Enterprises of the Kursk-Belgorod Mining Complex: Resource and

Economic Potential of Sustainable Development

Vera Samarina

a

, Svetlana Vostokova

b

and Olga Novikova

c

Starуy Oskol Technological Institute – а branch of National Research Technological University “MISiS”,

42 Makarenko st., Starуi Oskol, Russia

Keywords: Ferrous Metallurgy, Mining Complex, Ore Mining and Processing Plant, Iron Ore Deposit, Kursk Magnetic

Anomaly, Sustainable Development.

Abstract: The paper presents the authors’ point of view concerning resource and economic potential of the sustainable

development of enterprises of the mining complex, formed on the territory Kursk Magnetic Anomaly. In the

course of the research: a spatial layout diagram has been presented and a brief production characteristic of

plants in the Kursk-Belgorod mining complex has been given as well; based on the assessment of the volumes

of extraction of iron ore and quartzite, the production activity of the enterprises has been assessed; the resource

potential of the sustainable development has been estimated through the iron ore reserves as of 2019; based

on the values of the increase in the group of financial indicators for the period from 2012 to 2019, the

economic results and prospects have been estimated; taking into account a number of production and

economic factors, the prospects and limitations of the sustainable development of enterprises of the Kursk-

Belgorod mining complex have been identified. The research has shown significant economic achievements

of the mining and processing enterprises and favorable production prospects. The potential for increasing the

resource base of the complex is associated with increasing reserves at existing fields, and with the

development of new deposits.

1 INTRODUCTION

The relevance of the research is due to the need to

identify the resource and economic potential of

sustainable development of enterprises of the Kursk-

Belgorod mining complex, formed on the territory of

the world's largest iron ore province – the Kursk

Magnetic Anomaly, whose area is 160 thousand km

2

.

The sustainable development of industrial mining

complexes from the standpoint of achieving

economic results is considered, in particular, in

Russian (Kostyukhin and Savon, 2020; Serova et al.,

2020) and foreign (Barclay and Everingham, 2020;

Hao et all, 2020; Sanakulov, 2018) researchers’

works. Analyzing financial flows, R. Boschma et al.

(Boschma et al., 2014), M. Cehlar et al. (Cehlar et all,

2020), E. Korchak and T. Skufina (Korchak and

Skufina, 2020; Skufina et al., 2019), P. Papizh

(Papizh, 2015) defend the opinion that the mining

a

https://orcid.org/0000-0002-8901-5844

b

https://orcid.org/0000-0003-0017-7722

c

https://orcid.org/0000-0001-5839-4581

complex increases the investment attractiveness of

the region of presence, attracting national and foreign

investments. Industrial achievements, namely,

volumes of mined ore and produced iron ore

concentrate, pellets, sinter ore, etc., quite often

underlie the assessment of sustainable development

of mining complexes as well (Chen et al., 2015;

Narrei and Ataee-Pour, 2020; Fonseca et al., 2014;

Samarina et al., 2020; Sumit and Lodhia, 2014; Wang

et al., 2018). The industrial and economic results of

the activities of large industrial complexes were also

studied in the authors’ research (Samarina et al.,

2016; Samarina et al., 2019; Samarina et al., 2020).

Recognizing the significance of the results of these

and other scientific research, the authors emphasize

that currently in Russia there are no unified

approaches to assessing the resource and economic

potential of sustainable development of mining

222

Samarina, V., Vostokova, S. and Novikova, O.

Enterprises of the Kursk-Belgorod Mining Complex: Resource and Economic Potential of Sustainable Development.

DOI: 10.5220/0010588502220227

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 222-227

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

complexes localized in the iron ore province. All this

makes the presented research actual.

The purpose of the research is to characterize the

current state, as well as to assess the resource and

economic potential of sustainable development of the

Kursk-Belgorod mining complex.

Specific research objectives:

1. To present the spatial layout and brief

production characteristics of mining and processing

plants as part of the Kursk-Belgorod mining complex.

2. To assess production activities and resource

potential for sustainable development of mining

enterprises.

3. To compare the economic results and prospects

of mining enterprises.

4. To reveal the prospects and restrictions of

sustainable development of enterprises of the Kursk-

Belgorod mining complex.

2 MATERIALS AND METHODS

The research is based on an integrated approach,

which on the basis of territorial, resource, production

and organizational factors made it possible to identify

and study the prerequisites and prospects for the

sustainable development of the local mining complex

– an aggregative production association of enterprises

specialized in functional characteristics and localized

in a territory rich in iron ore deposits.

The core of the mining complex is mining and

processing plants (MPPs), the divisions of which are

interconnected by production processes: from the

extraction of iron ore, through its enrichment, to the

release of finished products such as iron ore

concentrate, sinter, pellets, hot-briquetted iron, etc.

(Papizh, 2015; Samarina et al., 2020; Sanakulov,

2018).

The research has been carried out on the materials

of the Kursk-Belgorod mining complex, formed on

the territory of the world's largest iron ore province –

the Kursk Magnetic Anomaly. The products of the

mining complex serve as the basis for Russian steel

production. Therefore, the most complete use of the

resource and economic potential depends not only on

the functioning of the Kursk-Belgorod mining

complex, but also on the development of many

sectors of the Russian economy. In addition, the iron

ore products of the enterprises of the complex as one

of the leading Russian export item are actively

exported abroad,

The paper analyzes the following performance

indicators of the enterprises of the Kursk-Belgorod

mining complex for the period from 2012 to 2019:

the results of production activities were

evaluated on the basis of indicators of the mass

of iron ore mined in 2019;

the resource potential was estimated through

iron ore reserves classified as A + B + С

1

as of

2019;

the economic results were assessed on the basis

of the growth for the period from 2012 to 2019

of the following financial results of MPPs:

revenue, profit from sales, EBIT and net profit;

the immediate economic prospects were

assessed on the grounds of the rating expert

evaluation presented on the Internet portal

Audit-Jt.ru.

The research involved some materials from the

state report "On the state and use of mineral resources

of the Russian Federation" (On the state, 2019); the

information from Stoilensky, Lebedinsky,

Mikhailovsky, Yakovlevsky MPPs and KMAruda

Combine’s official websites; the economic analysis

according to the enterprises book-keeping data has

been carried out using the Internet portal Audit-Jt.ru.

3 RESEARCH RESULTS AND

THEIR DISCUSSION

3.1 Mining and Processing Enterprises

on the Territory of the

Kursk-Belgorod Mining Complex

As of 2019, iron ore reserves of the categories A + B

+ C

1

of the Kursk-Belgorod mining complex

amounted to 31,457.1 mln tons and the category C

2

–

32,274.2 mln tons. The iron content in ores varies

from 29.5% (Stoilenskoye deposit) to 61.7%

(Gostishchevskoye deposit). There are several mining

and processing plants on the territory of the complex

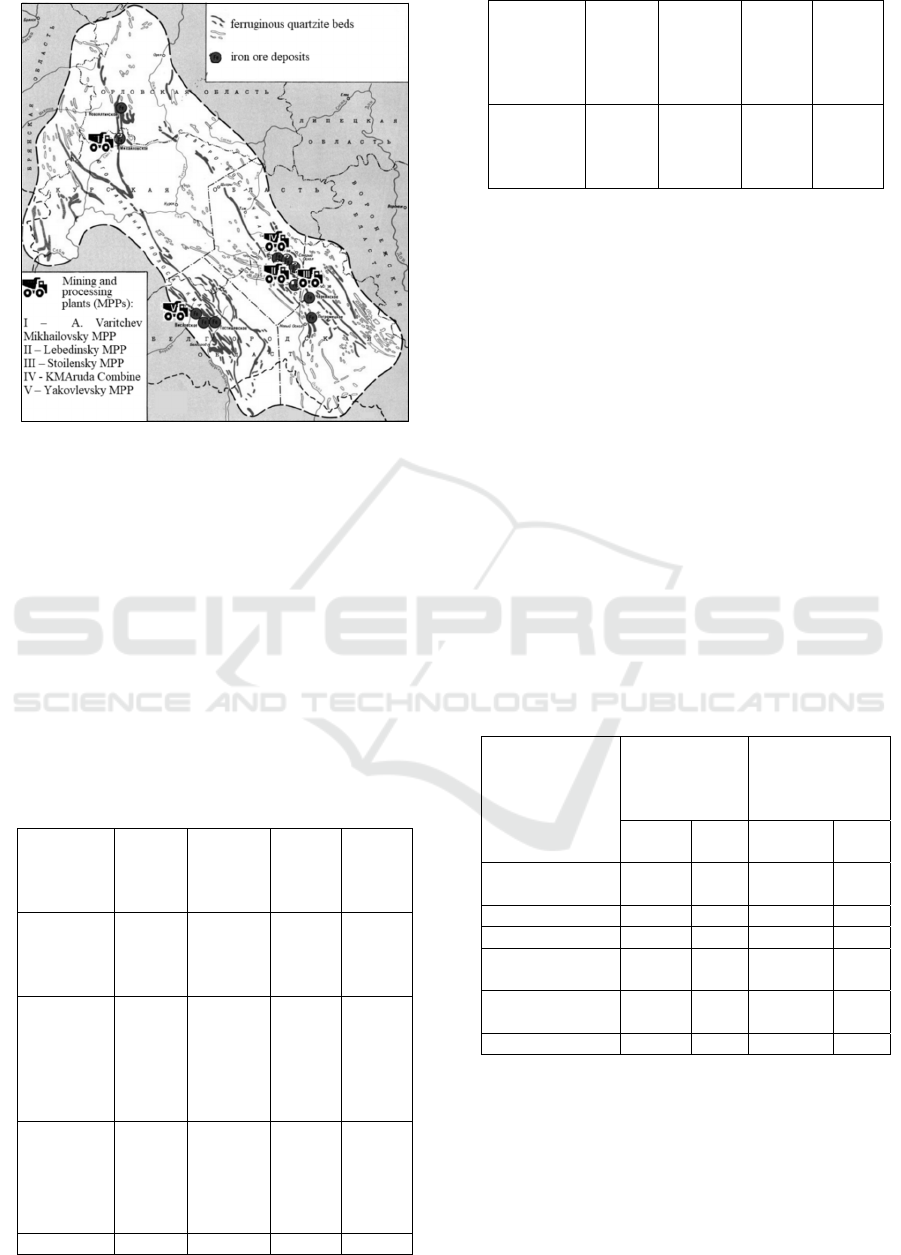

(Figure 1).

Enterprises of the Kursk-Belgorod Mining Complex: Resource and Economic Potential of Sustainable Development

223

Figure 1: The location of mining and processing plants on

the territory of the Kursk-Belgorod magnetic anomaly.

Most of MPPs gave the first ore in the 1950-60s

by means open-pit mining. An exception was

Yakovlevsky MPP (absorbed by Severstal in 2019),

mass ore underground mining began only in 2005;

currently an output is 1.2 mln tons. The cluster

supplies iron ore concentrate, ore, pellets, sinter ore

for Russian and foreign steel companies. JSC

Lebedinsky MPP produces hot-briquetted iron - the

most modern product of MPPs with iron content of

more than 90% (Table 1).

Table 1: MPPs as part of the Kursk-Belgorod mining

complex (compiled by the authors based on the information

from the MPPs’ websites).

Mining

enterprises,

Corporatio

n

Year of

opening

Personne

l, pers.

Mining

method

*

Iron ore

product

s **

Stoilensky

MPP,

NLMK

Group

1961 7540 О i/o; io

/c; io /

p

A.

Varichev

Mikhailovs

ky MPP,

Metalloinv

est

1957 9459 О s/o; io

/c; io /

p

Lebedinsky

MPP,

Metalloinv

est

1967 6413 О i/o; io /

p; hbi

KMAruda 1953 2380 U io /c

Combine,

Industrial

and

Metallurgic

al Holding

Yakovlevs

ky MPP,

Severstal

***

2018 1528 U i/o; s/o

* Method of ore mining: O – open-cut mining; U –

underground mining.

** Iron ore products: i/o – iron ore; s/o – sinter ore; io /c –

iron ore concentrate; io / p – iron ore pellets; hbi – hot-

briquetted iron.

*** The cessation of a legal entity activity from November

15, 2019

3.2 Production Activity and Resource

Potential for Sustainable

Development of Mining Enterprises

The authors estimate the production activity of the

mining complex through the volumes of iron ore

production; resource potential – through iron ore

reserves of category A + B + C

1

. The MPPs’ rating in

the Kursk-Belgorod mining complex in terms of

production and resource indicators is presented in

Table 2.

Table 2: Production and resource indicators of sustainable

development of enterprises of the Kursk-Belgorod mining

complex (compiled by the authors based on the materials

State Report (On the state, 2019).

Mining

enterprises

Production

activities (iron

ore mining)

Resource

potential

(reserves iron

ore

)

mln

tons

share mln tons share

Mikhailovsky

MPP

95.4 50.69 7674.0 29.7

Lebedinsky MPP 50.0 26.57 7011.4 27.1

Stoilensky MPP 36.8 19.55 6368.0 24.6

KMAruda

Combine

4.8 2.55 2922.0 11.3

Yakovlevsky

MPP

1.2 0.64 1872.3 7.2

Total 188.2 100 25847.7 100

The analysis shows that both from the standpoint

of assessing the resource potential and in the view of

production activities, Mikhailovsky MPP is in first

place: 7674.0 mln tons of iron ore reserves of

category A + B + С

1

(11.0% of the total Russian

reserves and 29.7% of the complex reserves); the

production amounted to 95.4 mln tons. The structure

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

224

of the MPP includes enrichment and pelletizing

plants, as well as a crushing and screening plant. The

number of personnel is about 9.5 thousand people.

The products are iron ore concentrate, fluxed and

non-fluxed iron ore pellets and sinter ore as well.

The second place is taken by Lebedinsky MPP:

7,011.4 mln tons of iron ore reserves of category A +

B + С

1

(9.5% of all-Russian reserves and 27.1% of

the complex's reserves); the production amounted to

50 mln tons. The structure of this MPP includes

enrichment, re-enrichment and pelletizing plants. The

number of personnel is about 6.4 thousand people.

Products: iron ore concentrate (including re-

enriched), fluxed and non-fluxed iron ore pellets, hot

briquetted iron.

The third place is taken by Stoilensky MPP:

6368.0 mln tons of iron ore reserves of category A +

B + С

1

(8.8% of all-Russian reserves and 24.6% of

the complex's reserves); the production amounted to

36.8 mln tons. The structure of the MPP includes a

pelletizing plant. The number of personnel is over 7.5

thousand people. The production: iron ore

concentrate, iron ore pellets, sinter ore.

Then, KMARuda Combine follows by a wide

margin: 2922.0 mln tons of iron ore reserves of

category A + B + С1 (3.2% of all-Russian reserves

and 11.3% of the complex's reserves); the production

amounted to 4.8 mln tons. The structure of the

combine includes a crushing and processing plant.

The number of personnel is 2.4 thousand people.

Products: iron ore concentrate.

Yakovlevsky MPP went out of its existence as a

legal entity on November 15, 2019, having joined

JSC Severstal as a structural unit. The deposit of the

same name is under development: the reserves of iron

ore of category A + B + С

1

are small: 1,872.3 mln

tons, but the reserves of category С

2

are estimated at

7,740.5 mln tons. The output was 1.2 mln tons. More

than 1.5 thousand people work at the MPP. The

production: iron and sinter ore.

3.3 Economic Results and Prospects for

the Activities of Mining Enterprises

of the Mining Complex

The economic results of mining enterprises were

assessed on the grounds of the growth values of a

number of financial indicators for the period from

2012 to 2019. The nearest economic prospects were

determined on the basis of the rating assessments

(Table 3).

Table 3: Indicators of economic development and prospects

of the Kursk-Belgorod mining complex’s MPPs (compiled

by the authors on the basis of the enterprises’ statements of

financial condition).

Mining

enterprises

Growth from 2012 to 2019, % Econo

mic

prosp

ects

Revenue Sales

profit

EBIT Net

p

rofit

Mikhailovsk

y MPP

103,4 127,6 113,6 116,1 ААА

Lebedinsky

MPP

118,1 129,4 124,7 138,1 ВВ

Stoilensky

MPP

107,5 121,3 111,9 111,8 АА

KMAruda

Combine

41,5 25,3 46,5 32,6 ВВВ

Yakovlevsky

MPP

n/a n/a n/a n/a n/a

* An assessment of the economic prospects of the

enterprises: BB – normal; BBB – positive; AA – very good;

AAA – excellent;

* n/a – no data for analysis.

From the standpoint of achieving profitability of

production activities, the best indicators are shown by

Lebedinsky MPP – for the period from 2012 to 2019,

this enterprise provided the largest increase in

indicators. This is followed by Mikhailovsky MPP

and Stoilensky MPP by a small margin. The results of

KMAruda Combine are much worse. At the same

time, Mikhailovsky MPP and Stoilensky MPP have

the best immediate economic prospects. KMAruda

Combine shows the worst result here too.

3.4 Assessment of the Prospects for

Sustainable Development of the

Enterprises of the Kursk-Belgorod

Mining Complex

Lebedinsky MPP demonstrates best economic

performance among the enterprises of the complex

and experts assess the nearest economic prospects as

"normal". In 2018, in the process of combining

deposits through revaluation and exploration of the

Lebedinskoye deposit, iron ore reserves of categories

A + B + С

1

increased by 3529.2 mln tons, category С

2

– by 3624.7 mln tons. At the same time, the reserves

of the Stoylo-Lebedinskoye deposit were

overestimated and decreased: categories A + B + С

1

by 2128.6 mln tons, category С

2

– by 1785.0 mln tons

(On the state…, 2019). Thus, the positive balance of

the increase in reserves of the combined field,

developed by Lebedinsky MPP, in the A + B + С

1

categories amounted to 1400.6 mln tons, in the С

2

category – by 1839.7 mln tons. The enterprise is the

Enterprises of the Kursk-Belgorod Mining Complex: Resource and Economic Potential of Sustainable Development

225

only producer of hot briquetted iron in Europe with a

content of useful substance more than 90%.

Stoilensky MPP has been developing the

Stoilensky ferruginous quartzite deposit for 60 years.

The MPP firmly occupies the third position in terms

of production and economic indicators among the

enterprises of the Kursk-Belgorod mining complex.

The bulk of the company's products are shipped to

Novolipetsk Metallurgical Plant, the largest steel

plant in Russia. The experts assess the immediate

economic prospects of the enterprise as “very good”.

KMAruda Combine is developing the

Korobkovskoe ferruginous quartzite deposit, which

has been in operation since 1953, using underground

mining. In order to increase production, the MPP is

developing all deep horizons, which increase the cost

of production. All economic indicators of the plant

are 2.5-5 times behind the corresponding indicators

of other enterprises of the Kursk-Belgorod mining

complex. Nevertheless, having closed the year 2017

with a net loss of 1.5 billion rubles, the enterprise was

able to make further profits: 2.17 billion in 2018 and

2.45 billion in 2019. The experts assess the immediate

economic prospects of the enterprise as “normal”.

Yakovlevsky MPP ceased to exist as a legal entity

on November 15, 2019, having joined Severstal as a

structural unit. The eponymous deposit of rich

hematite-siderite-martite ores (iron content is 61%) is

in developmental stage.

In addition to the deposits being in operation, on

the territory of the Kursk-Belgorod mining complex,

the Vislovskoye and Gostishchevskoye deposits with

rich hematite-martite ores (iron content is 60.7% and

61.7%), as well as the Prioskolkoe deposit of

ferruginous quartzite (iron content is 37.1 %). The

deposits are distinguished with complex mining and

geological conditions of the development. Therefore,

despite high potential, with existing technologies, the

development of these fields is not economically

expedient.

4 CONCLUSION

At the current productive rates, the reserves of iron

ore of the Kursk-Belgorod mining complex’s

enterprises will last for several centuries. The

research has shown MPPs’ significant economic

achievements and their favorable prospects. Despite

the high degree of development of the raw material

base, the expansion of existing production capacities

continues on the territory of the Kursk-Belgorod

mining complex. The potential for increasing the

resource base of the complex is associated, firstly,

with increasing reserves at existing deposits, and

secondly, with the development of rich in iron new

deposits.

The total production of the Kursk-Belgorod

mining complex’s enterprises amounted to 188.2 mln

tons, which is about half of the production in Russia.

At the same time, metallurgical enterprises located on

the territory of the complex smelt less than a quarter

of Russian steel. The lack of metallurgical capacities

is compensated by the supply of iron ore products to

the South Ural and West Siberian regions of Russia

which meet with resource shortage and also abroad.

The large scale of the raw material base, the

quality of iron ores, convenient horizons and simple

operating conditions in comparison with other iron

ore provinces’ deposits, provide the Kursk-Belgorod

mining complex with sustainable development and a

prominent place not only in Russia, but also on

international markets. The spread of the economic

crisis caused by the coronavirus pandemic may lead

to a decrease in the production activity of the country

and the world’s industry which will inevitably affect

the demand for iron ore products. It can be expected

that during the crisis, the mining of iron ore by the

Kursk-Belgorod mining complex’s enterprises will

significantly decrease, however, rich resource and

economic potential will allow a rapid increase in

production capacity with the recovery of the country's

economy.

REFERENCES

Barclay, M.A. and Everingham, J.-A. (2020). The

governance of mining regions in Australia (2000–2012).

Journal of Rural studies, 75: 196-205.

Boschma, R., Balland, P.-A. and Vaan, M. de (2014). The

formation of economic networks: a proximity approach.

Regional Development and Proximity Relations.

Cheltenham, UK and Northampton, MA, USA: Edward

Elgar.

Cehlar, M., Rybar, P., Mihok, J. and Engel, Ja. (2020).

Analysis of investments in the mining industry. Mining

technology and technology. 1 (8): 4-31.

Chen, L., Tang, O. and Feldmann, A. (2015). Applying GRI

reports for the investigation of environmental

management practices and company performance in

Sweden, China and India. Journal of Cleaner

Production, 98: 36-46.

Fonseca, A., McAllister, M. L. and Fitzpatrick, P. (2014).

Sustainability reporting among mining corporations: a

constructive critique of the GRI approach. Journal of

Cleaner Production, 84: 70-83.

Hao, Y., Wu, Y., Ranjith, P.G., Zhang, K and Li, P. (2020).

New insights on ground control in intelligent mining

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

226

with Internet of Things. Computer communications,

15015: 788-798.

Korchak, E.A. and Skufina, T.P. (2020). Welfare of

Resource-Extracting Cities in the Russian Arctic:

Challenges and Prospects. IOP Conference Series:

Earth and Environmental Science, 539 (1): 012072.

Kostyukhin, Yu.Yu. and Savon, D.Yu. (2020). Improving

steel market perfopmance indicators in the face of

increased competition. Chernye metally, 4: 64-68.

Narrei, S. and Ataee-Pour, M. (2020). Estimations of utility

function and values of sustainable mining via the choice

experiment method. Journal of Cleaner production,

26710, 121938.

On the state and use of mineral resources of the Russian

Federation in 2018: State Report.

Papizh, Yu. (2015). Principles of creation of territorial-

production clusters for the development of mining

regions. Visnyk Mariupolʹsʹkoho derzhavnoho

universytetu. Ser.: Ekonomika, 9: 38-48.

Samarina, V., Skufina, T., Samarin, A. and Baranov, S.

(2016). Some system problems of Russian mining

enterprises of ferrous metallurgy. International Review

of Management and Marketing, 6(S1): 90-94.

Samarina, V., Skufina, T., Samarin, A. and Ushakov D.

(2019). Modern conditions and prospects of Russia’s

coal mining industry development. Espacios, 40 (16): 6.

Samarina, V.P., Skufina, T.P., Kostyukhin, Yu.Yu. and

Savon, D.Yu. (2020). Relationship between iron ore

deposits and spread of heavy metals in shallow water

rivers: natural and man-caused factors. CIS Iron and

Steel Review, 19: 75-80.

Samarina, V., Skufina, T. and Samarin, A. (2020). The

experience of using GRI Standards in sustainable

development reports by Russian industrial corporations.

E3S Web of Conferences, 208: 07011.

Sanakulov, K.S. (2018). Navoi mining and metallurgical

combinat – leader of the mining industry in Uzbekistan.

Mountain magazine, 9: 4-9.

Serova, N., Korchak, E. and Skufina, T. (2020). The Arctic:

Strategic Priorities of Circumpolar Countries. IOP

Conference Series: Materials Science and Engineering,

753 (7): 1-8.

Skufina, T., Baranov, S. and Samarina, V. (2019).

Modeling the Production of GRP Regions of the North

of Russia. FarEastСon 2018. Smart Innovation, Systems

and Technologies, 139: 173-179.

Sumit, K. and Lodhia, N.M. (2014). Corporate

Sustainability Indicators: an Australian Mining Case

Study. Journal of Cleaner Production, 84: 107-115.

Wang, Ch., Wang, L. and Dai, S. (2018). An indicator

approach to assessing industrial sustainability: the

example of the Capital Economic Circle of China.

Cleaner Production Magazine, 194: 473-482.

Enterprises of the Kursk-Belgorod Mining Complex: Resource and Economic Potential of Sustainable Development

227