Fast-growing Tech Companies as a Driver of Regional and National

Sustainable Economic Development

Irina B. Dzyubenko

a

Institute of Economics and Industrial Engineering SB RAS, Academician Lavrentyev Avenue 17, Novosibirsk, Russia

Keywords: High-Tech Business, High-Growth Firms (HGFs), Fast-Growing Companies (FGCs), Exponential

Technologies and Organizations, Entrepreneurial Ecosystem, Sustainable Development.

Abstract: The article deals with the analysis of the fast-growing tech companies which are proved to be a key factor in

structural changes and sustainable economic growth. The intended purpose of this paper is to identify the

particular traits of fast-growing tech companies and to reveal the factors which determine the extent of their

development (both spatial and intensive) in various regions and countries. The paper employs multivariate

analysis methods in the evaluation of the data for 29 countries in order to achieve the purpose mentioned

above. A set of factors affecting the launch and growth of tech companies has been determined. The

relationship between the development of fast-growing high-tech companies and the following variables was

tested: the level and the dynamics of country's wealth, population’s welfare, as well as the share of R&7D

expenditures in GDP. Based on cluster analysis 4 groups of countries have been defined depending on the

indicators of fast-growing tech companies’ development and the characteristics of entrepreneurial ecosystem

there. The value of this paper is to provide practical tools for enhancing technology entrepreneurship. The

results of the research can be used in the development and implementation of support measures for fast-

growing companies.

1 INTRODUCTION

The unprecedented economic crises caused by the

coronavirus pandemic highlighted the urgency of

sustainable economic growth at the macro and micro

economy levels. Given the ability of High-Growth

Firms (HGFs) to generate sustainable and rapid

growth through the use of new technologies and

business models, it is fair to identify them as drivers

of regional and national sustainable economic

development. (Coad et al., 2014). It is believed that

HGFs create more than 40% of new workplaces,

although in some countries the share of such

companies is approximately 5% (Bravo-Boscia et al.,

2013). Moreover, FGCs might enhance the level of

productivity (Autio, 2009), perform as a benchmark

for potential entrepreneurs (Bosma et al. 2012),

promote the diffusion of innovations (Coad, 2009),

generate new knowledge (Colombelli et al. 2014),

support export orientation (Mason and Brown, 2010)

and stimulate industry growth (Du and Temouri,

a

https://orcid.org/0000–0002–7748–5486

2015). Furthermore, HGFs activities can have

multiplier effects (Moreno and Coad, 2015).

HGFs are particularly well represented in high-tech

industries, they are ubiquitous, but unevenly

distributed in different countries and regions.

According to Eurostat data, the number of high-tech

companies in the EU increased by 30% between 2014

and 2017, which is much higher than the 9% growth

rate of all active company’s in the EU business

economy. As a result, they accounted for about 11%

of all entities in the business economy (European

Commission, 2019). This fact demonstrates the

importance of high-tech companies in the business

dynamics of European countries.

The volatility of the conditions in which

companies operate, as well as their macroeconomic

and institutional environment, imply that HGFs -

friendly policies must be tailored to the specifics of the

region (Bosma and Stam, 2012). This makes the cross-

country analysis of FGC differences relevant (Coad et

al., 2014; Teruel and De Wit, 2011), as it takes into

account both economic conjuncture and institutional

540

Dzyubenko, I.

Fast-growing Tech Companies as a Driver of Regional and National Sustainable Economic Development.

DOI: 10.5220/0010593605400548

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 540-548

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

environment, and other characteristics of the

entrepreneurial ecosystem.

Despite the relevance of the problem under study

and increased attention to the issue (Teruel and De Vit,

2011), inequalities remain in the ability to initiate and

manage the creation and growth of FGCs, meanwhile

the available knowledge is limited. (Nightingale and

Coad, 2014). To fill this gap in the scientific literature,

we examine the institutional and macroeconomic

environment as well as the components of the

entrepreneurial ecosystem that shape cross-country

differences in the methods of HGFs development.

We focus on a specific type of HGFs - the fastest-

growing companies (FGCs) showing exceptional

growth (Lia et al., 2016). The number of such

companies is rather small and is associated with high

risks as they create and use new exponential

technologies (Ismail et al., 2017) and new untested

business models. This topic is still uncovered in the

economic literature. The growth of such companies

has a positive recycling dynamic and does not depend

on the size of the economy and the dynamics of its

development. In contrast, there is a correlation

between the dynamics of economic development and

the presence and growth rates of tech FGCs.

The results of this study show that the operating

environment of fast-growing tech companies differ

significantly in various countries and regions. The size

of а country's economy, the capacity of the domestic

market and the volume of domestic R&D expenditures

are not the determining factors in the development of

tech FGCs. These companies are concentrated in

countries with a high level of technological

development and population’s welfare, a well-

developed infrastructure, a low level of undue

influence and corruption, with the available latest

technologies and venture capital as well as with

favorable conditions for talents and entrepreneurship

development. The development of such companies

(spatial and intensive) is determined by the

institutional framework and the quality of the

entrepreneurial ecosystem. Tech FGCs, in turn, have

significant influence on them.

2 MATERIALS AND METHODS

The methodological basis of the study is the general

theory of economic growth and systems analysis. The

research is based on the data from the Deloitte 2016

Technology Fast 500 ™ EMEA rankings, which

covers the largest number of countries (Deloitte, 2016)

and companies' websites. The Deloitte Technology

Fast 500™ EMEA program is focused on the

technology ecosystems. It recognizes technology

companies that have achieved the fastest rates of

revenue growth in Europe, the Middle East, and Africa

(EMEA) during the past four years. In order to

participate in the ranking, a company must meet the

following eligibility criteria: be in business not less

than of four years, be headquartered within EMEA,

have base-year operating revenues of € 50 000 and a

current year operating revenue of at least € 800 000,

own proprietary intellectual property or proprietary

technology, sold to customers in products that

contribute to a majority of the company's operating

revenues.

A wide range of indicators characterizing the

macroeconomics and institutional environment and

other framework conditions conducive to the

development of tech FGCs are also used in the

analysis. FGCs indicator framework aims to capture

the most important factors that determine the overall

quality of tech FGCs ecosystem. Priority lies with

indicators that are tailored to tech FGCs and with

regional-level indicators since the FGCs ecosystem is

often determined by specific local circumstances

More than 90 indicators were analyzed to identify

factors that explain the significant differences in the

development of tech FGCs in different countries. In

order to determine the variables which would have

statistically significant influence on the FGCs

development for the relationship analyses both

correlation and regression methods were

implemented.

Through the cluster analysis method 4 groups of

countries have been identified, which differ in terms

of concentration and growth rates of the fast-growing

tech companies and in terms of characteristics of the

entrepreneurial ecosystem. Cluster analysis was

conducted using the k-means method. Transformation

of variables and clustering was carried out using the

maximum distance method. To perform calculations,

processing and evaluation of the data under study the

following software products were used: Excel, IBM

SPSS Statistica. The results obtained at this stage of

the research are presented below.

3 RESULTS AND DISCUSSION

3.1 Characteristics of the

Fastest-growing Tech Companies

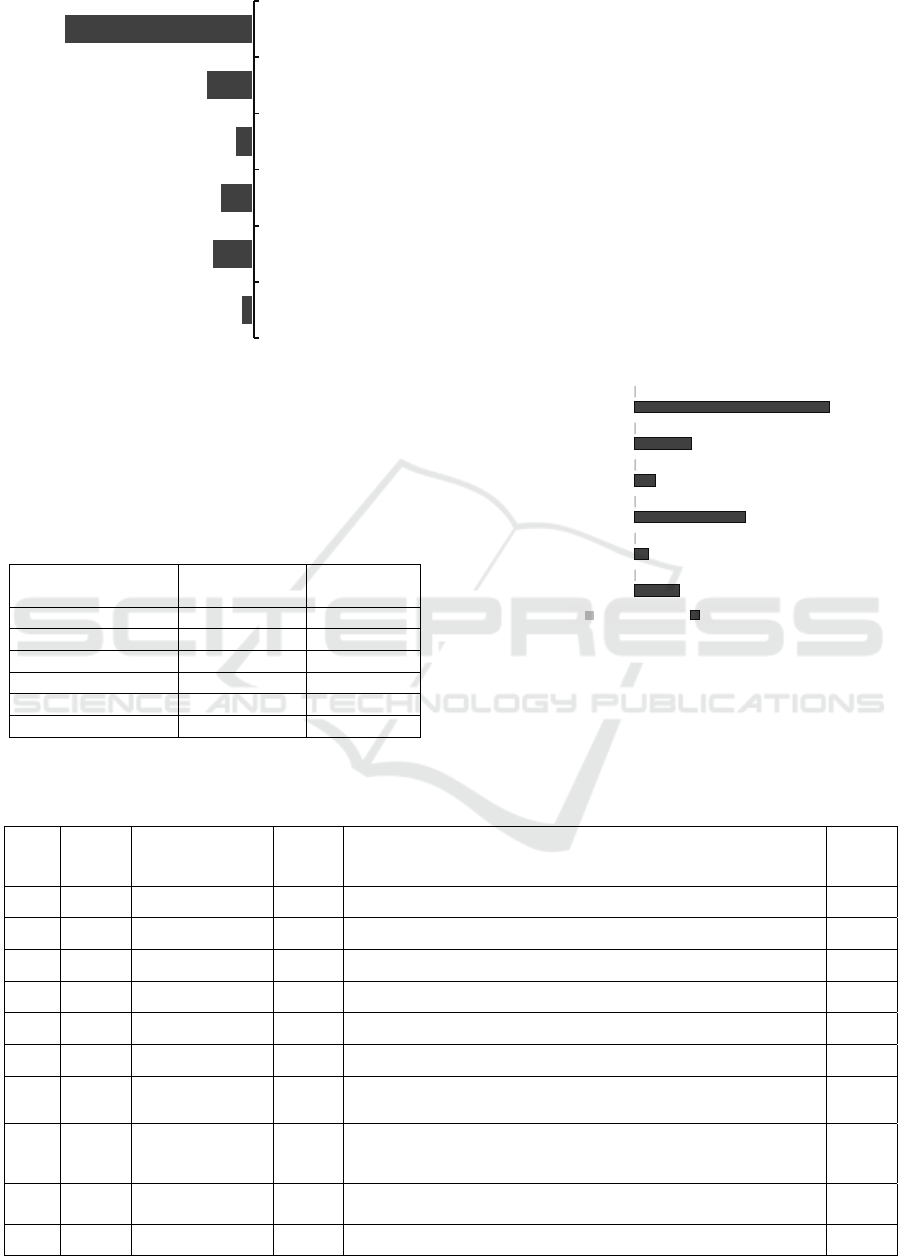

Technology Fast 500™ EMEA list, a ranking of the

500 fastest-growing innovation technology media,

telecommunications, life sciences and energy tech

companies (see Figure 1).

Fast-growing Tech Companies as a Driver of Regional and National Sustainable Economic Development

541

Figure 1: Sector structure of the Ranking.

The majority of fast-growing companies operates

in the software industry. However, these companies

demonstrate relatively low growth rates - 362% (see

Table 1).

Table 1: Number and growth rates of companies in various

sectors.

Sector

Number of

companies

Average

growth, %

Clean Technolo

gy

20 471

Communication 61 345

Hardware 49 962

Life Sciences 29 347

Media 70 644

Software 271 362

The leaders in terms of growth rates are hardware

companies (962%) whose share in the rating is less

than 10%.

The second place in terms of the number of

companies and their growth rates is followed is

followed by the media. The share of companies in this

sector is one and a half times larger than that in the

hardware, but the growth rates, in contras one and a

half times lower. Average growth rate of 29

companies related to the life sciences sector is equal

to 347%. The clean technology FGCs with 471%

revenue growth rate have the least presence in the

ranking.

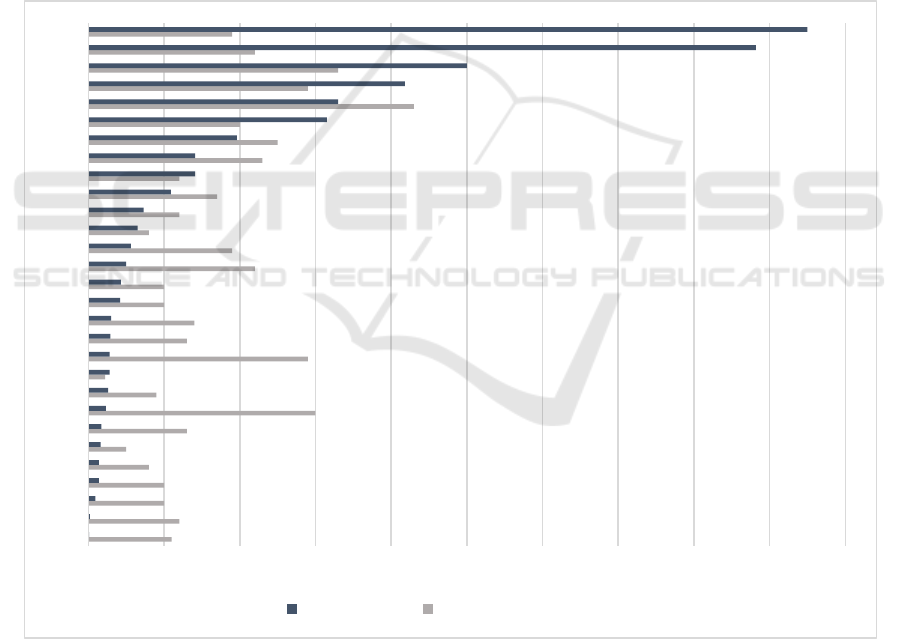

Between 2012 and 2015, the companies achieved

revenue growth of 212% to 28,126% (see Figure 2).

The median revenue growth is equal to 967%.

Figure 2: Four-year revenue growth.

The top-ten-ranked companies are featured below by

company, country, industry sector and four-year

growth percentage (see Table 2). Top companies in

the ranking show extraordinary growth.

Table 2: Top-10 Technology Fast 500 ™ EMEA Ranking.

Rating Country Company name

Revenue

increase,

%

Activity type / product Sector

1 Sweden Fingerprint Cards 28 126 User friendly fingerprint biometric solutions Software

2 Turkey Bilgikent 16 015 IT system and infrastructure provider and integrator Hardware

3 Poland Codewise 13 052 Online marketing tools Software

4 Norway Auka 11 487 Mobile payment platforms Software

5 France Horizontal Software 8 339 SaaS-based HR software Software

6 UK Brain Labs Digital 8 255 Media agency and provider of automated marketing solutions Media

7 Israel Magisto 8 119 User-friendly tools for making short videos and taking photos Media

8 France Chauffeur-Privé 7 020

Ride-sharing application enabling licensed drivers to offer rides to

clients.

Software

9 Austria

Wikifolio Financial

Technologies

7 001

Social investment platform for entrusting funds with registered

traders, based on their performance

Software

10 UK GoCardless 6 661 Application for direct debit management in enterprises Software

4%

12%

10%

6%

14%

54%

Clean Technology

Communications

Hardware

Life Sciences

Media

Software

6 548

1 967

16 015

3 039

8 255

28 126

213

213

214

229

216

212

Clean Technology

Communications

Hardware

Life sciences

Media

Software

Minimum Maximum

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

542

The average annual revenue growth of the

companies amounts to 445% (from 128,8% to 655%).

Thus, all tech FGCs show exponential growth. These

companies meet the criteria of an exponential

organization (ExO) (Ismail et al., 2017; Dzyubenko

and Dzyubenko, 2018) and use this business scaling

model. These companies generate high growth and

take leading positions in their fields. The most

important factors in their development are the

creation and use of fast-paced disruptive technologies

capable of providing exponential growth and

exponential cost as well as new business processes.

By linking their products to exponential growth and

lowering costs through new technologies, ExOs offer

products that are better, cheaper and more

personalized at the same time, for all customers. They

actively set up their own business platforms, which

allow them serve almost unlimited number of direct

connections with partners and customers. Platforms

are becoming fertile ground for the creation and

development of technology and business ecosystems

based on collective production and consumption

practices that blur the lines between supply chains,

performers, partners, customers and the general

public. Technology ecosystems create Such

environment and relationships which help high-tech

companies to grow and develop faster. Expanding the

technological framework allows companies to pool

resources and efforts, to foster exponential

innovation, and to amplify the impact on cost-

effectiveness. Technology, innovation and the

external environment form an entrepreneurial

ecosystem that is simultaneously influenced by high-

tech companies and affects their growth.

3.2 Development of Fast-Growing Tech

Companies in Different Countries

The Technology Fast 500 for EMEA 2016 list

includes the countries of Europe and the Middle East:

Austria, Belgium, United Kingdom, Germany, Israel,

Ireland, Netherlands, Iceland, Norway, Finland,

Sweden, Spain, Italy, Lithuania, Portugal, Slovenia,

Turkey, Czech Republic, Bulgaria, Bosnia and

Herzegovina, Hungary, Greece, Poland, Russia,

Romania, Serbia, Slovakia and Croatia.

High-tech FGCs operate in the entire business

economy of the region, although with varying

concentrations. The regional structure of the rating is

shown in Figure 3.

Figure 3: Regional structure of the Ranking.

France became the leader in terms of the number

of companies (94 companies), followed by the United

Kingdom (70), the Netherlands (54), Norway (50)

and Sweden (50) (see Figure 4). More than 60% of

FGCs is concentrated in the five leading countries.

Figure 4: Ranking of countries by the number of FGCs.

The concentration of tech FGCs in countries was

estimated in terms of their density (the number of

FGCs per million population). As for the FGCs

density, the ranking based on this indicator (Figure 5)

54%

6%

25%

4%

10%

WesternEurope

EasternEurope

NorthernEurope

SouthernEurope

MiddleEast

94

70

54

50

50

27

23

23

22

21

15

10

7

6

4

3

3

3

3

3

2

1

1

1

1

1

1

1

1

FRA

GBR

NLD

NOR

SWE

ISR

DEU

FIN

BEL

TUR

POL

ITA

IRL

CZE

SVK

HUN

ISL

PT

ROU

HRV

AUT

BGR

BIH

GRC

ESP

LTU

RUS

SRB

SVN

Fast-growing Tech Companies as a Driver of Regional and National Sustainable Economic Development

543

deviates a lot from the previous one. In the countries,

leading in terms of their number of FGCs, the

concentration of FGCs was lower than in the sparsely

populated countries with relatively small territory.

For instance, France ranks first in terms of the number

of FGCs and the ninth - in terms of their density. In

contrast, Iceland is 17th in terms of the number of

FGCs, but the second in terms of FGCs density. The

largest number of fast-growing companies per 1

million population is in Norway, Iceland, Sweden,

Finland and Israel. Despite well-developed economy

Germany takes the 19th place under this indicator.

Despite well-developed economy Germany takes the

19th place under this indicator.

Most tech FGCs are concentrated in countries

with a high level of economic development and the

most favorable framework conditions.

Austria's tech FGCs are leading in terms of the

average revenue growth in the country (4135%), their

growth is almost 15 times higher than that of Spain

(277%), which takes the last place. Austria is

followed by Portugal; whose FGCs grew on average

7.3 times faster than the Spanish ones. Turkey took

the third place with a small margin. United Kingdom,

Germany, France and Norway are middle-ranking.

Such results might be explained by the large number

and Norway are middle-ranking of companies in

these countries represented in the ranking and the

wide range of values of their growth indicators. Thus,

in the countries of the region, there is not only an

uneven distribution, but also an uneven growth of

tech FGCs.

Figure 5: FGCs density and R&D expenditure in different countries.

012345678910

RUS

GRC

SRB

ITA

TUR

DEU

HUN

POL

CZE

SVK

IRL

BEL

ISR

SWE

NOR

HGFsdensity R&Dexpenditure,%GDP

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

544

3.3 Relationship between the

Development of Fast-growing Tech

Companies and the Level and

Dynamics of the Country's Wealth,

Population's Welfare

The growth in the number and the development of

high-tech companies is undoubtedly a positive factor

for the economy of each country. However, it is

necessary to estimate, on the one hand, how the

economic environment contributes to the formation

and development of these companies and, on the other

hand, to find out if there is statistically significant

relationship between the number and growth rates of

high-tech companies, the country's wealth and the

level of population’s welfare.

Correlation analysis showed a moderate

relationship between the number of technological

FGCs and a country's wealth level as measured by

GDP (PPP). The correlation of the number of

technological FGCs with the welfare of the

population, measured by GDP (PPP) per capita, is

low (Table 3).

Table 3: Correlation table entrepreneurial ecosystem elements and output.

GDP (PPP) GDP (PPP)

per capita

GDP

growth rate

GDP growth rate

per capita

R&D expenditure

Number of FGCs 0,6 0,57 -0,18 -0,03 0,42

FGCs density -0,11 0,75 0,07 0,1 0,44

FGCs growth -0,02 -0,04 0,07 -0,19 0,08

Population welfare level in the sample, in general,

has greater influence on the FGCs density.

Correlation between FGCs density and GDP (PPP) is

low. However, the picture differs significantly across

groups of countries, depending on the level of their

economic development. Correlation coefficients

between the number of techs FGCs and the size of the

economy range from 0.98 for developed economies

to 0,12 for countries with economies in transition,

most of which are represented by one company. In the

group of developed economies with a high

concentration of FGC, their density correlates with

the level of population’s welfare (correlation

coefficient 0.85), and in the group of developing

countries, it does not (the correlation coefficient

0.14). Moreover, groups of countries with a high level

of economic development are also heterogeneous in

terms of the analyzed relationship. For instance, in

economically developed countries with a relatively

low concentration of FGC, the relationship between

the density of FGCs and the level of the country's

wealth and the population’s welfare is negative

(correlation coefficients -0.5 and -0.3, respectively).

In general, the presence of tech FGCs in most

countries does not depend on the size of the economy,

domestic R&D costs, correlates with the level of

population’s welfare and is determined by other

factors related to the specifics of the business

environment of each country, the technological and

entrepreneurial ecosystem. It can also be associated

with the episodic and rather uncertain and

unpredictable nature of high growth in companies.

The analysis showed that there was no linear

relationship between the growth rates of tech FGCs

and the level of the country's wealth, population's

welfare. In high-wealth countries (excluding

Austria), tech FGCs grow at a lower rate than in

relatively low-wealth countries, and vice versa. In the

group of countries with the highest level of

population’s welfare (Norway, Ireland, Iceland,

Sweden), the average growth rates of FGCs are the

lowest. The correlation between the growth rates of

companies' revenue and GDP (PPP) is weak positive,

and between the growth rates of FGCs and GDP per

capita it is weak negative (correlation coefficients are

0.07 and -0.19, respectively).

In practice there is no connection between the

indicators of FGCs development and gross domestic

expenditures on R&D. In countries with a high FGCs

density, indicators of domestic R&D expenditures %

GDP are relatively low, and vice versa (Figure 5). The

analysis shows a low correlation between these

indicators (see Table 3).

However, here, too, the picture is not uniform and

ambiguous. Countries leading in terms of GDP (Italy,

Russia, Turkey) are not experiencing fast growth of

FGCs. High-tech companies develop and grow better

in countries with a high level of GDP and

population’s welfare - Germany, United Kingdom,

Sweden. In some countries, not only high-tech

companies are growing rapidly, but also the country's

wealth and the population’s welfare. The growth rate

of tech FGCs is simultaneously an organic

consequence of the country's economic development

Fast-growing Tech Companies as a Driver of Regional and National Sustainable Economic Development

545

and at the same time actively affects the dynamics of

economic growth but is largely determined by the

internal factors of companies and the characteristics

of the entrepreneurial ecosystem.3.4

Relationship between the Development of

Fast-Growing Tech Companies and Entrepreneurial

Ecosystem

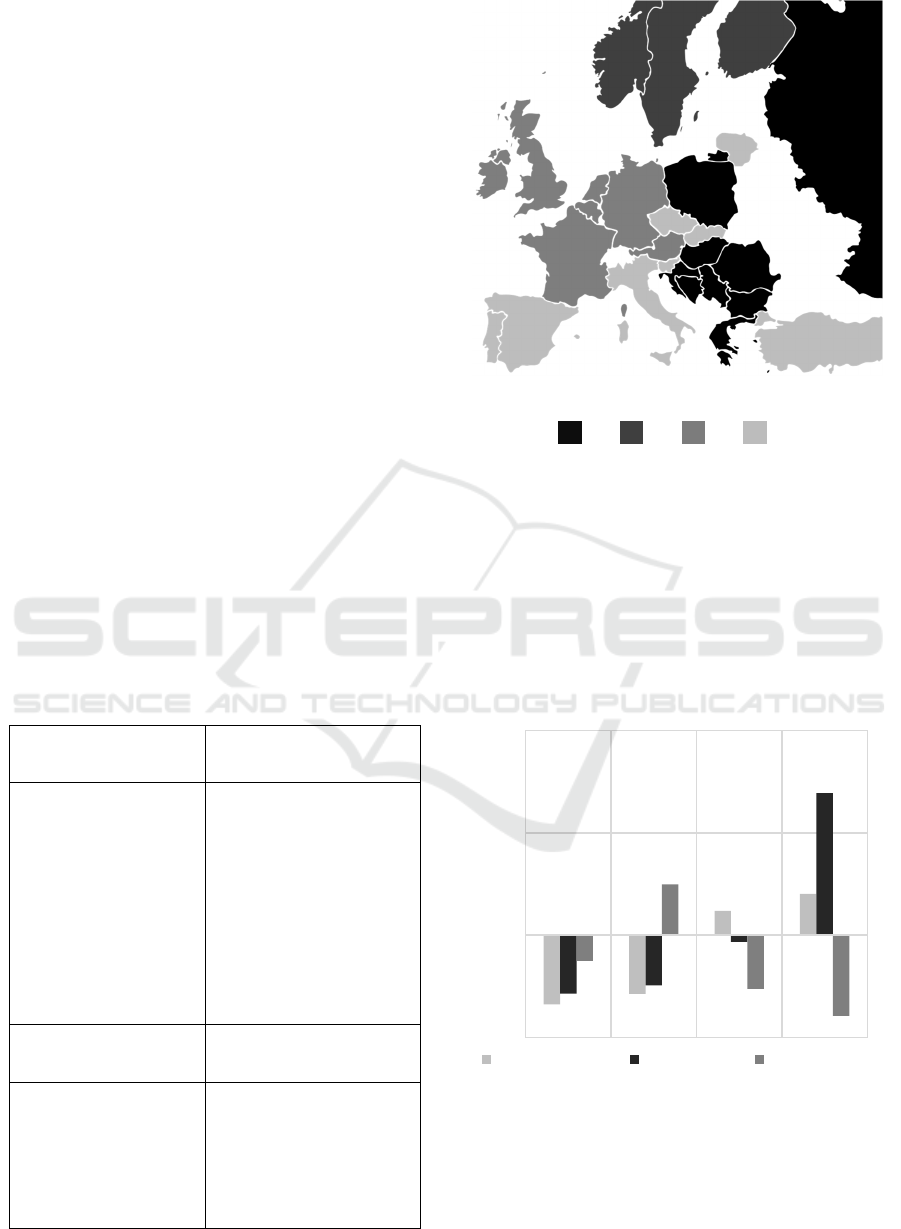

To identify the factors explaining the varying

levels of tech HGFs development in different

countries, a cluster analysis was carried out. HGFs

indicator framework are covers HGFs demographics

and key factors that broadly support or obstruct the

development of HGEs. It supports deriving country-

specific insights related to framework conditions

conducive to the development of HGEs, based on the

findings in the academic literature. Due to the limited

sample, ten indicators were used in the cluster

analysis. Therefore, the indicators do not cover every

single relevant framework condition but relies on

highly correlated indicators: HGFs density, GDP

(PPP) per capita, ICT infrastructure, degree of

customer orientation, technological adoption, country

capacity to retain talent, availability of latest

technologies, venture capital availability,

geographical concentration, undue influence and

corruption. The higher the value of the latter

indicator, the lower the level of corruption in the

country. The cluster analysis results are shown in

Table. 4, graphic visualization in Figure 6.

Table 4: Results of cluster analysis.

Cluster 1

(9 countries)

Cluster 2

(8 countries)

Bulgaria

Greece

Hungary

Poland

Russia

Romania

Serbia

Croatia

Bosnia and

Herzegovina

Spain

Italy

Lithuania

Portugal

Slovenia

Turkey

Slovakia

Czech Republic

Cluster 3

(7 countries)

Cluster 4

(5 countries)

Austria

Belgium

United Kingdom

Germany

Ireland

Netherlands

France

Iceland

Norway

Finland

Sweden

Israel

Cluster

1 2 3 4

Figure 6: Countries distribution by clusters.

Clusters represent the positions of countries in

terms of the level and dynamics of technological and

economic development, institutional environment

and regulations, infrastructure, efficiency of resource

markets and, as a result, the prevalence and dynamics

of FGCs growth. Figure 7 shows the medians of the

development indicators of FGC in a normalized, way

which permits cross-country comparison.

Figure 7: Development indicators of FGC by clusters.

The curves of the standardized average values of the

indicators included in the analysis for the obtained

clusters are shown in Figure 8.

-1

0

1

2

Cluster 1 Cluster 2 Cluster 3 Cluster 4

Number of HGFs HGFs densit

y

Avera

g

e

g

rowth

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

546

Cluster

1 2 3 4

Figure 8: Standardized average values of the studied

indicators by clusters.

Clusters 3 and 4 take similar positions. The leader

is cluster 4, which includes the Israel and Nordic

countries with a high level of economic development

and an institutional environment favorable for FGCs

development. The number of technological FGCs and

their density in this cluster is the highest. Cluster 3

leaves the leading position in terms of the analyzed

indicators, with the exception of infrastructure,

geographic concentration and degree of customer

orientation. This cluster joins well developed

countries of Central Europe, which have the highest

rates of economic growth, but the lowest average

annual R&D expenditures. As it was mentioned

above, the gap in growth rates between companies in

clusters 3 and 4 is explained by the large number of

ranking companies from these countries and a wide

range of values of their growth indicators. TOP 10

companies

operate

in the countries included in the 3rd

and 4th clusters.

Clusters 1 and 2, which represent the countries of

Southern, Eastern Europe and Turkey, differ

significantly in all analyzed indicators. In cluster 2,

the values of all indicators are lower than the average

values for the sample - the GDP per capita is one and

a half times lower, the FGCs density is five times

lower. The countries of this cluster have the lowest

share of R&D expenditures in GDP, the lowest value

of population’s welfare and the highest inflation rate.

The level of corruption is raising concerns. The

lowest positions of all indicators are in cluster 1. GDP

indicators are two times lower than the average for

the sample, the level of population’s welfare is almost

three times lower and, as a result, the number and

density of technological FGCs is more than 5 times

lower.

With a high level of technological development

and the population’s welfare, a well-established

infrastructure, a low level of undue influence and

corruption, with the available latest technologies and

venture capital as well as with favorable conditions

for talents and entrepreneurship development. Thus,

the differences in the prevalence and growth

dynamics of tech FGCs in different countries are

explained by the conditions of the institutional

environment and the characteristics of the

entrepreneurial ecosystem.

4 CONCLUSIONS

Tech HGEs bring together a unique group of

characteristics and circumstances and so require a

particular set of framework conditions to support their

development.

A cross-country analysis of the fast-growing tech

companies have shown that such companies are more

prevalent in countries with favorable economic and

institutional conditions than in countries that are

competitive in terms of GDP.

Such companies grow faster in countries with

high rates of economic growth, but there is an

interdependence: higher GDP growth leads to more

growth opportunities for companies and vice versa,

higher growth rates of companies contribute to higher

GDP growth, which confirms the findings of previous

studies (Bosma at al., 2012).

Different groups of countries perform above or

below the sample average; the correlation between

indicators differs significantly across groups of

countries. Certain natural and socio-economic

conditions favor the emergence of fast-growing

companies, but the size of the economy, the level of

the country's wealth, domestic R&D costs, and the

dynamics of the country's economic development are

not the determining factors for the emergence and

growth of tech FGCs. In contrast, there is a link

between the dynamics of the high-tech companies’

growth and the dynamics of the country's wealth

growth, measured by the rate of GDP growth. This

may lead to the conclusion that the growth rate of high

technologies and companies that create and distribute

them, on the one hand, is an organic consequence of

the economic state of the region, on the other hand, it

actively influences economic.

HGFsDensity

GDP(PPP)per

capita

UndueInfluence

andcorruption

ICT

Infrastructure

Technological

adoption

Degreeof

customer

orientation

Country

capacityto

retaintalent

VentureCapital

availability

Availabilityof

latest

technologies

Geographical

concentration

Fast-growing Tech Companies as a Driver of Regional and National Sustainable Economic Development

547

The results of the cluster analysis confirmed the

conclusions mentioned above. The conclusions

mentioned above environmental factors such as

macroeconomic stability, the quality of institutions,

the degree of trust in politicians, ethics and

corruption, infrastructure development, innovation

potential, and the ability of countries to maintain

favorable environment for talents have a significant

impact on the development of the fast-growing tech

companies.

The presented analysis shows the exceptional

importance of tech fast-growing companies, their role

as a dynamic element of the economy. The level of

FGCs development, on the one hand, corresponds to

the local economic environment and the level of

economic well-being and, on the other hand, the

intensity of FGCs actions reflects the dynamics of

economic growth. Tech FGCs are the drivers of

regional and national sustainable economic

development. The underdevelopment (both spatial

and intensive) of these companies means the weak

development of the regional economy.

5 FUNDING

The research was carried out according to IEIE SB

RAS research plan, project 5.6.1.5. (0260-2021-

0003) "Theory and methodology of researching

sustainable development of high-tech and

knowledge-intensive sectors of the economy in the

context of global challenges of the external

environment, technological, organizational and

institutional shifts."

REFERENCES

Coad, A., Daunfeldt, S., Hoelzly, W., Johansson, D.,

Nightingale (2014) High-growth firms: introduction to

the special section. Industrial and Corporate Change,

23 (1): 91–112. https://doi.org/10.1093/icc/dtt052

Bravo-Boscia, A., Criscuolo, C. and Menon, C. (2013).

What drives the dynamics of business growth? OECD

science, technology and industry, paper 1, Nesta, Р. 90.

https://doi.org/10.1787/5k486qtttq46-en

Autio, E. (2009). The Finnish paradox: The curious absence

of high-growth entrepreneurship in Finland. Discussion

Papers, 1197.

Colombelli, A., Krafft, J. and Quartaro, F. (2014). High-

growth firms and technological knowledge: Do gazelles

follow exploration or exploitation strategies? Industrial

and Corporate Change, 23(1): 261–291.

https://doi.org/10.1093/icc/dtt053

Mason, C. and Brown, R. (2010). High growth firms in

Scotland. Research report, Glasgow: Scottish

Enterprise, p. 67

Du, J. and Temouri, Y. (2015). High-growth firms and

productivity: Evidence from the United Kingdom.

Small Business Economics, 44(1): 123–143. DOI:

10.1007/s11187-014-9584-2

Moreno, F. and Coad, A. (2015). High-Growth Firms:

Stylized Facts and Conflicting Results. SWPS 2015-05.

http://dx.doi.org/10.2139/ssrn.2743181

European Commission, 2019 Eurostat - High-tech industry

and knowledge - intensive services (htec).

Luxembourg.

Bosma, N. and Stam, E. (2012). Local Policies for High-

Employment Growth Enterprises. OECD Report High-

growth firms: local determinants. Copenhagen, p. 27.

Teruel, M. and De Wit, G. (2011). Determinants of high-

growth firms: Why have some countries more high-

growth firms than others? Working Papers

2072/179670, p. 24 DOI:

10.4337/9781783472666.00010

Nightingale, P. and Coad, A. (2014). Muppets and gazelles:

Political and methodological biases in entrepreneurship

research. Industrial and Corporate Change, 23(1): 113-

143. https://doi.org/10.1093/icc/dtt057

Lia, М., Goetzb, S., Partridgec, M. and Fleming, D. (2016).

Location Determinants of High-Growth Firms.

Entrepreneurship and Regional Development, 28(1-2):

97-125.

https://doi.org/10.1080/08985626.2015.1109003

Ismail, S, Malone, М., Yuri van Geest and Diamandis, P.

(2017). Exponential Organizations: Why New

Organizations Are Ten Times Better, Faster, Cheaper

Than Yours (and What to Do About It). Moscow:

Alpina Pablisher, p. 393.

Deloitte, 2016 Technology Fast 500™ Meet the growth-

makers. Annual ranking of the fastest-growing

technology companies in Europe, Middle East and

Africa (EMEA). URL:

https://www2.deloitte.com/content/dam/Deloitte/globa

l/Documents/About-Deloitte/central-

europe/Deloitte%20Tech%20Fast%20500%20EMEA

%202016%20Ranking.pdf

Dzyubenko, I.B. and Dzyubenko, A.S. (2018). New models

of high-tech business: exponential organizations.

Moscow Economic Journal, 5: 188-211. DOI:

10.24411/2413-046Х-2018-15042

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

548