The Influence of Covid-19 on the Public Debt Growth and Default

Risk: A Fiscal Sustainability Analysis

George Abuselidze

a

Batumi Shota Rustaveli State University, Ninoshvili street 35, Batumi, Georgia

Keywords: Public Debt, Sovereign Debt, Debt Management, Default Risk, Fiscal Sustainability.

Abstract: This topic is relevant due to the fact that Georgia's public debt is increasing from year to year, and there is a

lack of comprehensive research on the public debt management. The problem is how to assess whether or not

the public debt is managed properly. The purpose of this article is to analyse and evaluate the Georgia public

debt management by developing a public debt management assessment model. The paper deals improving

mechanisms of State Debt management and determining its importance for economic development of the

country. It is offered in the future decisions, related to Georgia public debt management, to take into account

the burden of public debt to future generations.

1 INTRODUCTION

The global financial crisis of 2007-2008 and global

pandeconomic crisis of 2019 (Abuselidze &

Mamaladze, 2020; Abuselidze & Slobodianyk, 2021)

made a negative impact on Georgia’s fiscal

sustainability, which reflected in state budget deficit

and large-scale growth of state debt levels. Although

the current level of state debt is in a reasonable

interval, considering sharp social orientation of fiscal

policy since 2012, planned rate of fiscal

consolidations and the fiscal limits determined by the

“Act of Economic Freedom”, independent

assessment and analysis of fiscal sustainability for

medium and short term periods gains special

importance. Fiscal or state finance stability is the

ability of the state to maintain its current expenses,

taxes and other economic policies in long term,

without risking state’s ability to pay debts, or to

refuse to pay certain liabilities and budget expenses

(incl. pensions, health care, etc.).

2 METHODOLOGICAL

FOUNDATIONS

Study was conducted by means of qualitative and

quantitative methods. The logic of theoretical

a

https://orcid.org/0000-0002-5834-1233

analysis consists on the systemization of scientific

literature on public debt management assessment

criteria, indicators and methods; as well as analysis

and synthesis of evaluation criteria and indicators.

Empirical research is based on information from the

Ministry of Finance (2020), the Ministry of Economy

and Sustainable Development (2020), the National

Bank (2020), the Parliament (2018; 2019) and the

Georgian Department of Statistics (2020). My

research shows that management of public debt in

2009-2019 years was as acceptable by public debt

structure, indicators and its compliance with the

thresholds, and by public debt growth rates. Issues of

State debt management were studied by economy

scientists, among them Alesina et al., (1992),

Bhandari, Evans (Bhandari et al., 2017), Denison and

Guo (2015), Di Bartolomeo and Di Gioacchino

(2008), Dunaev (2013), Dutta (2018), Faraglia et al.,

(2010), Fastenrath et al., (2017), Hackbart and

Denison (2014), Kim and Lim (2018), Livne and

Yonay (2016), Mareček and Machová (2017), Scott-

Clayton and Zafar (2019), Trampusch (2015), Werner

(2013; 2014) and others. In their scientific researches,

they have deeply disclosed issues of state long-term

debt, Management Challenges, theory of debt

management, Enhanced debt management,

sustainable financial architecture, defined problem

issues in this area, however, the impact of debt

Abuselidze, G.

The Influence of Covid-19 on the Public Debt Growth and Default Risk: A Fiscal Sustainability Analysis.

DOI: 10.5220/0010587501510159

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 151-159

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

151

management on the economic and financial stability

requires continuous improvement and research.

3 RESULTS AND DISCUSSION

For the management and service of State Debt, its

quantitative calculation and reflection, it is necessary

to define what is actually a State Debt and which

major components are included in it.

With a State Debt definition, the WGPD

(Working Group on Public Debt) of the INTOSAL

(International Organization of Supreme Audit

Institutions) suggests, State Debt is defined as the

sum of optional and direct liabilities taken by state

institutions (INTOSAI-Public Debt Committee).

With the Definition provided by the International

Monetary Fund (IMF), the State Debt is defined as the

sum of debt of government sector and state

corporation, where the debt of the state sector

combines the unity of the debts of the country's

central, autonomous republics and local authorities,

and the state corporation's debt combines the debt of

financial and non-financial corporations and the

various financial institutions” (Definitions and

Accounting Principles, 2013).

According to the Law of State Debt of Georgia

(Legislative Herald of Georgia, 2016), the State Debt

is defined as “The debt in national currency, taken by

other institutions with the name of Georgia and

guarantee of Ministry of Finance, also the debt taken

by Financial Ministry, with the name of Georgia,

using state securities in national or foreign currency,

in addition the State Debt includes total amount of

state domestic and foreign debt received from the

financial resources approved by the International

Monetary Fund" (Transparency International

Georgia, 2019).

The definitions that offer international financial

institutions are sharply different from the definition

provided by the Georgian legislation. In particular,

under the legislation of Georgia the state liabilities

portfolio does not take into account the state non-

financial corporations liabilities, also the credit

liabilities of enterprises created by the state share

participation is not considered as part of State Debt.

This is attached to the state sector liabilities by

definition of the International Monetary Fund. Under

the INTOSAI definition, it is a state obligation.

The funds attracted by the State Debt are an

important source of budget financing and at the initial

stage of the budget planning process, It is important

for the country to properly determine the debt needs

in order to avoid liquidity risk and paying extra

expenses due to large amounts of debt, as long as the

State Debt management process implies development

and implementation of debt management strategy.

Generally, the initiator of taking foreign debt, if it

is considered as a source of funding of the budget, is

the Ministry of Finance, and if it is taken for funding

some investment projects, the role of the initiator

becomes a specific spending institution.

According to the 6th chapter of the budget project of

2018, 86% of the debt, 1,074,800.0 GEL was

allocated to the Ministry of Regional Development

and Infrastructure of Georgia (this indicator is

1,062,680.0 GEL in 2019), taking into consideration

the funds allocated for the defense, education, energy

and agriculture ministries for infrastructural

development, Overall, 95% of the total volume of

debt is financed to cover the expenditure incurred in

this direction (Transparency International Georgia,

2019).

The total volume of State Debt in the current year

is 2.04, 2019 forecast for 2.3 billion GEL (State audit

office of Georgia 2014, 2015; Analytical portal of

state audit office of Georgia, 2020; Budget monitor,

2020; Legislative Herald of Georgia, 2018) this is 245

million GEL higher than the previous year's figure.

The trend of decrease is reflected in the volume of

credit supporting credits, but the share of long-term

and investment credits increases (Analytical portal of

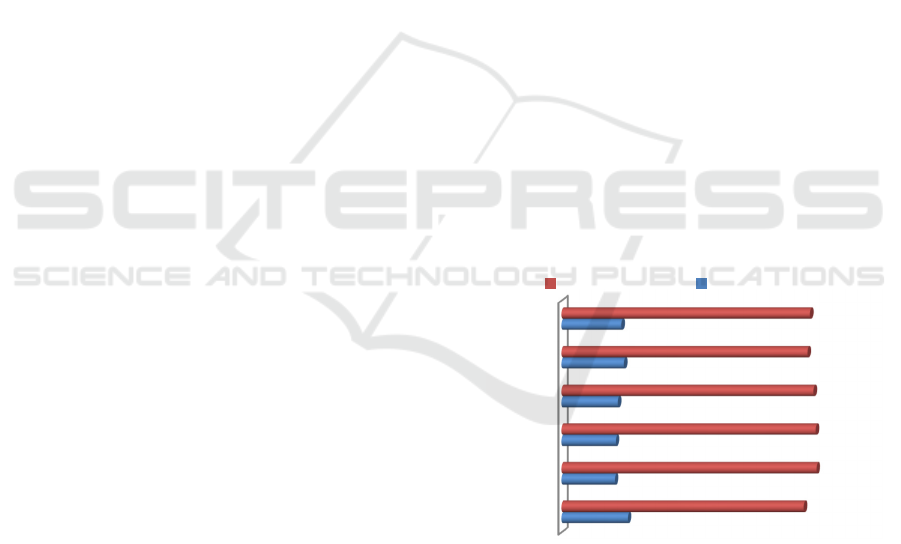

state audit office of Georgia, 2020) (see Figure 1).

Figure 1: Dynamics of public debt, %

Source: Author calculation on base budget monitor (2020).

According to the 2018 Budget project law

(Legislative Herald of Georgia, 2018), 790 million

GEL is allocated for the reduction of State Debt,

which is approximately 18% higher than the same in

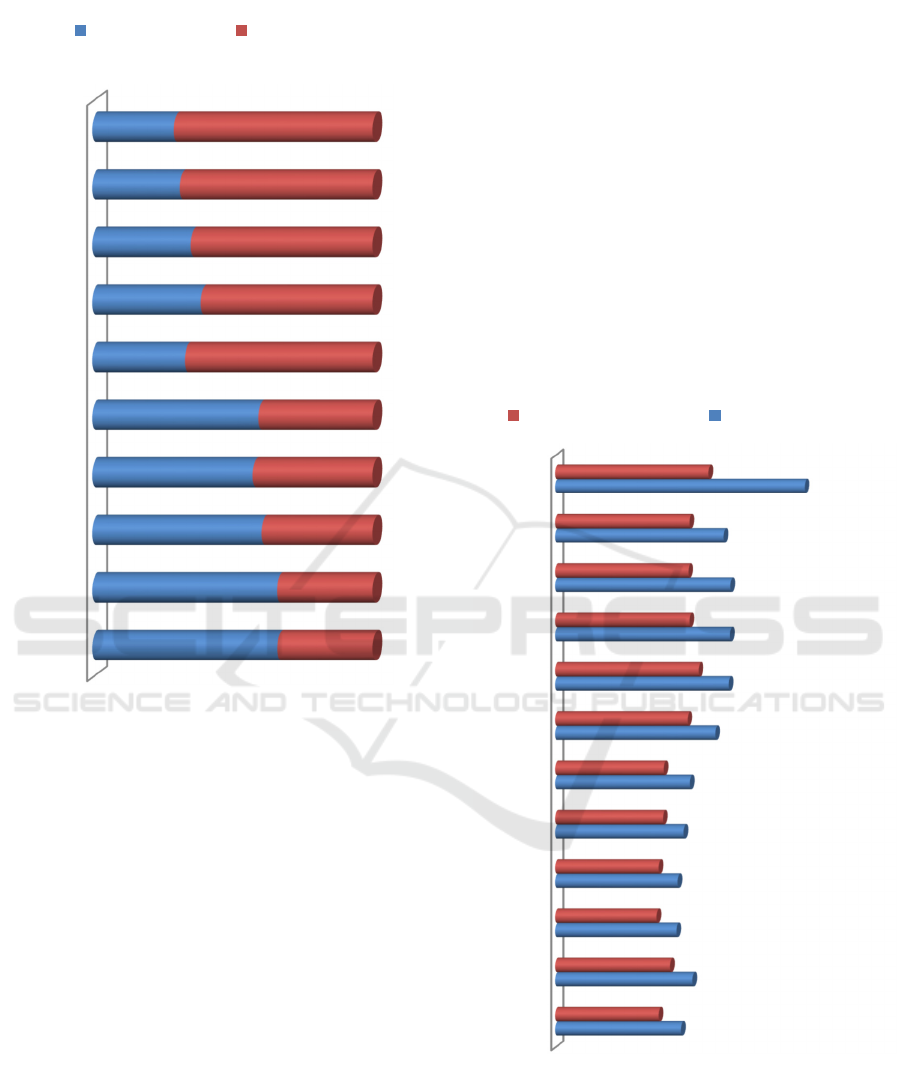

2017 (see Figure 2).

2015

2016

2017

2018

2019

2020

21,5

17,3

17,6

18,3

20,2

19,4

78,5

82,7

82,4

81,7

79,8

80,6

ExternalDebt DomesticDebt

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

152

Figure 2: Public debt service, %

Source: author calculation on base budget monitor (2020).

Depending on the foregoing, even though the

volume of debt increases, the funds allocated for its

cover are increased. The increase in liabilities is due

to attract investment credits and according to the

budget classification, the share of debt taken to

finance current expenditures is minimal. It shows that

if the current expenditure will be planned effectively,

the government's savings will be increased and

converted into investments, as a result, the state will

need less debt to finance investment projects. There

is no connection between the State Debt and the

current expenses, but if the funds needed to finance

the projects defined by the budget classification could

not be obtained, it will be necessary to reduce the on-

going expenditures. One of the most important tasks

for Georgia is to increase the share of state budget

revenues and related expenditures in the overall

domestic product (Abuselidze, 2020).

With the mobilization of internal resources,

according to the 2019 budget draft law, tax revenues

are increased compared to the previous year (State

audit office of Georgia), while the share of grants is

characterized by a decrease in trend, State Debt levels

are still increasing 44.6% of GDP which is less than

60% of the level defined by the Organic Law on

Economic Freedom Act in Georgia and If we take

into account that the level of State Debt service is

proportional to debt, the country has the opportunity

to take additional debt over the next few years,

However, a change in the Law on Economic Freedom

must be taken into account which implies a abolition

30% margin for budget expenditures in respect of

GDP (Legislative Herald of Georgia, 2018), which

means the absence of another powerful control over

the efficient spending of funds (Fig. 3).

Figure 3: Dynamics of Public Debt, % GDP

Source: Author calculation on based of Ministry of Finance

of Georgia (2020).

In line with the assumed impact of GDP growth

on declining public debt to GDP ratio, the scatter

diagram indicates that the decrease of public debt to

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

66

65,9

60,3

57,2

59,2

33

38,7

35,1

31,2

29,1

34

34,1

39,7

42,8

40,8

67

61,3

64,9

68,8

70,9

DomesticDebt ExternalDebt

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

30,8

33,6

29,7

30

31,4

33

39,2

42,5

42,8

42,9

41,2

61,1

25,3

28,1

24,8

25,3

26,4

26,6

32,4

35,1

32,9

32,6

32,9

37,5

ExternalDebt,%GDP PublicDebt,%GDP

The Influence of Covid-19 on the Public Debt Growth and Default Risk: A Fiscal Sustainability Analysis

153

GDP ratio is only possible through increase in

investment activity. The primary budget deficit did

not have significant influence on public debt in New

Member States countries (EU). The external debt

positively influenced public debt taking into account

large capital inflows before the crisis (Pecaric et al.,

2018).

Optimal amount of debt needs and optimal ratio

with GDP should be determined correctly so that it is

necessary to maintain the data base of the State Debt

for the current and previous years, to get detailed

information about the priorities and needs of a

particular field of economy.

The procedure for determining debt needs is

desirable to be regulated by special rules, in order to

ensure transparency of the process, but the most

important is the establishment of the State Debt

definition clearly and its compliance with

international standards, the fact that the debt of non-

financial corporations and enterprises, created by the

State's participation, does not take into account the

total amount of the State Debt, creates a threat to

poorly evaluated debt sustainability.

After the study of existing literature about

sustainable development (Dodds, 2008; Bell &

Morse, 2004; Logar, 2010), it is considered that there

is no universally accepted definition of sustainability.

However, according to Blanchard’s definition

(Blanchard, 1985; 1990), sustainability is achieved

when the government avoids accumulating large

volume debts based on current policy, more

specifically, sustainable fiscal policy implies

returning Debt ∕ GDP ratio to its initial level.

In our opinion, Blanchard’s (Blanchard, 1985;

1990; 2019) definition is inaccurate due to the

following circumstances: first of all, there is no

theoretical and practical reason why Debt ∕ GDP

ration should return to its initial level or any other

stable level, that will be lower or higher compared to

initial level. Second, the policy on the first stage may

consider increasing debt ratio to a level that can

actually be evaluated as an overly high and on next

step reducing debt level and returning to “safe” level.

For assessing fiscal challenges in medium term is

used indicator, based on which existing budget deficit

(structural initial balance) correction level is

calculated, that is necessary to achieve the desired

level of state debt at certain time. Hereby, the best

way to get rid from this is taking new loan that

exceeds amount repayment of principal and interest

of the credit, as well as other forms of capital outflow

from the country, that can be presented with the

following formula:

RT=L-S+O (1)

Where:

L - Volume of new credits;

S - Amount paid for credits;

O - Flow of capital from debtor country.

If RT>0, then volume of new credits, that debtor

is taking, exceeds the payments and there is a

resource outflow. When RT<0, it means recently

received credits don’t cover principal of credit and

service costs, i.e. there is a capital outflow from

debtor countries.

The debtor country will not refuse returning loan,

until receiving resources from creditors (e.g. Greece),

i.e. until RT>0. The debtor will always fulfill the

contract of returning principal and service costs, if

receives new loans from creditor.

Based on practices used by European

Commission (2009; 2012) fiscal sustainability based

on calculation of indicator is assessed as following: 1.

If the value of indicator is lower than 20, the country

is rated as low risk. 2. If indicator value is between 20

and 60, the country is rated as medium risk. 3. If

indicator value is more than 60, the country is rated

as high risk.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

154

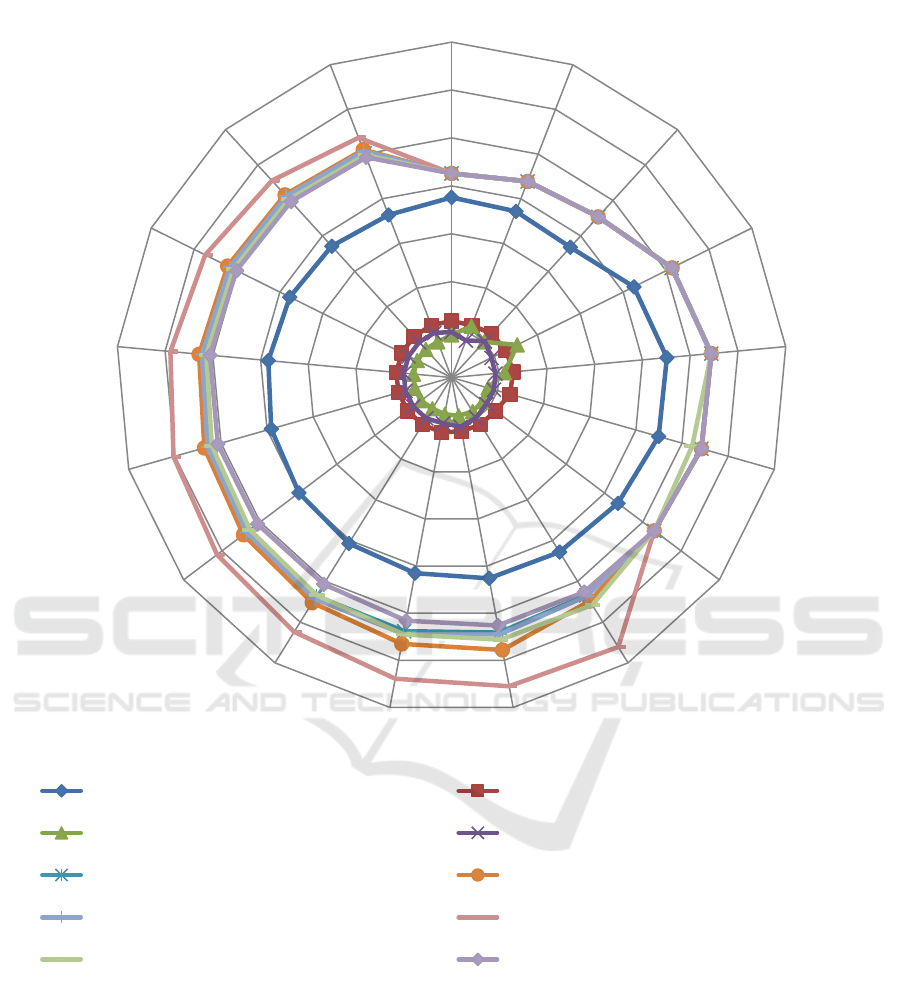

Figure 4: Fiscal sustainability based on calculation of indicator

According to the data of 2019, percentage of

government debt to GDP ratio was 42.6%, of which

32.8% was foreign debt. The results of the shocks

used to assess sustainability analysis based on actual

and forecast data on government debt for 2012-2028

give a satisfactory picture (see Figure 4). According

to all scenarios, government debt to GDP is growing,

but steadily maintains a declining trend. It should be

noted that in the case of any scenario, the

government's debt to GDP does not reach the critical

limit. However, the country is rated as medium risk

(see Figure 5).

‐10

0

10

20

30

40

50

60

2012

2013

2014

2015

2016

2017

2018

2019

20202021

2022

2023

2024

2025

2026

2027

2028

Governmentdebt primarydeficit

automaticdebtdynamics otheridentifiedcomponentsofdebtgrowth

realinterestrateshock shockofrealGDPgrowth

primarydeficitshock nominalexchangerateshock

combinedshock conditionalobligationsshock

The Influence of Covid-19 on the Public Debt Growth and Default Risk: A Fiscal Sustainability Analysis

155

Figure 5: State Debt Management

Source: Author calculation on based Ministry of Finance of Georgia (2020)

While fiscal sustainability analysis, inter-temporal

budget restriction or intermediate equilibrium

condition determines equivalence between initial

debt level and present value of primary proficiencies

of future period budgets’. This condition was

presented by Bohn (2005) with the following

formula:

𝐵

∑

1 𝑟

𝑃𝐵

(2)

Where:

𝐵

- state debt/ GDP,

r - real interest rate.

𝑃𝐵

- Primary Balance, that represents difference

between state revenues and expenditures (excluding

interest expenses).

Studies to assess sustainability in the fiscal policy

is mainly based on assessing the necessary level of

reduction in the budget deficit to ensure sustainability

in fiscal policy, based on fiscal gap indicator

calculation.

Sustainability indicator calculates the difference

between the current state of the budget deficit (initial

structural balance) and budget initial balance for debt

level stabilization, for ensuring fiscal sustainability in

long-term period. Sustainability indicator can be

determined by the following formula:

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

156

"𝐼𝑇𝐺𝐴𝑃

" "𝑅𝑒𝑎𝑙 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒

𝑅𝑒𝑎𝑙 𝐺𝐷𝑃 𝑔𝑟𝑜𝑤𝑡ℎ 𝑟𝑎𝑡𝑒" " " ∑_"𝑖

1" ^"∞" ▒"1 𝑅𝑒𝑎𝑙 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒" ^"

𝑖" "𝑃𝑟𝑖𝑚𝑎𝑟𝑦 𝐵𝑎𝑙𝑎𝑛𝑐𝑒 " ∑_"𝑖

1" ^"∞" ▒"1 𝑅𝑒𝑎𝑙 𝐺𝐷𝑃 𝑔𝑟𝑜𝑤𝑡ℎ 𝑟𝑎𝑡𝑒" /"1

𝑅𝑒𝑎𝑙 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒" "𝑖𝑃𝑟𝑖𝑚𝑎𝑟𝑦 𝐵𝑎𝑙𝑎𝑛𝑐𝑒"

/"1 𝑅𝑒𝑎𝑙 𝐺𝐷𝑃 𝑔𝑟𝑜𝑤𝑡ℎ 𝑟𝑎𝑡𝑒"

However, corrective measures to achieve fiscal

sustainability can be done in various ways. In

particular, by increasing the tax revenues (typically

on the basis of optimal tax pressure formations)

(Abuselidze, 2020), or/and by efficiencies social or

infrastructural expenses (Abuselidze, & Mamuladze,

2020; Abuselidze, Surmanidze, 2020; Abuselidze,

2019, 2021). When choosing policy, we should keep

into consideration its potential impact on economic or

fiscal sustainability. Causality between public debt

and economic growth can only be explained by

understanding the process of creation and change in

private debt. Keen provides theoretical framework,

concluding that private debt change influences

employment, whereby the crisis begins when private

debt to GDP starts declining, i.e. when private sector

starts deleveraging and public debt starts growing as

a response to rising unemployment (Pecaric et al.,

2018). According to Cecchetti et al., (2011) hold that

the high indebtedness may significantly increase the

risk premium influencing the future financing

activities. Kumar and Woo (2010) concluded that the

negative influence of high government indebtedness

can be linked to the decline in work productivity due

to the decline of investment activities, i.e. the

accumulation of fixed capital. In our opinion, for

overcoming the fiscal breakdown and decrease

deficit, more increase of tax burden can cause

slowdown in economic growth, which will have

negative impact on medium and long-term

sustainability. In our opinion, we can consider

optimal tax burden such conditions when favourable

economic environment is achieved for the best

functioning of economy and business building, i.e.

tax shall be optimal both for the state in whole and for

certain businessmen. Such level is the state of

simultaneous growth of budget revenues and output

and we consider, it is possible at 38.2% tax burden.

4 CONCLUSIONS

The budget planning is a complex process,

determining the State Debt forecast parameters and

maintaining them, helps with achieving a set of

macroeconomic indicators. It is an important

precondition for maintaining taken political course.

In the light of all above, the executive authorities

of the country must address the debt only if the

priority directions of the country are required to

finance and if the mobilization of tax revenue is not

sufficient for adequate financing of programs, sub-

programs and measures. In addition, due to the

specifics of the program budget, the operational

balance of the state budget of the country is negative

because of the need to first of all expenditures. This,

in turn, requires mobilization of sources of financing,

including taking a debt.

REFERENCES

Abuselidze, G., (2019). Modern Challenges of Monetary

Policy Strategies: Inflation and Devaluation Influence

on Economic Development of the Country. Academy of

Strategic Management Journal, 18(4):1-10.

Abuselidze, G. (2020). Optimality of Tax Policy on the

Basis of Comparative Analysis of Income Taxation.

European Journal of Sustainable Development,

9(1):272-293. doi:10.14207/ejsd.2020.v9n1p272

Abuselidze, G., Mamaladze, L. (2020). The Impact of the

COVID-19 Outbreak on the Socio-Economic Issues of

the Black Sea Region Countries. Lecture Notes in

Computer Science, 12253:453-467. doi:10.1007/978-3-

030-58814-4_32

Abuselidze, G., Surmanidze, M. (2020). Analysis of

Performance Efficiency of Legal Entities of Public Law

and Non-Profit Legal Entities under the Central and

Local Government Bodies: in Terms of the

Transformation of Georgia with the EU. Proceedings of

the 5th International Conference on European

Integration, 23-35. doi:10.31490/9788024844565

Abuselidze, G., Mamuladze, L. (2020). The Peculiarities of

the Budgetary Policy of Georgia and the Directions of

Improvement in Association with EU. SHS Web of

Conferences, 73, 01001.

doi:10.1051/shsconf/20207301001

Abuselidze, G., Slobodianyk, A. (2021). Pandeconomic

Crisis and Its Impact on Small Open Economies: a Case

Study of COVID-19. Advances in Intelligent Systems

and Computing, 1258:718-728. Springer, Cham.

doi:10.1007/978-3-030-57450-5_61

Abuselidze, G. (2021). The Impact of Banking Competition

on Economic Growth and Financial Stability: An

Empirical Investigation. European Journal of

Sustainable Development, 10(1):203-220.

doi:10.14207/ejsd.2021.v10n1p203

The Influence of Covid-19 on the Public Debt Growth and Default Risk: A Fiscal Sustainability Analysis

157

Alesina, A., Broeck, M. D., Prati, A., Tabellini, G.,

Obstfeld, M., Rebelo, S. (1992). Default Risk on

Government Debt in OECD Countries. Economic

Policy, 7(15):427-463. doi:10.2307/1344548

Analytical portal of state audit office of Georgia (2020).

Budget Monitor. Retrieved from:

https://budgetmonitor.ge/en/home

Bell, S., Morse, S. (2004). Experiences with sustainability

indicators and stakeholder participation: a case study

relating to a ‘Blue Plan’ project in Malta. Sustainable

development, 12(1):1-14. doi:10.1002/sd.225

Bhandari, A., Evans, D., Golosov, M., Sargent, T. J. (2017).

Fiscal policy and debt management with incomplete

markets. The Quarterly Journal of Economics,

132(2):617–663. doi:10.1093/qje/qjw041

Blanchard, O. J. (1985). Debt, deficits, and finite horizons.

Journal of political economy, 93(2):223-247.

doi:10.1086/261297

Blanchard, O. J. (1990). Suggestions for a New Set of Fiscal

Indicators. OECD Economics Department Working

Papers 79, (OECD Publishing, Paris, 1990).

doi:10.1787/435618162862

Blanchard, O. (2019). Public Debt and Low Interest Rates.

American Economic Review, 109(4):1197-1229.

https://www.aeaweb.org/articles?id=10.1257/aer.109.4

.1197.

Bohn, H. (2005). The Sustainability of Fiscal Policy in the

United States. CESifo Working Paper Series. 1446.

Budgetmonitor (2020). Dynamics of public debt.

https://budgetmonitor.ge/en/debt

Cecchetti, S. G., Mohanty, M. S., Zampolli, F. (2011). The

Real Effects of Debt. BIS Working Papers 352, (Basel:

Bank for International Settlements, 2011).

Denison, D. V., Guo, Z. (2015). Local Government Debt

Management and Budget Stabilization. In Local

Government Budget Stabilization 2, 121-139. Springer,

Cham. doi:10.1007/978-3-319-15186-1_7

Definitions and Accounting Principles(2013). Public Sector

Debt Statistics. Guide for Compliers and Users. 3-6.

http://www.tffs.org/pdf/method/2013/psds13ch2.pdf ;

Di Bartolomeo, G., Di Gioacchino, D. (2008). Fiscal-

monetary policy coordination and debt management: a

two-stage analysis. Empirica, 35(4):433-448.

doi:10.1007/s10663-008-9077-0

Dodds, R. (2008). Sustainable tourism and policy

implementation: Lessons from the case of Calvia,

Spain. Current Issues in Tourism, 10(4):296-322.

doi:10.2167/cit278.0

Dunaev, B. B. (2013). Optimizing the growth of real gross

domestic product. Cybernetics and Systems Analysis

49(1):98-109. doi:10.1007/s10559-013-9490-7

Dunayev, B.B. (2013). Dynamics of public debt

management. Cybernetics and Systems Analysis,

49(6):865-876. doi:10.1007/s10559-013-9576-2

Dutta, S. J. (2018). Sovereign debt management and the

globalization of finance: Recasting the City of

London’s ‘Big Bang.’ Competition & Change, 22(1):3–

22. doi:10.1177/1024529417734524

Dutta, S. J. (2019). Sovereign Debt Management and the

Transformation from Keynesian to Neoliberal

Monetary Governance in Britain. New Political

Economy, 25(4): 675–690.

doi:10.1080/13563467.2019.1680961

European Commission (2009). Sustainability report 2009.

European Commission (2012). Sustainability report 2012.

Faraglia, E., Marcet, A., Scott, A. (2010). In search of a

theory of debt management. Journal of Monetary

Economics, 57(7): 821-836.

doi:10.1016/j.jmoneco.2010.08.005

Fastenrath, F., Schwan, M., Trampusch, C. (2017). Where

states and markets meet: the financialisation of

sovereign debt management. New political economy,

22(3):273-293. doi:10.1080/13563467.2017.1232708

Hackbart, M., Denison, D.V. (2014). State Debt

Management Challenges. Sustaining the States: The

Fiscal Viability of American State Governments 101.

doi:10.1201/b17267-7

INTOSAI-Public Debt Committee. Guidance for Planning

and Conducting an Audit of Internal Controls of Public

Debt. Final Report.

https://www.coa.gov.ph/wgpd/Anexos/Products/PlanC

onducting_i.pdf

Kim, K., Lim, S. (2018). Determinants of state long-term

debt: The political market framework. The Social

Science Journal, 55(3): 359-368.

doi:10.1016/j.soscij.2017.11.002

Kumar, M. S., Woo, J. (2010). Public Debt and Growth.

IMF Working Paper 10/174, (Washington, D.C 2010).

Legislative Herald of Georgia (2016). Law of Georgia of

State Debt.

https://matsne.gov.ge/ka/document/view/32452?public

ation=11

Legislative Herald of Georgia (2018). Law of Georgia of

Economic Freedom.

https://matsne.gov.ge/ka/document/view/1405264?pub

lication=1

Livne, R., Yonay, Y. P. (2016). Performing neoliberal

governmentality: an ethnography of financialized

sovereign debt management practices. Socio-Economic

Review, 14(2):339-362. doi:10.1093/ser/mwv019

Logar, I. (2010). Sustainable tourism management in

Crikvenica, Croatia: An assessment of policy

instruments. Tourism Management, 31(1):125-135.

doi:10.1016/j.tourman.2009.02.005

Mareček, J., Machová, V. (2017). The influence of public

debt on the performance of the economy. SHS Web of

Conferences, 39, 01018.

doi:10.1051/shsconf/20173901018

Ministry of Finance of Georgia (2020). Public Debt.

Ministry of Economy and Sustainable Development of

Georgia (2020). Main Economic Indicators.

http://www.economy.ge/?page=ecoreview&s=37

National Bank of Georgia (2020). Balance of Payments of

Georgia.

National Statistics Office of Georgia (2020). Government

Finance Statistics.

Parliament of Georgia (2018). The Law of the State Budget

of 2018.

Parliament of Georgia (2019). The Law of the State Budget

of 2019.

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

158

Pecaric, M., Sliskovic, V., Kusanovic, T. (2018). Public

debt in new EU member states – Panel data analysis and

managerial implications. Management - Journal of

Contemporary Management, 23(1).

doi:10.30924/mjcmi/2018.23.2.81

Scott-Clayton, J., Zafar, B. (2019). Financial aid, debt

management, and socioeconomic outcomes: Post-

college effects of merit-based aid. Journal of Public

Economics,170:68-82.

doi:10.1016/j.jpubeco.2019.01.006

State audit office of Georgia (2014). State Debt

management efficiency audit.

https://budgetmonitor.ge/components/files/valis-

martva.pdf

State audit office of Georgia (2015). Audit of Effectiveness

of State Debt Management Information Systems.

https://www.sao.ge/files/auditi/efeqtianobis-

angarishi/2015/tb-informaciuli-sistemebi.pdf

Trampusch, C. (2015). The Financialisation of Sovereign

Debt: An Institutional Analysis of the Reforms in

German Public Debt Management. German Politics,

24(2):119-136. doi:10.1080/09644008.2015.1021791

Trampusch, C. (2019). The financialization of the state:

Government debt management reforms in New Zealand

and Ireland. Competition & Change, 23(1):3-22.

doi:10.1177/1024529418800778

Transparency International Georgia (2019). Analysis and

recommendations of the State Budget of 2019.

https://www.transparency.ge/en/blog/2019-draft-state-

budget-georgia-analysis-and-recommendations

Werner, R. A. (2013). Towards a more stable and

sustainable financial architecture–a discussion and

application of the quantity theory of credit. Credit and

Capital Markets, 46(3):357-387.

doi:10.3790/ccm.46.3.357

Werner, R. A. (2014). Enhanced debt management: Solving

the Eurozone crisis by linking debt management with

fiscal and monetary policy. Journal of International

Money and Finance, 49:443-469.

doi:10.1016/j.jimonfin.2014.06.007

The Influence of Covid-19 on the Public Debt Growth and Default Risk: A Fiscal Sustainability Analysis

159