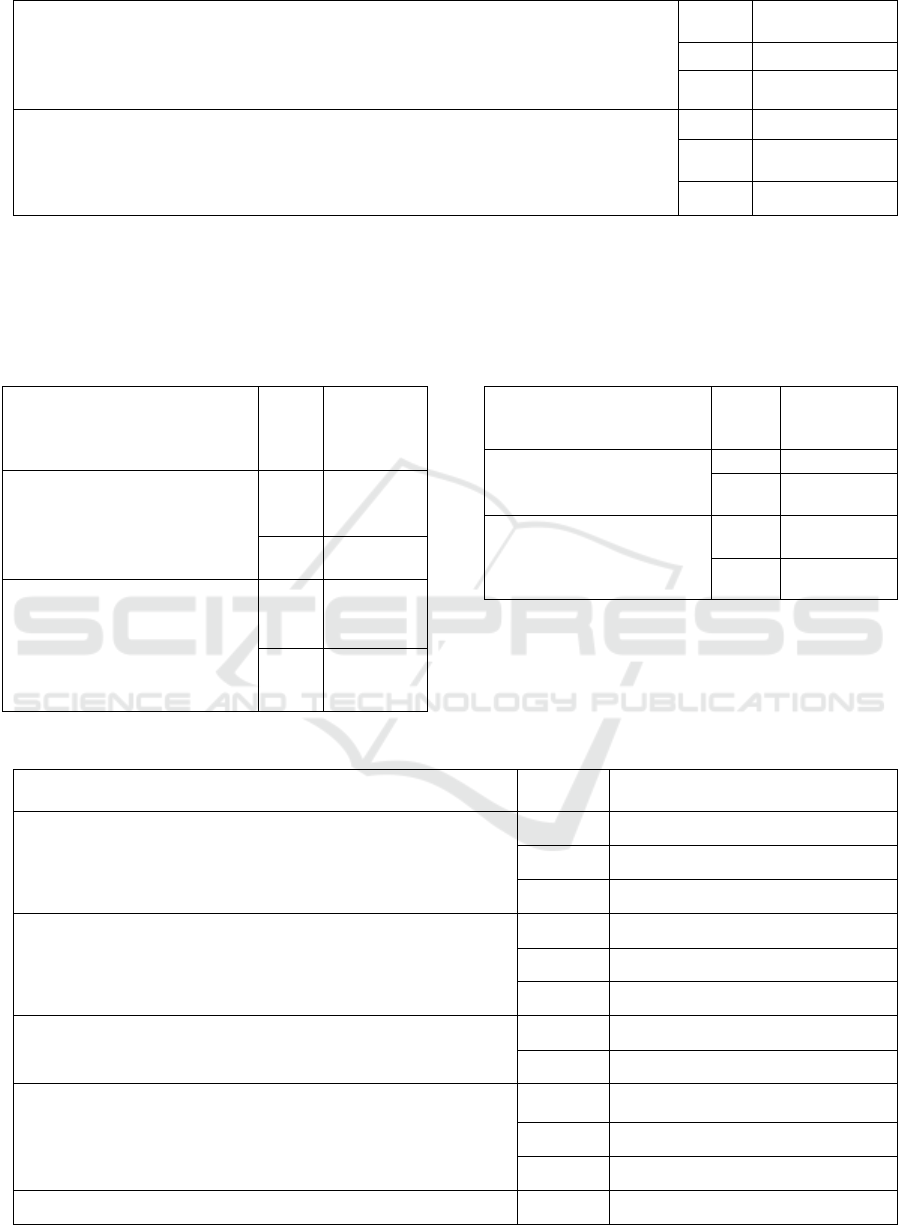

Table 1: Accumulated absolute indicators of the financial stability of the university.

Indicators Value

Total number of students in undergraduate,

s

p

ecialist and

g

raduate

p

ro

g

rams

The sum of the number of students enrolled in educational

p

ro

g

rams of bachelor's, s

p

ecialist's and master's de

g

rees

The number of enlarged groups of

specialties and directions (hereinafter -

UGSN)

Share of UGSN in the total amount

The total number of the teaching staff

(hereinafter PPS)

The total number of teaching staff excluding internal part-time

workers

̆

and working under civil contracts, excluding the

occupied rates, expressed as a percentage.

The proportion of the number of students

enrolled in master's programs and programs

for the training of scientific and

pedagogical workers (hereinafter - SPW) in

graduate school in the total number of the

g

iven contin

g

ent

The ratio of the reduced contingent of students to the reduced

contingent of students in Master's programs and postgraduate

teaching staff training programs

The number of publications of the

organization, indexed in the information

and analytical system of scientific citation -

Russian Science Citation Index (RSCI), per

100 academic staff

The ratio of the number of publications published in the reporting

year, included in the RSCI, to the number of teaching staff,

multiplied by 100

The amount of income from educational

activities

The amount of funds of the organization received during the

re

p

ortin

g

y

ear from educational activities

The amount of subsidies for the fulfillment

of a state task (hereinafter referred to as the

GZ

)

This subsidy is provided to institutions in accordance with

paragraph one of clause 1 of Article 78.1 of the Budget Code of

the Russian Federation

(

Kuznetsova, 2016

)

.

Table 2: Accumulated relative indicators of the financial stability of the universityю

Indicators Value

The volume of research

and development work

per 1 academic staff

The ratio of the total amount of funds received during the reporting year from the

implementation of research and development work to the number of teaching staff.

Average score of the

Unified State Exam

The ratio of the sum of the average Unified State Exam scores of students enrolled in

full-time studies based on the Unified State Exam results, adopted based on the

results of targeted admission in all areas and specialties of bachelor's and specialty

programs, multiplied by the number of such students enrolled in the corresponding

areas and specialties of bachelor's and specialty programs to the total number of such

students.

The results of students eligible for admission without entrance examinations are

recognized as the highest Unified State Exam results (100 points) in the relevant

general education subjects (Improving the financial, 2018).

Income from all sources

calculated on the

number of students

(reduced contingent)

The ratio of the amount of the organization's funds received during the reporting year

from budgetary and non-budgetary sources to the reduced contingent of students

enrolled in bachelors, specialists, and master's programs.

Development of a Model of Financial Stability of Universities

751

Continuation of table 2

Accumulation of

deterioration

Shows the degree of depreciation of fixed assets

Autonomy ratio Financial result (own funds) / The total amount of sources of formation of the

p

ro

p

ert

y

of the universit

y

(

excludin

g

obli

g

ations to the founder

)

(

Batkovsk

y

, 2017

)

Dependency ratio Obligations to creditors / The total amount of sources of formation of the property of

the university (excluding obligations to the founder)

(Improving the financial, 2018)

Coefficient of provision

of non-current assets

with long-term sources

of financin

g

The total amount of sources of formation of non-current assets / Total non-current

assets

Autonomy indicator

(PFY-1)

PFY - an indicator of

financial stabilit

y

The share of receipts from income-generating activities in the total volume of

receipts from income-generating activities and subsidies for financial support for the

fulfillment of the state task

Increase in receipts

from income-generating

activities (PFY -2)

Increase in receipts from income-generating activities in the reporting period in

relation to the period preceding the reporting period

Debt burden ratio (PFY

-3

)

Dependence of educational activities on borrowed funding sources

Share of overdue

accounts payable (PFY

-4

)

The ratio of the volume of accounts payable to the total volume of accounts payable

(excluding income payables)

Share of overdue

receivables (PFY -5)

The ratio of the amount of overdue receivables to the total amount of receivables

Deficit of funds from

income-generating

activities

(

PFY -6

)

Assessment of the indicator of accounts payable to funds from income-generating

activities

Table 2 shows the relative indicators of the financial

stability of the university. Analysis in these areas

involves the use of available information contained in

public reports. This makes it possible to conduct a

comprehensive assessment of the financial stability of

a state university. In general, the actual financial

condition of the organization can be represented only

by the integrated use of the results of absolute and

relative indicators.

4 DISCUSSION

Of great importance in the analysis of the financial

stability of an organization is the use of absolute

indicators:

the total number of students in undergraduate,

specialist and graduate programs,

the amount of income from educational

activities,

the total number of teaching staff, the

proportion of students in graduate programs

and postgraduate teaching programs in

postgraduate studies in the total number of

contingent,

the number of publications of the organization,

indexed in the information and analytical

system of scientific citation, per 100 academic

staff,

the amount of subsidies for the implementation

of the State Task, the number of enlarged

groups of specialties and directions. These

indicators are criterial, since they are used to

form metrics that allow you to determine the

quality of the financial condition (Flagship

Universities of Russia, 2020).

Relative values play an extremely important role

in modern conditions in the analysis of financial

stability, since they smooth out the distorting effect of

inflation on the reporting material. Their prevalence

is due to a certain advantage over absolute indicators,

since they allow one to compare objects that are

incomparable in absolute values, are more stable in

space and time, characterize homogeneous variation

series, and also improve the statistical properties of

indicators. The choice of indicators for the analysis of

financial stability should contribute to solving the

problem: to assess the financial stability on the basis

of accounting data.

As a result of the work done, we propose a model

for analyzing the financial stability of a state

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

752

budgetary educational institution of higher education,

created as a result of using all the above indicators,

taken from the classical methods of calculating

financial stability and indicators of the Ministry of

Education.

Using this technique, you can analyze the

company's activities throughout its existence and

carry out calculations annually to observe and analyze

the dynamics of the indicator. In the future, we

transferred all indicators to a point estimate, which

helped to draw a general conclusion about the level of

financial stability based on the results of assessing

both absolute and relative indicators.

The peculiarity of this model is that the financial

stability of the company is divided into the factors

that describe it. The factors represent the properties of

the first level, to which we attributed such

characteristics as - educational activities, research

activities, the state of fixed assets and financial and

economic activities. Further below the level are

indicators describing these factors, they constitute the

second level of indicators. Figure 2.2 shows the tree

of properties of the model for assessing the financial

stability of the state budgetary educational institution

of higher education.

The model includes the properties of three levels,

0 - the level is the main property, the indicator to the

definition, which our model aspires to. Below the

level, the enlarged properties are indicated, which

represent those areas of activity to which the

indicators we have highlighted belong.

The model presents the absolute and relative

indicators of the second level in the amount of

twenty-one.

For the best perception of the results, we suggest

using weight-adjusted scores, that is, each indicator

will have a weight of 0.048 for each of the 21

indicators out of a total ideal result of 1 or 100

percent. Each of the indicators of the university

receives a point taking into account the compliance

with one of the assessment factors. The calculation is

based on the ratios, where 2 points in a 3-point

gradation is 2/3 of the maximum mark, 1 point,

respectively, 1/3, in a 2-point system a similar

calculation. Accordingly, the scores adjusted for their

weight are presented in Table 3.

Table 3: Scores of the model for assessing the financial

stability of a state university, taking into account the

weight.

Point

score

Point weight in a 3-

point grading

s

y

stem

Point weight in a 2-

point grading

system

3 0,048

(

4,8%

)

2 0,032 (3,2%) 0,048 (4,8%)

1 0,016 (1,6%) 0,024 (2,4%)

Table 4 shows the scoring of the 2-level factors that

describe the property of the 1-level “Educational

activity”. Each point can be "obtained" according to

the condition indicated in the column for the absolute

value of the factor.

Table 4: Indicators of the scoring of factors of the 2nd level of the category "Educational activity".

Indicator name

Point

score

The absolute

value of the

facto

r

Total number of students in undergraduate, specialist and graduate programs 2 more than

10.000 students

1 less than 10,000

students

The number of enlarged groups of specialties and directions (UGSN) 2 more than 20

1 less than 20

Total number of teaching staff 3 The indicator

has increase

d

2 Indicator has not

chan

g

e

d

1 The indicator

has decrease

d

The share of the number of students enrolled in Master's programs and postgraduate

teaching staff training programs in the total number of the given contingent

2 more than 20%

1 less than 20%

Development of a Model of Financial Stability of Universities

753

The average score of the "unified state exam" of students taken on the basis of the results

of the "unified state exam" for full-time education at the expense of the corresponding

budgets of the budgetary system of the Russian Federation

3 from 80 to 100

2 from 60 to 80

1 from 40 to 60

The average score of the "unified state exam" of students taken on the basis of the results

of the "unified state exam" for full-time training with payment of the cost of training by

individuals and legal entities

3 61.63 and up

2 from 53.8 to

61.63

1 44 to 53.8

Table 5 shows the scoring of the 2-level factors

that describe the property of the 1-level "Research

activity".

Table 5: Indicators of the scoring of factors of the 2nd level

of the category "Research activity".

Indicator name

Point

score

The

absolute

value of

the facto

r

The number of publications of

the organization, indexed in the

information and analytical

system of scientific citation, per

100 academic staff

2

More than

20

1

Less than

20

R&D revenues (excluding funds

from the budgets of the

budgetary system of the Russian

Federation, state funds for the

support of science) per one

academic staff

2

More than

150 th,

rubles.

1

Less than

150 th.

rubles

A feature of this table is the use of only two-point

gradation. The following Table 6 lists the metrics for

the Basic Properties State property.

Table 6: Indicators of scoring of factors of the 2nd level of

the category "State of basic properties".

Indicator name

Point

score

The absolute

value of the

facto

r

Accumulation of

deterioration

2

Less than 0.5

1

More than

0.5

Coefficient of provision of

non-current assets with

long-term sources of

financin

g

2

More than

0.6

1

Less than 0.6

The final table describes the property "Financial

and economic activity".

Table 7: Indicators of scoring of factors of the 2nd level of the category "State of basic properties".

Indicator name

Point

score

The absolute value of the factor

The amount of income from educational activities

3

The dynamics are positive

2

The volume did not change (± 5%)

1

Dynamics is negative

The amount of subsidies for the execution of the state order

3

The dynamics are positive

2

The volume did not change (± 5%)

1

Dynamics is negative

Income from all sources calculated on the number of students

(reduced contingent)

2

More than 200 thousand rubles.

1

Less than 200 thousand rubles

Autonomy ratio

3

from 0.5 to 0.7

2

more than 0.71

1

less than 0.49

Dependency ratio

3

from 0.4 to 0.5

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

754

2

from 0.5 to 0.7

1

more than 0.71 and less than 0.4

Autonomy indicator (PFY-1)

3

Maximum value 70% or more

2

Satisfactory value: 30% - 69%

1

Minimum value 30% or less

Increase in receipts from income-generating activities (PFY -2)

3

Maximum value 8% or more

2

Satisfactory value: 0% - 8%

1

Minimum value 0% or less

Debt burden ratio (PFY -3)

3

Minimum value from 0% to 10%

2

Satisfactory value: 11% - 24%

1

Maximum value 25% or more

Share of overdue accounts payable (PFY -4)

3

Minimum value 0%

2

Satisfactory value: more than 0% -

u

p

to 1%

1

Maximum value 1% or more

Share of overdue receivables (PFY -5)

3

Minimum value 0%

2

Satisfactory value: more than 0% -

up to 1%

1

Maximum value 1% or more

Deficit of funds from income-generating activities (PFY -6)

3

Maximum value 0% or more

2

Satisfactory value: -15% - 0%

1

Minimum value -15% or less

5 CONCLUSION

The paper proposes the absolute and relative

indicators of financial stability used in the author's

model. The authors presented a model for assessing

the financial stability of a higher educational

institution. For a more visual result, one or 100

percent was taken as an ideal indicator, while all

indicators were assigned points in accordance with

whether they correspond to the standard value or not.

Thus, using this methodology, a state university is

able to quickly and qualitatively analyze its activities

from the point of financial stability and then

determine which indicators should be emphasized in

the future when planning their activities. In order to

develop the university in the future and increase its

prestige among applicants, one should take into

account those areas of activity in which negative

values of indicators were obtained. In conclusion, we

note that the analysis of the financial stability of a

public institution of higher education in modern

conditions is extremely important in the framework

of increasing the efficiency and effectiveness of the

activities of a higher educational institution.

Development of a Model of Financial Stability of Universities

755

REFERENCES

Aidemirova, Z.A. (2017). The role of the analysis of the

financial state of the financial in the management

system. Aeterna Scientific Publishing Center, pages 4–

8.

Batkovsky, M.A. (2017). Ensuring the financial stability of

the university.

Bondarenko, N.V. (2019). Education in numbers: short

statistical collection.

Financial sustainability of the university or how to

“balance” the quality? (2016) LLC "Editorial office of

the journal Accreditation in Education", 6: 58-60.

Flagship Universities of Russia (2020).

http://flagshipuniversity.ntf.ru/project

Frolkin, A.V. (2016). The concept of financial stability in

budgetary and autonomous institutions. Bulletin of the

Plekhanov Russian University of Economics, pages

127-132.

Improving the financial stability of universities. (2018).

Projects of Russian universities, 212. M.: FGBOU VO

"PRUE im. G.V. Plekhanov".

Improving the financial stability of universities. (2018).

Projects of Russian universities: scientific publication.

Ural Federal University named after the first President

of Russia B. N. Yeltsin (Yekaterinburg), Ministry of

Education and Science of the Russian Federation,

Russian University of Economics. G.V. Plekhanov,

212.

Kovaleva, V. 2019. NRU HSE, 96.

Kuznetsova, A.L. (2016). On the issue of assessing the

financial sustainability of a state university taking into

account financing from non-budgetary sources, 1(5): 29

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

756