The Fundamental Goals and Principles of Sustainable Development

of a Commercial Bank

Nadezhda N. Semenova

a

and Anastasia A. Vasilkina

b

Department of economics, National Research Mordovia State University, Bolshevistskay Street, Saransk, Russia

Keywords: Sustainable Development, Bank, Principles, Goals of Sustainable Development.

Abstract: Globalization, increased international competition, digital transformation have a significant impact on the

functioning of commercial banks. At the same time, the stability of banks is the most important parameter for

the development of the country's banking system. Under the influence of various endogenous and exogenous

factors on the activities of banks, the time lag in which a credit institution can be in a relatively static, stable

state is reduced. In this regard, the issues of ensuring the stability of the bank acquire particular relevance,

which requires the development of appropriate theoretical and methodological provisions. The authors

substantiated the fundamental principles of sustainable development of a commercial bank, taking into

account the components of the concept of sustainable development: economic, social, environmental and

institutional. Also, in accordance with the main goals within the framework of the four components of goal-

setting, theoretical and methodological principles of sustainable development of a commercial bank are

proposed.

1 INTRODUCTION

In the modern world, banks perform many different

functions: accumulating temporarily free funds of

legal entities and individuals and their placement,

mediation in payments, transactions in the stock and

foreign exchange markets, settlement and cash

services, acquiring, virtual pooling, etc. Banks do not

just accumulate financial resources, carrying out

internal accumulation of funds, they ensure their

continuous movement in order to ensure sustainable

development of the economy, address environmental

and social problems (Bespalov et al., 2019; Cosma et

al., 2020; Zhixia, 2018). Banks can reduce the

negative impact of environmental and climatic factors

on sustainable development by reallocating financial

resources in favor of green sectors of the economy

(Miah et al., 2020).

At the same time, the bank is influenced by many

factors of the external and internal environment,

which can lead to bankruptcy, loss of stability of the

organization (Bitkina, 2018; Semenova et al., 2019).

In this regard, the issues of developing fundamental

goals, principles and criteria for sustainable

a

https://orcid.org/0000-0002-2270-256X

b

https://orcid.org/0000-0002-1469-6075

development of commercial banks are highly

relevant.

2 METHODOLOGY

The study is based on an integrated approach that

considers the sustainable development of a bank as a

combination of four components: economic,

environmental, social and institutional. At the same

time, sustainable development is seen as a value

setting and the main goal of any bank.

The study is also based on the historical-genetic

approach, the essence of which is the analysis of

historical trends, the reproduction of the historical

and social logic of the development of economic

systems.

3 RESULTS AND DISCUSSION

The analysis of modern literature on the sustainable

development of commercial banks allows us to single

Semenova, N. and Vasilkina, A.

The Fundamental Goals and Principles of Sustainable Development of a Commercial Bank.

DOI: 10.5220/0010590403450350

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 345-350

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

345

out two main approaches to disclosing the content of

this definition: broad and narrow.

According to the first approach (foreign scientists

and various organizations), the sustainable

development of a commercial bank is considered

from the standpoint of the main provisions of the

general theory of sustainable development. It

provides an assessment of four main components

(economic, social, environmental and institutional) of

sustainable development of a commercial bank.

Note that the first reference to sustainable

development in banking was used in the World

Bank's report ". Sustainable Banking with the Poor:

A Worldwide Inventory of Microfinance

Institutions." It examined the sustainability of

microfinance institutions as a new, socially oriented

business model for financial activities (World Bank,

1997). However, this report does not provide a

definition of the definition in question, but only

describes the social services that financial institutions

provided to people with low income. The monograph

Sustainable Banking: The Greening of Finance

(2001) by J. Bouma, M. Jeucken and L. Klinkers

argues that banks have a role to play in ensuring

environmental sustainability.

Within the framework of a narrow approach

(Bulanov, 2015; Fetisov, 2003), the sustainable

development of the bank is considered from the

position of ensuring its equilibrium state, and further

prospects under the conditions of the action of

external and internal environmental factors (mainly

of an economic and social nature), without paying due

attention to the changes taking place in the ecological

and institutional environment.

Commercial banks are complex dynamic systems,

the functioning of which obeys the laws of dynamic

equilibrium. They, as adaptive systems, are able to

change their behavior and ensure sustainable

development through managerial influences

(decisions). In our opinion, operating in market

conditions, a commercial bank has boundaries of a

zone of stability, at each point of which the bank

remains stable. These boundaries change depending

on the influence of multidirectional factors: the

political situation in the country and in the world;

changes in the commodity, consumer and labor and

capital markets; changes in legislation in the field of

regulation of financial and credit relations; the policy

of the Central Bank of the Russian Federation and

international financial and credit institutions and

others. In the long term, a bank will be sustainable if

its development proceeds along the tube of the

stability zone along the trajectory of sustainable

development. If the vector of the bank's functioning

is stagnant, then at some point the bank may fall out

of the stability zone, which will lead to its

disappearance. Consequently, stability in the short

term does not ensure sustainable development of a

commercial bank in the future. Stability characterizes

the state of the bank in the short term, and sustainable

development - in the long term.

In our opinion, stability is a static state of an

object, characterized by a certain number of stable

values of the parameters of this object. This category

is identified with invariance, i.e. maintaining any

properties, parameters constant for any changes in the

external and internal environment. Sustainable

development is a process aimed at a qualitative and

quantitative change of an object, its characteristics

(parameters). Therefore, the category “sustainable

development” should be viewed from the perspective

of a dynamic approach. In this regard, we understand

the sustainable development of a commercial bank as

its ability to maintain a dynamic balance for a long

time, effectively using its internal potential, adapting

in a timely manner to changes in external and internal

environmental factors in order to achieve its goals.

Thus, according to this approach, it is necessary to

ensure the successful development of the bank in the

long term. In this regard, the sustainable development

of a commercial bank will be considered by us as a

general goal.

Within the framework of this general goal, several

subgoals should be distinguished, i.e. fundamental

goals. In accordance with the concept of sustainable

development, four sub-goals can be distinguished:

economic, social, environmental, and institutional.

Since commercial banks are important actors in

the financial system, which in turn is a component of

the national economy based on market relations, the

dominant goals of banks will be the goals of the

economic component of goal setting, namely: capital

growth and business value growth.

Achievement of this goal is ensured by setting and

achieving a number of derived goals or goals of the

next level. These include:

increasing the client base and increasing the

level of customer loyalty;

establishing long-term partnerships with

influence groups (employees, shareholders,

government bodies, and others);

improving the competitive position of the bank

in the banking and financial services market;

formation of a modern infrastructure of a

commercial bank and the introduction of

modern technologies in order to increase labor

productivity and efficient use of resources;

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

346

increasing the economic efficiency of activities

and management of the bank and its structural

divisions.

The fundamental goals of banks are: formation,

expansion and development of the client base,

increasing the level of customer loyalty. The

activities of a commercial bank should be aimed at

solving the problems of customers (legal entities and

individuals). This determines their loyalty, that is,

their commitment to the bank, their willingness to use

its services for a long time. The higher the level of

customer loyalty, the greater the profit and

profitability of banking.

Achievement by a commercial bank of the goal of

increasing its client base is complicated by the

conflicting interests of primarily two main categories

of clients: depositors and borrowers. Bank depositors

are individuals and legal entities. Entering into a

relationship with the bank, they are interested in high

interest rates on deposits with minimal terms for

placing their funds. At the same time, the bank's

borrowers consider the availability of credit, the

speed and simplified procedure for processing

documents, understated requirements (up to their

complete absence) to collateral, low interest rates and

long borrowing periods as the most important features

of a loan product. The bank also has its own interests.

For him, the quality of the loan is primarily

determined by guaranteed repayment, which, as a

rule, excludes quick procedures for considering

applications and issuing loans, as well as their

complete or partial lack of security. Consequently, the

bank must carry out its financial and credit activities

taking into account the economic interests of all

interested parties. Its regulatory role should be

reflected in the development of a reasonable

economic policy and adequate mechanisms to ensure

a balance of interests of partners not only in the

current period of time, but also in the long term. The

bank must not allow the interests of some partners and

counterparties to dominate over others, therefore one

of the fundamental goals of a commercial bank is to

establish long-term partnerships with influence

groups (stakeholders).

The owners (shareholders) of the bank are

interested in the growth of profits, market value and

sustainable development of the bank. It is important

for managers to ensure the sustainable development

of the bank in a dynamic market environment. The

bank's personnel are interested in confidence in

keeping their jobs, decent wages, and career

opportunities. Clients are interested in the fulfillment

of their obligations by commercial banks on time and

in full. Business partners are interested in the

reliability of the bank, in the clear and timely

fulfillment of its obligations, and trusting relations

with the bank. The authorities are called upon, in

cooperation with the bank, to protect the interests of

society and investors. The society is interested in the

bank's participation in solving national and regional

problems. Thus, the establishment of long-term

partnerships with influence groups based on mutually

beneficial interests is the key to the successful

development of not only the bank, but also its

stakeholders.

Achieving the goal of increasing the economic

efficiency of the bank's activities and management

affects all aspects of the bank's activities and directly

affects its financial condition of the credit institution

(the size and quality of capital and assets, profitability

and liquidity, costs, profitability and profitability), its

compliance with mandatory standards and limits

established The Bank of Russia, it also provides for

improving the quality of management of the bank, its

operations and risks.

Effective management of the bank's divisions is

also of great importance for the efficient operation of

a commercial bank. The bank's organizational

structure directly depends on the chosen business

model. But regardless of the chosen organizational

structure, it must meet the following requirements:

prompt decision-making, no duplication of functions,

quick solution of the assigned tasks.

The second component in the system of

sustainable development of a commercial bank is the

social one. In recent decades, attention has increased

to the problems of social responsibility of business

and its role in the socio-economic development of

society. The problem of socially responsible business

behavior is reflected in the studies of many scientists,

such as G. Bowen (1953), M. Schwartz (2003), J.

Stiglitz (2020), A. Carroll (2017). The concept of

corporate social responsibility provides for the

observance of norms and rules implicitly defined or

undefined by legislation (in the field of ethics,

ecology, mercy, philanthropy, compassion, etc.) that

affect the quality of life of individual social groups

and society as a whole.

The fundamental social goal of a commercial

bank in the system of its sustainable development is

to increase its social responsibility. Its content is

covered by the following sub-objectives:

сompliance with ethical standards of doing

business;

creation of favorable conditions for the life of

bank employees;

The Fundamental Goals and Principles of Sustainable Development of a Commercial Bank

347

joint solution of social problems with partners

and authorities.

Compliance with ethical business conduct is

referred to as "fairplay". Forming the parameters of

the banking product (term, interest, commission), the

bank sets the conditions for working with the client or

the “rules of the game”. A bank focused on

sustainable development must refrain from

misleading customers by including hidden fees and

paid services without notifying the client. Unfair

behavior of credit institutions leads not only to a

deterioration in the economic condition of the client,

but also in the future may lead to a decrease in the

performance of the bank itself, a threat to its

economic stability due to the loss of confidence in it.

Ensuring the harmonious development of the

individual is one of the basic provisions of the

Concept of sustainable development. In this regard,

one of the sub-goals of the social component of the

goal-setting of sustainable development of a

commercial bank is to ensure favorable living

conditions for the bank's employees, which implies

proper working conditions, decent wages,

opportunities for professional and career growth, and

the company's care for its employees. These measures

allow a commercial bank to reduce staff turnover,

build employee loyalty to the company, and increase

the competitiveness of a credit institution by retaining

qualified personnel.

An important goal in the social component of the

goal-setting of a commercial bank is also the joint

solution of social problems with partners and

authorities. This also applies to issues of charity.

Credit organizations can not only make donations, but

also act as a conduit between their clients and

charitable foundations.

The main goal of the environmental component of

goal setting is to increase the bank's environmental

responsibility. Its achievement can be carried out by

setting the following subgoals:

rational use of natural resources, including

energy resources, as well as resources used by

the bank itself (diesel fuel, gasoline, electricity,

natural gas, etc.). This goal can be achieved

through the use of energy-saving technologies,

optimization of the bank's logistics system,

including through cashing and outsourcing.

assistance by the bank in the implementation of

projects related to environmental protection,

rational use of resources, i.e. the so-called

"green" financing of the economy.

The main goal in the institutional component of

goal-setting is the development of the banking

institutional environment. Its implementation

requires the achievement of the following subgoals:

transition to a partnership model of interaction

between a commercial bank, the Central Bank

and authorities. Through participation in

associative structures such as the Association

of Russian Banks and the Association of

Regional Banks, commercial banks have the

opportunity to lobby their interests in

government bodies and contribute to changes

in the legislative and regulatory framework.

development of new forms of interaction

between the bank and partners, assistance in the

development of banking infrastructure. The

digitalization of the economy, IT innovations in

the financial sector, marketing technologies are

changing the environment for the functioning

of commercial banks, in which new

institutional elements appear, such as financial

and technical organizations using technologies

and innovations in the field of financial

services. The integration of a commercial bank

with leased organizations allows us to

significantly expand the boundaries of classical

banking by combining banking and non-

banking products, which contributes to an

increase in the level of customer service and the

profitability of banks.

To achieve the considered fundamental goals, the

bank must be guided by the relevant principles. In

accordance with the main goals within the framework

of the four components of the goal-setting of

sustainable development of a commercial bank, we

have proposed the basic principles of sustainable

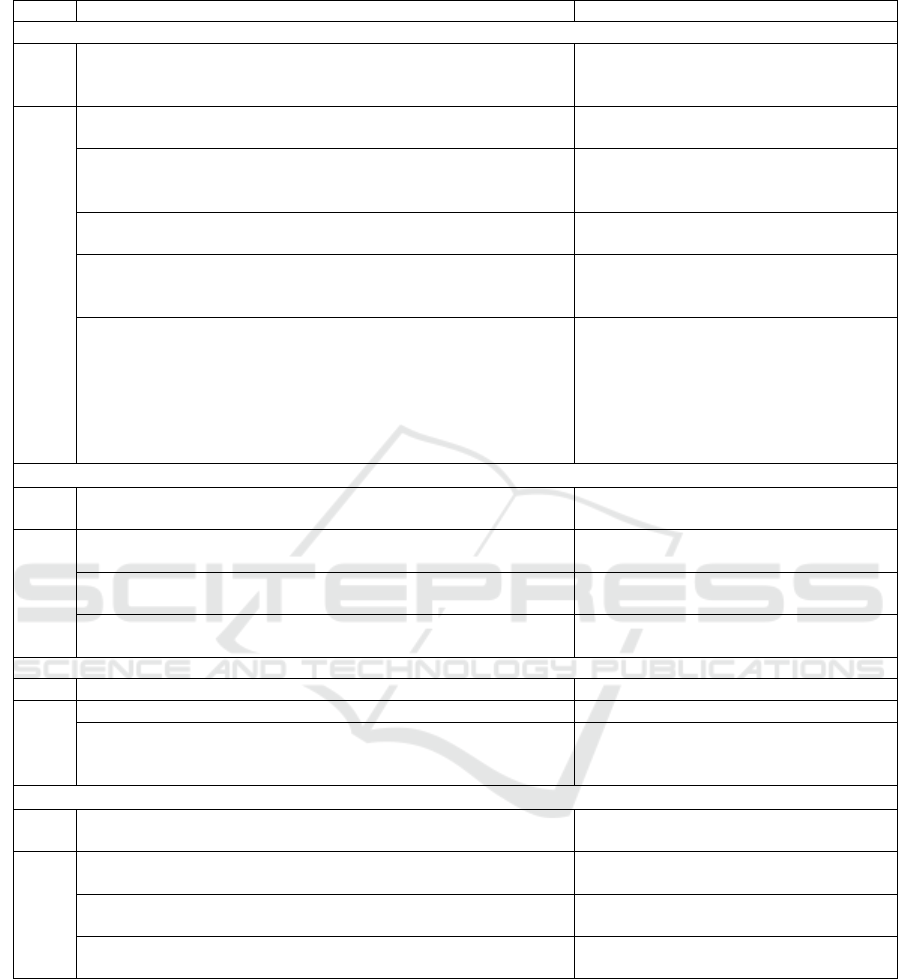

development of a commercial bank (Table 1).

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

348

Table 1: Fundamental goals and principles of sustainable development of the bank.

Level Goals Princi

p

les

The economic com

p

onent of

g

oal settin

g

1 1.1. Building up capital

1.2. Business value growth

Capitalization of own income

Capitalization of assets

Business diversification

2 2.1. Increasing the customer base and increasing customer loyalty Customer focus

Customer lo

y

alt

y

2.2. Establishing long-term trust relationships between the bank

and influence groups

Partnerships

Reliability of relationship

Trust

2.3 Improving the competitive position of the bank in the banking

and financial services market

Competitiveness

Com

p

etitive advanta

g

es

2.4. Formation of modern infrastructure of the bank and

introduction of new technologies

Information and technical security

Innovativeness

Securit

y

2.5. Improving the efficiency of activities and management of the

bank and its structural divisions

Effectiveness

Profitability and profitability

Resource saving

Motivation and stimulation of staff and

business partners

Minimizing risks

Trans

p

arenc

y

, o

p

enness of mana

g

ement

The social component of

g

oal settin

g

1 1.1. Increasing social responsibility in relation to shareholders,

em

p

lo

y

ees, customers of the bank and societ

y

as a whole

Social responsibility

2 2.1. Compliance with ethical business conduct Transparency

Fairness

2.2. Creation of favorable conditions for the life of bank

employees

Equity remuneration

Social securit

y

2.3. Joint solution of social problems with partners and

authorities

Social engagement

The ecolo

g

ical com

p

onent of

g

oal settin

g

1 1.1. Increasing the bank's environmental responsibilit

y

Environmental responsibilit

y

2 2.1. Rational use of natural resources Saving natural resources

2.2. Participation in financing and development of projects

related to environmental protection, rational use of natural

resources

Green financing

The institutional component of

g

oal-settin

g

1 Development of the banking institutional environment Participation in the development of the

b

anking institutional environment

2 2.1. Transition to a partnership model of interaction between the

b

ank and authorities

Partnership

2.2. Development of new forms of interaction between the bank

and

p

artners

Cooperation

Inte

g

ration

2.3. Development of modern banking infrastructure Involvement in the development of the

institutional environment

4 CONCLUSIONS

We regard sustainable development as the general

strategic goal of a commercial bank. This goal is

multifaceted, therefore, to achieve it in real practice,

it was structured into sub-goals, which made it

possible to identify the fundamental goals in

accordance with the requirements of the concept of

sustainable development in the following areas

(economic, social, environmental, institutional):

capital accumulation, business value growth;

increasing social responsibility; increasing

environmental responsibility; development of the

banking institutional environment. To achieve them,

it is necessary to implement the goals of the second

level, which reflect the bank's values at this stage of

The Fundamental Goals and Principles of Sustainable Development of a Commercial Bank

349

development. In accordance with the fundamental

goals, the principles of sustainable development

adequate to them have been substantiated.

REFERENCES

Bespalov, R.A. and Antonenko, S.V. (2019). Creation of a

"green" bank in the context of "digitalization" of the

economy. Bulletin of the Bryansk State University, 2:

143-151.

Bitkina, I.K. (2018). The influence of macroeconomic

factors on the deposit operations of commercial banks.

Bulletin of the Moscow Humanitarian and Economic

Institute, 1: 33-39

Bouma, J., Jeucken, M. and Klinkers, L. (2001).

Sustainable Banking: The Greening of Finance,

Sheffield, UK: Greening Publishing, 480.

Bowen, H. R. (1953). Social Responsibilities of the

Businessman. New York: Harper & Row, 248.

Bulanov, Ju.N. (2015). Stability of a commercial bank:

methodological aspects and methods of practical

implementation. Finance, credit, and banks, 3: 58-61.

Carroll, A. B., Buchholtz, A.K. and Shabana, K.M.

(2017). The Institutionalization of Corporate Social

Responsibility. Business and Society, 56 (8):1107-

1135.

Cosma, S., Venturelli, A., Schwizer, P. and Boscia, V.

(2020). Sustainable development and European banks:

Anon-financial disclosure analysis. Sustainability,

12(15): 61-46.

Fetisov, G.G. (2003). Stability of the banking system and

methodology for its assessment. Moskva: Finansy i

statistika, 425.

Miah, M.D., Rahman, S.M. and Mamoon, М. (2020). Green

banking: the case of commercial banking sector in

Oman. Environ Dev Sustain., 23: 2681–2697.

Schwartz M. and Carroll A. (2003). Corporate Social

Responsibility: A Three-Domain Approach. Business

Ethics Quarterly,13(4): 503–530.

Semenova, N.N., Ivanova, I.A. and Gribanov, A.V. (2019).

Assessment of external factors influence on

commercial bank deposit policy formation based on

dynamic modeling. Espacios. 40(13).

Stiglitz J. (2020). Key challenges facing modern finance:

Making the financial sector serve society. Finance:

theory and hractice, 24(2): 6–21.

World Bank (1997). Sustainable Banking with the Poor: A

Worldwide Inventory of Microfinance Institutions.

Washington, DC.

Zhixia, C., Hossen, Md. M. Muzafary, S. S. and Begum, M.

(2018). Green Banking for Environmental

Sustainability-Present Status and Future Agenda:

Experience from Bangladesh. Asian Economic and

Financial Review, 8(5): 571-585.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

350