Problems and Prospects of the Financial Risk Management System

Development of Economic Entities

Julia A.

Konopleva

a

, Olga N. Pakova

b

and Svetlana V. Zenchenko

c

Finance and credit Department, North-Caucasus Federal university, Stavropol, Russia

Keywords: Types of Risks, Security, Crisis Management, SPACE Analysis, Financial Risk Profile, Rating Assessment.

Abstract: In modern macroeconomic conditions the well-being and efficiency of economic entities can be achieved

through the formation of an economic security management system, including the assessment and the

neutralization of financial risks. The significance of this component is due to the fact that financial security

affects all the main functional areas of any organization. The financial risk management plays a huge role in

ensuring the sustainable development of both individual organizations and society as a whole, so the

company's risk management issues are relevant. Based on this, the purpose of the study develop scientifically-

based recommendations for improving the management of financial risks of economic entities. The scientific

significance and novelty of the research expand and deepen the scientific understanding of the problems and

prospects of the financial risk management system development. As a result, the next most significant

scientific results: the main proposals of the financial risk management in the sustainable development of the

organization; the expediency of implementation of an adaptive risk management framework and

implementation of targeted measures; developed a system of gradual assessment of risks in the organization.

The results of the study are of applied importance which consists in substantiating methods for improving the

efficiency of risk management in organizations. The implementation of the recommendations and the

introduction of an adaptive risk management structure will reduce the threat level of their manifestation and

negative impact on the activities of economic entities.

1 INTRODUCTION

The current macroeconomic situation is characterized

by high variability of the external financial

environment and therefore the main element of

ensuring the effectiveness of the organization's

financial activities is the formation of the financial

risk management system. It lets the necessary volume

of sources of formation and attraction of financial

resources is calculated, the optimal ways of their

further use are determined and, ultimately, the level

of investment attractiveness of the organization is

ensured.

The main factors which reduce the effectiveness

of the organizations include the lack of an optimal

sound and actual financial risk management system,

fragmentary information about the market dynamics

a

https://orcid.org/0000-0002-1213-8803

b

https://orcid.org/0000-0001-7281-6023

c

https://orcid.org/0000-0003-0850-5305

and market conditions, not the full capabilities of its

main competitors, a lack of management training.

These factors determine the need for the

formation of the financial risk management system in

the organization in the current conditions of economic

development, accompanied by the transformation of

the external financial environment, changes in its key

tasks and internal corporate goals due to the

emergence of new business projects within the main

areas of activity, as well as the transition to a new

stage of the life cycle which determines the relevance

and significance of the research topic.

452

Konopleva, J., Pakova, O. and Zenchenko, S.

Problems and Prospects of the Financial Risk Management System Development of Economic Entities.

DOI: 10.5220/0010592304520460

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 452-460

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 RESEARCH METHODOLOGY

2.1 Urgency

The relevance of the research topic is due to the

increased importance of the scientifically based

approach in the management of financial risks of

economic entities.

The purpose of the research studies various

financial risks and develop evidence-based

recommendations for improving the financial risk

management of companies.

In accordance with this goal, it is necessary to

solve the following tasks:

study of the concept of risks, factors and causes

of their occurrence;

classification of financial risks;

consideration of various risk management

methodologies;

development of directions for improving the

corporate financial risk management.

2.2 Scientific Significance of the Issue

In the scientific field there is no single point of view

on the content and nature of risk, which is due to the

multidimensional nature of risks, the complexity of

their accounting in practice, as well as gaps in

legislation. The following key concepts are presented

below, which together reflect the content side of risk.

Firstly, the risk should be considered as the

probability (threat) of the economic entity losing its

share of internal resources, reducing profitability or

increasing costs from current production and

financial activities (Mamaeva L. N., 2018). This

means that the risk is associated with the possibility

of a certain adverse event or event.

Secondly, the concept of "risk" is associated with

the term "risk situation" which is expressed by the

possibility of a qualitative and quantitative

assessment of the level of probability of the

corresponding course of action. Such situation is

characterized by the following conditions:

uncertainty, necessary to choose an alternative

(including refusal to choose), as well as the right to

assess the probability of implementing the chosen

alternatives (Knight F., 2017).

Now the theory of risk management is one of the

most important components of project management,

because in almost all areas of life, people are used to

facing a lot of uncertainties. Uncertainty is a property

that is inherent in any activity of an economic entity,

since the implementation of any project is always

possible for any unforeseen results or situations

(Krysanova N. V. Pankratova M. E., Kuznetsov A.

N., 2017).

The main purpose of any company increases its

market capitalization, or its value, based on the total

value of all outstanding shares. It is obvious that any

risk is a threat of a further fall in the value of the

company, so risk management is especially important

to implementing any projects. Based on the above, the

category "risk" is used in many areas of activity, but

there is no general approach to the definition of this

term.

Risk – the possibility that an unfavorable outcome

will occur.

Risk management is a purposeful and consistent

activity of the company to increase its profit and

capitalization while minimizing the consequences of

risks.

Like most scientists we believe that economic risk

arises in connection with certain activities and

manifests itself through the results of these activities.

Here are some more definitions:

Risk – a situation in which the exact result of an

economic entity's decision is unpredictable, but the

course of action is known which makes it possible to

neutralize the negative variants of its resolution

(Senchagov V. K., 2012);

Risk – the probability of losses, losses, shortfall

of planned income, profits (Higgins, R., 2013);

Risk – a possible deviation of the results of the

activity of a commercial organization from those

predicted at the time of making a decision

(Teplyakova E. V., 2016).

It should be noted not only the risk of losses and

losses, but also the chance to acquire the benefits of

one of the counterparties of the transaction at the

expense of the other (Pakova, O. N. Konopleva Yu.

A., Berdanova A., 2017).

Financial risks associated with working with

financial assets, including credit, currency, interest

rate and market risks, as well as illiquidity risks

(Puchkova S. I., 2016).

Risk as the possibility of failure is an objective

category which exists independently of the will and

consciousness of people, but the risk can be

considered as a subjective category: the risk is

associated only of the threats, the existence of which

the subject is informed of the risk; therefore,

ignorance of the danger is equivalent to the absence

of risk (risk subject is the person who decides and is

responsible for the result, the risk object is defined

value which can be lost as a result of the impact of

risk) (Krui M., 2015). On the other hand, risk is

identified with possible luck (Konopleva J. A.,

Problems and Prospects of the Financial Risk Management System Development of Economic Entities

453

Zenchenko S. V., Pakova O.N., Sokolova A. A.,

2017).

Thus, the value of the information may

significantly exceed the reduction in the value of the

risk object as a result of the implementation of the

risk. We believe that all definitions of risk represent

the personal views of the authors, ranging from the

definition of risk as the probability of an unfavorable

result of a financial transaction to the definition of

risk as the uncertainty of financial results in the

future.

The most consistent among them is the statement

that risk in its primary basis is uncertainty.

A key component of the financial risk

management system in the company is the timely

identification of problems and prospects of a financial

base. In our opinion risk is a situational aspect of the

activity of a business entity which arises in the case

of making management decisions in favor of

choosing probabilistic alternatives that can

potentially generate chances of achieving the desired

goals, despite the presence of various dangers and

threats; it reflects the possibility of a negative

deviation of the actual results of the activity from the

planned ones. Accordingly hazards and threats should

be considered as risk factors and in any case should

not be identified with it itself. Therefore, it is possible

to determine the risk and its degree in a situation of

uncertainty only by one of the methods of calculating

the probability of the occurrence of negative

consequences of uncertain events. If this method fails,

the result remains uncertain. Therefore we can draw

the following conclusion, risk is the probability of

experiencing a loss of expected economic (financial)

benefits or direct losses through the occurrence of an

uncertain (accidental) event that concerns the

property interest of members of the company.

2.3 Problem Statement

A huge range of financial risks in accordance with

their classification system expands the possibilities in

the formation of a more effective system for

managing them.

As you know, the assessment of the financial

condition of the company is a system of economic

tools that characterize the availability and use of

financial resources of the company. Comprehensive

and reliable assessment of the financial situation,

reflecting the results the organization's cash flow is

the main source of information about reliability,

business activity, and competitiveness.

If risk is loss of resources or income, then there is

also a quantitative measure of them, determined by

the absolute or relative level of losses. In absolute

terms the risk can be determined by the amount of

possible losses in material or monetary terms. In

relative terms, the risk is the amount of possible

losses attributed to a certain base, which can be

understood as the property status of the entrepreneur,

or the total cost of resources for this type of business

activity, or the expected income (profit) from

entrepreneurship.

In the modern literature on crisis management, the

essence of the financial crisis is expressed through

such concepts as a tactical, strategic crisis, as well as

a crisis of solvency.

The tactical crisis is considered as a set of signs

that characterize the increasing discrepancy in the

implementation of the company main activities which

is expressed in a decrease in production volumes,

profitability and efficiency of labor resources. The

prolonged course of a tactical crisis can lead to the

development of financial instability which ultimately

leads to the transformation of the crisis into a strategic

one. Its prerequisites are the absence or weak level of

development and implementation of the strategic

development directions of the organization,

expressed in the imbalance of the management's

desire to maximize the financial results of the

business and maintain a high level of financial

stability.

A solvency crisis is the inability to make basic

payments due to a shortage of cash and non-cash

funds. This type of crisis acts as the premise of a

strategic financial crisis, and as a consequence of the

tactical crisis of the organization.

The division of the financial crisis into types

makes it possible to form and implement appropriate

measures for effective preventive and anti-crisis

management.

A financial crisis is a failure in the overall system

of functioning of the company's finances. If a crisis

financial situation persists, it could be the reason for

the occurrence of bankruptcy. In this regard, the

purpose of anti-crisis management is to develop and

implement measures to promptly improve solvency

and financial stability.

2.4 Theoretical Part

Based on the goals and principles of anti-crisis

financial management it is possible to consider the

features and mechanisms of its implementation

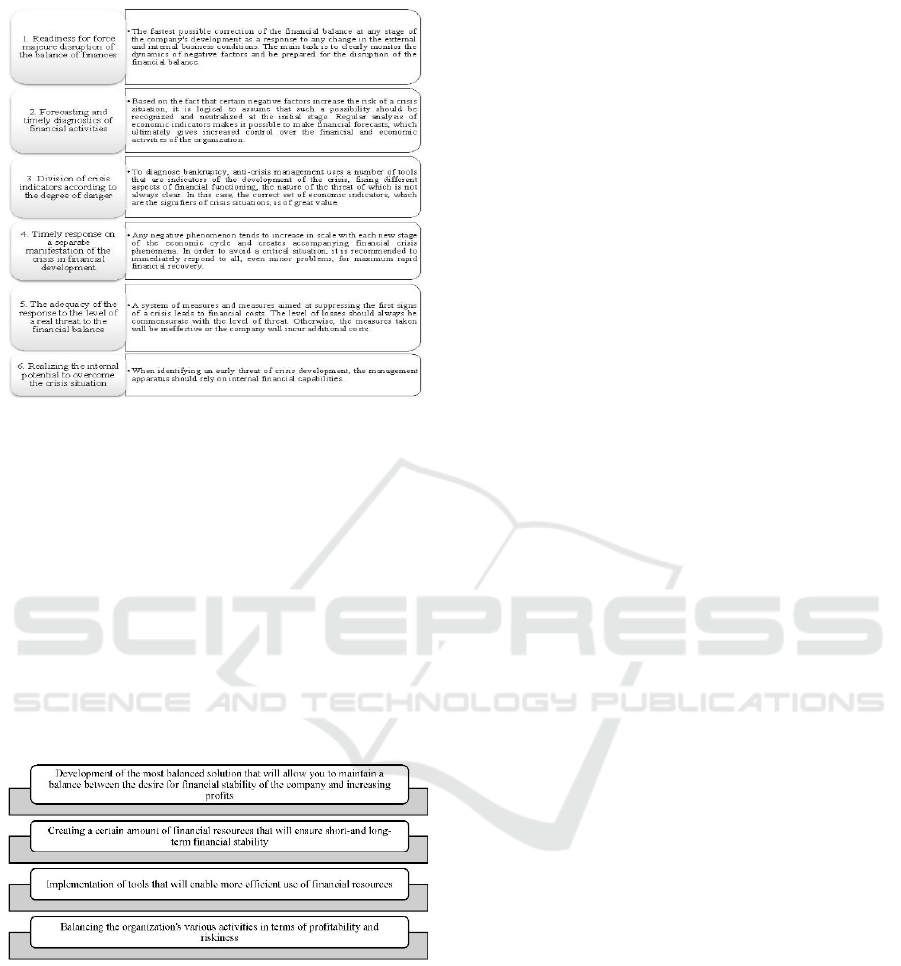

(Figure 1).

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

454

Figure 1: Principles of anti-crisis financial management.

The anti-crisis management policy is a set of

mechanisms and tools for preliminary assessment of

the risks of bankruptcy and financial recovery,

contributing to the recovery from the crisis. This

means that the mechanism for implementing the anti-

crisis financial management of the organization is the

system financial flow management, based on the anti-

crisis financial strategy and the financial position of

the organization.

The tasks that need to be solved in the process of

developing and implementing a financial anti-crisis

strategy are shown in Figure 2.

Figure 2: Tasks to be solved in the process of developing

and implementing a financial anti-crisis strategy.

Thus, we can come to the logical conclusion that

the process of crisis management is based on the

creation of a clear plan for future activities, the main

characteristics of which are constant readiness for

possible instability of the financial situation of the

organization.

2.5 Practical Significance

In the process of diagnosing a pre-crisis financial

situation in an organization, there is an objective need

to develop a system of preventive measures to prevent

a financial crisis. At this stage, financial management

is transformed into weak signal management and has

a preventive nature which means constant monitoring

of the financial potential and stability of the

organization, and also, the implementation of

measures to prevent bankruptcy in the current

economic conditions.

A set of measures aimed at preventing crisis

development should be implemented proactively and

consist of the following stages:

- reducing the volume of investments in high-risk

segments of the organization's financial work;

- improvement of measures for insuring material

internal and external risks;

- partial sale of excess assets and those that do not

participate in the processes of accumulating

additional material reserves;

- restructuring of partner organizations debts, as

well as equivalent financial resources in monetary

form.

The next step is a deep and objective analysis of

the internal financial condition of the organization

and an assessment of its capabilities in order to

overcome the financial crisis. It is possible to form

appropriate tools and mechanisms within the

framework of anti-crisis financial management. Here

it is important to implement the following actions:

1. To diagnose the net cash flow received in a

crisis situation for the organization, and its volume

required to restore financial stability.

2. Perform a comprehensive analysis of the

insurance reserves of financial resources and the level

of their sufficiency in crisis conditions.

3. Identify areas where investment and operating

costs can be reduced.

Higgins R. considers insolvency as the excess of

monetary expenses over their receipt, provided that

there are insufficient reserves to eliminate the

discrepancy. This situation is called a "crisis pit",

which is accompanied by problems with repayment

accounts payable (Higgins, R., 2013). In such

circumstances, it is important to implement anti-crisis

measures to optimize the flow of financial flows to

cover the shortfalls caused by high costs and low

incomes. Measures to optimize cash flow for the

purpose of repayment of urgent and overdue debts are

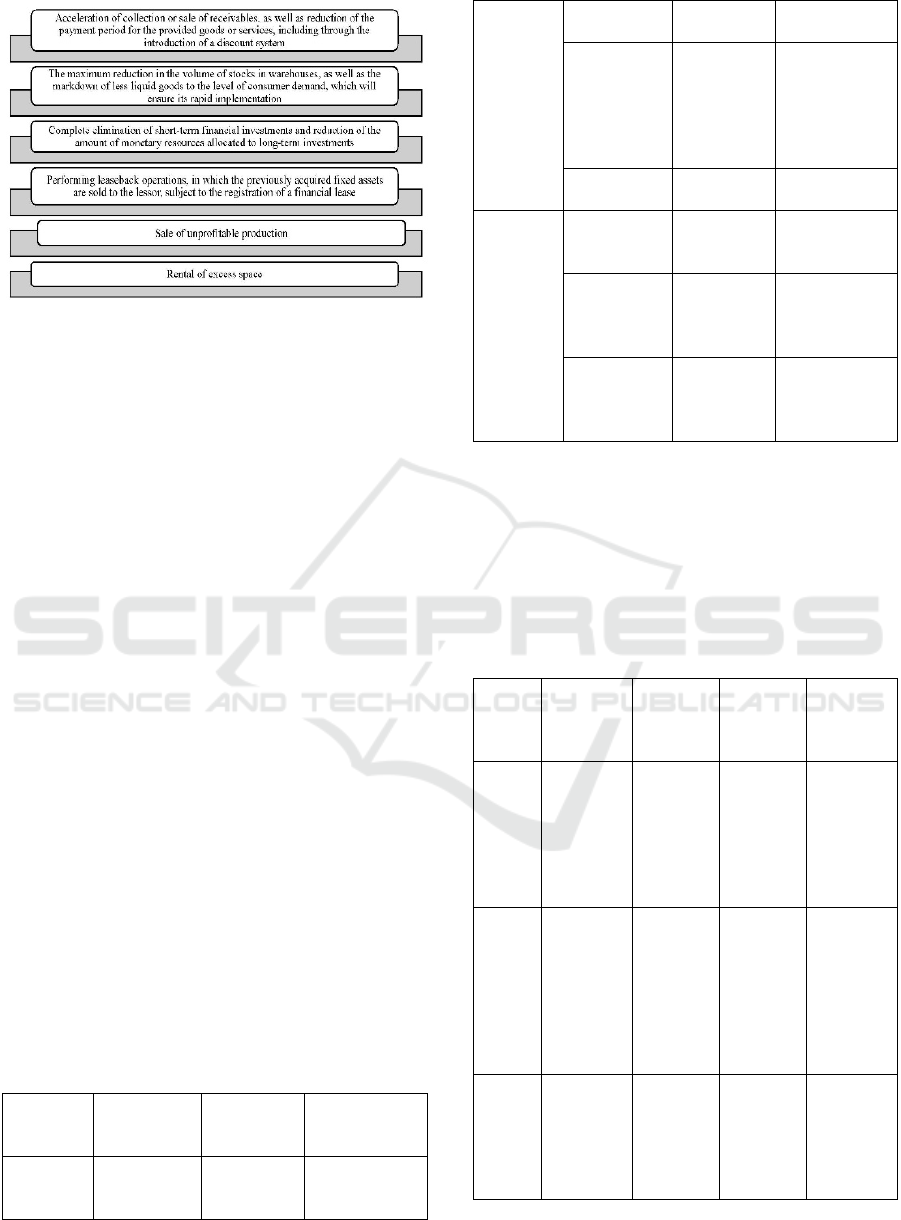

shown in Figure 3.

Problems and Prospects of the Financial Risk Management System Development of Economic Entities

455

Figure 3: Measures to optimize cash flow in order to repay

urgent and overdue debts.

Summarizing the results of the study at this stage,

it can be noted that the financial risks of an

organization in the system of ensuring internal

economic security include elements that for an

individual economic entity may have different

priorities based on the nature of the existing threats.

Through accurate and timely determination of the

probability of a particular financial risk, it becomes

possible to develop an effective financial policy and

thereby ensure economic security. Implementation

plan anti-crisis financial management is a set of

mechanisms by which the impact on the financial

position of the company is carried out. This complex

can be characterized by the combination and

consistent implementation of applied methods and

tools (both preventive and anti-crisis) as part of the

mechanism of anti-crisis financial management,

which includes personnel, information, control and

anti-crisis subsystems.

3 RESULTS OF THE STUDY

Assessment of financial risks in the activities of

Russian construction industry organizations involves

structuring the assessment process into two groups:

external and internal (Table 1).

Table 1: Indicators for assessing financial risks in the

activities of economic entities.

Group Risk Approach

to

assessment

Method of

assessment

External

financial

risks

1 Currency

risk

Market

analysis

Evaluation of

the

organization's

multicurrency

activit

y

2 Credit

risk

Dynamic

analysis

Analysis of

the dynamics

of the

structure of

credit funds

in the capital

3 Market

ris

k

Strategic

anal

y

sis

SPACE

anal

y

sis

Internal

financial

risks

4 Solvency

risk

Coefficient

method

Calculation

of liquidity

indicators

5 Business

risk

Coefficient

method

Calculation

of indicators

of business

activit

y

6 Financial

stability

risk

Coefficient

method

Calculation

of financial

stability

indicators

Calculation of financial stability indicators the

assessment of each risk was carried out on a three-

point scale. The following interpretation rules were

used to translate the results of the evaluation of each

indicator into a three-point scale (Table 2).

Table 2: Rating interpretation of the results of the

assessment of financial risk indicators in the organization's

activities.

Risk Method of

assessment

3 points

(high risk

severity)

2 points

(average

risk

severit

y)

1 point

(low risk)

1

Curren

cy risk

Evaluatio

n of the

organizati

on's

multicurre

ncy

activit

y

High

multicurre

ncy

activity

Average

multicurre

ncy

activity

Low

multicurre

ncy

activity

2

Credit

risk

Analysis

of the

dynamics

of the

structure

of credit

funds in

the ca

p

ital

Positive

dynamics

of credit

funds

Unstable

dynamics

of credit

funds

Negative

dynamics

of credit

funds

3

Marke

t risk

SPACE

analysis

Getting a

priority

aggressive

strategy

Getting a

priority

competitiv

e or

defensive

strateg

y

Getting a

priority

conservati

ve

strategy

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

456

4

Solven

cy risk

Calculatio

n of

liquidity

indicators

Most of

the

indicators

do not

meet the

standard

values

The

indicators

partially

do not

correspon

d to the

standard

values

Most of

the

indicators

correspond

to the

standard

values

5

Busine

ss risk

Calculatio

n of

indicators

of

business

activit

y

Unfavorab

le

dynamics

of

indicators

Unstable

dynamics

of

indicators

Favorable

dynamics

of

indicators

6

Financ

ial

stabilit

y risk

Calculatio

n of

financial

stability

indicators

Most of

the

indicators

do not

meet the

standard

values

The

indicators

partially

do not

correspon

d to the

standard

values

Most of

the

indicators

correspond

to the

standard

values

The maximum possible number of points that can

be obtained as a result of evaluating all six types of

financial risks is 18 points, the minimum is 6 points.

When receiving an assessment from 6 to 10 points, a

low level of severity of financial risks is stated, from

11 to 14 points-an average level, from 15 to 18 points-

a high level.

Let us consider the results of the assessment of

each identified financial risk in the activities of the

organizations under consideration

1. Currency risk

Currency risk in the system of financial risks of

economic entities demonstrates the probability of loss

of financial resources due to changes in the exchange

rate. The exposure to this risk will be determined by

the multi-currency activity of the financial and

economic operations of the organization: the higher it

is, the more pronounced the currency risk is.

According to the study, the share of financial and

economic transactions performed by the analyzed

construction companies using foreign currency is

insignificant. Therefore, we can talk about a low level

of the organization's exposure to currency risk (1

point).

2. Credit risk

To assess the credit risk, it is necessary to consider

the dynamics of credit funds in the capital of the

organization. The active use of credit funds increases

the likelihood of credit risk. Over the past three years,

there has been an unstable trend in the use of credit

funds in the capital of companies (Table 3).

Table 3: Dynamics of the use of credit funds in the

capital of construction companies

Indicator 2017 2018 2019 Deviation

2019/2017

Lon

g

-term credit facilities

Borrowed

funds,

thousand

rubles.

2 175548 300174 300172

Short-term credit facilities

Borrowed

funds,

thousand

rubles.

447926 447213 477502 29576

The severity of the credit risk of the organization,

based on the activity of using credit funds, is average

(2 points).

3. Market risk

To assess market risk, we use the SPACE analysis

method, which allows us to assess the market

situation from four sides:

- the financial potential (strength) of the

organization (FS);

- the competitiveness of the organization (KP);

- the attractiveness of the industry (PO);

– stability of the industry (WITH).

The results of the company's SPACE Analysis

score are presented in Table 4.

Table 4: Results of the SPACE analysis of the

microeconomic environment of the construction company.

Criteria Evaluation Weight Generalized

score score

Financial stren

g

th of the or

g

anization

(

FS

)

Return on

investment

5 0,8 4,0

Financial

autonom

y

5 0,8 4,0

Solvency of the

or

g

anization

6 1,0 6,0

The level of

financial ris

k

4 0,5 2,0

General evaluation of the criterion 16,0

Com

p

etitiveness of the com

p

an

y

(

СС

)

Return on sales 5 0,6 3,0

Market share 5 0,1 0,5

The

competitiveness

of the services

4 0,1 0,4

Customer

loyalt

y

6 1,0 6,0

Product qualit

y

6 0,9 5,4

General evaluation of the criterion 15,3

Attractiveness of the industr

y

(

AI

)

Profit level 6 0,8 4,8

Stage of the

industry life

cycle

5 0,8 4,0

Problems and Prospects of the Financial Risk Management System Development of Economic Entities

457

The

development of

the industr

y

6 0,8 4,8

Ease of market

entr

y

5 1,0 5,0

General evaluation of the criterion 18,6

Stability of the industry (SI)

The stability of

earnin

g

s

6 0,8 4,8

Development of

innovations

5 0,5 2,5

Marketing

opportunities

5 0,5 2,5

General evaluation of the criterion 9,8

Based on the results of the general assessments of

the key criteria, the vector of the recommended

strategy for the development of the organization is

built in the SPACE coordinate system. The beginning

of the vector is at the point of origin, the end of the

vector is at the point " A " with the coordinates (X: Y)

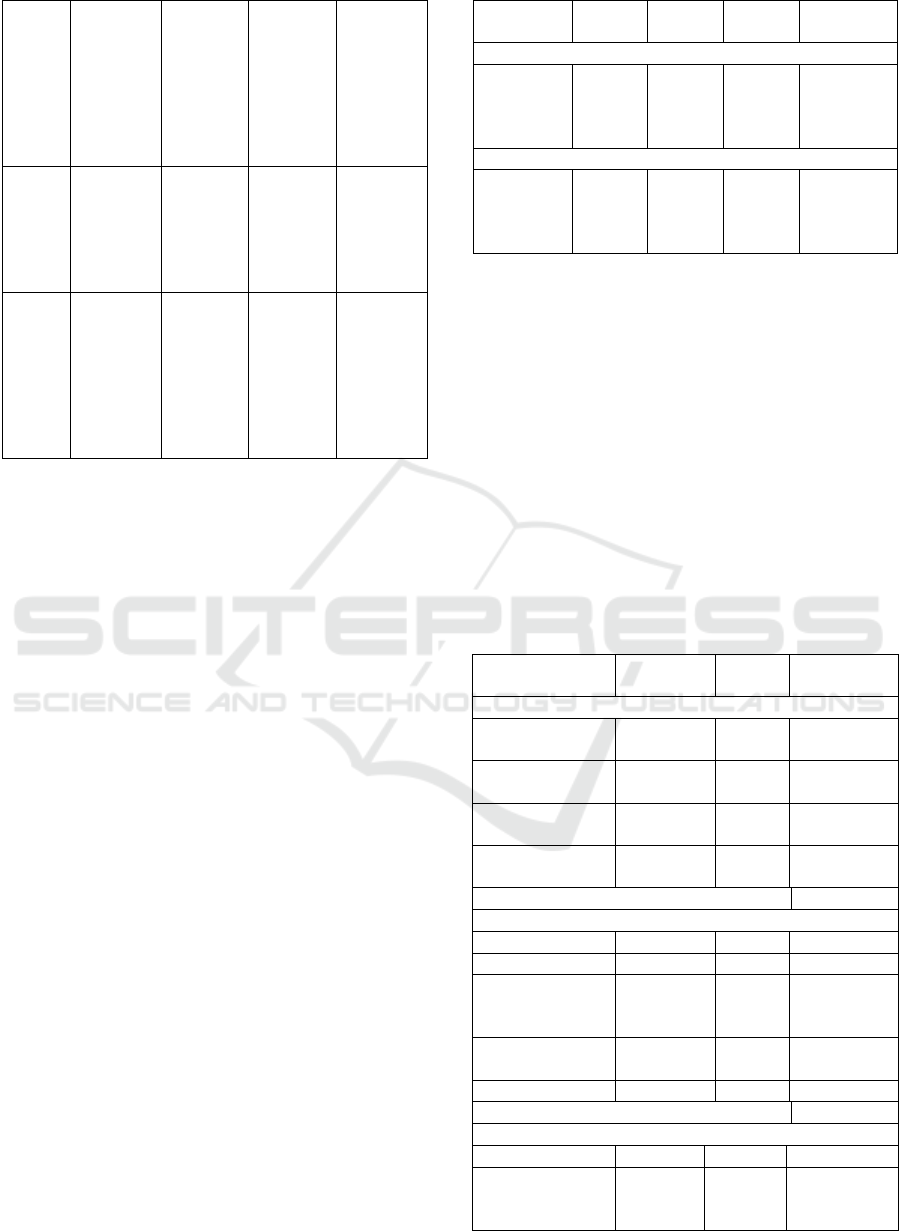

shown in Figure 4:

X = PO-KP (1)

Х = 18,6 – 15,3 = 3,3;

Y = FS-SO (2)

У = 16,0 – 9,8 = 6,2.

Figure 4: SPACE Analysis matrix.

The obtained result of the SPACE analysis

indicates the feasibility of implementing an

aggressive market strategy, therefore, the market risk

is estimated at 3 points.

We summarize the results of the assessment for

each considered financial risk (Table 5).

Table 5: Results of the evaluation of financial risks

Risk Com

p

an

y

#1 Com

p

an

y

#2 Com

p

an

y

#3

co

re

Status S

c

o

r

e

Status S

c

o

r

e

Status

1

Currency

ris

k

1 Low

risk

1 Low risk 1 Low

risk

2 Credit

risk

2 Average

risk

level

2 Average

risk level

2 Averag

e risk

level

3 Market

risk

3 High

level of

ris

k

2 High

level of

ris

k

3 High

level of

ris

k

4

Solvency

ris

k

1 Low

risk

1 Low risk 1 Low

risk

5 Business

risk

3 High

level of

ris

k

2 High

level of

ris

k

2 High

level of

ris

k

6 Financial

stability

ris

k

1 Low

risk

1 Low risk 1 Low

risk

Total 11 Average

risk

level

9 Average

risk level

10 Averag

e risk

level

The obtained values, equal to 9-11 points,

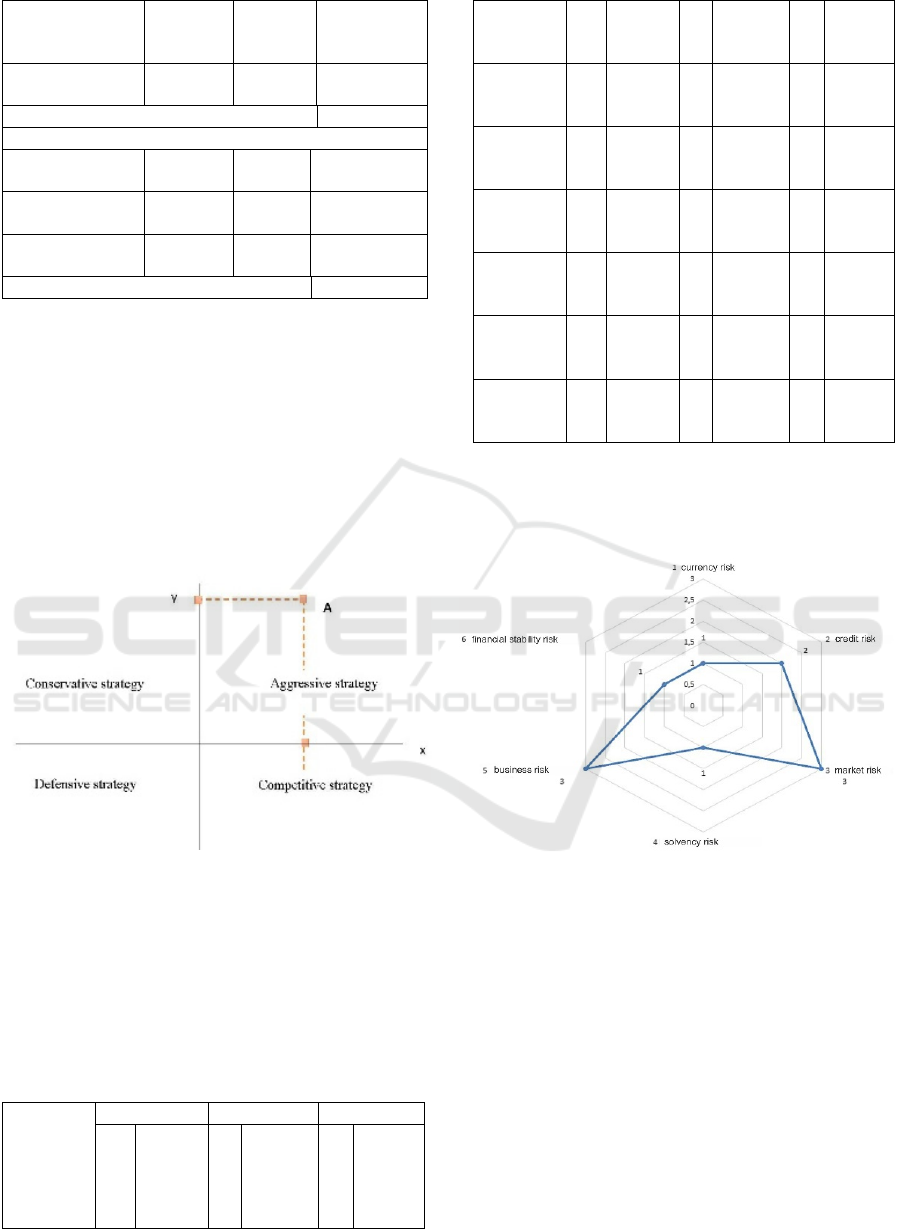

correspond to the average level of severity of

financial risks in the activities of the considered

organizations. The most pronounced are market risk

and business activity risk (Figure 5).

Figure 5: Financial risk profile.

Thus, the results of the assessment of financial

risks in the activities of the organizations under

consideration characterize their average level of

severity, which updates the assessment of the

effectiveness of the current financial risk

management system of the organization.

4 DISCUSSION OF THE

RESULTS

In order to improve the scientific level of financial

risk management of the organization, it is advisable

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

458

to develop a system of recommendations and

proposals.

The conducted assessment of the financial risks

and the assessment of the effectiveness of the current

financial risk management system have determined

the feasibility of improving the management

activities of economic entities in this area. In this

context of the study, the concept of a more optimal

management system is formed the main directions of

which are shown in Figure 6

.

Figure 6: Directions for managing the organization's

financial risks.

Thus, the proposed financial risk management

system for a construction company is a complex

mechanism that contains diagnostic, management and

control functions. For the company's management,

their practical use will provide an opportunity to

quickly identify financial risks, plan funds for their

elimination, as well as conduct preventive control and

prevention of financial risks. The technology of

implementation of the proposed system will allow

you to perform the established sequence of

management, which, ultimately, will ensure the

effective application of its provisions by the

management of the organization.

It is necessary to implement the proposed

financial risk management system in the organization

described in table 6.

Table 6: Recommendations for improving the financial risk

management system

Recommendations Description

Creation of a

financial risk

management unit in

the structure of the

finance department

It is proposed to allocate a

financial risk management unit

in the structure of the finance

department consisting of 2

specialists, the first of whom

will be responsible for

monitoring and evaluating

financial risks, the second-for

planning and monitoring the

implementation of measures to

reduce financial

r

isks

Regulation of the

new financial risk

management policy

It is advisable to regulate the

implementation of the

proposed financial risk

management system by

creating a special document

describing the new financial

risk management polic

y

External audit of

financial risks

The organization is

recommended to conduct an

external audit of financial risks

at the initial stage of

implementation of the

proposed financial risk

management system due to the

lack of competence of full-time

specialists

5 CONCLUSIONS

At the theoretical stage of the research, the tasks

related to the definition of the essence of financial

risks and approaches to their assessment in the

activities of modern companies were solved. The

analysis of the scientific literature has shown that

financial risks arise in connection with the movement

of financial flows and are manifested mainly in the

financial resources markets. Financial risks

significantly affect the efficiency of business entities.

At the same time, financial risks are amenable not

only to accounting, but also to management. For the

purposes of risk measurement, it is necessary to

initially investigate all possible risks, identify them

and classify them.

The structure of the financial risks assessment

were divided into two groups: external (currency,

credit, market) and internal (risk of solvency,

business activity, financial stability). The analysis

showed compliance with the average level of

financial risks in the activities of construction

companies. The most pronounced are market risk and

business activity risk.

The concept of an effective financial risk

management system is formulated, which will allow

to quickly identify (diagnose) financial risks in the

management of the organization, to develop measures

to eliminate the identified financial risks, to

implement subsequent control of the prevention and

correction of financial risks.

Thus, the purpose of the study was achieved due

to the solution of all the tasks set.

Problems and Prospects of the Financial Risk Management System Development of Economic Entities

459

REFERENCES

Higgins, R. (2013). Financial management: capital and

investment management, 464 p.

Knight, F. (2017). The concept of risk and uncertainty. 360

p.

Konopleva, J. A., Zenchenko, S. V., Pakova, O.N.,

Sokolova, A. A. (2017). Monetary and financial risks in

International relations. Advances in Economics,

Business and Management Research Proceedings of

the International Conference on Trends of

Technologies and Innovations in Economic and Social

Studies, 38:331-336.

Kovalev, V. V. (2016). Financial management: theory and

practice, 3rd ed., 1104 p.

Krui, M., Galay, R. (2015). Fundamentals of risk

management. A textbook, 389 p.

Krysanova, N. V., Pankratova, M. E., Kuznetsov, A. N.

(2017). Features and problems of legal regulation of

insolvency (bankruptcy) of economic companies.

Noginsk: analitika Rodis, 230 p.

Mamaeva, L. N. (2018). Risk management. A textbook, 256

p.

Pakova, O. N., Konopleva, Yu. A., Berdanova, A. A.

(2017). Risks in the Russian financial market in the

context of globalization. Bulletin of the North Caucasus

Federal University, 2 (59):92-95.

Puchkova, S. I. (2016). Financial management. MGIMO-

University, 196 p.

Senchagov, V. K. (2012). Financial security of Russia.

General course: the textbook, 815 p.

Teplyakova, E. V. (2016). Financial risks: the essence,

classification and methods of their assessment, 8:673-

676.

Tsvetkova, E. V., Arlyukova I. O. (2015). Risks in

economic activity. A textbook. 409s.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

460