Corporate Property Tax as One of the Factors of Sustainable

Development

Larisa A. Aguzarova

1

and Fatima S. Aguzarova

2

North-Ossetian State University named after K.L. Khetagurov, Vladikavkaz, Russia

Keywords: Tax on the Property of Organizations, The Value of Property, Fixed Assets of the Company, Budget.

Abstract: The corporate property tax is recognized as a regional direct payment that goes to the budgets of the

constituent entities of the Russian Federation. As the authors of the article rightly note, the sustainable

development of the country's regions depends on the performance of this tax. Conducted in the study, the

analysis allowed to conclude that the proportion of minor tax revenues in the budgets of the Russian

Federation, despite the fact that taxes on the property he occupies a significant share. When studying the

chosen topic, the most relevant problems are revealed, including: problems related to unstable tax legislation

in the part of Chapter 30 of the Tax Code of the Russian Federation; problems of corporate property tax

evasion, and others. The authors suggest ways to solve the identified problems: ensuring stable tax legislation;

strengthening the procedure for conducting tax administration and control.

1 INTRODUCTION

The corporate property tax is one of the regional

taxes. This means that the organizational and legal

basis for its construction is established by the federal

authorities, with the exception of such elements as tax

rates, payment deadlines and tax benefits. These

elements may be established by the authorities of the

subjects of the federation within the permissible norm

of the Tax Code of the Russian Federation.

The sustainable development of the regions is

directly affected by the performance indicators of the

corporate property tax in the budgets of the budget

system of the Russian Federation.

Since the object of taxation of this tax is

recognized as property, it is included in the group

"Property taxes". In addition to the tax under

consideration, this group includes: transport tax;

gambling tax; land tax; and personal property tax.

2 RESEARCH METHODOLOGY

The value of the corporate property tax in the Russian

tax system is not as high as, for example, the mineral

1

https://orcid.org/0000-0002-2607-3932

2

https://orcid.org/0000-0003-2699-8561

extraction tax or the value added tax. However, the

number of property taxes under consideration, the

payment is ranked first in terms of revenue (Figure 1).

482

Aguzarova, L. and Aguzarova, F.

Corporate Property Tax as One of the Factors of Sustainable Development.

DOI: 10.5220/0010592704820488

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 482-488

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Figure 1: Dynamics of corporate property tax in the general system of property taxes of the budgets of the Russian Federation

for 2016-2019 (billion rubles).

The data in Figure 1 confirm the fact that the

corporate property tax dominates the property tax

system of the consolidated budget of the Russian

Federation for 2016-2019. For example, if in 2016 the

amount of property taxes amounted to 1117.1 billion

rubles, then 764.7 billion rubles of them are the

component of the property tax of organizations, the

amount of income from other property taxes is 352.4

billion rubles (Batashev, 2020).

The nature of the tax is that its payment is made

regardless of whether there is the positive results of

financial-economic activity of subjects or not, i.e.

whether the owner of the property has the income

from the use of the objec or not, the removal of taxes

is necessaryly carried out (even with unprofitable

activities of the organization). In this regard, the tax

refers to direct real payments. In this case, there are

advantages and disadvantages. The advantages

include the fact that the payment of corporate

property tax to the budget is inevitable, so this

payment is characterized by the stability of revenues,

it is not subject to various economic fluctuations and

cataclysms. At the same time, the owner of the

organization's property may suffer financial

insolvency in different periods and then have to resort

to loans, credits and other leverage to stay in the

market (Aguzarova, 2018). Note that the already

insolvent owner of the property additionally burdens

himself by taking out a loan, which we consider a

serious disadvantage.

3 RESULTS OF THE STUDY

In modern realities, the largest number of regional

budgets are not self-sufficient, they need additional

financial sources. Although the corporate property tax

is recognized as a stable source, its component in the

budget system of the subjects is insignificant. (Table

1).

0

200

400

600

800

1000

1200

1400

Property taxes Tax on property of organizations

1117,1

764,7

1250,5

856,3

1397

985,4

1350,9

918,8

2016 2017 2018 2019

Corporate Property Tax as One of the Factors of Sustainable Development

483

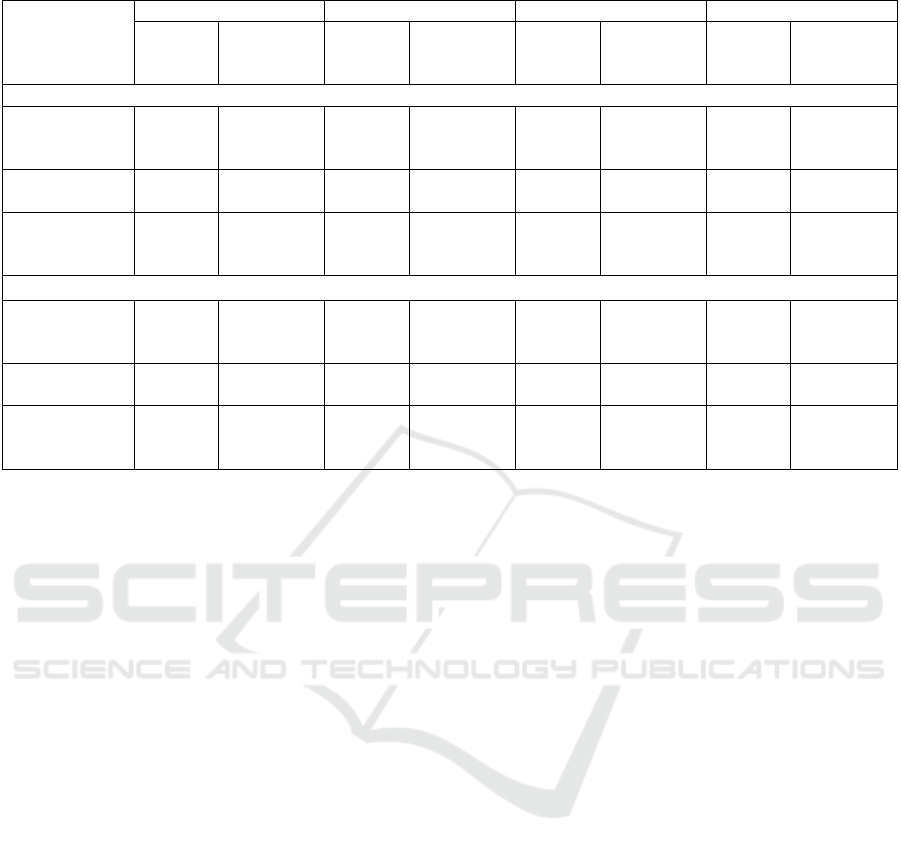

Table 1: The share of corporate property tax in the budgets of the budget system of the Russian Federation for 2016-2019.

Name of

indicator

2016 2017 2018 2019

Fact.,

Billion

rubles.

Specific

gravity., %

Fact.,

Billion

rubles.

Specific

gravity., %

Fact.,

Billion

rubles.

Specific

gravity., %

Fact.,

Billion

rubles.

Specific

gravity., %

Bud

g

ets Of The Bud

g

et S

y

stem Of The Russian Federation

Budget

revenues

including:

28181,5 100,0 31046,7 100,0 37320,3 100,0 39497,6 100,0

Property taxes

From them:

1117,1 4,0 1250,5 4,0 1397,0 3,7 1351,1 3,4

Tax on

property of

organizations

764,7 2,7 856,3 2,8 985,4 2,6 918,8 2,3

Budgets of the constituent entities of the Russian Federation

Budgetr

evenues

including:

9923,8 100,0 10758,1 100,0 12392,5 100,0 13572,3 100,0

Property taxes

fromthem:

1117,1 11,3 1250,5 11,6 1397,0 11,3 1350,9 10,0

Tax on

property of

organizations

764,7 7,7 856,3 8,0 985,4 8,0 918,8 6,8

Source: official website of the Federal Treasury of the Russian Federation // http: // roskazna.gov.ru, calculations of the

authors.

The analysis carried out in Table 1 showed that

for 2016-2019, the budget revenues of the budget

system of the Russian Federation, including the

revenues of the budgets of the subjects, are steadily

increasing. As for the tax on the property of

organizations, among them, it should be noted that

there is an unstable income, since until 2018 there is

a dynamic growth, in 2019, tax revenues decreased.

In general, for the entire period, corporate property

tax receipts increased by 154.1 billion rubles

(performance 2019«-» performance 2017).

The decrease in tax revenues is due to the

introduction of amendments to the Tax Code of the

Russian Federation, concerning the taxation

procedure. In accordance with Federal Law No. 302-

FL of 03.08.2018 "On Amendments to Parts One and

Two of the Tax Code of the Russian Federation",

movable property is excluded from taxation starting

from the tax period of 2019 (Korshunova, 2020). As

a result, the tax revenue decreased.

Despite the fact that the share of the tax in the

budgets of the country's budget system increased in

2018, there is a decrease over the entire period: 2,7%;

2,8%; 2,6%; 2,3% accordingly. A similar indicator in

the budgets of the constituent entities of the Russian

Federation was: 7,7%; 8,0%; 8,0%; 6,8%

accordingly.

It is important to note that until 2019, all property

taxes, including the tax under consideration, were

fully credited to the budgets of the constituent entities

of the Russian Federation. However, since January 1,

2019, another payment has been added to the property

tax system - the "Single Tax payment of an

individual", which is distributed between the two

levels of the budget system. Part of the proceeds from

the payment of the new payment goes to the federal

budget, the other part - to the budgets of the subjects

of the Russian Federation. So, in 2019. the total

amount of the single tax payment for individuals was

183230,4 thousand rubles, from them to the Federal

budget allocated 183204,3 thousand RUB, the

remaining 26.1 thousand RUB credited to the budget

of the RF subject.

A single tax payment of an individual is

recognized as money voluntarily transferred to the

budget system of the Russian Federation to the

corresponding account of the Federal Treasury by a

taxpayer-an individual in order to fulfill the

obligation to pay personal income tax, transport tax,

land tax, and property tax (Isaev, 2019).

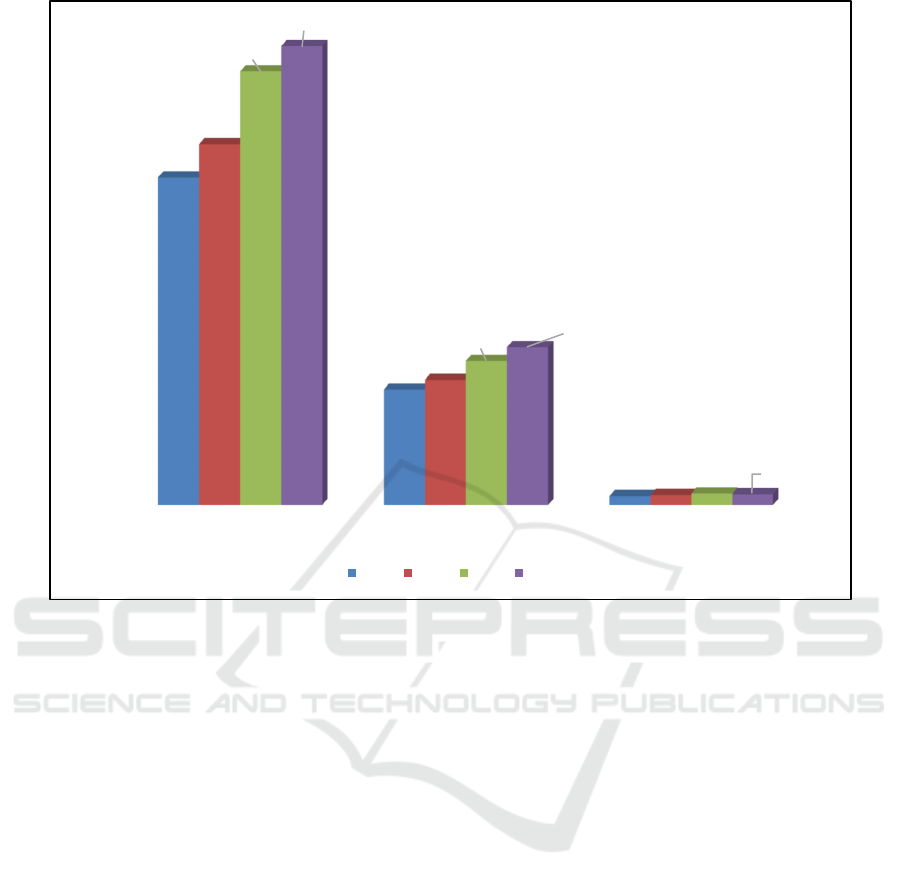

Figure 2 shows the dynamics of corporate

property tax revenues in the budget revenues of the

budget system of the Russian Federation for 2016-

2019, in order to identify its role (Figure 2).

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

484

Figure 2: Dynamics of corporate property tax revenues in the budget revenues of the budget system of the Russian Federation

for 2016-2019 (billion rubles).

Figure 2 shows that for 2016-2019, the corporate

property tax does not play a significant role in the

budgets of the budget system of the Russian

Federation, including in the budgets of the constituent

entities of the Russian Federation, and the proceeds

from its payment are insignificant.

4 DISCUSSION OF THE RESULTS

Despite the fact that the tax on the property of

organizations has a long-term practice of levying,

problems with it remain to this day.

In Russia, the system of property payments paid

by organizations due to the specifics of the historical

development of the country is in the process of

formation. In countries with developed market

economies, a system of property taxes has already

developed, taking into account both national

characteristics and the uniqueness of individual

territorial entities. First of all, this is due to the fact

that property taxes are a significant source of income

for the budgets of territories and affect their

sustainable development (Kozin, 2020). Despite the

fact that each country has its own methods and

mechanisms for taxing the property of organizations,

it is possible to distinguish a number of general

principles for implementing the property tax

mechanism: a single tax regime prevails; the object is

land, buildings (industrial, residential) and other

types of real estate.

It should be noted that problems still remain in the

Russian system of property taxation in organizations.

One of these problems is the mechanism for

determining the tax base. In most countries, the

calculation of the taxable base usually takes into

account the market value of the property subject to

taxation. In some countries, there are cadastre

systems that are predefined for accounting for

information about property objects, property.

Benefits are mainly provided taking into account the

specifics of the object, the type of real estate, and not

taxpayers. Tax payments on property taxes of

organizations are mainly received by local budgets.

In Russian tax practice, the procedure for

determining the tax base is still undergoing a stage of

reform (Alieva, 2021). Only since 2015, the tax base

of some objects of property of organizations has been

determined based on the cadastral value (shopping

0

5000

10000

15000

20000

25000

30000

35000

40000

Budget revenues of the Budget System of

the RF

Budget revenues of the constituent

entities of the RF

Tax on property of organizations

28181,5

9923,8

764,7

31046,7

10758,1

856,3

37320,3

12392,5

985,4

39497,6

13572,3

918,8

2016 2017 2018 2019

Corporate Property Tax as One of the Factors of Sustainable Development

485

centers, administrative and business centers, premises

not housing). The other part of the objects of property

of organizations is still determined based on the

average annual cost of fixed assets of the enterprise.

In our opinion, certain measures should be taken

to solve the problem in this direction (Ilyasov, 2019).

In particular, we completely eliminate the definition

of the tax base of the property's facilities

organizations on the basis of the cadastral value (so

that when determining the taxable base, only the

cadastral value of the organization’s property is taken

into account).

There are problems concerning the definition of

objects of property of organizations. As you know,

the objects of taxation include real estate owned by

the owners and on the balance sheet of the enterprise

(buildings, garages, etc.). When implementing

control measures, tax authorities often identify

incorrectly recorded or completely unaccounted

objects of property of organizations, despite the fact

that they are difficult to hide (Ivanov, 2021). This

means that if an object of property is not taken into

account, is not registered with the tax authorities and

does not appear on the balance sheet as fixed assets,

property tax property tax is not paid, becausethere is

no information about this objec. In the documentation

of organizations, information on the object of taxation

is incorrectly reflected, for example, the cadastral

value is incorrectly indicated (either overstated or

understated), the useful life, etc.

It is important to take into account one more point

when determining the objects of real estate. The Civil

Code of the Russian Federation refers to immovable

objects of vessels subject to state registration: air, sea,

inland navigation. In addition to the tax on the

property of organizations, these objects are subject to

transport tax (Vishnevsky, 2018). According to the

tax legislation one and the same object may be the

subject of tax payment only once during a single tax

or accounting period. Here there is a fact of double

taxation and this problem should be solved. It is

advisable to pay attention to the fact that the Tax Code

of the Russian Federation does not clearly define the

concept of real estate. It is the absence of the concept

that leads to double taxation.

As a recommendation to taxpayers, we note that

you should carefully evaluate all the objects of

property of organizations that are registered as real

estate. It is important to take into account how

autonomous each registered object is, how strongly it

is involved in the technological processes of the

enterprise, and other factors.

In order to avoid mistakes in the qualification of

property as immovable, production companies may

be recommended, based on a full-scale analysis of

judicial practice, to develop methodological

recommendations for their employees on such

qualifications. It is necessary to describe in detail the

rules and guidelines that should be used by staff when

qualifying a newly acquired objects of fixed assets

and registering them for accounting.

Such measures will help to level out some of the

claims of the tax authorities in respect of fixed assets,

for which the tax on the property of organizations is

not planned to be calculated and paid.

An equally important problem of corporate

property taxation is the instability of Russian tax

legislation. In recent years, a large number of

amendments have been made to Chapter 30

"Corporate Property Tax" of the Tax Code of the

Russian Federation, which highlights the

imperfection of legislative norms. For example, the

list of real estate taxed at the rate of 0% has been

changed. This innovation, on the one hand, only

improved the financial situation of some payers (that

is, the change occurred in favor of tax payers).

However, on the other hand, as a result of changes in

the list of immovable property taxed at the rate of 0%,

tax revenues to the budget decreased (Federal Law

No. 242-FL of 03.07.2016). The procedure for

reflecting the property of organizations in the Unified

State Register of Taxpayers in case of errors has also

changed. Now the cadastral value should be taken

into account from the tax period when this value was

applied incorrectly.

The situation when there is an incorrectly

specified information in the Unified State Register of

Real Estate (hereinafter-USRT) (overstatement or

understatement of the cadastral value) creates

considerable problems with the payment of tax. For

example, when the cadastral value is overstated, there

is a special challenge mechanism that allows you to

make certain adjustments to the calculation method

and ultimately achieve a fairer tax assessment.

However, this definition is unique to others. For

clarity, we will give the opposite situation. The

taxpayer owns a real estate object that was estimated

at 50 million rubles in the Unified State Register of

Legal Entities. At first glance, it may seem that the

amount is not small, however, since we are talking

about the property tax of objects under the

jurisdiction of the organization, the above amount is

sufficient and acceptable. But at the same time, in this

particular example, the amount of 50 million rubles.

it turned out to be extremely low (due to a technical

error in the USRT, relatively speaking, "one zero was

lost").

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

486

Further, in the course of the planned regular

revaluation, it was found that the object was already

valued at 500 million rubles. It is obvious that real

estate could not rise in price by 10 times, even though

real estate prices in dynamics tend to increase (taking

into account their physical wear and tear). The newly

established cadastral value indicates that the previous

estimate was incorrect in terms of the possibility of a

technical error.

Note that Article 378.2 of the Tax Code of the

Russian Federation states that the taxpayer in the case

of revaluation (increase in cadastral value) must take

into account the new cadastral value only from the

next year. Both the tax authorities and the Supreme

Court in the ruling of 19.07.2019 No. 305-KG18-

17303 "If the taxpayer realizes that the cadastral

valuation is initially greatly underestimated, he can

not expect that after its revision, the new value will

be applied from the next tax period (Abakarova,

2020). In taxation, the fair market value, determined

by the court in disputed cases, should be applied,

including in respect of past tax periods" concluded

that this applies exclusively to bona fide taxpayers.

Relatively speaking, another taxpayer who decided

not to draw attention to his undervalued 10 times (due

to the smaller amount of tax payment) was in a

hopeless situation for his bad faith.

At first, all the courts, including the Supreme

Court of the Russian Federation, considered that an

unscrupulous taxpayer could not expect to apply the

increased cadastral value only from the next tax

period, because he had to be aware of the fact of

underestimating his estimate. And there is a situation

in which the taxpayer needs to pay additional tax on

the property of organizations for all previous years,

taking into account the fact that it is necessary to

evaluate the market value at their own expense at the

beginning of each tax period and pay extra taking into

account this point.

Thus, in addition to numerous inaccuracies and

shortcomings, including in the tax legislation itself in

the field of property taxation of organizations, which,

as the above example has shown, can often turn

against the taxpayer himself, he must also keep in

mind the aspect of good faith and abuse of law,

because a completely different level of control is

formed by the tax authorities, with an eye on the

behavior of the taxpayer (Lermontov, 2021).

It is no secret that every payer-legal entity tries to

reduce the tax burden as much as possible, saving on

tax payments. Since the initial value of the property

is taken as the basis for calculating the tax on the

property of organizations, there is a deliberate

underestimation of it (the value of real estate is

underestimated when buying). For example, an

organization has acquired real estate on the market for

a certain period of time. The official documents

clearly indicate an undervalued price, by prior

agreement of the parties to the transaction. This

means that when determining the amount of corporate

property tax, the amount of payment will be lower

than the potential possible amount (Bryzgalin, 2020).

The result of such an example is a tax savings for the

payer, and a loss of additional financial resources for

the budget.

In accounting, there is such a concept as "physical

wear and tear" (it is also called material or technical),

which is understood as the loss over time (partial or

complete) of the original characteristics of the

property object as a result of the impact of various

factors (natural, climatic, human, etc.factors). In other

words, physical wear is understood as a deterioration

in the operational properties of the property and a

decrease in its value. The indicators of physical wear

and tear are affected by the chronological age of the

property object, the quality of materials.

5 CONCLUSIONS

Thus, we have identified the actual problems of

taxation of the property of organizations. These

include: the problem of determining the tax base (the

part of the property is determined on the basis of the

cadastral value, the other part is based on the average

annual value); the problem of determining the

properties of the entities (objects of property

considered incorrect or is breached, also is the place

to be double taxation); problems associated with the

unstable tax legislation in the part of Chapter 30 "the

property Tax of the organizations" of the tax code;

problems of corporate property tax evasion; problems

of property exploitation, the useful life of which has

been exhausted.

To solve the identified problems, we propose: to

completely reduce the definition of the taxable base

of the objects of property of organizations based on

the cadastral value; to clarify the objects of real estate

(to evaluate the objects of property of organizations

registered as real estate); to ensure stable tax

legislation (so that the norms of tax legislation are

permanent and accurate); to strengthen the procedure

for tax administration and control (so that there is no

fact of tax evasion); to eliminate worn-out objects of

property from life.

Corporate Property Tax as One of the Factors of Sustainable Development

487

REFERENCES

Abakarova, R. (2020). The reform of the property tax of

organizations. Development of regional economies,

1(42): 107-111.

Aguzarova L. and Aguzarova F. (2018). Planning of tax

payments as a factor of economic growth. European

Research Studies Journal, 21(S2): 195-206.

Alieva, P. (2021). Analysis of the company's financial

performance. Academic journalism, 1: 63-87.

Batashev, R., Kurbanov, S. and Ayubova, J. (2020).

Research on the state of property taxation as a source of

income for regional budgets. Bulletin of the Academy of

Knowledge, 4 (39): 402-406.

Bryzgalin, A. (2020). Accounting policy of an enterprise

for tax purposes. Taxes and Financial Law, 3: 8-106.

Ilyasov, B., Makarova, E., Zakieva, E. and Gizatullina, E.

(2019). Estimation of data on the income of the

population in the regional context by the method of the

main components. Economy of the Region, 15 (2): 601-

617.

Isaev, A. (2019). The effects of inter-regional redistribution

of financial resources: the general equilibrium

approach. Economy of the Region, 15(2): 618-630.

Ivanov, P. and Shitov, A. (2021). Subdivisions for

combating tax crimes (history of origin and

development). Questions of history, 1: 232-239.

Korshunova, L. and Shmalko, M. (2020). Calculation of

property tax taking into account changes in legislation

since January 1, 2020. Accounting in construction

organizations, 3: 26-31.

Kozin, A. (2020). Concessionary agreement: features of

taxation at the concessionaire. Tax policy and Practice,

4 (208): 46-51.

Lermontov, Yu. (2021). Changes in tax legislation since

January 1, 2021. Financial Bulletin: Finance, Taxes,

Insurance, Accounting, 1: 22-31.

Vishnevsky, V., Chekina, V. and Robot V. (2018). Tax

inspector or how it can be used: a review of the

problems and solutions. Journal of tax reform, 4(1): 6-

26.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

488