Assessment of the Paradox of the Formation of Economic Systems in

Different Types of Countries

Nadezhda M. Goreeva

1a

, Larisa N. Demidova

2b

and Olga V. Savchina

3c

1

Department of Economics and Statistics, KF FSBEI HE RT SAU, Kaluga, Russia

2

Department of Statistics, Plekhanov Russian University of Economics, Moscow, Russia

3

Department of Accounting, Audit and Statistics, Peoples’ Friendship University of Russia (RUDN University), Moscow,

Russia

Keywords: Social Institutions, Dualism of the World Economic System, Factors of Efficiency of Public Institutions,

Global Productivity, Public Utility, Global Economic System.

Abstract: The modern economic system demonstrates the inconsistency of the redistribution of gross value added

(GVA) and gross domestic product (GDP) in the direction of developed consumer countries. On the basis of

the system of indicators that characterize the effective socio-economic development of countries and the

optimal combination of statistical methods that allow us to classify and model the factors that form such a

performance of the economies of countries, the authors have established the reasons for their leading positions.

The article examines the systems of models of countries with different levels of socio-economic development,

their social utility and different degrees of development of institutions in each group of countries: developed

and developing. The evaluation and modeling showed that the Gini coefficient, which shows the degree of

social differentiation, has a high correlation with 4 indicators that characterize the efficiency of economic

development (consumer confidence index, human development index, inflation index, and the share of high-

tech industries in the GDP of countries). The authors proved that it is social utility that should ensure the

multilateral development of human potential, which, in turn, contributes to economic growth. The paper also

reveals the intensity of structural changes that may occur in the structures of gross value added and the

employed population in order to determine the trends of their further distribution by industry.

1 INTRODUCTION

After the end of the Second World War and collapse

of the colonial system there appeared a group of

countries in the world map that were named as the

third world counties.

At that time USSR and the United States were the

major political rivals, with USSR heading the so-

called socialist block countries, while the United

States heading the capitalist countries. There was an

unreconciled conflict between the rival systems for

the future of developing countries in all the domains

from industrial espionage and infamous “brain wash”

to political sabotage and expansive military intrusions

aimed at overthrowing the undesired regimes.

a

https://orcid.org/0000-0002-2749-4720

b

https://orcid.org/0000-0001-5906-1455

c

https://orcid.org/0000-0003-3391-8785

Until the end of the 80-ies, each of the

antagonistic parties made attempts to spread their

influence, including in Europe, in order to maximize

their power in the third world countries. This lead to

the emergence of countries with socialist orientation,

that fell into the zone of interest of the USSR.

However, in the very beginning of the 90-s, after

the USSR disintegration and the socialist camp

collapse, the situation changed dramatically. The

unipolar economic world, headed by the United

States, evolved into a bi-polar one, with the second

pole being divided between the European countries

and Japan. Other countries were considered to be

satellites equally distant from the center and

depending on the functions, which they performed in

a newly formed system of coordinates. Russia found

Goreeva, N., Demidova, L. and Savchina, O.

Assessment of the Paradox of the Formation of Economic Systems in Different Types of Countries.

DOI: 10.5220/0010587401430150

In Proceedings of the International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure (ISSDRI 2021), pages 143-150

ISBN: 978-989-758-519-7

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

143

itself among second-tier countries with relatively low

level of economic development, shrinking

population, and lack of own development strategy. At

the same time the country had a vast territory and,

most importantly, contrary to China, India, and

Brazil, military and nuclear potential that was

comparable to that of the United States.

The transition to market economy meant in fact a

complete rejection of the previous ideology of

development that was based on the public property.

This transition resulted in privatization of the public

property in 1991 when the enormous Soviet empire

disintegrated.

The cutoff of the existing economic structure and

the sharp decline in revenues from exports of mineral

resources due the structural changes in the world

markets, did not allow Russia to change the model of

economic development and occupy a deserved place

in the international division of labor.

At the same time, in the 90s, Russia began to form

a socio-economic structure, which developed into a

structure with fundamental features that distinguish

the transition economy from developed countries.

The authors attempt to identify the factors of

development of a particular socio-economic model of

the state, the place that Russia occupies in the

international division of labor, and the role of public

utility.

2 METHODOLOGY

Our research methodology encompasses the

following three key components:

1. design of the system of indicators, which

characterize the processes of social and economic

development of models of state (both developed and

developing);

2. high-level overview of the process of collecting

and processing of data and selection of analysis

methods;

3. calculation and interpretation of research

results.

As the first step of the study, we evaluated the

trends in structural factors and indicators of labor

productivity in domestic economies.

As the second step, we built a factor model based

on the data from 42 countries: 27 EU countries (main

developed countries); 5 BRICS countries (the semi-

developed countries); 10 Asian and Latin American

countries (where the model of social and economic

development for the last decades permitted to take

leading positions in their respective regions).

As the third step of the study, we identified the

main basic factors that form social utility of an

economic model, determining the basis for selection

of an effective feature of economic structure.

One of the aspects of comparative analysis is the

classification of OKONKH and OKVED. To

characterize the identification of gross value added,

the structural differences indices of Salai and

Ryabtsev were used.

3 RESULTS

Let us attempt to answer the complex question about

the development of a social and economic model of

the country.

The first aspect that distinguishes a country with

transitional or, as it is often said, developing

economy, from a developed country is the dualism of

its social-economic structure. What is its essence?

First of all, in such a country, the structure of the

economy as well as its social and cultural life are

divided into two parts, while the interpenetration and

interaction between them are rather limited.

This statement is proved in the first place by

comparison of structure of economic sectors of GDP

with the corresponding distribution of the working

population.

For example, from the distribution of gross value

added by sector and the number of workers employed

in respective sectors in Russia, we can see the duality

of the system in the distribution of production surplus

(Table 1).

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

144

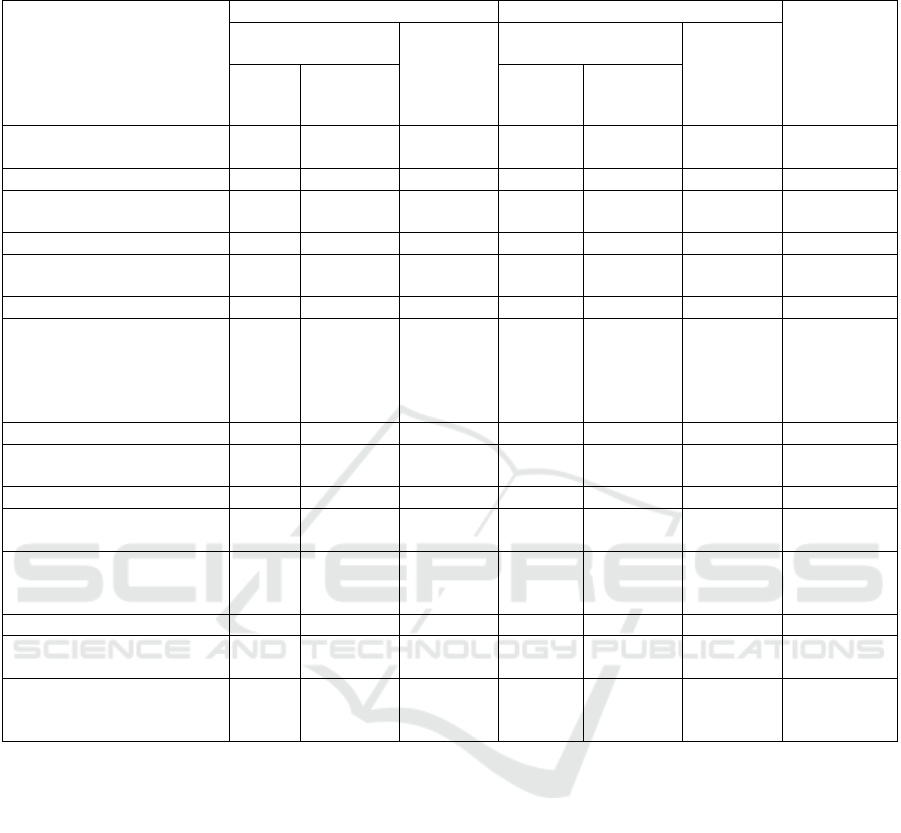

Table 1: The structure of gross value added (GVA) and the average annual number of people employed in the economic line

of business (OKVED) for 2002 and 2018 in Russia.

Type of economic activity 2002 2018 The rate of

labor

efficiency

growth in

2016 to

2002, %

structure,

%

Economic

sector

labor

efficiency

structure Economic

sector

labor

efficiency

GVA employed GVA employed

Agriculture, hunt and

forestr

y

5,99 12,552 0,477 4,5 6,5 0,692 145,073

Fishing and fishery secto

r

0,3 0,183 1,639 0,2 0,2 1,000 61,013

Excavation of mineral

resources

6,7 1,774 3,777 9,4 2,2 4,273 113,132

Process plants 17,2 18,430 0,933 13,6 14,4 0,944 101,179

Production and distribution

of energy, gas and wate

r

3,6 2,883 1,249 3,4 3,2 1,063 85,108

Construction 5,4 6,800 0,794 6,2 7,2 0,861 108,438

Wholesale and retail trade;

repair of vehicles,

motorbikes , household

goods and personal demand

items

22,9 15,091 1,517 15,9 16,6 0,958 63,151

Hotels and restaurants 0,9 1,641 0,548 0,8 1,9 0,421 76,825

Transport and

communication

10,2 7,802 1,307 8,8 9,5 0,926 70,849

Financial activit

y

2,9 1,091 2,658 4,5 2,0 2,250 84,650

Operations with real estate,

rent and rendering services

10,6 7,494 1,414 11,8 7,2 1,639 115,912

Public administration and

providing military security,

obligatory social insurance

5,1 4,790 1,065 7,8 7,4 1,054 98,967

Education 2,9 9,209 0,315 7,3 9,4 0,777 246,667

Health care and rendering

social services

3,3 6,707 0,492 3,7 8,0 0,463 94,106

Rendering other community

facilities and personal

services

1,9 3,553 0,535 2,1 4,3 0,488 91,215

Source: Authors’ calculations based on the data from the site

http://www.aero.garant.ru/?utm_source=ivo&utm_medium=text&utm_content=demo-regional&utm_campaign=lead-from-

dri#form_title;

Authors’ calculations based on the data from the site http://www.gks.ru

*highlighted the sectors with labor efficiency growth in 2018 compared to 2002.

We can see from the table above that the main part

of added value was created in extractive industries

during the previous two decades, whereas

approximately 2,2% of all labor power was engaged

in it by 2018.

It is evident that the correlation of a sector added

product and the employment gives, as a result, a

sector level of output or a sector labor efficiency.

The considerable superiority of the extracting

sector of economy is also evident here. It also

confirms a superior rate of a labor efficiency growth

which in extracting industries is equal to 13.2%. What

are the consequences of such state of things?

The most evident part of this phenomenon lies in

the fact that extracting industries generate both the

largest part of profit in the economy, the lion’s share

of which is actually a natural resource rent; these

industries also create more than 50% of all payroll

fund (without accounting undisclosed earnings)

(Okediji, 2011; Luca Ferrini, 2012; Petrov, 2015).

As far as the most important element of an added

value is concerned, only about 22% of the total sum

of depreciation expenses fall into the share of an

extracting industry, based on capital consumption,

which is one of the key priorities of economic growth.

Besides, it is natural to assume that as far as these

sectors are mainly consumers of innovations created

in the economy, their role in a scientific and

technological progress, compared with the processing

industry, is, mildly speaking, meager

Assessment of the Paradox of the Formation of Economic Systems in Different Types of Countries

145

(Kapelyushnikov, 2014; Marinov, 2014; Goreeva et

al, 2013).

Economies, that exist at the expense of

exploitation of natural resources and as a result

position the international division of labor for long-

term inactivity, can be characterized by the common

feature: underdevelopment of social and economic

structure.

Besides, it should be noted that the year 2002 was

chosen for a comparative evaluation due to the

transition of the Russian statistics from the Russian

Classification of Sectors of the Economy (OKONH)

to application of Russian National Classification of

Economic Activity (OKVED) (Chernyaev et al.,

2014).

The GVA (Gross Value Added) indicators broken

down by Russian Classifier of Economy Branches

(OKONH) were calculated for the period from 1997

to 2004 and by OKVED sectors – from 2002 to 2012.

The structures of industry sectors related to Russian

Classification of Economy Branches and OKVED

differ rather considerably; that is why the year 2002

was taken as a reference period to eliminate the lack

of the results comparability. All evaluations were

calculated in both Russian Classification of Economy

Branches and OKVED versions for 2002 year.

The comparative evaluation of sectors included

into classifiers shows that the transition from Russian

Classification of Economy Sectors (ОКОNH) to

OKVED lead to the increase of a labor remuneration

share in GVA industry by approximately 4 percentage

points just as the GVA share of this sector started to

reduce considerably faster.

Thus, the labor force becomes cheaper. Notably,

in Kapelyushnikov’s opinion, the range of a relative

reduction in price of labor force in extracting

industries was rather impressive: the share of labor

remuneration in GVA of this sector reduced by more

than two and a half times – from 37,5% in 2002 to

almost 15% by 2013. Therefore, the growth of labor

productivity was mainly achieved in the country at

the expense of reduction in direct labor costs

(Chaykovsky, 2011; . Druzhinin and Prokopiev,

2015).

An important aspect of the study was the

identification of the intensity of structural changes

that may occur in the structures of gross value added

and employed population in order to determine the

trends of their future distribution by industry. We

used data from 2016 and 2002 to calculate the

coefficients. The main indicators characterizing the

materiality essentiality of structural changes are:

A. Salai index

𝐼

∑

(1)

where:

V1-the share of the industry in gross value added

(the structure of the employed population by industry)

in 2016;

V2-share of industry in gross value added

(employment by industry) in 2002;

n-the number of specific weights in the structure

of industries.

This indicator takes its values in the range from 0

to 1. The closer the index value of A. Salai to one, the

more significant are the structural differences.

Already at index values above 0.2, structural

differences are considered significant. However, it

should be taken into account that the value of the

index will depend heavily on the number of elements

to which the whole set is divided. The more of them,

the more the index will be leveled.

Ryabtsev index does not take into account the

number of specific weights of the structure and does

not depend on the number of parts of the population:

index V. M. Ryabtseva

𝐼

∑

∑

(2)

Rating scale measures of importance of

distinctions of structures according to the criterion of

V. M. Ryabtseva presented below in table 2.

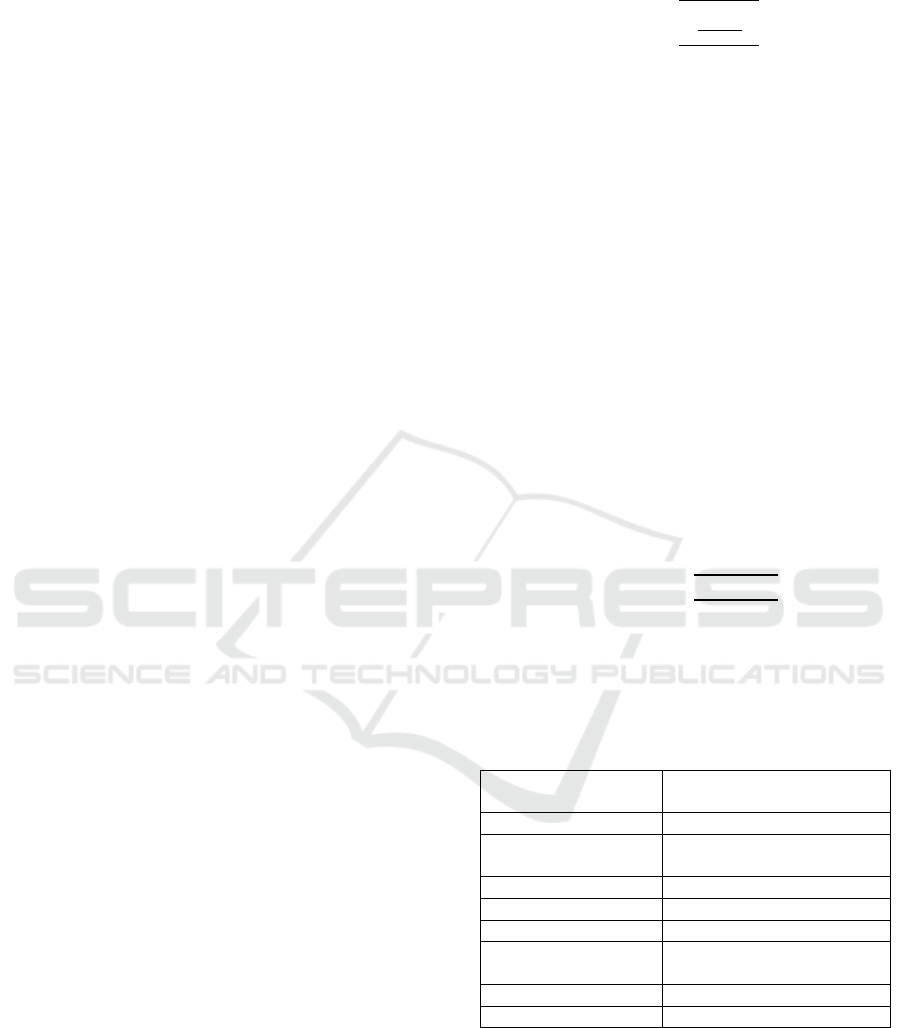

Table 2: Border force structural differences on the criterion

of V. M. Ryabtseva.

The range of values

of the criterion

Characteristics of the

structural differences

0,000

–

0,030 identit

y

of the structures

0,031 – 0,070 very low level of

differences

0,071

–

0,150 low difference

0,151

–

0,300 si

g

nificant level differences

0,301

–

0,500 significant difference

0,501 – 0,700 rather significant level

differences

0,701

–

0,900 o

pp

osite t

yp

e of structures

0,901 and above total opposite of structures

Source: (Shakhnovich, 2014).

Calculations of the index A. Salai showed that this

coefficient on gross value added amounted to 0,18. In

the structure of employment – it is 0,14. Thus, A.

Salai index showed no significant differences in the

structure of employed by industry. There are

noticeable changes in the structure of gross value

added. However, it is necessary to take into account a

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

146

sufficiently large number of gradations of the specific

weight of the indicator – 15 sectors, which

significantly reduces the scientific significance of the

result and confidence in it.

The index of V. M. Ryabtsev calculated by us

does not depend on the number of gradations of the

aggregate structure. During the same period, the

index for the structure of the employed population

was 0,13, which can be interpreted as a low level of

differences in the structure of employed by industry

for the period from 2002 to 2016. However, this

index calculated on the gross value added and equaled

to 0,16 shows a significant level of variation in VDS.

Thus, the index suggests that there are significant

differences in the structure of gross value added.

In the short run, attempts to improve the social and

economic structure leads, as a rule, to the situation

chasing the economic efficiency. However, the

efficiency of state should be determined by the level

of the public utility, rather than solely by the

economic efficiency of national activity. The income,

generated in effective industries and fields of national

economy, is transferred to the state to support

distributive relations amongst the recipients. As a

result, the effective industries, do not receive back

enough funds for their own development.

As a result, there arises a strong differentiation of

incomes across the industry sectors and groups of

population. This does not permit to use a human

capital to the full extent. Evaluation of the factors,

which lead to such a situation, is one of the vital tasks,

as it would permit to successfully solve the problem

of creating favorable conditions for development of

the society and the economy.

The most convenient form for factorial analysis is

building correlation models, which permit to

quantitatively evaluate the influence of each taken

indicator on a social efficiency of life of every

member of a society (Moskovskaya et al., 2011).

The countries with high living standards

(European Union countries), average living standards

(BRICS countries, i.e. developing countries such as

China, Indonesia, Malaysia), and low living

standards (Peru, Columbia, Chile and others) were

taken into a regression model.

The analysis of 2015 correlation of the Gini

coefficient, which shows the degree of social

differentiation, with 4 indicators, which characterize

the economy development efficiency (index of

consumer confidence, index of a human potential

development, inflation index, and a share of high-tech

industries in GDP of countries) prove the presence of

a rather strong relationship.

The three-factor model included only the index of

a human potential development, inflation index, and

the share of high-tech industries in GDP of countries.

The results of modelling are presented in Table 3.

Table 3: Countries grouping according to the index of the absolute level of 1% increment of growth for high-tech industries

share in GDP in 2018.

Groups of

countries

according

to the

absolute

level of 1%

increment

of growth

for high-

tech

industries

share in

GDP, %

Numb

er of

count

ries in

a

group

Share

of EU

countrie

s in

each

group

Coefficient

of funds

renewal and

upgrade, %

Investments

in a fixed

capital

Inflatio

n level,

%

HPDI

(human’s

potential

developme

nt index),

%

Proportion of

the population

with incomes

below

minimum

subsistence, %

Coeffi

cient

of the

lost

earnin

g

s*

2018

2015

2018

2015

2018 / 2015

2018

2018

2015

2018

2018

0,007-0,04 28 100 28,6 18,7 19,3 100,

6

100,3 85,9 86

,2

5,4 5,2 1,64

0,04-0,072 2 50 23,5 21,5 22,0 102,

2

101,8 83,7 84

,0

2,5 3,0 2,69

0,072-0,09 4 25 33,5 20,9 21,5 104,

2

104,7 81,9 82

,1

4,1 4,2 2,57

0,09-0,121 8 0 31,9 25,6 20,4 104,

6

104,2 73,6 77

,7

5,9 6,0 4,29

Source: Calculated by authors on the basis of Eurostat data.

*Correlation of an average occupational earning to an average pension in the country

Assessment of the Paradox of the Formation of Economic Systems in Different Types of Countries

147

Thus, the majority of developed countries in

grouped data does not have a high share of high-tech

industries in GDP. At present developing countries

represent the main flagships for the economy growth

driven by technological development. The level of

social protection of the population and differentiation

of incomes is ambiguous given the similar inflation

expectations in the countries.

A deflation scenario of development can be

observed in the world economy that is related to a

gradual slowdown of investments – the main driver

of countries’ economies. This situation is related not

to the lack of resources, but rather to the excess

supply due to the end of dollar emission. Besides that,

the problems caused by the dollar being the world

currency, have aggravated.

It had an especially adverse effect on developing

countries where the level of investments declined by

more than 5% in 2016 compared to 2015, which in

turn affected the rates of industrial production. In the

other two groups of countries the level of investments

declined by more than 1%. As a result, the degree of

a social inequality and uncertainty of the society

regarding its future have increased. The coefficient of

lost earnings showed its 2,6 times growth related to

the last group.

4 CONCLUSIONS

In the past two decades, a unipolar world transformed

into a bio-polar world in which Russia found itself in

a group of developing countries. At the same time,

having vast territory, natural resources, and cheap

labor and providing a considerable contribution to the

world GDP, the country remains socially ineffective.

In Russia, as a representative of developing

countries, an analysis of the structure of gross value

added and purchasing power conducted for the period

from 2002 to 2018 inclusive showed that the bulk of

gross value added during this period was created in

the extractive industries, however, they employ only

2.2% of the total labor force, which causes high rates

of productivity growth in this sector. The main part of

the profit received in this sector is rent from natural

resources and in the absence of its own high

technologies, the main directions of supply of high-

tech goods are imports. Thus, the average annual

share of exports of high-tech goods from China to

Russia over the past 5 years was more than 30%

(Birdsall, 2010).

The share of high tech goods in the total volume

of the Chinese export showed steady growth and

reached 40% (The economic system of modern

Russia: ways and objectives of development:

Monograph Ed. A.A. Porokhovsky, 2015).

Transformations and economic growth in countries-

beneficiaries without investment and reduction of

purchasing power of both households and producers

adversely affect the economic efficiency of Russia

(Demidova et al., 2018).

This is proved by models for developing and

developed countries which showed that in modern

conditions the state’s emphasis on superiority of

market mechanisms over social policy can lead to

stable economic growth but not to increased welfare

of a society.

The constructed correlation and regression

models for developed groups of countries and

developing groups of countries showed that both in

most cases do not have a significant share of high-

tech industries in GDP. Today, developing countries

are the main engine of economic growth and

technology development. However, the level of social

protection of the population and income

differentiation are very ambiguous. In this regard, the

global economy is developing a scenario of deflation

of development, which is characterized by a

slowdown in investment activity associated with

oversupply due to the cessation of dollar issuance.

This has a particularly negative impact on the group

of developing countries, where the level of

investment decreased by more than 5% in 2018

compared to 2015. As a result, the rate of industrial

production has decreased and social inequality in the

community has increased. According to the authors,

the coefficient of lost earnings showed an increase of

2.6 times compared to wages in developed countries.

The economic development in the majority of

countries does not actually lead to effectiveness of

social institutions or reduction of income inequality.

And this holds true even for developed countries. In

this case the basic strategy of state programs should

be aimed at development of human potential of every

member of a society.

Russia as a country-consumer, rather than a

manufacturer of modern technologies, cannot

develop its economy without creating an effective

social infrastructure aimed at the development of

human capital through the formation of intellectual

and innovative environment. Institutional

transformations should involve an innovative value

chain that would include fundamental research,

applied R&D, and commercial technologies. Only in

this case the Russian domestic economy can compete

with China, India, and other countries. Institutional

developments in the form of the fund of national

welfare and state funds for development should

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

148

become the key tools to solve the strategic problems

of the economy formation. It is also required to form

such institutions of development as techno parks,

business incubators, and technology transfer centers,

all in in the conditions of insufficient financing.

The efficiency of the Russian economy should

contribute to a correspondingly fair distribution of

resources. This can lead to emergence of consensual

ideology, which is aimed at the growth of social

effectiveness of the economy and protection of the

country population.

A high-level objective to focus solely on

economic rational of any economic institution at the

expense of its actual utility is explained by the

increased requirement for lowering costs and

increasing labor productivity. However, a low

technological level of production and lack of

opportunity to produce a variety of industrial products

knowledge-based components, which would have

high domestic demand, lead to a high import

substitution and dependence on foreign supplies of

ready-made products. In addition to that, the problem

is further aggravated by a depressive state of the

science.

The implications for Russia are the lack of

financing for research and development and, as a

result, current incapability to occupy any niche in the

world production.

In most sectors, forming the GDP of Russia, a

share of high-tech products is fairly low and involves

only production of raw materials or semi-finished

goods and, therefore, does not give a possibility to get

a bigger share of value added.

The solution to this problem, which resonates in

the experience of some countries, can be the increase

of a part of expenses for R&D from the Federal

Budget allocated on a competitive basis. However,

there arises a question about changing the

institutional component of state aimed at ensuring

social utility of every member of the society. The

share of gross value added and labor productivity in

any sector of the national economy should be

proportional and correspond to the labor

remuneration which a worker receives. This

proportionality should also be taken into account

while implementing the redistributive relations in the

economy of the country.

The required and sufficient condition here is a

creation of a successful anti-inflationary monetary

policy and a fiscal policy, which will permit to

distribute the resources in the country, activity of the

state in the field of foreign trade turnover, allowing to

mitigate negative consequences of declining trade

cycle in the economy. Favorable living environment

for the population and their confidence in the future

should be maintained.

The main dilemma today encompasses the role of

the state in the Russian Federation as a subject of

economic activity and the necessity of cardinal

changes in the legal and judicial system. If these

changes do not take place, the differentiation between

poor and rich countries will deepen even further.

Furthermore, the obsolete structure of the economy

creates a dependent development path. The current

challenges are due to the fact that from the one side,

there is a requirement to develop market institutions,

and from the other side, there arises a requirement to

increase social purposes of these institutions. Today

such dualism remains one of the most important

issues of many states.

REFERENCES

Okediji, O.O. (2011). Institutions and economic

development: theory, policy and history. Journal of

Institutional Economics, 7(4): 473–498.

Luca Ferrini (2012). The Importance of Institutions to

Economic Development. Retrieved from: http://www.e-

ir.info/2012/09/19/the-importance-of-institutions-to-

economic-development/

Petrov, N.A. (2015). Impact of changes in production

factors correlation on cyclical development in global

economy: auto-abstract thesis Candidate for economic

sciences: 08.00.01. N.A. Petrov; SGEU -22p.

Kapelyushnikov, R.I. (2014). Productivity and labor

remuneration: a little bit of simple arithmetics. M.

Publishing house of Higher School of Economics.

Series WP3 “Labor market problems”, 10-12.

Marinov, A.A. (2014). Developing regional innovation

subsystem on the basis of the government and business

interests coordination. The thesis abstract.

https://dlib.rsl.ru/viewer/01005547584/.

Goreeva, N.M., Demidova, L.N. and Chernyaev S.I.

(2013). The world crisis influence on Russia economic

stability. Modern problems of science and education, 1:

289.

Chernyaev, S.I., Goreyeva, N.M., Demidova, L.N. and

Ogloblin, I.Y. (2014). The fractal nature of the Russian

financial system during crisis». European science

review, № 5-6, pp. 235-239.

Chaykovsky, D.V. (2011). Theory and methodology of the

formation and application of value added under IFRS

on a micro and macro level. The thesis abstract.

Druzhinin, P.V. and Prokopiev E. A. (2015). Modeling of

sectoral structural shifts in the Russian economy.

Economic analysis: theory and practice, 16 (415): 26-

36.

Shakhnovich, R.M. (2014). Inflation and anti-inflationary

policy in conditions of radical reforms.

http://av.disus.ru/dissertatciya/1042961-1-inflyaciya-

Assessment of the Paradox of the Formation of Economic Systems in Different Types of Countries

149

antiinflyacionnaya-politika-usloviyah-radikalnih-

reform.php

Moskovskaya, A.A. et al. (2011). Social entrepreneurship

in Russia and in the world: practice and research.

https://www.hse.ru/data/2011/11/01/1269337965/04.p

df

Birdsall, N. (2010). The (Indispensable) Middle Class in

Developing Countries; or The Rich and the Rest, Not

the Poor and the Rest. Working Paper Center for

Global Development, p. 207.

The economic system of modern Russia: ways and

objectives of development: Monograph Ed. A.A.

Porokhovsky. (2015). Moscow: Faculty of Economics,

Moscow State University named after M.V.

Lomonosov, 896 p.

Demidova, O.A., Daddi, P., Medvedeva, E.V. and

Signorelli, M. (2018). Modeling the Employment Rate

in Russia: a Spatial-Econometric Approach. Economy

of Region, 14(4): 1383-1398

ISSDRI 2021 - International Scientific and Practical Conference on Sustainable Development of Regional Infrastructure

150