Accessibility of Financial Services in the Aspect of the Population

Financial Literacy Development on the Example of the Republic of

Bashkortostan

Aisylu I. Bulatova

1,2 a

1

Chair of Finance and Taxation, Bashkir State University, K. Marks ¾ str., Ufa, Russian Federation

2

Ufa Regional Methodological Center for Financial Literacy, Institute for the Education Development of the Republic of

Bashkortostan, Mingazhev, 120 str., Ufa, Russian Federation

Keywords: Access to Financial Services, Financial Literacy, Financial Instruments, Financial Institutions.

Abstract: The article considers the need to develop the availability of financial services as a condition for improving

the quality of the population life. As one of the important aspects of the financial accessibility development

in the study, a significant place is occupied by the issues of improving of the population financial literacy.

The key components of financial accessibility are presented from the perspective of international financial

organizations. The chronology of the adopted legal acts in the field of financial education is considered. The

analysis of the conducted sociological research results on the regions of Russia is given. The assessment of

the financial literacy level is given on the example of the Republic of Bashkortostan by the quantitative

characteristics of credit institutions in the region. Recommendations for improving the availability of financial

services to the population are given.

1 INTRODUCTION

Access to financial services is strictly linked to

improved financial literacy. This is reflected in the

fact that financial literacy at the level of

consciousness increases the availability of financial

services.

The need to accelerate the development of

financial literacy in the country is justified by the fact

that a high level of financial literacy contributes to

raising the living standard of the population.

For Russia, the problem of access to financial

services is complicated by the fact that most of the

population has distrust to financial institutions, and

also has no understanding of the financial instruments

functioning basic principles.

For the most ordinary people, even the simplest

financial instruments can seem complex and

incomprehensible. This is reflected in current trends

of savings. There are about 70% of existing savings

in Russia are formed in the form of bank deposits.

Since the population is wary of more effective tools

for investing money, such as investments in the

a

https://orcid.org/0000-0001-7390-7381

securities market, because it doesn’t understand the

essence.

Sociological studies demonstrate that the essence

of the implemented pension system is

incomprehensible to citizens Russia, the prospects for

receiving a decent pension are especially not credible

among young people. The next proposals for the

transformation of the pension system are irritating.

One of the main problems of the crisis, the

growing overdue debt on loans and the declining

trend in the banking industry as a whole is the lack of

the population awareness about the financial sector of

the economy. This is also due to the lack of a

significant part of the population rational

management money culture, the lack of a financial

planning habit, family budgeting, etc.

The high level of lending to the population, the

tightening of bank lending conditions and the vast

shadow sector of the economy contribute to the rapid

development of the microfinance services market in

Russia. Potential borrowers either cannot or do not

want to contact banks. In this case, banks are replaced

368

Bulatova, A.

Accessibility of Financial Services in the Aspect of the Population Financial Literacy Development on the Example of the Republic of Bashkortostan.

DOI: 10.5220/0010590803680374

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 368-374

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

by microfinance organizations that agree to issue a

loan to almost anyone, at a much higher percentage.

Due to the fact that many different financial

instruments have recently appeared, the population

with negative experience in the past is distrustful of

their use. Therefore, the accessibility of financial

services is important to consider through the lens of

the population financial literacy.

2 METHODOLOGY

The work was carried out on the basis of an analysis

of Russian and foreign literature, scientific sources, a

review of the regulatory framework, a synthesis of

statistical materials from various official documents

of government bodies and others that affect the

process of improving financial literacy, as well as

data from sociological surveys of the National

Agency for Financial Research (NAFI), the All-

Russian Center for Public Opinion Research

(VCIOM), etc.

The data of the Central Bank of the Russian

Federation were used and summarized to study the

institutional provision of financial services in the

region and indicators of the credit and financial

system.

3 RESULTS

From the point of view of the development of Russian

thought, such Russian economists as: Manakhova

I.V., Shevyakov M.Yu., Belekhova G.V., Zelentsova

A.V., Bliskavka E.A. and Demidov D.N., Boranukov

A.A., Mamuta M.V., Vasyukova L., Masyuk N.,

Vasyukova O. and a number of others made a great

contribution to the development of basic theoretical

and methodological provisions on the impact of

financial literacy on the Russian economy effective

development.

By examining the researchers majority opinion

involved in the study of the financial literacy essence,

we can formulate the concept of financial literacy as

knowledge, skills and attitudes of using financial

services to meet basic financial needs.

The interpretation of the concept of "financial

literacy" is widely presented in the works of foreign

scientists, but there are not many works of Russian

authors. Therefore, research in this field is relevant

and in demand.

The main problems characterizing the current

state of financial literacy include:

1. Lack of long-term financial planning skills;

2. Ignorance of modern financial instruments and,

as a result, the ability to make a balanced decision on

the choice of certain financial services;

3. The habit of hoping for state help;

4. Difficulties with financial risk assessment;

5. Lack of the legislative framework for consumer

protection knowledge;

6. Lack of financial legal aid;

7. Lack of state-implemented pension reforms

understanding.

The modern definition of financial inclusion has

evolved over the past decade.

In 2009, Financial Accessibility Centre (CFI)

analysts formulated the main parameters of financial

accessibility:

1) Ability of the entire able-bodied population to

receive a full range of quality financial services;

2) Availability of financial services;

3) Ability to easily receive financial services;

4) Respect for the human dignity of clients by the

financial services provider (Vasyukova, Masyuk and

Vasyukova, 2019).

In 2010, World Bank Group analysts identified

the following key components of financial

accessibility: products (payments, savings, insurance,

lending), characteristics (price availability, physical

accessibility, convenience, quality (including

consumer protection)) and channels (access points,

infrastructure, institutions, and customers).

In 2011, Alliance for Financial Inclusion (AFI)

identified three components of financial affordability:

physical accessibility, demand and quality of

financial services (Mamuta, 2016).

In 2012, the Organization for Economic Co-

operation and Development (OECD) proposes to

consider financial affordability in conjunction with

financial literacy, identifying opportunities for

innovative ways of delivering financial services as a

key characteristic of financial affordability (Atkinson

and Messy, 2012).

According to the Bank of Russia, financial

accessibility is understood as "full access to the basic

set of financial services of the entire country

population and small and medium-sized businesses"

(Official website of the Central Bank of the Russian

Federationю (online)). Among the key indicators of

financial accessibility, the regulator includes

quantitative indicators of institutional security, the

volume of transactions carried out in a cashless

manner, the volume of issued bank cards, the volume

of loans provided, the number of actively used bank

accounts, the quality of financial services provided

based on the results of sociological surveys.

Accessibility of Financial Services in the Aspect of the Population Financial Literacy Development on the Example of the Republic of

Bashkortostan

369

According to the World Bank, in 2017, about 1.7

billion people did not have access to banking services.

Such people are called financially unincorporated

- they are deprived of the financial system benefits:

they have neither a bank account, nor the ability to

make money transfers, nor receive cheap loans. They

rely on the informal sector, preferring cash, hand-over

money and keeping values "under the mattress."

These people are not protected from legal or financial

risks - their money can be stolen, they can devalue,

they can be deceived, they will not be able to protect

rights in court. At the same time, we are talking about

a rather large amount. According to McKinsey

estimates, currently about $4.2 trillion of savings are

in the informal sector - this is more than the entire US

consumer credit market.

According to the Global Findex Database, in

developed countries the level of availability of

financial services is several times higher than in the

poor. For example, Switzerland, with a financial

availability level of 98.4%, has a PPP GDP per capita

of $59.3 thousand, and in Turkey, with 68.6% of PPP

GDP per capita, it is $25.4 thousand. In poor

countries, rates are even lower (Klimenko, 2020).

In developed economies, people are more

involved in the financial system and actively use it,

for example, they use credit and debit cards and make

digital payments.

The high availability of financial services has a

positive impact on the country's economy. This is

reflected in an increase in the speed of money

circulation, a decrease in the shadow economy, an

increase in competition between financial

institutions, contributing to the development of the

financial sector as a whole, and also helps in the fight

against corruption. Therefore, improving financial

accessibility can be seen in the interests of both

society and the State (Klimenko, A., 2020).

From the point of the measures importance view,

taken in Russia, we turn to the existing regulatory

framework.

As part of the Project of the Ministry of Finance

of Russia and the World Bank «Promoting financial

literacy and financial education in the Russian

Federation», all-Russian awareness-raising events are

ongoing.

On September 25, 2017, the Government of the

Russian Federation signed Decree No. 2039-r "On

Approval of the Strategy for Improving Financial

Literacy in the Russian Federation in the 2017-2023"

The Bank of Russia sets itself a set of tasks aimed

at creating conditions that contribute to the expansion

of financing opportunities for a wide range of

business entities

(Main directions of the Russian

Federation financial market development for the

period of 2019 – 2021).

In the «Main directions of development of the

Russian Federation financial market for the period

2019-2021», the following are identified as priority

areas of development:

1. Ensuring the protection of the financial services

consumer’s rights and improving the financial

literacy of the population;

2. Increasing the population financial services

availability, for the small and medium-sized

enterprises;

3. Discouraging unfair behavior in the financial

market;

4. Increasing investor attractiveness to public

equity financing through improved corporate

governance;

5. Development of bond market and syndicated

lending

6. Improvement of financial market regulation,

including application of proportional regulation,

optimization of regulatory burden on financial market

participants;

7. Professional development of persons whose

professional activities are related to the financial

market;

8. Promotion of electronic interaction

mechanisms in the financial market;

9. International cooperation in the development

and implementation of rules governing the global

financial market;

10. Improving Financial Market Stability Toolkit

(Main directions of the Russian Federation financial

market development for the period of 2019 – 2021).

To assess the modern level of the population

financial literacy, we will use the data of studies

conducted in 2018-2019 by NAFI. As a result, a

regional financial literacy rating was compiled,

conducted in each of the 85 constituent entities of the

Russian Federation (Figure 1).

Figure1: Distribution of regions by financial literacy.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

370

The integrated financial literacy index includes

three components: knowledge, skills and attitudes in

relation to finance.

In general, in Russia from 2018 to 2019, the

overall indicator increased slightly from 12.12 to

12.37 points (Rating of financial literacy of the Russia

regions, 2018, 2019).

Regions are ordered by Index value - from the

largest value to the smallest. Group A (places 1-16),

Group B (places 17-33), Group C (places 34-52),

Group D (places 53-69), Group E (places 70-85).

Let us consider the level of financial literacy on

the example of the Republic of Bashkortostan (RB)

and compare the data for 2018-2019 years.

In the Republic of Bashkortostan, the aggregate

index is 12.47, which is slightly higher than in Russia.

According to knowledge, skills, installations, the

region is within group C (34-52 places). And this is

better than the indicators of 2018 (in terms of skill

level, the Republic of Bashkortostan was in group D

(places 53-69)).

Table 1: Comparative analysis of federal (RF) and regional

levels (RB) indicators distribution for 2018-2019 years.

2018 2019

№

Indicator name RF RB RF RB

1 Financial

sustainability of

the famil

y

42

%

40

%

45

%

47

%

2 Savings formation 17

%

24

%

18

%

14

%

3 Savings in the

form of deposits

25

%

35

%

20

%

20

%

4 Using bank cards 75

%

77

%

82

%

81

%

5 Cashless payment

of

p

urchases

16

%

18

%

29

%

26

%

6 Using mobile and

Internet Banking

31

%

36

%

56

%

57

%

7 Financial pyramid

reco

g

nition

26

%

24

%

8 Competent signing

of contracts

18

%

20

%

15

%

16

%

9 Bank trust level 64

%

64

%

In addition to the indicators indicated in Table 1,

the study also showed the segmentation of the

population according to such criteria as age,

availability of higher education, sex, residence in the

city (in the village), etc.

The analysis provides the following conclusions:

1. According to the indicator "financial stability of

the family," expressing a positive response from

respondents: "If your family loses its main source of

income, how long will you be able to pay all the

necessary expenses without borrowing money?," The

percentage of respondents "At least a month" is a

negative deviation from the federal level (42% of the

Russian Federation; 40% RB). This may indicate that

it is not possible to form an "airbag" due to the low

level of wages, and the savings formation level in the

RB is 7% higher than in Russia as a whole (17% of

the RF; 24% RB).

2. According to the indicator "recognition of

financial pyramids," the level of the region also lags

behind the federal level (26% RF; 24% RB).

3. Quite interesting is the alignment of the

selected segments. For example, according to the type

of settlement, the financial stability of the rural

population is higher when the main source of income

is lost; rural residents are more inclined to form

savings. But urban residents, due to their large

technical capabilities, are more likely to pay cashless

purchases, use a mobile and Internet bank, have a

higher level of knowledge in recognizing financial

pyramids; they are more competent in the procedure

for signing contracts.

4. Paradoxically, in our opinion, it seems that the

population with higher education is less inclined to

savings than without it (22% with higher education,

24% without higher education).

5. The level of available education practically

does not affect the competent signing of contracts

(with higher education 20%, without higher education

21%).

6. Indicators such as "financial stability of the

family" (men - 45%, women 37%), "formation of

savings" (women 26%, men 21%), "savings in the

form of deposits" (men 38%, women 32%) stand out

the largest differences in the percentage of responses

in the "by sex" segment.

7. In the segment of age groups, "financial

stability of the family," "savings in the form of

deposits" the level decreases after 44 years; The "use

of bank cards" is high for almost all age categories

except 60-79 years (53%). "The use of mobile and

Internet banks" decreases after 44 years.

"Recognition of financial pyramids" is more

characteristic of the group of 25-34 years old, the

level of competent signing of contracts is higher in

the age category of 35-44 years (25%). The "level of

confidence in banks" is growing from 18 to 44 years

old (64-72%), from 45 years old it begins to decline.

Quite interesting are the results of a study

conducted in March 2020 by NAFI in the context of

crisis events in the Russian economy. The total

number of respondents amounted to 1,600 people

over 18 years old in 136 settlements in 50 regions of

Accessibility of Financial Services in the Aspect of the Population Financial Literacy Development on the Example of the Republic of

Bashkortostan

371

Russia. The sample is based on official statistics from

Rosstat and represents the population of the Russian

Federation by sex, age, level of education and type of

settlement. Statistical data error does not exceed 3.4%

(NAFI, 17.04.2020).

The research was directed to the chosen strategy

of population financial behavior identification in

crisis.

So, at insufficiency of the money population

prefers to borrow each other (49%), to a lesser extent

in the form of the bank credits (up to 20%). Quite

possible it is connected with big debt load of the

population and rather expensive cost of credit.

The greatest number of answers (36%) at

problems with finance seeks to cut down costs, 15%

of respondents said that they found additional

earnings and only 8% used the created savings.

On average in the country more than 30% of

Russians for the last year came up against a situation

when income isn't enough for a covering of all

operating costs.

Regarding formation of the population savings

and investments, for the last three years the Russians

in the three of rating choose the investments

connected about acquisition of the real estate,

opening bank deposits, investments in precious

metals (NAFI, 17.04.2020).

From the point of view of the region institutional

characteristics, we will give statistics on the territorial

presence of existing credit institutions and their

divisions in the Republic of Bashkortostan for 2019 –

2020 (Bank of Russia. Statistics, 2021).

Table 2: Statistics of existing credit institutions and their

division’s territorial presence in the RB.

01/2020 01/2021 changings

Head Office 1 1 0

Branches 12 8 -4

Representati

ve office

5 4 -1

Additional

offices

624 624 0

Cash desks

outside the

cash cente

r

1 0 -1

Credit and

cash offices

59 52 -7

Operating

offices

129 126 -3

Mobile

Cash

Check

p

oints

27 27 0

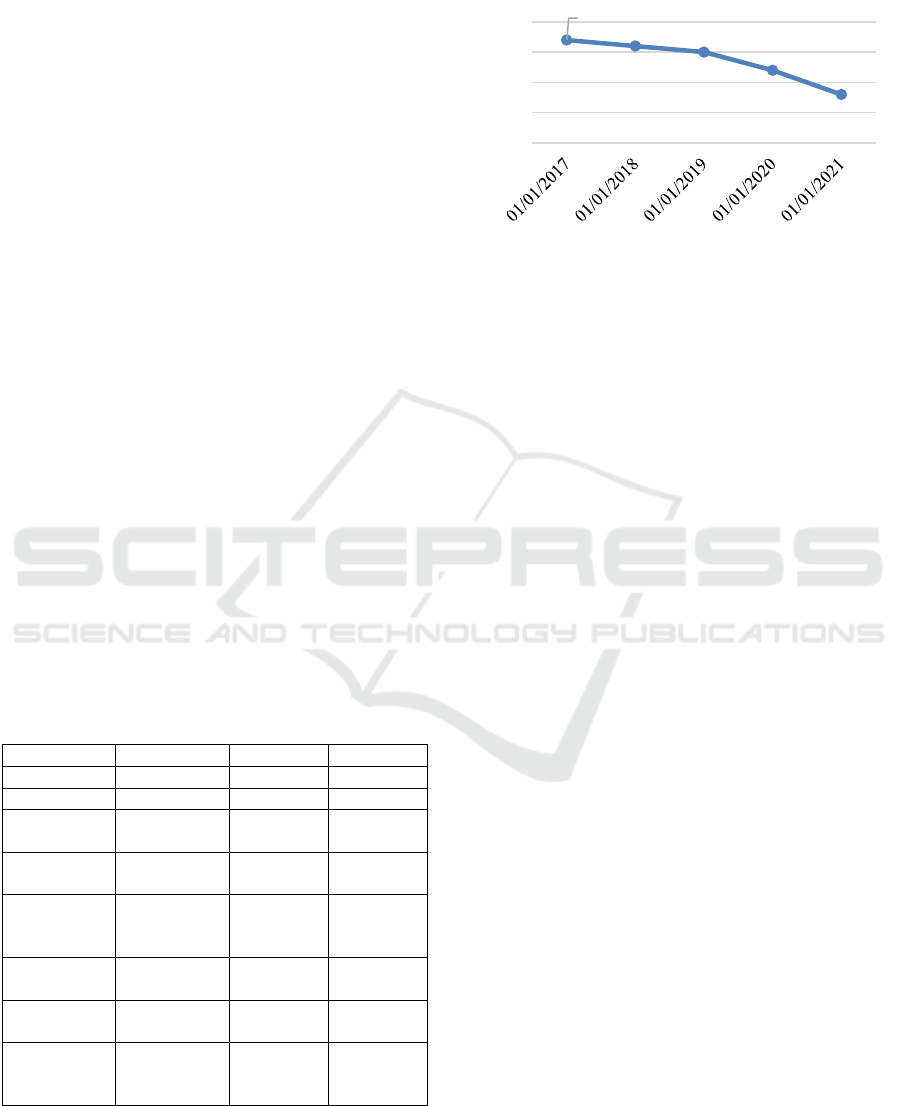

Figure 3 shows the dynamics of credit institutions

branches number in the RB: there is a tendency to

reduce them from 01.01.2017 to 01.01.2021.

Figure 3: Dynamics of the number of branches of credit

institutions in the RB.

Thus, in the RB as of 01.01.2021, compared to

01.01.2020, the largest change was recorded in

reducing credit and cash offices - by 7 units, reducing

branches - by 4 units, reducing operating offices - by

3 units; the number of head offices, additional offices

and mobile cash centers remained unchanged. The

increase in the number of existing credit institutions

and their divisions in RB for the studied dates has not

been recorded.

During the period from 01.01.2017 to 01.01.2019

there is a tendency to decrease the number of credit

institutions in the region and a decrease of credit

institutions branches number.

Recently, from the point of view of development,

it should be noted that the financial services

development is moving towards remote technologies.

In this regard, the frequency of financial services

using and their channels can be considered through

the volume of non-cash settlements in the region.

We will conduct a comparative analysis of the RB

with the regions of the Volga Federal District. Table

3 shows the distribution of the leading regions of the

Volga Federal District by the number of cashless

settlements for 2014-2019 (Bank of Russia. Statistics,

2021).

17

16

15

12

8

0

5

10

15

20

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

372

Table 3: Distribution of the Volga Federal District leading

regions by the number of cashless settlements for 2014-

2019.

Year Thousands of units

2014 1) Republic of Bashkortostan - 11024,8

2) Samara region - 9798,5

3) Perm Krai - 9381,8

2015 1) Perm Krai - 137560,2

2) Republic of Bashkortostan - 123073,1

3

)

Samara re

g

ion - 117639,3

2016 1) Republic of Bashkortostan - 206679,9

2) Samara region - 195902, 2

3

)

Re

p

ublic of Tatarstan - 193746,5

2017 1) Republic of Bashkortostan - 60278,7

2) Samara region - 57852,4

3) Republic of Tatarstan - 54186,5

2018 1) Republic of Bashkortostan - 580607,4

2) Republic of Tatarstan - 566654,6

3) Samara region - 535896,7

2019 1) Republic of Tatarstan - 796550,4

2) Republic of Bashkortostan - 780859,7

3) Samara region - 687235,7

Thus, for 2019, the regions-leaders of the Volga

Federal District in the number of cashless settlements

are the Republic of Tatarstan, the Republic of

Bashkortostan and the Samara Region. During 2014-

2019 RB is one of the top three leaders in the study

indicator, takes first place in the ranking except for

2015 and 2019 (Bank of Russia. Statistics, 2021).

Dynamics of cashless transactions not related to

payment of goods and services by regions of the

Volga Federal District from 2017-2019 is

characterized by a sharp increase. Non-cash

settlements, not related to payment of goods and

services, prevail among physical persons, and since

2015 there has been a significant increase in the

number of non-cash transactions among legal

persons.

4 DISCUSSION RESULTS

This indicates that there is an intense movement

towards remote digital technologies.

From the point of view of developing financial

literacy programs, it is important to take into account

the following:

1. Take into account the values of the region

financial literacy level indicators (financial stability

of the family, a tendency to save, etc.).

2. Match deviations of values from the federal

level.

3. Assess the role and capacity of regional

authorities as well as institutions involved in financial

education.

4. To form groups of students depending on such

parameters as "type of settlement," "age category,"

since they show different behavioral attitudes.

Accordingly, the proposed themes should focus on

problem areas.

5. Apply more interactive forms of training.

6. Young people are more likely to learn technical

innovation in the financial sector, and the older

generation will need more quantity of time.

7. Focus on topics that cause more problems in

understanding and skills: "risk assessment in the

financial services market," "consumer knowledge,"

"financial fraud," "pension".

8. Disclose more information on how to invest

funds that are unconventional for the Russian

Federation.

9. Carry out advisory activities on the practical

use of ATMs, terminals, Internet banking, mobile

banking, etc.

10. Mandatory inclusion of financial literacy

occupation in all educational institutions.

11. To provide the widest possible information

campaign on events activities to the population.

12. To increase the Internet coverage of remote

areas.

5 CONCLUSION

Thus, from the point of view of the increasing

financial services availability, it is important to

develop three directions:

1. Developing a national strategy to improve

access to financial services

2. Developing regional programs to improve

financial literacy taking into account the specifics of

the region, as well as identified problem areas of

financial education

3. Modernization payment systems with the

possibility of universal coverage of digital financial

services.

So, for example, McKinsey & Company

considered that increasing the availability of financial

services using digital finance could lead to an

increase in global GDP by $3.7 trillion by 2025.

Therefore, digital infrastructure is so necessary:

mobile communications, the Internet, and the

availability of mobile phones (Klimenko, A., 2020).

In general, we should noting that the effect of

increasing financial literacy is very significant, as it

can be attributed to:

1. Improving the investment behavior of the

population, improving the economic efficiency of

households.

Accessibility of Financial Services in the Aspect of the Population Financial Literacy Development on the Example of the Republic of

Bashkortostan

373

2. Stimulating the inflow of funds into the pension

system.

3. Increased investment in financial institutions

for collective investment.

4. Development of brokerage activities by

increasing the volume of investments in the securities

market.

In conclusion, the Republic of Bashkortostan has

been actively working for a long time to increase the

population financial literacy level. During this time,

rich experience has been accumulated in introducing

school students and teachers to the study of financial

disciplines.

Positive experience of this region is possible for

adoption by other regions from the Russian

Federation positive economic growth position

formation.

REFERENCES

Atkinson, A. and Messy, F. (2012). Measuring Financial

Literacy: Results of the OECD INFE Pilot Study,

OECD Working Papers on Finance, Insurance and

Private Pensions, OECD Publishing, 15.

Financial accessibility. Official website of the Central Bank

of the Russian Federation,

https://cbr.ru/develop/development_affor/

Klimenko, А. (2020). Financial inclusion: how access to

financial services contributes to economic

development. PaySpace Magazine.

https://psm7.com/fintech/finansovaya-inklyuzivnost-

kak-dostup-k-finansovym-uslugam-sposobstvuet-

razvitiyu-ekonomiki.html

Main directions of the Russian Federation financial market

development for the period of 2019 – 2021. Central

Bank or Russian Federation.

http://www.consultant.ru/document/cons_doc_LAW_

343942/6f478f41d12d9de245d28b5e2f31ff8deb43a3f

7/

Mamuta, M.V. (2016). Financial availability and financial

literacy. Central Bank of Russian Federation.

https://files.rmcenter.ru/year/2016/02/finfin/pdf/16_Fe

bruary/Sessiya_1/2016-02-16_MamutaMV.pdf

Rating of financial literacy of the Russia regions. National

Program for Improving Financial Literacy of Citizens

«Druzhi s finansami». 2018, 2019.

https://karta.vashifinancy.ru/

Report on the implementation of the measures plan to

increase the level of the population financial literacy of

the Republic of Bashkortostan, approved by the Order

of the Government of the Republic of Bashkortostan of

August 4, 2015 № 828-r (2019).

https://minfin.bashkortostan.ru/documents/reports/283

660/

Statistics of existing credit institutions and their divisions

territorial presence. Official site of Bank of Russia,

2021. https://www.cbr.ru/statistics/bank_sector/lic/

Strategies of Russians financial behavior in crisis. National

Agency of Financial Research (NAFI). 17.04.2020. ,

Available at: https://nafi.ru/analytics/issledovanie-kak-

rossiyane-spravlyayutsya-s-finansovymi-

trudnostyami/

Vasyukova, L., Masyuk, N. and Vasyukova, O. (2019).

Influence of the Financial Knowledge Index on

Forming a Strategy for Financial Behavior of Financial

Services Consumers. 34th International-Business-

Information-Management-Association (IBIMA), Vision

2025: Education Excellence and Management of

Innovations Through Sustainable Economic

Competitive Advantage, pages 12566-12575

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

374