Sustainable Development and Investment Policy

(on the Example of the USA)

Boris Lavrovskii

1,2 a

1

Novosibirsk State Technical University, Novosibirsk, Russia

2

The Institute of Economics and Industrial Engineering within the Siberian Branch of the Russian Academy of Sciences

Novosibirsk, Russia

Keywords: Investment Policy, Macroeconomic Dynamics, Fixed Assets, Special Period, Labor Productivity, USA.

Abstract: It is well known that the overwhelming number of countries with a developed market in the period from the

early to mid-1970s to the present is characterized by a tendency towards a reduction in the cumulative average

annual growth rate of per capita GDP. However, no earlier than the mid-1980s and no later than the mid-

2000s, a specific (special) period of time with a gentle line of cumulative dynamics emerged. As for the United

States and only for this period, the article also provides an illustration of the predominant growth of GDP in

relation to fixed capital. After the end of the special period, the dynamics everywhere again sharply weakens.

The article is devoted to the study of the phenomenon of a special period on the example of the United States.

It is shown that the stabilization of the growth rate of labor productivity in the considered period of time is

associated with the dynamics of specific capital requirements. In turn, it was revealed that the factor

influencing the amount of capital requirements, and, thereby, the dynamics of productivity is the intellectual

component of investment. Thus, the nature of the special period, the predominant growth of the product

relative to fixed capital in the United States during approximately 1980-1990s, is to a certain extent clarified.

1 INTRODUCTION. STATEMENT

OF A QUESTION

As is known, since the late 1960s and early 1970s,

practically in all developed countries there has been a

clear tendency towards a weakening of economic

dynamics. The downtrend is not, however,

monotonous. At a certain stage (not earlier than the

mid-1980s and not later than the mid-2000s), the

indicated trend is interrupted, the cumulative (with a

base, for example, 1970), average annual GDP

growth rates stabilize or even slightly increase.

This period can be considered "special". This

article attempts to investigate its nature using the

example of the United States.

2 SPECIAL PERIOD

The period of time with a relatively stable dynamics

of per capita GDP between phases with a declining

a

https://orcid.org/0000-0001-9452-5649

trend, we called a special period. It turned out that the

presence of such a period is characteristic of most

developed countries (Table 1).

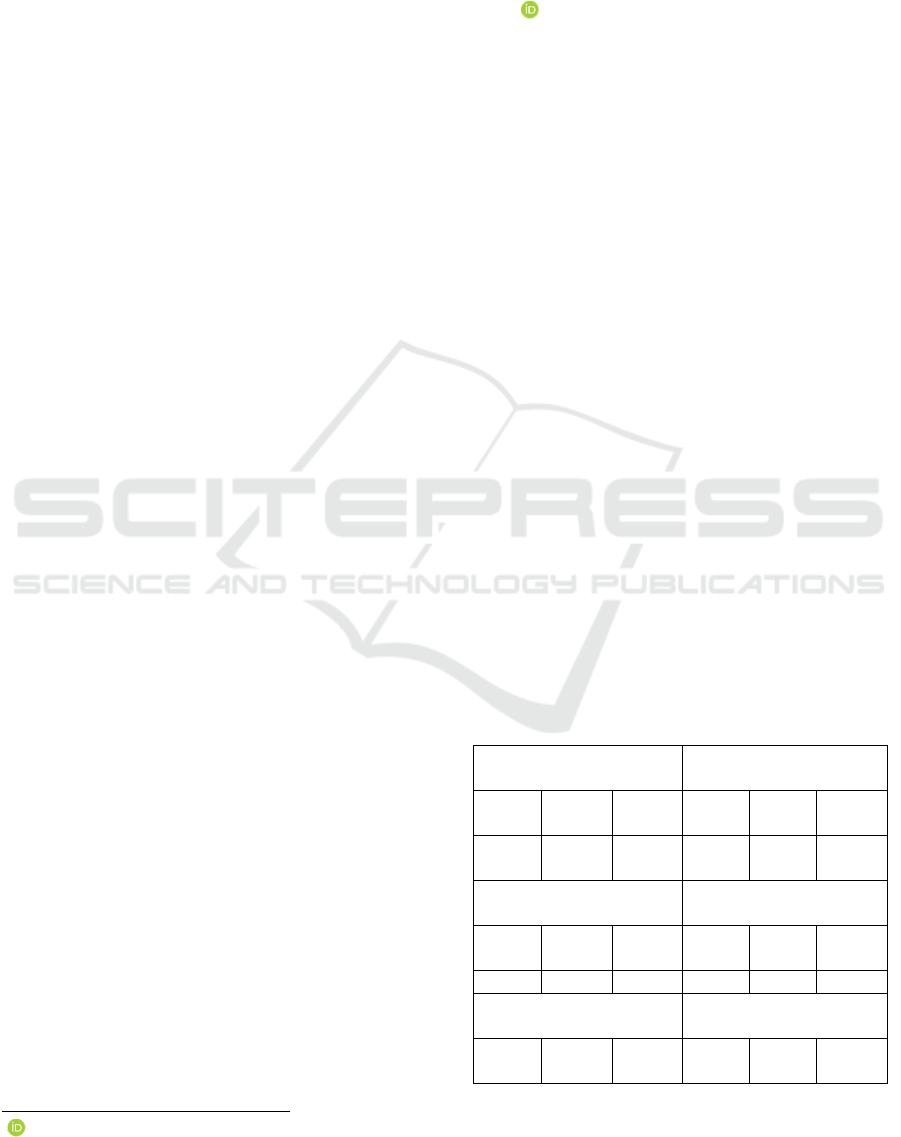

Table 1. Cumulative average annual growth rates of GDP

per capita by periods in developed market countries (GDP

per capita, constant 2010 US$)*

Austria

(1995-2008)

Netherlands

(1991-2009)

1971-

1994

1971-

2008

1971-

2019

1971-

1990

1971-

2009

1971-

2019

2,5

2,4

2,0 1,9

1,9

1,7

Luxembourg

(1990-2007)

Norway

(1992-2001)

1971-

1989

1971-

2007

1971-

2019

1971-

1991

1971-

2001

1971-

2019

3,1 3,2 2,40 3,1 3,1 2,2

Belgium

(1997-2008)

Portugal

(1987-2008)

1971-

1996

1971-

2008

1971-

2019

1971-

1986

1971-

2008

1971-

2019

446

Lavrovskii, B.

Sustainable Development and Investment Policy (on the Example of the USA).

DOI: 10.5220/0010592104460451

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 446-451

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2,2 2,2 1,8 2,6

2,6

2,1

Greece

(1988-2010)

Singapore

(2003-2010)

1971-

1987

1971-

2010

1971-

2019

1971-

2002

1971-

2010

1971-

2019

1,8

1,8

1,2 5,1

5,0

4,5

Denmark

(1985-1997)

United States

(1985-2007гг.)

1971-

1984

1971-

1997

1971-

2019

1971-

1984

1971-

2007

1971-

2019

2,0

2,0

1,6 2,1

2,1

1,8

Israel

(1985-2007)

United Kingdom

(1988-2007)

1971-

1984

1971-

2007

1971-

2019

1971-

1987

1971-

2007

1971-

2019

2,1

2,1

1,9

2,3

2,3

1,8

Spain

(1989-2007)

France

(1994-2001)

1971-

1988

1971-

2007

1971-

2019

1971-

1993

1971-

2001

1971-

2019

2,4

2,4

1,9

2,2

2,2

1,6

Italy

(1983-1991)

Finland

(2000-2008)

1971-

1982

1971-

1991

1971-

2019

1971-

1999

1971-

2008

1971-

2019

2,8

2,8

1,4

2,6 2,7 2,0

Canada

(1985-2007)

Sweden

(1990-2007)

1971-

1984

1971-

2007

1971-

2019

1971-

1989

1971-

2007

1971-

2019

2,1

2,1

1,7

1,9

1,9

1,6

Korea, Rep.

(1983-2003)

Germany

(1995-2001)

1971-

1982

1971-

2003

1971-

2019

1971-

1994

1971-

2001

1971-

2019

7,2

7,2

5,8

2,3

2,2

1,8

Switzerland

(1989-2008)

1971-

1988

1971-

2008

1971-

2019

1,1

1,1

1,0

* The boundaries of the special period are indicated in

brackets.

In a number of developed countries, for example,

Australia and Japan, the presence of a special period

has not been revealed. In all cases, the cumulative

average annual growth rate of GDP per capita during

the special period is comparable to the analogous

indicator prevailing before it began. In some

countries, the average annual growth rate of GDP per

capita in a special period is slightly lower than the

indicators that existed before it began (Singapore,

Germany), in Finland - slightly higher. But the

"second wind" is not eternal, and after the end of the

special period, the pace has sharply decreased

everywhere.

We tend to associate the nature of the special

period with the computer information boom that

began approximately in the mid-1980s. The positive

impact of computer technology has manifested itself

in almost every developed country. The new local

trend usually lasted for about 10-20 years and ended

most often by the middle - end of the 2000s. Earlier

than all other countries, opposition to the global trend

towards weakening economic dynamics manifested

itself in the USA, Denmark, Israel, Italy, Canada,

Rep. Korea. This phenomenon has manifested itself

en masse since the late 1980s, early-mid 1990s

(second wave).

The first bell, indicating the end of a special

period, rang in 2000 and was connected, apparently,

with the global financial crisis, when the shares of,

first of all, high-tech companies literally collapsed.

The inertia associated with the influence of computer

technology, however, continued until 2008. World

financial and economic crisis 2008-2009 put the last

points over the i.

With regard to countries with emerging markets,

there is no need to talk about a certain special period.

However, in most of these countries, over the past two

to three decades, economic development has ceased

to be chaotic. It has become more orderly,

characterized by an increasing rate of growth in GDP

per capita. In different countries, growth began in

different years, but, as a rule, not earlier than the

beginning, the mid-1990s. And it continued until the

end of the period under review. It is possible that

these two to three decades were necessary to provide

susceptibility to the results of the computer

revolution.

3 STAGES OF ECONOMIC

GROWTH IN THE USA

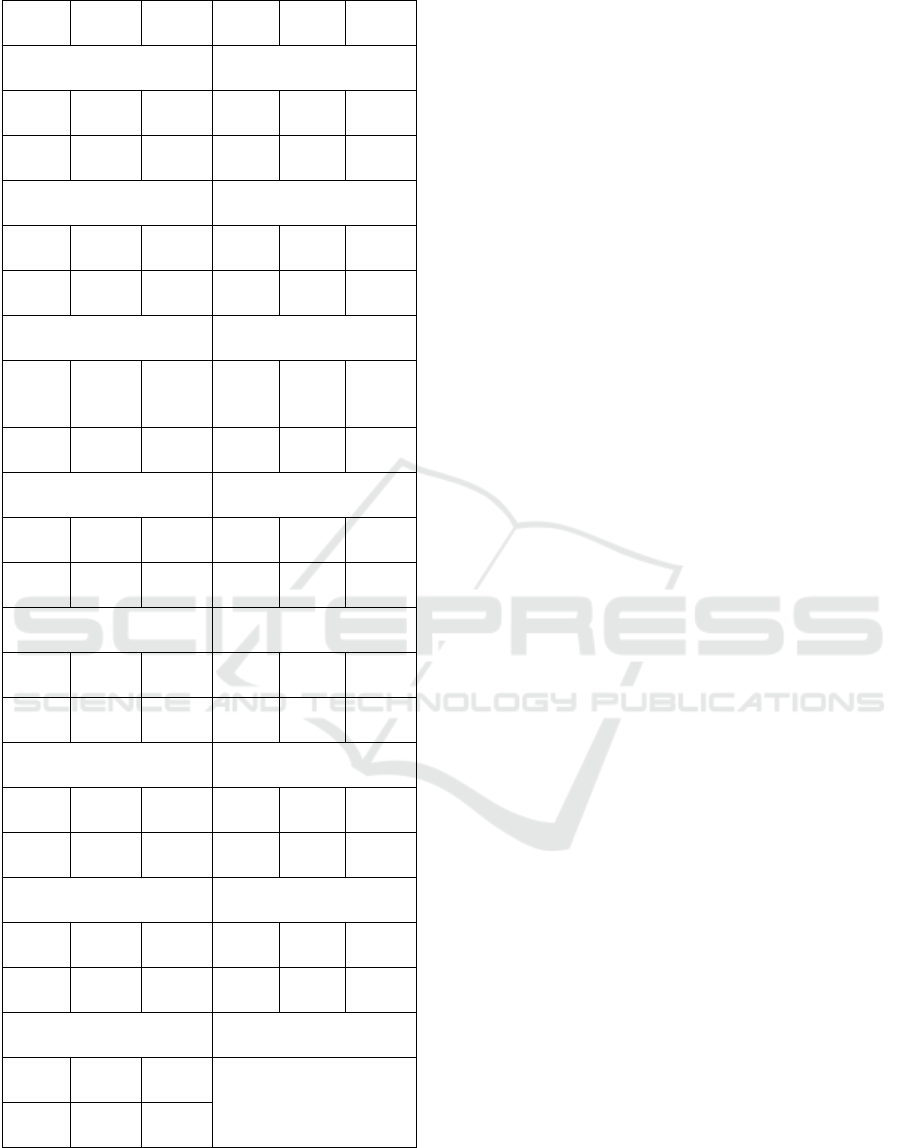

The ratio of indicators of the dynamics of GDP and

fixed production capital, its change over time can give

a certain idea of the characteristic features of

Sustainable Development and Investment Policy (on the Example of the USA)

447

economic growth, extensive or intensive type of

development. Data for the USA are presented in Fig.

1.

Figure 1: Growth index of GDP and fixed assets (constant

2009 US$),%, 1955-100.

Until the mid-1980s, the production base and

product release developed almost synchronously,

indicating an extensive type of development. In the

next 20 years or so, there has been a predominant

dynamics of GDP relative to fixed capital, which is a

sign of intensive growth. Since about the middle of

the 2000s, the growth rates of both indicators have

practically equalized again.

The phenomenon of predominant product growth

is the subject of further analysis.

4 DECOMPOSITION OF

PRODUCTIVITY DYNAMICS

INTO EXTENSIVE AND

INTENSIVE COMPONENTS

Qualitative characteristics of the production

apparatus (PA) measured by numerous technical and

economic indicators reflecting its specific aspects and

properties. We associate the consolidated generalized

assessment of the quality of PA at the macroeconomic

level with the indicator of labor productivity. The

higher this indicator, the higher the level of

technological perfection of the PA.

The restructuring of the PA, the replacement of

obsolete fixed assets can be carried out on the basis

of two types of technologies, each of which ensures

productivity growth. The difference between the

types consists in the ratio of the productivity of the

equipment supplied for replacement and its cost,

more precisely, the value of the specific investment.

In one case, these are breakthrough technologies with

specific investments that are fundamentally better

than those being replaced; in the other, they are

modern ordinary technologies with a ratio of cost and

productivity similar to replaceable methods of

production.

If the worker's labor productivity increases less or

approximately to the extent of the increase in the cost

of his workplace (capital-labor ratio), then it is natural

to attribute this growth to ordinary technologies.

These technologies are based on routine R&D,

knowledge mainly of yesterday. Replacing obsolete

assets with conventional technologies increases

productivity, but at best maintains the same capital

intensity (сapital productivity). Higher growth rates

of productivity in relation to capital-labor ratio are

due to the phenomenon of breakthrough technologies

that have fundamentally better technical and

economic parameters. This type of technology

provides an increase in both productivity and capital

productivity; generated by fundamental R&D, new

knowledge.

The idea of measuring the measure of

innovativeness of the PA modernization project is to

try to decompose the increase in labor productivity

into extensive and intensive (innovative) factors that

generate it. On the one hand, this is an increase in

fixed capital (capital-labor ratio), on the other, a

change in its qualitative components, that is, the

volume of product per unit of fixed capital (capital

productivity).

At the operational level, the measurement of the

innovation component within the framework of the

considered approach is associated with the dynamics

of capital productivity. An assessment of the intensity

of innovative activity is considered to be the part of

the increase in productivity due to the dynamics of

capital productivity. The more productivity growth

exceeds growth of the capital-labor ratio, the higher

the level (scale) of innovation, the role and

importance of the innovation factor.

As is known, labor productivity index can be

expressed as multiplication of the capital-labor ratio

and the capital productivity indices:

cprclpr

III

,

(1)

where is the labor productivity index, is the

capital-labor ratio and is the capital productivity

index.

For the case of continuous time, taking the

logarithm of equation (1), we obtain:

cprclpr

III lnlnln

,

(2)

Thus, the productivity index is presented as the

sum of the capital-labor and capital-productivity

indices. On the basis of relation (2), it is possible to

single out a part of the rate of productivity growth due

to a change in capital productivity:

100

300

500

700

1955

1960

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

2015

GDP Fixedassets

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

448

pr

cpr

in

I

I

ln

ln

, (3)

Within the framework of this approach, the

parameter will be considered an estimate of the

intensity of innovative activity.

So, the positive growth rates of capital

productivity and capital-labor ratio make it possible

to "naturally" decompose the increase in labor

productivity into factors that explain it, without any

remainder. Negative growth rates of capital

productivity, testifying to the predominant growth

rates of capital-labor ratio relative to the dynamics of

labor productivity, lead to a parameter value less than

zero.

An important note is as follows. A negative value

does not necessarily mean that there is essentially no

innovation activity. Apparently, the following

statement will be true: a positive value of the

parameter is sufficient, but not a necessary condition

for the presence of innovative activity.

Using this technique, we present data that give

some idea of the nature of the reproduction process in

the United States, the role of the innovation factor

(formula 3) already in certain quantitative estimates

(table 2).

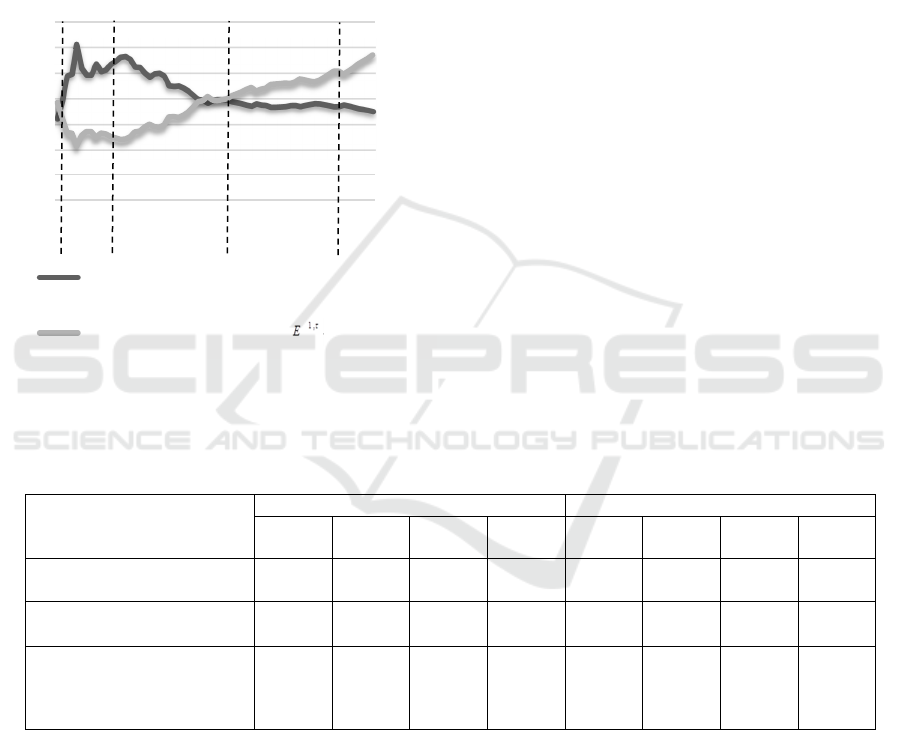

Table 2. Share in total productivity growth due to increased capital productivity (assessment of the intensity of innovative

activity) by periods ( 2009 US$),%

Base yea

r

1955 1985 2005

Perio

d

1956-1985 1956-2005 1956-2016 1986-2005 1986-2016 2006-2016

Value

in

2,6 17,8 15,0 41,2 29,5 -7,6

It turned out that in general for the period 1956-

2016. approximately 85% of the productivity gain is

due to investments based on routine, 15% - on

fundamental research and development. It is also

possible to assert with certainty about the presence of

a special twenty-year period of time, which had a

decisive influence on the picture of the reproductive

process over the entire more than half a century. In

1986-2005. more than 40% increase in productivity is

achieved due to advanced technologies; of providing

a significant advantage in the growth of labor

productivity over the ratio of capital and labor.

5 THE NATURE OF

INNOVATION. THE ROLE OF

THE INTELLECTUAL

PRODUCT

Consider an approach to studying the nature of the

growth of capital productivity. As you know, in the

fundamental Harrod-Domar equation, economic

dynamics is functionally linked to the rate of

accumulation and the marginal capital intensity

(capital ratio):

Y

I

Y

I

G

:

, (4)

where G - GDP growth rate, I - investments , Y -

GDP,

Y

- GDP increase.

By analogy with this equation, we represent the

increase in labor productivity

P

r

as a function of

the volume of specific investments (for the creation

of one job)

,1

I

for the period [1,

] and the

indicator

,1

E

, which we call normalized investments

for the period [1,

]:

,1

:

,1

Pr EI

, (5)

where

P

r

=

P

r

-

0

P

r

;

,1

I

=

1

1

i

i

i

i

L

I

;

,1

E

=

1

1

i

i

i

i

L

I

:(

P

r

-

0

P

r

)

=1,…,

T

,

Designations:

P

r

- labor productivity in year;

0

P

r

- labor productivity in the base year 0;

i

I

- gross

production investment in year i;

i

L

- the number of

people employed in year i.

Sustainable Development and Investment Policy (on the Example of the USA)

449

The parameter

,1

E

is interpreted as the need for

capital for the growth of labor productivity of the unit

intensity; answers the question of how many dollars

of production investment is required over a certain

period to equip one workplace in order to increase the

worker's productivity per unit during the period. In

what follows, for brevity, the dimensionless

parameter will be called "normalized investment" or

"capital requirement".

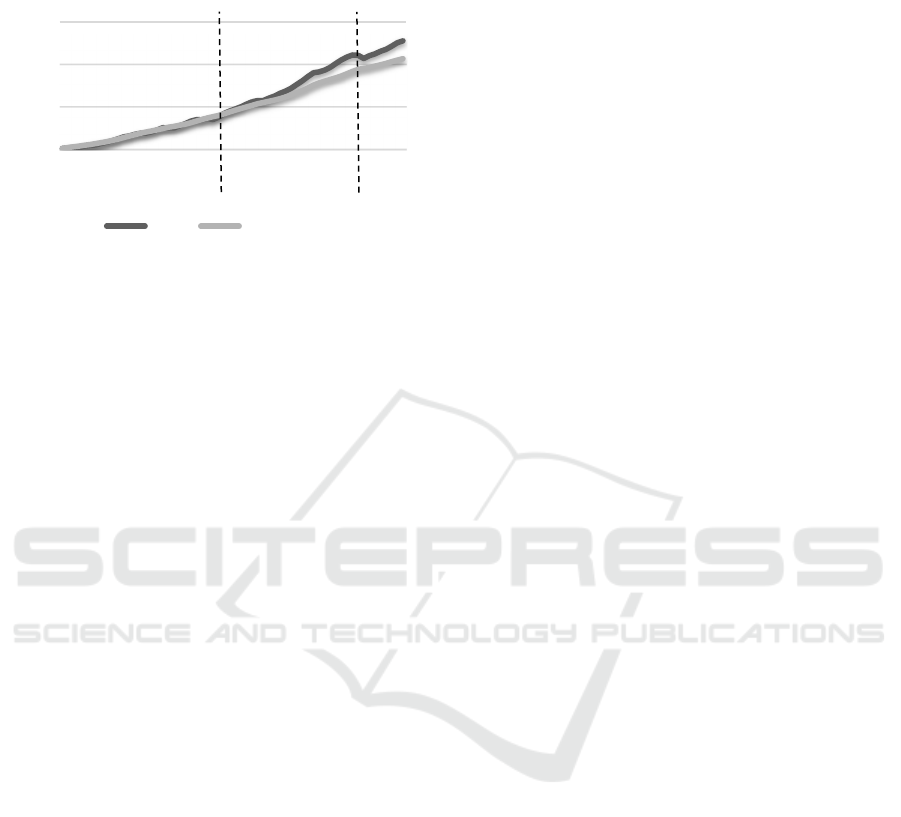

Data on the dynamics of labor productivity and

normalized investment are presented in Fig. 2.

Figure 2: Dynamics of labor productivity and normalized

investment (2009 US$),%, base 1950

In fig. 2, the relationship between the cumulative

indicators of normalized investments and the

cumulative dynamics of labor productivity is clearly

visible. In particular, the decrease in the cumulative

capital requirement in 1951-1955. accompanied by

an increase in cumulative productivity growth; to the

period of significant growth in the cumulative

indicators of normalized investment from the mid-

1960s to the early 1980s corresponds to a noticeable

decrease in the cumulative rates of productivity

growth, etc. Thus, it is likely that the relationship

between changes in capital requirements and

productivity growth rates is reversed.

In turn, it is appropriate to assume that the factor

influencing the amount of capital demand, and,

thereby, the dynamics of productivity, is the

intellectual component of investment (table 3).

Table 3: Dynamics of labor productivity and parameters that generate it by periods

Indicators Fixed base Variable base

1951-

1965

1951-

1982

1951-

2003

1951-

2016

1951-

1965

1966-

1982

1983-

2003

2004-

2016

Average annual increase

rate of labor productivity,%

2,8 1,9 1,9 1,7 2,8 1,1 1,8 1,2

Parameter value

,1

E

4,1 7,0 8,0 9,8 4,1 11,2 8,0 14,1

Increase in the share of an

intellectual product in

production investments in

average annual terms, p.p.

0,74 0,35 0,43 0,37 0,74 0,03 0,48 0,19

During 1966-1982. the share of the intellectual

product in production investments remained

practically unchanged. The consequence was a sharp

increase in the value of the parameter

,1

E

- from 4,1

in 1951-1965. up to 11,2 in 1966-1982 and, thus, a

reduction in the average annual increase rate of labor

productivity (2,8% and 1,1%, respectively). A

significant increase in the share of an intellectual

product in production investments in 1983-2003.

(0.48 pp on average per year) created the conditions

for reducing the parameter

,1

E

to 8,0 and raising the

average annual increase rate of labor productivity to

1,8%. Modest and unstable growth of the intellectual

product in 2004-2016. proved insufficient to

withstand a significant increase in capital

requirements. The performance momentum has

weakened again.

Thus, the nature of the special period, the

predominant growth of the product relative to fixed

0,0

2,0

4,0

6,0

8,0

10,0

12,0

0,0

0,5

1,0

1,5

2,0

2,5

3,0

3,5

1951

1956

1961

1966

1971

1976

1981

1986

1991

1996

2001

2006

2011

2016

Averageannualincreaserateoflabor

productivity,%‐leftscale

Normalizedinvestment‐rightscale

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

450

capital in the United States during approximately

1980-1990s, is to a certain extent clarified.

6 THE DISCUSSION OF THE

RESULTS

It is believed that overcoming the long-term negative

trend in the development of the US economy is

associated with the neoconservative policy of

President Reagan (Reaganomics). It cannot be denied

at the same time that this policy was carried out

during the years of the computer revolution. Its

economic consequences in terms of innovative

development manifested themselves in a more

favorable dynamics of specific investments than

before. With the accumulation rate practically

unchanged, it became possible to accelerate labor

productivity and macroeconomic growth.

A little later than in the United States, the positive

fruits of computer technology manifested in most of

the developed countries of the world. After the crisis

of 2008-2009. The “computer rent” was exhausted,

and the developed countries returned to the trajectory

of declining growth.

An important further task is to assess the specific

indicators that have given rise to a special period in

most developed countries, not just the United States.

7 CONCLUSION

Macroeconomic dynamics in the United States

closely correlates with changes in the indicator

characterizing the need for capital. In turn, the value

of this need is apparently determined by the share of

the intellectual product in production investments.

We tend to associate the nature of the special period

in the United States and other developed countries

with the computer-information boom of the 1980s

and 1990s. The positive impact of computer

technology has manifested itself in almost all of them,

although to varying degrees.

The first bell, indicating the end of a special

period, rang in 2000 and was connected, apparently,

with the global financial crisis, when the shares of,

first of all, high-tech companies literally collapsed.

The inertia associated with the influence of computer

technology, however, continued until 2008. World

financial and economic crisis of 2008-2009 placed the

last points over the i.

ACKNOWLEDGEMENTS

The article was prepared within the framework of the

project "Socio-economic development of Asian

Russia based on the synergy of transport accessibility,

systemic knowledge of the natural resource potential,

the expanding space of interregional interactions",

Agreement number with the Ministry of Science and

Education No. 075-15-2020-804.

REFERENCES

A Strategy for American Innovation: Securing our

Economic Growth and Prosperity. Washington, DC,

February 2011.

A Strategy for American Innovation: Securing our

Economic Growth and Prosperity. Washington, DC,

February 2011.

Bureau of Economic Analysis.

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step

=2#reqid=19&step=2&isuri=1&1921=survey

Harrod, R. (2008). Economic dynamics theory. The Central

Economic Mathematical Institute of the Russian

Academy of Sciences Publ, 210 p.

Lavrovskii, B. (2020).Intellectual product as factor of

economic growth. Proceedings "Theoretical problems

in innovations", "Innovation policy and innovation

management."Innovative Solutions", Scientific-

Technical Union of Mechanical Engineering Industry-

4.0, 1(4):22-24.

Lavrovskii, B. L. (2018). Assessment of Innovation

Intensity: the Case of USA, Economy of Region,

14(1):281-291.

National Security Strategy of the United States of America.

December (2017). https://www.whitehouse.gov/wp-

content/uploads/2017/12/NSS-Final12-18-2017-

0905.pdf. Cited April 15, 2020

Supyan, V. B. US economy in a polycentric world:

prospects for maintaining positions.

https://interaffairs.ru/jauthor/material/2345

Suslov, V., Baranov, A., Lavrovskii, B. (2017).

Macroeconomic Model of the Scientific-Technological

Progress. 2017 10th International Conference

"Management of Large-Scale System Development"

(MLSD). DOI: 10.1109/MLSD.2017.8109692

Varnavskij, V.G. (2018). The role of the United States in

world industry and trade as a global problem. Contours

of global transformations: politics, economics, law,

11(2):100-112. DOI: 10.23932/2542-0240-2018-11-2-

100-112

Voytolovskiy, F.G., Kirichenko, E.V. (2016). SSHA:

vozmozhnosti i predely ekonomicheskogo i

politicheskogo liderstva, T.1, IMEMO RAN, 240 s.

Word Development Indicator (WDI). URL:

https://databank.worldbank.org/source/ world-

development-indicators

Sustainable Development and Investment Policy (on the Example of the USA)

451