Financial Mechanism for Sustainable Regional Development

Anastasiia Ostovskaya

a

, Elena Polishchuk

b

and Irina Pavlenko

c

V.I. Vernadsky Crimean Federal University, Prospect Vernadskogo 4, Simferopol, Russia

Keywords: Financial Mechanism, Sustainable Development, Region, Index, Integral Index, Priority Direction.

Abstract: The research is devoted to the study of the financial mechanism and its impact on the effectiveness of regional

policy, improving the quality of life of the population and the level of sustainable development of the region.

It is established, that the solution of the problems influencing social and economic development of the region,

needs realization of the basic group of problems, development and realization of strategic directions which

influence on perfection of the financial mechanism. Five basic directions of development of the financial

mechanism of the region were singled out: 1) anti-crisis direction; 2) direction connected with the restoration

of the financial mechanism of sustainable development of the region; 3) direction connected with the

formation of the main sources of the financial mechanism of sustainable development of the region; 4)

innovation and investment direction; 5) direction connected with the capacity building of the financial

mechanism of sustainable development of the region. The presented directions suggest the application of

appropriate tools, forming financial flows, contributing to the achievement of sustainable development of the

region.

1 INTRODUCTION

Regions showing steady economic growth make a

priority goal within social and economic development

strategy and are also an indicator of the strong

economy of the country. For this reason, the acute

problems requiring urgent solution include

identifying the regional potential, applying efficient

instruments for utilization of such potential,

economic effect maximization and meeting regional

socio-economic needs, which are expected to result in

the steady development of the region.

Lack of financial resources for regional

development is explained by a number of factors

including the following: the majority of the regions

have insufficient tax basis, they are economically

unappealing for investors and lack potential and

infrastructure to attract financial resources from the

international organizations into their project activity.

Therefore, such regions are particularly vulnerable,

experience lack of financing and, thus, require

different financial mechanisms and instruments to

support their development.

a

https://orcid.org/0000-0002-7582-6531

b

https://orcid.org/0000-0001-7796-4770

c

https://orcid.org/0000-0001-6783-6273

To a great extent, the efficiency of the financial

mechanism in a region affects the efficiency of the

regional policy, improves quality of living and rate of

sustainable development of a region.

Successful performance and development of the

regional economy greatly depend on the conditions in

the region and its ability to provide self-sustained

budget for its activities, define its own priorities in

development and financial stability maintenance and

achieve well-balanced financial indices while

expanding its economic resources (Verbinenko &

Badylevich, 2012).

The purpose of the research is elaboration of

practical recommendations on strengthening the

financial mechanism in sustainable development of a

region.

According to our hypothesis the development of

the financial system of the region presupposes

optimal, rational and efficient utilization of the

financial mechanism in order to meet the social and

economic goals.

Advanced financial mechanism of regional

development is based on defining a model of the

regional financial system development.

Ostovskaya, A., Polishchuk, E. and Pavlenko, I.

Financial Mechanism for Sustainable Regional Development.

DOI: 10.5220/0010588201990206

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 199-206

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

199

Financial sustainability works as an indicator of

efficient regional development as it shows capability

of the region to develop socially and economically

while effectively involving innovative tools of

financial resources management with the purpose of

balancing out the disproportions in financing

different segments of regional economy (Pande &

Pande R., 2007).

Regional development requires efficient

economic foundation that would facilitate social,

economic and ecological stability. Economic self-

reliance of the regions depends on the economic

resources available for their independent functioning,

meeting the needs of the territory and financing socio-

economic development (Golodova, 2011).

According to our reckoning, modeling efficient

financial system of the regions remains an issue and

originates from the effective combination of federal

and local budget financing, financing from the

businesses, the population, financial and credit

institutions as well as external investments.

Social and economic development certainly

results from the mutual efforts of all the subjects

capable of accumulating resources by means of

building an efficient financial mechanism with the

purpose of enhancing its financial sufficiency. For the

time being, many researches have been focusing on

the model of the country’s financial mechanism and

its functioning, which is, first of all, explained by the

tangled situation in the country in terms of financial

security (Farrakhova & Daryakin, 2017).

The leading role in creating efficient mechanism

of socio-economic development in the regions

belongs to the organization of budgetary relations,

forming of stable income base and delimitation of

authority between the center and the regions as well

as between the government and local authorities,

functional gradation of regional expenditures,

preferences in economic regulation of local order

placement and number of orders, small and medium

enterprise development, organization of the market

infrastructure, etc.

2 SOLUTIONS AND

RECOMMENDATIONS

The financial mechanism characterizes capability of

the regions to utilize their financial resources in order

to meet social and economic needs of the subjects and

defines potential for their development. This provides

for the possibility of carrying out its quantitative and

qualitative evaluation with regards to its financial

sufficiency.

Despite dependence of the capacity and

sufficiency of the financial mechanism on the

regional financial system, facilitating its ability to

promptly and efficiently react to threats and withstand

them is one of the priority goals and a factor of steady

socio-economic development (Makarova, Zubko,

Bestuzheva, Chusov, Surkova, 2016).

We shall make allowance for the formation and

utilization of the financial mechanism on the basis of

a complex of financial relations, and such systemic

approach requires result-oriented processes, i.e.

processes directed at achieving a certain set of goals.

The goals of formation and utilization of the

financial mechanism include:

optimization of financial resource capacity and its

management;

building security system in order to prevent the

regional economy from the destructive effects of

internal and external factors;

insuring social security and wellbeing of the

population;

building up financial stability reserve of the

economy.

The algorithm of structuring and utilizing the

financial mechanism is based on definitive and

scientifically grounded principles providing for its

effective functioning and meeting the goals that have

been set.

Organizational side in building up and utilization

of the financial mechanism of regional development

is one of its basic elements providing a link between

objects and subjects. This process consists in

exploring the object, identifying potential and

existing, external and internal factors, their impact,

planning and constant monitoring of the decision

making efficacy.

These functions shall be performed by the

subjects, i.e. governmental and local authorities,

businesses, households, financial and credit

institutions and external investors supposedly acting

to the benefit of the region’s socio-economic

development. Herewith, governmental and local

authorities are obliged to lay the ground for the

workability and efficiency of the financial

mechanism functioning in the regions and to control

compliance with laws.

Among the objects there may be observed , firstly,

a certain hierarchy in the national economy within the

territory of the regions subject to the implementation

of the financial mechanism; secondly, a complex of

financial relations facilitating formation and

utilization of the financial mechanism of regional

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

200

development; thirdly, the total of all financial

resources.

Financial methods functioning as impact

instruments in the process of formation and utilization

of the financial mechanism were defined. The impact

is achieved through managing the flow of financial

resources owned by the subjects, efficacy evaluation,

economic stimulation and responsibility for poor

utilization of funds (Menshchikova, 2010).

3 METHODOLOGY OF THE

STUDY

Financial sufficiency of the regions is directly

dependent on the volume of its own financial

resources, budget efficacy and autonomy, which is

achieved by means of effectively utilizing the

financial mechanism that can fully satisfy social and

economic needs of the region while leaving out

external resources or minimizing their involvement.

Efficacy of the socio-economic development of

the region is to a great extent conditioned by

successful local budgeting which involves building

up a system of financial relations directed at the

accumulation, distribution and utilization of financial

resources of local authorities to insure financial

sufficiency of the regions and their steady

development.

When evaluating budgeting, it is reasonable to

take into consideration the local incomes of the region

as well as inter-budgetary transfers. Hence, the

budget structure includes tax revenues (TR), nontax

revenues (NTR), income from capital transactions

(ICT) and inter-budgetary transfers (IBT). Therefore,

the capacity of the budget mechanism of the regions

(BM) is calculated according to the following

formula:

BM = TR + NTR + ICT+ IBT (1)

Socio-economic development of the regions

predetermines growth of the financial mechanism

capacity of the businesses, which is consequently

expected to improve their financial sufficiency, i.e. to

provide for their ability of successful financial

resources management in the conditions of

continuing disruptions from inside and outside and

their ability to develop themselves in the running

period and in the long term.

Capacity of the businesses’ financial mechanism

in the regions (BFM) is defined as a total of their own

capital (OC) and borrowed capital (BC):

BFM = OC + BC (2)

Evaluation of the businesses’ financial

mechanism has the purpose of on-the-spot correction

in management and its adequate functioning and is

carried out on the basis of index system combining

wealth index, liquidity and financial solvency indices,

financial soundness index and profitability index.

In regards to financial and credit institutions, their

financial mechanism capacity (FCIFM) is defined by

their own capital (OC) and customer deposits (CD),

i.e. the funds obtained from legal entities and

individuals.

FCIFM = OC + CD (3)

Evaluation of the financial and credit institutions’

financial mechanism involves the indices based on

capital structure and capital adequacy, structure of the

obtained and borrowed funds, asset quality and

dynamics of certain assets and liabilities (Zinisha,

Ivanenko, Labanova, 2019).

Adequately selected instruments in the financial

and credit institutions’ financial mechanism

evaluation allow for prompt and efficient detection of

their weaknesses and potential as well as for

disclosure of hidden reserves in order to enhance their

functional efficiency.

External investors’ financial mechanism (EIFM)

is defined by the direct foreign investments (DFI)

attracted into the economy of the regions:

EIFM = DFI (4)

External investors’ financial mechanism

evaluation is crucial due to the fact that foreign

investments are capable of contributing to the

financial stability and economic growth in the regions

in the conditions of limited internal funding.

The total financial mechanism of regional

development (FMRD) is represented by the formula

below:

FMRD = BM + BFM + FCIFM + EIFM (5)

Defining financial mechanism capacity provides

for the possibility of evaluating the economic

potential of the regions and their subjects (local

authorities, businesses, financial-and-credit

institutions, external investors), which is expected to

result in better planning of their socio-economic

development.

Elaboration and refinement of the financial

management mechanism in the regions requires prior

Financial Mechanism for Sustainable Regional Development

201

analysis of their built up financial mechanism

capacity, external and internal factors of its formation

and utilization (Stehnei, Irtysheva, Gurina, 2018).

By means of comparing the methods of distinct

complex evaluation, taxonometry method was found

the most adoptable for the purpose of synthesizing the

overall performance index of the financial

mechanism of regional development; this method is

based on defining the deviation between the objects

of the analysis and the reference standard.

The input information matrix is represented

below in its standard form:

11 1 1

21 2 2

1

1

... ...

... ...

.....

... ...

.....

... ...

jn

jn

iijin

mmjmn

x

xx

x

xx

X

x

xx

x

xx

(6)

n – the number of indices (j=1,2,...,n);

m – the number of years (i=1,2,...,m);

Хіј – the value of index j which defines the index

of year i.

The indices which do not make a significant

difference for the final result were excluded from the

preliminary list. Doing this required calculation of the

coefficient of variation according to the formulae:

j

j

j

X

=ν

σ

(7)

m

)X(X

=σ

m

1=i

j

2

-

j

ij

(8)

(9)

Х

іј

– the value of index j for year i;

jX

– arithmetical average of index j;

2

j

ij

XX

– mean-square deviation of index j;

ν

j

– coefficient of variation of j.

Such condition shall be taken into account for

each j index:

ν

j

> e,

е – an extreme value.

Thus, in case the coefficient of variation of

indices (νj) is less than 0,1, they are semipermanent

and are considered equivalent. From the standpoint

that the selected indices are varied, their values can

be standardized (normalized) according to the

formula:

j

j

ij

σ

X-

=

X

Z

ij

(10)

The next stage required comparison of the

obtained factual data to the value identified as a

referenced standard. All the indices were to be

divided into two groups: driver indices (their growth

facilitates financial mechanism of regional

development) and disincentive indices (such

deferring growth).

In order to measure the referenced standard point

(P

0

), it was necessary to select the largest values

among the driver indices and the lowest values among

the disincentive indices:

001 0 0

( ,..., ,..., )

kn

P

zzz

(11)

where

max

ok ik

i

zz

kJ

min

ok ik

i

zz

kJ

J – the multitude of driver indices.

The final stage of defining the integral index

required a set of operations. First, the deviation

between the points (C

io

) that represent the analyzed

elements and the referenced standard point (P

0

) was

calculated according to the formula:

2

00

1

()

n

iikk

k

Czz

(12)

i =1,2,….,m,

k =1,2,….,n.

Second, the integral index value of the financial

mechanism of regional development was calculated

according to the formula:

2

000

1

1

()

m

i

i

SCC

m

(13)

m

X

=X

m

1=i

j

ij

∑

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

202

Hence, the integral index allows for the complex

financial mechanism level analysis in relation to the

development of a specific region and suggests a set of

measures in order to eliminate the problems detected

in the process of enhancing the financial mechanism

of each subject. The closer the integral index comes

to 1, the higher is the level of the financial mechanism

and, vice versa, the smaller is the index, the less

sufficiency it shows (Storonyanska, 2015).

With the reference to the integral index, we

singled out five levels of financial mechanism of

regional development: low, above average, average,

above average and high; the strategy of enhancing the

financial mechanism is selected according to the

level. The extreme values of integral index are given

in table 1.

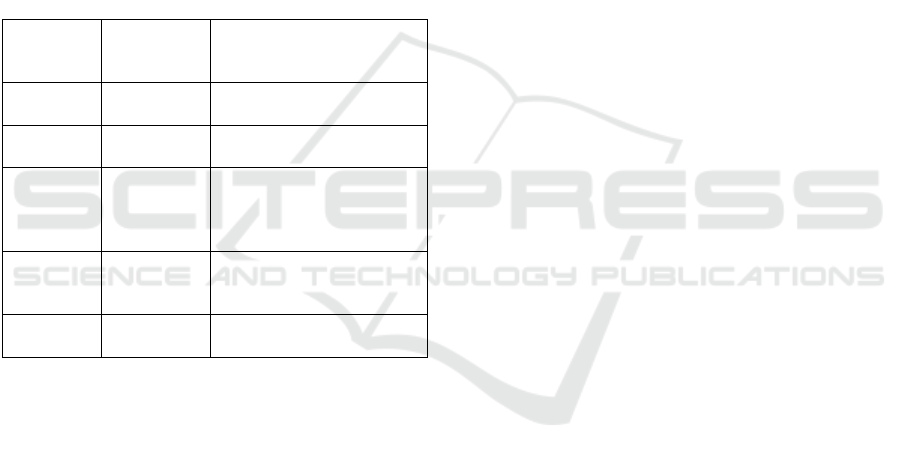

Table 1: Characteristic of the financial mechanism levels of

regional development.

Interval

Financial

mechanism

level

Strategy of enhancing

financial mechanism

[0;0,2)

low Anti-recess strategy of

regional development

[0,2;0,4)

below

average

Financial mechanism

recuperation strateg

y

[0,4;0,6)

average Resources

optimization strategy in

building up the financial

mechanism ca

p

acit

y

[0,6;0,8)

above

average

Innovation and

investment strategy of

re

g

ional develo

p

ment

[0,8;1]

high Financial mechanism

enhancement strate

gy

Therefore, differentiated approach with applied

criterion of financial mechanism level allowed for

singling out five groups of regions: regions with low

financial mechanism level, regions with below

average financial mechanism level, regions with

average financial mechanism level, regions with

above average financial mechanism level and regions

with high financial mechanism level. With regards to

the recurrent effect of the diverse internal and

external factors of different, either positive or

negative nature, on the financial system of the region,

the current level of financial mechanism is largely

situational and may be subject to change in the next

periods. Subsequently, it is of great importance to

select the correct strategy, the most efficient model of

financial system development and implement it

timely and appropriately.

The issues reported in the study suggest necessity

of elaboration and implementation of the strategy to

enhance the financial mechanism of regional

development as a tool providing for the stability of

the regional financial system and socio-economic

development. The strategy involves a number of

measures insuring a greater extent of independence

for the local budgets, elaboration of the complex

recuperation program for domestic businesses,

implementation of the mechanisms withstanding

internal and external threats to their economic

activity, enhancement of the households’ financial

mechanism and their involvement in the investment

processes, stimulation of bank activity and foreign

investments in the regions through economic and

administrative support and initiation of cross-border

cooperation.

4 DISCUSSION

Dynamic development of regions in an open economy

is impossible without determining the system of

priorities and ensuring the coherence of actions of all

government bodies, enterprises and organizations,

along with the population, and financial and credit

institutions located on its territory (Ul'janickaja,

2013).

Solving the above-mentioned issues of socio-

economic development requires the development and

implementation of a regional strategy. The strategy of

strengthening the financial mechanism of regional

development holds a key place among its

components, which is primarily due to the importance

of financial support for its functioning and

development.

The strategy of strengthening the financial

mechanism of regional development is a model for

the development of its financial system, which

provides for the most rational, optimal, effective use

of the mechanism for achieving regional goals. This

strategy is one of the main tools for implementing a

balanced financial policy of the state, while the

financial goals of regional development should be

formulated in the form of a certain concept (Tolstova,

2012a).

When implementing the strategy of strengthening

the financial mechanism for the regional

development, it is important to conduct a strategic

analysis, a comprehensive study of external and

internal factors and identify their impact in order to

develop activities to achieve the goals of regional

socio-economic development.

Considering that the strategy is formed on the

basis of a conceptual approach, there are five possible

options. The most appropriate option is selected

Financial Mechanism for Sustainable Regional Development

203

according to the existing level of the financial

mechanism, which is determined beforehand. Each

strategy includes the main objectives that should be

aligned with the goals of the regional social and

economic development, the mechanisms for its

implementation. The institutional environment

should be taken into account as well (Tolstova,

2012b). .

Common to all strategies for strengthening the

financial mechanism of regional development are the

activities aimed to restore the financial stability of the

regions, intensify financial flows and ensure further

development.

The priority objectives include the following:

building up the region’s own financial

mechanism;

optimization of inter-budgetary relations;

stimulating business activity of enterprises and

organizations, as well as self-employment;

– assistance in attracting investment resources for

regional development.

The choice directly depends on the regional

financial mechanism level and represents the optimal

direction for its financial system operation. The

strategy foresees a sequence of actions taken by local

and state authorities with the optimal combination of

appropriate instruments for strengthening the

financial mechanism in order to attain balanced

regional development of the financial system (table

2).

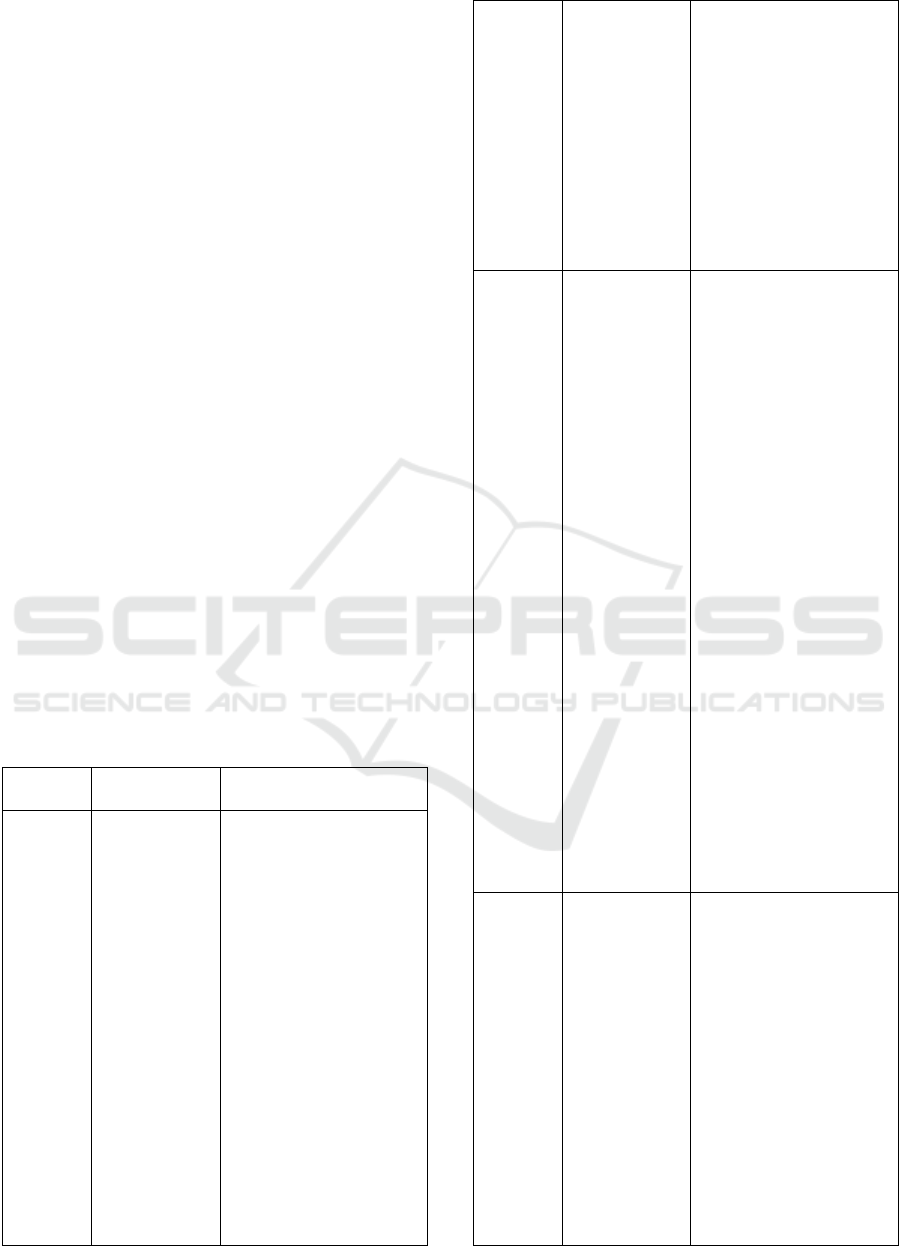

Table 2: Strategic directions to strengthen the financial

mechanism of regional development.

Directio

n

Basis for the

application

Measures

Anti-

crisis

direction

The financial

system of a

region is in

crisis (low

level of all

components of

the financial

mechanism)

restrictions in the

provision of guarantees

by local authorities to

prevent possible abuse

and increase in budgetary

debt;

stimulating

entrepreneurial activity in

the region through the

creation of an appropriate

institutional environment,

introduction of a tax

incentive system,

provision of

administrative assistance

to local authorities;

liquidation of financially

weak banks or their

joining to more

financially stable banking

institutions;

assistance in financial

rehabilitation of

unprofitable enterprises

in the regions;

optimization of the

regional sectoral structure

and diversification of its

economy;

financial support to the

city-forming enterprises

in order to remove

economic and social

tensions in the region

Restorati

on of the

financial

mechani

sm for

regional

develop

ment

The regional

economy is at

the stage of

recession

balancing the needs in

financial resources and

the opportunities for their

formation (attraction) in

the regions;

restrictions in financing

economic sectors with no

or low social and

economic effect;

improvement of the

investment climate in the

region to attract external

investors to the regional

financial system;

stimulating the

investment activity in the

region funded by local

business entities and the

population, regional

financial and credit

institutions;

establishing a

mesoprudential

supervision system for

effective risk

management, aimed at

minimizing (avoiding)

losses from possible

threats of macro, meso,

and microlevel

Fosterin

g the

sources

of

financial

mechani

sm

formatio

n for

regional

develop

ment

The fall (a

significant

slowdown in

growth) of the

main

sustainable

development

indicators in

the regional

financial

system

(medium level

of the

financial

mechanism

components)

attracting external loans

to finance operating

expenses and capital

expenditures having the

maximum economic

and/or social effect;

assistance in developing

the market of local

borrowings, which will

allow to supply the local

budget with funding on

innovative projects aimed

at social and economic

development of the

regions;

assistance in the

formation of a

p

owerful

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

204

regional capital through

the mechanism of

partnership in financing

investment projects by

combining the capitals of

financial and credit

institutions, business

entities, local authorities,

the population (in various

combinations

)

Innovati

on and

investme

nt

direction

Sustainable

development

of the regional

financial

system (high

and medium

level of the

financial

mechanism

components)

stimulating innovation in

the region;

creating financial and

credit institutions that

will specialize in

financing investment

projects in the region;

stimulating innovation

and investment activity of

local authorities by

refusal to use the

revenues from the

implementation of

investment projects for

interbudgetary leveling,

and allocating these funds

for the regional

develo

p

ment

Building

up

financial

mechani

sm

capacity

for the

regional

develop

ment

The region has

a significant

financial

development

mechanism

(the highest

level of all

components of

the financial

mechanism)

supporting the real

economy, especially the

export-oriented sectors;

promoting the

interregional and cross-

border cooperation;

stimulating the

development of clusters

in the region

To evaluate the effectiveness of the strategy

implementation, a system of relevant indicators is

used both by individual financial mechanism

components and by an integral indicator. The

implementation of the strategy for strengthening the

financial mechanism for the regional development is

based on an integrated approach and should take into

account the financial possibilities of the territory,

provide for an alternative development of the

financial system, depending on the level of the

financial mechanism in order to meet the needs and

safeguard the harmonious development of all regions.

5 CONCLUSIONS

The comprehensive study of the financial mechanism

of regional development conducted in this study

resulted in practical findings that enable to achieve

the main objectives according to the stated purpose,

namely:

1. Sustainable socio-economic development of

the regions requires adequate funding, which is

currently limited by the insufficiency and

inaccessibility of financial resources. Therefore,

strengthening the regional financial mechanism

remains an urgent challenge for the country's

financial policy. The financial mechanism of regional

development is an aggregation of financial resources

and opportunities for their formation, their capacity

building and effective use in accordance with the

internal and external conditions to meet the needs of

the regions and ensure their social and economic

development.

2. The financial mechanism acts as an object for

assessing the financial ability of the regions being a

prerequisite for socio-economic development. It is

suggested to consider the financial viability of the

regions as an ability for socio-economic development

based on the effective use of innovative tools for

managing the financial resources. This will result in

resolved imbalances in financing the needs of the

regions, facilitating the formation of a growing

volume of the gross regional product and

counteracting the permanent destructive influence of

external and internal factors in short and long term

perspective.

3. The implementation of the financial

mechanism for the regional development is carried

out with an integrated approach and takes into

account the financial possibilities of the territory,

provides alternative directions for the financial

system development, depending on the level of the

financial mechanism to meet the needs and ensure the

harmonious development of all subjects. A

differentiated approach to the selection of directions

made it possible to distinguish five directions: the

anti-crisis direction; direction aimed at restoring the

financial mechanism; direction aimed at fostering the

sources of financial mechanism formation;

innovation and investment direction; direction aimed

at building up financial mechanism capacity. Each

direction involves the use of appropriate instruments

to streamline financial flows and achieve sustainable

development of the regions.

ACKNOWLEDGEMENTS

The study was carried out with the support of the

Program for the Development of the Federal State

Autonomous Educational Institution of Higher

Financial Mechanism for Sustainable Regional Development

205

Education V.I. Vernadsky Crimean Federal

University for 2015-2024.

REFERENCES

Farrakhova, D., Daryakin, A. (2017). Management of the

finances of households in conditions of sustainable

development. Revista QUID.

Golodova, Zh. (2011). Formation and management of the

region’s financial potential to ensure its economic

growth. Moscow. 2

nd

edition.

Makarova, N., Zubko, E., Bestuzheva, L., Chusov, I.,

Surkova, V. (2016). Institutional tool of financial

policy: contractual policy. European Research Studies

Volume XIX.

Menshchikova, V. (2010). Strategy of social and economic

development in the regional management system.

Vestnik TGU.

Pande, R., Pande R.K. (2007). Financial mechanism for the

relief expenditure in India: some observations. Disaster

Prevention and Management. DOI:

10.1108/09653560710758305

Stehnei, M., Irtysheva, I., Gurina, O. (2018). Financial

mechanism of the socio-oriented economic

development of the Black Sea Region. Baltic Journal of

Economic Studies, 2018. DOI:

https://doi.org/10.30525/2256-0742/2018-4-4-202-208

Storonyanska, I. (2015). Strategic priorities of regional

financial policy modernization. Economic Annals-XXI.

Tolstova, M., (2012a). Financial strategy of the territory:

problem characteristics and organizational principles.

Vestnik Chuvashskogo Universiteta.

Tolstova, M., (2012b). System-forming principles for the

formation and implementation of the regional financial

strategy. Vestnik Chuvashskogo Universiteta.

Ul'janickaja, N. (2013). Development of a regional

management strategy: conceptual approach.

Inzhenernyj Vestnik Dona.

Verbinenko, E., Badylevich, R. (2012). Financial potential

as the basis for regional development. Sever i rynok:

formirovanie ekonomicheskogo porjadka.

Zinisha, O., Ivanenko, I., Labanova, S. (2019). Financial

aspects of local government reform in the Russian

Federation. International Journal of Recent Technology

and Engineering (IJRTE). DOI:

10.35940/ijrte.D6762.118419

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

206